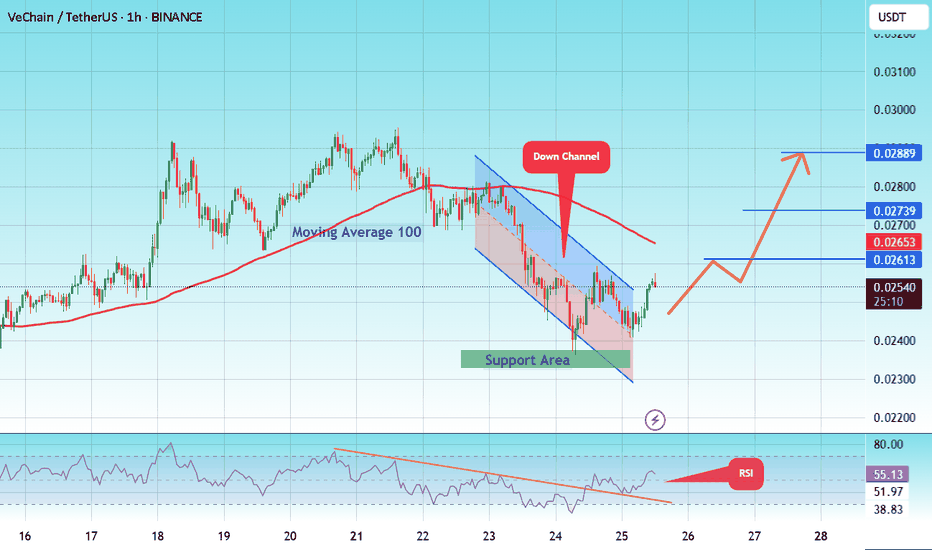

#VET/USDT – Falling Wedge Breakout?#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.02310, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.02360.

Entry price: 0.02545

First target: 0.02613

Second target: 0.02739

Third target: 0.02889

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Vetbtc

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02086.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02160

First target: 0.02226

Second target: 0.02274

Third target: 0.02344

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02456.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02480

First target: 0.02530

Second target: 0.02565

Third target: 0.02612

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.02750, which acts as strong support from which the price can rebound.

Entry price: 0.02936

First target: 0.03070

Second target: 0.03200

Third target: 0.03391

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.02600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02750

First target: 0.02838

Second target: 0.02908

Third target: 0.03000

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.02460.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02620

First target: 0.02700

Second target: 0.02765

Third target: 0.02853

VETUSDT on the Edge – Is a Major Breakdown Coming?Yello! Is VETUSDT on the verge of a bigger drop, or could a reversal be in play? The price action is signaling a critical moment, and traders need to stay sharp. A major move is brewing let’s analyze the setup.

💎#VETUSD remains under strong bearish pressure, repeatedly rejecting from the descending trendline and key supply zone. Price is also trading below the 200 EMA, reinforcing the bearish momentum and signaling that sellers remain in control. Until VET reclaims $0.02695, the risk of further downside remains high.

💎The next major support level to watch is $0.02117, where a temporary bounce could occur. However, if selling pressure continues, VET is likely to push lower toward $0.01906, a historically strong accumulation zone. This level will be crucial either it holds as a buying opportunity, or we see deeper downside continuation.

💎For the bulls to regain control, it must reclaim $0.02695 and break past the supply zone. A sustained push beyond $0.025, combined with strong buying momentum, could indicate the start of a recovery. However, a true trend reversal will only be confirmed if NYSE:VET closes above $0.02695 and reclaims the 200 EMA, invalidating the bearish setup and signaling bullish strength.

Patience is key, Paradisers. The market rewards those who wait for confirmation instead of chasing every move.

MyCryptoParadise

iFeel the success 🌴

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.02666

Entry price 0.02950

First target 0.03080

Second target 0.03200

Third target 0.03300

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.02630

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2700

First target 0.02810

Second target 0.02920

Third target 0.03064

VET buy/long setup (4H)VET appears to be bullish.

We are seeing higher lows within the RANGE.

It can move from the demand zone toward the targets on the chart.

A liquidity pool is also visible on the chart, which we have marked.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.03165

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.03342

First target 0.03500

Second target 0.03712

Third target 0.03979

#VET/USDT lONG Ready to go higher#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.04570

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.04670

First target 0.04860

Second target 0.05180

Third target 0.05546

#VET/USDT #VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.04111

Entry price 0.04407

First target 0.04640

Second target 0.04860

Third target 0.05090

#VET/USDT Ready to go up#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.04900

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.05160

First target 0.05317

Second target 0.05633

Third target 0.06000

#VET/USDT Ready to go up#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.03870

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.04200

First target 0.04416

Second target 0.04597

Third target 0.04209

#VET/USDT#VET

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in green at 0.02200

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, upon which the price is based higher at the discount

Entry price is 0.02312

The first target is 0.02750

The second target is 0.03070

The third goal is 0.03440

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.02200

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02430

First target 0.02300

Second target 0.02362

Third target 0.02425

VECHAIN another failed blockchainThis chart is of #VET priced in #BTC

A massively hyped supply chain project.

Another problem that didn't need solving by cryptography.

The chart has a massive head and shoulders is below a major previous low

and after this bull run, I can envisage losing more value.

#FinancialDamage

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the ascending channel and we are now touching this support at a price of 0.02250

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02277

First target 0.02330

Second target 0.02400

Third target 0.02457

VeChain green area to refill your bag before the alt seasonVeChain is an established blockchain that has evolved well, following trends and demonstrating a significant pump capacity when you look at its past price action. Additionally, this coin does not have any VC unlocks, and most of its supply has already been unlocked.

However, I do not like how they embrace the carbon/save the planet from climate change ideas. I am quite frustrated by all this nonsense, woke socialist ideas. We are here to make money and create new tools in a new industry; who cares if it emits carbon or not? The whole climate change vs. crypto debate is highly hypocritical and political.

This is a red flag for me, so I do not invest in this coin. However, some friends and people I respect in the crypto community are all over this project, so here is my entry point.

VeChain is still in consolidation and has not reached the bottom of it. It will likely continue to go down, and a good price to hold for the upcoming altseason is 0.023-0.025. Ideally, 0.020 would be perfect, but I am not sure if that opportunity will come again. Anyway, this coin will probably do x2-x5 in the next few months, so it's not a bad deal compared to what banks can offer for your money.

DYOR.

VET - 900% Potential in the bull run, get ready now. #VET/USDT #Analysis

Description

---------------------------------------------------------------

+ VET has reached the support trendline and price is expected to consolidate in this area.

+ Once the price reaches this are, i'm expecting it to bounce back, this gives us good opportunity for a trade with huge profit potential.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 0.021038 - 0.025285

Stop Loss: 0.017169

------------------------------

Target 1: 0.033475

Target 2: 0.049533

Target 3: 0.060345

Target 4: 0.083920

Target 5: 0.118305

Target 6: 0.181948

Target 7: 0.246760

------------------------------

Timeframe: 1W

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo