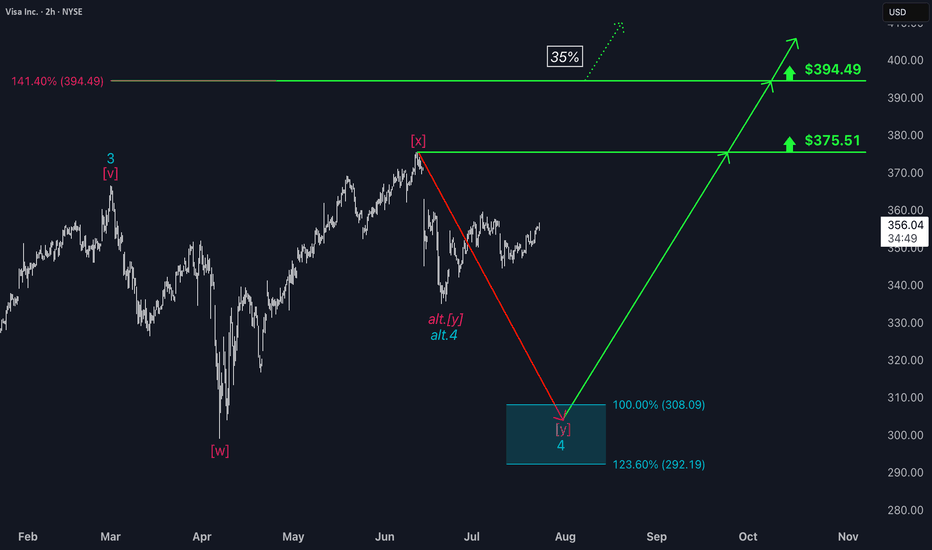

Visa: Waiting in the Wings Visa has entered a phase of sideways consolidation — but this does not affect our primary scenario. We continue to see the stock moving within magenta wave , which is expected to complete the larger turquoise wave 4 inside our turquoise Target Zone between $308.09 and $292.19. After that, we anticipate a renewed upward impulse. Turquoise wave 5 should then push the stock beyond the resistance levels at $375.51 and $394.49. Meanwhile, we are keeping two alternatives on our radar. The first has a 35% probability and assumes the correction is already over, meaning turquoise wave alt.4 is complete. The second is a more bearish scenario (32% probability) visible on the daily chart. It suggests that the high of green wave alt. may already be in, which would imply that the ongoing alt. wave is headed toward a lower low below the $234.30 support level.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Visa

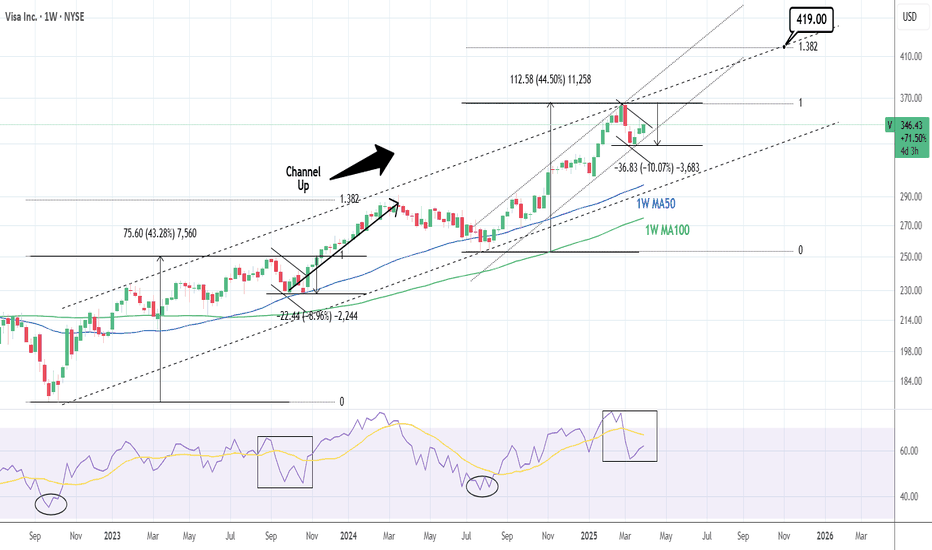

VISA on a strong Bullish Leg targeting $440.Visa Inc. (V) has been trading within a Channel Up pattern since the October 10 2022 market bottom. After December 2022, every test of the 1W MA50 (blue trend-line) has been the most optimal long-term buy opportunity, being also a Higher Low (bottom) of the pattern.

