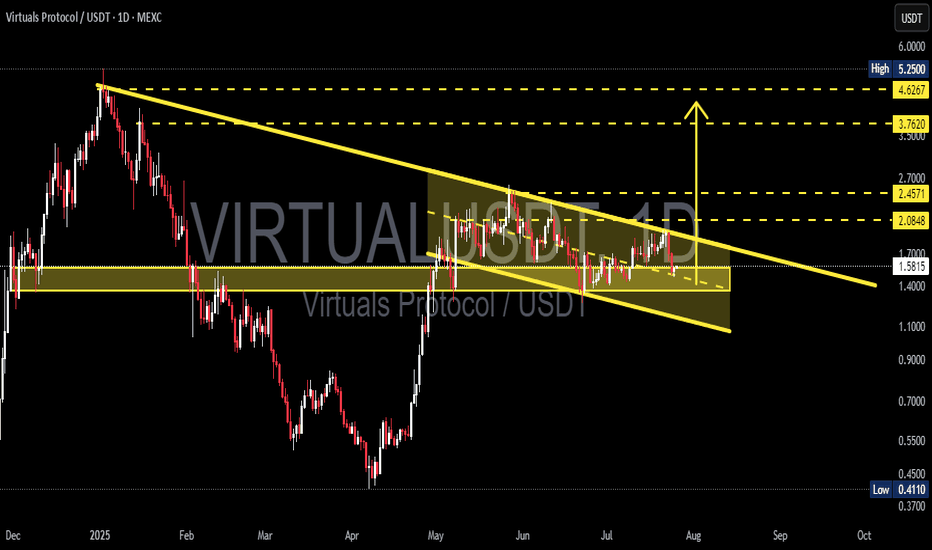

VIRTUALUSDT – Is the Wedge Nearing Its End? A Breakout Could!⏳ Current Situation:

VIRTUALUSDT is approaching a crucial moment after months of sideways price action. Following a steep decline from its all-time high ($5.25), price action has formed a Falling Wedge pattern — a well-known bullish reversal formation.

Now, as price consolidates toward the wedge's apex, the potential for a breakout grows stronger with each passing day.

---

📌 Pattern Structure:

Pattern: Falling Wedge (Bullish Reversal)

Duration: Since May 2025 (multi-month)

Support line: Ascending slope, catching lower dips

Resistance line: Descending pressure trendline

Price action: Trapped inside the wedge, signaling accumulation and shrinking volatility

This structure suggests that a large move may be right around the corner.

---

🔼 Bullish Scenario (Breakout):

If VIRTUALUSDT successfully breaks above the upper wedge boundary (~$1.70), the following key resistance levels could become major bullish targets:

1. $2.08 – Initial breakout confirmation level

2. $2.45 – Key resistance zone; breakout could accelerate here

3. $3.76 – Strong historical supply area

4. $4.62 – Major previous resistance

5. $5.25 (ATH) – Long-term bullish target if strong momentum follows

💡 Tip: A volume spike on the breakout adds confirmation and reduces the risk of a false breakout.

---

🔽 Bearish Scenario (Breakdown):

If the price fails to break out and instead falls below the wedge support (~$1.40):

1. Look for support near $1.20 – $1.10

2. Further downside could lead to $0.70 – $0.50

3. The ultimate support lies around $0.41, the current all-time low

⚠️ Note: A breakdown without volume can be a fakeout. Always wait for confirmation.

---

🎯 Conclusion & Strategy:

> VIRTUALUSDT is coiling inside a falling wedge pattern — typically a prelude to an explosive move. Whether bullish or bearish, the breakout direction will offer a strong trading opportunity.

Suggested Strategy:

Watch for breakout + volume confirmation before entering

Place tight stop-loss below wedge support if buying the breakout

Set tiered take-profits based on horizontal resistance zones

#VIRTUALUSDT #AltcoinBreakout #FallingWedgePattern #CryptoSetup #BullishReversal #BreakoutWatch #AltcoinAnalysis #CryptoTechnical #VolumeBreakout

Virtual

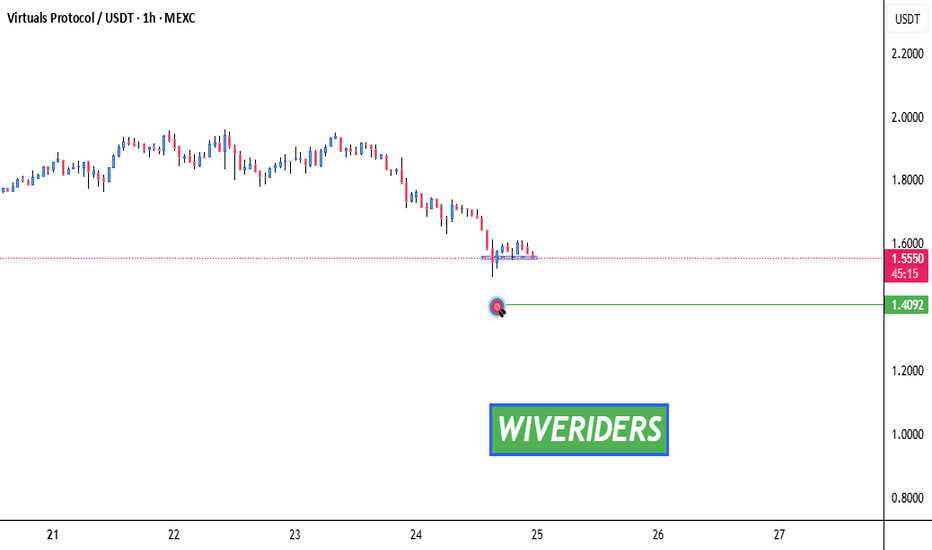

Testing Blue Support – Key Level Ahead!🚨 SPARKS:VIRTUAL Testing Blue Support – Key Level Ahead! 📉🔵

SPARKS:VIRTUAL is currently testing the blue support zone.

📊 If a breakdown occurs, we could see a move toward the green line level as the next target.

🛑 Watch for confirmation — this could signal further downside if sellers take control.

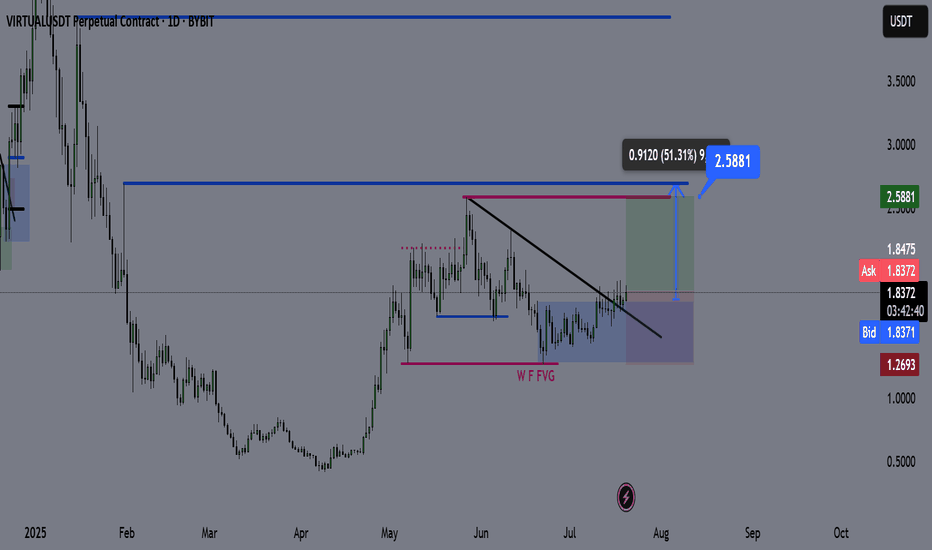

Virtual Coin – Technical Outlook & Trade Plan🔍 Technical Analysis

✅ Price has broken and closed above the bearish trendline, indicating a shift in market structure.

