Volume Indicator

Volume Climax| Key Levels| Need Bull Volume Follow through!Hello Traders!,

Welcome back!

Today’s chart update will be on ICX, bulls have got very critical levels to break to maintain a bullish bias…

Points to consider,

- Price testing resistance

- Rejection from major trend line

- RSI coming into resistance

- EMA’s holding price as support

- Volume climax

ICX is trying to maintain a bullish projection but there is not enough follow through from the bulls. Price harshly got rejected from trend line resistance, signalling strong sell pressure, a return to local support line is more probable.

The stochastics is currently in the lower regions, can stay here for an extended period of time, however lots of stored momentum to the upside. RSI is coming into its apex, meaning a break is imminent, the direction of the break will dictate the direction of ICX.

The EMA’s are currently holding price as support, this must stay true for the bullish bias as price tests critical levels. The recent volume climax signals that there are a lot of sellers at upper trend line resistance.

Overall, in my opinion, ICX is more probable to return back to the local trend line as bull volume has not followed through. This will cool of all indicators such as the RSI before ICX has another attempt at breaking current resistance.

What are your thoughts on ICX, can it maintain a bullish bias?

Please leave a like and comment

And remember,

“The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street.” – Jesse Livermore

Dlt TINY ROCKETDLT/BTC

Using AZV indicator with Profile Analysis

Buy signal: (Bounce back ) ( Breakout )

Profile Sell Target : 610 SATS

AZV Sell signal : AZV - NO of bars = 26 & Multiplier = 2

AZV Signal type = Open Target

SL : Close 1 Hr Heikin candle below 536 SATS

AZV link :

JSE:FBR Famous Brands Backup Potentially CompleteFamous Brands has been in a redistribution trading range (TR) and we have been looking for the markdown to continue after a backup to the TR (see post below). The backup (BU) action has formed a smaller trading range that has indicated upthrust ( Which is also the BU of the larger range ). Now we have seen a last point of supply (LPSY) and selling volume on earnings and we can expect the markdown to start.

JSE:CSB Cashbuild Markdown to continueCashbuild has broken out of the redistribution trading range (TR) and has attempted to rally back into the TR (See post below). The 26000 level has proven strong resistance with high volume rejection. After this strong selling, we can expect the markdown to continue.

JSE:ASC Ascendis Health the pain continuesAfter breaking the downward stride the hope was that an accumulation trading range (TR) was forming. However, it seems there is no buying interest in the stock with the volume drying up. Attempts to rally have been poor and formed lower lows. The TR has been broken and there could now be more downside to come.

JSE:AVI AVI still waiting for the markdown to continueWe have been following the AVI distribution since the beginning of the year (see posts below). We are now in the markdown phase. Price has found some support at 8500 but is looking like selling pressure could push it through this level. The 200 day MA has been tested and we see an increase in volume on down bars as it pushes up against 8500. Watching for the break lower.

JSE:CLS Clicks Still Waiting for the Backup ActionAfter breaking the reaccumulation trading range (TR) with signs of strength (SoS) we now see a smaller trading range forming which should lead to some backing up action before the markup in phase E starts. After the breakout and SoS we have had localised buying climax (BC), automatic reaction (AR) and now a secondary test (ST) of the BC completing phase A of the sampler TR that is forming. There is no demand (low volume) and I am expecting the price to stay in the TR until a spring forms which completes the backing up (BU) action to test the breakout level of the larger reaccumulation TR. For now, some patience is required for the TR to complete before going long and following the markup.

ACB BLOOD| Volume Climax| Oversold Bounce?Hello Traders,

Today’s chart update will be on ACB – Aurora Cannabis INC, which is in a severe down trend that has been respecting Fibonacci extension levels. Price is currently testing a critical technical level that needs to hold to avoid capitulation…

Points to consider,

- Strong establish bear trend

- Support being tested

- Structural resistance retest

- Stochastics in lower region

- RSI oversold

- Volume Climax

ACB has clearly been putting in lower highs consecutively on the daily timeframe, there are no signs yet of this changing. ACB is currently testing a critical support level that is in confluence with the 1.618 Fibonacci level. This level needs to hold otherwise ACB is in a risk of capitulating. Structural resistance has been confirmed with a bearish retest which also further confirms the S/R flip.

