Volatility

Charging Stations, Reduced Rates and Politics.With the future of the car industry looking dark and bright at the same time, HTZ has been over sold and bullied hard since its last pump with tesla ect.

My long term target I know it will hit is $8 over the next year.

I rarely call on meme stocks but no one is seeing this one coming ;)

Gold Price Rollercoaster: Is the Rally Just Beginning?The gold price has had a pretty crazy six days, jumping from 3,014 USD on April 9, 2025, to 3,357 USD on April 17 – that’s a solid 11%+ gain. So, what’s going on now? Is the gold rally over, or could we see even more upside? Let’s break it down.

🔥 What’s driving the gold price?

The big reason behind the recent surge is the trade war between the US and China. Trump has slapped new tariffs on imports from China, Mexico, and Canada, which has shaken things up in the markets. The Fed has also warned that these tariffs are bigger than expected, and could slow down growth and increase inflation.

When things get uncertain, investors tend to rush to safe havens like gold, and that’s exactly what’s happening right now. The demand for gold is up, and so is the price.

📉 What does the ECB rate cut mean?

The European Central Bank (ECB) has lowered interest rates by 0.25% today, dropping from 4.5% to 4.25%. They’re trying to help the economy out and ease inflation.

Lower rates mean fixed-income investments aren’t as attractive, which makes gold a better option. But, the US Fed has made it clear they won’t cut rates before June 2025, which could strengthen the US dollar and make gold a little less appealing.

🕊️ What if there’s a trade deal?

Now, imagine there’s a breakthrough – a trade deal, fairer tariffs, and everyone’s calming down. That could change things for gold:

📉 Less risk = less demand for gold: If things chill out, less capital will flow into gold.

💵 Stronger Dollar?: A trade deal could make the US dollar stronger, which isn’t necessarily great for gold. But Trump has made it clear that he doesn't want a strong dollar, since it makes US goods less competitive abroad. Even if the dollar does strengthen, it might put pressure on gold since it becomes more expensive for people using other currencies.

🔁 Money shifts: If things get calmer, investors might move away from gold and back into stocks or bonds for better returns.

So, a deal could definitely slow down or even end this gold rally.

🧭 What does this mean for investors?

Daytraders

For day traders, the current ups and downs can offer some good opportunities, but they also come with risks. The markets are super sensitive to news about the trade war and rate cuts. Quick gains are possible, but you’ve got to be careful. If a trade deal happens, expect the classic “Sell the News” scenario where the market cools off.

Medium-Term Investors (1 Month)

Over the next few weeks, we’ll see if more trade war news or central bank decisions impact the gold price. The rally could keep going, but nothing is guaranteed. If you’re in it for the medium-term, keep your positions flexible and manage risk closely. A trade deal could be bad news for gold, though.

Long-Term Investors

Long-term, gold is still a great way to hedge against inflation and geopolitical risks. The current trends could help gold prices, but keep in mind there could be some ups and downs. If the price drops due to a trade deal, it might actually be a good opportunity to buy.

📊 The Bottom Line

Gold has been on a hot streak lately, driven by the trade war and central bank moves. Whether this rally continues or cools down depends on what happens next. A trade deal could bring a correction. So, keep an eye on things and adjust your strategy accordingly.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

$30 imminent GME’s momentum is ROARING— Ever since the BTC news dropped GME has had significant volume front ran $27, flexed a savage pullback to lock in support, and handed us a golden entry last week. Went long and snatched shares at $24, $27, and $30—stacked for the next month’s fireworks. All eyes on BTC holding that weekly 50MA; if it cracks probably crashing to $60K+ to test support at that snooze-fest of a pattern. GME insider buys are screaming conviction. A dip close to $20 would be another gift. We are exactly at some weekly resistance and the floor could fall out of the market Wednesday with tariffs taking effect. Volatility has been off the charts across the board seems like the perfect storm. ANNND 4/20 is around the corner. “The most entertaining outcome is the most likely,”

COCORO. Do Only Good Everyday.Cocoro price is hold above moving average and if you use the basic strategy through Fibonacci retracement - now is an excellent entry point with 400% potential gain.

