Velocity

Analysis of BTCUSD levels of interest; suggested price Vmax zoneBulls will need to see this volume bar at continue to increase in magnitude. Failure to further develop the volume at the current spot price likely suggests pullback potential; pullback potential is limited, perhaps, to the next lowest volume profile peak circa ~56,965 USD. Notice, the 54,391.69 to 49,244.89 has notably low development on the volume profile; this low magnitude suggests that in the event of a pullback, price action will move with high velocity through this area. Peak velocity of price movement is expected to hit a Vmax at 52,630.94. However, this is better considered a price level of high importance, as it could easily also become a new support level, where buyers seek to buy BTC at a "discount," or, in stark contrast, breakdown into this level could potentially lead to a drawdown/correction - only time can tell. No recommendations. Not trade advice.

SPX SPY ES - Throw Over - SPX/M2 Money Stock For HK, this is the most important Chart we follow and obey.

The larger TF here - Daily - perfectly illustrates how Price moves

along a trend range... Until it snaps and collapses quickly.

This is precisely what we believe will occur in the next few weeks

or perhaps sooner.

We will see a sharp reversal with 2 distinct thrusts down as primaries.

Time is running out for the Buy Side.

What took months to build will be taken out quickly.

€40B Euros Pumped ETH Today have we found a new support lineI have found it amazing to watch such phenomenal amount of money pump into ETH, €40 Billion Euros pumped in today, but it is such a velocity that if this continued ETH would have a market cap as big as Bitcoin within a month, surely a correction must be imminent, if this is the top line for today, have we found our new resistance line for a short while for a breather? if ETH continues like this it will have a €700B Market cap in 10 days, that's ridiculous, my prediction is expect a correction. Just a reminder Im a newbie having fun, watching candles go up and down, I would be happy to buy some ETH at €2500. Not financial advice of course, enjoy this crazy ride.

Don't just look at M2, look at M2 relative to the Velocity of M2Looking at M2 it looks incredibly Inflationary but where exactly is that Inflation? So I had to dig deeper, if you look at M2V, the Velocity of M2 or in easier terms, the number of times that the average unit of currency is used to purchase goods and services within a given time period, you will notice a sharp decline in M2V accelerated by the pandemic crisis. Now if you look at the amount of M2 you have to consider for it to be inflationary, it also has to have a high velocity, or productiveness inside the economy. So if you now look at M2*M2V, the amount of M2 multiplied with it's velocity, the chart on the left, you see that relative to it's velocity M2 by far has not increased as dramatically as it seems if you just look at the amount. So if the amount of liquidity in the system increases but the realitve productivity of that money goes down it most likely is not as inflationary as you might think by only seeing the increased amount of liquidity. The crucial thing to watch is now if the increased amount of liquidity will increase in velocity which then very well can lead to a much higher inflation in cosumer goods. But keep in mind that there is a good chance a lot of the realitvely inactive money might has been inactive because it has positioned in equities and commodities, so if the economy now reopens some of that investments might be liquidated to consume rather than staying invested in financial assets, that not only concernes households but also small and medium businesses. So it is mostly crucial to keep a close eye on the M2V to see if actual consumer good inflation is to come or if this amount of liquidity will just keep raising the market to even more all time highs. This also coincides with yields which eventually can be very harmful for governments in huge debt, and as the fed has to rely on private banks to buy treasuries, which won't do that in the current extent, if real inflation is on the horizon, soly because they would loose a lot of money holding most liquid assets like treasuries or reserves, the fed won't be able to continue buying so much of the government debt causing the government to find someone else to buy it or to force public savings institutions into buying it by else going bankrupt out of inability to service it's debt.

Velocity is breaking our of the ascending triangleNYSE:VEL is breaking our of the ascending triangle. Anticipated price action and targets are shown on the chart. Closest stop level at 5.4$ or ideally at 4.65$.

Hit the like button please if you find this useful :)

This is only my own view and not financial advice, do your own analysis before buying or selling

Happy Trading!

