S&P 500 Short Setup – Key Resistance in Focus!🔥 I’m watching this critical resistance zone on the S&P 500 (US500)! A rejection at this level could spark strong bearish momentum. A clear reaction at resistance is key for confirmation.

📍Entry: 5,726.50 USD – just below the key resistance, but only after rejection is confirmed

🎯Targets:

TP1: 5,645.00 USD

TP2: 5,610.00 USD

TP3: 5,585.00 USD

⛔Stop-Loss: 5,768.00 USD

⚡ Patience is crucial, waiting for confirmation reduces risk and boosts accuracy! Would you take this trade? Let me know below! 👇

Volatility

Bitcoin Analysis: Trump Tariffs AnnouncementAs of April 2nd, 2025, Bitcoin finds itself at a pivotal technical crossroads, with price action consolidating within a well-defined range as markets prepare for Trump's upcoming tariff policy speech. The cryptocurrency has experienced significant volatility in recent weeks, with a sharp decline from the $98,000 level followed by a consolidation phase.

Technical Structure and Price Action

The daily chart reveals Bitcoin trading in a rectangular consolidation pattern between approximately $79,800 and $88,800. This range-bound price action follows a substantial corrective move from recent highs, with the market now seeking direction. Current price hovers around $84,890, sitting below the mid-point of this established range.

The blue box on the chart highlights this recent consolidation zone, where price has been oscillating for several trading sessions. This pattern typically represents a pause in the market as buyers and sellers reach temporary equilibrium before the next directional move.

Volume Analysis Provides Crucial Insights

Looking at the Relative Volume Indicator (RVOL) at the bottom of the chart, we can observe several noteworthy volume patterns:

-Several green bars exceeding the 2.0x threshold indicate periods of significantly above-average volume during the decline and subsequent consolidation

-More recent trading sessions show predominantly yellow and red bars, suggesting a return to average and below-average volume as the market consolidates

-The most recent green volume spike coincides with a bullish candle, potentially indicating renewed buying interest

This volume profile suggests that while the initial selloff occurred on strong volume (confirming the downtrend's validity), the recent consolidation is happening on decreasing volume – often a precursor to a significant move.

Critical Levels to Watch

With Trump's tariff announcement looming, traders should monitor these key levels:

Support: $79,800 (lower range boundary)

Intermediate resistance: $88,800 (higher range high)

Intermediate support: $82,000 (recent swing low)

What Could Happen Next?

The cryptocurrency market's reaction will likely hinge on the tone and specifics of Trump's tariff policies:

Bullish Scenario

If Trump's tariff policies are perceived as positive for risk assets or specifically favorable for cryptocurrency:

A break above $90,000 could trigger a relief rally toward previous highs

The declining volume during consolidation could represent a coiling effect before an explosive move higher

Target zones would be $95,000 and potentially a retest of the $98,000 area

Bearish Scenario

If the announcement creates market uncertainty or suggests policies that might negatively impact risk assets:

A breakdown below $79,800 would confirm continuation of the larger downtrend

Volume would likely expand on a breakdown, providing confirmation

The next major support zones would become $75,000 and $70,000

Conclusion

Bitcoin stands at a technical inflection point, with the upcoming tariff announcement serving as a potential catalyst for its next major move. The consolidation pattern, coupled with the volume profile shown in the RVOL indicator, suggests traders should prepare for increased volatility.

Given the mixed signals – bearish price structure but consolidation with occasional above-average volume spikes – a measured approach is prudent. Traders would be wise to wait for a definitive break of either range boundary with confirming volume before establishing significant positions.

The next 24-48 hours could determine whether Bitcoin resumes its longer-term uptrend or continues the correction that began from the $98,000 level.

INTRADAY MOVEMENT EXPECTEDi can see still there is liquidity above at the poc of the weekly volume

but if the price can cross up the level it can visit the next resistance above

so if the price at london session cross down the value area i will expect visit the levels shown on the chart as support and make the rejection

so we have to follow the plan and and use the levels on the chart risk management safe the profit secure the orders after the price move stop at break even

we wish happy trade for all

NQ Power Range Report with FIB Ext - 4/2/2025 SessionCME_MINI:NQM2025

- PR High: 19697.00

- PR Low: 19595.25

- NZ Spread: 228.25

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

10:30 | Crude Inventories

Key daily zones updated

- 200+ point rotation above Monday's high

- Auction back inside previous week range

- Retraced 1/3 of Friday's selloff

Session Open Stats (As of 12:25 AM 4/2)

- Session Open ATR: 437.34

- Volume: 31K

- Open Int: 248K

- Trend Grade: Neutral

- From BA ATH: -13.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

PEB Pacific Edge NZBreakout and retest with bollinger band squeeze

I've posted multiple times about this stock and it is no doubt high risk and speculative,

but technically it is showing bullish signs in my opinion and looking ready to move

Full disclosure I've owned this stock for a while now, and looking at long term (years) play

NQ Power Range Report with FIB Ext - 4/1/2025 SessionCME_MINI:NQM2025

- PR High: 19413.75

- PR Low: 19326.75

- NZ Spread: 194.25

Key scheduled economic events:

09:45 | S&P Global Manufacturing PMI

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Prices

- JOLTs Job Openings

Holding below previous week's low

- Advertising rotation above previous session high, into breakout range

Session Open Stats (As of 12:35 AM 4/1)

- Session Open ATR: 442.17

- Volume: 38K

- Open Int: 247K

- Trend Grade: Neutral

- From BA ATH: -14.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

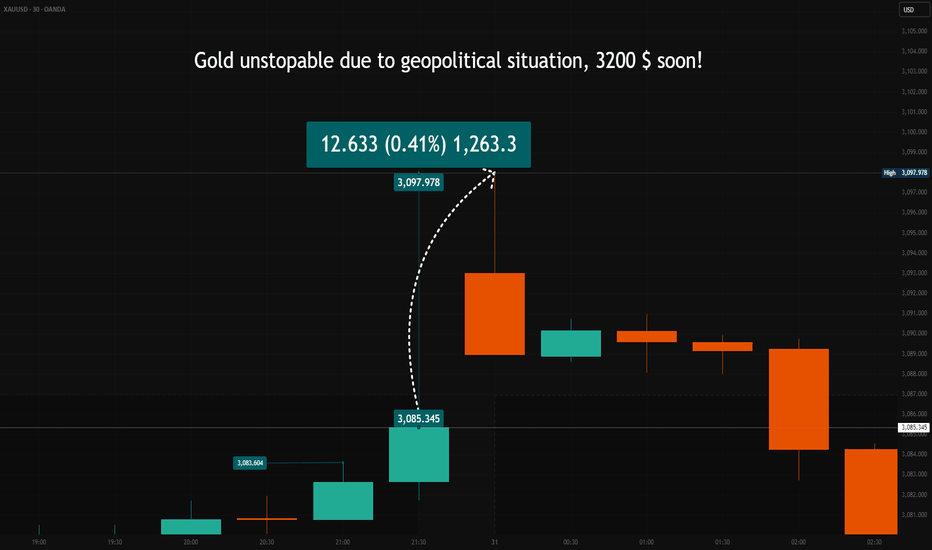

Gold Price Surges Amid Market Uncertainty – What’s Next?The late Friday session on March 28, 2025, ended with a strong rally in gold, as multiple price candles attempted to push higher. By 10 PM CET, gold had settled at $3,085.345, reflecting significant bullish momentum.

As the market reopened on Monday, the gold price gapped up by approximately +$12.5 , opening at $3,097.978 .

This type of price gap typically occurs when buyers are willing to pay more than the previous session’s close, signaling strong demand.

What’s Driving the Gold Rally?

The answer lies in a mix of tariffs, war, and recession fears. The global financial landscape remains highly unstable, and in times of uncertainty, gold historically acts as the preferred safe-haven asset. Investors are flocking to the precious metal as a hedge against economic instability.

Adding fuel to the fire, on April 2nd, additional U.S. tariffs imposed by President Donald Trump are set to take effect. This move could further disrupt markets, potentially driving even more capital into gold.

The Interest Rate Factor – A Hidden Risk?

While gold is surging, there’s a crucial factor to watch: Federal Reserve policy. So far, Fed Chair Jerome Powell has maintained a cautious stance on interest rates. However, if the situation deteriorates, the Fed might be forced to cut rates earlier than expected to stabilize the economy.

This could create a paradox for gold traders. While rate cuts typically support gold in the long run, a sudden policy shift could trigger a short-term sell-off as investors adjust their positions. If that happens, gold could see a sharp correction before resuming its trend.

Final Thoughts

Gold remains in a strong uptrend, but traders should stay cautious. If the Fed pivots and announces rate cuts sooner than expected, we could see a pullback in gold before the next leg higher. The coming days will be critical – keep an eye on April 2 and any shifts in Fed policy that could shake up the market.

👉 Will gold continue its rally, or are we facing a major pullback? Share your thoughts in the comments! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

NQ Power Range Report with FIB Ext - 3/31/2025 SessionCME_MINI:NQM2025

- PR High: 19365.00

- PR Low: 19275.00

- NZ Spread: 201.25

Key scheduled economic events:

09:45 | Chicago PMI

Continuing value decline below Friday's low

- Broke previous weeks low

- Short-term rotating off 19180s inventory floor

Session Open Stats (As of 12:45 AM 3/31)

- Session Open ATR: 444.15

- Volume: 70K

- Open Int: 241K

- Trend Grade: Neutral

- From BA ATH: -15.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/28/2025 SessionCME_MINI:NQM2025

- PR High: 20011.75

- PR Low: 19983.25

- NZ Spread: 63.5

Key scheduled economic events:

08:30 | Core PCE Price Index (MoM|YoY)

Holding value in the weekend gap range at previous session close

- Daily rotation short out of the Keltner average cloud, 20400-600 range

Session Open Stats (As of 12:55 AM 3/28)

- Session Open ATR: 421.56

- Volume: 22K

- Open Int: 233K

- Trend Grade: Neutral

- From BA ATH: -11.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/27/2025 SessionCME_MINI:NQM2025

- PR High: 20098.00

- PR Low: 20003.25

- NZ Spread: 212.0

Key scheduled economic events:

08:30 | Initial Jobless Claims

- GDP

Partial weekend gap fill

- Retracing above previous session close, in previous week range highs

- Re-enters daily Keltner average cloud near 20200

Session Open Stats (As of 12:35 AM 3/27)

- Session Open ATR: 439.39

- Volume: 42K

- Open Int: 228K

- Trend Grade: Neutral

- From BA ATH: -11.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

03/24 SPX Weekly GEX Outlook, Options FlowYou can see that every expiry has shifted into a stronger bullish stance heading into Friday, with GEX exposure moving upward across the board—though total net GEX is still in negative territory, while net DEX (delta exposure) is positive. This combination points toward a likely near-term rebound this week, which makes sense after testing the 5600 range last week….

Here’s a more detailed breakdown of the key zones and likely moves this week:

Bullish Target:

The current uptrend could reach 5750 on its first attempt (already reached in Monday, thx bullsh :) ). If a positive gamma squeeze emerges at that level, we might see an extension to 5800 or even 5850 as a final profit-taking zone for bulls this week.

HVL (Gamma Slip Zone):

Placed at 5680, this threshold currently supports a low-volatility environment. A drop below 5680, however, could reignite fear and fuel bearish momentum.

Put Floors & Net OI:

The largest net negative open interest (OI) cluster is at 5650, with the next key level near 5600. At 5600, net DEX reads fully positive, suggesting strong buying support if the market tests that lower boundary.

NQ Power Range Report with FIB Ext - 3/25/2025 SessionCME_MINI:NQM2025

- PR High: 20531.50

- PR Low: 20504.00

- NZ Spread: 61.5

Key scheduled economic events:

08:30 | Durable Goods Orders

09:30 | Crude Oil Inventories

Cleared previous week high, raising value towards 20600

- Auctioning inside daily Keltner average cloud below previous session close

- Weekend gap remains unfilled

Session Open Stats (As of 1:55 AM 3/25)

- Session Open ATR: 432.71

- Volume: 24K

- Open Int: 224K

- Trend Grade: Neutral

- From BA ATH: -9.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Turtle Trader IndicatorSo apparently Trading View has now removed the ability to publish indicators as a free users.

So unfortunately I cannot publish this anymore.

This is a prototype indicator I wrote after finishing the book, "The Complete Turtle Traders".

I plan to update modify this with my own TVMV framework and talk about other rules for trading as opposed to simply copying the old school turtles because the economic conditions today are simply very different than they used to be. I did backtest this and I wasn't terribly impressed. It wasn't horrible or anything, it just didn't fit my personal style.

For context, Turtle Trading Indicator is designed to implement the Turtle Trading strategy, a systematic approach developed by Richard Dennis and William Eckhardt in the 1980s. This strategy is known for its trend-following methods, using price breakouts and volatility to manage trades. The indicator plots visual signals for entries, exits, and position additions, making it easier for traders to follow the rules manually on their charts.

How It Works

Entry and Exit Signals: It uses breakouts above X-day highs or below X-day lows for entries, with exits based on Y-day highs or lows. Users can choose between System One (20-day breakout, 10-day exit) or System Two (55-day breakout, 20-day exit).

Volatility-Based Position Sizing: The indicator calculates position sizes using the Average True Range (ATR), ensuring risk is proportional to account capital, typically 1-2% per trade.

Risk Management: Stop-loss levels are set at 2N (twice the ATR) from the entry price to limit losses.

Pyramiding: It signals when to add to winning positions as the price moves favorably by 0.5N, helping to capitalize on trends.

How to Use It

To use the indicator:

Attach it to your chart on TradingView.

Look for entry signals (green triangles for long, red for short) to initiate trades.

Use the displayed position size for entries or additions, adjusting for your instrument if needed (e.g., stocks, futures).

Monitor for pyramid signals (lime or orange triangles) to add to positions.

Exit when exit signals appear (blue triangles), and always respect the plotted stop-loss levels.

Hope you enjoy and if you wanna see more indicators like this, consider following and giving this a boost. If it reaches 100 boosts, I'll update it or publish the strategy version otherwise I'm just gonna keep any updates in house.

NQ Power Range Report with FIB Ext - 3/25/2025 SessionCME_MINI:NQM2025

- PR High: 20366.25

- PR Low: 20342.25

- NZ Spread: 53.5

Key scheduled economic events:

10:00 | CB Consumer Confidence

- New Home Sales

Weekend gap remains unfilled and untested

- Return to daily Keltner average cloud above 20276

- Retracing below previous session close, holding in the highs

- 180+ point value increase above previous week auction

Session Open Stats (As of 12:55 AM 3/25)

- Session Open ATR: 446.54

- Volume: 25K

- Open Int: 227K

- Trend Grade: Neutral

- From BA ATH: -10.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

TTD longNASDAQ:TTD long

(The Trade Desk, Inc. (TTD) is a technology company that provides a demand-side platform for digital advertising. Here's a quick overview:

1. Business: TTD specializes in programmatic advertising, using AI and data analytics to automate and optimize ad placements in real-time across various digital platforms.

2. Financial Performance:

- 2024 Revenue: $2.4 billion (26% year-over-year growth)

- Q4 2024 Revenue: $741 million (22% year-over-year growth)

3. Stock Performance:

- Current Price: $59.34 (as of March 24, 2025)

- Year-to-date performance: Down approximately 36%

4. Growth Drivers:

- Connected TV (CTV) advertising

- Shift to programmatic advertising

- Privacy-friendly advertising model

5. Challenges:

- Recent earnings miss and lower-than-expected Q1 2025 guidance

- Increased competition from major tech companies

- Economic slowdowns potentially impacting ad spending

6. Market Position:

- Leader in the demand-side platform (DSP) market

- Strong presence in CTV advertising

- No reliance on first-party data, unlike competitors like Google and Meta

Despite recent challenges, analysts remain generally bullish on TTD's long-term prospects in the growing digital advertising industry)

Gold Spot (XAU/USD) – Technical Analysis Using Volume Profile 1. Key Observations (Volume & Gann Focused)

a) Volume Profile Insights:

POC (Point of Control): $3022.81 – high volume concentration area currently acting as a mid-range pivot.

Value Area High (VAH): Near $3032 – price has respected this zone multiple times as short-term resistance.

Value Area Low (VAL): Near $3012 – the lower boundary of prior trading activity, marking potential support.

b) Gann High-Low Signals:

Confirmed Gann High near $3045 aligned with recent rejection zone.

Recent Gann Low around $3012 – price has shown a bounce here, confirming it as a potential demand zone.

c) Liquidity Zones:

Liquidity Grab at $3040-$3045 – prior highs swept with a quick selloff, indicating institutional stop hunting.

Potential Sell Stops resting below $3012 (Range Low), marked as a key liquidity target if bearish continuation plays out.

d) Volume-Based Swing Highs/Lows:

Swing High at $3035-$3045 (low volume node followed by reversal).

Swing Low at $3020-$3022 near the POC – acting as a high-volume support base.

2. Support & Resistance Levels

a) Key Support:

$3022.81 (POC – key reaction zone).

$3012 (VAL and Gann swing low – confirmed support).

b) Key Resistance:

$3032 (VAH – rejected multiple times).

$3045 (Liquidity sweep and previous Gann swing high).

3. Chart Patterns & Market Structure

a) Trend Direction:

Currently range-bound, but short-term bullish structure forming inside a rising channel off the $3012 low.

b) Pattern Observations:

Range Structure: $3012 to $3045.

Channel Formation: Price is oscillating upward in a defined channel.

Breakout Opportunity: A clean break above $3032 opens space toward $3045 again.

4. Trade Setup & Risk Management

Trade Direction Entry Zone Target 1 (T1) Target 2 (T2) Stop-Loss (SL)

📈 Bullish Entry $3020–$3022 $3032 $3045 $3012

📉 Bearish Entry $3032–$3035 $3020 $3012 $3046

c) Risk Management:

Minimum Risk-Reward Ratio: 1:2

Position Sizing: Risk 1–2% of account equity per trade.

Execute only on confirmation of rejection or break of zone (avoid blind entries).

NQ Power Range Report with FIB Ext - 3/24/2025 SessionCME_MINI:NQM2025

- PR High: 20102.50

- PR Low: 20050.50

- NZ Spread: 116.5

Key scheduled economic events:

09:45 | S&P Global Manufacturing PMI

- S&P Global Services PMI

Unfilled weekend gap up of 0.38% above the session open

- Gap fills below 19978

- Auction return to previous week's highs

Session Open Stats (As of 12:15 AM 3/24)

- Session Open ATR: 458.01

- Volume: 54K

- Open Int: 226K

- Trend Grade: Neutral

- From BA ATH: -11.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/21/2025 SessionCME_MINI:NQM2025

- PR High: 19909.75

- PR Low: 19880.00

- NZ Spread: 66.75

No key scheduled economic events

Maintaining 2 week range, inside previous session range near the close

- Previous session closed inside print

- Advertising rotation back to week lows (constantly has been used for liquidity)

- Relatively tight PR

Session Open Stats (As of 12:55 AM 3/21)

- Session Open ATR: 459.60

- Volume: 26K

- Open Int: 226K

- Trend Grade: Neutral

- From BA ATH: -12.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/20/2025 SessionCME_MINI:NQM2025

- PR High: 20026.25

- PR Low: 19944.25

- NZ Spread: 183.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Philadelphia Fed Manufacturing

10:00 | Existing Home Sales

Auctioning in previous session highs above the close

- Maintaining weekly range below 20200

- Advertising daily rotation back to Keltner average cloud

Session Open Stats (As of 12:55 AM 3/20)

- Session Open ATR: 472.57

- Volume: 26K

- Open Int: 213K

- Trend Grade: Neutral

- From BA ATH: -10.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/19/2025 SessionCME_MINI:NQM2025

- PR High: 19723.00

- PR Low: 19666.25

- NZ Spread: 126.75

Key scheduled economic events:

09:30 | Crude Oil Inventories

14:00 | FOMC Economic Projections

FOMC Statement

Fed Interest Rate Decision

14:30 | FOMC Press Conference

Majority of volume in contract month M

- Counter breakout close of previous session

- Rotating back inside previous week range towards 19400 inventory

- AMP margins temporarily increased in preparation for Fed events

Session Open Stats (As of 12:55 AM 3/19)

- Session Open ATR: 472.38

- Volume: 32K

- Open Int: 194K

- Trend Grade: Neutral

- From BA ATH: -12.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18675

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 3/18/2025 SessionCME_MINI:NQM2025

- PR High: 20066.50

- PR Low: 20033.25

- NZ Spread: 74.25

No key scheduled economic events

Rolled over to contract month M with near volume match with H

- Slight rotation above previous week high

- Fading inside previous session range, below the close

Session Open Stats (As of 12:55 AM 3/18)

- Session Open ATR: 476.01

- Volume: 26K

- Open Int: 144K

- Trend Grade: Neutral

- From BA ATH: -11.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22667

- Mid: 21525

- Short: 19814

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone