LONG LEVI REVERSAL Upwards, established SUPPORT, RSI OVERSOLD,THE MAIN REASON TO WHY THE STOCK FEEL MORE THEN EXPECTED WAS BECAUSE EARNINGS DID NOT BEAT LAST YEARS BUT THEY ARE STILL POSITIVE. THEY ARE A PROFITABLE COMPANY BASED ON THEIR FINANCIAL STATEMENTS, CASH FLOWS, AND BALANCE SHEET.

INDICATORS:

RSI: IT IS AT 34, WHICH IS REALLY LOW AND IS HEADED UPWARDS SINCE IT WAS AN OVERREACTION. THE COMPANY WILL EASILY GO BACK UP AT LEAST A 1 UPWARDS.

MACD: IT IS ABOUT TO CHANGE MOMENTUM IN TERMS OF UPWARDS TREND. IN A DAY OR SO FROM NOW IT SHOULD BE POSITIVE MEANING GREEN MOMENTUM UPWARDS.

THE REVERSAL IS HAPPENING.

Valueinvesting

Why Gazprom Has Plenty of Fuel Left in the Tank.Gazprom has been undervalued for years, so why buy today? The price spike of 2019 shows a change of sentiment. Investors are now willing to dip their toes into Gazprom.

Statistically, stocks that are trading at 12-month highs, perform better in the long term than otherwise. So the 2019 price spike is actually another good reason to consider investing in Gazprom.

Looking back over the last 4 years, Gazprom failed to break above $5.3 (a technical “resistance” line). Making any buy above $5.3 a good entry point into Gazprom. That line was breached in 2019, and since then Gazprom rocketed up. Where is the next resistance? Potentially around $9.1 where historically there has been a lot of price action. It would not be surprising for Gazprom to range in this area for a time. Beyond that, the air is clear.

Arguably the most important thing to look at from a technical perspective is momentum. Momentum is the trend (up or down) of a stock’s price. Gazprom has been in a downward trend, below the 200 Day Moving Average (DMA), for most of the last decade. However, recent spike above the 200DMA has put Gazprom back into “buy” territory. This is a classic example of what Jim O’Shaughnessy would call: “a cheap stock on the mend”.

Cheap from its fundamental valuation, with price appreciation on the mend.

Daimler post-dividend drop offers buying opportunityDaimler recently gapped down in a big way after its dividend and a CEO change, which offers an opportunity for investors to get back in at low prices. Daimler isn't the sexiest automotive company, but it's fast becoming a leader in the autonomous vehicles space. It's already got a level 2 autonomous rig on the road, cutting the cost of traffic incidents by 95%. By 2025 it expects to field a fully autonomous truck. Whatever you think about putting truck drivers out of business, this is bound to be insanely profitable for Daimler.

Analyst ratings on Daimler are super mixed, mostly because some analysts are more forward-looking than others. Last year Daimler's earnings were down year-over-year, mostly because of R&D costs. However, the company delivered a solid earnings beat in Q1 on the strength of its autonomous truck business, and I think it will solidly beat estimates again in Q2. In the meantime, Daimler's formed a nice, gentle upward channel. Pick it up on pullback to channel bottom for a steady return until next earnings on July 25. Analyst upgrades or earnings estimate revisions could benefit the stock before then.

Note that Daimler trades as both DMLRY and DDAIF.