The Stochastics is in lower regions, can stay down here for an extended period of time, however we do have lots of stored momentum to the upside. The RSI historically bounces from such oversold conditions; however we don’t have a clear sign of the bounce starting.

Strong bear volume has put in a volume climax bar, signalling a potential exhaustion in the bearish trend; it would only be natural for the price to see a relief bounce from such lows. ACB has also been respecting the Fibonacci Extensions, price is approaching the 1.618 Fib Extension that is in confluence with the critical support level, increasing the probability of a bounce.

Overall, In my opinion, ACB is on the verge of capitulating if this critical support is not held, it is however more probable for an oversold bounce due to the sharp decline in this bear trend.

What are your thoughts on ACB?

Please leave a like and comment,

And remember,

“If you don’t respect risk, eventually they’ll carry you out.” – Larry Hite

TRXBTC Trend Change| Higher Lows|Key Resistance ! Hello Traders!

Today’s chart update will be on TRX, 240 timeframe, testing an important resistant level that needs to break to keep the bullish bias. A break from this level will increase the probability of TRX testing structural resistance, which has multiple technical confluences.

Points to consider,

- Confirmed Trend Change

- Support provided by EMA’s

- Key resistance being tested

- Stochastics projected upwards

- RSI trading in upper region

- Healthy Volume

- VPVR cluster showing low volume of transactions

- Structural resistance as next target

TRX has broken its lower low projection and has successfully put in consecutive higher lows as it comes into a key resistance. TRX needs to break this resistance with convincing volume to keep the uptrend intact. Support is currently being provided by the EMA’s which has turned bullish from local lows.

The stochastics is currently trading in the upper region, can stay up here for an extended period of time, however we do have lots of stored momentum to the downside. The RSI on the other hand is respecting its support (red line), bouncing of it multiple times.

Volume is currently healthy, its needs to sustain with bull volume to break resistance, which will also avoid the chances of a false break. The VPVR is showing low volume of transactions from resistance to structural resistance. This signals that this cluster will pose little resistance in terms of volume of transactions, if and when TRX tests.

Structural resistance is the technical target for TRX as this level is in confluence with multiple technical indicators such as the .50 Fibonacci level and the 1.618 Fibonacci Extension.

Overall, In My Opinion, TRX has established an uptrend with consecutive lower highs, the market structure has changed. TRX needs to break current resistance levels in order to keep the bullish bias. Volume is looking very healthy for this break, so we do have a greater probability of breaking resistance and meeting technical target.

What are your thoughts on TRX trend change?

Please leave a like and comment,

And remember,

“If you don’t respect risk, eventually they’ll carry you out.” – Larry Hite

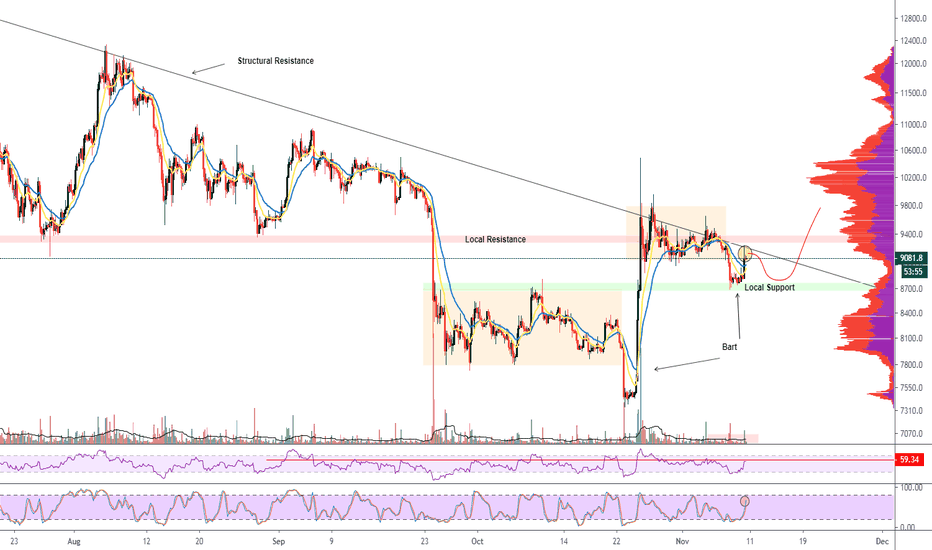

BTC Bart Fractal|Strong Resistance|Need Volume Follow Through!!Hello Traders,

Today’s update will be on Bitcoins recent developments, where a possible fractal is playing out with a confirmed Bart pattern. BTC is now trading at a very strong resistant point which can only be broken with strong bull volume.

