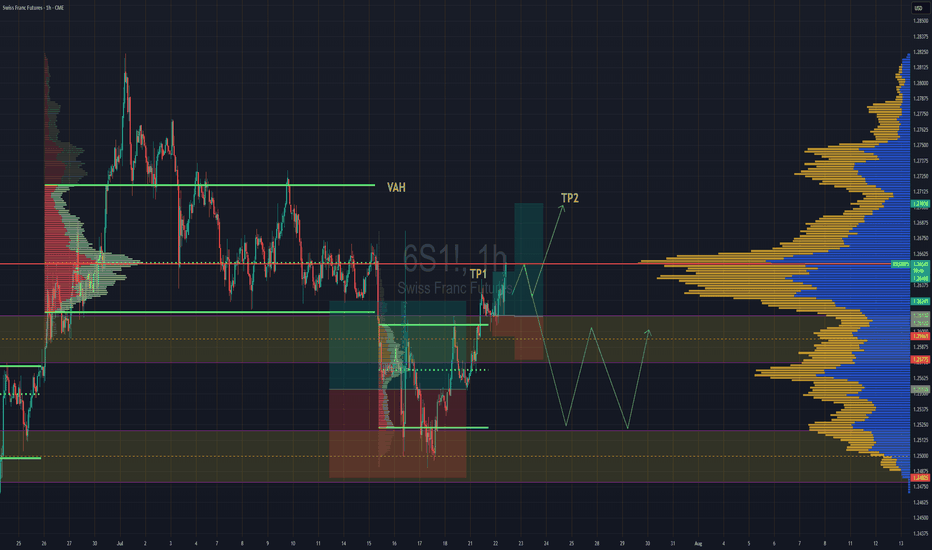

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong and we reject hard from the POC then we might lose the value area and fall back down to previous value area to continue consolidation there until further notice.

Volumeprofileindicator

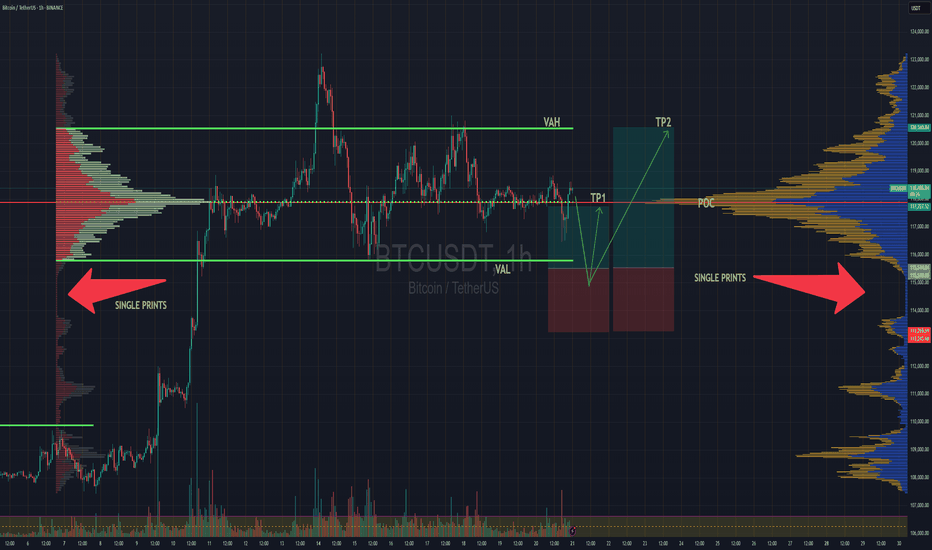

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

XAUUSD LONG AND SHORT Hi Guys,

Weekly VP prints out some important levels, which I have marked on the chart. Each of those levels acts as a support level therefore buyers showing up is expected. Break below 294 and confirmation would result in price further dropping to 272.

Also 316 and levels above it have been marked as resistance and seller showing up is expected.

Make sure add your own logic into this before taking any position.

Be honorable

The more time passes the more confident i amThe more time moves (i tried to catch the knife when i witnessed the reaction at 217)

i become increasingly more confident on an upmove (at least a gap close).

I wanted to make note that there's a baby head and shoulders bottom in this fractal change and we have bullish divs on RSI.

so it makes increasingly higher probability we will make a full rotation play to value high level (at about 250 usd) and fill the gap.

and i can make a lower timeframe trendline.

infinite money glitch here we GO

check my other posts on TSLA to enjoy my TA and the main idea for higher timeframes!