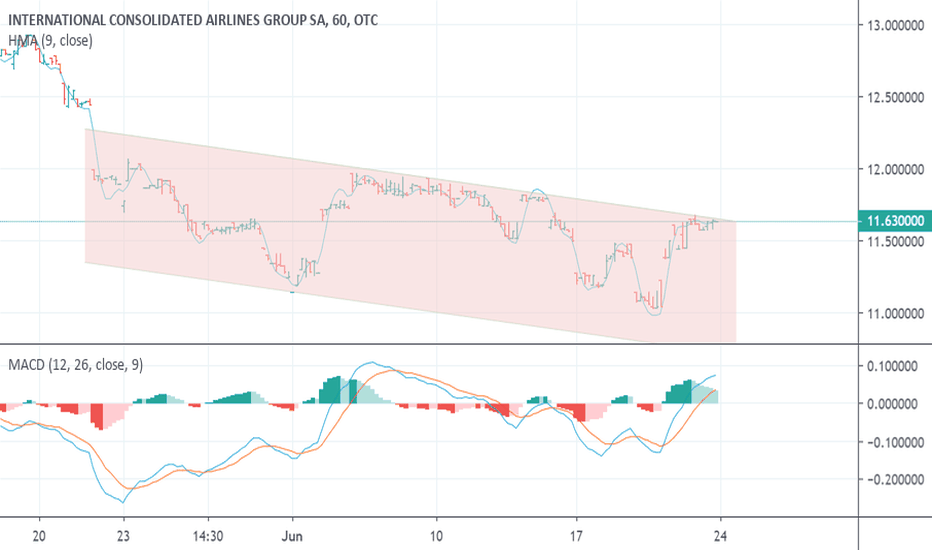

ICAGY short-term short play -- currently near channel topICAGY is a great value stock, and I've been watching for a turnaround for a long time. It's got excellent analyst ratings, a good dividend, and a great P/E.

Unfortunately, it's been in a downward trend for months and is likely to continue downward until a significant catalyst such as a beat on the August 2 earnings report.

It got a bump a couple days ago when it announced a big order of new Boeing jets, but this only pushed it to the top of its channel. With a lower high and bearish divergence on the MACD, I expect a turn downward toward channel bottom on Monday. The alternative is upward channel breakout, which is unlikely but would be nice.

Sidenote: ICAGY always does really well in November, leading up to its dividend payout, then drops hard on the ex-dividend date. That'll be a good month to go long on this stock, if not before.

Bluzelle: 12M Cap on Binance / Decentralized DatabasesBluzelle built a decentralized storage technology that makes it an edge network. This ensures that data is as close to the customer as possible, leading to fast performance. Current data storage systems are centralized. This makes them vulnerable to attacks, system failures, and performance issues.

Bluzelle’s servers are spread out all over the world. These servers are interconnected and they each replicate the same data. Customers can request data and the request will be fulfilled by the server that is able to respond the fastest. Thanks to this massive replication, even if a server goes down, it does not matter as all the other servers can handle the same request. New servers can be deployed at any time to replace existing ones or to increase geographic availability. Much like how Cloudflare fulfilling requests for web content on the edge, Bluzelle fulfills requests for data.

TA:

Bluzelle is currently bouncing from the bottom of the channel where it has resided for the past 10 months. Willy indicator has crossed upwards and volume has picked up significantly. Three drives to the downside on the weekly chart indicate a potential exhaustion from sellers.

FA:

Bluzelle is one of the lowest market cap coins on Binance, currently sitting around 12M total cap.

Bluzelle is a technology project w/ low hype and high development. The trade is not crowded.

Bluzelle has a live data cache product with 30x the performance of the competition: blog.bluzelle.com

Bluzelle will have nodes with node requirements. All services are paid for in Blz.

Two targets are posted on the chart for traders... but I believe Bluzelle has the ability to go much higher for the patient investor.

AUDUSD 1,000 PIP POTENTIAL. LONG TERM BULLISH (Heaps of Upside) AUDUSD WEEKLY

minus a brief stint in the midst of the financial crisis, AUDUSD hasn't seen price maintained below .6900 for over 15 YEARS!!

As a long-term value play I can't think of a better opportunity at the current moment,

Heaps of upside.

1,000 Pip Trade in the making!

What Investors Don't Consider When Bashing TSLA!

NASDAQ:TSLA Is extremely undervalued and I'll tell you why I believe the stock will be worth IMHO 15x its current value in the next 10 years.

NASDAQ:TSLA has a market cap of $34B as of market closing Friday May 24th. The brand is most known for electric Vehicles and a controversial & genius CEO.

Revenues for 2019 is expected to be $30B...so it will be trading at 1x sales and revenue has been growing at a clip of approx. 60% per year.