" Cocoro is latest family member adopted by Atsuko, the mother of Kabosu (aka Doge). This is the official IP token from the Own The Doge family, fully licensed and authenticated. When you own this token, you're not just collecting something cute - you're helping support Atsuko and non-profits that benefit both humans and dogs! "

Short VIDT40% on 20x leverage will make generational wealth. The downside is solely based off my model prediction and current volatility measurements and that the asset is being delisted.

GEX Analysis & Options “Game Plan”🔶 Short- and longer-term perspective in a high IV, negative GEX environment

🔶 KEY LEVELS & RANGES

Spot: 221

Gamma Flip / Transition: around 250 (the turquoise zone on the chart)

– This zone typically marks a “power shift.” If price decisively breaks above 250 and holds, market makers’ gamma positioning could flip from neutral/negative to positive.

Put Support: 200

– A large negative gamma position has accumulated here, making 200 a strong support level. If it breaks, the downside may accelerate.

Call Resistance: 400

– A major long-term “call wall” where a significant amount of OTM calls are concentrated. It’s more relevant to LEAPS; currently far from spot, so not a realistic short-term target.

Call Resistance #2: 300

– A medium-term bullish objective, still above the 200-day MA. You’d need to be strongly bullish to aim for ~300 by May (e.g., going for a 16-delta OTM call).

Short-Term / Intermediate GEX Levels:

– There are gamma clusters around 220–230 and 250–260 . These areas often see higher volatility, possible bounces, or stalls (chop) due to hedging flows.

🔶 WHATEVER SCENARIO – SHORT TERM (0–30 DAYS)

A) Upside Continuation / Rebound

– If TSLA closes above 225–230 , the next target is 240–250 (transition / gamma flip).

– If it breaks above 250 and holds (e.g., successful retest), market makers may shift to “long gamma,” fueling a quicker move to 260–270 .

– Resistance: 250, 300, with an extreme LEAPS-level at 400.

B) Downside Move / Bearish Break

– If price dips below ~220 and sustains, the next targets are 210–200 (major put wall / negative gamma).

– If 200 fails, negative gamma may magnify the sell-off. It’s an extreme scenario but still on the table given high IV and macro/geopolitical risks.

– Support: 210, 200 — likely stronger buying interest near 200, possibly a short-term bounce.

– The options chain suggests near-term hedging via puts for this scenario.

C) Chop / Sideways

– If TSLA stays in 210–230 , market makers (short options) might benefit from high IV/time decay.

– Negative GEX, however, can trigger sudden moves in either direction; caution is advised.

🔶 LONGER-TERM FOCUS (6–12 MONTHS, LEAPS)

NET GEX = -61.97M (negative territory) suggests longer-dated positioning is also put-heavy or carries notable negative gamma.

HVL / pTrans = 250 is a key pivot; cTrans+ = 400 is distant call resistance. Between these levels, there’s a mix of put/call dominance.

If Tesla undergoes a fresh growth phase (AI, robotaxi, energy storage, etc.) and clears 250/300 , 400 could become the next significant call wall — but that’s more of a multi-month horizon.

🔶 STRATEGY IDEAS (High IV Environment)

1. Short-Term Bearish

– If you’re bearish and expecting TSLA to test 220–210, consider a bear put spread or net credit put butterfly (lower debit) to leverage high IV.

– Targeting 200, but keep in mind negative gamma may accelerate downside movement.

2. Medium-Term “Contra” Bullish (bounce to 250)

– If GEX suggests a bounce off 210–220, consider a bull call spread (e.g., 220/240) or a net debit call butterfly (220/240/250).

– Be mindful of sudden swings, as we remain in negative gamma territory.

3. Longer-Term Bullish (>3–6 months)

– A call butterfly with upper strikes around 300–350 offers capped debit and higher potential payoff if a bigger rally materializes.

– A diagonal spread (selling nearer-dated calls, buying further-out calls) exploits elevated front-end IV.

4. Neutral / Range-Bound

– If TSLA stays in 200–250 , you could use Iron Condors (e.g., 200/260) to benefit from time decay and any IV collapse.

– Exercise caution: negative gamma can generate abrupt, directional moves, making a neutral stance riskier than usual.

🔶 ADDITIONAL NOTES & “BIG PICTURE”

High IV & Negative GEX: TSLA has a track record of large swings. Negative GEX can intensify sell-offs, while forced hedging might trigger rapid rebounds.

Preferred Structures: With expensive premiums, spreads (vertical, diagonal) and butterfly configurations generally fare better than plain long options (less vulnerable to time decay).

Potential Catalysts: AI announcements, Autopilot breakthroughs, new product lines, and macro changes can swiftly alter market dynamics. Keep tracking GEX updates and news flow; TSLA tends to respond dramatically to fresh developments.

🔶 Bottom line: From 221 spot, watch 210–200 on the downside and 240–250 on the upside short term. Medium-term bullish target = 300 , while 400 remains a far LEAPS scenario. High IV + negative gamma = fast, potentially volatile moves — so risk management and spread-based approaches are crucial.

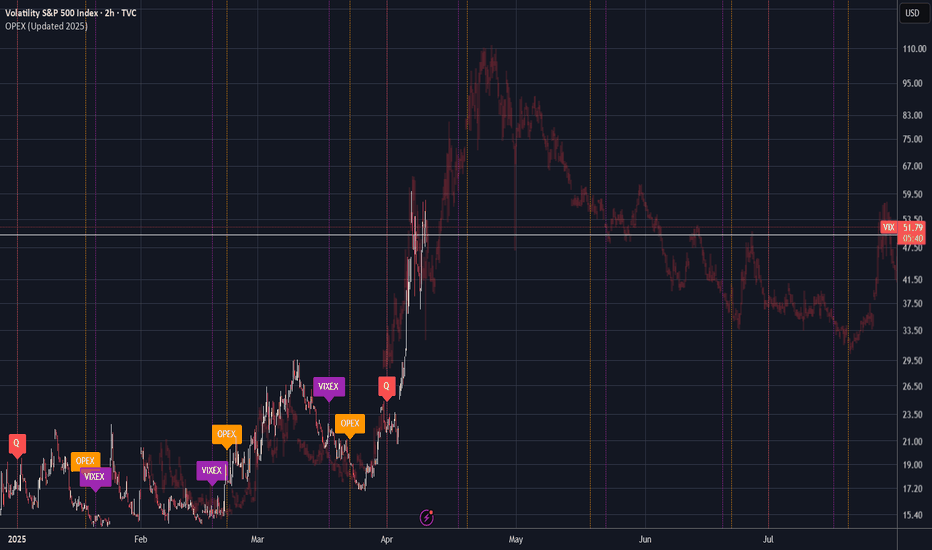

04/07 GEX + Historic VIX Highs: Extreme Volatility with OptionsWow, where to begin? We’ve just come through a week that even the most thorough analysts found surprising.

Last Friday’s brutal sell-off triggered such a massive margin call rally that even the hedge funds were forced to exit gold—which is usually considered a safe haven—on Friday.

The VIX is at a historic high — no joke. We last saw levels like this during the 2008 crisis and the COVID panic in 2020.

📌 High IV = High Theta

When implied volatility (IV) is high, theta (the time decay of options) is also high. This means that maintaining long put protection becomes extremely expensive. From a broker’s hedging perspective, if they are short expensive put options, they can gradually buy back their futures positions over time (all else being equal). As IV rises, this buyback becomes increasingly attractive for them.

Let’s look at our weekly SPY analysis using GEX Profile (Gamma Exposure) indicator first:

It’s definitely not a cheerful chart!

* Below 520: We have strikes dominated by puts. The largest negative GEX “profit-taking zone” sits at 490. If price reaches that level and the support fails (the previous major bottom from April 2024), we could move even further down into a very wide negative squeeze zone, possibly as far as 445.

