#VANA/USDT#VANA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 6.52.

We are seeing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 6.75

First target: 6.98

Second target: 7.24

Third target: 7.52

Vanadium

Tweets on Charts - VOX stoch divergenceJust adding a new chart to show how Twitter and Tradingview are now working well together

Vox Royalty - Vanadium and Gold updatebit.ly ,

A busy year for Vox Royalty in2 021, Vox’s partners announced 80k meter drilling for 2021,

Investors should expect multiple resource updates which will add considerable value to Vox’s current royalties.

Pitombeiras (PEA Stage) – PEA Update and Drilling update

• Vox holds a 1% net smelter royalty over the Pitombeiras vanadium-iron ore project;

• On May 4, 2021, Jangada announced additional drilling results and an updated mineral resource and PEA timing:

◦ 22 drill holes for 1,466m completed with 18 holes intersecting vanadiferous titanomagnetite mineralisation;

◦ Upgraded and expanded Mineral Resource Estimate and revised PEA scheduled for completion in Q3 2021; and

◦ PEA focus is on evaluating a Direct Shipping Ore operation for the export of a saleable magnetite concentrate containing a minimum of 62% Fe and additional credit from 25% contained V2O5.

The Pitombeiras project should be fast-tracked towards productions around Q1 2022.

Battery metals are becoming more important as the world moves towards electrification.

As well as Vanadium Vox across its 50 royalties has several copper projects all well capitalised, moving towards final investment decisions and production.

last year Vox lead the industry in acquisitions, bringing regular organic news flow over the next few months investors should expect new updates on new gold royalties.

youtu.be

Metals - FVANModel has given entry signals for First Vanadium Corp.:

- First Vanadium Corp. engages in the acquisition, exploration, evaluation, and development of mineral properties in Canada and the United States. The company's flagship property is the Carlin Vanadium project, which comprises 150 unpatented mineral claims covering an area of 2,608 acres located in Elko County, Nevada. It also explores for copper, silver, and gold minerals.

- Vanadium is critical in basic materials.

- We are very excited about opportunities in the commodities and basic materials sectors, as we believe a macro turn is approaching in the nearest future.

- Technically in a bull flag at the end of a Wyckoff accumulation structure with a spring, possibly testing the channel top.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

Metals - VONEModel has given entry signals for Vanadium One Iron Corp.:

- Vanadium One Iron Corp. explores for base and precious metals in Canada. It holds a 100% interest in the Mont Sorcier iron ore and vanadium project located in Quebec, Canada.

- Iron and Vanadium are key metals for industrials.

- We are very excited about opportunities in the commodities sector, as we believe a macro turn is approaching in the nearest future.

- Technically in a cup and handle, with a Wyckoff accumulation structure on the handle, possible breakout.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

LGORF Inverse heads and Shoulders This is about as perfect of a bottoming action as you will ever see. The company sells Vanadium used in EV batteries which is becoming a hot market.

The run should move the stock 4-6 times present price.

Yews I own it and no I am not investing professional

3p / 3.69p resistance 6p big target / strong catalystsJangada is a great top invesment:

BoD aligned with shareholders holding most of the float

6p warrants due to expiry in October 2020

Have 26% of Volare Metals valued at around $5.5m for Jangada Mines

Valore Metals also own Pedra Branca PGE (great asset) & drilling over summer.

Jangada catalysts:

7 holes assay results to come back soon

JORC estimated resource

PEA

UUUU Can Benefit Long Term LongThere are several stocks that are worth considering in this bottoming of the Uranium cycle. Some have better looking charts than others, and some have held up better than others. Yet, I've decided to go with $UUUU, even though it has not held up best thus far.

Technically, we may have just seen a capitulation-esque move, setting up the last best chance to get in. I was able to average in on January 31 for $1.41... (bringing my average entry to $1.71) but am posting this now at $1.68.

There is bullish divergence set up on this weekly chart with MACD and RSI printing a higher low, coinciding with the most recent low in price.

Also, see the yellow line for average volume, which has clearly ticked up since 2017 levels and the notable spike since June 2018.

This all looks very bullish to me long term.

I don't have a target in mind yet, but buying and holding unless and until there is a monthly close below $1.20.

Fundamentally, Energy Fuels (UUUU) not only can benefit from the long term resurgence of Uranium, but also is positioned to benefit from its Vanadium.