Tesla's revenue grew 10x in 5 years...that's insane. If Tesla's revenue grows by half that compounded amount in the next 5 years it will have revenue of $75B! At 5% net margins which is typical for the automotive industry(And Tesla is far from being "Typical") profit can be $3.75B. With a p/e multiple of 10, it is a $37.5B company all day long--basically where it sits currently.

Year after year I see more and more Tesla's on the road and every person I ask who owns one says they love it--including me!

Oh ya, that's right... NASDAQ:TSLA also owns the largest Lithium battery plant in the world...the Gigafactory. I forgot about that... the vision here is to make lithium a highly used energy source for powering cities and supplying other automakers with energy units for their cars. Genius. Lithium battery sales alone can outpace their auto unit.

NASDAQ:TSLA is such a new company..it hasn't even begun to monetize on the brand and technology in other areas like Honda, Ford, and Toyota.

Tesla can come out with Motorcycles, Pick up trucks, Freight Trucks, Seadoos, Motorboats, lawnmowers, and the list goes on...and let's not forget Autonomous taxi services (UBER valued at $70B with half the revenue of TSLA).

Of course, Tesla has to get it's shit together with vehicle production first; but when it does and it will, the company will come out with a forest of other products that it's raving fans will purchase. Today at $190 a share the company is a steal and a half.

The company has such a strong world-renowned brand and is at the cusp of the worlds most crucial topic; Climate Change. The funny thing is it spends basically $0 on advertisement when other automakers spend billions.

In conclusion, NASDAQ:TSLA is a great risk:reward investment. The downside is always the most important thing to look at in comparison to the upside and IMHO Tesla has very little downside in terms of its fundamental value. Remember Apple in the 90s (www.nytimes.com).

The Green Eggs & Ham of MMJTGODF 786 fib retracement at entry time for growth on earnings and big money.

buy and hold, one of few larger MMJ companies to not rocket up since end of dec 2018.

Longer Term Dividend and Value Investing on Coca Cola KORecent Earnings of $0.20 against the analyst consensuses of $0.43 is a big disappointment.

This is a "surprise" whopping 53.3% drop against expectations.

Coca Cola is a consumer staples stock and if you like them as much as Warren Buffett, this could be a high probability winning trade with dividend and capital appreciation on the longer term.

DBD Go LONG!! (this is a great gem)NYSE:DBD

After joining in the October sell-off...Diebold has hit a bottom and not only bounced convincingly, buy gained an investor with a 14% stake (Black Rock Inc.) according to recent filings.

Go Long anywhere here in the $3.5-$4.2 range. Upside potential: (+200%) w/ Long Hold strategy possibly getting into 4x territory.

Republic Protocol: Decentralized Dark Pools / NodesRepublic Protocol was recently added to Binance exchange and is currently sitting at a 12 million dollar market capitalization.

Republic Protocol is an open-source protocol powering dark pool exchanges. REN is a utility token that provides fuel and security to the engine.

Dark pools are currently a missing infrastructure component in the crypto ecosystem and exist for the purpose of facilitating large volume trades for institutional investors that would otherwise influence market conditions if displayed on book.

As a protocol, anyone will be able to build dark pool based exchanges or integrate dark pools into their current exchange infrastructure once the Republic Protocol team releases their sdk.

Speculation:

Republic Protocol was added to Binance during peak bear market and at a very low valuation. The main net will enter a public phase in January, allowing anyone to run a node. The token exists for this purpose. Anyone holding 100k Ren reserves the right to deploy one of these nodes.

The current supply is around 600mm ren, with the rest of the tokens being locked by a long vesting period to ensure the team works towards the future. At an adjusted market cap based on the circulating supply, ren is actually sitting at a 7.5mm usd valuation.

The Republic Protocol team also announced RenVM, which will allow people to use the ren network for private compute operations.

When the public is allowed to launch Ren nodes, this will constrain the supply and increase demand for the token, leading to a potential appreciation in price.

TA:

Only limited history is available on binance, but Ren is currently sitting around ATLs usd wise.

