VIRTUAL/USDT – Rebound Incoming or Deeper Collapse?🔍 Overview: Bearish Pressure, But Structure Holds

VIRTUAL/USDT is currently consolidating within a well-defined Descending Channel pattern that has been forming since early May 2025. While the trend is bearish, price action remains within a controlled structure — a potential sign of hidden accumulation or smart-money positioning.

What makes this setup compelling is that price has just touched the lower boundary of the channel while also interacting with a historical demand zone around 1.20–1.25 USDT, which previously triggered a strong rally back in May.

---

🧠 Key Technical Pattern: Descending Channel + Historical Demand Zone

Descending Channel → Suggests consistent selling pressure but within a structured range — no real breakdown yet.

Demand Zone (1.20 – 1.25 USDT) → A historically strong support level that has launched sharp upward moves in the past.

Decreasing Volume → Could indicate weakening bearish momentum as price approaches key support.

---

📈 Bullish Scenario (Bounce from Support):

If the price manages to hold and forms a reversal signal (such as a bullish engulfing or hammer candle), we could see a relief rally toward key resistance levels.

🎯 Potential Bullish Targets:

1. 1.6787 USDT – Mid-channel resistance

2. 1.9000 USDT – Psychological and structural resistance

3. 2.0848 – 2.4571 USDT – Horizontal resistance zone and top of the channel

4. 3.7620 – 4.6267 USDT – Extended targets if breakout occurs with volume

📌 Bullish Confirmation Needed: A strong breakout above the channel midpoint + increasing volume to confirm a potential trend reversal.

---

📉 Bearish Scenario (Breakdown from Channel):

If the price fails to hold above the 1.20–1.25 support and breaks below the channel support, we may see increased selling pressure and a continuation of the downtrend.

🎯 Downside Targets:

1.00 USDT – Psychological support

0.90 – 0.70 USDT – Previous accumulation range

0.4110 USDT – All-time low and ultimate downside target

🚨 A strong breakdown with high volume could trigger panic selling and a prolonged bearish leg.

---

🎯 Conclusion:

> VIRTUAL/USDT is at a pivotal decision point — hold and bounce, or break and slide.

The structure is still intact, and the price is testing two critical technical zones simultaneously: the descending channel support and a major demand area.

This is not the time to chase price, but to observe and prepare for confirmation. A strong signal here could set the tone for the next major move.

#VirtualUSDT #CryptoTechnicalAnalysis #DescendingChannel #DemandZone #ReversalSignal #AltcoinAnalysis #CryptoTradingSetup #PriceActionTrading #SupportResistance

VIRTUALUSDT

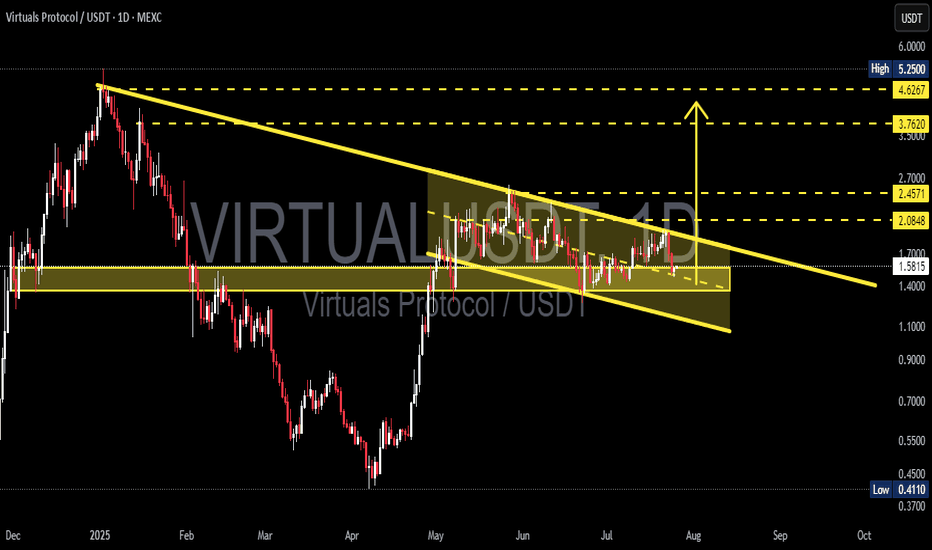

VIRTUALUSDT – Is the Wedge Nearing Its End? A Breakout Could!⏳ Current Situation:

VIRTUALUSDT is approaching a crucial moment after months of sideways price action. Following a steep decline from its all-time high ($5.25), price action has formed a Falling Wedge pattern — a well-known bullish reversal formation.