✅ It’s currently consolidating above the trendline, and each retest is showing strong bullish reactions.

✅ The bullish daily demand zone is holding aggressively, reinforcing upward momentum.

I do not expect a significant retracement from here until we reach the purple line (2.59). The current structure suggests price wants to seek higher liquidity.

📌 Trade Plan

Entry: Current market (above trendline + demand zone reaction)

Take Profit (TP): 2.59 (Purple Line)

Stop Loss (SL): 1.26 (Daily Close Below)

📊 Bias: Bullish

🕰️ Timeframe: Daily

📍 Invalidation: Daily close below the demand zone and trendline support

💬 Feel free to share your thoughts or ask questions below!

VIRTUAL – Setting Up for a July Breakout - $4 in the Horizon!

Another coin worth bidding on: $VIRTUAL.

It's setting up nicely above the mid-range of the current trading range, with a clean S/R flip off the previous cluster zone.

The 3-day MA is holding well, and the downtrend from the local highs is set to expire on July 6th.

Expecting a strong trend to kick in during the second week of July, with potential to push toward the $4 mark.

VIRTUALUSDT Forming BullishVIRTUALUSDT is showcasing a powerful bullish structure after a prolonged accumulation phase near the $0.80 to $1.00 support zone. The breakout from this accumulation base has resulted in a parabolic move, confirming a strong shift in trend. Currently, the pair is forming a bullish continuation pattern, with high volume inflows suggesting increasing investor confidence. The recent consolidation above previous resistance is a positive signal for trend continuation, and technical targets show potential for a 120% to 130% upside in the coming sessions.

The setup aligns with classic market psychology, where a strong move is often followed by a period of profit-taking before the next leg higher. The technical projection zones around $2.60 to $3.00 are realistic based on the depth of the prior impulse move. Furthermore, VIRTUALUSDT is gaining traction in the DeFi and virtual asset space, with its protocol generating buzz in 2025's altcoin resurgence. This combination of narrative and chart structure makes it a potential top mover.

From a risk-reward perspective, this pair presents a favorable long entry with minimal downside if stop losses are positioned just below recent swing lows. As the broader market recovers, strong technicals like these could deliver amplified gains compared to average tokens. It's worth noting that smart money often positions itself before explosive runs—and this chart suggests accumulation has already occurred.

Investors and swing traders should keep this pair on their radar as it continues to carve higher highs and higher lows. If momentum persists, VIRTUALUSDT could become one of the standout performers in the altcoin space this quarter.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$VIRTUAL Breakout Alert!!A clean inverse head and shoulders pattern has just triggered, and we’ve already seen a strong breakout above the neckline!

This is a classic bullish reversal signal, and the chart is screaming momentum

🟢 Key Levels:

• Entry around the neckline breakout

• Targets lined up: $2.36, $2.59, and $2.89

• SL below right shoulder: $1.91 for risk control

The 200 EMA is now sloping upward — further confirmation of trend shift!

VIRTUAL TA Masterclass — Elliott Wave Meets Gartley HarmonicVIRTUAL has been on fire! Printing a clean 5-wave Elliott impulse with a +431% run in just 33 days. But after every strong trend comes a healthy correction, and that’s where we likely are now. Trading below key resistance and showing signs of exhaustion. The question: Where is the next high probability trade setup?

Let’s break down what the chart is telling us.

🧠 Structure Overview

Wave 5 peaked at $2.2169

Wave A dropped -25%

Wave B bounced +30%

Currently: VIRTUAL's trading under the $2 psychological level and weekly open ($2.0358) → signs of momentum cooling

A corrective Wave C is likely underway, and all signs point toward a very specific zone.

