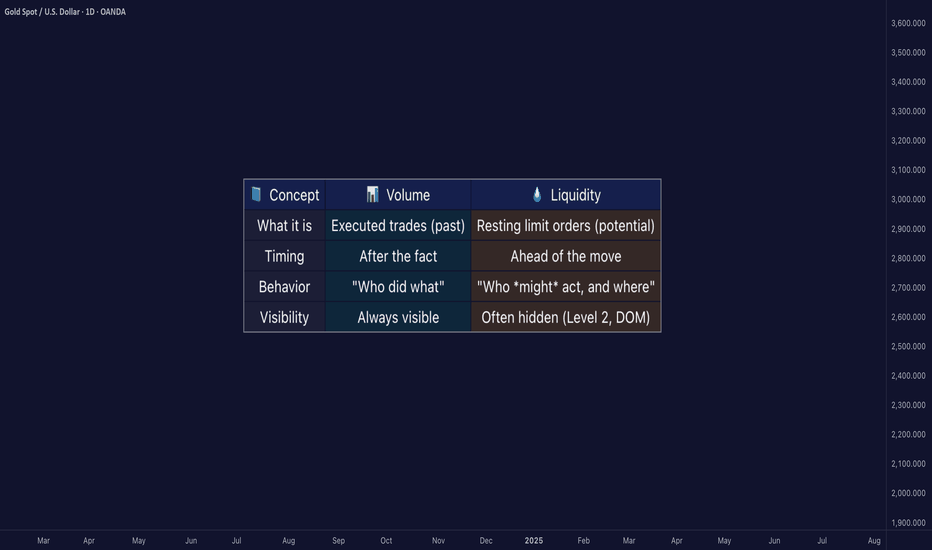

Liquidity ≠ Volume: The Truth Most Traders Never Learn█ Liquidity ≠ Volume: The Truth Most Traders Never Learn

Most traders obsess over volume bars, but volume is the footprint, not the path forward.

If you’ve ever seen price explode with no volume or fail despite strong volume, you’ve witnessed liquidity in action.

█ Here’s what you need to know

⚪ Volume Is Reactive — Liquidity Is Predictive

Volume tells you what happened.

Liquidity tells you what can happen.

█ Scenario 1: Price Jumps on Low Volume

❝ A price can jump on low volume if no liquidity exists above.❞

⚪ What’s happening?

The order book is thin above the current price (i.e., few or no sellers).

Even a small market buy order clears out available asks and pushes price up multiple levels.

Volume is low, but the impact is high because there’s no resistance.

⚪ Implication:

This is called a liquidity vacuum.

It can happen before news, during rebalancing, before session openings, on illiquid instruments, or during off-hours.

Traders often overestimate the strength of the move because they only see the candle, not the absence of offers behind it.

█ Scenario 2: Move Fails on High Volume

❝ A move can fail on high volume if it runs into a wall of offers or bids.❞

⚪ What’s happening?

There’s a strong surge of aggressive buying or selling (high volume).

But the order book has deep liquidity at that level — large resting limit orders.

The aggressive traders can’t chew through the liquidity wall, and price stalls or reverses.

⚪ Implication:

This is called liquidity absorption.

Market makers or institutions may intentionally absorb flow to stop a breakout.

Many retail traders mistake this for “fakeouts,” but it’s really liquidity defending a level.

⚪ What the Research Says

Cont, Stoikov, Talreja (2014): Price responds more to order book imbalance than trade volume.

Bouchaud et al. (2009): Liquidity gaps, not trade size, are what truly move markets.

Hasbrouck (1991): Trades only impact price if they consume liquidity.

Institutions don’t chase candles — they model depth, imbalance, and liquidity resilience.

⚪ Where the Alpha Lives

Liquidity tells you where the market is weak, strong, or vulnerable — before price moves.

Fakeouts happen in thin books.

Reversals occur at hidden walls of liquidity.

Breakouts sustain when liquidity follows the price, not pulls away.

If you understand this, you can:

Enter before volume shows up

Avoid chasing dead breakouts

Fade failed moves into empty space

█ Final Truth

Volume is the echo. Liquidity is the terrain. Alpha is in reading the terrain. You want to study the structure, because price moves toward weakness and away from strength. Learn to see where liquidity is, or where it’s missing, and you’ll see trading with new eyes.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Volumefootprint

SPY to $585?: EOY Price TargetUsing the Magic Linear Regression Channel on TradingView.com we look at some possible scenarios for SPY price movement. A shorter term regression channel shows SPY at the top of the channel and rejecting it today - even with more buyers than sellers in the TradingView Volume Footprint chart view.

The bottom of the channel converges with last pivot low near $584. It could conceivable go lower, but with lower volume likely during the holiday season, it would seem less likely for it to make any more big moves barring some major unexpected event.

My personal interpretation of the Volume Footprint chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I signed up for an expensive plan on TradingView, but I think there are some parts of the chart that I can't use properly.

I think the Volume Footprint chart is a chart that can be used when you sign up for a premium plan. (I may be wrong, so please check.)

I think it's because I'm used to the old way, so I feel resistant to new things, and the explanation is difficult to read.

In order to solve that problem a little, I'd like to explain how to interpret the chart using only the core interpretation methods.

Since my explanation may be different from the creator's intention, I strongly recommend that you read the creator's explanation.

Volume Footprint Chart Description:

www.tradingview.com

----------------------------------------

I think you should pay attention to and interpret the part indicated above.

I think the section marked as VAL, VAH is the section that is mainly traded.

Therefore, I think that depending on which direction it deviates from this section, it will affect the future flow.

Therefore,

- If it rises near or above VAH, it is likely to show an upward trend,

- If it falls near or below VAL, it is likely to show a downward trend.

-

The next thing to look at is the column indicated next to each volume. (The part that the arrow points to)

- The column in the Sell Volume section indicates that it is a section with strong selling pressure,

- The column in the Buy Volume section indicates that it is a section with strong buying pressure.

(The creator explains that this is the part that is indicated by the imbalance of volume.)

Anyway, since there is a high possibility of a rebound or reversal in the part where this column is indicated, I think it can be a tradable section depending on whether it receives support or resistance in this part.

-

The Delta section shows the difference between Sell Volume and Buy Volume.

-----------------------------------------------------------

The time frame charts that are good for viewing the volume footprint chart are 1s, 1m, 15m, 1h, and 1D charts, so I recommend viewing them with the corresponding time frame charts.

If it deviates from the VAL, VAH area near 1, 1-1 and 2, 2-1 shown on the chart, a trend is formed, so you should check whether it deviates from this section.

If it does not deviate, it can be interpreted that there is a high possibility of sideways movement.

-

Therefore,

1. Is it located near VAL, VAH?

2. Is there a section where columns are created next to Sell Volume, Buy Volume?

I think this chart allows you to detect the trading volume, that is, the movement of buyers and sellers, with the above two things.

-

Have a good time.

Thank you.

--------------------------------------------------