Now, as price consolidates toward the wedge's apex, the potential for a breakout grows stronger with each passing day.

---

📌 Pattern Structure:

Pattern: Falling Wedge (Bullish Reversal)

Duration: Since May 2025 (multi-month)

Support line: Ascending slope, catching lower dips

Resistance line: Descending pressure trendline

Price action: Trapped inside the wedge, signaling accumulation and shrinking volatility

This structure suggests that a large move may be right around the corner.

---

🔼 Bullish Scenario (Breakout):

If VIRTUALUSDT successfully breaks above the upper wedge boundary (~$1.70), the following key resistance levels could become major bullish targets:

1. $2.08 – Initial breakout confirmation level

2. $2.45 – Key resistance zone; breakout could accelerate here

3. $3.76 – Strong historical supply area

4. $4.62 – Major previous resistance

5. $5.25 (ATH) – Long-term bullish target if strong momentum follows

💡 Tip: A volume spike on the breakout adds confirmation and reduces the risk of a false breakout.

---

🔽 Bearish Scenario (Breakdown):

If the price fails to break out and instead falls below the wedge support (~$1.40):

1. Look for support near $1.20 – $1.10

2. Further downside could lead to $0.70 – $0.50

3. The ultimate support lies around $0.41, the current all-time low

⚠️ Note: A breakdown without volume can be a fakeout. Always wait for confirmation.

---

🎯 Conclusion & Strategy:

> VIRTUALUSDT is coiling inside a falling wedge pattern — typically a prelude to an explosive move. Whether bullish or bearish, the breakout direction will offer a strong trading opportunity.

Suggested Strategy:

Watch for breakout + volume confirmation before entering

Place tight stop-loss below wedge support if buying the breakout

Set tiered take-profits based on horizontal resistance zones

#VIRTUALUSDT #AltcoinBreakout #FallingWedgePattern #CryptoSetup #BullishReversal #BreakoutWatch #AltcoinAnalysis #CryptoTechnical #VolumeBreakout

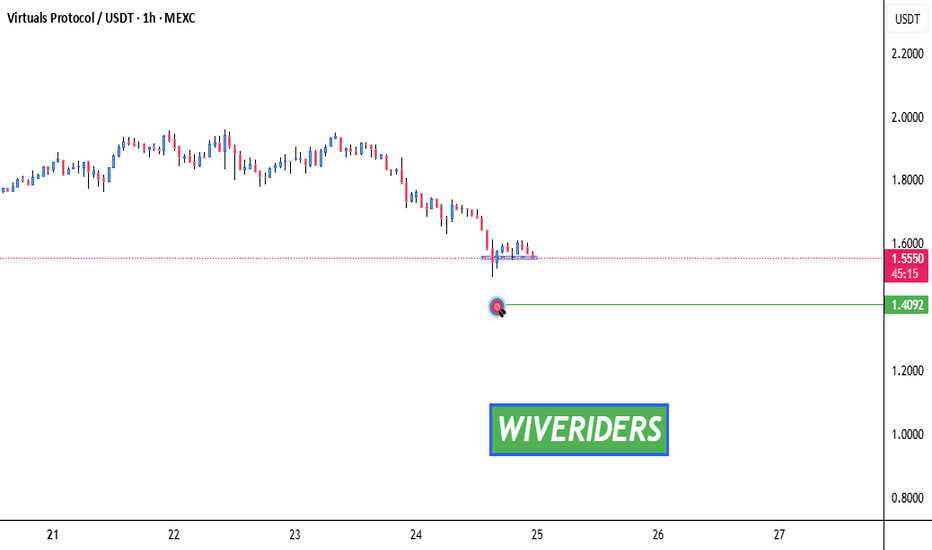

Testing Blue Support – Key Level Ahead!🚨 SPARKS:VIRTUAL Testing Blue Support – Key Level Ahead! 📉🔵

SPARKS:VIRTUAL is currently testing the blue support zone.

📊 If a breakdown occurs, we could see a move toward the green line level as the next target.

🛑 Watch for confirmation — this could signal further downside if sellers take control.

VIRTUAL – Setting Up for a July Breakout - $4 in the Horizon!

Another coin worth bidding on: $VIRTUAL.

It's setting up nicely above the mid-range of the current trading range, with a clean S/R flip off the previous cluster zone.

The 3-day MA is holding well, and the downtrend from the local highs is set to expire on July 6th.

Expecting a strong trend to kick in during the second week of July, with potential to push toward the $4 mark.

VIRTUALUSDT Forming BullishVIRTUALUSDT is showcasing a powerful bullish structure after a prolonged accumulation phase near the $0.80 to $1.00 support zone. The breakout from this accumulation base has resulted in a parabolic move, confirming a strong shift in trend. Currently, the pair is forming a bullish continuation pattern, with high volume inflows suggesting increasing investor confidence. The recent consolidation above previous resistance is a positive signal for trend continuation, and technical targets show potential for a 120% to 130% upside in the coming sessions.

The setup aligns with classic market psychology, where a strong move is often followed by a period of profit-taking before the next leg higher. The technical projection zones around $2.60 to $3.00 are realistic based on the depth of the prior impulse move. Furthermore, VIRTUALUSDT is gaining traction in the DeFi and virtual asset space, with its protocol generating buzz in 2025's altcoin resurgence. This combination of narrative and chart structure makes it a potential top mover.

From a risk-reward perspective, this pair presents a favorable long entry with minimal downside if stop losses are positioned just below recent swing lows. As the broader market recovers, strong technicals like these could deliver amplified gains compared to average tokens. It's worth noting that smart money often positions itself before explosive runs—and this chart suggests accumulation has already occurred.

Investors and swing traders should keep this pair on their radar as it continues to carve higher highs and higher lows. If momentum persists, VIRTUALUSDT could become one of the standout performers in the altcoin space this quarter.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$VIRTUAL Breakout Alert!!A clean inverse head and shoulders pattern has just triggered, and we’ve already seen a strong breakout above the neckline!

This is a classic bullish reversal signal, and the chart is screaming momentum

🟢 Key Levels:

• Entry around the neckline breakout

• Targets lined up: $2.36, $2.59, and $2.89

• SL below right shoulder: $1.91 for risk control

The 200 EMA is now sloping upward — further confirmation of trend shift!

Phemex Analysis #81: Pro Tips for Trading VIRTUAL In the rapidly evolving landscape of cryptocurrency, Virtuals Protocol ( PHEMEX:VIRTUALUSDT.P ) has emerged as a notable player, particularly within the AI and metaverse sectors. As of May 16, 2025, VIRTUAL is trading at approximately $1.85, with a 24-hour trading volume of around $280 million and a market capitalization of $1.21 billion. This positions VIRTUAL as a significant asset within the crypto market, reflecting growing investor interest.

Recent developments have further bolstered VIRTUAL's prominence. The introduction of veVIRTUAL, a vote-escrowed token system launched on May 13, 2025, incentivizes long-term staking and governance participation. Additionally, expansion to the Solana blockchain and partnerships with initiatives such as the AI Hackathon highlight Virtuals Protocol's commitment to cross-chain development and community engagement.

Given these dynamics, traders are keen to understand potential trajectories for VIRTUAL's price movement. Let's explore several possible scenarios to guide your trading strategies.

Possible Scenarios

1. Bullish Continuation

VIRTUAL has demonstrated impressive growth, achieving a 234% increase over the past month. If this momentum continues, reinforced by ongoing developments and increased adoption, VIRTUAL may test critical resistance levels around $2.50 and potentially approach its all-time high of $5.07.

