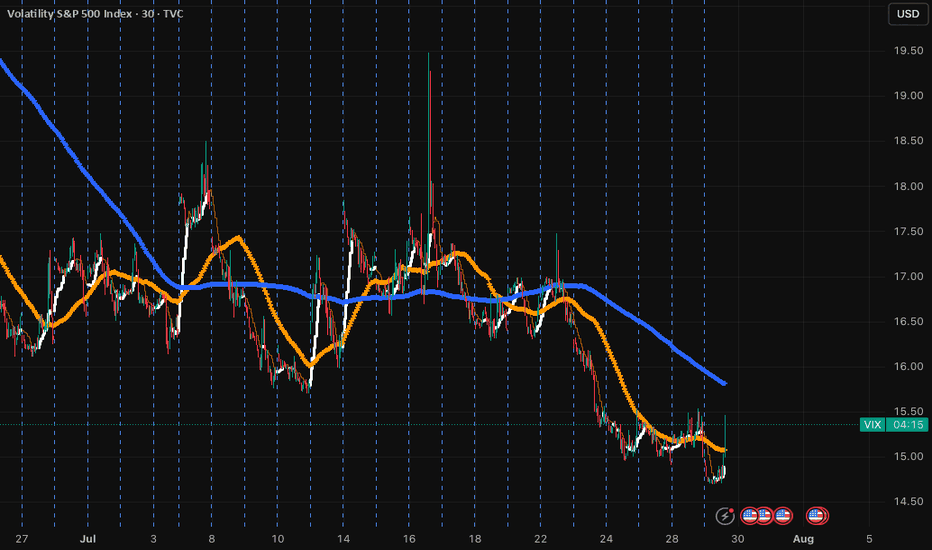

I told you so....VIX is the golden goose! All this fake pump in the market was just not sustainable. It is very clear that there are holes and the money printing can't last forever. The S&P fake pumps, and artificial tariffs (which Americans pay 90%) are created out of thin air. The reality is that defaults are very high across the board for most debt classes, VIX is at a YEAR LOW (doesn't happen to often, signaling massive complacency), and now the song will end and all the retailers will be holding the bag! Learn how to trade the VIX! DM me for details.

Always do your own due diligence, but historically this is a good time to get out :) You need to see and take action when you see red flags....

Vixlong

$VIX target $88-103TVC:VIX looks to be bottoming here and I think the next move higher is going to be the big one I've been waiting for.

We did well last month catching that move into April 7th via UVXY calls. I started buying calls again April 24th for 5/30 - 6/20 and have continued buying as VIX has declined.

Now the chart is finally looking like it's bottoming and I'm getting short signals on a lot of the charts -- therefore my conviction is growing that we're close to a reversal here.

I think this move will be a move that happens once every 10+ years and the gains have the potential to be massive if it happens.

Let's see if it plays out.

VIX | Nov 19, 2025 Call Options | Strike $21TVC:VIX , the great "fear" index, has two looming price gaps on the daily chart. Every gap has always been filled in the history of the $TVC:VIX. Given the 90-day tariff pauses and forever world turmoil, there will (undoubtedly), be a spike in the TVC:VIX to close these open gaps. It's just a matter of timing... I've chosen to go 6 months out on the option date (November 19, 2025) as a hedge to my portfolio ($3.45 per contract). I plan to add more contracts if the TVC:VIX dips into the 13-14 area, too.

I truly dislike timing the market, but such a position could be a nice 3x gainer of the TVC:VIX spikes to $36 in short time. Or... totally worthless if we are in a constant bullish market for the next 6 months.

Time will tell.

VIX Clips 60 as Market Volatility and Tariff UncertaintyThe VIX Clips 60 as Market Volatility and Uncertainty Surge on Tariff Announcement

The CBOE Volatility Index (VIX), often dubbed the “fear gauge,” surged past the 60 threshold this week—the highest level since August 5, 2023—as markets reacted violently to an unexpected announcement by the U.S. President regarding global tariffs. The sharp rise in the VIX, which measures market expectations of 30-day volatility, underscores the profound uncertainty now gripping investors, with the Dow Jones Industrial Average plummeting over 1,000 points and the S&P 500 entering correction territory. The trigger? A sweeping tariff policy unveiled by the administration on Liberation Day, a symbolic holiday marking a shift in economic strategy, which has sent shockwaves through global markets.

