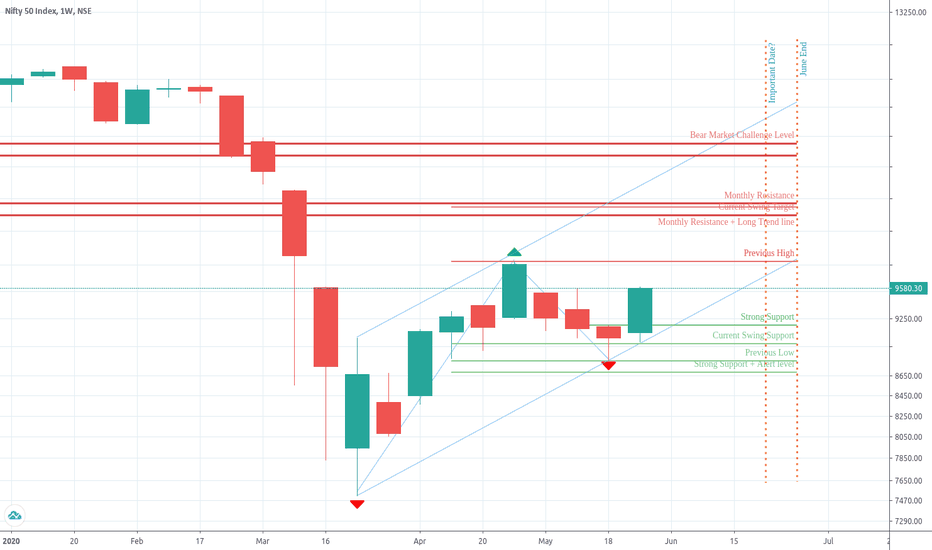

NIFTY monthly view June 2020Dear traders,

I had posted my monthly view on March 27

Now things have moved enough to create a monthly view for June.

There are two things I want to mention which I try to tell myself every single day

Technical Analysis if just a way of logical thinking and deciding your own course of action amidst market uncertainty. These lines , averages and indicators are there to keep your emotional mind in check when the market makes random movements. Market defines these lines, it does not obey these lines.

There is no point in making predictions and certain about it, but there is a lot of value in developing an independent view based on your observations and loosely adhering to it.

This is my monthly view. It helps me to trade on smaller time frames.

I observe the following things from the chart.

Intermediate bottom is well established. The downswing above it created another higher bottom in the week of 18th May, which is yet to be confirmed.

NIFTY is now in the process of making an upswing and likely to break/touch intermediate top of 9989.

Volatility has dropped from 80 to 30s.

The stimulus package is behind us. COVID-19 is no longer a sudden shock. The world has started understanding more about the virus.

All developed country governments are pushing a lot of money to the system. For Indian markets, the view is likely to be uncertain for some time.

Now I’ll express my trading point of view.

I still believe we are in a bear market. That is significant price / time deterioration is likely to occur in the current wave of selling. I will reconsider my view when NIFTY sustains above 11200-11400 level.

One of the characteristics of bear market is it contains very strong rallies, which creates doubts in the mind of players having ‘bearish view’. I think NIFTY may just do that in the coming days. I don't know where NIFTY will head, but the trend is bullish on daily and weekly timeframes, and mostly the trades should be on the long side.

The current rally gets confirmed in the coming week by sustaining above 8978 and 9178.

In the current state, I won't be shorting NIFTY till I see some kind of range formation or breakdown.

If current upswing is very fast and very audacious in breaking resistance levels - like rising too quick and breaking barriers which everyone watches - 10000, 11000, it will further confirm my view of it being a bear market rally. If it is a slow grind with retracement, I have to reform my view.

What can change?

There are multiple types of information.

Information known to everyone.

Information known to very few.

Information unknown to everyone.

If there is some risk which is unknown to everyone, then the market structure alters dramatically. The first two kind of has not much impact on the structure

I'll review the structure again if and when this kind of information comes to me.

That's all! Wish a great trading weeks ahead!

View

EUR/GBP Bullish View by ThinkingAntsOk🔸 4H CHART EXPLANATION:

.

🔸 We have two potential scenarios to consider on this pair.

.

🔸 The bullish one, in case price breaks the Resistance Zone, this could lead to a bullish move towards the next zone at 1.31500.

.

🔸 And the bearish, in case price breaks the Ascending Trendline to the downside, this could lead to a bearish move towards the Support Zone at 1.2200.

.

🔸 Will look for a lower timeframe setup when the direction is clear.

🔸DAILY CHART ANALYSIS:

EUR/USD Bullish View by ThinkingAntsOk🔸 4H CHART EXPLANATION:

.

🔸 Price broke the Descending Trendline.

.

🔸 After that, it consolidated on a Descending Wedge, which was broken to the upside.

.

🔸 At this moment price is facing the Resistance Zone at 1.09800, which, if it is broken, it has potential to reach the next zone at 1.1200.

.

🔸 Will look for a lower timeframe bullish setup.

🔸DAILY CHART ANALYSIS:

AUD/USD on a Reversal Zone by ThinkingAntsOkDAILY CHART EXPLANATION:

🔸 "AUD/USD On the Reversal Zone":

.

.

🔸 Price has been on a downtrend for more than two years.

.

🔸 It is now facing the bottom of the Descending Channel, which is a reversal level.

.

🔸 Be careful, we are considering this level as a rejection zone but just for a retracement of the downtrend, this is not a trend change.

.

🔸 Will look for a lower timeframe bullish setup.

🔸 4H CHART ANALYSIS:

Long Term Analysis on NZD/USD by ThinkingAntsOk🔸 "NZD/USD Long Term View" Weekly Chart:

.

.

🔸 Price is facing the Weekly Support Zone.

.

🔸 If it bounces here, it has potential to reach the Descending Trendline.

.

🔸 If the Descending Trendline is broken, then the next target zone is the Resistance Zone.

.

🔸 We are waiting for a lower timeframe bullish setup to get involved on this pair.

🔸 DAILY CHART ANALYSIS:

USD/CAD Bullish View by ThinkingAntsOkDAILY CHART EXPLANATION:

🔸 "USD/CAD Breaking the Downtrend" Daily Chart:

.

.

🔸 Price has been on a Descending Wedge for more than a year.

.

🔸 It has broken the Descending Trendline of the Wedge today.

.

🔸 We consider it has potential to reach the Resistance Zone at 1.35300, and, if this zone is broken, then the next target is the Resistance Zone at 1.36500.

.

🔸 We are waiting for a lower timeframe corrective move to get involved on this pair.

WEEKLY CHART ANALYSIS:

EURUSD short (Longterm Analysis, Supply Demand, Trend Line)Hello Traders !

Today I would like to share my long term analysis for EURUSD on the daily chart .

We can see that this pair is in an overall downtrend. Price made a correction move and broke it. I expect now the continuation of the downtrend.

Of course we could see a retest of the trend line but we need to wait how the daily is closing. It looks like we are forming a new Supply/Demand Zone .

I expect on EURUSD a big short on the long term view.

For a nice Scalp Trade we need to look at the lower timeframes to see some confirmations.

Let me now in the comment section below your view on EURUSD and what you think about my Analysis.

Please leave a Like

Thank you and we will see next time

- Darius.