M2 Supply * M2 Velocity = GDP, Right?Hey y'all, Somebody care to explain the anomaly of 2020 here?

This has never happened in the 40 years of data here, maybe it happened sometime before. What has the FED f up now? And what does it mean? As I see it either the dollar gives up and goes full kenukistan, or GDP Goes down again. They can also try to print this s away, however it seems that by printing they will further decrease velocity, as it doesn't really translate to inflation, except in the stock market. Which everyone ofcourse knows what a joke it is. I just hope one day some of us may have the balls, and the wisdom to short the thing at the right time.

Anyhow, really interested if anyone out there has a say on this matter?

LINK - Good entry point coming soon?I'm ready to start making gains on $LINK again, I don't know about you guys. We've got favorable conditions for some profit over the next month if things play out accordingly.

As always, DYOR, but the way things are looking on the daily, in my opinion LINK is continuing it's consolidation with slowing velocity and unless the price closes well below support or reverses direction, a breakout is likely. Not ready to test the ATH I don't think. Outside of centralized exchanges, there is much interest in X:LINK Liquidity Pools, with a favorable amount of ETH -> LINK swaps.

With support at $9.48 I think the week of 2-OCT-2020 -> 12-OCT-2020 will present a good buying zone for future profits. Judging by the loss of velocity in price decline over the last two waves, I've arrived at the point I have, turns out that a 38% decrease in velocity over 19 bars pretty much hits the established support; also a good sign when a little math coincides with what's on the chart.

I'll be keeping my eye out closer to the 12th for an entry below $9.

This is not financial advice, DYOR (Do your own research): I am just a walking, talking bag of meat. You wouldn't take financial advice from a walking, talking bag of meat would you? I didn't think so.

The velocity of money is plunging so let's make some coin off itHardly surprising though, this has taken place whenever GDP contracts & unemployment increases as it certainly will this year. I think one would suspect that this could lead to risk of deflationary effects - which I know sounds odd when one thinks and sees first hand the rampant money printing and radical expansion of money supply, and inflation increasing. I am still heavily biased towards inflation arising over the next few years, with rates eventually rising to combat inflation - but I do want to be on the lookout for any hints as swiftly as possible that my ideology may be wrong.

I suspect this drop within the velocity of money is especially pronounced in hospitality industries, restaurants, hotels, aerospace, airlines, tourist destinations - where capital is not being exchanged as freely. We also have unemployment up so some individuals simply are being much more wary of purchasing wants, with potential needs still needing to be met on the horizon.

I think mfg's as well have had supply issues coupled with demand issues, with inventories only now ramping back up. With the low demand, and low supply this is a sour recipe that creates less opportunities for transactions, again hurting the velocity of money.

What does all of this mean? I think one needs to carefully weigh the proper strategies in the event inflation or deflation where to occur. In the event of the dreaded stagflation again, the writing will be more clear if that is to occur, but again we need to plan accordingly and develop strategies for each.

A simple strategy I am doing even outside of the fixed income corporate debt/Div yield strategies etc is within actual real estate.

If one were to acquire a home in this environment and inflationary affects play out, you essentially get to double dip on the inflationary affects in a favorable manner. the devaluation of the dollar will be an effect of the inflation. What does this mean for your mortgage?

The dollar amount of the debt side of the mortgage will decrease in value, relative to the purchasing power of the dollars within the debt. The debt itself gets eroded away from inflation. Very favorable if you have debt.

We want equity with debt of course though. And much more equity relative to the volume of debt. The equity of the home will actually be continuing to rise because the value of dollars continuing to loose value will require more dollars to purchase the same amount of equity - meaning the equity increases in terms of dollars.

So inflation will result in the loan decreasing in a dollar weighted comparison, while the equity in the home will increase because of the dollar's devaluation.

Equity relative to a home is one thing, but this comparison can be made with equities (stocks) as well, but I think the home comparison may be helpful in getting my logic communicated clearly.

Again, this does not mean to go wild longing equities - just like you do not want to go wild and start buying junk houses in the middle of Antarctica

We need to be tacticians with finesse

***If you have a great strategy please be sure to share it with me.***

MZM Money Supply and VelocityMZM money supply is M2 Money supply less small-denomination time deposits plus institutional money funds.

Recall that M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks

& Recall that M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

MZM Money supply is at ATH which generally makes sense. As time goes on more printing will occur.

The 'scary' thing about this chart is that MZMV, the velocity of this very broad money supply, is now <1.

That means every dollar is used in transaction <1 time per unit time... an all time low!

Velocity of Money (M1 and M2)M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks.

M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

Velocity of money signaling economic depressionM2 money velocity is considered the pulse of an economy. This metric refers to the number of times a unit of currency changes hands between people and businesses.

As you can see, the velocity of money has been nosediving for decades. This is the story of the real economy, not the financially engineered stock market.

Notice that as interest rates began to normalize, the velocity of money saw some relief in its drastic fall. There's no doubt it will continue falling as interest rates move lower once again.

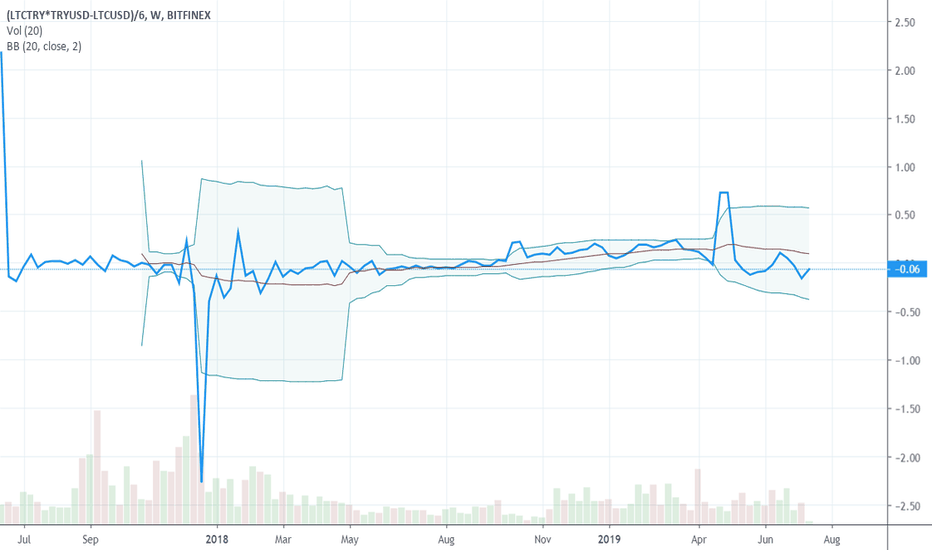

Velocity of LTC in real timeMany peaple not understanding derivative in calculus, them a show that is a velocity of coin´value. maybe in line graph is more easy to see. i chosse turkshi cause is more away of usa. i belive that gmt is a phase of real global price in a absolute time.

VelocityShares (ETF:TVIX)(NASDAQ) Buy Limit $25.02 >>> $25.63NASDAQ:TVIX

VelocityShares Daily 2x VIX Short-Term ETN (TVIX)

---

Buy Limit 1 - $25.02

Take Profit - $25.63

Stop Loss - $24.27

------

Take Profit = +2.44%

Stop Loss = -3.00%

AMD Momentum Run, Velocity Run, Profit-takingAMD has run with momentum driven by pro traders’ activity. The Pros will often be the initial driving force behind a Velocity run (see rectangle around the velocity run.) A velocity run is different from a momentum run as the candles do not overlap. One thing for options traders to remember is that when pro traders are swinging a giant lot trade for a short-term profit, they will often buy Option Puts as an insurance policy against the risk. So rising Option Puts doesn’t mean that the “options market thinks this stock will go down.” Rather, a surge of options puts with a velocity run is indicative of pro traders.

Currently the stock is under heavy large-lot profit-taking. Smaller funds are buying too late in the run.