SWING IDEA - V2 RETAILV2 Retail , a small-cap value fashion retailer with a pan-India presence, is showing strong bullish momentum and a textbook swing trade setup backed by multiple breakout signals.

Reasons are listed below :

Breakout from a VCP (Volatility Contraction Pattern) – indicating accumulation and strength

Ascending triangle breakout – classic continuation pattern

Cleared major resistance zone, confirming bullish intent

Maintains a clear uptrend with higher highs and higher lows

Target - 2350 // 2530

Stoploss - weekly close below 1745

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

VCP

INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (71).

EPS Growth:

a. Quarterly QoQ: -

b. Quarterly YoY: +11.20%.

c. TTM YoY: +32.14%.

d. Annual YoY: +6.07%.

(-)

1. There is no significant breakout with substantial volume.

$INDF (VCP - 10W 10/3 4T)Position update: July 31, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3. Price action moves in the opposite direction of the declining general market.

4. The stock moves on its own drummer, rallying 30% to a new 52-week high, while the broader market declined 14%.

5. Volume has dried up, indicating less supply coming to the market.

6. Significant volume expansion on the breakout.

Considerations:

1. The percentage of stocks trading above their 200-day moving average stands at 51%—a positive sign and a strong indication of a potential bull market campaign.

2.Despite the technical strength, the stock squatted into the close, signaling potential weakness in the breakout. Risk should be managed carefully with appropriate stop-loss placement.

This represents a quintessential VCP breakout, offering a clean pivot entry with minimal risk. I’m seeing improved traction in my personal trades and have accordingly increased my position sizing at this stage.

CASA - FLAT BASEPosition update: July 10, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Flat Base with a clear, low-risk entry.

3. The base has VCP characteristics.

4. The stock moves on its own drummer, hitting an all-time high while the index struggles to reclaim its highs.

5. A shakeout that weed out weak holders has strengthen the setup properly.

6. Volume has dried up, indicating less supply coming to the market.

7. Strong fundamentals, with consistent increased in year-over-year earnings growth.

Consideration: The breakout was not accompanied by a significant volume surge.

This is a classic Flat formation or Darvas Box Theory with a clear pivot entry and minimal risk. I’m starting to see increased traction in my personal trades—a very positive sign to trade larger in this market environment.

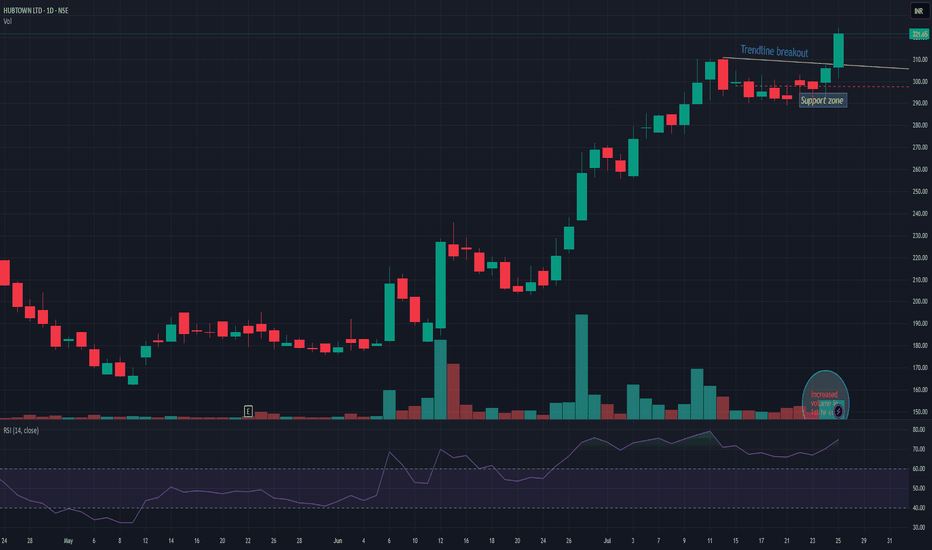

$DEWA (VCP - 6W 19/6 3T)Position update: July 21, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3.Currently forming a VCP following a prior price surge of nearly 150%, demonstrating strong momentum.

4. The stock moves on its own drummer, rallying close to 150% while the broader market advanced just 23%.

5. Displays high relative strength, outperforming sector and index benchmarks.

6. Volume has dried up, indicating less supply coming to the market.

7. Significant volume expansion on the breakout.

Considerations: Despite a favorable technical setup, risk should be managed diligently given the stock's sharp ascent and potential for profit-taking. Establishing stop-loss levels and monitoring market conditions is essential.

This is another quintessential VCP breakout with a clear pivot entry and minimal risk. I’m starting to see increased traction in the market now—a very positive sign to scale up trading size.

