Vixfix

ridethepig | VIX Exploding 📌 ridethepig | VIX Exploding

Morning all... a short post, but one that is full of dramatic events. The 'discovered naked short' from wsb is a wildfire burning...the cleanest place to see the damage is in vol. This discovered vector in GME clarified the damaged relationship between central banks and market pricing while QE infinity provides a cover a 'risk free' environment. It's very similar to the round trip explosion we traded last year from 12 to 85 and back again.

When you pin shorts (the root of all evil), whether its GME, BB or VIX... it has enormous mobility. The magic of reddit has exposed Melvin Capital, Blackrock (own +/- 10% of GME) et al, while Citadel cheerlead in the background and will of course be fine and make money either way.

Let us take a closer look at the possible moves with the VIX; I find that the 44 pivot which is in the crosshairs can do one of two things;

a) The offer can evaporate rather quickly, even if it was previously nailed by barrier, which will trigger a momentum gambit towards 85.

b) We can attack and our opponent (sellers) without any anxiety step back in to occupy the control since it is their jurisdiction, i.e. one ladder that is controlled by your opponent.

Now consider the latest chart update:

Here a) was very much dependent on the October 2020 highs. Bear in mind how unafraid the buyers which are moving with force are. The wildfires are capable of satisfying a healthy appetite from retailers. with that in mind we are going to see capitulation across some more names.

Thanks as usual for keeping the feedback coming 👍 or 👎

ridethepig | VIX for the Yearly Close📌 @ridethepig VIX Market Commentary 18.12.2020

A good time to update the VIX chart for the traditional Quad witching flows....After an exchange in Q1 2020 with VIX exploding to the topside as widely expected for all those following, there is now what follows, an opportunity for a panic cycle next week (21st December) followed by another window in January for the extraction. A weaker sell side has allowed the zig zag advance, buyers are threatening to decisively break the highs once more unlocking an execution at 85 for another board clear.

The position in my books is finally won by buyers, the ending will be instructive of US equities in particular. The position also has a chance of drawing at 20.0x support. While the same 85 targets (the position is an important link to the GA run off in Jan), taking the highs means we must chase and play from the centre. Buyers will wish to prove that 'resistance' is hanging by a thread, it might work.

Thanks for keeping the feedback coming 👍 or 👎

EGR - onward and upward?Quick look at EGR which is looking at a nice end to 2020.

After a run-up in September following positive news, EGR dropped off and failed to break through the 0.382 fib resistance.

Support has been found at $0.14 (Support 1), confirmed by WVF which strongly indicates market bottoms at this level.

Trading has since pushed away from Support 1 and the 0.5 fib resistance has been tested multiple times in the past week.

A positive end to the trading week sees EGR placed to test the 0.5 fib resistance again next week, after entering an upward-trend channel.

This is likely to continue as indicated by the WVF trend, in addition to a decrease in volatility as per BBW and a change in momentum indicated by the MACD.

If the 0.5 fib resistance is broken there is a good chance that this will run up to the previous 0.382 fib resistance.

ridethepig | VIX Panic Cycle📍 The theme we have set ourselves here for an expansion in Vol into next week, would usually provide enough material for an entire website, but lack of space compels me to moderate this into a short and snappy post.

I shall only point out the most important notions and events from 2019 and save a deeper examination for later.

The most brilliant post covid act, to be sure the idea of an expansion in volatility is not only linked to the increase in danger from a health rollercoaster which I propagated, based on the models. But VIX's move is surprising and I will not deny the brilliance of the full retrace.

Also interesting is our earlier attempts to break up and make use of the flexible highs which we discovered ahead of US elections. All models are ticking up for the NY session today and looks set to last into next week. Aiming for the full set-up with 42 and 85.

It is also worth noting that 42 is an interesting defence, going on to pressurise Biden with a 'hospital pass' for those familiar with the terminology in Rugby, it is where you are so fixated on catching the ball while it is in the air, that you forget about everything else around you. This early complacency, looks as anti-pseudo-capitalist as possible, but has found a good number of followers and turned out to be an extremely fruitful trade in equities. Major chart updates coming across the board over the coming hours and weekend.

Thanks as usual for keeping the feedback coming 👍 or 👎...

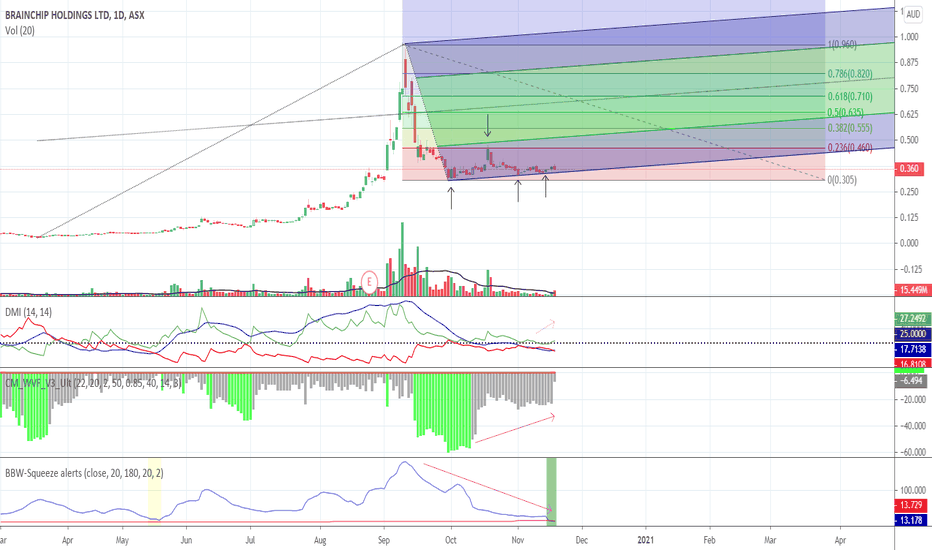

BRN consolidation over?Quick technical analysis of ASX:BRN following its rapid rise and subsequent consolidation over the past two months.

In summary:

Indicators are showing that support has been found at ~$0.31 and the .236 fib retracement level / -0.5 schiff resistance level has been tested.

As per BBW, volatility is decreasing which indicates that a breakout may be on the horizon. The BBW-squeeze also shows a potential alert for an entry point. This is supported by the Vix which hints that we have moved away from market bottoms.

Finally, DMI+ remains above ADX and has been toying with the 25 level. Movement above this level would further strengthen technical indicators for ASX:BRN .

The above indicate that BRN is in a favourable position for opting in. This would be further strengthened by positive news and / or increase in trading volume.

DYOR.

ridethepig | Vix into the elections and 2021📌 Vix - Volatility

An expansion of volatility is coming; the attempt to step against the flow of Covid chapter II is reckless to say the least. According to my models, we have unfinished business to be done at 85 once more. I will continue to hold longs and look to add on dips for example towards 25, or enjoy a momentum gambit when we see the breakup.

This idea is very similar to the same struggle we had in Q1.

The stratagem of a contraction in globalisation is illustrated via an expansion of volatility . Buyers opened the attack position in a +600% move as capitalism surrendered. Sellers are already on their last legs.

ridethepig | Volatility into the electionsI should like to start with a reminder of the operational plan for the first Covid chapter.

📌 Covid Chapter I

The terrain here was clear.

My models were picking up on a sweep of the lows in VIX to clear the path for a +600% expansion. In order for us to manoeuvre around this we must understand how large hands move various assets at quite a precise moment.

Let's continue to work through this example of the first chapter which will set the scene for our current leg. So the lows were swept in Q419 as expected to prepare the manoeuvres from that point. So the next chart should be considered here as a fortified support with lust to expand. It would only be right and proper for us to describe what comes next as impulsive, a move that was not without reason and certainly not without fear.

And finally buyers ran out of steam as we approached the 85 main SWING TARGET .

From 85 I was eyeballing a retrace towards 25. Look how easy it is to make use of the expansion. I see this as further proof of the enormous vitality of overprotecting support/resistance. If you 'know' where are the stops, you know hot to make use and expose with an appropriate reply.

This was one of my favourite calls.

📌 Covid Chapter II

This is clear proof that we are in sync with lockdowns and covid providing the manoeuvres. As we enter into the eye of the storm for the second wave, sentiment is definitively turning softer, although this case is much more complicated.

If buyers remain passive above the 44/45 highs then we can see a well-timed massage from stimulus. In other words, we need the moves to happen before the elections and are running out of time. Buyers have developed a considerable appetite, bankruptcies are coming and complacency is repeating itself.

We have two possibilities here existing for the terrain in Covid Chapter II.

The breakout of the highs in this consolidation block to unlock a re-visit of 85 resistance assuming things go tits up in the coming days/weeks. Sellers of volatility have nothing immediately in play because of covid and contested election risk. The only correctness of the thesis comes from stimulus, which is an expectation now for after the elections.

Thanks as usual for keeping the feedback coming 👍 or 👎

ridethepig | Surfing the Vix⚠️ Chapter IV: Vix and microstructure ⚠️

For those following the swings in Vix since 2019 you will know we are tracking for the overprotection from sellers and how to try to get rid of the 'all is back to normal' sentiment.