The VIX at 60: A Sign of Extreme Fear

The VIX typically hovers around 15-20 under normal conditions, reflecting moderate uncertainty. However, readings above 30 indicate heightened anxiety, and levels above 50 are rare, historically occurring during major crises like the 2008 financial collapse or the 2020 pandemic sell-off. This week’s spike to 60 marks a dramatic escalation, signaling a market gripped by fear. Analysts attribute this to the suddenness and scale of the President’s tariff announcement, which caught investors off guard after a period of relative calm.

The Liberation Day Tariff Announcement

On Liberation Day—a holiday commemorating historical freedoms—the administration announced a 25% tariff on a broad range of imports from key trading partners, including China, the EU, and others, effective immediately. The move, framed as a “national economic security initiative,” aims to curb perceived trade imbalances and protect domestic industries. However, its immediate impact has been severe:

Scope and Speed: The tariffs apply to $500 billion in goods, targeting sectors like semiconductors, automotive parts, and consumer electronics. The abrupt implementation, with no prior warning or negotiation, has left businesses scrambling to adjust supply chains.

Political Context: The announcement coincided with domestic political tensions, including debates over inflation and job creation. The White House argued the tariffs would “level the playing field” for American workers, but critics warned of retaliation and inflationary pressures.

Market Chaos: Sectors Under Siege

The tariff shockwave rippled across asset classes:

Equities: The S&P 500 fell 2+% on Monday, its worst single-day drop since March 2020. The Nasdaq, heavily weighted in tech stocks reliant on global supply chains, plunged over 5%.

Sectors: Semiconductor firms like Intel and AMD tanked, while automakers such as Ford and Tesla declined sharply.

Expert Analysis: A Volatility Tipping Point

Historical Parallels and Economic Risks

The current volatility mirrors past crises:

2008 Financial Crisis: The VIX hit 80 as Lehman Brothers collapsed, but the current crisis stems from policy, not financial contagion.

2020 Pandemic Sell-Off: The VIX spiked to 82 as lockdowns paralyzed economies, but today’s uncertainty is self-inflicted.

However, the tariff-driven uncertainty poses unique risks:

Inflation: Higher import costs could push inflation back above 4%, complicating the Fed’s rate-cut path.

Global Growth: The World Bank warns that trade wars could shave 2% off global GDP by 2025. Emerging markets, reliant on exports, face currency crises.

Looking Ahead: Can Calm Return?

Markets may stabilize if the administration signals flexibility. Potential pathways include:

Negotiations: A G20 summit in September offers a venue for de-escalation, though diplomatic progress is uncertain.

Policy Reversal: If tariffs are delayed or narrowed, the VIX could retreat. However, the President’s rhetoric suggests a hardline stance.

Corporate Adaptation: Companies might pivot to domestic suppliers, but such shifts take years, prolonging volatility.

Conclusion: A New Era of Uncertainty

The VIX at 60 marks a pivotal moment. Markets are now pricing in not just the immediate tariff impact but a broader shift toward protectionism and policy-driven instability. For investors, the path forward is fraught with uncertainty. While short-term volatility may ebb with reassurances, the long-term consequences—trade wars, inflation, and geopolitical friction—could redefine global economics for years.

With Liberation Day’s tariffs reshaping the landscape, one thing is clear: the era of low volatility is over. The question now is whether policymakers can navigate this new turbulence—or if markets will remain hostages to fear.

Greatest Volatility of all times is approaching...#vix the volatility index has been accumulating since covid 2020 crash. In higher time frame, TVC:VIX has broken out in 5th August 2024 and it was just a test!.. Then continued consolidation till this time , also doing the retest. at this zone, accumulation of the 2020 covid crash for a new impulsive wave!..

In lower time frame , several days ago VIX broke out the accumulation zone coming from 5th August and this warns you about your greedy positions my friends. We haven' t seen a real great volatility since covid crash and VIX chart is getting alarming. You' ve been warned. Not financial advice.

Temporary INVALIDATION: If VIX dumps below 13 zone , this will be more secure. Below 10 is the main invalidation.

Market Open: VXX Pops...This morning, the VIX popped to $19.26, not seeing levels like this since the Jan. 27th, 2025 jump to $19.93, where the SPY saw an almost 3% drop, NASDAQ dropped 5%.

We saw concerns of heightened market uncertainty, with investors weighing robust consumer spending against mixed economic signals. There were murmurs that the subdued durable goods orders and emerging signs of slowing GDP growth might signal that the current momentum is hard to sustain. Additionally, dovish cues from the Fed—which hint at a more cautious approach to rate hikes—raised questions about whether these measures could ultimately mask underlying inflationary pressures and economic challenges.

On the corporate front, the market was further rattled by underwhelming earnings reports from several key technology players, a sector that had previously driven much of the market’s optimism. This divergence in performance—where defensive sectors such as consumer staples and financials held their ground while growth stocks stumbled—added to the overall anxiety.

Finally, the backdrop of ongoing geopolitical tensions and sporadic trade disputes continued to contribute to a risk-off sentiment, ensuring that market volatility remains elevated.

Follow us for more Financial & Investment News at @MyMIWallet

VIX is dying and the markets are flying!TVC:VIX NASDAQ:QQQ AMEX:SPY

Do you see now!👀

Yesterday I posted about the TVC:VIX making a bear flag pattern and showed you what's happened the last two times!

The VIX is dying and the markets are flying! The TVC:VIX has a lot more room to the downside as well.

You know what that means! 🚀

VIX volatility index fills the gap, what now?#vix the volatility index has filled the gap shown on the chart as red box. Also TVC:VIX index has broken down the bull flag. But, the question is: "A fake down?"

If vix had did this as a fake movement (and only gap filling dump), then a great volatility awaits all markets, just soon.

VIX Spike to 'Covid' Crash Levels... What Happens NextThe last time the VIX spiked this high was during the March 2020 Covid 'Crash' which was followed by an epic Bull run after that, and proved to be one of the best buying opportunities.

With Japan's unwinding of their 'Carry Trade' and overall US stock market correction, the FED is likely to do an emergency rate cut this month.

And the US elections are coming up, which likely means QE to prop up the economy, as the the next liquidity cycle begins...

So this could be a great signal to flip back to Bullish in the crypto markets.

Fear and Greed is also down to 25, which is another good indicator of sentiment reverting to the mean and back toward Greed sooner than later.

I'm buying, and happy my limit buy orders from yesterdy for SOL at $115, $120, and $125 all filled today and already are in profit.

The Fear Index and Geopolitical TensionsIn an era marked by geopolitical tensions and economic volatility, the fear index emerges as a crucial tool for traders seeking to navigate turbulent markets. This article delves into the historical significance of the fear index, exploring pivotal moments like the Cuban Missile Crisis, the 1973 Oil Crisis, and the 2008 Financial Crisis. By understanding how investor psychology and market sentiment intertwine with the fear index, traders can gain a competitive edge.

In today's world, marked by unprecedented geopolitical tensions, understanding the fear index has never been more crucial. As global conflicts escalate, the fear index provides essential insights into market sentiment and helps risk managers navigate through these turbulent times.

A Geopolitical Powder Keg

We are witnessing a convergence of significant geopolitical events:

Russo-Ukrainian Conflict: Ongoing hostilities have far-reaching implications for global stability.

Middle Eastern Volatility: Potential for a full-scale war involving major powers like Israel, the U.S., and Iran.

Sino-Taiwanese Tensions: Threats of a Chinese invasion of Taiwan with severe repercussions for the semiconductor industry and global economy.

Pro-Palestinian Protests: These could escalate into widespread violence, further destabilizing the political and economic landscape.

The Role of the Fear Index

The fear index, often measured by market volatility, acts as a barometer of investor sentiment in the face of these geopolitical risks. By closely monitoring the fear index, risk managers can gain early warnings of market disruptions and develop strategies to mitigate potential crises.

Historical Context

Historical precedents show how the fear index responds to geopolitical tensions:

Cuban Missile Crisis (1962): Stock markets plummeted due to heightened anxiety, underscoring the impact of geopolitical events on market sentiment.

1973 Oil Crisis: The Arab-Israeli War and subsequent oil embargo led to global economic downturns, reflecting the fear index's potential spike during such crises.

9/11 Attacks: The fear index surged as markets reacted to the unprecedented nature of the terrorist attacks.

2008 Financial Crisis: Global financial instability caused a dramatic increase in the fear index, providing early warnings of the impending market collapse.

COVID-19 Pandemic: The pandemic's economic halt saw the fear index spike, signaling early disruptions.

Methodologies for Calculation

Understanding how the fear index is calculated enhances its utility:

Volatility Indexes (e.g., VIX): Measure implied market volatility.

Sentiment Analysis: Assess sentiment through news and social media.

Investor Behavior Metrics: Analyze options trading and margin debt levels.

Combining these approaches offers a comprehensive view of market fear in response to geopolitical tensions.

The Psychological Impact

Investor behavior during geopolitical crises is influenced by:

Loss Aversion: Heightened sensitivity to potential losses.

Herd Mentality: Following the crowd amplifies reactions.

Availability Heuristic: Overestimating the probability of easily recalled events.

Strategic Applications

Risk managers must adopt a holistic approach, integrating the fear index with geopolitical and economic data to develop robust contingency plans. While the fear index can't predict crises' exact timing or magnitude, it provides valuable early warnings to prepare for potential disruptions.

Conclusion

The fear index is indispensable for navigating today's geopolitically charged environment. By monitoring market sentiment and identifying emerging trends, you can protect your investments from unforeseen events and build resilience. Embrace the insights offered by the fear index to stay ahead in these volatile times.

$VIX 's strong chart indicates an incoming volatility#vix volatility index chart made double bottom and W bounced. The bullish movement will likely continue even more while the chart made bullish flag in lower time frame.

Also recent days #dxy dollar index chart made a bullish breakout and while VIX and TVC:DXY are both getting stronger, this will not likely be good for #btc #altcoins #stocks etc. I think something is cooking... Better not to be over greedy. Not financial advice.

Large correction coming soon? $VXX is the play.If you've been following me for a while, you know that I've been warning of a crash for some period of time, and now I think we're within weeks of that playing out.

I've largely been bullish for the past year, with periods where I thought things might fall, but now all of my upside targets for BTC have been hit (minus GETTEX:54K which is still possible) and stocks are looking like they're on their last leg higher. While I'm very bullish over the long-term (into 2027), I think that the rest 2024 will be bearish (which would catch a majority of the market off guard as everyone is expecting a top to be put in by the end of this year). They're not really expecting for the rest of the year to be bearish and for 2025-2027 to be the real bull run. This is my base case.

I've been watching VXX for sometime, and I think we're very close to the levels where we'll see a reaction higher.

I think over the next couple of weeks, some data will come out that sends VXX into a capitulation move lower, down to the $12-13 supports that are on the chart. Those levels will be great levels to buy some calls.

I'll be buying June $20 + $25C as I think those will provide the best risk/reward for this move, if it is to play out.

Let's see if it plays out.

Vix Gaps up 18% with Israel/Iran Conflict The Markets are moving money into buying Puts and this signals Fear. This is what war does I suppose and is the logical scenario that we would anticipate. Put Options are being bought as market participants anticpate lower prices on the Indices overall in the Short term at least here. We gapped up to a Daily level on the Vix where we consequently observed a decrease. The Size of the gap coupled with the Daily level and the not-too-far off Weekly level provided a strong place to reverse to fill the gap. The market is up 3% on the day after being up much more. Since the beginning of the Israel/Iran Conflict (Monday April 15th) the Vix is up 9% . As we move further into Q2, I'm anticpating a continued pullback in the broader stock market or even range. Vix may go sideways or range