* HVL zone: 520–546: A choppy area around the gamma flip.

* Above 546: This would signal a +10-15% rally, putting us in a positive gamma zone. However, such a scenario currently seems unlikely—at least based on the gamma levels we see right now.

I won’t sugarcoat it: we’re at levels now where the market could easily move 10% in either direction. So, in my view, forget about conservative option strategies with flat delta exposure.

🤔 What Can We Do?

Important: This analysis reflects my personal opinion only. It’s primarily for those looking to speculate in this highly uncertain environment. If you’re holding put options strictly as a hedge, then this may not be directly relevant to you. In these conditions, the number one rule is to survive—hedges are meant to protect assets or guard against margin calls, not to make profit.

Currently, IV (implied volatility) and VIX are at historic highs. For them to stay this elevated, we’d need new negative headlines and further major market drops. While that could certainly happen, statistically it becomes less and less likely as time goes on.

Buying Put Options …. no way?

First off, there are plenty of challenges if you plan to buy put options right now—most of all their cost. Put options are nearly twice as expensive as calls in many cases.

Does this mean I recommend selling puts or put spreads? I’m not saying you shouldn’t, but be aware: this isn’t for the faint-hearted or for beginners (the risk is high!). It might be worth exploring butterfly or vertical debit spread strategies, as our goal remains the same as always: to maximize the risk–reward ratio.

🐂 If You’re Bullish

This might sound like a ninja move, but one possibility is to buy call butterfly spreads. Yes, the market could still drop—that’s absolutely possible. But statistically, it’s becoming less likely that we’ll see another huge leg down without some form of rebound.

- Slight Move Up: In the event of a mild rise, call spreads and call butterfly strategies can significantly outperform a simple long call. The short legs in a spread/fly offset high theta costs and mitigate the negative effects of falling IV.

- Even with a +10% Move: A long call is often still not the best choice in this environment—even if the option goes deep in the money.

Where Call Spread/Butterfly Can Fail

If stocks rally 15–20% or more and IV also increases (which would be unprecedented in just a few days).

If the market crashes and VIX spikes above 100 (IV would skyrocket, raising the cost of all options further).

Cheap Bullish Calendar Spread

In a situation like this, even a cheap calendar spread can be a good play — the risk is relatively low, especially if managed well and the breakeven range is wide. Of course, if implied volatility drops, the spread could narrow, but that would likely come with a market rally, which theta can help capitalize on.

🐻 If You’re Bearish

I strongly advise against buying single-leg puts, even on a 0DTE (zero-days-to-expiration) basis. If you’re convinced the market will keep dropping, I’d only consider debit spreads, aiming for a solid risk–reward ratio (in my case, I look for at least 1:2 risk-to-reward).

⚖️ If You Want to Stay Neutral / Omni bullish

If you prefer not to pick a direction, you could try to capitalize on historically high IV with a May-expiration Iron Condor. This is the classic TastyTrade approach, with the caveat that you must monitor GEX levels and IV daily and adjust the far side as needed.

Risk Management: If the spot price threatens one of your short strikes, you probably shouldn’t wait around in this volatile environment. It’s usually better to close the position and take a small loss than to hope for a reversal—hoping can become very expensive!

Conclusion

The market is extremely volatile, and expensive options mean traditional strategies may not work as well as they usually do. Stay cautious, manage risk meticulously, and don’t be afraid to close out losing trades quickly. As always, surviving to trade another day is the most important rule.