Every Bullish Leg has been +5% stronger than the previous, which leads us to believe that the current Bullish Leg will peak at around +49.50% (+5% from +44.60%). This translates to $440 Target towards the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency exchange Coinbase (COIN), while simultaneously putting pressure on Mastercard (MA) and Visa (V) shares.

According to media reports, market participants are concerned that stablecoins could pose serious competition to these companies, which earn revenue primarily from transaction fees. This serves as an example of how blockchain technology, with its low-cost features and high speed, could disrupt leaders in the traditional finance sector.

Technical Analysis of Mastercard (MA) Stock Chart

In May, MA shares formed an upward trend (shown in blue), but this was already broken by a strong downward move, accompanied by a wide bearish gap in the $575–$585 range.

Near the lower boundary of the channel, a contracting triangle pattern (shown in black) can be observed – this can be interpreted as a temporary balance between buyers and sellers. However, it didn’t last long: the widening spread of bearish candles (1 and 2) indicates growing selling pressure.

It’s possible that following a drop of over 9% from the June high, Mastercard (MA) shares might attract buyers betting on a short-term rebound. Nevertheless, in the longer term, developments related to the GENIUS bill could contribute to a continued downward trend.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Visa: Resistance ApproachingThe next key step for Visa should be overcoming resistance at $394.49 during magenta wave . However, if support at $339.61 fails to hold, our alternative scenario (33% probability) will be activated—suggesting the recent high already marked the end of the corrective wave alt. in magenta. In that case, a renewed decline below the $299 mark would be likely, aiming to complete the alternative turquoise wave alt.4 on a larger scale.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

VISA - A Pump & Dump? Help me understand please.To places where no stock price has ever gone before..

What makes VISA so special?

The credit industry is currently staring into the abyss due to massively rising payment defaults.

Why is VISA skyrocketing in price, breaking through every barrier as if they were made of butter?

I don't know, and I'm very puzzled.

What will happen if economic conditions become even more difficult and the madness we're currently experiencing fully hits, and hardly anyone can service their consumer debt anymore?

I think at that point, VISA will look like a

Pump & Dump too like many others.

I'd appreciate any info on why VISA is rising so much.

"King of Cards" How Does Visa Make Money?NYSE:V

To be honest, VISA stock is the kind of investment that really feels solid and reliable. I bought a bit of VISA a few years ago, and before I knew it, the price had climbed past $300 and I started getting those occasional dividend notifications. The dividends aren’t huge, but it’s nice to see that money coming in automatically. I can see why so many dividend investors like VISA.

VISA is, of course, the same “VISA” you see on your credit cards. Globally, they dominate the credit card market, with nearly half of the market share, and they’re among the top 10 biggest companies in the US by market cap.

These days, cashless payments have become the norm, and that trend really works in VISA’s favor. Most analysts expect VISA to keep growing steadily, with annual revenue and profit increases of around 10%. VISA has also raised its dividend every year for over 16 years, making it a classic “dividend growth” stock. The yield itself is under 1%, but the key is that the dividend keeps getting bigger.

Recently, VISA’s been expanding into new businesses too-like Visa Direct for money transfers-so they’re evolving from just a credit card company into a global payments platform. Maybe that’s why even Warren Buffett has invested in VISA.

Of course, there are risks. There’s always talk of antitrust regulation, and new fintech companies like PayPal are trying to take market share. In fact, VISA’s stock has underperformed the market a bit in the last few years. But VISA’s economic moat (the barriers that keep competitors out) is still very strong.

Looking at the current price, VISA’s P/E ratio is actually a bit lower than its five-year average, so some people think it’s undervalued right now. That’s why I think VISA is a stock you can hold in your portfolio for the long term and feel pretty comfortable about.

- VISA is the clear leader in global payments, and as we move toward a cashless society, its growth prospects look strong.

