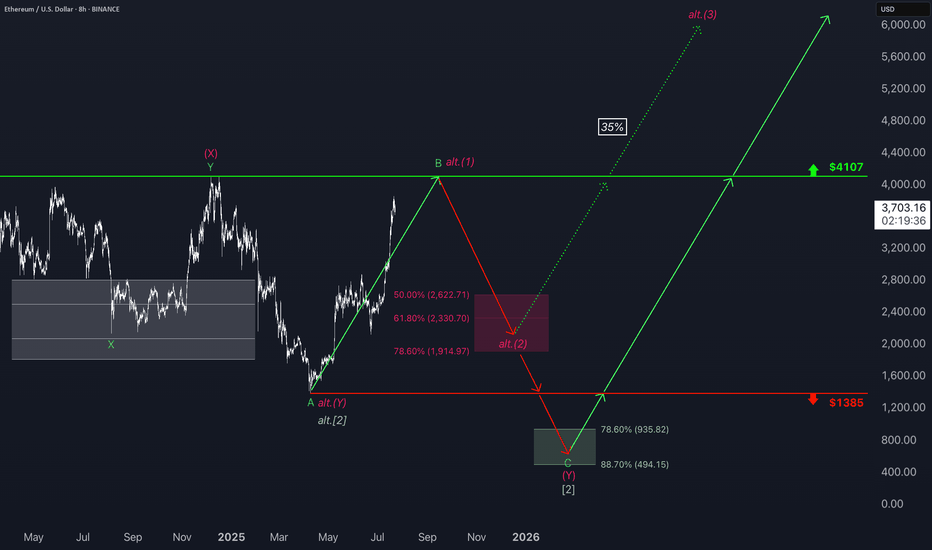

ETH: Eyes Resistance, But Correction Still LoomsEthereum has also seen a modest pullback since yesterday morning, but here too, it’s too soon to confirm a high for turquoise wave B. Accordingly, we anticipate further gains in this corrective rally—potentially up to resistance at $4,107—before the subsequent turquoise wave C takes over and drives the price down into the green long Target Zone ($935.82–$494.15). Within this range, we primarily expect the low of the wave- correction, which has now lasted more than four years, setting the stage for a long-term trend reversal to the upside. According to to our alternative scneario, magenta wave alt.(1) would complete with the next high. The following pullback, attributed to wave alt.(2), would then only extend into the slightly adjusted magenta Target Zone ($2,622–$1,914) before a move to new all-time highs (probability: 35%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Vitalikbuterin

The Chart you don't want to see: Coinbase Vampire attacked ETHBrian Armstrong is a significant influencer in both Silicon Valley and now Washington, D.C., where he is instrumental in shaping legislation and attracting investments that benefit Coinbase and its shareholders.

Vitalik writes blogs and appoints EF directors who appear to have ambiguous gender identities and are quite out there on the spectrum.

Jesse Pollak is yet another astute player who has leveraged ETH's technology to transform BASE into a powerhouse integrating neatly into Coinbase platform for payments and now DEX trading within app.

ETH will thrive.

However, as we've observed, Joe Lubin's return as a public figure to advocate for and steer the future of Ethereum has never been more crucial.

But will it be sufficient to compete with Brian and Jesse? They seem to be operating on a significantly higher plane.

Ethereum’s Last Chance: Let Jesus Take The WheelEthereum’s price action over the course of this crypto bull run, and especially since the beginning of this year, 2025, has been nothing short of horrendous. It’s failed to hold almost every single important level that it needed to, to be able to keep pushing higher. This has caused almost all crypto investors and altcoin traders to pull their investments out, and drive the price even lower. At its current point, altcoin traders have lost all but 100% of the confidence they once had in it, and to retail investors, this is basically toxic waste once they see the losses that have been taken, it’s driving them away en masse.

With that being said, this is ETH’s final stand, it’s time to either show out, or go home with nothing to show for itself. It’s at a very critical support level right now, and if it breaks down below this, the trade will be cancelled. It’s just finished completing the ‘Jesus Take The Wheel’ pattern on the weekly & MONTHLY. This is an extremely high probability pattern, and could cause a blow-off top for Ethereum.

We also see that we got a Wykoff Pattern here, with the last one that we got around the $2k level being a fake out. The only other times it has printed aside from the last fake out, it has been the start of a bull run. ETH now has 6 weeks in total, or about 4 more weeks from now to start recovering old levels, and taking off to the moon.

I drew a bar pattern on the chart that I took from its original bullish pattern from the start of the 2013 bull run. I believe we’ll have a shortened cycle, and due to not having much time left to complete the bull run during this 4-year cycle, that’s all we will get. Thankfully, the price has been beaten down so much, that getting in now, will offer 1000% gains, in just about 6 months. This will be one of the most incredible feats in all of crypto.

Fear is at an all time high, and ETH has been teasing everyone with a bull run for months and even years now. We haven’t seen an all time high since 2021. Most investors will suffer from boredom exhaustion as well, and with the stock market also sinking, we could see a huge push once we recover some levels, for the masses to finally come into the market via Ethereum ETF’s, so they don’t have to actually risk any money moving crypto around. The boomers and traditional investors with stock accounts will be free to throw cash at these ETF’s and that’s what will give us our final pumps past all time highs, once the crypto traders all get back into the market, and get us to new ATH’s in the first place, and help us recover key levels.

One thing is clear: ETH needs to stop trying so hard to control its environment, it’s time to just let Jesus Take The Wheel 🚀

ETHEREUM BITCOIN (BEST-CASE)CRYPTOCAP:ETH is the main platform for thousands of apps and blockchains, all powered by the Ethereum protocol.

