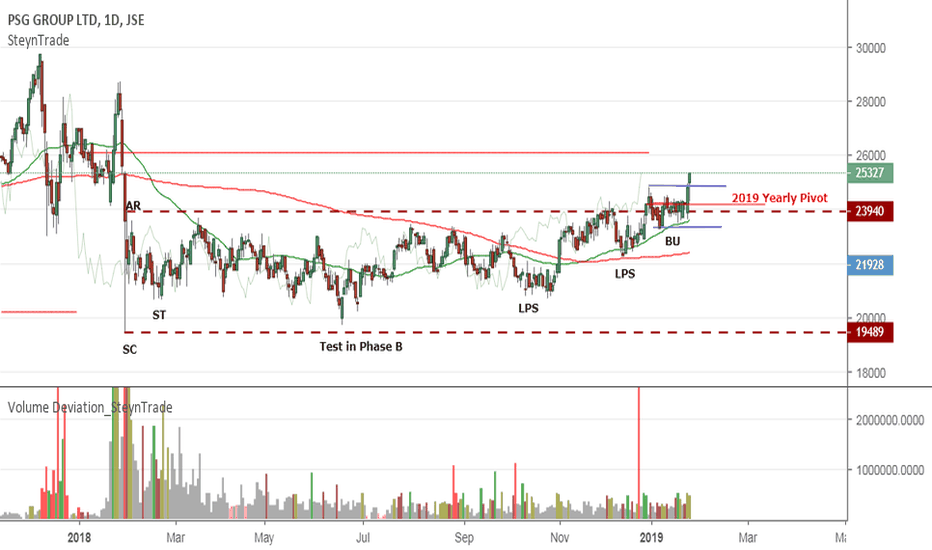

JSE:PSG Markup StartingPSG was in an accumulation TR and is currently breaking out. After a last point of support (LPS) and back up (BU) to the TR we now see a break out with some volume indicating the markup has started.

Volume Indicator

JSE:SAP: Sappi is Being DistributedSAP has been in a trading range after a Buying Climax (BC) in May 2017. It looks like a Wyckoff Distribution is taking place. There is increased volatility and volume on the declines and low volume on the up moves. The declines has been larger and quicker than any of the declines in the uptrend leading to the BC . Increase volume is seen mostly at the top of the trading range. We could already be in the mark down in Phase D but will have to see how the range develops further. If this is Phase D we should see the start of the mark down soon.

JSE:J200 Top40 at the Top of the 'Trading RangeOn the daily timeframe (TF) following the Wyckoff logic, there was a change of character that formed a Trading Range (TR) with the Selling Climax (SC) and Automatic Rally (AR). This is at the bottom of a larger TR on the weekly TF (See post below). After a Secondary Test (ST) of the lows, the price is testing the top of the TR again. This is also the 2019 Yearly Pivot Point and 200Day MA. We are now in Phase B and expect a contraction in volume and a test of the lows in Phase B before we can look for Phase C and a move out of the range. Negative divergence on the TDI (RSI) also indicates a possible move down.

JSE:J200 Top 40 Approaching Resistance After a Change of Character (CoC) and major Sign of Weakness (SoW) the JSE Top 40 has been seen the start of a smaller trading range (TR). Price is now approaching the top of the TR (Round number 49000) with confluence with the 200 Day SMA and the 2019 Yearly Pivot Point. The Rally is seen on lower volume than the decline and negative divergence with the RSI. Looking for a reaction to confirm a move to the bottom of the TR in the week to come.

JSE:RBX Raubex Facing Selling PressureRaubex has started trading in a downward sloping channel. Significant divergence is seen between the with the RSI rising and the Volume RSI pushing lower. This indicates selling in the background even as the price was rising. Price has found resistance at the upper channel line and the 2019 Yearly Pivot Point. Looking for a continuation of the downward stride.

JSE:AVI Lining up for a poor start to 2019AVI has been ranging since the beginning of the year. However, this looks like a distribution range. The declines with in the range have wider bars and sharper declines than any previous declines since listing. The last decline was on high volume and the attempted rally seems to be failing at the Yearly Pivot Point. Will be watching for price action and if the oversold trend line will be broken decisively for the markdown to start.

JSE:NRP NEPI Rockcastle Potential Spring and TestNEPI has been range bound since February. At the end of November we have seen a spring on high volume. There has been a lower volume test and I am waiting for a good bullish bar to start building a position and a jump across the 200Day SMA. However, some caution is still needed as the 200Day SMA seems to be holding. There is divergence on the Volume RSI confirming buyers in the market.

JSE:J200 Top 40 Still Indicating WeaknessReconsidering the evaluation of the trading range (TR) it could be evaluated as an inclining TR. The initial part of the trading range had some signs of accumulation but after an up thrust (UT) a strong distribution character has emerged. Before the end of 2018 price had a change of character (CoC) with signs of weakness (SoW) on increasing volume. Now the Top 40 is attempting a week rally to the 200 Day SMA and new Yearly Pivot Point on decreasing volume. The number of stocks above their 200 D SMA has increased but is still below 50% and in a declining trend. The number of stocks above their 50SMA can also be seen as slightly declining. If the evaluation of an inclining TR is correct the Top 40 has however not broken the TR. Will be watching the next reaction to the downside to see how the small recent TR develops for continued distribution or accumulation.

$TREP Huge Revenues and Net Profits for 2018 TBA SoonIn 2017 Financials were $8 Million in Total Revenue, Gross Profit was over $3.2 Million and Net Profits were $602K.

$TREP Does not dilute and does not convert

$TREP has Total Revenue of $6.9 Million in the first 9 months of 2018.

$TREP being a PEO has Prepaid Workers compensation Assets of $19.9 million.

$TREP Total Assets are $21,884,236

I do believe the company will be releasing a shareholder update very soon on its operations and future goals for this year. The chart is starting to also show a slow and steady uptrend.

EURUSD Looks Like AccumulationUsing the Wyckoff logic we seem to be in a downward sloping Accumulation Trading Range (TR). Volume has declined since the Selling Climax (SC), which seems to be due to the lack of interest in buying the USD which had been driving the EURUSD down. We see a potential spring and test in Phase C and am now looking for the markup in Phase D to start. Currently, there is some effort in pushing the price up, with little response. Once all the supply has been absorbed we could see the start of the markup.

Gold Being Accumulated?Gold has been forming a base since 2013 that may be resolving itself. Looking at the wcykoff phases we have potentially seen a Last Point of Support ( LPS ) and am currently seeing the markup in phase D. There is diminishing spread and volume on backups and Signs of Strength (SOS) on rallies. On the volume RSI we see negative divergence sowing supply being absorbed at lower prices below the midpoint of the range (Preliminary Support - PS). Gold Stocks could be the ones to watch going into 2019.

$CYBF Cont's Up - Acquisition of Just Content N Vivio Rebranding$CYBF Has consolidated from its highs of .89 last month after the massive shareholder update listing several upcoming catalysts for the company. Namely the Acquisition of Just Content Software and the Rebranding of the Vivio App. The Cyber-fort Twitter has been very active and the company is working behind the scenes to get everything done. I anticipate major updates on its upcoming business goals in the next month most likely the middle of January next year. In anticipation of this I also anticipate the PPS to increase from here to around $1.00 by the time anything major is announced. At the current PPS this is a steal imo and close eyes should be kept on the company for further updates as the year draws to a close.

JSE:TKG Telkom Great Wykoff StudyIt is not a good time to buy Telkom but it makes a good study of the Wyckoff principles. The first thing to notice is the pattern: Markdown - Accumulation - Markup - Distribution - Markdown - Accumulation - Markup and now potentially forming a range again. The next notice the two ways that markups and markdowns en: 1) The first Markup and Markdown ended by an inability to move to the oversold or overbought trend line, 2) The second two had over throws of the lines. Both these setup resulted in a trading range forming. The next thing is to notice how the trading range forms. Only the main labels are added to have less clutter. Volume increases on the Preliminary Supply (PSY) or Support (PS) and it is possible to even be the highest volume for the range as is the case in the Distribution Range. Next a Selling (SC) or Buying (BC) Climax is formed on volume stopping the trend (Phase A). After a Aromatic Rally (AR) or Automatic Reaction (AR) (Still Phase A) a period of low volume in the TR forms where the Composite Operator (CO) is carefully either Distribution or Accumulating stock (Phase B). Once this is done the TR ends in a Spring; Upthrust after Distribution (UTAD) or Last Point of Supply (LPSY) / Support (LPS) Before breaking the TR (Phase C). Once it has been marked out of the TR a backup to the trading range first takes place (Phase D) before the Markup or Markdown can begin (Phase E). Also notice how the Volume RSI can assist in providing a clue if an accumulation or distribution is forming.

JSE:NPN Naspers Testing the Long-term Trend Channel Naspers has been in a down sloping channel since it a throw over of the long-term trend channel and Buying Climax (BC) formed in November 2017. It has now reached the oversold line of the long-term channel and there has been some bullish action. We see a spring with increase in volume on the reaction also seen in gaps to the upside. The Volume RSI has shown divergence with price since the start of the downward sloping channel. This all seems bullish but a jump of the 200Day SMA would have to be seen to confirm the markup in Phase D.

JSE:PSG Still Ranging?PSG Group has been ranging since a selling climax (SC) in January 2018. Recently there was a change in character after a breakout of a small trading range with a minor sign of strength. Price has marked up to the top of the trading range defined by the Automatic Rally (AR) after the SC. However, supply is seen with some effort without response also indicated by the divergence with the Volume RSI. So it seems the TR could continue and we need to wait for Phase C still to develop.

JSE:BIL BHP Billiton Remains OverboughtSince last month BIL has been pushing the overbought trend line (See last months tracking of BIL in the link below). It is now trading in a range with continued tests of the highs. There is multiple divergences between price and the Volume RSI indicating a possible break back to the oversold line. A second set of double tops can be seen. After a drop in volume on the second test a move to the resistance line of the range a then to the oversold line of the trend is expected.

Swing Trading: Catching Up with Cenovus (TSX:CVE)Cenovus Energy seems to be swinging wildly as it gets ready to settle in for the winter.

Here are two trades picked up by our AllTradeSignals Volume Pressure Gauge over the past couple of weeks:

Trade #1 - 10% gain in 9 days

Trade #2 - 6.5% gain in 1 hour (!)

(Side note: For me, trade #2 is still "open" as I feel like there's room to run. But you could have taken profit there for an easy 5% once it started to drop.)

16% in two trades... enough to upgrade your family's Christmas gifts.

Interested in the AllTradeSignals Volume Pressure Gauge? Get in touch with us here on TradingView!

$DAVC 10K Filed A/H's Friday In Anticipation of News10K Only covers through July 31st It seems they may have made some progress on the Urban Development then and now, possibly the closing of the deal. Also of note the possibility of a buyout, especially since the O/S and Float has remained the same since the start of the year.

Needless to say the accumulation is through the Roof, which says alot ;-)

www.otcmarkets.com

JSE:GFI Goldfields a Wyckoff StudyGFI has been an interesting chart to look at from a Wyckoff perspective. GFI had been stronger than the sector group (Gold Miners J150). However, with the sharp decline was lagging the sector and now is again showing strength. After the initial decline we had a redistribution range with an upthrust after distribution (UTAD), some low volume tests of the UT and a Markdown. Then a smaller accumulation TR was formed on high volume and a nr 3 Spring (low volume spring) which often does not require test before markup. After the initial markup in Phase D we now we see a Backing UP (BU) action to the accumulation TR on declining volume. Once this is complete the mark up in Phase E of the smaller TR will start. This markup should reach the larger TR at around 4500 which will be also be the BU for the redistribution TR which could mark a further markdown of the larger TR. If it breaks 45000 back into the redistribution range this would be very bullish.