Pro Tips:

Entry Strategy: Consider entering positions on confirmed breakouts above key resistance levels such as $2.16, particularly if accompanied by high trading volume.

Risk Management: Implement stop-loss orders near recent swing lows, such as $1.76, to protect your positions from sudden market reversals.

2. Consolidation Phase

After significant price movements, VIRTUAL may enter a consolidation phase, trading within a defined range as the market absorbs recent gains. Such periods can provide opportunities for range-bound trading strategies or accumulation for long-term growth.

Pro Tips:

Identify Key Levels: Monitor key support and resistance zones, notably $1.27 (support) and $2.16 (resistance), to effectively execute buy and sell orders within the trading range.

Patience: Avoid overtrading during consolidation phases. Wait for clear breakout signals before making significant trading decisions.

3. Bearish Reversal

Despite recent successes, external factors such as broader market downturns or unforeseen negative news could trigger a bearish reversal. If VIRTUAL falls below critical support levels, notably $1.50, further declines could follow.

Pro Tips:

Short Positions: Experienced traders might consider short-selling strategies to profit from potential declines, ensuring they maintain a clear exit plan.

Long-Term Accumulation: For long-term investors, significant price dips could represent buying opportunities. Watch key support levels such as $1.27, $1.00, and $0.67 for potential entry points to accumulate VIRTUAL at lower valuations.

Conclusion

Virtuals Protocol's innovative approach to integrating AI within the blockchain ecosystem positions it as a compelling asset in the crypto market. While recent developments and price movements suggest potential for continued growth, traders must remain vigilant. Employing sound risk management and staying informed about ongoing developments is essential. By considering the scenarios outlined above, traders can navigate VIRTUAL's market dynamics with greater confidence and strategic insight.

Pro Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Watch for Resistance Breakout! 🚨 SPARKS:VIRTUAL Bearish Head and Shoulders Formed – Watch for Resistance Breakout! 📉

SPARKS:VIRTUAL has formed a bearish head and shoulders pattern! 🧠 To confirm the trade, we need a breakout of the red resistance zone. If the price breaks through, it could signal that buyers are back, setting up for a potential reversal! 🔥

Let’s monitor this closely! 💼💸

Virtuals Protocol VIRTUAL price analysisThe price of #Virtual is approaching $1.60, the price at which trading began almost six months ago.

It will be harder and harder to push the price of OKX:VIRTUALUSDT.P upward, because just look at the chart and see how much it was bought earlier and at what trading vol it is now growing.

And what will happen to the #Virtual price if it starts selling off "to zero", those who believed in the "marketing prospects" of #VirtualsProtocol at the time - and as it turned out - bought at highs... ?

The levels shown on the chart are working quite well and can serve as a good guide for making trading decisions.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Breaking: Virtual Protocol ($VIRTUAL) Spike 29% Today Built on the Ethereum chain, Virtual protocol's native token ( SPARKS:VIRTUAL ) saw a noteworthy uptick of 29% today albeit the crypto market growth was modest today.

With the RSI at 75 and momentum growing, SPARKS:VIRTUAL seems poised to break the pass the $1.60 resistant zone and reclaim the $1 Billion market cap eventually.

On a bearish tone, failure to break pass the 1-month high pivot could resort to a consolidatory move to the 38.2% Fibonnaci retracement point a level technically seen as the support point.

What is Virtuals Protocol?

Virtuals Protocol (VIRTUAL) is an innovative cryptocurrency that aims to revolutionize virtual interactions through its AI and Metaverse protocol. Serving as the infrastructure layer for co-owned, human-curated, plug-and-play gaming AIs, Virtuals Protocol is at the forefront of integrating artificial intelligence with immersive virtual environments.

Virtuals Protocol Price Data

The Virtuals Protocol price today is $1.36 USD with a 24-hour trading volume of $410,193,840 USD. Virtuals Protocol is up 32% in the last 24 hours. The current CoinMarketCap ranking is #73, with a market cap of $886,828,030 USD. It has a circulating supply of 652,196,092 VIRTUAL coins and a max. supply of 1,000,000,000 VIRTUAL coins.