- The dividend is small but growing every year, and the stock price has trended upward over the long term.

- There are risks like regulation and fintech competition, but most still see VISA as a solid investment.

Maybe you like this Video deal with VISA

below comment!

VISA:Respecting the 61.8% Fibonacci Level and Going for New HighWho doesn't know VISA? Almost everyone has or has had a VISA card. VISA stock has an unbeatable bullish outlook, which, like all stocks on the stock market, has retraced its rise.

---> What is its current situation?

If we look at the chart, its appearance is CLEARLY BULLISH (Bull), having gone through a retracement phase. The retracement it has made is EXACTLY THE 61.8% Fibonacci, AND IT HAS RESPECTED IT. Since reaching that retracement on March 14, the price has not stopped rising. It is currently BREAKING KEY ZONES to initiate an attack on NEW HIGHS IN VALUE. If it surpasses the 352 zone, it will go directly to the highs, and will most likely break them to explore new prices for the stock.

--------------------------------------

Strategy to follow:

ENTRY: We will open two long positions if the H4 candle closes above 352.

POSITION 1 (TP1): We close the first position in the 366 zone (+4%) (highs zone).

--> Stop Loss at 336 (-4.2%).

POSITION 2 (TP2): We open a Trailing Stop position.

--> Initial trailing stop loss at (-4.2%) (coinciding with the 336 level of position 1).

--> We modify the trailing stop loss to (-1%) when the price reaches TP1 (366).

-------------------------------------------

SET UP EXPLANATIONS

*** How do I know which two long positions to open? Let's take an example: If we want to invest €2,000 in the stock, we divide that amount by 2, and instead of opening one position of €2,000, we'll open two positions of €1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but it automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance. This specified distance is the trailing Stop Loss.

--> Example: If the trailing Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% during increases. Therefore, the risk decreases until the position enters a profit. This way, you can take advantage of very strong and stable price trends, maximizing profits.

VISA: One of the steadiest 2025 stock picks.Visa remains bullish on 1W and is about to do so on its 1D technical outlook as well (RSI = 54.200, MACD = 1.140, ADX = 29.207). The 1W Channel Up is what keeps the long term trend bullish and 1D is just recovering from neutral grounds the correction of March's first 2 weeks. This is nothing new for the stock as it had the same -9% correction in September 2023 after a symmetric +43.28% bullish wave. After this correction, the index extended the rally to the 1.382 Fibonacci extension before the stronger correction.

You can see that the 1W RSI pattern now is identical to then. Consequently, we again expect a technical rebound to the 1.382 Fib extension either at or over the 2 year Channel Up (TP = 419.00) by the end of the year.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Visa: Bottom Already Established?Visa might have already reached the low of the magenta wave ; however, for now, we allow slightly more room for the downside. Nonetheless, once this interim correction has concluded, the price should proceed higher during the magenta wave and surpass the resistance at $366.34. We currently consider it 34% likely that the stock will break above this level to form a fresh high with the magenta wave alt. . But primarily, we view the regular wave as already complete.

The global market is rebootingOn February 18, negotiations between the United States and Russia are scheduled to take place in Saudi Arabia. These talks could pave the way for restoring economic relations and addressing global challenges.

“American companies lost over $300 billion by exiting the Russian market,” said Kirill Dmitriev, head of RFPI, on the eve of talks with the U.S. delegation in Saudi Arabia. He emphasized the importance of economic dialogue, noting that the Russian market remains attractive to investors.

It is now known that several major American companies intend to return to Russia. Amid a potential thaw in U.S.-Russia relations, Visa (#Visa), Mastercard (#MasterCard), Apple (#Apple), PepsiCo (#PepsiCo) and McDonald's (#McDonald) have all announced their intentions in recent days.

The U.S. stock market remains resilient thanks to domestic growth drivers. Additionally, several key factors are expected to drive growth in the near future:

Federal reserve monetary policy: A possible rate cut or maintaining low interest rates is spurring investments. This, in turn, boosts company valuations and pushes up indices such as the Dow Jones (#DJI30) and S&P 500 (#SP500).

Technology sector: Ongoing advancements in AI, cloud services, and biotechnology are attracting capital. Moreover, integrating artificial intelligence into large businesses helps reduce costs by automating routine processes, while AI algorithms enhance strategic planning and risk management.