Will bulls have enough in the tank to break resistance or is a retracement back to support more probable?

Points to consider,

- Trend confirmed Bart pattern

- Local Support Respected

- Local Resistance is in Confluence with Structural Resistance

- RSI Neutral

- Stochastics Projected upwards

- EMA yet to turn bullish

- Volume needs follow through

The recent trend in Bitcoin’s price has been following a fractal with a confirmed Bart from local support. BTC consolidated before an impulse move down, where bulls instantaneously showed up to move price right back in to resistance. The current level that is being tested needs to break for strong bullish momentum.

Local support was respected by Bitcoin, confirming the S/R flip. This signalled that buyers were strong, putting in a healthy retest of previous resistance. Local Resistance however is in confluence with the macro structural resistance. This is a very strong area that Bitcoin needs to break for continued bullish momentum. For this to come to fruition, we need strong follow through with bull volume, otherwise price will retrace back to local support.

RSI is currently testing resistance in neutral territory; it is not in overbought nor oversold at current given time. The Stochastics is projected upwards, we still have momentum stored to the upside if Bitcoin is capable of breaking the strong resistance.

The EMA’s are yet to turn completely bullish, the yellow EMA needs to cross the blue EMA to confirm bull momentum. Volume is very important right now for Bitcoin, we need an increase in bull volume, currently it is looking very weak.

Overall, In My Opinion, local support has been tested and respected, but we do have very strong resistance levels that need to break. Volume is very key right now, like I mentioned, it does look quite weak but it is too early to tell. A retest of local support again is quite probable at current given time before an impulse break of major resistance levels.

What are your thoughts on the recent developments of Bitcoin?

Please leave a like and comment,

And Remember,

“Opportunities come infrequently. When it rains gold put out a bucket not a thimble.” – Warren Buffet

JSE:J200 Top 40 Institutional SellingLooking at a weekly chart it seems that we are in distribution that has started in 2015. We now see volume off the tops of the Last Point of Supply (LPSY). There are Signs of Weakness (SoW) and change of character in the background. I break below the yearly pivot point which should be tested this week could result in significant declines.

Using Past Bitcoin Volume To Predict Future Price$ / Tick is calculated using 1 tick = $0.01 What you're doing is taking the total volume executed across ALL the exchanges... Then subtracting the HIGH and the LOW to get the range.. then dividing the two . What that does is evenly distributes/allocates volume to each tick of price movement on the bar. these are daily bars.

e.g $1.00 = 100 ticks. Volume 5000, Range High to Low = $100 (Ticks = 10000)

0.5 BTC of volume executed in every tick (5000 BTC / 10000 Tick Range)

This is converted to $ amounts using the average price. So the numbers on the posted on the chart is the Volume Per Tick that was executed that day * multiplied * by the $$ of dollars spent that day on volume.

e.g. Average price = $3,000. 0.5 BTC (from above) * $3,000 (average Price) = $1,500 spent in every tick.

This is then summed. Another way to express it is { * Average Price (OHLC4) }

So here's what has happened since 2013:

It topped out at the peak in 2013. Since, it increased steadily from the 2013 top until hitting 10x the $275k figure from the 2013 top (from $275,000 to $2,500,000 Dollars Per Tick) in January 2017. It then stayed stable throughout 2017 after breaking the old 2014 ATH of $1,100 / BTC. It continued to remain Stable until we hit the ATH at $20k, Dec 2018.

It then began increasing again until the bottoming/accumulation in Jan/Feb 2019. Then came the bullish leg up. IN SPOT BTC it has since been decreasing. This should, in theory, be a bad sign. (i.e. "Low volume pump")

HOWEVER, if you factor in that most trading is happening on Bitmex and now Bybit... we can add those Dollars per Tick & Volume as well. Doing so, we are currently at 4.5x of the Dollar Per Tick amount of the 2018 top ($2,500,000 to $11,100,000)

.