#VIRTUALUSDT - Head and Shoulders Formation and Targets! Hey there, everyone! Next up, we’re looking at the position for #VIRTUALUSDT. When I combine the volume and RSI components and consider the price being very close to the trendline (with a small breakout on lower timeframes), I’m expecting an Inverse Head and Shoulders formation.

The exact targets will change depending on the breakout confirmation level, but I’ve tried to provide approximate targets in this analysis.

Wishing you all a green-filled day with my best wishes. 🌱

What do you think about my analysis? Drop your thoughts in the comments and let’s discuss!

#AlyAnaliz #TradeSmart #CryptoVision #VIRTUALUSDT

#VIRTUAL Ready For Another Leg Down Before Bullish Reversal Yello, Paradisers! Is #VIRTUAL gearing up for a full-blown collapse, or will the bulls fight back at critical support? Let’s break down #VirtualsProtocol:

💎#VIRTUALUSDT has already broken below the falling wedge, confirming that sellers remain in full control. The breakdown from this pattern signals that the expected bullish reversal has failed, and the trend remains decisively bearish. The price action is also clear—momentum is heavily bearish, and unless something shifts fast, we could see much lower levels ahead.

💎The previous major support zone at $0.60 - $0.65 has flipped into resistance, making it a crucial level to watch. Any short-term bounce into this area is likely to face strong selling pressure from sellers of #VIRTUALUSD. Only a break above $0.935 would invalidate this bearish outlook and signal a shift in momentum.

💎If the rejection plays out, the next downside target sits at $0.40, with a high probability of further decline toward the major support zone at $0.31 - $0.07. This is where buyers must step in—otherwise, a much deeper drop could follow.

💎RSI remains weak, and volume is declining, confirming the lack of strong buying interest. As long as this continues, the bearish pressure is likely to persist.

The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

VIRTUAL (Y25.P1.E1). Looking for capitulationHi traders,

We have seen this play out many times.

If we hit this level, I believe its the buying zone as pivot 1 of 5 wave to complete accumulation range.

How will it perform after that is hypothetical and not worth giving an opinion until we see more price action.

Virtual fits the typical ALTs wave 5 count to the top filling standard versions of a fibonacci aligned with 5 impulse waves to the top. Similarly, I'm looking for a diagonal ending bear market that we just witnessed.

This might align well with the ALT season , OTHERS chart or BTC dominance reversal level.

All the best,

S.SAri

$VIRTUAL to $5Virtual has a good long term set up. I'm accumulating under $1.

The VIRTUAL token has a total supply of 1 billion tokens, with approximately 648 million currently in circulation. The distribution includes:

Public Distribution: 600 million tokens

Liquidity Pool: 50 million tokens

Ecosystem Treasury: 350 million tokens, released over time with a cap of 10% per year for the next 3 years.

VIRTUAL is used for creating new AI agents, staking for governance, and purchasing agent tokens, which are paired with VIRTUAL in liquidity pools. This structure creates deflationary pressure as more VIRTUAL is locked, potentially supporting its value.

Based on the platform's growth potential and market trends, the price forecasts for VIRTUAL are:

1 Year: $2.00, reflecting expected growth in agent adoption.

2 Years: $3.00, as the ecosystem matures and revenue increases.

5 Years: $5.00, considering long-term expansion in the AI and gaming sectors.

A surprising detail is the rapid growth from a $50 million market cap in March 2024 to over $1.6 billion, indicating strong market interest but also highlighting the speculative nature of its future value.

FET vs Virtual? What you choose?Now stances marked is short, for you not to short and buy these coins at a more discounted rate and for others, who holds, may average, FOMO's may buy 35% and buy at more down levels below.

As you can see in the following chart of FET/USDT (Monthly) Halted 2 months on 50 SMA for a smooth up reversal, though this is not the only thing you shall look for, but among all those its a dataset to look upon.

Quite obvious to know that if FET/USDT moves, it needs time to ripe and then move.

For shorts, or scalpers direction is marked. You won't expect how the market turns table out.

