Volume

Silver (XAG/USD) Technical Analysis – March 13, 2025 (15-Min Cha1. Trend Identification

Short-Term Uptrend Developing:

The price is trading above the 200-period moving average (blue line), indicating bullish momentum.

The Point of Control (POC) at 33.017 suggests a key liquidity zone where buyers have been active.

Key Resistance Levels in Focus:

The price is currently struggling near 33.043, with the next resistance at 33.259 (higher POC level).

A break above 33.259 could trigger a further rally.

2. Key Support & Resistance Levels

Immediate Support: 33.000 - 33.017 (POC, psychological level).

Immediate Resistance: 33.259 (higher POC, recent high).

Upside Target: 33.500 - 33.600 (upper channel projection).

Downside Risk: 32.900 - 32.800 (lower channel support).

3. Volume Analysis

Last 120 Bars: Up Vol > Down Vol by +26.82%, indicating strong buyer dominance.

Last 60 Bars: Up Vol > Down Vol by +41.46%, further confirming short-term bullish strength.

Interpretation:

Buyers are clearly in control, but the resistance at 33.259 needs to be breached for a strong continuation.

If price pulls back to 33.017 and finds support, it may provide a better entry point.

4. Chart Patterns & Projections

Bullish Continuation Scenario:

If price breaks above 33.259, it is likely to rally toward 33.500 - 33.600 (upper trend channel).

Bearish Pullback Scenario:

A failure to break 33.259 could lead to a retracement toward 32.900 - 32.800.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy above 33.259 (breakout confirmation) or on a pullback to 33.017 (strong support).

Stop-Loss: Below 32.900 (recent low & lower channel boundary).

Targets:

First Target: 33.400

Final Target: 33.600 (upper channel resistance).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 33.000 (breakdown confirmation).

Stop-Loss: Above 33.100 (recent consolidation zone).

Targets:

First Target: 32.900

Final Target: 32.800 (lower channel support).

Risk-Reward Ratio: 1:2 or better.

INTC LONGIt seems to me that we are in a nice accumulation area for INTC with more positive news coming out from the company and large volumes around $20 level. The biggest scare seems to be current market volatility but so far the stock was unfazed. I'd say this is a good spot to buy for anyone interested in this company.

Expecting ORDI to expand lower once againORDI: Yesterday in the morning I was pretty bearish on ORDI but my first short scalp attempt got stopped. Price kept flipping supply into demand in the 30 min timeframe and I catched a long from demand. I was aware that price is facing resistance and that it definitely needs to keep going locally. It shouldn´t start showing weakness. Then it SFP´d it´s own local high into the .886 and started retesting local demand once again. That already looked bearish to me because bulls really needed to keep pushing. So I took profits off the long and flipped short. In that zone it was a question of no trade or a short trade especially after the 30 min timeframe started to show weakness. My bearish context of "building volume lower" is still given. Price still isn´t showing real strength from the bull perspective. We keep consolidating below the pwPOC which is bearish. We keep building value below the pmVAL which is bearish. We could only become more bullish if the pwPOC get´s claimed, if it holds and if the pmVAL get claimed. A whole lot of work to do. I was checking the OBV to get more information about this local consolidation. If you check the 4 hr timeframe, that looks a lot like absorption to me. Longs are coming in, OBV is already higher than the previous high but we are still having a lower high in price. So MMs are filling their shorts and eating up all the longs. I have used this bearish context as confluence for my short. After checking the 30 min timeframe I have seen that we kept making higher highs locally but OBV just keeps grinding down. This is a sign for a weak bullish move. So overall all these information are just supporting my bearish idea. I really think that MMs keep filling their shorts to prepare an expansion to the downside. I have put my stop at entry and am safe after a TP1. I am not interested in longs from lower because of the whole bearish context. Seeing these longs coming in again from the lower golden pocket screams for punishment. If my short would get stopped, I would observe if price could make a higher high and how it would react at the upper resistance zone of pwPOC and daily level. Given the context of MMs filling their shorts between the .786 and .886, what indeed happened yesterday in the evening, it wouldn´t make sense for me to go for a higher high. This reversion to the mean should keep failing. My next TP is at the 4 hr low which should definitely get hit if we see a bearish expansion. The 3rd closing would be at the fib expansion level below.

DAX Index Technical Analysis – March 12, 2025 (15-Min Chart)1. Trend Identification

Reversal to Bullish Momentum:

The price has broken above the 200-period moving average (red line), indicating a shift from bearish to bullish sentiment.

The Point of Control (POC) at 22,324.82 previously acted as strong support, from which price has bounced.

Volume Confirmation of Bullish Move:

The last 60 bars show an up-volume dominance of +32.10%, confirming that buyers are gaining control.

However, the 120-bar volume is still slightly negative (-1.71%), indicating lingering selling pressure.

2. Key Support & Resistance Levels

Immediate Support: 22,500 - 22,550 (recent breakout zone).

Stronger Support: 22,324 (POC) – a critical level where buyers stepped in.

Immediate Resistance: 22,700 - 22,750 (local resistance zone).

Upside Target: 23,000 - 23,200 (upper trend channel projection).

3. Volume Analysis

Last 120 Bars: Up Vol < Down Vol by -1.71%, showing slight selling pressure.

Last 60 Bars: Up Vol > Down Vol by +32.10%, indicating strong short-term buying activity.

Interpretation:

Bullish Confirmation: Buyers have stepped in aggressively, pushing price above the 200-MA and key support zones.

Watch for Pullbacks: A retracement toward 22,500 - 22,550 could provide a better long entry before continuation.

4. Chart Patterns & Projections

Bullish Continuation Scenario: If price holds above 22,550, it is likely to move toward 23,000 - 23,200 within the ascending channel.

Bearish Pullback Scenario: If price fails to hold 22,500, a retracement to 22,324 or lower is possible.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy near 22,550 (pullback entry) or above 22,750 (breakout confirmation).

Stop-Loss: Below 22,500 (recent support).

Targets:

First Target: 22,900

Final Target: 23,200 (upper channel resistance).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 22,500 (breakdown confirmation).

Stop-Loss: Above 22,700.

Targets:

First Target: 22,400

Final Target: 22,324 (POC & key support).

Risk-Reward Ratio: 1:2 or better.

US 100 Technical Analysis – March 12, 2025 (15-Min Chart)1. Trend Identification

Bearish Bias:

The price is trading below the 200-period moving average (red line), indicating overall bearish momentum.

The Point of Control (POC) at 19,449.24 represents a high liquidity area, acting as a strong resistance level.

Short-Term Consolidation:

The price is oscillating around 19,375, suggesting market indecision before a breakout or breakdown.

2. Key Support & Resistance Levels

Immediate Resistance: 19,400 - 19,450 (POC and recent highs).

Immediate Support: 19,300 (lower consolidation boundary).

Stronger Support: 19,000 (psychological level & lower trend channel).

Upside Target: 19,500 - 19,600 (breakout scenario).

3. Volume Analysis

Last 120 Bars: Up Volume < Down Volume by -15.53%, indicating stronger selling pressure.

Last 60 Bars: Up Volume < Down Volume by -10.28%, reinforcing short-term bearish dominance.

Interpretation:

Bearish Sentiment Dominates: Selling pressure is higher, increasing the probability of a breakdown below 19,300.

If buyers regain control near 19,300, a bounce toward 19,450 is possible.

4. Chart Patterns & Projections

Bearish Breakdown Scenario: If price fails to hold 19,300, it could drop to 19,000 (blue channel projection).

Bullish Reversal Scenario: A breakout above 19,450 could trigger a move toward 19,500 - 19,600.

Trade Setups & Risk Management

1. Short Trade Setup (Bearish Breakdown)

Entry: Sell below 19,300 (confirmed breakdown).

Stop-Loss: Above 19,400 (previous resistance).

Targets:

First Target: 19,150 (mid-support).

Final Target: 19,000 (key support).

Risk-Reward Ratio: 1:2 or better.

2. Long Trade Setup (Bullish Breakout)

Entry: Buy above 19,450 (confirmed breakout).

Stop-Loss: Below 19,375 (recent consolidation zone).

Targets:

First Target: 19,500 (local resistance).

Final Target: 19,600 (upper channel).

Risk-Reward Ratio: 1:3 or better.

Sweet Spot To Sell The BTC Pullback In a strong downtrend. Every pullback on the 4hr and Daily chart will be hyped by the bulls & super cycle evangelists as a "WE'RE BACK" moment.

I will continue to take this same setup, selling Major swing highs on 4HR & Daily chart on BTC until the Daily Chart flips bullish. Until then or some news come out, we will remain in the downtrend until we hit the target shown in my last analysis, see link below.

Technical Analysis of Gold (XAU/USD) – 1H Chart1. Trend Identification

Transition from Consolidation to Uptrend:

The price has broken out of a prolonged consolidation phase around the Point of Control (POC) at 2911.933.

The 200-period moving average (blue line) was previously acting as resistance but now appears to be flipping into support.

Short-Term Bullish Momentum with Caution:

The projected price path (blue and red channels) suggests an uptrend toward the 3,020 - 3,060 zone but with potential retracements.

