NZD/CAD: Day Trading Analysis With Volume Profile 📊 On NZD/CAD is nice to see strong sell-off from the price 0.87550 , there are nice to see strong volume area....

Where is lot of contract accumulated...

I thing that sellers from this area will be defend this short position...

and when the price come back to this area, strong sellers will be push down the market again...

Weekly POC + Strong Downtrend + Strong volume area is my mainly reason for this short trade....

Happy trading

Dale

Volumecluster

AUD/CHF continue with the Downtrend 👇On AUD/CHF is nice to see strong sell-off from the price 0.66710 and 0.66950 , there are nice to see strong volume area....

Where is lot of contract accumulated...

I thing that sellers from this area will be defend this short position...

and when the price come back to this area, strong sellers will be push down the market again...

Strong Downtrend + Strong volume area is my mainly reason for this short trade....

Happy trading

Dale

AUD/JPY continue with the Uptrend ☝️On AUD/JPY is nice to see strong buying reaction from the price 79.35 , there is nice to see strong volume areas....

Where is lot of contract accumulated...

I thing that buyers from this area will be defend this long position...

and when the price come back to this area, strong buyers will be push up the market again...

Buying activity + Strong volume area is my mainly reason for this long trade....

Happy trading

Dale

AUD/CHF: Volume Profile 📊 and Price Action Analysis 📋Right now is strong intraday volume cluster on AUD/CHF ...

On AUD/CHF is nice to see strong buying reaction from the price 0.66552 , there is nice to see strong volume areas....

Where is lot of contract accumulated...

I thing that buyers from this area will be defend this long position...

and when the price come back to this area, strong buyers will be push up the market again...

Resistance from the past + Buying activity + Strong volume area is my mainly reason for this long trade....

Happy trading

Dale

Bulls have control (AAPL)If I have a choice between giving good and ehh news first, I always pick the good news: the good news is that the stock just broke two long term resistance lines(RLs). The ehh news is that up ahead, AAPL could see increased volatility as it is now trading in a megaphone pattern. The RSI indicates much of the same; a breakout leading to a broadening megaphone pattern. However, I remain firmly bullish, but because if AAPL broke past the third RL it would have been too good to be true. Look for AAPL to bounce off last week’s support line, and it should retest the third long term RL. To accurately predict when another breakout will happen, look for contracted volume/ volume cluster (which I have circled for Last week’s breakout), and watch the RSI as well. However, in the case we see another steep drop off in price and RSI, I would keep a neutral outlook. Feel free to comment with stocks for me to do chart analysis on!

GBP/USD Short idea 🧐After 1-2 Days accumulation was created one significant volume clusters...

This Volume clusters will be good enter for the short trade.. 1.22088

Because i expect that this strong sellers will be defend their short positions.

This is so simple setup..

Move down.. Accumulation.. Another move down.. and waiting for come back to the accumulation.

Happy trading

Dale

USD/CAD sell-off ↘️After strong sell-off can you see on Volume profile significant volume cluster.

When the price come back to this volume cluster i expect short reaction and hope so that this strong sellers will be defend their short position.

This level is from my Members section for intraday trading.

Happy trading

Dale

A Strong Support On Oil 🛢️Today, I am going to look more into intraday Oil analysis. You know, even an intraday trade could prove a good starting point for a swing (or long-term) trade. So, if you are looking for an ideal price to jump in a long-term long on Oil, then this analysis could prove helpful.

Buying activity on Oil

The first significant buying activity on Oil occurred a few days ago (2nd April) when Donald Trump made a statement that he made an agreement with Saudi Arabia (Oil gained around 25% immediately).

I believe that this could be the start of a new uptrend. For this reason, I am looking for significant volume clusters created within the newly formed trend.

What I did was that I used my Flexible Volume Profile on the most significant trend day – the day of the announcement (2nd April). It revealed a nice volume cluster (around 22.20) that occurred before the news came out.

Now, do you think that the big guys who move and manipulate the markets did not know beforehand about this announcement? I am not really sure. I guess that they knew and I think they were jumping into longs in this volume cluster area.

What will happen when the price makes it back to this volume cluster again? I think that it is pretty likely that those big guys will try to defend their longs. They will try and push the price upwards again. That’s why I think it will work as a support.

Another confirmation

There is also one more confirmation here. If you look at the picture below, then you can see that the price reacted quite nicely to this 22.20 area in the past. It worked as a resistance.

It was not exactly the 22.20 level, but it does not matter. The important thing is that it was somewhere in this area.

When the price went past the resistance it then became a support.

So, we have a Trend Setup based on the volume cluster and a resistance becoming a support setup.

OPEC meeting tomorrow

There is an OPEC meeting scheduled on Thursday (tomorrow). This could really make the Oil prices very volatile. You should be very careful trading the Oil at that time tomorrow. My advice would be to avoid trading it. At least avoid doing intraday trades on Oil. The situation on Oil is now very tense.

I hope you guys liked today’s analysis. Let me know what you think in the comments below!

Stay safe and happy trading!

-Dale

AUD/CAD: A Complete Volume Profile Analysis 📈Today, I would like to do an intraday analysis of the AUD/CAD. What caught my eye here were two things. First, strong buying activity (uptrend). Second, rotation areas created within the uptrend. There are usually heavy volumes traded in rotation areas like these so I used my Flexible Volume Profile to check them out.

Significant volume areas

The Volume Profile shows two significant volume areas here. The first one at 0.8629 and the second (the lower one) at 0.8546.

What happens when there is such a heavy volume area created in an uptrend? This usually indicates that strong buyers were adding to their long positions there (in the rotation areas) and then pushing the price even higher.

When the price makes it back to these levels again (in a pullback) then those strong buyers will most likely defend their longs and they will push the price upwards again. This is what I expect to happen at those two heavy volume levels.

If you look at the first one, then you can see that it actually got tested today in the Asian session. There was a fast and precise reaction to it. This makes this level spent and I don’t really expect any more reactions to it. Well, in fact there could be another reaction to it but the chances are lower now…

The second level at 0.8546 is still intact. It hasn’t been tested yet and I expect a buying reaction from it (when there is a pullback).

Resistance turns into a Support

There is also another thing I like about this 0.8546 level. The thing is that it worked as a resistance in the past – the price bounced twice off this level. I marked this in the picture above. When the price went through this resistance, it then became a support. This is a simple Price Action setup which I like to use.

Weekly Point Of Control

That’s not all! There is one more confluence to all this. This confluence is on a Weekly Volume Profile. This Weekly Volume Profile tool shows how the volumes got distributed throughout the whole week. The picture below shows a Weekly Volume Profile from the previous week (the profile on the left). As you can see, the Point Of Control (= place where most of the volumes got traded) was just a bit above our 0.8546 level.

Pretty cool, right? This adds one more confluence to our level!

Weekly POC is definitely a very important place in any chart. Every institutional trader who works with this or similar time frame knows where the weekly POC is. And so should we!

I hope you guys liked today’s analysis. Let me know what you think in the comments below!

Stay safe and happy trading!

-Dale

What happened on USD/JPY? – EXPLAINEDOne of the most important things about the JPY currency to remember is that it is a safe haven currency. This means then whenever there is some uncertainty like war, natural crisis, disasters etc…then people shift their funds to safe assets (JPY, CHF, GOLD,…). They want their money to be safe.

What happens to a currency when everybody gets crazy buying it? It strengthens. Rapidly. Then as the uncertainty and panic start to fade, also the prices of safe haven assets start getting back to normal.

Have a look at the picture below. It is the USD/JPY Daily chart. I marked two places. They look very similar, right? What you see is the JPY strengthening rapidly (USD/JPY goes down= JPY is getting stronger) and then getting back to normal. This is the big guys pumping their money in and out of JPY currency as a reaction to uncertainty.

USD/JPY rejection – EXPLAINED

Lets now talk about the smaller picture on USD/JPY and have a look at what exactly happened on Monday and Tuesday.

Monday opened with a 120 pip gap and then there was a crazy sell-off. People were buying JPY massively. The price moved more than 400 pips downwards.

Then there was a rotation (this is important – I will talk about it later) and on Tuesday the USD/JPY completely reversed. It closed the gap and moved over 400 pips upwards! This completely negated the selling activity!

USD/JPY gap

One more thing worth pointing out is the nice reaction to the heavy Volume Cluster which got formed above the gap (marked in red).

Strong rejection of lower prices

Overall the price on USD/JPY went aggressively downwards, then turned and the next day it completely negated the whole sell-off. This is what I call a Strong rejection of lower prices.

What I am interested in in such strong rejections is whether there was some significant place where heavy volumes got traded. I use my Flexible Volume Profile on the rejection and this immediately shows me if there is such a place or if there isn’t.

In this case it is crystal-clear. HUGE volumes got traded around the 102.28 area. So what happened here? First, sellers were pushing the price downwards (400 pip move). Then everything calmed down and big guys started quitting short positions and entering longs. They did this in the rotation.

*BTW to enter a long you need somebody who sells it to you. Who was selling? All those guys who thought that this downward movement will continue. Those guys were adding to their shorts.

So, in the rotation buyers entered longs and their next move was aggressive buying. This aggressive buying (buying with market orders) caused a new uptrend.

Volume Cluster around 102.28

This heavy Volume Cluster you see on the picture above is currently a strong support. Why? Because buyers were entering a lot of their buying positions there. When the price makes it back to this level again it is pretty likely that those buyers will become active and that there will be another buying reaction. This should help to move the price upwards from this area again.

I hope you guys liked this analysis. Let me know what you think in the comments section below!

Happy trading!

-Dale

CAD/JPY GAP 💡Now this is a different story! There was a 160 pip opening gap on the CAD/JPY! The price haven’t even get close to closing it. The volatility is pretty big here. This means the gap could get filled shortly. I would not be surprised if it got filled today or tomorrow.

It does not matter too much when it will get closed though. The thing which I find interesting here is the heavy Volume Cluster which got created before the gap (Volume Cluster with the heaviest volumes at 78.51).

According to the gap trading strategy this Volume Cluster should work as a strong resistance and when the price closes the gap and hits it, then it should react to it and go downwards again.

Adjusting to a bigger volatility

When the volatility rises to such extent like now then it is necessary to adjust to such market conditions. If you were used to trading with 10 pip Stop Loss then now when the volatility rose you should widen your SL (and TP).

In most of the cases I like to stick to my fixed Stop Loss and Take Profit pip values but when volatility changes as drastically as now then I adjust it. At least for a few days until all gets back to normal again.

I hope you guys liked this article. Let me know what you think in the comments below! And remember to trade carefully especially in conditions like these.

Happy trading!

-Dale

EUR/USD: All Significant Supports EXPLAINEDThe EUR/USD is pushing upwards like crazy. It made over 400 pips just in eight days! An interesting thing is that there were eight consecutive bullish Daily candles (all green). Not a single pullback! This is a sign of strong and aggressive buyers. Even a blind person can see this.

How to trade in a trend

The main intraday trading strategy in such a situation is to wait for little pullbacks and enter long trades at supports.

In this article, I will focus mostly on those supports.

When there is an uptrend like now, it is best to use the Flexible Volume Profile to look into the volumes and how they were distributed throughout the uptrend.

What you are looking for are significant Volume Clusters. A Volume Cluster created within an uptrend tells you this: There were a lot of buyers adding to their buying positions there. Then they pushed the price even higher.

How does that help? When the price makes it back to a Volume Cluster then there is a solid chance that those buyers will become active again and that they will try and push the price upwards from this Volume Cluster.

The current situation on the EUR/USD

Let’s now have a look at the EUR/USD and examine all the Volume

Clusters one by one. Below, you can see a 30 Minute chart of the EUR/USD

with all significant Volume Clusters numbered #1 to #4.

#1 Volume Cluster

This one was created close to the beginning of the new strong buying activity. What i like about this one is that the volumes are distributed in a way that there is no doubt where the support is (Volume Cluster is nicely visible and “sharp” looking).

#2 Volume Cluster

This one is a bit weird one. There was a bit of sideways price action and then the price shot upwards. What happened an hour later was that there was a little pullback. This pullback went almost into the Volume Cluster zone.

Now it seems that those volumes have already been tested by this (support is no longer valid). Maybe it will still work but it would be the 2nd test and 2nd tests don’t have as good win rate as the 1st tests.

#3 Volume Cluster

I liked this one and I was looking forward to trading it. However, the price went quite close to it and then made a strong buying reaction. It seems that this support is also spent (tested).

My general rule is that a level is tested if price turns 3 pips or closer before reaching it. In this case, it was a bit more than 3 pips but given the higher volatility we see on EUR/USD now I rather discard this level because to me it just looks already tested.

#4 Volume Cluster

This one is already spent. The price made a nice pullback to it, and there was a 30 pip reaction. This support is no longer valid because the price has already reacted to it.

I hope you guys liked this Volume Cluster analysis. Let me know what you think in the comments below!

Happy trading!

-Dale

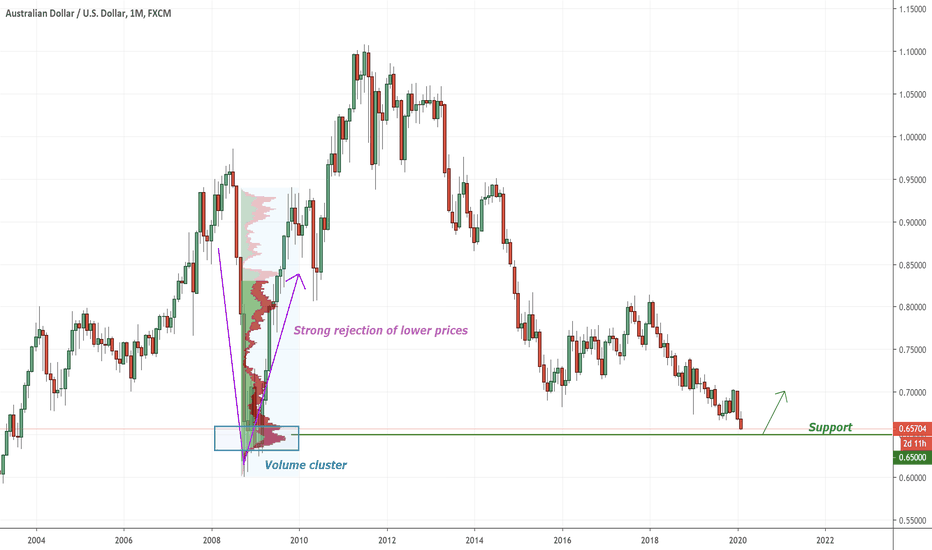

A MAJOR Support on AUD/USD NOW! 🎯There is now a lot of attention on the AUD/USD. The reason for this is that it has just hit it’s 11 year low!

There are fundamental reasons for this (fires, Coronavirus,…) but I don’t really believe the AUD can fall indefinitely. Sooner or later it will bottom out and I think this moment is coming!

Look back in the past

When a trading instrument falls to its multi-year lows and you want to look for a place where it could bottom out, then it is best to load some historical data and check out if the price was as low or lower in the past.

If you load enough of historical data, then chances are that you will find out that the price actually was as low or even lower at some point in the past.

Check out the volumes

The next thing you want to do is to use Volume Profile tool to look into volumes and their distribution. The important thing is how the volumes were distributed in the past, when the price was as low as it is now.

When you do this, you may be able to identify a strong Support which would mark a place where the price could stop falling and reverse.

I did just that on the Monthly chart of AUD/USD:

AUD/USD Monthly chart analysis

In the chart above you can see that the price is now hitting an area where it already was in 2009.

The first thing that should get your attention should be the strong rejection of lower prices (in 2009). I marked it in the chart.

This rejection tells us that the price was falling rapidly. There were three months of crazy selling. Then the price turned and went into a crazy uptrend.

This means that sellers were pushing the price downwards but then very strong buyers came in and with massive force and aggression started a new uptrend.

Volume Profile analysis

If you look into the volume distribution in this rejection area from 2019, then you can see that there was a significant Volume Cluster created around 0.6500.

This Volume Cluster points us to the place where the buyers who turned the price in 2009 placed lots of their buying positions. For them, this is the most important place in this whole rejection!

As you can see, currently the price is getting into this area again. Will those buyers from 2009 still be there defending their positions? I think they will!

I know it is over 11 years, but strong volume zones like this one don’t just get forgotten. Markets have good memory!

What happens now?

Now I think the chances are that the downtrend will stop and possibly turn. Price is approaching a strong volume area which will most likely be defended by strong buyers. Those buyers will try to push the price upwards again.

Remember that this is a Monthly chart, so this may not happen today or tomorrow! It could take a few months! With trades like this patience is the key!

I hope you guys liked today’s article. Let me know what you think in the comments section below!

Happy trading!

-Dale

USDJPY not to trade every VOLUME CLUSTER blindlyToday I would like to do a swing trade analysis of the USD/JPY and show you some points that I think are pretty important there.

Crazy USD/JPY buying

There was some pretty aggressive buying on the USD/JPY recently. The price shot 240 pips upwards just in two days!

What also happened here was that 10 months old gap got closed as a result of this buying activity.

Gaps on forex are pretty important for two reasons. First, they tend to get closed soon. Second, if they don’t get closed, then there is likely to be a trend. This happened on the USD/JPY in 2019. There was a gap which did not close and this started a new strong downtrend.

Sudden price reversal

So, we have a gap closed and strong buying activity. Then the price suddenly turned.

Why did that happen? One word – Volumes.

Back in 2019, there was a Volume accumulation right before the new downtrend started. There were clearly strong sellers building up their selling positions.

After they accumulated their selling positions they pushed the price aggressively downwards. They were so strong, that buyers were not even able to close the gap I mentioned before.

Now, after 10 months the price went back into this area again.

What happened few days ago is that sellers from 2019 became active again and started an aggressive selling activity.

What I also think happened is that the buyers who were pushing the price upwards recently started to get rid of their long positions (because they saw the aggressive sellers from 2019 becoming active again). When a buyer closes his position he SELLS. This helps to drive the price downwards.

Those were the two factors that turned the price so sharply.

What now?

Now, after the sudden price reversal the price is heading towards a newly formed Volume Cluster. Under normal circumstances such Volume Cluster would be a nice support to go long from.

What is pretty risky in this particular situation is the strength of the rejection that we see on USD/JPY right now.

In other words – this Volume Cluster would be a pretty nice level to trade only of the price didn’t do what it just did – sharp reversal almost immediately after this Volume Cluster got formed.

I am not saying that this support won’t hold but I think longs in such situations are really risky and not really worth it.

The point is that it is generally better not to trade every Volume Cluster blindly , but to look at what is going on in the market and filter out the most risky trades.

I hope you guys liked the article. Let me know what you think in the comment section below!

Happy trading!

-Dale