This vibrant ecosystem fuels innovation and a wide range of decentralized apps and services.

Free and global Ethereum accounts

Pseudo-private, no personal information needed

Without restrictions anyone can participate

No company owns Ethereum or decides its future

Mr.Million | Why ETH Doesn’t Look Good Near-Term From a purely technical standpoint, I do not see a reason for upside in the near future.

Negative sentiment around ETH is also growing:

ETH is relatively slow 🐌and its fees remain high. A new version (ETH 2.0) may take a while to drop.

SOL-based projects gaining momentum. 🚀

Let’s see if #VitalikButerin can reclaim ETH’s past glory and make ETH great again! 😉✨

Vitalik Buterin Adopts Hippo Moo Deng, Making MOODENG Soar 92%The cryptocurrency world is abuzz as $MOODENG, the meme coin inspired by Moo Deng the hippo, skyrockets by 92% in the wake of Ethereum co-founder Vitalik Buterin adopting the beloved animal. With this development, $MOODENG has cemented its place as a meme coin with both cultural significance and real-world impact.

Vitalik Buterin's Game-Changing Adoption

Vitalik Buterin has officially joined Thailand's Khao Kheow Open Zoo’s Wildlife Sponsorship Program, becoming the adoptive father of Moo Deng, a pygmy hippo adored by fans worldwide. The Ethereum co-founder donated a staggering 10 million Thai baht (approximately $287,000) to support Moo Deng and her family. This philanthropic gesture is in line with Vitalik’s recent advocacy for meme coins that integrate charitable contributions into their ecosystem.

The donation is part of a larger Wildlife Adoption Project and will fund a 1,600-square-meter facility for Moo Deng. This development sparked widespread excitement, leading to a surge in $MOODENG’s trading volume by 300% in the past 24 hours.

MOODENG’s Meteoric Price Rise

Following Vitalik’s announcement, $MOODENG surged 70% within an hour and has since reached an impressive 92% gain over the last 24 hours. The token is currently trading at $0.0001942, with an intraday high of $0.0002446. Trading activity also spiked in the derivatives market, with open interest in MOODENG futures increasing by 9% in just 4 hours, now valued at $115.42 million.

Adding to the momentum, Coinbase has listed $MOODENG, further legitimizing the token and increasing accessibility for investors.

Technical Outlook

$MOODENG is riding a bullish wave, with the Relative Strength Index (RSI) at 72, signaling an overbought condition. However, with a current market cap of $94 million, there’s ample room for further growth.

Key levels to watch include:

- Immediate Support: At the 38.2% Fibonacci retracement level, providing a cushion for potential price corrections.

- Major Resistance: $0.00031, a critical selling point that could mark the next leap toward a $500 million market cap in the long term.

The bullish trend shows no signs of slowing, making $MOODENG an attractive option for traders and investors.

The Vitalik Effect

Vitalik Buterin’s endorsement of $MOODENG isn’t just a momentary hype boost; it underscores the token’s potential to combine the viral appeal of meme coins with meaningful charitable initiatives. His donation has drawn attention to the ethical side of cryptocurrency, where tokens can serve a greater purpose beyond speculation.

What’s Next for $MOODENG?

The $MOODENG community is rallying behind this newfound momentum, with expectations of further price surges as more investors flock to the token. The project’s alignment with Vitalik’s values and its integration into mainstream platforms like Coinbase provide a strong foundation for sustained growth.

With its unique blend of humor, philanthropy, and robust technical performance, $MOODENG is shaping up to be one of the most compelling stories in the crypto space this year.

ETHEREUM projects to $18,000 Using logarithmic projections the measured move of this #HVF takes #ETH well in to the teens.

The caveat being it may not happen in 2025 but completes the pattern, later on this decade.

It is a big market cap of around 2 trillion based on the current circulating supply.

So not a pie in the sky valuation at all.

@TheCryptoSniper

SHIBA INU — 2024-5CRYPTOCAP:SHIB is a meme token which began as a fun currency and has now captured mainstream attention as a meme coin. What started of as a meme coin has attracted a decent following of developers who have built a decentralized ecosytem around the token, including a dedicated L2 chain Shibarium.

Ethereum (ETH) Set for a Breakout as Market Momentum BuildsEthereum ( CRYPTOCAP:ETH ) appears primed for a significant breakout to the $4,500 level, fueled by bullish momentum and recent groundbreaking developments. As Bitcoin (BTC) reaches a historic all-time high of $100,000, attention is shifting towards CRYPTOCAP:ETH , often dubbed the "silver to Bitcoin's gold," indicating that the much-anticipated altcoin season may be on the horizon.

Game-Changing Metamask Update

A pivotal catalyst for ETH's potential surge is the new feature from MetaMask, one of the most popular decentralized exchanges (DEXs) and crypto wallets. MetaMask now allows users to swap tokens on the Ethereum network without needing ETH for gas fees. This gas fee is incorporated directly into the exchanged tokens, significantly lowering barriers to entry for traders.

Previously, users needed CRYPTOCAP:ETH to pay for gas fees when swapping tokens, often hindering smaller traders and leaving profits predominantly in the hands of wealthy investors. This system discouraged many from engaging in trading on the Ethereum network, contributing to Solana's recent dominance in the memecoin landscape due to its lower fees. With this new initiative, Ethereum aims to regain market share by offering a more accessible and user-friendly experience, potentially driving an influx of activity on the network.

Currently, this feature is exclusive to the MetaMask browser extension but will soon be available on its mobile app, expanding the accessibility even further.