Technical Analysis of Super Micro Computer Inc (SMCI)Upon analyzing the stock SMCI , we observe a significant turning point starting in 2022, following a long period of sideways movement where the stock struggled to break above the $40 level.

After this prolonged sideways phase, the stock broke out with a clear upward trend, highlighted by the ascending trendline (green), characterized by higher highs and higher lows.

Following a year of gains, the stock entered a consolidation phase but then broke out again to the upside with strength, accompanied by a substantial increase in volume.

After reaching a peak in March 2024, the stock began a downward phase that is still ongoing.

Potential long entry points, where the stock might bounce or change trend direction, are found in the following two support areas:

Support area S1;

The POC 1 area.

If the stock begins to rally again, it will be crucial to monitor its behavior as it approaches the descending trendline (green), which could serve as a more conservative initial target.

More ambitious targets are POC 2 and resistance R1, both within a price range of $900 to $1,000.

Technical Analysis on Intel (INTC)Using long-term volume analysis with the Volume Profile, we observe that Intel's ( INTC ) current price has moved below a significant monthly Point of Control (POC). To gain a clearer perspective, it will be crucial to wait for the monthly close to determine whether the price remains above or below this POC level.

By zooming in to the daily or H4 timeframe, we notice a potential rounding formation in both the candlesticks and volume, indicating a possible shift in trend direction.

Bullish Scenario:

To confirm a bullish scenario, it will be necessary to wait for a monthly close above the POC. This signal will be strengthened if the volumes increase as well.

Bearish Scenario:

If the price stays below the POC, the bearish scenario suggests potential targets, as illustrated in the image below. It may be possible to consider short entries at the levels indicated as Target 2 and Target 3.

SQQQ is rising today LONG

SQQQ trended down the last two days of last week and especially Friday as the technology stocks surged

Yesterday had price consolidation and generally less trading volumes. I believe that

SQQQ will bounce at this level. It is supported by a cross above the POC line of the volume

profile. Under that line is the stop loss while the target is 17.95 at last week's pivot high

The relative volume void above 17.3 suggests that price may have great movement once

getting over that level. A confirmatory MACD line cross sets the reversal .

4015_Possible Trend reversal (Bullish setup)4015

**Bullish Points:**

Price at significant support level (Volume profile) confluence with 78% fib level

Bullish divergence is observed

Small entry can be taken now (Aggressive)

Further entry can be taken after descending channel breakout, or

at next support level 118.6 (DCA strategy)

**Bearish Points:**

Price is moving in downtrend, series of LH/LL

H&S pattern breakdown and retest of neckline

Current stop loss is specified

Trail stop loss if price goes up

Place SL below 118 (DCA strategy)

GOOD LEVEL FOR LONG we expect the price gone down with correction to reach our setup

the accumulation setup following the trend

as shown on the chart the level is very important for long just

follow my instructions for mange the trade

price move 20 pips in profit breakeven

price hit the sl 40 pips than reversal setup

target is 100 pips

Market Profile vs Volume Profile: Which one is a better tool?There is an ongoing discussion within the trading community about which tool is better for analyzing market behavior: Market Profile (MP) or Volume Profile (VP). The former was popularized by Jim Dalton in his book "Mind Over Markets," while the latter has many advocates as well, including Peter Reznicek (aka ShadowTrader). With the release of the new "Time Price Opportunities" (TPO) indicator by TradingView, we can now closely examine the disparities between the two and explore which one works better.

For starters, I won't delve into explaining what Market Profile is and all its related artifacts (e.g., TPO, single-prints, poor high/low, etc.). TradingView has done a commendable job explaining key concepts in the indicator description. For those seeking more, Jim Dalton's "Markets in Profile" is a recommended resource, an easier and more up to date reading than the original book. Additionally, there are numerous free webinars available on YouTube.

Both MP and VP serve similar purposes:

1. Assess day character by analyzing shape of intraday distribution (price-time/price-volume)

2. Identify important levels that are not visible on the standard bar chart (VAH, VAL, POC)

3. Spot structural weaknesses and anomalies.

The key difference is in the basic building block: Market Profile uses time at certain price level whereas Volume Profile uses volume.

Let’s look at AMEX:SPY chart to explore the differences

What stands out is that intraday distributions are nearly identical. There are slight differences in key levels (VAH, VAL, POC) but they are negligible. Note how on Wednesday, the price first retests Tuesday's VAH, then Monday's VAL, then again Tuesday's VAH. After confirming support, it rallies up the next day.

From the perspective of the stated goals, we can efficiently achieve the first two, regardless of the tool we use. The third goal is a bit tricky and requries a seperate long discussion. So I won't dwell on it here

In overall, we can see that Market and Volume profiles are pretty much alike and it doesn’t make much difference which one you’ll be using.

Or does it? So far, we looked at the regular hours chart (RTH). What about futures and similar instruments that trade 24 hours? Let's look at CME_MINI:NQ1! chart

Here, the difference in distributions and levels is much more pronounced. The best example is Friday where not only POCs are completely misaligned but even the shapes of distribution (MP is more like a bullish p-shape, whereas VP is a bearish trend day).

The disparity in distributions is explained by the difference in volume traded during regular hours (high volume) and extended hours (low volume). Due to this asymmetry, Volume Profile is always heavily skewed towards RTH. Meanwhile, Market Profile is session-neutral, giving the same weight to overnight and regular hours TPOs.

Understanding of disparity doesn’t answer question of which tool is better. For example, when it comes to key levels, price sometimes respects MP levels and sometimes VP ones. My take is that we need to pay attention to both when they are pronounced. Good example is Tuesday’s prominent MP POC. Although it was built up overnight on low volume, it was revisited the day after and acted as resistance.

To conclude:

For tickets that trade primarily in the regular session (or if you look on RTH session chart only) there is no difference whether to use Market or Volume profile. Both provide same information. (note that volume data on lower timeframes depends on your broker and/or whether you buy real-time data from exchange; reliability of volume data is a separate discussion topic).

If you’re trading 24h instruments I find more useful using MP as it can give important information about non-regular low-volume sessions. For RTH, it will still give the same results as VP. You can also use a combination of two but then you’ll face a challenge of reconciling difference in distribution shape (like the Friday example). As there is no clear answer how to do it, I recommend sticking to one tool at a time.

P.S. I have not done any research on very low timeframe (<5m) for intraday accumulations/distributions. As MP was originally developed to analyze day character (Jim Dalton suggests using 30m TPO) it might not be well suited for lower timeframes (e.g. if you trade within 1h range), and this is the area where VP has advantage. Another point to consider is that currently TradingView provides a wider range of VP tools, incl fixed range, anchored, etc…

Trader's Guide: Volume Range Profile 📊Welcome, traders! In this guide, we'll explore a tool that can significantly enhance your trading skills - the Volume Range Profile. You'll learn how to use it to identify key support and resistance levels, trend reversals, and execute successful trades. 📊💹

Key Learning Points:

Understanding Volume Range Profile:

The Volume Range Profile is a tool that displays trading volumes at various price ranges.

It helps identify where the market has the highest volume and where key support and resistance levels are formed.

Volume Analysis:

The first step in using Volume Range Profile effectively is to analyze the volume data.

Look for price areas with significant spikes in volume as these often indicate areas of interest to traders.

Identifying Key Levels:

Using Volume Range Profile, you can identify the Point of Control (POC), which is the price level with the highest volume.

Additionally, you can spot the Value Area High (VAH) and Value Area Low (VAL), which represent price ranges where the majority of trading activity occurs.

Support and Resistance Levels:

The POC, VAH, and VAL can serve as dynamic support and resistance levels.

When the price approaches these levels, it's essential to watch for potential reversals or breakouts.

Trading Strategies:

Volume Range Profile can be used in various trading strategies, including range trading, breakout trading, and trend confirmation.

For example, a breakout above the VAH may indicate a bullish move, while a breakdown below the VAL could signal a bearish trend.

Risk Management:

Always implement proper risk management strategies in your trades.

Consider placing stop-loss orders below support levels and take-profit orders near resistance levels identified using the Volume Range Profile.

Continuous Learning:

Practice using the Volume Range Profile in different market conditions to enhance your skills.

Stay updated with market news and trends to adapt your trading strategies accordingly.

By incorporating Volume Range Profile analysis into your trading routine, you can gain valuable insights into market sentiment and make more informed trading decisions. Happy trading! 🚀📊

XRPBTC Possibly The Most Bullish Chart In Crypto!I applied the fixed range volume profile tool to the history of XRPBTC pair on Bittrex on a weekly timeframe. It shows a very well defined clear level of support and resistance formed by the POC.