Corporate earnings growth: Increasing corporate profits are one of the key factors supporting the positive momentum in the stock market, including the S&P 500 (#SP500), which reflects the performance of the 500 largest U.S. companies. Strong quarterly reports from these companies play a crucial role in reinforcing investor confidence and ensuring market stability.

Geopolitical expectations: Tensions among major global players like the U.S., EU, and Russia could lead to sanctions, trade wars, and economic restrictions, which negatively impact the global economy and stock markets. A thaw in relations could reduce the likelihood of such conflicts and, consequently, lower the risks associated with sanctions and instability.

FreshForex analysts are confident that as geopolitical tensions ease, companies will start to return, which will undoubtedly drive up their stock prices. Don’t miss this chance – invest in stocks with us!

Our terminal offers 270 trading instruments, including CFDs on corporate stocks and indices. Trade with a favorable leverage of 1:1000 and enjoy attractive bonuses!

VISA bullish outlook like Mastercard - Target to $380Visa is looking good fundamentally and technically.

Strong Financial Performance: Visa reported a 14% earnings increase and 10% revenue growth, exceeding expectations.

Growth in Payment Volumes: Payments volume grew 9%, with a 16% rise in cross-border transactions.

Positive Market Sentiment: Analysts view Visa as a top pick due to its strong travel-related spending and valuation.

Strategic Partnerships: Visa partnered with X to launch the X Money Account, enhancing its digital payment services.

Price> 20 and 200MA

W Formation

Target $380.00

VISA issuing the first buy signal of the pattern.VISA Inc. (V) has gone a long way since our buy signal almost 5 months ago (August 29 2024, see chart below):

As you can see it was a buy signal just before a 1W MACD Bullish Cross, and straight hit our $320.00 Target before it started pulling-back again the past 30 days.

The +2 year Channel Up pattern is intact and in fact the recent break below the 1D MA50 (blue trend-line) is the first buy signal that is being waved as the price is almost at the bottom of the internal (dotted) Channel Up, which is the Bullish Leg of the +2 year pattern.

The minimum decline within this pattern has been -7.30% so there is still some room for a new low but the 1D MACD indicates we might be seeing a Bullish Cross soon.

In any case, this is a solid level for a first buy entry if you are a long-term DCA investor. Target the top of the 2-year Channel Up at $330.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

VISA flashing a short-term sell signal.Visa Inc. (V) has been one of our most accurate recent stock predictions (August 29, see chart below), as it is about to complete the buy signal we gave on the Channel's bottom to a +27.36% rise and hit our $320.00 Target:

Needless to say, if you took that call, evaluate your options as the profit is already enormous. Moving forward, specifically zooming in on the 1D time-frame, we can see that Visa is flashing its first sell signal in a while.

The price isn't only almost at the top of the 2-year Channel Up but more importantly, the 1D MACD has completed a Cup sequence on a Bearish Cross, similar to all early corrections at the start of this Channel.

As you can see all MACD Bearish Crosses were followed by pull-backs of similar size with the minimum being -7.30%.

As a result, we can expect the stock to hit and even break below the 1D MA50 (blue trend-line) at $295.00 (-7.30% decline), which would be also near the 0.382 Fibonacci retracement level (similar to the December 22 2022 Low).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

VISA filling gap BEarishVISA looks like to fill the gap up opening it did on its earnings

It will probably retest the support of 292 to 296 area

At this point entries can be made to ride the long term bull trend of Visa

its a fundamentally strong stock which will benefit from rate cuts

Entry : 292-296

Stop loss : 270

Visa (V): Pullback Incoming After New All-Time HighsVisa ( NYSE:V ) has reached our anticipated wave 3 target, a significant milestone for this stock that has consistently delivered strong performance. Recently, regulators in the EU have begun probing Visa and MasterCard’s fees, assessing their impact on businesses. While this could pose some risks, Visa’s overall trajectory remains promising.

The stock has been setting new all-time highs consistently, but with the potential completion of wave ((v)) and wave 3, we are now looking for a pullback. This correction could offer a great opportunity to open new long positions. Our target range for the pullback is between $280 and $260, though the exact level remains uncertain. Before this, there could still be further upside, with a potential minor retracement between $311 and $325 that would support a bearish short-term outlook.