Technical Indicators Signal Bullish Potential

From a technical standpoint, ETH's charts reveal promising signs. Despite a 1.73% dip at the time of writing, ETH is trading within a falling wedge pattern—a bullish formation that typically signals an imminent breakout. The Relative Strength Index (RSI) stands at 60, indicating strong buying pressure and positioning the asset firmly in bullish territory. Additionally, CRYPTOCAP:ETH remains above key moving averages, suggesting that upward momentum is building.

Notably, CRYPTOCAP:ETH briefly broke above the falling trend channel earlier, signaling the beginning of a potential bullish renaissance. While this move was short-lived, largely due to trading volume being siphoned into BTC, the broader market conditions will favor altcoins in the coming weeks. If Bitcoin's dominance stabilizes, the altcoin season could see CRYPTOCAP:ETH soaring past $4,500 and beyond.

A New Era for Ethereum

This combination of fundamental advancements and technical strength positions Ethereum for a potentially explosive rally. The reduced gas fee burden will attract more traders to the network, increasing transaction volume and demand for $ETH. Coupled with the broader market rally, this development could mark a turning point for Ethereum ( CRYPTOCAP:ETH ), setting it up to challenge new highs.

As the crypto market evolves, Ethereum's adaptability and innovations like those from MetaMask ensure it remains at the forefront. With the stage set, all eyes are on ETH's next big move—potentially reaching the $4,500 mark and beyond in the near future.

NYAN Meme Coin: A Rising Star in the Memecoin UniverseNYAN Meme Coin is making waves in the cryptocurrency space, combining humor, community engagement, and philanthropy to carve out its niche in the volatile memecoin market. Launched stealthily with no presale, 0% tax, LP burnt forever, and a renounced contract, NYAN embodies decentralization and transparency—hallmarks that resonate with its growing community.

Fundamental Analysis

NYAN derives its charm from its playful association with internet cat memes and its dedication to its community. A notable 9% of its supply is reserved for future philanthropic endeavors, particularly for animal shelters, blending humor with real-world impact. Its current market cap of $2.9M and a fully diluted valuation (FDV) of the same reflect a token in its early growth stage, yet to fully unlock its potential.

NYAN boasts a unique endorsement: Ethereum’s co-founder, Vitalik Buterin, has adopted its logo as his profile picture on Uniswap and Etherscan, lending the coin unprecedented credibility in a meme-driven space. Trading solely on Uniswap V2, it offers an early-entry opportunity for those seeking exposure to this burgeoning memecoin.

Technical Analysis

NYAN’s technical performance aligns with its fundamental appeal. Currently up 13.3%, it trades above all major moving averages, signaling bullish momentum. A two-day rally has solidified its position within a rising trend, although a short-term consolidation may be on the horizon. With its 235% 7-day growth, NYAN outperforms both the global crypto market (+3.6%) and Ethereum ecosystem tokens (+12.7%).

Its current price, 69.37% below its all-time high of $0.061501, and a staggering 935.41% increase from its all-time low, presents both growth potential and historical resilience.

The Bigger Picture

NYAN Meme Coin is more than a playful digital asset; it’s a community-driven project with philanthropic undertones, riding the wave of decentralized finance. However, as with any memecoin, risks like high volatility and a lack of structured development remain.

For early investors and enthusiasts, NYAN presents an enticing blend of humor, utility, and community spirit. With its strong fundamentals and technical indicators, now might be the perfect time to consider this rising star in the memecoin universe.

Vitalik Buterin Drives New Innovations & Bullish Trends for ETHEthereum ( CRYPTOCAP:ETH ), the world’s second-largest cryptocurrency by market cap, is undergoing a transformative journey, marked by visionary updates and community-driven momentum. With Ethereum’s recent price surge to $2,631, up 4.11% in the last 24 hours, and a broader bullish trend across the market, the Ethereum ecosystem is positioning itself as a powerhouse in blockchain technology and decentralization. This article explores both the technical and fundamental aspects influencing Ethereum’s outlook, along with new philanthropic efforts led by Vitalik Buterin.

Vitalik Buterin’s MIL:1M Donation to Ukrainian Humanitarian Aid

One of the biggest stories recently has been Vitalik Buterin’s donation of over 400 ETH (approximately $1 million) to four Ukrainian humanitarian organizations, including one helping children affected by the ongoing conflict. This philanthropic act underscores Ethereum’s commitment to community-driven initiatives and the impact of decentralized finance (DeFi). Interestingly, the ETH used in this donation came from swapped meme coins, including $MOODENG, $EBULL, and $DOG. This donation not only provides aid to those in need but also highlights the growing role that cryptocurrencies, even meme tokens, play in supporting humanitarian causes.

Ethereum’s Evolution: “The Splurge” and Upcoming Hard Fork

The Ethereum protocol is on the verge of critical updates with the upcoming hard fork, as outlined in Vitalik Buterin’s “The Splurge.” This final segment of Ethereum’s development roadmap focuses on refining the Ethereum Virtual Machine (EVM), introducing account abstraction, optimizing transaction fees, and enhancing cryptographic functions.

1. EVM Object Format (EOF): The next upgrade will integrate the EVM Object Format, bringing a modular approach to Ethereum’s code. This update allows for better code separation and improved performance, making the network more efficient for smart contracts and decentralized applications (dApps).

2. Account Abstraction: A significant focus within “The Splurge” is account abstraction, which enables greater flexibility in transaction verification. This enhancement will allow users to pay transaction fees in ERC20 tokens instead of solely in ETH, broadening accessibility across the network.

3. Transaction Fee Optimization and Cryptographic Advancements: Ethereum’s upcoming update aims to make transaction fees more predictable and cost-effective. The use of advanced cryptographic methods will also enable more robust and efficient blockchain operations, further enhancing Ethereum’s performance and scalability.