These prospects are increased all the more by the global push for the 'green' economy... regardless of the actual merits behind such push.

A recent short video from Francis Hunt is titled " Oil is Dying ".

Why fight the big money?

May this post be of use to you.

In God's Will

UIOGD - JMJ

AUS Vanadium - High Strength Steel InvestingVanadium oxide/pentoxide is used to harden steel to make high strength steel for concrete reinforcement, automobiles (thinner gauge/light weighting), and aerospace engines, and things like submarines. ASX:AVL UUUU

This is micro/small cap mining stock that specializes in vanadium pentoxide, which for HSS used near 15-18% with iron and reduces corrosion as well.

V2O5 is not mined effeciently by many and China will need for infrastructure. It showed the climb last year and dipping at 618fibretracement entry. wait for it.

Can't see correction below 0.618, Fib min-max values.

3.35p / 3.53p target slice - 2.30p - 2.50p possible entry LONGWe might not have much of a retrace but I tend to go for the best entry possible, target looks conservative but always best to play it safe & slice never hurts.

Miton Group have been loading up on shares recently.

2.30p ideal entry if not below it at 2.05p so expose wisely.

Positives:

Great asset - Sable Zinc Kabwe Project - The Project targets to produce annually over 8 000 tonnes of zinc, 1 500 tonnes of vanadium and 15 000 tonnes of lead as it ramps up to full capacity over a 2-year period.

Cashed up as placing was done at 2.25p just a week or so ago

Negatives:

Be aware that there is a secured convertible loan note of GBP6.11 million attached to the project

Colin Bird is within the BoD

CLN's:

At any time that the loan is outstanding, ACAM may at its absolute discretion, by conversion notice, elect to convert the loan and all accrued but unpaid interest into 5 per cent unsecured convertible loan notes with a conversion price of 2.81 pence (ZAR 53.98 cents) ("Subscription Price") and a maturity date which falls on the third anniversary of the Closing Date.

During the loan period, Jubilee may notify ACAM of its intention to prepay the whole of the loan balance by prepayment notice. On the date of any prepayment Jubilee will issue warrants to ACAM to a value equal to 50 per cent of the amount of the loan and all accrued but unpaid interest thereon divided by the Subscription Price.

Largo ResourcesLargo resources one of the lowest cost vanadium producers with main project in Brazil. Company explores for vanadium, iron, tungsten, and molybdenum. Earnings have been exploding due to appreciation in vanadium prices last year. I belive prices of Vanadium the 23 element in the atomic table will go north in the next few years which will be triggered by shortage in supply and increased demand. Chinese new rebar standard, Tesla gigafactory in China and Nevada. VRF adoption for renewable energy. Technical point of view RSI oversold, MACD momentum change, Volume increased. 0,70% fib retracement giving very good RRR with at least 2:1. Good Luck

At strong support & possible bounce - bullish divergencePlacing was at 1.75p so bear in mind they are fully funded at the moment.

Very strong bullish divergence & strong support here.

I don't hold but see is as a possible trade from this levels.

if 1.5p is lost then best to leave stock as we might be heading to new lows.

Metals play including vanadium.

