ES MINI TRADE IDEAEcco cosa mi aspetto nei prossimi giorni sull' S&P500, il prezzo si trova attualmente sul livello 0.618 di Fibonacci, ci sono tuttavia ancora due resistenze importanti che sono i due livelli immediatamente successivi. Il target è il POC del volume profile posizionato sull' ultimo swing, in quanto il prezzo tende a ritornare verso il suo livello di equilibrio (quello con i maggiori volumi di scambio). Nel breve termine per ora resto long, ma attenzione allo scenario macro e alla price action settimanale che si trova ancora in downtrend.

Volumeprofileindicator

BTC Reaction at Re-Distribution Trading Range Upper BoundThe BTC price continues to be observed within a Wyckoff re-distribution trading range (to be confirmed or to fail) with the upper bound given by the automatic rally (ARa) daily high and the lower bound given by the selling climax (SC) daily low.

The secondary test (ST) on July 3 had a Spring-like effect, catalyzing a very nice rally (+19%) that wicked above the trading range upper bound. I expect the BTC price to test the point of control (POC) around $20,472. Let’s see how the BTC price reacts at the POC (e.g., Will it fall through the POC support or reverse direction?).

With regard to the Phoenix Ascending (PA) indicator (lower panel), upward momentum (Energy, grey) is diminishing. We will be observing downward momentum soon. The blue line at level 70 will provide support for the BTC price. Given the levels and likely trajectories of the blue and red lines, a steady, step-wise move down (similar to the reaction from June 26 through July 3) seems likely.

Wyckoff abbreviations: automatic rally (ARa), selling climax (SC), secondary test (ST), upthrust (UT), upthrust after distribution (UDAT), preliminary supply (PS), failed upthrust (FUT), last point of supply (LPSY), shakeout (SO), sign of weakness (SOW), Phase A (Ph A), Phase B (Ph B), Phase C (Ph C), Phase D (Ph D), Phase E (Ph E).

This is not financial advice. I am not your financial advisor. This is my opinion.

Case Study Volume Profile GBP/JPY Been working on a new trading strategy that involves using the volume profile of each security/forex pairs to exploit the market by only entering and exiting trades in unfair market price areas (low volume nodes) to create profit without having to fight in high volume node area which are general areas of consolidation.

Would love to get your thoughts

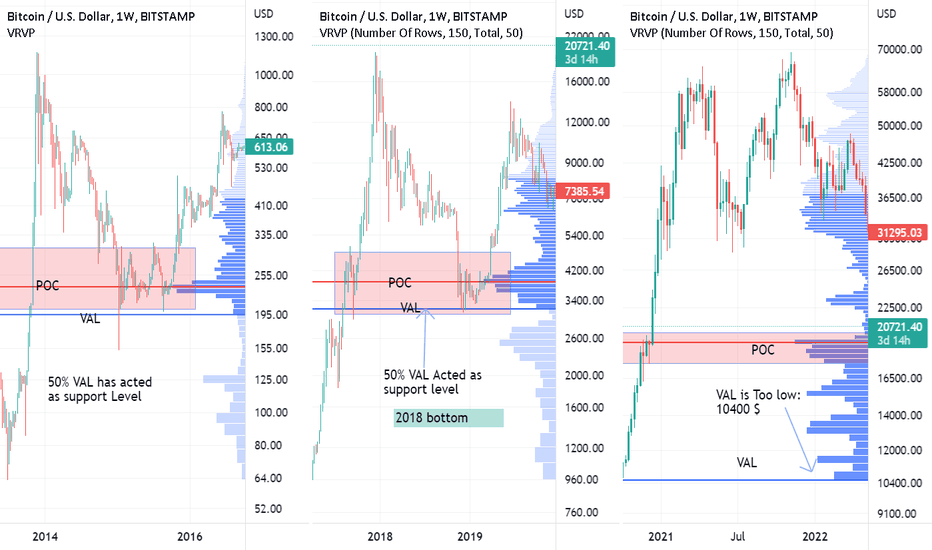

Volume profile: Bull run will not be soonExamining the volume profile of bitcoin and comparing it with the previous two cycles shows several issues:

1. Price of control has not been the level of bitcoin support but has created an area around which bitcoin fluctuates (Suppoer area range- accumulation area)

2- Fluctuation around the POC has continued for at least a few weeks

3- VAL 50% has acted as a support level for Bitcoin in this range

A comparison with the current situation shows that Bitcoin now needs to be more consolidated in this price range or further reduced in price. Fluctuations in the current range around the current POC will range from $ 17,000 to $ 22,000.

LBS / Lumber Futures potential long trade incomingMy chart idea illustrates a confluence of fundamental and technical analysis which leads me to believe a long trade in the Lumber futures market may getting close.

On the fundamental side:

- We have seen Commercial buyers become net long for a whole month, last time this happened was mid 2020 and this then led to a ~130% price rise over 2 months when the price went from roughly $350 up to $820, albeit it was a bumpy ride with numerous gaps up and down along the way. This recent commercial buying activity is shown with the blue above the zero line in the COT report indicator.

On the technical side:

- There is clear bullish divergence on the daily chart between price and the RSI.

Key technical levels to watch:

- Volume profile going back almost 1yr (as much as I could fit onto daily chart) shows the biggest volume cluster / Point of Control sits around $620, so price needs to break above this and hold the level to confirm break of down trend.

