GBPJPY - SAME AS USDJPY GOING DOWN - KEEP SELLING From my viewpoint, the GBP/JPY pair has recently exhibited a notable bearish trend, reaching an eight-week low which suggests additional caution in the short term. Monitoring key support levels like the 185.63 area and the psychological level of 185.00 is crucial for planning trading strategies. I am watching for a potential technical shift towards a more pronounced bearish trend, especially if the pair closes below 181.80, which could reinforce the bearish outlook.

Furthermore, economic news and political events from Britain and Japan could impact the GBP/JPY pair, so I am closely following upcoming announcements from the Bank of Japan and key economic indicators from the UK. Any signs of a shift in monetary policy or unexpected economic data could act as catalysts for increased volatility. I maintain a balanced approach, combining technical analysis with fundamental developments to form a comprehensive market view and be prepared to adjust my positions according to market fluctuations.

SEE MY ANALYSIS ON THE CHART:

drive.google.com

40 PIPS RUNNING DOWN PROFITS ON THI ONE:

drive.google.com

Ventas

USDJPY - BEARS ALREADY KILL BULLSThe USD/JPY pair closed bearish on Friday, with the dollar trading below 150 yen due to growing concerns about a weakening global economic outlook. This bearish trend was influenced by cooler-than-expected U.S. inflation data and expectations of a potential Federal Reserve rate cut in the future.

Looking ahead to next week, forecasts will likely consider the current economic indicators and central bank policy expectations. The market is pricing in rate cuts by the Fed by December 2024, which has contributed to the dollar's weakness and may influence the trend for the next week. Investors will be monitoring these developments to anticipate the USD/JPY pair's direction.

"And it perfectly fulfilled the idea that we had outlined."

drive.google.com

drive.google.com

USDJPY - BEARS WILL KILL BULLS?The current trend of the USD/JPY is showing bearish signals as it is trading in a bearish zone below the levels of 151.00 and 150.70. There was a break below a major bullish trend line with support at 151.65 on the hourly chart, indicating that the pair is declining and exhibiting bearish signs below the 151.00 level.

Regarding consolidation, the USD/JPY is expected to maintain a narrow consolidation within the 151.10 to 151.90 range during the day. There is strong resistance around 151.90 and key support between 151.10 and 151.20. If the pair breaks below this key support area, the adjustment could be halted for the week.

However, the USD/JPY has managed to stay above the psychological level of 150.00 and has shown intraday gains around the mid-150.00s, staying above the 100-period Simple Moving Average (SMA) on the 4-hour chart. Furthermore, a recovery above 150.91 could renew buying interest, targeting the 151.00 level and potentially retesting the year-to-date high at 151.91.

In summary, the current trend shows a mix of technical signals. While there is bearish pressure below key resistance levels, the pair's ability to stay above 150.00 and potential buying interest above 150.91 suggest there could be short-term recovery opportunities. As always, future movements will depend on a variety of factors, including economic developments and market news.

drive.google.com

drive.google.com

drive.google.com

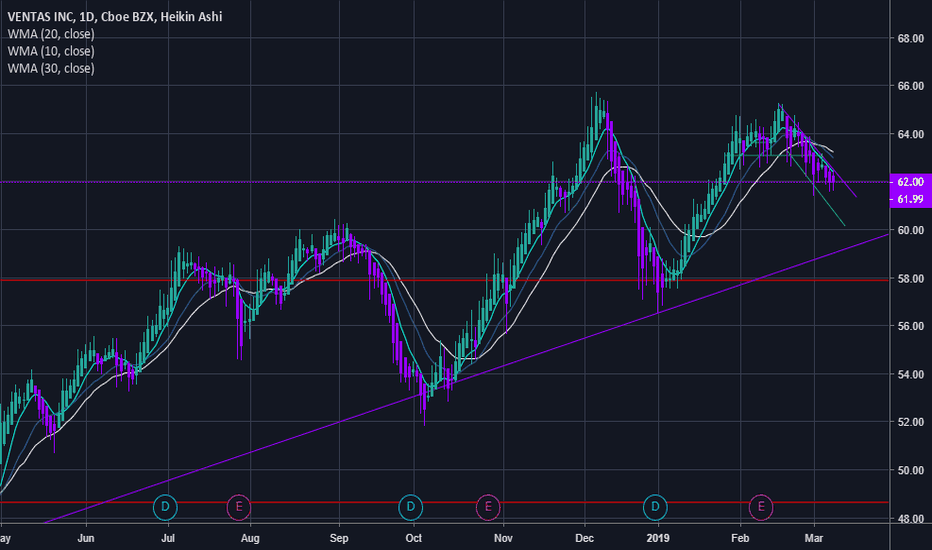

PREDICTION 1 - USA STOCKS - VENTAS INC. -VTR - PROFIT = 5,90%Hi Followers,

Welcome to my page,

I will be posting 10 charts on USA #STOCK #MARKET this month.

Using a Unique Technical Analysis, invented by me.

Later one, if charts work on stocks, later I will talk more about it.

As far as our technical Analysis is identifying there is a big possibility that this company is oversold, and that a double bottom just happened, which opens a trade opportunity.

This could be an over 5% profit trade and could end between Dec 15th to Dec 31.

The company #Ventas Inc. - #VTR #NYSE is an S&P 500 company #SPX500, is a leading real estate investment trust. Its diverse portfolio of approximately 1,200 assets in the United States, Canada, and the United Kingdom consists of seniors housing communities, medical office buildings, university-based research and innovation centers, inpatient rehabilitation and long-term acute care facilities, and health systems. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development, and advisory services to highly rated hospitals and health systems throughout the United States. References to Ventas or the Company mean Ventas, Inc. and its consolidated subsidiaries unless otherwise expressly noted.

Good Luck and Good Profit

USDCHF SHORTUSDCHF OFERTA MENSUAL EN CONTROL, SEMANAL EN CONSOLIDACIÓN.

VENTAS EN ZONA DE OFERTA 4H.

DE SER ELIMINADA ASUMIMOS LA PERDIDA Y ESPERAMOS (A CONFIRMACIÓN) VENTAS EN LA ZONA DE OFERTA DIARIA. a CONFIRMACIÓN PORQUE ESA ZONA HA SIDO TESTEADA VARIAS VECES, ALTAS POSIBILIDADES DE SER ELIMININADA.

SI ERES UN TRADER AGRESIVO PUEDES VENDER DESDE QUE LLEGUE EL PRECIO A LA ZONA DE DESEQUILIBRIO EN 4H O ESPERAR CONFIRMACIÓN SI ERES UN TRADER MÁS CONSERVADOR.

Lo que yo estoy viendo en el BitcoinLas zonas de control a bajas temporalidades me muestran falla alcista, por lo cual estimo que el patrón bajista aun continua. Leo opiniones en los comentarios. La zona de fuerte resistencia indicada en el gráfico es vulnerable temporalmente de cancelarse la proyección bajista.