This has to be the most bullish chart out there. No doubt once XRPBTC breaks out of this zone, it will significantly outperform BTC.

This is a regular scale / nonlogarithmic chart, which I think gives you a better image of what XRP can do once it breaks out of this range.

NQ - Volume Profile on Day Chart

Using a composite volume profile and setting the bars to significant lows in the last couple of years, you can see that the VPOCs (Volume Point of Control) are almost perfect.

By using a hollow Composite Volume Profile in conjunction with a Solid Volume Profile, you can spot-check where low and high volume nodes are on different time-scale profiles.

What does all of this mean? Basically, my thesis regarding volume profile, which is shared by some, is that liquidity will be attracted to the low volume profile nodes. Liquidity will find a presence in these depressions, causing prices to gravitate to the local area, filling in the node to build a shelf. This allows for a stronger base or foundation to continue its positive drift upward. However, caution is necessary, as this strategy can work against bulls if the price gets trapped under a substantial shelf, making it harder to climb upward.

Composite Volume Profile indicator below

Fixed Range Volume Profile, How do I use it?I can say that Fixed Range Volume Profile is strong tool to determine targets and stop loss, POC point of control as per my research represent a central price and bar close price is turning around it, so when you assign take profit and stop loss as per it, you reduce the risk and have a plan B to manage your trade.

as you see in above chart for BTCUSD, we have trend line on daily time frame, I cut the chart to 3 successive zones representing 3 cycle, 1 cycle is from the trend to trend and applied "Fixed Range Volume Profile" on all 3 ranges/cycles, last cycle has not finished yet, and I show POC1, POC2 and POC3 prices.

I consider this line as central price for a range and we can see how price keep moving above and down POC1 & POC2 prices.

for the last range/cycle (not completed yet because it has not reach the uptrend line yet, we see POC3 = $30,200 and the current price $29,590 so price is under POC3 and we can guess it is going to trend at approximately $27,750, this is 1st hint.

2nd hint is to take "Fixed Range Volume Profile" for the all uptrend, did you notice it? I think the price is going to POC(all range) = $28,300 (support)

Now we came to the best part of our subject, the what if question and how to set up a plan?:

what is stop loss?

we need a 1H bar close above POC3= $30,200+100= $30,300 (resistant) and we buy target $31,380 (you should know why!) and for stop loss, we need close price 1H again down $30,200

what is take profit?

we can set $28,300 for safe and $27,750 if you want to risk a little bit, this is first target, but what if bar 4h close down POC= $28,300? here we can set a 2nd take profit at $26,400 (you should know why!)

this is what I wanted to share with you and I will be glad to answer your questions.

I did go short for BTCUSD this morning, enter price $29,165 and I set a take profit at $29,322 because I am working on 15 min timeframe.

Can USD/JPY rally through this 300-pip liquidity gap?Divergent monetary policies between the Fed and BOJ have allowed USD/JPY to extend its bullish trend on the daily chart. Whilst the Fed are very close to their terminal rate, they have to keep the threat of further hikes on the table to tame inflation expectations. When coupled with the ultra-easy policies of the BOJ, we've seen USD/JPY return to its cycle highs.

However, the current resistance level around the November high marks the lows of a ~300-pip liquidity gap - and such areas can see prices move swiftly through them if revisited.

Soft US inflation data last November sent USD/JPY aggressively lower on the day, and left the liquidity gap to potentially be filled. The question now is whether bulls can persist and send prices within it, which could see USD/JPY head for the range highs around 145.

Of course, a building threat for bulls to keep in the back of their mind is that Japan's Ministry of Finance or the BOJ could become vocal about yen volatility to spook JPY bears. But until then, we prefer to buy dips on the daily chart or seek bullish continuation patterns on lower timeframes.

NRP ( Energy Stock) Reversal PatternNRP is an energy stock. Shown on a 15-minute chart it appears to have a reversal pattern.

The mass index indicator's value has risen above 27 and is about to trigger with a fall under

26.5. The normalized MACD shows a cross of the MACD and signal line well below the zero line.

The 28 period linear regression line has given a buy signal below the last candle. Importantly,

the analysis of the HA candles is they have changed from red to green and the indecision

candles with large wicks compared with the candle body have ended in favor of a larger

bodied green candle without predominant large wicks. I will look for a long entry on the

3 to 5 minute time frame expectant for a target at the POC line of the volume profile or

about 50 which would be a decent profit for this low risk trade.