We are monitoring this closely and have alerts set to act when the time is right. Visa remains a long-term performer, but patience will be key to capitalizing on its next move.

V Visa Options Ahead of EarningsIf you haven`t bought V before the previous earnings:

Now analyzing the options chain and the chart patterns of V Visa prior to the earnings report this week,

I would consider purchasing the 282.5usd strike price Calls with

an expiration date of 2024-11-1,

for a premium of approximately $5.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Technical Analysis on Visa (V)Visa's stock ( V ) shows a clear long-term uptrend.

Following a decline in 2022, it regained its 2021 highs in early 2024, breaking through resistance and continuing its upward trend.

The stock reached new highs around the $290 area, then retraced, forming a bullish flag pattern, down to a support area near $250.

Currently, it is testing the highs again in the $290 area, reached via a gap up after positive earnings and revenue announcements. If it confirms a breakout above resistance, with a potential retest, the stock could continue its bullish trend.

VISA: 2 year Channel Up seeks the next bullish wave.Visa is on a neutral 1D technical outlook (RSI = 53.426, MACD = 2.190, ADX = 43.132) and just above neutrality levels on 1W (RSI = 56.042) as despite being supported by the 1W MA50, it has been rejected twice on the R1 level. That would have been concerning on any other occasion but this time it's not as we consider this similar to the November 2022 R1 pullback, which after being contained by the 1W MA50, it reversed to the 1.382 Fibonacci extension. The 1W RSI trading above its MA for 2 months now, is also similar to October-November 2022. Consequently, we turn bullish again, aiming for the 1.382 Fib (TP = 305.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The Payment Card Titan: Comparing Visa, Mastercard, and Amex◉ Abstract

The global credit card market is projected to grow from USD 559.18 billion in 2023 to USD 1,146.62 billion by 2033, driven by advancements in digital payment technologies, e-commerce growth, increased financial literacy, and urbanization, especially in Asia-Pacific.

Visa leads the market with a 38.73% share, followed by Mastercard and American Express. Visa and Mastercard operate primarily as payment networks, while American Express both issues cards and offers unique rewards. Financially, all three companies show strong revenue growth, with American Express yielding the highest ROI but also carrying significant debt.

Despite this debt, American Express appears undervalued based on financial ratios. Overall, while American Express presents an attractive investment opportunity, Visa and Mastercard also demonstrate solid fundamentals and growth potential for investors in the expanding credit card market.

Read the full analysis here . . .

◉ Introduction

The Global Credit Card Market Size was Valued at USD 559.18 Billion in 2023 and the Worldwide Credit Card Market Size is Expected to Reach USD 1146.62 Billion by 2033,

◉ Key Growth Drivers

● Digitalization and Technology: Advancements in payment technologies, including mobile wallets and contactless payments, enhance convenience and security.

● E-Commerce Growth: The rise of online shopping increases demand for credit card payments, as consumers prefer their ease and safety.

● Financial Literacy: Improved understanding of financial products encourages more consumers, especially in developing regions, to adopt credit cards.

● Urbanization: Growing urban populations, particularly in Asia-Pacific, lead to greater access to banking services and credit facilities.

● Emerging Markets: Rising disposable incomes in developing countries drive new credit card accounts as financial institutions expand their offerings.

● Consumer Convenience: The preference for quick and easy payment methods boosts credit card usage over cash transactions.

● Rewards Programs: Attractive loyalty programs incentivize consumers to use credit cards for everyday purchases.

● Regulatory Support: Government initiatives promoting cashless transactions foster a favourable environment for credit card adoption.

◉ Market Overview

As of 2022, the global credit card market was primarily led by Visa, which held a 38.73% share of the worldwide payment volume. Mastercard followed with a 24% market share, while American Express (Amex) accounted for 4.61%. Notably, China UnionPay is also a major player in this space, surpassing Amex in terms of purchase volume

◉ Key Players in the Payment Card Industry

1. Visa NYSE:V

● Market Cap: $552 B

● Market Share: 38.73%

● Business Model: Payment network facilitating transactions between consumers, businesses, banks, and governments globally.