TAPG (VCP 10W 18/4 3T)Position update: July 9, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook VCP setup with a clear, low-risk entry

3. Has absorbed its majority line of supply.

4. The stock moves on its own drummer, hitting an all-time high while the index struggles to reclaim its highs.

5. High relative strength.

6. Volume has dried up, indicating less supply coming to the market.

7. Strong fundamentals, with consistent triple-digit year-over-year earnings growth.

8. Significant volume surge on the breakout.

Considerations: Despite a favorable technical setup, risk should be managed diligently given the stock's sharp ascent and potential for profit-taking. Establishing stop-loss levels and monitoring market conditions is essential.

This is a quintessential VCP breakout with a clear pivot entry and minimal risk. I’m starting to see increased traction in the market now—a very positive sign to scale up trading size.

TAPG - VCP (11W 18/4 3T)IDX:TAPG - VCP

(+):

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (86).

8. There has been a significant breakout with substantial volume

**EPS Growth:**

a. Quarterly QoQ: -46.42%.

b. Quarterly YoY: +117.27%.

c. TTM YoY: +111.05%.

d. Annual YoY: +94.02%.

(-)

1. Trump Implements a 32% Increase in Tariffs on Indonesia

2. The market is volatile due to the ongoing war

$BSX VCP-style ascending triangleBoston Scientific (BSX)

Pattern

VCP-style ascending triangle. Three higher lows have squeezed price against the 108 ceiling while volume dries up each contraction.

Trigger & Risk Plan

• Buy-stop: 108.15 on ≥150 % average volume

• Stop: 102.00 (handle low / rising trend-line)

• Starter size only; add 25 % more if price closes above 110.50 the same day.

Reward Map

Measured triangle target 118 — followed by the cup-handle projection near 124-129 if momentum really kicks.

Why I Like It

• Relative strength already outperforming XLV and SPX.

• Medical-device peers SYK and MDT quietly firming — sector tailwind.

• “Overbought” RSI is a feature, not a bug, right before real breakouts.

Case Study: Banking a +7 % Pop on OLLI’s VCP/ Ascending TriangleMomentum in discount retail has been stealth-strong all quarter, so when Ollie’s Bargain Outlet (OLLI) flashed a textbook volatility-contraction break I pulled the trigger. Below is the full play-by-play, numbers included, plus the process tweaks I’m carrying into the next trade.

1. The Setup

• Pattern: VCP-style ascending triangle under 121 resistance

• Context: Post-earnings drift sideways, volume drying up each contraction

• Catalysts: Strength across discounters (DG, WMT, DLTR) and bullish seasonality

• Risk: 1 % of account, stop pre-defined at 115

2. Execution

• 20 Jun – Stop-limit filled at 121.01 once intraday volume hit 2.6× ADV

• 24 Jun – Trimmed 3 sh at 129.13 (+6.7 %) to “feed the monster” and recycle BP

• 30 Jun – Trailing stop (ratcheted daily) closed remaining 7 sh at 129.94

3. Results

• Gross P&L: +86.89 USD, +7.18 % on position

• R-multiple: +1.45 R on initial risk

• Expectancy (TraderSync): +3.83 % — proof the process carries a positive edge

4. What Went Right

• Bought only after volume confirmed the breakout

• Stop never widened—only tightened

• Early partial locked in reward and removed emotional pressure

5. Improvement Plan

• Keep a 10 % “runner” until first close below 10-EMA or heavy distribution day

• Back-test a +25 % add on day-two follow-through (+2 % price, >1.5× volume)