- Coincidently the above mentioned level measures up almost precisely ($618) with a Fibonacci level when using the recent double top as anchor points.

- When drawing a simple trend resistance line from the recent high in march and down to current price then you can see that this trend has not been broken yet, however the line recently intersected $620 level. If price breaks the trend then the $620 level shouldn't be far off.

- Lastly on the weekly chart price is just touching oversold levels in the RSI. Historically Lumber hasn't prolonged periods at this level, it typically touches or breaks the level and reverses back within a few weeks.

In summary it looks like ~$620 is a key level that needs to be broken above and if it can hold that level until weeks end then I'd be looking to position a long entry.

The Lumber futures market does offer big reward when it moves however it is very illiquid with tendency to price gap once it starts trending so caution needs to be exercised!

BTC bull swing target 30185On the Binance BTCUSDT spot market, a volume profile with a 1 USDT resolution on the current daily rotation shows a POC (Point of Control) around 30185 USDT.

With some noise, the daily candles in this current accumulation zone have been playing with the current VAL and VAH as support and resistance.

Over the past several days, the current POC has behaved as it often does, as a magnet.

A return to the current POC range around 30185 USDT (from the current 29300 USDT price action up) is a reasonable bull swing target to watch.

Still hope for Bitcoin?Well…Bitcoin is for four days below the accumulation structure. Yes, till some days ago it was an accumulation structure. On-chain metrics confirmed that.

As a reminder: Most whales whose sold their Bitcoins during the distribution between March and May 2021 didn’t buy them back at the bottoms.

The bull market between July and November, yes, was a bull trap. It’s complicated, I’ll explain it maybe some other time.

So, is still there any hope for BTC?

After the accumulation, I was expecting a quick bull rally to $50k or near the previous highs before the Hell. And that … was my most optimistic scenario for BTC.

This type of breakout of $34k - you can see in the chart - would be absolutely healthy under the appropriate conditions. Like no war, no pandemic, and the rest.

The longer the time BTC remains below $34k, the more bearish it becomes.

If we regain it quickly, we may see again $40k.

Todays candle (at least as it formed till the time of writing this) is bullish, in the short term of course. So, I expect at least a return to $34k in the next days.

For me, it’s not the right time to buy these dips. Market is highly volatile. It’s wise to wait for stability before making any decision.

Thanks for reading this!

Remember investing is a probability game.

Follow for more reports & like and share if you appreciate this.

Not a financial advice. Always do your own research.

Is MANA heading to $2.30 or $1.00MANA broke two crucial supports: the first at $1.68 & the second at $1.50.

Between $1.50 and $1.07 there is not some significant support to stop the price from a possible fall.

The next important supports is at $1.08 and the liquidity zone between $1.07 – 0.92.

Resistance at $1.68 has tested a few days ago…so the likelihood of a return to this level is low, not impossible. In the short-term, of course.

Be careful with your high leveraged shorts.

1) Market is in extreme fear

2) We are nearer the bottom than the top

3) In 4H LTF formed a local demand zone

These are not good signs for (long-term) shorts.

On the other hand, today’s candle closes below $1.34.

• If you are looking for short entries wait for a return to $1.50 or near $1.68 and a bearish confirmation candle.

Stop loss or alert above $1.50

Take profit at the liquidity zone

• If you are looking for long entries, near $1.00 or below is a good price.

LINK at Crucial Support. What to do!LINK broke $10 important support in relatively high volume.

Entire crypto market is in panic, a beautiful indication that we are approaching the bottom.

• To begin the uptrend LINK needs to regain, in a short period of time, $10 level.

• I don’t suggest to short LINK now, cause it’s already near to a bottom. It’s wise to wait for a break and test $7.50 as resistance before taking a short.

• You can add some LINK in your HODL portfolio at $7.50 only if you are intent on holding them, even if it goes below $4.90.

Stay out of leveraged trading, market is too risky and volatile.

Thanks for reading this!

Remember investing is a probability game.

Not a financial advice. Always do your own research.

Follow for more reports & press the like button if you like this.

BTCUSDT monthly overviewBTCUSDT long term overview. Confluences: Show of weakness w/ Chaikin Oscillator, divergence from ATH in Awesome Oscillator and show of continuation tendence w/ Fisher Transform. Weekly condition is bearish. Head and Shoulder target in daily timeframe: pullback to neckline accomplished, TP1; Fibonacci Retracement from bear flag target is TP2. Chaikin Oscillator is near of zero below. Big SOW. Price can dump below 32,9k.

Awaiting Symmetrical Triangle BreakoutAs you can see, the price action has formed lower highs and higher lows in NSE:MOTILALOFS . The volatility has also dropped massively. The RSI (9) in Hilega_Milega is having higher lows and equal highs, showing the strength is ramping up. The target out of this breakout is 1075, however, it may break down.

ENTRY position @ Breakout with strong momentum crossing up above VOLUME PROFILE POINT OF CONTROL

Hello Trader. Above is purely my opinion. It doesn't mean that you need to trade accordingly. Please note that I'm not Sebi registered advisor or technical analyst . Trade on your own conviction and please consult your advisor before investing . If you like the idea, do not forget to support with a like and follow.