As these updates take effect, Ethereum’s potential is expanding, as evidenced by decreasing fees on decentralized exchanges (DEX) and growing developer interest.

Technical Analysis

Ethereum’s technical indicators paint a promising picture. Currently trading at $2,631, CRYPTOCAP:ETH has shown a 2.47% uptick, largely mirroring Bitcoin’s bullish rise to $71,000. Ethereum’s RSI sits at a healthy level, confirming a favorable momentum pattern that aligns with bullish technical formations.

Ethereum’s chart shows a subtle rising wedge, suggesting the possibility of a continued uptrend. The appearance of a “three white soldiers” pattern—a bullish formation where three consecutive candlesticks close progressively higher—signals an upward reversal, reinforcing the likelihood of Ethereum ( CRYPTOCAP:ETH ) pushing towards the $3,000 mark.

Ethereum’s Relative Strength Index (RSI) remains stable, indicating there is room for further upward movement before hitting overbought levels. Paired with increasing volume, this setup is favorable for a bullish continuation as investor confidence grows.

If momentum continues to build and Ethereum ( CRYPTOCAP:ETH ) maintains its trajectory, a pivot towards the $3,000 mark seems plausible, especially given the upcoming hard fork and increasing institutional interest.

A Strong Community and Visionary Leadership Drive Ethereum’s Momentum

Ethereum’s role in the crypto world goes beyond price movements and technical charts. Since its inception, Ethereum has fostered a decentralized ecosystem that enables users worldwide to create, transact, and innovate. Vitalik Buterin’s leadership has emphasized social good, community engagement, and technological advancement, allowing Ethereum to retain a strong community and global relevance.

With ongoing developments like “The Splurge” and continued network upgrades, Ethereum ( CRYPTOCAP:ETH ) has deem fit to be a robust and scalable platform that can accommodate both the needs of developers and the demands of decentralized finance.

### Conclusion: Ethereum’s Path to $3,000 and Beyond

Ethereum ( CRYPTOCAP:ETH ) is at a pivotal moment in its evolution, and current technical indicators and development updates signal a bullish future. With the imminent EVM upgrades, transaction fee optimizations, and the support of a vibrant community, ETH has the momentum to reach new heights. Investors should watch for a potential breakout towards the $3,000 pivot as Ethereum ( CRYPTOCAP:ETH ) solidifies its place as a leader in the blockchain space.

Vitalik Buterin’s $EBULL Memecoin Boost: Is $1 Achievable?In the fast-moving world of cryptocurrency, one mention from a key figure can send token prices soaring. Such was the case when Ethereum co-founder Vitalik Buterin highlighted $EBULL, a relatively unknown memecoin, on social media. Following his tweet, $EBULL skyrocketed by over 3000%, temporarily surging to a price of $0.001618. However, after the initial euphoria, the token's value has since corrected, currently trading at $0.0005037.

Vitalik Buterin’s Charitable Influence

Vitalik Buterin’s stance on memecoins has evolved over time. Rather than dismissing them outright, he’s embraced their potential for positive societal contributions, notably by converting memecoins sent to him into Ethereum (ETH) for charitable donations. Over the last nine days, Buterin has donated $884,000 to various causes, after converting $2.78 million worth of memecoins into ETH. One of those tokens was $EBULL, alongside others such as Moo Deng (MOODENG) and Monsterra (MSTR).

Buterin’s tweet, which praised $EBULL for its charity initiatives, catapulted the token into the limelight. He expressed admiration for memecoins that make a positive impact on the world and encouraged developers to donate tokens directly to charity instead of sending them to him. This alignment with social good has created a growing perception that memecoins can serve a greater purpose, beyond just being speculative assets.

The $EBULL Surge and Immediate Correction

$EBULL saw a meteoric rise, shooting up by more than 3000% within an hour of Vitalik’s tweet, with a brief peak at $0.001618. The token’s market capitalization also ballooned to $12 million during this period, capturing the attention of both seasoned and new traders alike. However, this rally was short-lived, and $EBULL’s value has since retreated to $0.0005037. While this correction might seem concerning, it’s important to note that price fluctuations are common in the crypto space, particularly for emerging tokens like $EBULL.

Technical Analysis of $EBULL

From a technical standpoint, $EBULL remains an intriguing prospect. The current price of $0.0005037 is supported by a strong base, and the Relative Strength Index (RSI) of 46 suggests that the token is neither oversold nor overbought. This positioning implies a potential for continued growth without being in the danger zones of extreme volatility. The crucial support level at $0.0005 has held firm, and traders are eyeing a rebound.

Looking ahead, the token’s short-term resistance lies around the $0.001 mark, and if $EBULL can break through this barrier, it could re-ignite a rally toward its all-time high of $0.0133, achieved in August 2024. With the token’s total supply capped at 10 billion $EBULL, speculatively, it could reach $1, which would push its market capitalization to a significant $10 billion.

Can $EBULL Reach $1?

The Ethereum is Good token ($EBULL) has a strong narrative driving its momentum. Its association with Vitalik Buterin has brought credibility, especially considering the token’s charitable contributions. As more projects in the cryptocurrency space adopt socially beneficial models, there is growing interest in memecoins with a mission.

However, the road to $1 won’t be easy. For $EBULL to reach that price point, it will require substantial adoption, liquidity, and widespread listing on major exchanges. Currently, $EBULL is available on smaller platforms like LBank and Poloniex, but plans are underway to get the token listed on major exchanges such as Binance, Coinbase, Kraken, and OKX. These listings could dramatically increase the token’s visibility and trading volume, making the $1 target more realistic.