Conclusions:

If we include derivative volume we would infer that we have to finish generating double the economic mass (in the trading ecosystem) and we'll be off to our upper targets of 300k.

If we conclude that derivative is "fake volume" because it's not real bitcoin, but rather "paper bitcoin" and thus discount it. We're likely in a B (or X) wave and I'll get my $1200 bitcoin.

My inclination is that we are in a bull market and will see new ATH's. I don't think I'll get my $1,200 bitcoin =(

However, I would imagine that by this analysis, we can conclusively settle the argument if there ever was one: Derivatives are driving the market. Bitcoin and its 21 million supply may still be a part of the value proposition but with 100x availability in more and more places, a supply limit is a figment of the imagination when it comes to supply/demand and price discovery. Derivatives create an infinite supply of bitcoin by just adding 0000s to your position size and executing it against the market. The arb bots and indexing functions keep the price at parity, so, exchanges do have to move together. But, through margin, there is virtually an unlimited supply of Bitcoin

FLAMER DISCLAIMER:

Target is arbitrary... it should carry no weight. This is not a precise price prediction. Time to the right of the chart is arbitrary, this is not a precise timing prediction.

DYOR - Do Your Own Research. I present the data for your analysis... not because I'm convinced I'm right. I'd be happy to hear contrary thoughts

BTCUSD Adam and Eve Formation | Double Bottom ! Hello Traders!

Today’s chart update will be on Bitcoin’s recent developments, a potential bullish formation, an Adam and Eve bottoming is playing out... We also have a visible double bottom within this formation.

Points to consider,

- Trend Consolidating after initial bull move

- Support is found in the green zone

- Local resistance is at the $9,700 area

- Stochastics currently trading neutral

- RSI respecting trend line

- EMA’s supporting price

- Volume has tapered off

- Technical target in confluence with local top

After recent pump in bitcoin’s price, it has been consolidating above the $9,000 price, which is very bullish. Adam was formed by a V-Shape recovery and Eve is currently being formed by a rounded bottom, this technically is a bullish formation, a pattern that needs to break resistance for confirmation.

Support is found in the green zone, price has tested this area twice, putting in a potential double bottom within a bullish formation. Local resistance is found at the $9,700 area, this is a key area in the bullish formation, and it needs to break for a confirmation and a continuation in the overall trend.

The Stochastics is currently trading neutral, is has stored momentum in both directions. We need to see more signs to determine where the stochs are headed. The RSI however is respecting its trend line; it needs to hold for Eve’s rounding bottom to complete.

The EMA’s similarly to the RSI needs to hold price as support to complete Eve’s rounding bottom as it comes into local resistance. Volume is very important to watch if and when price testes local resistance. We need to see an influx of bull volume upon breakout; this will complete and confirm the bullish formation.

Overall, IMO, this Adam and Eve pattern will come to fruition if the EMA’s successfully hold price as it comes into resistance. A break needs to be backed by bull volume to avoid the chances of a false break. The technical target for this Adam and Eve formation aligns perfectly with the local top…

What are your thoughts?

Please Leave a like and comment

And remember,

“Dangers of watching every tick are twofold: overtrading and increased chances of prematurely liquidating good positions” – Jack Schwager

TRXBTC Daily Trend Change | Increase in Bull Volume Hello Traders

Two more months in the year, how time flies…

Today’s chart update will be on TRXBTC, we have a potential daily trend change which is backed up with strong bull volume…

Points to consider,

- Trend is putting in new higher lows

- Resistance at .236 Fibonacci retracement

- Support held by EMA’s (EMA’s Bull Cross)

- Stochastics trading in upper region

- RSI testing its local resistance

- Visible increase in bull volume

TRX has been on the move as of late, changing its overall daily trend with consecutive higher lows as it comes into local resistance. This resistance, the .236 Fibonacci Retracement, is in confluence with structural resistance, a key area that needs to be broken for a continuation.

Support is being held by the EMA’s which does look quite strong after a confirmed bull cross. This cross initially signalled the daily trend change.

The stochastics is currently trading in the upper regions; a healthy retracement in the trend can come to fruition as the stochastics does have a lot of momentum stored to the downside.