I am expecting this in for FETUSDT

Coming to VIRTUAL - The Chart marked are something to be seen and is quite interesting

Have a look at this above charts. Weekly shows nothing much but yeah, ive seen this pattern, it traps buyers a lot from this point, retracing down 32% from the CMP, but theres a catch!

How can you plan your buys? Just look at the chart. The green line is a major magnet to attract the price to top, averting momentum for shorters, see the small initial dips i have marked, retracing to the tops and back and again falling, So my ideal idea is you may cmp 35% at the small dips and major buys at the 0.91 levels.

Expecting same 75% retracement on this as well.

Pardon me, the chart i shall had zoomed, but i missed it!!

Not the time to buy the dip! Wait to buy the strength!!! I just published my article on ai16z and my thoughts on Virtual is very similar to ai16z.

The current chart set up for Virtual is pretty ominous, however, I am still bullish on Virtual.

The new US president just came into the office and also his (and the rest of his family) meme sucked all the liquidity out of the rest of the crypto market. The market is very volatile and it is hard to do technical analysis at the moment.

The one thing I can say is that it is not the time to be hopeful and keep buying every dip to add to your position. I haven’t sold any of my Virtual because I don’t trade with leverage. And my allocation for this asset is small. However, once Trump meme mania settles and the liquidity starts to flow back to the rest of the crypto market, I will start to look for an opportunity to buy more. However, I will not buy the dip: I will buy the strength!!

What I mean by buying the strength is I will only buy when the momentum for the bull clearly comes back. I won't try to buy just because the price is cheap.

I usually use two time frames - daily and 4h. I will wait until the daily stochastic resets and start to roll back to 50 and the 4H MACD lines properly cross and enter the bull zone (above 0).

Also, I am waiting to see if 4H candle can move and close above $2.92 area at Fib 0.236, which gives me an idea if the momentum is strong enough to start to move up.

BUY - take off after consolidation? Virtual protocol completed a strong correction from $5.1 to $2.2. The price fell to the key Fib zone (Blue Fib line in the chart) bounced up with a strong bullish candle formation in the 4H chart.

The price broke and closed above the descending parallel channel as well as Fib 0.236 (orange Fib line in the chart). As I mentioned in my last article, when the price breaks above Fib 0.236, there is a good probability it continues to move to Fib 0.5-0.618 area. If it only reaches 0.382 and retraced back down, it usually means that it is a continuation of the bear trend (at least in my past observation.)

In this case, the price shot up to Fib 0.618 but now it is pulling back. Given that there are two layers of sell blocks sitting above the Fib 0.618 area, there is no surprise the price is coming now.

All momentum indicators in the 4H chart have reached the overbought territory and are moving downwards. However, both Daily and 4H MACD are way above 0, so I interpret it as the dominant trend is bullish but it is a correction phase.

If the price is going to move in the classic style, I anticipate it is likely to oscillate between $3-$4 range. And once the 4H momentum indicators reset and start to move upwards, it is going to start another leg up to and beyond the previous ATH.

There are many "IF". It all depends on when Bitcoin decides its decisive move. But my overall bias for Virtual and crypto market in general is very bullish.

I have been holding Virtual last year (purchase price is about $0.50) and I haven't sold any. I might start taking profit in stages when the daily MACD or RSI starts to form a clear negative divergence.

BUYGAME is an AI agent infrastructure project in the Virtual protocol ecosystem. A small market crypto project is extremely volatile and can be unpredictable, but I enjoy trading a project like this based on technical analysis.

Technical analysis can be very subjective. Depending on which time frames you are trading and how you are seeing patterns, you can draw support/resistance/trend lines in so many different ways for more mature assets like Bitcoin, FX, and indices. But a young asset like GAME, doesn't have much price action history, therefore, it can be easy to see where the price moves and retraces according to Fibonacci level in 4H and Daily charts. There are no prior historical patterns and price levels so we have to go with textbook style moves. I am not sure if that is the case, but I feel like that's what is happening in many new crypto projects.

The price started to move up on the 5th Dec and peaked on the 3rd Jan. It is the very first time in this asset's history that the momentum indicators travelled from the bottom to the top in the daily chart. So I drew the Fib retracement line there. The price dropped right at Fib 0.786 (the last line of defence for the bull), formed tweezer bottom, and strongly bounced up in the 4H chart.