This is a shorter update than the previous three chapters, intentionally aimed at casting some light on how sellers are overshooting support and how risk 'may' appear in the microstructure. So let us start by recapping the swings between the starting point of the expansion which set this all in motion:

Capitulation waters clearly represents a manoeuvre which is closely intertwined with microstructure and liquidity game theory and indeed must always be so because of the nature of free markets. Nevertheless, there are traces of overshoots to the downside . For example when sellers went overboard to sweep the lows underneath 12 in attempt of opening the single digit block: Buyers loaded and created a strong basing formation as pointed out in chapter II.

In the area where sellers overshot is a strategy you will notice me using often. Play through the charts and notice how minimal drawdown was required at the base ( for which we gave incredible respect ) and because we had to keep in mind the unavoidable possibility of economic cycle inversions.

Here is the final example in the recap after we exploded towards the 85 final target as called from 12 (+500% and a historic move in volatility).

"VIX Completing the Swing to 85"

Intending to meet a possible barrier at 38 and 25, only now does it become clear as to why price stalled at the highs instead of developing a three figure vix print. No matter what happens, this has and will remain three superb chapters of effortless unravelling of the soft retail and unaware institutional money .

The spare room to 100 remains open.

I think the 'everything is back to normal' crowd are too hasty in this and do not realise the tsunami of bankruptcies and debt on the horizon as we enter into year-end and 2021.

Every digit retrace point in the VIX from current levels should be bought aggressively for a position way out to the 85 highs and 100 extensions for an epic news headline. This move should by now be chalked on all charts .

As usual thanks all for keeping the feedback coming 👍 or 👎

Volatility decreased, but price hasn't responded.Chainlink crypto (LINKUSD) 3 hour timeframe volatility as measured by williams VIX Fix Indicator has decreased which would normally indicate higher prices. however price has remained below green horizontal line. Expecting price to rally in short term at least to above green line.

ridethepig | VIX Slingshot In Play 📌 Working in public has given us a live example of Volatility expanding in times of a crisis.

Here it is usually a swing recap for those following. As you will remember we made good use of the initial tempo in the retreat :

The show must go on... in came buyers with the counter attack and no surprises on the timing, covid was simply the trigger.

To save the overshoots, we cleared all and even covered some at the 85 highs.

📌 When a deep retrace came into play it has created enough energy for a slingshot.

Buyers of volatility are quite happy to exchange here at the lows as they are in full control and holding the bid at 🔑 support. Sellers of vol and the 'everything is back to normal crowds' will be condemned to liquidation. This wave 2 attempt at breaching support which has miserably failed today is a visual example of pinning your opponent.

The key point is liquidations. Global Equities are complacent, retail have bought as much as they can. Large hands have cleared, since the Covid chapter II irritates them (from a retracement perspective at the very least). And it will comedown to a massacre in VIX... Seriously it is just as well we are seeing the back of VVIX...that really was a monster.

📌 How and Why these slingshots occur in VIX?

When major forces on both sides clash together, it comes down to an exchange. In this case the health crisis cannot be solved via the monetary or fiscal side, shutting down the economy has caused long term repercussions. Especially with the elderly and overshoots on dependencies.

In simply terms the older demographics will be forced into using savings to support families, businesses will be more defensive with capital, the issue is not solved with stimulus, it is solved with CONFIDENCE . The policy mistakes here are off the charts and may even cost Trump the election.

As usual thanks for keeping the feedback coming 👍 or 👎

ridethepig | VIX Panic Cycle?📍 The main function of the VIX appears to be miles ahead of the relevant flows. In this sense, it itself tends to be mobile. And yet (for it has great vitality!) it is not rare to witness it display considerable activity. Namely:

1️⃣ From the initial ' Swing the Vix into Fed and Q close ' the Vix was prepared .

2️⃣ A certain elasticity, which shows itself in the 'Capitulation Waters' was appropriate to generate the energetic slingshot given the appropriate circumstance.

3️⃣ The journey looked so promising, connection breaks in Vol are usually one way express trains. Stay long.

4️⃣ If we can continue the advance in the absence of capitalism, we are set for a measured return on the expectation of normality but only with more clarity on the timing side. Once reality hits shore, the masses will realise they were sold a turd.

5️⃣ The home run!! A flawless (and serious contender for trade of the year btw) 600%+ swing from the 11/12 lows all the way to 85. Now to put the icing and sprinkles on top, we had to take care of business at the 85 highs.

6️⃣ ...here we are. After a round trip we are back to the strong support at 25 and just below the centre of the flow at 38. The power to develop knowingly here and systematically, unlike during the middle of Covid is to the buyers advantage. The effect of the cycle ending will convey more than one quarter's worth of damage. As soon as the stabilisers (stimulus) is turned off, we are heading for a Sovereign Debt Crisis .