Volkswagen (VOW3): Potential Climb to €150Volkswagen AG is currently a highly interesting stock for us, especially given that it is a massive enterprise and the European market has seen significant sell-offs, in contrast to most American automakers which remain relatively high. However, it's important to note that automakers are typically quite volatile. If not for the high dividend yield, which currently stands at 15%—exceptionally high for a company of this size—it might not even be worth considering. Looking at the daily chart, we've observed a decline from 252€ to a low of 97.83€, marking the nadir of the overarching Wave II.

We placed our very first entry at the start of this cycle at 101€, which is now at 121€. We have yet to break out from the major trend channel. A new, smaller trend channel has formed, suggesting that an upward breakout could potentially lead us out of both channels, providing a short-term boost. This could bring us to the level of Wave (X), around 150€, concluding the Wave (1).

We successfully entered a new position on the 2-hour chart for Volkswagen, as we placed a limit order at the 50% retracement level, which was reached yesterday. This entry should give us a significant boost, aiming to challenge the trend channel line again and potentially reaching new local highs around 130€. There's also a dividend distribution coming up next month for Volkswagen, which might influence market behavior as investors could decide to take profits afterwards.

We are not trying to predict short-term movements; instead, we aim to position ourselves for the long term and hold our investments for extended periods. We have strategically placed our stop-loss below Wave ((ii)) to only get stopped out if the scenario is invalidated. However, we see theoretically huge potential upwards, with 150€ being just an initial target.

VOW

Upsize potential for VAG (VOW) due to EV salesVAG shows potential for doubling its share value in the next year due to EV sales.

Fundamentals:

VAG outplaced TSLA in Europe by sales of EVs in 2022 and has strong momentum which is backed by models ID.4 and ID.3 will continue.

eu-evs.com

Technicals:

- potential ending C (from ABC) -wave on weekly

- with the potential to end at the top of the channel on weekly - about 400 EUR/share

- 0.382 retracement from the spake in 2008 is at the same 399 level.

VWAGY Volkswagen a real Tesla competitorIf you haven`t bought the dip of my first idea, at $141:

Or you haven`t seen the sales comparison of these giants:

Then you should know that Volkswagen could surpass Tesla in electric-car sales as soon as next year.

If the market were to apply multiples similar to Tesla and Nio Inc. to VW’s battery-electric vehicle business, it would be worth about 195 billion euros ($230 billion), more than all of the company is worth now, analysts led by Tim Rokossa wrote in a report Monday. They lifted their price target for VW shares by 46% to 270 euros. (bloomberg.com)

The indicators are bullish on all timeframes!

If you are also interested to test some amazing BUY and SELL INDICATORS that i use, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

#VOW - New (un)Normal #Volkswagen #VW #VWGroup10.1 million short-time workers of 30 million employees (without public service) in Germany alone, collapsing demand for cars and interrupted Just In Time production chains but the stock exchange is going crazy, as if there were no skid marks nor profit declines nor climate goals with drastic CO2 reduction, ....

It should be fine with me and give the stock exchange a few more weeks to move into the 145-155 Euro range.

At 140 Euros, however, my first alarm clock rings for a closer look at the structure, to see if a bad awakening could come from June/July.

But maybe the sales crisis is only taking place in Europe, North- and South America and the Chinese, who are responsible for half of the VW sales, are more than compensating the drop of sales. Will all mentioned concerns above simply wiped out?

www.kfz-betrieb.vogel.de

Short term long,

medium term short but wait for new Q2-numbers.

Greetings from Hannover

Stefan Bode

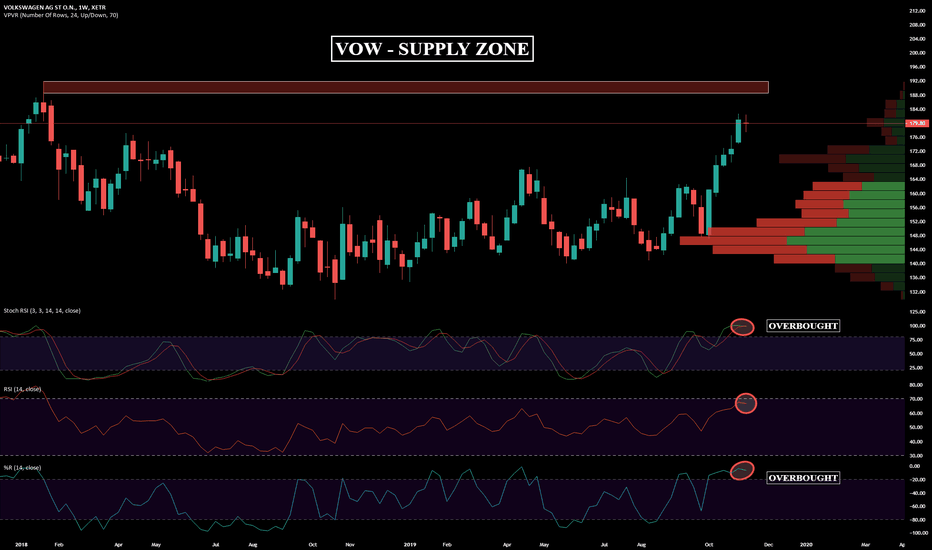

VOW - WEEK CHARTVOW - Volkswagen AG

Hi, today we are going to talk about Volkswagen AG and its current landscape.

Volkswagen AG it's poised to gain traction on the market since Tesla today has shaken the European auto markets by announcing that it has chosen the region of Berlin in Germany over the U.K to be the new engineering and design center site. A big step for the company that until now had to rely on a single plant in Fremont, California, to sustain the whole Tesla produce chain. The new Tesla factory should become fully operational only in 2021, according to Musk estimates.

The establishing of Elon Musk company on European soil sets a significant threat to the European automakers, which can be seen in a type of allegory represented by the Golden Steering Wheel award that Musk received in Germany yesterday. The prize was due the Model 3 been elected the midsize car of the year, beating the BMW and Audi models. We must remember that several countries on the European Union like Norway, Germany, France, U.K, Scotland, Netherlands and Ireland, have been making efforts to drastically reduce its using of fossil fuels cars, as an effort to diminish pollution. With the expansion of Tesla manufacturing network, with possibilities of more accessible prices, Tesla that it's already ahead on the electric car race will have the upper hand on the sector, and it might weaken its European competitors.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.