Daily MACD is remaining in the bull territory. Daily Stochastics have reset and entered the bull zone. When you go to 4H chart, MACD lines have crossed and are entering to the bull territory. The price is travelling inside the sell block in the 4H chart, but once it clears, it has not much pressure to move to the last month high at $0.36 zone and move up further.

I don't trade small projects like this with leverage. I pick projects with good fundamentals and buy with a small allocation of my capital. I bought GAME tokens at $0.25 area in late Dec. I intend to hold it for a while and when Daily momentum indicators start to form negative divergence, I might sell all or sell some.

BUYWell, I was hoping the price would consolidate for a while when it broke above the trendline and Fib 0.236, but it blasted off to Fib 0.618, instead. Last nights CPI data must have been a major catalyst for this move.

I have bought Virtual at around $0.50 Nov last year and I haven't sold any yet. I am bullish on Virtual and I intend to invest and hold for a while, instead of trading.

I am looking for an entry to buy more. I personally don't think it matters too much to buy it for $4 , $3.80. or $3.50 IF you are to hold it for several months. However, currently the price is hovering around Fib 0.618 which is the area the price often corrects temporarily. Also, two sets of sell orders sitting right above it. The 4H Stochastics has already reached the overbought territory (although it doesn't mean much when the momentum is very strong. It can stay in the overbought territory for a long long time and the price keeps going up.)

What I am going to do is to wait and see how the price will settle during Asian and European a.m. sessions. If the price comes down to Fib 0.382-0.5 level, I will buy more.

Almost time to buy, not yet! ! Yesterday, I published my analysis on Virtual protocol and wrote that I would buy when a certain conditions are met.

These conditions are:

1) Daily stochastics (9,3,3) reset and start to move upwards

2) Daily MACD remains above 0 level (bull zone)

3) 4H MACD lines cross and enter the bull zone.

4) 4H stochastics are not overbought territory (it is okay if the conditions above are met but it might experience a few more pull backs if stochastics are overbought)

5) 4H candle breaks and closes above the top descending parallel channel and stays and also it is above Fib 0.236.

In the last few days, the bull is starting to show some signs of strength. Daily stochastic has reset and now is moving back up. Daily MACD remains in the bull territory. Therefore, the environment to open a long position is now present. The price has moved and closed above the descending parallel channel as well as Fib 0.236 in the 4H chart.

HOWEVER, the 4H stochastics has already reached the overbought territory and rolling down before 4H MACD made it to the bull territory. That means, the first attempt for the bull run has failed. The price might move sideways between key fib levels for a while until the stochastic is reset.

$VIRTUAL Rockets Past $3.20: Bulls Eye $5.00 Target!$VIRTUAL/USDT 4H Chart Analysis

Breakout confirmed: SPARKS:VIRTUAL has broken above the $3.20 resistance with strong volume, indicating bullish momentum and a potential trend continuation.

Current price: $3.95.

Key levels:

Support: $3.20 (recently established support following the breakout).

Resistance:

Target 1: $4.40 (next immediate resistance).

Target 2: $5.00 (extended resistance if bullish momentum continues).

Pattern: A textbook bottom formation has been completed, signaling a strong reversal.

Trade setup:

Entry: Current level ($3.95) or on a pullback near $3.60.

Target:

T1: $4.40.

T2: $5.00 (if momentum sustains).

Stop loss: Below $3.60 to minimize downside risk.

Risk-to-reward: Favorable R:R, particularly if the price sustains above $3.60 and trends toward T2.

Confidence level: 8/10, given the clean break of $3.20 resistance and volume confirmation

.

Considerations:

Volume confirmation: Ensure buy volume remains strong, especially near $4.40.

Momentum check: Watch RSI for signs of overbought conditions as price approaches $4.40-$5.00.

Resistance reaction: Be prepared for potential consolidation or rejection near $4.40 before targeting $5.00.

This setup suggests a strong bullish continuation if $3.60 holds, with clear upside targets in sight.