#VET/USDT – Falling Wedge Breakout?#VET

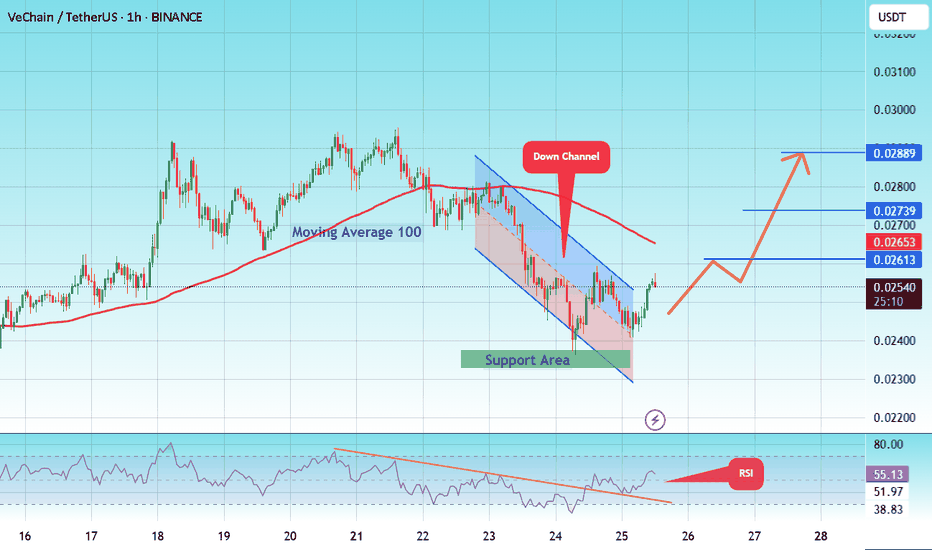

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.02310, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.02360.

Entry price: 0.02545

First target: 0.02613

Second target: 0.02739

Third target: 0.02889

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Vetusd

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02086.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02160

First target: 0.02226

Second target: 0.02274

Third target: 0.02344

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.02456.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.02480

First target: 0.02530

Second target: 0.02565

Third target: 0.02612

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.02750, which acts as strong support from which the price can rebound.

Entry price: 0.02936

First target: 0.03070

Second target: 0.03200

Third target: 0.03391

Check if it can break through 0.03779-0.04757 at once

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(VETUSDT 1W chart)

Support zone: 0.00440-0.101741

Resistance zone: 0.03779-0.04757

If it breaks through the resistance zone upward and maintains the price, it is expected that a step-by-step uptrend will begin.

Therefore, it is important to check whether there is support around 0.03779-0.04757.

-

(1D chart)

The key is whether it can maintain the price by receiving support near the M-Signal indicator on the 1M chart and rising to around 0.03779.

If it fails to rise, you should check for support near 0.02778.

If it falls below the 0.01741-0.2135 range, you should stop trading and watch the situation.

Therefore, the 0.01741-0.2135 range is an important support range from a short-term perspective.

-

The 0.03779, 0.04757, and 0.06603 points are important points as HA-High indicator points on the 1W, 1M, and 1D charts.

It is expected that a breakout trade will be possible when it breaks through the 0.03779 point, but since an important point is located before it rises much, the point to watch is whether it can maintain the price by rising above 0.04757 at once.

Therefore, when making a breakout trade, check if it rises above 0.04757, and if not, respond.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.02600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02750

First target: 0.02838

Second target: 0.02908

Third target: 0.03000

#VET/USDT#VET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.02460.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02620

First target: 0.02700

Second target: 0.02765

Third target: 0.02853

VeChain: Struggling…VeChain is struggling to stay above the key support at $0.018, but the anticipated low of the orange corrective wave ii should form above this red line – or may have already done so. Once the bottom is indeed settled, we expect the orange wave iii to break out impulsively, pushing well beyond the $0.08 resistance, where the entire orange five-wave move should ultimately complete the blue wave (iii). However, if VET falls below $0.018, the broader green wave alt. will reach a new bear market low (probability: 38%). Primarily, we consider wave as already finished.

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.02666

Entry price 0.02950

First target 0.03080

Second target 0.03200

Third target 0.03300

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.02630

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2700

First target 0.02810

Second target 0.02920

Third target 0.03064

VET buy/long setup (4H)VET appears to be bullish.

We are seeing higher lows within the RANGE.

It can move from the demand zone toward the targets on the chart.

A liquidity pool is also visible on the chart, which we have marked.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

VeChain: Down AgainAfter a brief recovery, VeChain is trending lower once more. The low of the orange wave ii from early February is approaching but shouldn’t be undercut for the structure of the orange impulse wave iii to remain intact. Soon, we expect a decisive and sustained breakout of this wave iii above the resistance at $0.08. As a mid-term target, the entire orange five-wave sequence should ultimately complete the blue wave (iii).

#VET/USDT#VET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.03165

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.03342

First target 0.03500

Second target 0.03712

Third target 0.03979

VTHO could spike 150% VTHO spike roughly 400% last Tuesday because of new token list to Korean exchange which catch my attention. I watched this chart for week and I believe this could spike another 150% if Big whales step in the buy zone or announcements.

I believe .007 is heavy resistance zone worst case if reject at, fail to reach, or BTC/ETH dump occur then I'll cut position and move on from this token.

VTHO must hold at around .005.

Just sharing my ideas. I do not provide financial advice and I am not a qualified licensed investment advisor. I'm just trading here as my side hustle.

#VET/USDT lONG Ready to go higher#VET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.04570

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.04670

First target 0.04860

Second target 0.05180

Third target 0.05546

#VET/USDT #VET

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.04111

Entry price 0.04407

First target 0.04640

Second target 0.04860

Third target 0.05090

VETUSD H2 Best Level to BUY/HOLD +80% gains🔸Hello guys, today let's review 2hour price chart for VET. Outlook remains bullish currently pullback in progress, however buying low still is a perfect trade setup.

🔸VET is currently re-accumulating for a re-test of recent high set at 0.075. risk/reward shifts in bulls favor towards range lows of the recent range set at 0.04.

🔸Recommended strategy bulls: Price action contained within bullish channel. get ready to buy low near 0.04, TP is 0.075USD +80% gain. BUY/HOLD setup for patient traders.

🎁Please hit the like button and

🎁Leave a comment to support our team!

RISK DISCLAIMER:

Trading Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.