However, recent volume analysis suggests short-term selling pressure is increasing, which could lead to a pullback before continuation.

2. Key Support & Resistance Levels

Immediate Support: 2,900 - 2,911 (POC and recent breakout zone).

Immediate Resistance: 2,920 - 2,930 (current price range resistance).

Stronger Resistance: 3,000 - 3,020 (psychological level & upper channel).

Downside Risk: If price falls below 2,900, it may test 2,880 - 2,860.

3. Volume Analysis

Last 120 Bars Volume:

Up Vol < Down Vol by -0.28% (neutral to slightly bearish sentiment).

Last 60 Bars Volume:

Up Vol < Down Vol by -23.28%, showing short-term selling pressure dominance.

Interpretation:

The long-term volume trend is neutral, but short-term volume suggests sellers are controlling the market, which could lead to a temporary pullback before continuation.

4. Chart Patterns & Projections

Bullish Scenario: If the price sustains above 2,911, it could trend toward 3,020 - 3,060 within the ascending channel.

Bearish Scenario: A breakdown below 2,900 could lead to a correction toward 2,880 - 2,860.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 2,930 (confirmation of strength).

Stop-Loss: Below 2,900 (previous support zone).

Targets:

First Target: 2,980 (mid-channel resistance).

Final Target: 3,020 - 3,060 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 2,900 (confirmed breakdown).

Stop-Loss: Above 2,920 (previous support turned resistance).

Targets:

First Target: 2,880 (key support).

Final Target: 2,860 (lower channel boundary).

Risk-Reward Ratio: 1:2 or better.

LinkedIn Post: Professional Market Insight on Gold (XAU/USD)

📊 Gold (XAU/USD) – Technical Outlook & Trade Setup 📊

Gold has broken out of a consolidation phase around $2,911 and is now trading near resistance at $2,920 - $2,930. While the long-term trend remains bullish, short-term volume indicates increasing selling pressure (-23.28%), suggesting a possible pullback before continuation.

🔍 Key Observations:

✅ Support Zone: $2,900 - $2,911 (Point of Control).

✅ Resistance Zone: $2,920 - $2,930 (immediate breakout level).

✅ Potential Bullish Move: If Gold sustains above $2,930, we could see a rally toward $3,020 - $3,060.

✅ Potential Bearish Pullback: A rejection at $2,920 could lead to a retest of $2,880 - $2,860.

📈 Trade Setup:

Bullish Play: Buy above $2,930, stop below $2,900, targets $2,980 - $3,060.

Bearish Play: Sell below $2,900, stop above $2,920, targets $2,880 - $2,860.

🔑 Risk Management: Disciplined trade execution and strong risk-reward ratios are key! Always protect capital first.

What’s your outlook on Gold? Let’s discuss in the comments! 👇 #Gold #Trading #XAUUSD #RiskManagement #TechnicalAnalysis

Technical Analysis of Silver (XAG/USD) – 1H Chart1. Trend Identification

Medium-Term Bullish Trend: The price has been rising since early March, reclaiming the 200-period moving average (blue line), a sign of renewed buying strength.

Short-Term Consolidation: The price is currently testing resistance near the Point of Control (POC) at 32.551, indicating an important decision point for the next move.

Bearish Short-Term Volume Shift: The last 60 bars show higher selling volume (-33.63%), suggesting potential weakness in the short term before a breakout or pullback.

2. Key Support & Resistance Levels

Immediate Resistance: 32.55 - 32.60 (POC and recent highs).

Immediate Support: 32.00 - 32.20 (recent demand zone).

Stronger Support: 31.80 - 31.50 (lower channel boundary).

Upside Targets: 33.00 - 33.20 (upper channel projection).

3. Volume Analysis

Last 120 Bars Volume: Up Vol > Down Vol by 12.95%, showing medium-term buying dominance.

Last 60 Bars Volume: Up Vol < Down Vol by 33.63%, indicating short-term selling pressure, which may lead to a minor pullback before continuation.

4. Chart Patterns & Projections

The projected path (blue and red channels) suggests two scenarios:

Bullish Breakout: Above 32.55, targeting 33.00 - 33.20.

Bearish Pullback: A rejection at 32.55 could push the price toward 31.80 - 31.50 before a potential recovery.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 32.60 (confirmation of resistance breach).

Stop-Loss: Below 32.20 (to avoid false breakouts).

Targets:

First Target: 33.00

Final Target: 33.20 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 32.20 (confirmed breakdown).

Stop-Loss: Above 32.60 (recent resistance).

Targets:

First Target: 31.80 (lower channel mid-support).

Final Target: 31.50 (strong support zone).

Risk-Reward Ratio: 1:2 or better.

Technical Analysis of EUR/USD (1H Chart)1. Trend Identification

Bullish Trend: The price has been in a strong uptrend, trading well above the 200-period moving average (blue line), indicating continued buying interest.

Current Consolidation: The price is moving sideways near 1.0844 (Point of Control - POC), suggesting accumulation before a potential breakout or breakdown.

2. Key Support & Resistance Levels

Immediate Resistance: 1.0885 - 1.0900 (recent highs).

Immediate Support: 1.0844 (POC level) – a crucial liquidity zone.

Stronger Support: 1.0800 (psychological level and near the moving average).

Upside Targets: 1.1000 - 1.1100 (upper channel projection).

3. Volume Analysis

Last 120 Bars Volume: Up Vol > Down Vol by 37.23%, indicating strong bullish dominance.

Last 60 Bars Volume: Up Vol > Down Vol by 3.44%, showing that buyers are still in control, but with less dominance than the broader trend.

4. Chart Patterns & Projections

The projected path (blue and red channels) suggests two scenarios:

Bullish breakout above 1.0900, with a move toward 1.1000 - 1.1100.

Bearish breakdown below 1.0840, leading to a retracement toward 1.0700 - 1.0600.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 1.0900.

Stop-Loss: Below 1.0840 (previous support).

Targets:

First Target: 1.1000 (psychological level).

Final Target: 1.1100 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Breakdown Scenario)

Entry: Sell below 1.0840 (confirmed breakdown).

Stop-Loss: Above 1.0900.

Targets:

First Target: 1.0700 (mid-channel support).

Final Target: 1.0600 (lower channel boundary).

Risk-Reward Ratio: 1:2 or better.

BTCUSD.P Binance Futures, Bullish Reversal🔹 Mid-Term (1D) Analysis:

Trend and Patterns:

Falling Wedge lower touch – A bullish reversal signal.

Breakdown of the previous Rising Wedge – There was strong selling pressure in the past, but now signs of stabilization are emerging.

VWAP and Volume Profile – Strong resistance is visible around $100,000.

Key trend reversal levels – Support at $74,000–76,500, while strong resistance lies between $90,000–100,000.

🔹 Key Levels:

Support: $74,500–76,500

Resistance: $90,000–94,000, then above $100,000

Mid-term target: $100,000–108,000

🔹 Mid-Term Forecast:

If Bitcoin successfully breaks out of the Falling Wedge and surpasses $90,000, the next target could be $100,000. However, if the $74,500 support level fails, further correction down to $72,000 or even $68,000 is possible.

✍️ Important Note: The above post provides general information and should not be considered specific investment advice. All investments carry high risk, especially in volatile cryptocurrency markets. Every investment decision should be based on thorough market analysis and an individual’s risk tolerance!

Nasdaq short-term long: Bounce off Trendline, RSI DivergenceIn summary, I think that there is a good odds that Nasdaq will rebound in the short-term because it has bounced off a 2-year trendline and RSI has diverged with price. Using QQQ to gauge volume, I can also see that there is a healthy volume to support a reversal. However, take note that as of now, I will still consider this to be a corrective wave up and not a major trend reversal to the upside. Meaning, the major trend is still down.

EUR/USD continue with the UptrendOn EUR/USD , it's nice to see a strong buying reaction at the price of 1.07080 and 1.06270.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Uptrend and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

NQ - Volume cluster On NQ , it's nice to see a strong buying reaction at the price of 19880.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Strong rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

ES - Strong rejection of lower prices On ES , it's nice to see a strong buying reaction at the price of 5697.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong buyers will likely push the market up again.

Strong rejection of lower prices and high volume cluster are the main reasons for my decision to go long on this trade.

Happy trading

Dale

SPY and QQQ at MAJOR LevelsThe charts shown are highlighting the 12 month periodic volume profile chart. Currently, the S&P 500 and Nasdaq 100 are bouncing off major 2024 value areas.

Nasdaq 100:

Last week we can see how bulls lost the 2024 value area high (VAH) and couldn't reclaim. As a result we swiftly moved down to the point of control (POC) where we found buyers show up.

S&P 500:

Coincidently, the S&P 500 moved down to the 2024 VAH where it also found buyers show up.

Moving Forward:

These areas remain very important and should be monitored going forward. If a bounce is to happen here, bulls would like to see the Nasdaq reclaim the 2024 VAH and even work back into the current 2025 VAL.