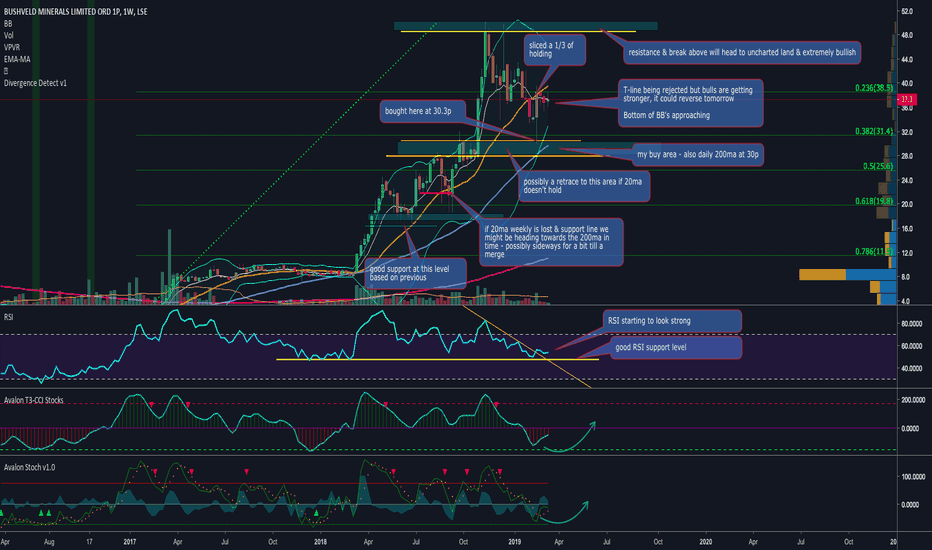

Weekly T-line close to break / RSI stronger #mfchartRSI trend line stronger and towards end of day a few buys kicking in and almost closing above t-line, tomorrow might be the day we could end the week above it.

Bought at 30.3p and sliced 1/3 at 38.5p and holding the rest for bigger %

will add more if we test the support again but bottom of BB's are moving up.

there’s a couple of things expected in Q1 for BMN:

- Brits resource estimate

- Capital allocation framework and dividend policy

Both were reiterated in their latest presentation released a week ago

Big news I’m expecting later in the year:

- JSE listing

- Mokopane mining right

- Brownfield processing acquisition

- Bushveld Energy results from battery test with Eskom and potential contracts for grid level storage

I’m also expecting the vanadium price to move up as the year progresses, there’s a structural supply deficit which isn’t expected to disappear until 2023 or so.

Western Uranium & VanadiumWSTRF is US micro mining stock with two valuable metals with upward pricing.

WSTRF

Uranium Oxide and Vanadium Pentoxide

Mkt Value is micro at 47M, so going upward based on its natural ore resource assets.

Was down near 32-33% and up 21.5% today.

Play with own money, no advice given. Do own research on high strength steel and nuclear power (no CO2 output) and gaps in both resources for next 1-5 years.

My buy zone 28p-30p - 50ma weekly & 200ma daily supportA great company with 0 debt & making solid revenue with Vanadium

Scaling in as we speak with 1st tranche today and if I get 28p I will add further.

Many annotations are from following chart for months.

Please do your own research.

Solid future investment.

PROPHECY DEVELOPMENT STRONG BUYPCY exploration and development VANADIUM project in Nevada. One of the only pure vanadium mine projects in the US next to the TESLA Gigafactory Nevada. Vanadium pointed as critical mineral for the US. Prices have raised more than 500% for the last few years. VANADIUM, URANIUM, COBALT thats the resources for the future. Nice pullback to 61.8% fib retracement after break out. 200MA acting as support. RSI 50 hold for buyers. Good Luck

Largo ResourcesLGORF

Vanadium Flake and high grade source to V2O5 for making high strength steel. 0.5% V2O5 will double the strength of steel. Above this it can improve corrosion protection and harden metals like in aircraft engines. It is also offering a new battery technology that is more reliable than Lithium-Cobalt-Manganese batteries. The stock has already jumped 148.5% since July and climbing back to Oct. 30 high of 3.48 from current 3.33.

Who will make Vanadium reflux batteries is my next question, anyone?

Watching from 786fibretracement and nearing Oct. 30 high.

Uranium Futures flashing buyTruth: Supply & Demand gaps. See 2008-2018 Uranium Futures

Truth2: Some Uranium miners also mine bonus rare metal Vanadium (pentoxide) for HSS, automotive, EV, aerospace engines, infrastructure HSS rebar.

U

UEC

OTC:FOSYF

UUUU 23% up, 10% down

NYSE:AZZ

LSE:YCA

OTC:WSTRF

TSX:MGA

OTC:BKUCF

TSXV:VONE

FWB:JT71

FWB:U9M2

TSXV:GLV.H

Vanadium One Energy Corp. VONE

Vanadium One Energy Corp, formerly Vendome Resources Corp, is a Canada-based mineral exploration company. The Company focuses to acquire near-term production exploration mining projects and existing producers. It operates through the business segment of exploration for mineral resource properties. Primary targets are Vanadium and Magnesium. Titanium and Gold are other opportunites on their lands found. 2 lb. V2O5 to every ton of steel = 2x its strength, aka high strength steel. So the opportunity is still yet to be mined, but in a mining community as land mine leases. 29M shares and 2.9M Mkt Cap.

Note: The Company has not generated any revenues. Check out their website vanadiumone.com/presentation to know facts as anyone viewing and buyer beware.