Moreover, the team behind $EBULL is reportedly working on forming partnerships and collaborations that could further bolster its market position. If the token gains access to a larger audience and proves its utility beyond charitable donations, the path to higher valuations becomes more feasible.

Broader Market Sentiment

The broader cryptocurrency market has been unpredictable in 2024, with many altcoins and memecoins experiencing volatility. However, positive sentiment has been building around tokens that focus on social good, thanks in part to Vitalik Buterin’s endorsement.

$EBULL’s surge follows a similar pattern seen with other memecoins that have gained from Buterin’s attention, such as Moo Deng (MOODENG), which saw a 470% increase in value. This pattern highlights how influential figures like Buterin can shift market dynamics. In fact, Ethereum itself saw a slight uptick in price, rising by 1.2% and briefly touching $2,476, largely attributed to Buterin’s renewed activity in the memecoin space.

Conclusion: What’s Next for $EBULL?

While $EBULL’s recent price surge was short-lived, its long-term potential remains intact. With solid technical support, a total supply of 10 billion tokens, and Vitalik Buterin’s backing, there is plenty of optimism surrounding the token. However, for $EBULL to reach $1, it will require continued market adoption, increased liquidity, and listings on major exchanges.

The memecoin market is volatile, and traders should approach it with caution. But with a growing trend of socially conscious tokens, $EBULL could be well-positioned to capitalize on the increasing demand for memecoins with real-world utility.

In the end, $EBULL’s future will depend on its ability to sustain its current momentum and navigate the challenges ahead. If the token’s development team delivers on its promises and secures more exchange listings, the possibility of reaching $1 may not be as far-fetched as it seems.

First Neiro On Ethereum May be Set for Short-Term BreakoutFirst Neiro On Ethereum (ETH: $NEIROCT) is rapidly gaining attention in the cryptocurrency world, especially among meme coin enthusiasts. With a notable rise in its trading volume and the formation of bullish technical patterns, (ETH: $NEIROCT) is currently positioned for a potential breakout.

Technical Analysis

The 4-hour price chart for (ETH: $NEIROCT) reveals a bullish symmetrical triangle pattern, a technical signal that typically indicates a continuation of the current trend—in this case, upward. The recent breakout from key resistance levels, coupled with increasing volume, suggests that further gains could be on the horizon.

As of now, (ETH: $NEIROCT) is trading at $0.0017 with a $728 million market cap and a staggering $1.01 billion in 24-hour trading volume. The increase in trading volume is a crucial indicator of growing demand, especially as the token moves past significant resistance levels. This surge in trading volume places (ETH: $NEIROCT) among the top 10 most traded cryptocurrencies, surpassing many larger projects.

Breaking Structural Levels

Analysts have noted that (ETH: $NEIROCT) is currently breaking key structural levels, which opens the door for the token to achieve new all-time highs. With (ETH: $NEIROCT) up 41% this week and the token’s price currently hovering around $0.001722, the next challenge is for it to solidify its position above $0.0014, a key resistance level. If (ETH: $NEIROCT) can close the next two 4-hour candles above this point, we predict a surge toward $0.002060 in the coming 24 hours.

MACD and RSI Indications

Looking at the shorter-term charts, the MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) both show bullish signals. The MACD line has recently moved well above the signal line, typically seen as a strong indicator of growing bullish momentum. Meanwhile, the RSI is holding in the mid-80s, suggesting that although the token is overbought, this may not be a negative signal during a pump cycle. The slightly upward-sloping RSI indicates that buyers are not letting up, further strengthening the bullish outlook.

However, it's important to keep in mind the risks. Should (ETH: $NEIROCT) fail to maintain its momentum and drop below the $0.001476 support level, a wave of selling pressure could push the price down to $0.000830 in the short term.

Strong Market Demand

From a fundamental perspective, the growing interest in $NEIROCT can be attributed to its limited supply and its status as one of the most traded meme coins. Its high ratio of trading volume to market cap at 1.6, four times higher than FTT’s 0.4, indicates a significant demand for the token. This is a clear sign that many traders are jumping in, anticipating further growth as $NEIROCT solidifies its position.

$NEIROCT’s rise from a $1 million market cap in August to $700 million has provided early investors with life-changing gains. With Binance listing the token, $NEIROCT has become a household name in the meme coin category, though its potential for massive returns is now more limited than it was at launch. A continued rally to a $1 billion market cap would yield a 2x return, but that’s modest compared to the meteoric gains seen during its early days.

Price Prediction: Short-Term Gains Possible

The potential for short-term gains remains strong, we are forecasting a rise toward $0.002060 if the token continues to hold key levels. However, investors should keep an eye on Bitcoin and broader market conditions, as $NEIROCT's bullish continuation will likely depend on BTC’s price action. A strong CPI report this week could propel Bitcoin past $65,000, creating a positive environment for meme coins, including $NEIROCT. Conversely, a poor inflation print could see Bitcoin retest $60,000, putting short-term pressure on risk assets like meme coins.

Conclusion: Is $NEIROCT Still a Good Buy?

The truth is $NEIROCT is no longer a low-cap gem, but its recent bullish price action indicates that it still has room to grow with modest gains easy 2x on reaching $1 Billion market cap. Investors looking for a potential breakout play in the meme coin space might want to keep a close eye on $NEIROCT, but caution is advised in case the bullish momentum fades.

Fable Of The Dragon (TYRANT): A Vitalik-Backed Token Surges 54%Monday, 7th October 2024 – In a remarkable week of bullish activity, Fable Of The Dragon (ETH: $TYRANT) has surged 54% today and 117% over the last 7 days. The token, which has gained significant attention due to its unique mission and backing by Vitalik Buterin, the co-founder of Ethereum, continues to demonstrate robust momentum.