The RSI confirmed the bullish divergence, and is now trading in the upper region at local resistance. If this resistance breaks, is can trade in the orange highlighted box for an extended period of time, as history suggests.

Volume has been a great indicator; we have had an increase in bull volume, showing that buyers are strong in this trend change. We need to see this continue for local upper resistances to be tested.

Overall, IMO, TRX has had an impressive trend change with follow through; a healthy correction is not farfetched. This will cool of the stochastics and RSI indicators before another leg up, this will also allow the trend to put in another higher low…

What are your thoughts?

Please leave a like and comment

,

And remember

“You’re going to learn a million things, then you need to forget them all and focus on one.” - SunriseTrader

ETHBTC Oversold Bounce? Key Support Area| Volume Climax Hello Traders!

Hope your all enjoying your weekend,

Today’s update will be on ETHBTC, key levels to watch after this initial dump, will a bounce come to fruition or a continuation?

Points to consider,

- Trend broke out of falling wedge pattern on the macro timeframe

- Support at .50 Fibonacci

- Local resistance in confluence with local top

- Stochastics in lower regions

- RSI currently oversold

- EMA’s yet to meet price

- Volume climax Bars

After initial break from its falling wedge pattern, ETH topped out at local resistance before a massive dump to the .618 Fibonacci retracement level. It is currently holding support at the .50 Fibonacci level, the wicks down to the .618 level signals that buyers a strong, this area is also in confluence with local support.

Resistance is where price has locally topped out; ETH needs to break this key level for a bullish continuation in the overall trend.

The stochastics is currently in lower regions, no bottoming signal yet, it can stay in these regions for an extended period of time, a bounce however will have a lot of stored momentum to the upside.

The RSI is currently way oversold, needs to cool off from these areas, if price holds support and moves up then the RSI will have a chance to recover so with other indicators…

EMA’s are yet to meet price, it has been holding as resistance thus will add more selling pressure to the price when it meets at local support. A cross of the EMA’s at local support will be extremely bullish…

Volume has climaxed, signally a temporary bottom for ETH, unless price breaks through the .618 Fibonacci within the next couple days.

Overall, IMO, local support is strong here, last time ETH wicked down; it had a rally into local resistance. Bulls need to defend this key level, otherwise yearly lows are on the cards if support was to be broken.

What are your thoughts?

Please leave a like and comment,

And remember,

“Only The Game , Can Teach You The Game” – Jesse Livermore

MCOBTC Rising Wedge | Bearish Divergence | Correction?Hello Traders,

Today’s chart update will be on MCOBTC, where we have had a potential Adam and EVE bottom from yearly lows. Price is now testing key support that needs to hold, however we are seeing bearish signs such as the bearish divergence..

Points to consider,

- Trend is considered bullish with lower highs

- Major Resistance broke, now support

- Local resistance at 5632 Satts

- Stochastics projected downwards

- RSI diverging from price

- EMA’s holding support

- Volume below average

MCO is at a critical point in its trend where we do see multiple bearish signs in the chart. The trend is bullish however is testing key support in a falling wedge formation, a correction into the zone is more likely to be at play.

Major Structural resistance has been broken from yearly lows; MCO needs to hold current area to confirm an S/R flip. Local resistance however is at 5362 Satts, the VPVR between the two segments show a decrease in the volume of transactions. This signals that bulls are more likely to test local resistance due to low levels of transaction…

The stochastics is projecting more probable downside potential; bears have stored momentum if a correction does play out. RSI is currently diverging from price; this puts more emphasis on the bearish divergence as price puts in consecutive higher highs whilst the RSI puts in lower highs.

The EMA’s is currently holding support which is in confluence with structural support, making the zone more significant for the bulls. Volume is well below average, we needs to see an influx of volume if price where to break and or bounce from current area…

Overall, IMO, MCO is more probable to have a correction as we do see multiple bearish signs, we have a rising wedge formation in confluence with a bearish divergence. Volume is also extremely low; we need to see an influx of bull volume if price were to have a chance of respecting key support.

What are your thoughts on MCO? Will we have a correction here?

Please leave a like and comment

And remember,

“Time is your friend; Impulse if your enemy “- John Bogle