• Simplify order flow by defaulting to single OCO brackets

NASDAQ:OLLI

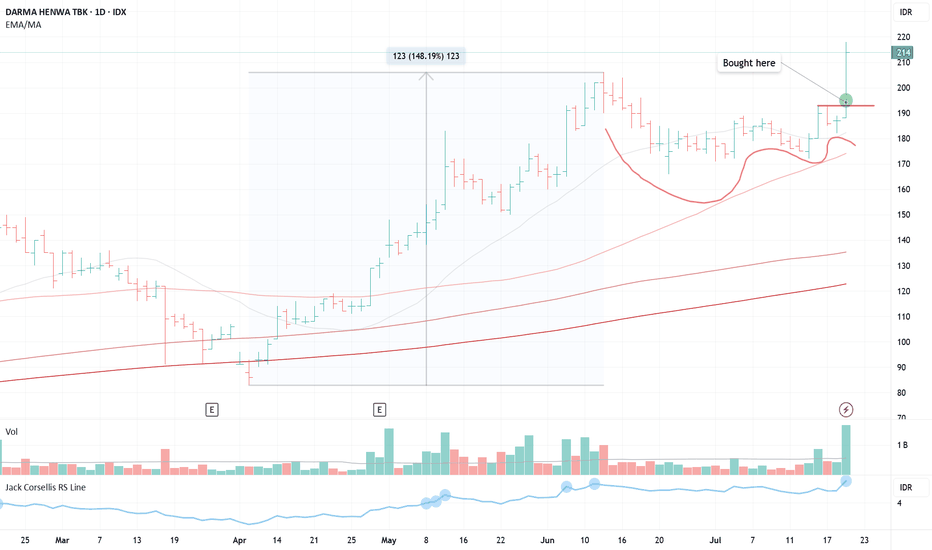

BNLI - VCP (11W 21/4 3T)IDX:BNLI - VCP

(+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (98).

8. There has been a significant breakout with substantial volume.

9. The price surged up by 150% and paused only for 24%, indicating a strong uptrend.

10. The stock is the leader of its sector.

**EPS Growth:**

a. Quarterly QoQ: +0.96%.

b. Quarterly YoY: -2.27%.

c. TTM YoY: +34.60%.

d. Annual YoY: +38.06%.

(-)

1. The major market is focused on Danantara and Hilirisasi stocks.

TRUK - VCP (118W 66/27 3T)IDX:TRUK - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (84)

9. Breakout with huge volume

(-)

1. There is nothing good with the fundamental

JARR VCP - (144W 80/28 4T)IDX:JARR - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (85)

9. EPS Growth:

a. Quarterly QoQ: +56.12%

b Quarrerly YoY: +255.56%

b. TTM YoY: +208.21%

c. Annual YoY: +237.44%

10. Breakout with huge volume

(-)

1. Nothing, just perfect :)

CARE - CUP WITH HANDLEPosition Update: May 16, 2025

Key factors:

1. Low-risk entry point.

2. Very clear bases with VCP characteristics.

3. A confirmed Stage 2 uptrend, indicating upward continuation.

4. The stock is outperforming, rising even as the broader market trends lower.

5. Displays strong relative strength against the market and peers.

6. Volume dries up suggests less supply coming to the market.

7. Many stocks start showing traction based on my own stock continuum.

Considerations: While the breakout was not accompanied by a significant volume surge, this development is occurring within the early stages of what appears to be a new bull market cycle. This macro backdrop may provide additional support and follow-through potential.

I’d like to see if it can hold up and follow through from here.

SAME - VCP (10W 25/5 3T)IDX:SAME - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (80)

9. 9. EPS Growth:

a. Quarterly QoQ: +852.30%

b. Quarterly YoY: +570.99%

b. TTM YoY: -3.34%

c. Annual YoY: -3.36%

(-)

1. Breakout with huge volume but long wick

Note: I will sell half if hit first Stop Loss, and sell remaining on the last stop loss on first cheat buy

MFIN - VCP (16W 41/18)IDX:MFIN - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (95)

9. EPS Growth:

a. Quarterly QoQ: +22.24%

b Quarrerly YoY: +185.92%

b. TTM YoY: +22.24%

c. Annual YoY: +23.08%

(-)

1. Breakout with red candle

2. Lack of liquidity

NICL - VCP (192W 82/24)IDX:NICL VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (93)

9. EPS Growth:

a. Quarterly QoQ: +45.05%

b. TTM YoY: +872.03%

c. Annual YoY: +1,029.03%

(-)

1. Breakout with low volume

ELPI (VCP - 26W 14/4 3T)Position update: March 25, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook double bottom with VCP characteristics.

3. Has gone through its majority line of supply.

4. Moving on its own drummer, the stock consolidates while the index suffers a terrible decline.

5. High relative strength.

6. Volume dries up as less supply coming to the market.

7. Strong fundamentals, with consistent year-over-year earnings growth.

Considerations: Despite these strengths, the broader market remains in a bearish phase, down over 20% from its all-time high. Geopolitical risks, persistent net foreign selling, declining investor confidence, and concerns over the government downplaying the stock market's significance continue to contribute to an unstable market environment.

NEST - CUP WITH HANDLEPosition Update: February 6, 2025

Key factors :

1. Low-risk entry point.

2. Very clear bases with VCP characteristics.

3. Has gone through its majority line of supply.

4. Moving on its own drummer, the stock price increased while the market crashing down.

5. High relative strength stock.

6. Volume dries up as less supply coming to the market.

7. The breakout was confirmed with a huge surge in volume.

Considerations : The current market environment remains challenging, with broader indices showing uncertain and inconsistent behavior. It is very few stocks that setting up decent bases.

I’d like to see if it can hold up and follow through from here.