Token Overview: A Token With Purpose

Fable Of The Dragon, represented by the token $TYRANT, is not just another cryptocurrency; it stands at the intersection of innovative blockchain technology, digital identity, and philanthropy. The token's multi-faceted utility positions it as a key player in the evolving cryptocurrency landscape, and its long-term mission extends far beyond simple financial transactions.

Digital Currency & Marketplace for Soulbound Tokens

At its core, $TYRANT functions as a digital currency, facilitating seamless transactions and exchanges across various platforms. Its primary distinction, however, lies in its role within a marketplace designed for Soulbound Tokens (SBTs). These unique, non-transferable digital assets represent a person’s passions, interests, and identity, making them personal and intrinsic to their owner. By tying ownership of these tokens to an individual, Fable Of The Dragon emphasizes individuality and authenticity within its digital ecosystem.

Integration with NFTs and Governance

$TYRANT further extends its utility into the world of Non-Fungible Tokens (NFTs), enabling users to buy, sell, and trade digital collectibles and artworks in a secure and decentralized manner. With the rapid growth of digital art and NFTs, this feature positions the token to capitalize on the booming digital collectibles market.

Another critical element of the $TYRANT token is its function in governance. Token holders have the power to influence the platform’s direction, participate in votes, and contribute to decisions on the platform. This governance feature ensures the community remains at the heart of the project’s development, promoting a **democratic and decentralized approach**.

Supporting Anti-Aging Research

Perhaps one of the most compelling aspects of the Fable Of The Dragon project is its commitment to anti-aging research. The team behind $TYRANT is dedicated to supporting scientific advancements through donations, special programs, and community engagement. This humanitarian angle sets the project apart, aligning its mission with individuals passionate about longevity and medical progress.

As the crypto world continues to expand, Fable Of The Dragon demonstrates that blockchain technology can have applications that reach beyond finance, contributing meaningfully to societal benefit.

Technical Analysis: Bullish Momentum Continues

Fable Of The Dragon’s strong fundamentals are now being matched by equally impressive technical indicators. As of today, $TYRANT is up 54%, and over the past week, it has surged 117%, signaling a strong bullish phase that many investors are eager to capitalize on.

The token is currently in a bullish breakout from a falling wedge pattern, a significant technical indicator often associated with a potential upward trend reversal. This pattern signals that the token could be headed for sustained bullish momentum.

At the time of writing, the Relative Strength Index (RSI) of $TYRANT is sitting at 83, which is firmly in the overbought territory. While this could suggest that the asset is due for a short-term correction, in this case, it is serving as a catalyst for more buying momentum. The overbought RSI reflects a strong demand for the token, with investors showing no signs of slowing down. The token is currently trading above major moving averages, which indicates sustained upward momentum. These averages often serve as key support levels, reinforcing the token’s current bullish trajectory.

With momentum building, $TYRANT appears poised to revisit its March 2024 high of $0.36, a key resistance level that, once broken, could pave the way for even greater gains.

The Road Ahead: A Token on the Rise

Beyond its technical and fundamental strengths, Fable Of The Dragon continues to capture the imagination of the cryptocurrency community. The project’s animated film, linked to the $TYRANT token, not only provides entertainment but also serves as a medium to convey the project's mission and values. This innovative integration of entertainment and crypto helps differentiate the project, adding to its appeal and ensuring broader outreach.

$TYRANT’s no tax transaction policy makes it an even more attractive proposition for both seasoned investors and newcomers to the crypto space. By eliminating transaction taxes, the token encourages adoption by providing a user-friendly experience.

In conclusion, Fable Of The Dragon is a visionary project with far-reaching implications. From facilitating digital transactions to supporting anti-aging research, it represents the best of what blockchain technology can offer. As the token continues to surge in value and gain community traction, now may be the perfect time for investors to hop in and ride the wave to new highs.

Final Thoughts

With a robust foundation, strong community engagement, and promising technical indicators, $TYRANT is positioned to achieve even greater success. Whether you’re interested in the token’s potential as a digital currency, NFT marketplace tool, or its role in philanthropy, Fable Of The Dragon has something for everyone. Investors and blockchain enthusiasts alike should keep a close eye on this project as it continues to grow and evolve.

Disclosure: Always perform your own research before investing in any cryptocurrency.

Fable Of The Dragon: A Pioneering Blend of Blockchain InnovationIntroduction:

In the rapidly evolving world of cryptocurrencies, unique projects often stand out due to their innovative nature and commitment to societal impact. One such project is "Fable Of The Dragon," which not only leverages blockchain technology for security and transparency but also aims to contribute significantly to anti-aging research and community building. This initiative reflects a thoughtful integration of technology with philanthropic goals, driven by the $TYRANT token.

Soulbound Tokens (SBTs)

"Fable Of The Dragon" is distinguished by its use of Soulbound Tokens (SBTs). These digital tokens are a novel concept in the blockchain space, representing non-transferable assets that signify an individual's achievements, interests, and identity. Unlike traditional tokens, SBTs cannot be traded, making them a personal and permanent fixture in a user's digital portfolio. This attribute enhances the security of digital identities and provides a new layer of interaction within the blockchain community.

The project's ecosystem also includes an engaging digital marketplace where these unique tokens can be showcased and celebrated. This platform not only fosters a sense of community among participants but also allows them to contribute to charitable causes effectively.

The Gaming Experience:

An integral part of "Fable Of The Dragon" is the "Legend of Fantasy War" game, which offers an immersive experience where players can engage in adventures, customize characters, and participate in narrative-driven events. The game is designed to reward players with SBTs for their achievements, further promoting the concept of digital identity and community within the ecosystem.

Security Measures:

The security framework of "Fable Of The Dragon" is robust, incorporating advanced blockchain technologies to safeguard user data and assets. The project employs a unique approach by integrating Soulbound NFTs into its security measures, ensuring that each digital asset is securely linked to its owner's identity. Additionally, the $TYRANT token operates on a 0% tax policy, minimizing potential vulnerabilities associated with transaction fees.

Market Performance and Tokenomics:

The $TYRANT token is not only a medium of exchange within the ecosystem but also a symbol of the project's broader goals. It facilitates transactions across the platform, including the trading of NFTs and participation in the digital marketplace. The token's design is aimed at simplifying transactions while ensuring security and fostering a user-friendly experience.

Technical Outlook

The $TYRANT token is currently trading at $0.0531, showing signs of stabilization after a prolonged downtrend. Several key technical indicators suggest a potential shift in momentum.

The token is hovering around a significant support level at $0.05, which has held firmly in recent sessions. If this level continues to act as support, it could provide a foundation for a further upward move.

Immediate resistance is located around the $0.087 mark, which coincides with the 200-day Moving Average (MA). A breakout above this point would be a bullish signal, potentially leading to further gains. Shorter-term resistance can be observed near the 50-day MA at $0.0463.

- Moving Averages:

- The 50-day MA is at $0.0463, and the price has managed to stay above it, indicating short-term upward momentum.

- The 200-day MA sits at $0.0874, which may act as a stronger resistance if the price continues to rise.

The MACD indicator is currently signaling a potential bullish crossover, with the MACD line crossing above the signal line. This could indicate that bullish momentum is starting to build. The Relative Strength Index (RSI) is currently at 59, suggesting that the token is in a neutral zone. A move toward 60 would indicate increased buying pressure and could be a sign of further upside potential.

- Cup and Handle Pattern: A potential cup and handle pattern is forming on the daily chart, which is a classic bullish setup. The "cup" has formed over a longer period with a rounded bottom, while the "handle" is currently developing. This pattern typically signals an upward breakout if confirmed by rising volume and a price surge above resistance.

Overall, $TYRANT is showing early signs of recovery, and traders should watch for a potential breakout above the $0.087 resistance level. A break above this key resistance would likely confirm a reversal from its prolonged downtrend. However, failure to maintain the $0.05 support could signal further downside risk.

Conclusion:

"Fable Of The Dragon" stands out in the blockchain community for its innovative use of technology to build a secure and engaging ecosystem. The project's focus on creating meaningful social impact, coupled with its commitment to enhancing digital identity security, sets a new standard for what blockchain technology can achieve. As the project continues to evolve, it offers a promising model for how technology can be harnessed to benefit society at large. Whether you are a gamer, a crypto enthusiast, or a philanthropist, "Fable Of The Dragon" offers a unique opportunity to be part of a revolutionary project that bridges the gap between technology and social good.

Consolidation Phase: Indecision Before the Next Breakout?Can Ethereum make the next headlines again?

🌐🚀 ETH/USD Consolidation Phase: Indecision Before the Next Breakout? 🔄💪

In this latest analysis, we’re seeing significant developments in the ETH/USD market that could set the stage for a major move upwards. Let’s dive into the details:

🟢 March 2022 Triangle: Back in March 2022, we saw a massive triangle pattern as the price searched for direction. Eventually, ETH broke to the upside, marking a pivotal move.

📝 ETF Approval Effect: Fast forward to the ETF approval, Ethereum faced strong rejections at the $4,000 and $3,900 levels. This caused a retracement, but it found strong support at the 0.5 Fibonacci level. This rebound from $2,300 to $2,800 was swift, signaling renewed bullish momentum.

🔺 Breakout Potential: The current price action indicates that ETH is attempting to re-enter a crucial wedge pattern. A successful breakout above the resistance zone could lead the price to test $3,640 and even higher levels in the coming sessions.

📊 Open Interest & Market Sentiment:

Recent data shows that open interest in ETH futures across various exchanges is currently sitting at approximately $4.79 billion.

This strong open interest across multiple platforms suggests that both retail and institutional traders are heavily engaged in the Ethereum market, with significant capital tied up in futures contracts. The robust open interest is a positive sign that there is a lot of attention on ETH, particularly as it attempts to break out of its current consolidation phase.

Current Situation:

Sideways Consolidation: After a significant rally, ETH is now consolidating in a sideways range between the $2,300 support level and the $2,900 resistance level, labeled as the area between the 0.5 to 0.168 Fibonacci levels.

Market Psychology:

This phase typically indicates indecision in the market. Buyers and sellers are battling for control, but neither side has been able to push the price significantly above or below this range. This kind of consolidation often precedes a breakout, so keep a close watch on these key levels!

A surge in open interest often precedes significant price movements, and with Ethereum currently on the cusp of key technical levels, we could see a strong move in either direction. However, the overall sentiment leans bullish, especially if we see a push through the $2,828 breakout level.

Moreover, the ETH funding rates and liquidation data indicate a relatively stable market with balanced long and short positions, reflecting ongoing market indecision. Traders should watch for any shifts in funding rates, which could signal a change in momentum.

Keep an eye on these developments and manage your risk accordingly as we could be headed for an exciting period of price action!

One Love,

The FXPROFESSOR 💙

Short term:

Chainlink #LINK v #Ethereum to 2.4X?Chainlink is exhibiting bullish market structure against ETH

Bullish market structure just means higher high's and higher lows --- uptrend

After a strong move

we are seeing a nice backtest of previous resistance

let's flip this into support and continue this trend into 2024

Ethereum Faces Downward Pressure Amid Bitcoin Decline Ethereum ( CRYPTOCAP:ETH ) finds itself under mounting pressure as it grapples with a second consecutive day of decline, exacerbated by Bitcoin's downturn and lingering uncertainty over regulatory approval for a spot Ethereum ETF. The recent plunge in Ethereum's price, coupled with significant liquidations, underscores the challenges facing the cryptocurrency amid a volatile market landscape.