● Card Issuance: Does not issue cards itself.

● Global Reach: Extensive acceptance network across more than 200 countries.

2. Mastercard NYSE:MA

● Market Cap: $474 B

● Market Share: 24%

● Business Model: Payment processor and network partnering with banks to offer various card products.

● Card Issuance: Does not issue cards itself.

● Global Reach: Broad acceptance worldwide with diverse products catering to different consumer needs.

3. American Express NYSE:AXP

● Market Cap: $203 B

● Market Share: 4.61%

● Business Model: Card issuer and payment network offering unique benefits and rewards directly to cardholders.

● Card Issuance: Issues its own cards.

● Global Reach: High acceptance rate in the US (99% of merchants), lower in Europe and Asia due to higher transaction fees.

◉ Technical Aspects

● From a technical perspective, there's a notable similarity among the three stocks: each is exhibiting strong bullish momentum, consistently achieving higher highs and higher lows.

● All three stocks have formed a Rounding Bottom pattern, and after breaking out, their prices have climbed to new heights.

● While Mastercard and American Express are currently trading at their all-time highs, Visa is positioned just below its peak.

◉ Relative Strength

The chart vividly demonstrates that American Express has excelled remarkably, achieving a return of nearly 85%, whereas Mastercard and Visa have delivered returns of 28% and 20%, respectively.

◉ Revenue & Profit Analysis

1. Visa

● Year-over-Year

➖ In FY23, Visa achieved a remarkable revenue increase of 11.4%, reaching $32.7 billion, up from $29.3 billion in FY22.

➖ The EBITDA for FY23 also saw a significant rise, totalling $22.9 billion compared to $20.6 billion in FY22.

● Quarter-over-Quarter

➖ In the latest June quarter, Visa's revenue rose to $8.9 billion, slightly surpassing the $8.8 billion reported in March 2024. This reflects a year-over-year growth of nearly 9.5% from $8.1 billion in the same quarter last year.

➖ The EBITDA for the most recent June quarter reached $6.2 billion, indicating an almost 9% increase from $5.7 billion in the same quarter last year.

➖ In June, the diluted EPS saw a modest rise, climbing to $9.35 (LTM) from $8.94 (LTM) in March 2024, which represents a notable year-over-year increase of 18.6% from $30.3 (LTM).

2. Mastercard

● Year-over-Year

➖ Mastercard's revenue for FY23 experienced a robust growth of 12.9%, reaching $25.1 billion, up from $22.2 billion in FY22.

➖ The EBITDA for FY23 also increased, reporting $22.9 billion, up from $20.6 billion in FY22.

● Quarter-over-Quarter

➖ In the recent June quarter, Mastercard's revenue climbed to $7.0 billion, compared to $6.3 billion in March 2024. Year-over-year, this marks an increase of nearly 11% from $6.3 billion in the same quarter last year.

➖ The EBITDA for the latest June quarter was $4.4 billion, reflecting an almost 9% rise from $3.9 billion in March 2024.

➖ In June, the diluted EPS saw a slight increase, rising to $13.08 (LTM) from $12.59 (LTM) in March 2024, which is a significant year-over-year increase of 23% from $10.67 (LTM).

3. American Express

● Year-over-Year

➖ For the fiscal year 2023, the company experienced a remarkable revenue growth of 9.7%, reaching an impressive $55.6 billion, compared to $50.7 billion in fiscal year 2022.

➖ Additionally, operating income showed a positive trajectory, with fiscal year 2023 reporting $10.8 billion, an increase from $10 billion in the previous fiscal year.

● Quarter-over-Quarter

➖ In the latest June quarter, revenue continued its upward trend, totalling $15.1 billion, up from $14.5 billion in March 2024. This represents a significant year-over-year growth of nearly 8.7% from $13.9 billion in the June quarter of the previous year.

➖ Furthermore, operating income for the June quarter reached $3.2 billion, marking a substantial increase of almost 19% from $2.7 billion in the same quarter last year.

➖ The diluted earnings per share (EPS) also saw a remarkable rise in June, climbing to $13.39 (LTM) from $12.14 (LTM) in March 2024, which is a significant jump of 36% compared to $9.83 (LTM) in the same quarter last year.