NQ Power Range Report with FIB Ext - 4/11/2025 SessionCME_MINI:NQM2025

- PR High: 18597.75

- PR Low: 18464.50

- NZ Spread: 297.25

Key scheduled economic events:

08:30 | PPI

Retraced 50% of Wednesday's range

- Rotating off 18400 zone pivot, above previous session close

- High volatility sentiment continues

Session Open Stats (As of 12:55 AM 4/11)

- Session Open ATR: 865.12

- Volume: 54K

- Open Int: 236K

- Trend Grade: Bear

- From BA ATH: -17.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/10/2025 SessionCME_MINI:NQM2025

- PR High: 19359.00

- PR Low: 19242.25

- NZ Spread: 261.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- CPI (Core|YoY|MoM)

13:00 | 30-Year Bond Auction

FOMC gave 1900 point lift back to April 2 range

- Mechanical rotation off daily Keltner average crowd

- No change in volatility expectations

Session Open Stats (As of 12:25 AM 4/10)

- Session Open ATR: 815.83

- Volume: 58K

- Open Int: 243K

- Trend Grade: Bear

- From BA ATH: -16.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Path to 100 VIXI wrote this note on TVC:VIX a few days ago:

www.tradingview.com

And am now expanding it a bit more.

As someone who was working middle office during the original 2016 Trump Election, Brexit, during the Taper Tantrum and a few other major events - I want to lay out my principles on trading the VIX because spikes like this bring a lot of "first time" VIX traders to something that trades like NOTHING ELSE in the market.

This is not a stock in a short squeeze, this is not a generic index.

This is like nothing you've ever traded before. In fact, I'd encourage you to take advantage of TradingView's chart options and instead look at the chart of -1*$TVC:VIX.

That alone should give you pause.

----------------------------------

So - let's start with the principles of the finance business as laid out in the masterclass which was the movie "Margin Call" .

"John Tuld: There are three ways to make a living in this business: be first, be smarter, or cheat."

1. Be First.

You are not first if you are buying above the historic average of VIX 20-21.

If you were buying CBOE:UVXY since Jan 2025, you'd be up 175% right now and likely looking to re-balance into your desired long term asset positions.

2. Be Smarter.

* Are you taking into consideration the VIXEX Cycle?

* Do you know the effect of VIXEX before or after monthly OpEx?

* Do you know the current implied volatility curve of options ON the VIX?

* Do you know that of the last 4 times the VIX has hit 50, it went on to 80+ 50% of the time after that?

* Yes, I've seen the charts going around about forward S&P X year returns but did you know that after the VIX spike to 80 in October 2008, the market (in a decreasing volatility environment) went on a further 35% decline in the next 4-5 months?

* Where is the MOVE? What are the bond indexes & bond volatility measures doing? And if you don't yet understand that equities ALWAYS reacts to what is going on in the rates / yield world... you'll find out eventually. I hope.

3. Cheat

When things start going wrong, everyone wants an easy solution.

That's why its called a relief rally. It feels like relief - the bottom is in, the worst part is over.

But that is what the really big players have the biggest opportunity to play with the day to day environment.

They know our heuristics. They encourage the formation of cargo cult style investing whether that's HODL in the cryptocurrencies or Bogleheads in the vanguard ETFs.

It's all the same and encourages you to forgot first principles thinking about things like:

1. Is this actually a good price or is it just relatively cheap to recent history?

2. Who's going to have to dilute to survive the next period of tighter lending, import costs from tariffs, or whatever the problem of the day is.

3. VIX correlation - volatility is just a description of the markets. Its not a description of the direction. There is periods where volatility is positively correlated to the price movement (like during earnings beats). Know about this and know when it changes.

4. Etc.

Some have pointed out that is more appropriately a measure of liquidity in the SPX.

When VIX is low, that means there is lots of "friction" to price movement. It means that there is tons of orders on the L2 book keeping the current price from moving in any direction too quickly.

When VIX is high, that means there is very low "friction" to price movement. It means there are very few orders on the L2 book and market makers can "cheat" by appearing to create a low volume rally and then rug pull that price movement very quickly (not via spoofing, more just dynamic management of gamma & delta hedging requirements).

Additionally - volume itself becomes deceptive. Volume is just indicating that a trade happened.

Its not telling you to what degree the spread between the bid and ask has blown out to 1x, 2x, or 5x normal and that trades are executing only at the highest slippage prices in that spread.

All of these things are considerations that the market makers can use to make a "buy the dip" situation that works heavily to their advantage.

TLDR: "If you can't spot the sucker in your first half hour at the table, then you are the sucker"

----------------------------------

So - why / when would VIX go to 100?