Bitcoin's Influence and Regulatory Hurdles:

Ethereum's ( CRYPTOCAP:ETH ) price trajectory mirrors that of Bitcoin, with both cryptocurrencies experiencing substantial losses in the past 24 hours. Bitcoin's nearly 6% decline catalyzed similar downturns in Ethereum, resulting in over $500.6 million in liquidations across the crypto market. Regulatory uncertainty looms large as the US Securities and Exchange Commission (SEC) delays decisions on Ethereum ETF applications, leaving Ethereum's price vulnerable to external factors.

Historical Q2 Performance and The Purge:

Despite the gloomy start to Q2, historical data suggests a potential silver lining for Ethereum. Past second-quarter performances have yielded positive results for Ethereum, barring a notable exception in 2022. Crypto analyst @ali_charts highlights Ethereum's average Q2 gains, hinting at the cryptocurrency's resilience amid market volatility. Ethereum co-founder Vitalik Buterin's insights on "The Purge" offer a glimpse into Ethereum's long-term progress, signaling efforts to streamline operations and enhance decentralization.

Technical Analysis and Price Projections:

Technical analysts caution against Ethereum's potential descent below critical support levels, with projections pointing to a possible dip below $3,000 if the $3,400 support level is breached. As Ethereum ( CRYPTOCAP:ETH ) hovers around $3,300., investors brace for further volatility amid fluctuating market sentiments and technical indicators.

TYRANT. Anti-aging narrative with brand new utility.RSI has been in oversold zone for almost several months. The global parallel channel is wide. The volatility in it is very high. However, capitalization is insignificant to consider this as a disadvantage. Also, there was not a single listing even on small exchanges. If it falls to lower line of the channel, I personally will DCA.

P.S. Vitalik Buterin supports $TYRANT

ETH AT CRUCIAL SUPPORT!!At we take a look at the ETH/USDT, we can see that is is trading in a massive broadening wedge pattern. Every time it touched the trendline, it bounced nicely.

Will history repeat itself?

Another thing to keep in mind is that the area which it touched is also lining up with the golden pocket for extra confluence. This is still a bullish chart until support fails.

Remember we trade based off probabilities and theres a higher probability we get a bounce instead of a drop but since we can't predict the future we must alwasy protect our portfoliio with a stop-loss.

Let me know your thought sin the comments below

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

STORJ Price Spikes After Vitalik's Mention: Will It Keep Rising?Vitalik Buterin, Ethereum’s co-founder, highlighted a cryptocurrency on the Warpcast social network on March 8. As a result, this led to a notable price surge. Buterin’s influence on market dynamics is well acknowledged. This time, his latest discussion focused on DePIN projects.

He explored the potential for success among these projects, which aim to reinvent longstanding ideas such as SEED_DONKEYDAN_MARKET_CAP:STORJ and decentralized alternatives to Uber. Buterin questioned the viability of these projects’ success in the current market. Following his insights, the price of SEED_DONKEYDAN_MARKET_CAP:STORJ spiked by 18%. Shortly after, it fell by 9% but is still up by 7% from its daily open on Saturday.

STORJ Price Analysis

From its ATH of nearly $4, the price of SEED_DONKEYDAN_MARKET_CAP:STORJ has been in a multi-year bear market, dropping to a low of $0.22 in January 2023. After some sideways movement, SEED_DONKEYDAN_MARKET_CAP:STORJ retested this level on several occasions, with its last retest in August leading in a major recovery.

KEY TAKEAWAYS

Vitalik Buterin mentioned STORJ, spiking its price briefly.

STORJ shows potential for a larger bull cycle.

Its price movement depends on breaking December highs.

Vitalik Buterin, Ethereum’s co-founder, highlighted a cryptocurrency on the Warpcast social network on March 8. As a result, this to a notable price surge. Buterin’s influence on market dynamics is well acknowledged. This time, his latest discussion focused on DePIN projects.

He explored the potential for success among these projects, which aim to reinvent longstanding ideas such as STORJ and decentralized alternatives to Uber. Buterin questioned the viability of these projects’ success in the current market. Following his insights, the price of STORJ spiked by 18%.

Shortly after, it fell by 9% but is still up by 7% from its daily open. Was this just a temporary event or part of a larger rise?

STORJ Price Analysis

From its all-time high of nearly $4, the price of STORJ has been in a multi-year bear market, dropping to a low of $0.22 in January 2023. After some sideways movement, it retested this one on two more occasions, with its last retest in August resulting in a major recovery.

STORJ could have started a larger bull cycle.

SEED_DONKEYDAN_MARKET_CAP:STORJ climbed to $1.20 in December, which was an interaction with the larger descending resistance anchored at the all-time high. A rejection occurred, with the price decreasing to $0.50 on January 25.

The uptrend from last August until December showed a typical five-wave pattern. Since it came after a period of consolidation, it could be the starting move in a larger bull cycle.

This is why there is a strong chance that the rise from January’s low will lead SEED_DONKEYDAN_MARKET_CAP:STORJ to a breakout above the descending resistance and new highs. Our first target would be around $2.

However, SEED_DONKEYDAN_MARKET_CAP:STORJ ’s price is currently trading at a lower price than the one in December. Therefore, we first need to see its rising above that before we can expect higher prices. Until this happens, there is an equal chance that the price will be headed below $0.50 again.