◉ Valuation

● P/E Ratio

➖ Visa stands at a P/E ratio of 29.1x.

➖ Mastercard is at a P/E ratio of 38.7x.

➖ American Express shows a P/E ratio of 20.6x.

➖ When we analyze these figures, it becomes clear that American Express appears significantly undervalued compared to its peers.

● P/B Ratio

➖ Visa has a P/B ratio of 14.3x.

➖ Mastercard's P/B ratio is a staggering 64x.

➖ American Express, however, has a P/B ratio of just 6.8x.

This further reinforces the notion that American Express is currently undervalued in the market.

● PEG Ratio

➖ Visa's PEG ratio is 1.56.

➖ Mastercard's PEG stands at 1.71.

➖ American Express shines with a PEG ratio of just 0.56.

➖ This metric also highlights American Express's superior value proposition compared to its peers.

◉ Cash Flow Analysis

➖ Visa's operating cash flow for the fiscal year 2023 has risen to $20.8 billion, marking a notable increase from $18.8 billion in fiscal year 2022.

➖ Similarly, Mastercard has experienced growth in its operating cash flow, which has reached $12 billion in fiscal year 2023, up from $11.2 billion in the previous year.

➖ In contrast, American Express has reported a significant decline in its operating cash flow, decreasing from $21.1 billion in fiscal year 2022 to $18.6 billion in fiscal year 2023.

◉ Debt Analysis

1. Visa

● Debt to Equity Ratio: Approximately 0.52 as of June 2024, indicating a stable financial structure with moderate leverage.

● Total Debt: About $20.6 billion.

● Total Shareholder Equity: $39.7 billion.

● Analysis: Visa's ratio reflects a cautious debt approach, balancing equity and debt financing, with net debt well-supported by operating cash flow, enhancing financial stability.

2. Mastercard

● Debt to Equity Ratio: Approximately 2.10, indicating a higher reliance on debt compared to Visa 5.

● Total Debt: $15.6 billion.

● Total Shareholder Equity: $7.5 billion.

● Analysis: Mastercard’s higher ratio suggests it is more aggressive in leveraging debt for growth initiatives compared to Visa. This strategy may lead to greater volatility in earnings due to interest obligations.

3. American Express

● Debt to Equity Ratio: Approximately 1.80, indicating a significant level of debt relative to equity 5.

● Total Debt: $53.2 billion.

● Total Shareholder Equity: $29.54 billion.

● Analysis: American Express’s ratio shows a strong reliance on debt financing, which can enhance growth but also introduces risks related to interest payments and market conditions.

◉ Top Shareholders

1. Visa

● The Vanguard Group has notably boosted its investment in Visa, now commanding a remarkable 7.52% share, reflecting a 0.62% increase since the close of the March quarter.

● In contrast, Blackrock maintains a stake of approximately 6.7% in the firm.

2. Mastercard

● When it comes to Mastercard, Vanguard has also made strides, raising its ownership to an impressive 8.27%, which is a 1.02% uptick since the end of March.

● Blackrock, on the other hand, has a substantial 7.56% stake, showing a 1.17% growth from the same period.

3. American Express

● As for American Express, Warren Buffet’s Berkshire Hathaway boasts a significant 21.3% stake in the company.

● Meanwhile, Vanguard holds a 6.36% interest, while Blackrock has a 5.89% share.

◉ Conclusion

After a thorough analysis of both technical and financial indicators, we find that American Express offers a compelling valuation opportunity that is likely to attract investors. Nonetheless, it is important to recognize the significant debt load the company carries, a concern that also extends to Mastercard.

● From a technical standpoint, the chart for American Express seems to be stretched thin. Investors might want to hold off for a corrective dip to secure a more advantageous entry point.

● Mastercard's financial results reflect solid performance, though it carries a high level of debt. The technical chart indicates a slight overvaluation. Savvy investors might look to build their positions during times of price stabilization.

● Visa presents a well-rounded synergy between its technical and fundamental metrics. Its chart reveals a remarkable rebound, approaching previous all-time highs after a notable decline. The company's valuation and growth potential make it a compelling investment choice.