⚠️ Liquidity Dynamics

The longer VIRTUAL grinds sideways near $2.00 without showing real momentum, the more vulnerable late long positions become:

Retail traders are buying resistance

SLs are likely clustered just below Wave A’s low

This creates a liquidity pocket waiting to be swept — perfect fuel for Wave C

🔍 The $1.58–$1.47 Support Cluster: 14 Layers of Confluence

This zone isn’t guesswork — it’s loaded with technical overlap:

1️⃣ 1:1 Trend-Based Fib Extension of Wave A → $1.573

2️⃣ Monthly Open → $1.5354

3️⃣ 0.382 Fib Retracement of the entire rally → $1.5295

4️⃣ Bullish Fair Value Gap → $1.57–$1.53

5️⃣ Anchored VWAP from ATH → ~$1.46

6️⃣ Anchored VWAP from Wave 3 → ~$1.46

7️⃣ 0.618 Fib Speed Fan Support (~end of May timing)

8️⃣ 4H 233 SMA → ~$1.52

9️⃣ 4H 200 EMA → ~$1.52

🔟 Daily 200 SMA → $1.5251

1️⃣1️⃣ Weekly 21 SMA → $1.462 (reinforces the VWAP zone)

1️⃣2️⃣ Declining Daily Volume → momentum weakening

1️⃣3️⃣ Liquidity Pool below Wave A → likely to be swept

1️⃣4️⃣ $2 = Golden Pocket Resistance + Psychological Barrier

🔴 Short Trade Setup (Active as Long as SFP Holds)

For those favouring downside continuation toward the Wave C target, a short setup is in play:

Entry: Weekly open retest around $2.0358

Stop-loss: Above SFP high at $2.143

Target: 1:1 Trend-Based Fib Extension of Wave A → $1.573 or the Swing Low of Wave A at $1.647

R:R ≈ 1:4 — a solid, well-structured short opportunity

As long as price remains below the SFP and the $2.00 golden pocket resistance, bears maintain control.

🟢 Long Trade Setup

Entry: Ladder between $1.58–$1.47

Avg. Entry: ~$1.53

SL: Below $1.40

TP1: $1.88 (local resistance) → R:R ≈ 1:2.5

TP2: $3.33 (0.618 Fib of entire bear market) → R:R ≈ 1:12

👉 Bonus TP for Harmonic Setup: 0.618 Fib of CD leg

✨ Bonus Confluence: Potential bullish Gartley Harmonic in Play

VIRTUAL is also forming a valid Gartley harmonic pattern — one of the most reliable reversal setups in classical trading theory.

🔸 XA: B retraced to 0.602 → ✅ (criterion: ~0.618)

🔸 AB: C retraced 0.87 → ✅ (valid range: 0.382–0.886)

🔸 CD: Projected to complete at 0.786 of XA → ~$1.474

• CD is a 1.356 expansion of BC

• AB ≈ CD symmetry is valid

• TP = 0.618 retracement of CD leg

This adds even more weight to the $1.47–$1.53 buy zone.

📘 Educational Takeaway

The best setups don’t rely on one method — they align multiple disciplines. Here, we have Elliott Waves, Fibonacci retracements, anchored VWAPs, volume structure, moving averages, time symmetry, and now a harmonic pattern — all pointing to the same opportunity. Most traders never wait for alignment. That’s why most lose.

💬 Final Words

✍️ Smart trading isn’t about always being in a trade — it’s about being in the right one at the right time.

While others FOMO at $2, you wait for the right opportunity to come to you — where structure, liquidity, and probability all shake hands.

The patient are rewarded. Always.

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Phemex Analysis #81: Pro Tips for Trading VIRTUAL In the rapidly evolving landscape of cryptocurrency, Virtuals Protocol ( PHEMEX:VIRTUALUSDT.P ) has emerged as a notable player, particularly within the AI and metaverse sectors. As of May 16, 2025, VIRTUAL is trading at approximately $1.85, with a 24-hour trading volume of around $280 million and a market capitalization of $1.21 billion. This positions VIRTUAL as a significant asset within the crypto market, reflecting growing investor interest.

Recent developments have further bolstered VIRTUAL's prominence. The introduction of veVIRTUAL, a vote-escrowed token system launched on May 13, 2025, incentivizes long-term staking and governance participation. Additionally, expansion to the Solana blockchain and partnerships with initiatives such as the AI Hackathon highlight Virtuals Protocol's commitment to cross-chain development and community engagement.

Given these dynamics, traders are keen to understand potential trajectories for VIRTUAL's price movement. Let's explore several possible scenarios to guide your trading strategies.

Possible Scenarios

1. Bullish Continuation

VIRTUAL has demonstrated impressive growth, achieving a 234% increase over the past month. If this momentum continues, reinforced by ongoing developments and increased adoption, VIRTUAL may test critical resistance levels around $2.50 and potentially approach its all-time high of $5.07.

Pro Tips:

Entry Strategy: Consider entering positions on confirmed breakouts above key resistance levels such as $2.16, particularly if accompanied by high trading volume.

Risk Management: Implement stop-loss orders near recent swing lows, such as $1.76, to protect your positions from sudden market reversals.

2. Consolidation Phase

After significant price movements, VIRTUAL may enter a consolidation phase, trading within a defined range as the market absorbs recent gains. Such periods can provide opportunities for range-bound trading strategies or accumulation for long-term growth.

Pro Tips:

Identify Key Levels: Monitor key support and resistance zones, notably $1.27 (support) and $2.16 (resistance), to effectively execute buy and sell orders within the trading range.

Patience: Avoid overtrading during consolidation phases. Wait for clear breakout signals before making significant trading decisions.

3. Bearish Reversal

Despite recent successes, external factors such as broader market downturns or unforeseen negative news could trigger a bearish reversal. If VIRTUAL falls below critical support levels, notably $1.50, further declines could follow.

Pro Tips:

Short Positions: Experienced traders might consider short-selling strategies to profit from potential declines, ensuring they maintain a clear exit plan.

Long-Term Accumulation: For long-term investors, significant price dips could represent buying opportunities. Watch key support levels such as $1.27, $1.00, and $0.67 for potential entry points to accumulate VIRTUAL at lower valuations.

Conclusion

Virtuals Protocol's innovative approach to integrating AI within the blockchain ecosystem positions it as a compelling asset in the crypto market. While recent developments and price movements suggest potential for continued growth, traders must remain vigilant. Employing sound risk management and staying informed about ongoing developments is essential. By considering the scenarios outlined above, traders can navigate VIRTUAL's market dynamics with greater confidence and strategic insight.

Pro Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Watch for Resistance Breakout! 🚨 SPARKS:VIRTUAL Bearish Head and Shoulders Formed – Watch for Resistance Breakout! 📉

SPARKS:VIRTUAL has formed a bearish head and shoulders pattern! 🧠 To confirm the trade, we need a breakout of the red resistance zone. If the price breaks through, it could signal that buyers are back, setting up for a potential reversal! 🔥

Let’s monitor this closely! 💼💸

FIO is ready for the trendLarge-cap coins showed growth yesterday following the tops, and memcoin bullying is subsiding today, followed by a high probability of bullying in the remaining altcoin market. I expect the main day of growth tomorrow until Sunday afternoon, then the probability of a major pullback prevails until the middle of the new week.

Today, fio, which I considered for work in the first place, continues to accelerate growth. The main goal is to retest the key level of 0.025, which will open the way up to 0.50-75. We can see a repeated breakdown and consolidation above today. If the second half of the month opens above the level by June, the fio may move into the range of 0.045-60. With sufficient volatility, a test of this range is likely tomorrow.

After working fio and chess up to 60-90% from current levels as the most undervalued assets in finance today, quick adx pivx can be additionally considered for scalping. There is also a high probability of a new blizzard on atm city acm fantokens with new hays.

Good KOMA growth potentialAt the end of last week, I recommended keeping KOMA memcoin in mind as having a very high growth potential, as it is only at the development stage. Against the background of a new wave of growth in the second half of this week, we can expect much stronger growth. The minimum goal is to consolidate above the key level of 0.05, which will open the possibility of continuing the trend to the range of 0.075-100. With sufficient volatility, there is a chance of a breakdown immediately to the 0.1 test.

In addition to koma, I am considering chess and fio for work. Also on the weekend, a bul run on fantokens up to 3-5X atm city acm is likely.

Virtuals Protocol VIRTUAL price analysisThe price of #Virtual is approaching $1.60, the price at which trading began almost six months ago.

It will be harder and harder to push the price of OKX:VIRTUALUSDT.P upward, because just look at the chart and see how much it was bought earlier and at what trading vol it is now growing.

And what will happen to the #Virtual price if it starts selling off "to zero", those who believed in the "marketing prospects" of #VirtualsProtocol at the time - and as it turned out - bought at highs... ?

The levels shown on the chart are working quite well and can serve as a good guide for making trading decisions.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Breaking: Virtual Protocol ($VIRTUAL) Spike 29% Today Built on the Ethereum chain, Virtual protocol's native token ( SPARKS:VIRTUAL ) saw a noteworthy uptick of 29% today albeit the crypto market growth was modest today.

With the RSI at 75 and momentum growing, SPARKS:VIRTUAL seems poised to break the pass the $1.60 resistant zone and reclaim the $1 Billion market cap eventually.

On a bearish tone, failure to break pass the 1-month high pivot could resort to a consolidatory move to the 38.2% Fibonnaci retracement point a level technically seen as the support point.

What is Virtuals Protocol?

Virtuals Protocol (VIRTUAL) is an innovative cryptocurrency that aims to revolutionize virtual interactions through its AI and Metaverse protocol. Serving as the infrastructure layer for co-owned, human-curated, plug-and-play gaming AIs, Virtuals Protocol is at the forefront of integrating artificial intelligence with immersive virtual environments.

Virtuals Protocol Price Data

The Virtuals Protocol price today is $1.36 USD with a 24-hour trading volume of $410,193,840 USD. Virtuals Protocol is up 32% in the last 24 hours. The current CoinMarketCap ranking is #73, with a market cap of $886,828,030 USD. It has a circulating supply of 652,196,092 VIRTUAL coins and a max. supply of 1,000,000,000 VIRTUAL coins.

About AI's theme coin (token)...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

It seems that AI themes are currently classified into 5.

I will explain the coin (token) with the highest market capitalization in each theme.

-------------------------------------

(NEARUSDT 1D chart)

NEAR is classified as an AI & Big Data theme.

In order to turn into an uptrend, the price must be maintained above 3.756 and rise above the M-Signal indicator on the 1M chart.

Since OBV has broken through the upper line of the Price channel, the point to watch is whether it can continue to rise.

-

(FETUSDT.P 1D chart)

FET is classified as an AI Agents theme.

The key is whether it can maintain the price by rising above 0.848.

Since OBV is passing through the middle line of the Price channel, we should see whether it can be supported and rise near the M-Signal indicator on the 1D chart.

-

(VIRTUALUSDT.P 1D chart)

VIRTUAL is the No. 1 market cap ranking of the AI Agent Launchpad theme.

The key is whether it can maintain the price near the M-Signal indicator on the 1D chart and rise to around 1.1602.

-

(FARTCOINUSDT.P 1D chart)

FARTCOIN is classified as AI Memes theme.

The key is whether the price can be maintained around the Fibonacci ratio 0.236 (0.6228) and rise to around 1.4148.

If it fails to rise, it should check for support around 0.3822.

-

(TAOUSDT 1D chart)

TAO is classified as Generative AI theme.

The key is whether it can be maintained by receiving support around 271.1 and rising above 312.5.

In the meantime, it should be checked whether it can rise above the M-Signal indicator on the 1W chart.

If the M-Signal indicator of the 1W chart rises above and the price is maintained, it is expected to turn into an upward trend.

-------------------------------------------

Most coins (tokens) are showing the same flow as the coins (tokens) above.

This shows that the current section is an important turning point.

I think that in order to survive this important turning point and turn into an upward trend, an increase in trading volume must accompany it.

Therefore, I think it would be a good idea to check the current trading volume status by checking the flow of OBV of each coin (token).

There are three ways to interpret the OBV indicator.

1. If OBV is rising from the 0 point, it is an increase in buying power, and if it is falling, it is an increase in selling power.

2. If OBV is located above the EMA line of OBV, it is highly likely that buying power will increase, and if not, it is highly likely that selling power will increase.

3. Applying the formula of the Price channel to OBV, if each Price channel line breaks upward, there is a high possibility that the buying force will increase, and if it breaks downward, there is a high possibility that the selling force will increase.

In addition to the interpretation of 1, 2 and 3 can be interpreted as the possibility that the price will rise when the buying force increases, and the possibility that the price will fall when the selling force increases.

In 1, the price area around the 0 point is considered the selling area (volume profile) and is likely to play the role of support and resistance points.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

#VIRTUAL Ready For Another Leg Down Before Bullish Reversal Yello, Paradisers! Is #VIRTUAL gearing up for a full-blown collapse, or will the bulls fight back at critical support? Let’s break down #VirtualsProtocol:

💎#VIRTUALUSDT has already broken below the falling wedge, confirming that sellers remain in full control. The breakdown from this pattern signals that the expected bullish reversal has failed, and the trend remains decisively bearish. The price action is also clear—momentum is heavily bearish, and unless something shifts fast, we could see much lower levels ahead.

💎The previous major support zone at $0.60 - $0.65 has flipped into resistance, making it a crucial level to watch. Any short-term bounce into this area is likely to face strong selling pressure from sellers of #VIRTUALUSD. Only a break above $0.935 would invalidate this bearish outlook and signal a shift in momentum.

💎If the rejection plays out, the next downside target sits at $0.40, with a high probability of further decline toward the major support zone at $0.31 - $0.07. This is where buyers must step in—otherwise, a much deeper drop could follow.

💎RSI remains weak, and volume is declining, confirming the lack of strong buying interest. As long as this continues, the bearish pressure is likely to persist.

The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

VIRTUAL (Y25.P1.E1). Looking for capitulationHi traders,

We have seen this play out many times.

If we hit this level, I believe its the buying zone as pivot 1 of 5 wave to complete accumulation range.

How will it perform after that is hypothetical and not worth giving an opinion until we see more price action.

Virtual fits the typical ALTs wave 5 count to the top filling standard versions of a fibonacci aligned with 5 impulse waves to the top. Similarly, I'm looking for a diagonal ending bear market that we just witnessed.

This might align well with the ALT season , OTHERS chart or BTC dominance reversal level.

All the best,

S.SAri

$VIRTUAL to $5Virtual has a good long term set up. I'm accumulating under $1.

The VIRTUAL token has a total supply of 1 billion tokens, with approximately 648 million currently in circulation. The distribution includes:

Public Distribution: 600 million tokens

Liquidity Pool: 50 million tokens

Ecosystem Treasury: 350 million tokens, released over time with a cap of 10% per year for the next 3 years.

VIRTUAL is used for creating new AI agents, staking for governance, and purchasing agent tokens, which are paired with VIRTUAL in liquidity pools. This structure creates deflationary pressure as more VIRTUAL is locked, potentially supporting its value.

Based on the platform's growth potential and market trends, the price forecasts for VIRTUAL are:

1 Year: $2.00, reflecting expected growth in agent adoption.

2 Years: $3.00, as the ecosystem matures and revenue increases.

5 Years: $5.00, considering long-term expansion in the AI and gaming sectors.

A surprising detail is the rapid growth from a $50 million market cap in March 2024 to over $1.6 billion, indicating strong market interest but also highlighting the speculative nature of its future value.

FET vs Virtual? What you choose?Now stances marked is short, for you not to short and buy these coins at a more discounted rate and for others, who holds, may average, FOMO's may buy 35% and buy at more down levels below.

As you can see in the following chart of FET/USDT (Monthly) Halted 2 months on 50 SMA for a smooth up reversal, though this is not the only thing you shall look for, but among all those its a dataset to look upon.

Quite obvious to know that if FET/USDT moves, it needs time to ripe and then move.

For shorts, or scalpers direction is marked. You won't expect how the market turns table out.

I am expecting this in for FETUSDT

Coming to VIRTUAL - The Chart marked are something to be seen and is quite interesting

Have a look at this above charts. Weekly shows nothing much but yeah, ive seen this pattern, it traps buyers a lot from this point, retracing down 32% from the CMP, but theres a catch!

How can you plan your buys? Just look at the chart. The green line is a major magnet to attract the price to top, averting momentum for shorters, see the small initial dips i have marked, retracing to the tops and back and again falling, So my ideal idea is you may cmp 35% at the small dips and major buys at the 0.91 levels.

Expecting same 75% retracement on this as well.

Pardon me, the chart i shall had zoomed, but i missed it!!

VIRTUAL - A Long Opportunity or More Pain Ahead?VIRTUAL has dropped over 50% from its all-time high of $5.14, now trading around $2.50. A head and shoulders pattern has formed, with price currently testing the neckline, a bearish sign that could signal further downside. Let’s break down potential targets and trade setups.

Key Levels and Support Zone:

1.) POC from December 2024 Range:

Located at $1.67, a significant level from previous trading activity

2.) Anchored VWAP:

Taken from the lows, currently around $1.62, reinforcing the $1.66 zone as strong support

3.) Fibonacci Retracement (Log Scale):

The 0.382 Fib from the recent wave sits at $1.77, providing additional confluence for the support area

4.) Trend-Based Fibonacci Extension:

The 0.786 Fib aligns at $1.71, further strengthening the $1.70–$1.80 range as a reliable support zone

Trade Setups:

Short Setup:

Entry: $2.836 (Fib retracement 0.618 from the current downtrend)

Target: around $1.80

Stop Loss: Above $3

Risk-to-Reward: 5:1

Potential Drop: 30–40% from the entry level

Long Setup:

Entry: $1.70–$1.80 range

Target: Depends on confirmation and take profit areas. A realistic initial target could be around $2-$2.30

Stop Loss: Below $1.52

Risk-to-Reward: 2:1 or better depending on take profit strategy

$VIRTUAL Rockets Past $3.20: Bulls Eye $5.00 Target!$VIRTUAL/USDT 4H Chart Analysis

Breakout confirmed: SPARKS:VIRTUAL has broken above the $3.20 resistance with strong volume, indicating bullish momentum and a potential trend continuation.

Current price: $3.95.

Key levels:

Support: $3.20 (recently established support following the breakout).

Resistance:

Target 1: $4.40 (next immediate resistance).

Target 2: $5.00 (extended resistance if bullish momentum continues).

Pattern: A textbook bottom formation has been completed, signaling a strong reversal.

Trade setup:

Entry: Current level ($3.95) or on a pullback near $3.60.

Target:

T1: $4.40.

T2: $5.00 (if momentum sustains).

Stop loss: Below $3.60 to minimize downside risk.

Risk-to-reward: Favorable R:R, particularly if the price sustains above $3.60 and trends toward T2.

Confidence level: 8/10, given the clean break of $3.20 resistance and volume confirmation

.

Considerations:

Volume confirmation: Ensure buy volume remains strong, especially near $4.40.

Momentum check: Watch RSI for signs of overbought conditions as price approaches $4.40-$5.00.

Resistance reaction: Be prepared for potential consolidation or rejection near $4.40 before targeting $5.00.

This setup suggests a strong bullish continuation if $3.60 holds, with clear upside targets in sight.