Bitcoin Approaches Strong Support ZoneA double top has been confirmed on a daily chart with a downside target around 74550. This corresponds nicely with previous resistance turning potential support (73794-71958) and an upward sloping trend line. Below this zone are two overlapping volume profile ledges (70721-57340). I expect buyers to enter and hold 65k+. However, if 56k is taken out significant chart damage will be done for bulls.

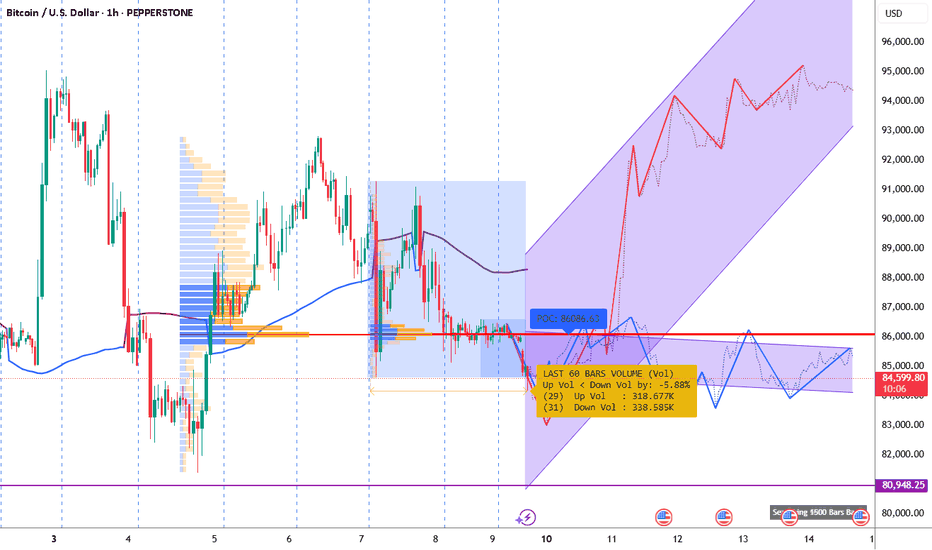

Technical Analysis of Bitcoin (BTC/USD) – 1H Chart1. Trend Identification

The price is currently in a consolidation phase after a recent downtrend, with potential for reversal based on the projected price movement within the ascending channel.

The 200-period moving average (blue line) is acting as dynamic support. A breakout above it could confirm bullish momentum.

Point of Control (POC) at 86,086.63: This suggests a high liquidity zone where price is likely to react.

2. Key Support & Resistance Levels

Immediate Resistance: 86,000 - 86,500 zone (aligned with POC and previous consolidation).

Immediate Support: 84,000 - 84,500 (current trading range).

Stronger Support: 80,948 (purple line, potential demand zone).

Upside Targets: 90,000 - 95,000 (upper boundary of projected channel).

3. Volume Analysis

The last 60 bars’ volume profile shows selling pressure slightly higher than buying pressure (-5.65%), suggesting potential short-term bearish movement before a bounce.

If price holds above 84,000 and buying volume increases, it strengthens the bullish case.

4. Chart Patterns & Projections

The projected path (red and blue lines) suggests a potential bullish breakout into an ascending channel, targeting 95,000.

A potential double bottom is forming around 84,000, which could act as a reversal signal.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Near 84,500 - 85,000 (buying into support).

Stop-Loss: Below 83,800 (to protect against a breakdown).

Targets:

First Target: 86,500 (POC zone).

Second Target: 90,000 (psychological level).

Final Target: 95,000 (upper channel resistance).

Risk-Reward Ratio: At least 1:3 (depending on position sizing).

2. Short Trade Setup (Bearish Breakdown Scenario)

Entry: Below 83,800 (breakdown confirmation).

Stop-Loss: Above 85,000 (previous support turned resistance).

Targets:

First Target: 82,000

Second Target: 80,948 (key support level).

Risk-Reward Ratio: 1:2 or better (depending on volatility).

Buy Render**Buy Render (RNDR)**

The weekly RSI has dropped below 40, signaling oversold conditions and a potential buying opportunity.

Beyond technicals, Render is fundamentally strong:

✅ **Leader in Decentralized GPU Rendering** – The network provides scalable GPU computing power for rendering graphics, AI, and metaverse applications.

✅ **Rising Demand for AI & 3D Workloads** – As AI, virtual reality, and 3D content creation grow, Render’s decentralized model offers cost-effective and efficient solutions.

✅ Strong Partnerships & Adoption**—Backed by major industry players, the Render Network is gaining traction in the creative and enterprise sectors.

With technicals aligning with a fundamentally bullish long-term outlook, this could be an attractive entry point.