BTC wise, Ren has just broken this falling wedge structure to the upside and is pushing into a zone of resistance. However, the volume oscillator on the bottom of the chart indicates a shift of power from bears to bulls, signalling a potential ability for the technical pattern to play out.

DYOR as always, but I believe Ren to be a solid long term play and at least a potential short term flip based on public main net launch in January and the TA presented and the TA that is not able to be displayed on Tradingview.

Other infrastructure based protocols such as ZRX are currently trading at 100mm+ valuations, and Ren has some of the most actively developed GitHubs in all of crypto.

Safe Haven - add dividends REIT sectorReal Estate sector has shown to be safe haven and not oversold sector to other stock sectors, which were way oversold to value.

I give thanks today for understanding enough, but still expect growth here. Mid-term stocks usually do well in ensuing 6 mo.

period, however during bearish times a safe haven is a consideration.

If you have another sector, make it a conversation. FOREX, Crypto, and calls/puts would be only other if considered a sector.

Does anyone have link for history of when shorting (calls/puts) was created and why? Please comment @pokethebear.

Emperor Entertainment Hotel: A Weighted CoinI believe Emperor Entertainment Hotel ( 296 HK ) is a weighted coin. www.slideshare.net If we focus on how insiders have actually behaved, they’ve treated investors well. The market concerns seem overblown. That discount has been compounded recently by the bear market in China and Hong Kong, and Macau gaming stocks have declined more than the indices. Even if Macau gaming activity declines and Emperor’s assets underperform competitors, unless insiders behave unfairly, it’s hard to find downside in the stock and the upside is multiples of the current price.

Metronome - 14mm usd cap "Gem" with Bitcoin Core Dev CreatorMetronome (www.metronome.io) is a built to last cryptocurrency originally created by Bloq, headed by Jeff Garzik (core bitcoin developer).

It has a unique auction mechanism that controls inflation of the money supply and built in converter contracts that provide liquidity in wallet in either direction (think a mini bancor). The converter contract currently has ~4000 eth of buyside liquidity and 500k metronome in sellside liquidity. This liquidity shifts based on the day's auction price.

Metronome is self governing and portable... meaning that users will soon be able to move their tokens in between blockchains. Because of this, metronome will survive forever.

Metronome is intended as a store of value.

From a technical perspective, we can see that Metronome has broken its horizontal range.

I believe this project is extremely undervalued from a fundamental perspective and am targeting 100million -250million usd market cap to sell.

Idex seems to be the most liquid place to purchase, but it's available in the Metronome wallet as well as Bittrex and other exchanges.

DYOR and feel free to join their telegram. They are very helpful.

We could get a big(ger) discount on a great companyWhat company is the only one that was in the DJIA 100 years ago and still often ends up in?

Better, what company was in the DJIA back in 1896 and the only one that is still in the USA, did not get bought by another company, did not die, did not become smaller...?

They have survived that long, and grew. In 2000 the company was worth 600 billion (900 billion inflation adjusted), making it one of the biggest of all times, still far behind Saudi Aramco (Apple looks cute in comparison). Afaik the biggest oil company ever is the arab one at over 4 trillion (Standard Oil was in the 1-2 area).

I think the record thought... during the period of the Tulip Mania, the Dutch East India Company was worth 78 million Dutch guilders, which translates to a whopping $7.9 trillion in modern dollars.

Anyway, General Electric is a "wonderful company" right? I can only recommend reading about them, making sure nothing too crazy is going around.

This is actually similar reasoning to what Buffet did with Coca Cola in 1988, which made him immensly rich. But maybe he just got lucky...

Seriously, that company survived 2 wars and only grew bigger, they survived the SEC, the american justice system, and they are down 80% from ath.

If we get a recession soon (next 2 years) and the price goes even further down, yet the company still keeps doing its thing, and we get to buy at like 5$... Come on lol

If this happens I will look and try to find more about them & also check did whatever bad news circle around them already happen to GE? How did it react, etc.

Regardless, if it goes really low something like 2.50 and the revenues are still way up there and the company is not shutting down... I mean, the risk is very low and the potential reward would be amazing? Would not even have to go up to ath, 25$ would be a 1000% return, plus these juicy dividends...

If investors leave does this even matter to them? They do not sell shares to raise funds do they? Would need to check that.

Oh ye, easy mode activated by the way: if it keeps going down with a strong bear trend, and then you suddenly get a spike in price: institutions are buying heavilly obviously they are the only ones that can stop trends like this. Good guys did the homework for us and know this is a great company.

What to look for next is for another leg down, hopefully with divergence, and then we buy. We do not care if the price keeps going down because this here is value investing not trading.

The institutions do all the hard work, we just sit there and play video games, and we get to buy in cheaper and get better returns :D

If the price keeps falling, it is a chance to buy more lower (you only used a few percent of your wealth to buy so you have plenty of money left right?) NEVER USE LEVERAGE this is for idiots only.

And people complain that institutions are all powerful and idk what other conspiracy theories. Institutions are my b*tches and I rob them on a daily. Nothing beats being a super mobile quick agile individual that answers to no one.

Undervalued and Extremely Bullish StockHey guys, I'm back to report on this new stock that I found and I'm loving it right now.

The name of the company is Vale, they're steel manufacturers. This company has had fantastic earnings growth and is still undervalued with only a 5 ev/ebitda still!

Their stock got beat down all the way to $2 a share but they have made an amazing comeback, obtaining around 600% in two years. All the indicators point towards bullish with a nice little profit target of around $17 a share (Range of 16.50-17.50). This target obviously depends on earnings coming out soon and although I can't give a specific time frame, I know that a 20% minimum target really helps improve my likelihood of investing in it.

It's important to use more than technical analysis when investing. Although I love to use technical analysis, I don't just look at any stock and hope that it works out. Using technical analysis EXCLUSIVELY is like a pitcher who only throws a fastball; doesn't matter how good it is, eventually, some batter is gonna come up and bite you in the ass with a homer. Value investing is a fantastic tool and technical analysis helps make sure that you don't invest too early when value investing (Which I think is the biggest flaw of just using value investing)! So I absolutely recommend you guys broaden your repertoire to help increase confirmation of stock setups!

I think this company is set up for some good things here, but don't invest before earnings in 8 days. Way too risky of a move.

Any questions? Leave a comment down below.

Fun-fair public release in March!Hi guys, We see that bitcoin is going sideways so that means that the alt coins have a change to grow in bitcoin value!

Fun-fair will have is public release around March and you also see this in the chart!

So hold tight in your seats because we will have a take of soon!

Like and comment under my chart!

Adioos

CLF: Contrarian OutlookCLF is a buy in my opinion but the price must close above the .786 fib retracement box I have placed in on the chart for a long position to be considered. Noted for a lagging share price to the industry, yet considered a great company with potential. To those trading the steel market, fundamentally the opinion is definitely swaying towards bullish for 2018.

--US housing starts rose 3.3% to a SAAR of 1.297 million units (November) and The Architectural Billing Index rose to 55, both of which are good signs for an increase in the demand and spending on steel. Coupled with the future infrastructure projects proposed by trump signs are looking good.

--Toyota/Mazda plant has just been approved in Alabama, estimating 300,000 vehicles per year starting in 2021.

--Chinese Steel exports have fallen for over 15 consecutive months.

---CLF announced a new HBI plant in Ohio w/ a capacity of 1.6+million tons a year.

For a safe position, i am looking for price to close above the .786 fib as stated above, this would reject the potential pattern i have drawn on the chart. The boxes are calculating +/-2 % variance of the Fibonacci ratios. If we do not see a close above, a daily doji and a bounce of the .786 could be signs for a lower share price. In that case look to enter around 5.70 which seems to be a good support, or look for a completion of the ABCD pattern.

EBAY Long 2-6 Weeks Technicals and valuation support a bullish rebound. Supports at 35 from the channel it has been trading in since June. PE of 5.2 is a steal in this market where the S&P trades at a PE of 25. Excellent margins support their profitability. There should be enough space in e-commerce for both Ebay and Amazon NASDAQ:AMZN allowing both to continue to grow.