In 2020, its easy to forget that a culmination of things stopped the crash at -35%.

* March 17, 2020 VIXEX wiped out a significant amount of long volatility positions.

* March 20, 2020 Opex wiped out a significant proportion of the short term put positions

* March 20, 2020 Fed Reserve announced to provide "enhanced" (i.e. unlimited) liquidity to the

markets starting Monday March 23, 2020.

* April 6th, 2020 Peak of Implied Volatility (point where options "most expensive") - which meant that buyers / sellers started providing more & more liquidity following this point.

In 2025, we have yet to see:

* Any motion towards intervention from the Fed for liquidity.

* Any motion from the significant fundamental investors (we're not close to an attractive P/S or P/E on most stocks for Buffett & Co to start buying)

* Any significant motion from companies on indicating strategies about capital raises, layoffs, or other company level liquidity reactions.

* Any "reset" of options in either volatility or hedging. Numbers below as of April 9, 2025:

- SPY 2.8M Put OI for April 17

- VIX 3.5M Call OI for April 16

Just an example but maybe IF we see those clear and NOT get re-bought for May Opex... we might be ready to call a top here at 50 VIX.

Otherwise.... we're just at another stop on the path to 100.

NQ Power Range Report with FIB Ext - 4/9/2025 SessionCME_MINI:NQM2025

- PR High: 17240.00

- PR Low: 16971.00

- NZ Spread: 601.5 ⚠

Key scheduled economic events:

10:30 | Crude Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Mechanical pivot off Monday's high

- Rotating back into 16700s inventory

- AMP margins and volatile session open indicates we're still in the volatility storm

Session Open Stats (As of 12:45 AM 4/9)

- Session Open ATR: 692.29

- Volume: 84K

- Open Int: 256K

- Trend Grade: Bear

- From BA ATH: -24.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Need clarity on what's most likely to come? I got u!Price has followed my path to a tea (Not exact prices but more of the cycles of price movement)

We will hit 450 on QQQ by Tuesday and Trump is most likely to back peddle on tariffs for select countries.

TARIFFS ARE ONLY MEANT TO REDUCE THE 10 YY FOR TRUMP TO REFINANCE OUR NATIONAL DEBT.

Nothing else.

Please see my black line of what I think price action will do.

NQ Power Range Report with FIB Ext - 4/8/2025 SessionCME_MINI:NQM2025

- PR High: 17753.75

- PR Low: 17644.50

- NZ Spread: 244.0

No key scheduled economic events

Volatility remains high with Trump tariff excitement

- Advertising rotation off previous session low

- Holding above the close below the high, inside Friday's range

- AMP margins temp increase remains

Session Open Stats (As of 12:45 AM 4/8)

- Session Open ATR: 627.37

- Volume: 48K

- Open Int: 272K

- Trend Grade: Bear

- From BA ATH: -21.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/7/2025 SessionCME_MINI:NQM2025

- PR High: 17100.00

- PR Low: 16550.00

- NZ Spread: 1231.0 ⚠

No key scheduled economic events

AMP margins remain increased due to tariff news

- Continue high volatility value decline, 2.45% weekend gap

- Weekend gap fills above 17417

- Overall sentiment: anxiously hesitant in hopes of a nearby bottom

Session Open Stats (As of 12:15 AM 4/7)

- Session Open ATR: 593.15

- Volume: 131K

- Open Int: 276K

- Trend Grade: Bear

- From BA ATH: -25.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/4/2025 SessionCME_MINI:NQM2025

- PR High: 18698.00

- PR Low: 18588.25

- NZ Spread: 245.25

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

11:25 | Fed Chair Powell Speaks

AMP margins remains increased but lowered to 25%

- Value decline continues, dipping into 18400s inventory

- Auction holding just below previous session low

Session Open Stats (As of 12:55 AM 4/4)

- Session Open ATR: 482.31

- Volume: 48K

- Open Int: 261K

- Trend Grade: Bear

- From BA ATH: -18.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18106

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone