FET on Fire: Volume-Backed V-Pattern Breakout in 4H Structure💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing FET on the 4-hour timeframe .

👀 After breaking out of its range around $0.75, FET experienced a solid upward move , reaching $0.876 . However , it was rejected from that level and faced heavy selling pressure , eventually forming a consolidation box on the multi-timeframe .

The break of this box, accompanied by rising volume and a total market structure break , led to a move toward the $0.778 resistance , where the price dropped again — this time with significant sell volume .

🎮 The Fibonacci levels in this chart are drawn based on volume-based market activity — specifically from the candle where the sell-off began to the candle where selling pressure ended and a reversal candle formed .

It may sound a bit technical , but the 0.236 Fib level acted as a key V-pattern resistance , which was beautifully broken with a strong $2,571,800 volume, and the candle closed above it .

Following that , traders showed reactions to this level , and the liquidity absorption can be seen in the form of wicks .

🔑 The next important zone is the 0.382 Fibonacci level at $0.675, where we see two possible scenarios :

Reaction and pullback , followed by a breakout .

Breakout first , then a pullback .

You can also place a buy stop at this level — just make sure to use a wider stop-loss .

⚙️ The structure is looking relatively good . The 61.9 RSI region could cause some noise in lower timeframes , but the key area is RSI 70 , which is the entrance to the Overbought zone .

🔼 Volume has been decent , especially considering today is Saturday and a weekend session . This adds more confirmation to the breakout of the V-pattern and the potential end of the correction .

🖥 Summary :

FET is one of those coins with strong recovery potential , operating in the AI sector . It tends to respect classic price action patterns , and with well-drawn Fibonacci levels , volume confirmation , and RSI moving into Overbought , it often activates buy-stop positions cleanly .

💡 Disclaimer :!!! .

Vpattern

From Fakeout to Takeoff: How the V-Pattern REALLY WorksEver seen a support level break, only for the price to rocket back up in a V-shape? That’s the V-Pattern in action! In this post, Skeptic from Skeptic Lab breaks down the step-by-step mechanics of this powerful setup. From the fakeout that traps short sellers to the surge of buy orders from liquidations, you’ll learn exactly how buyers flip the script and create explosive reversals. Perfect for traders looking to spot high-probability setups. Join me to decode the markets—check out the steps and level up your trading game!

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

How to trade with V patterns !!!In trading, a V pattern is a chart formation that resembles the letter "V" and is used in technical analysis to identify potential reversals in price trends. It is one of the most common and recognizable patterns, signaling a sharp decline followed by a quick recovery.

Here's a breakdown of the V pattern:

Characteristics of a V Pattern

Sharp Decline (Left Side of the V):

The price experiences a rapid and steep drop, often driven by strong selling pressure or negative market sentiment.

This decline is usually quick and may occur over a short period.

Reversal Point (Bottom of the V):

The price reaches a low point where selling pressure exhausts, and buyers step in.

This is the point where the trend reverses, often accompanied by high trading volume.

Sharp Recovery (Right Side of the V):

The price rebounds quickly, mirroring the steepness of the initial decline.

The recovery is driven by strong buying pressure, often fueled by positive news or a shift in market sentiment.

Types of V Patterns

V Bottom (Bullish Reversal):

Occurs at the end of a downtrend.

Signals a potential reversal from bearish to bullish.

Traders look for confirmation of the reversal, such as a breakout above a resistance level or increased volume.

Inverted V Top (Bearish Reversal):

Occurs at the end of an uptrend.

Signals a potential reversal from bullish to bearish.

Traders watch for a breakdown below a support level or decreasing volume as confirmation.

How to Trade the V Pattern

Identify the Pattern:

Look for a sharp decline followed by an equally sharp recovery.

Use trendlines or moving averages to confirm the reversal.

Wait for Confirmation:

Avoid entering a trade too early. Wait for the price to break above a resistance level (for a V bottom) or below a support level (for an inverted V top).

Set Entry and Exit Points:

For a V bottom, enter a long position after the price breaks above resistance.

For an inverted V top, enter a short position after the price breaks below support.

Use stop-loss orders to manage risk, placing them below the reversal point for a V bottom or above the reversal point for an inverted V top.

Targets:

Measure the height of the V pattern and project it upward (for a V bottom) or downward (for an inverted V top) to estimate potential price targets.

Key Considerations

Volume: Higher trading volume during the reversal confirms the strength of the pattern.

Market Context: V patterns are more reliable when they align with broader market trends or fundamental factors.

False Signals: Not all V patterns lead to sustained reversals. Always use additional indicators (e.g., RSI, MACD) to confirm the trend.

The V pattern is a powerful tool for traders, but it requires careful analysis and risk management to avoid false signals and capitalize on potential opportunities.

What is V pattern? V pattern is a basic trading pattern which happens when market gets chaotic!

It has a sharp decline(left angle) and a sharp recovery (right angle)

Most of the times, V patterns won't change anything and their effect on market is mostly nothing!

The trends will continue after these patterns are crafted!

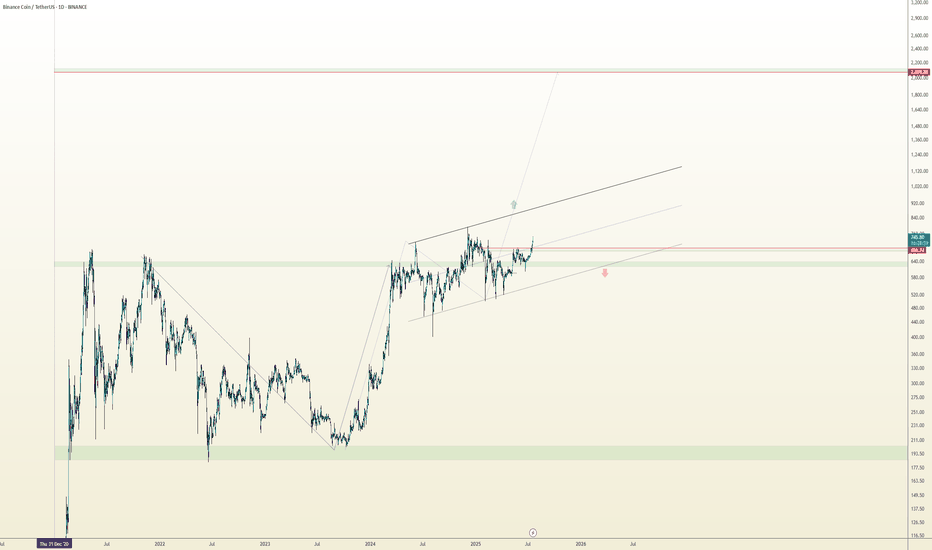

for example look at the BINANCE:BNBUSDT Chart and you can see that the price was pretty stable. after a sharp deny and a sharp recovery, the price shall return to the ranging stat which It was in!

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

EURCAD Thoughts?Hello traders!

After a whole year we were able to reach last year highs.

My question is the following: do you think V pattern is in place? Or we are going to pullback to 1.41702 level and continue to the upside?

Many factors are in place such as limit sells, possible rise in oil prices which is going to make CAD pair stronger.

ETH/USDT : Formed reversal V pattern BINANCE:ETHUSDT

Hello everyone 😃

Before we start to discuss, I'll be so glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it!

We have taken all of the Targets on $ETH's short and now,

There's a formed reversal V bottom.

It's also can be known as a Deviation below the neckline!

$ETH has retested the neckline and it could be a good option to take Long towards $1818 as a higher S/R line with a stop-loss below the current local low.

I'll split my entries into two points.

- $1590 ( First Entry )

- $1565 ( Second Entry )

📝 The reason that I added $1565 is that we have a swing low below there and $ETH might go for a sweep before any major leg up.

Also, You can trade with an invalidation strategy based on a trigger entry above $1670.

Hope you enjoyed the content I created, You can support us with your likes and comments!

Attention: this isn't financial advice we are just trying to help people with their vision.

Have a good day!

@Helical_Trades

KCSUSDT wants to retest the 18$From my previous analysis we made more than 27% and the price followed my drawing. Now the price is testing the monthly as new support after the first rejection.

The market created a V pattern on 10$ and now the price wants to retest the 18$.

How to approach?

IF the price is going to have a breakout from the 4h resistance According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

CRYPTO Markets situation(What is going to happen right now?)Hi every one

the latest dip in crypto markets was pretty unfortunate for a lot of people. but the dump is only temporary! as you can see we provided some examples for you that shows the market is forming The V pattern! V pattern happens when the market gets emotional and people act on their Greed and Fear!(It is usually associated with high trading volume) V patterns Don't Effect the market trend. In our opinion the market will be back to where It has been few days ago and It would continue the bullish trend!

Thank you for seeing idea .

Have a nice day and Good luck

Tan after very strong rises, at the beginning of a break again!AMEX:TAN

Solar & Clean Energy ETF - This is undoubtedly one of the goals the world is striving for right now

Has made a +33% since the last breakout - in a huge uptrend!

T.A SETUP - Bull flag + (mini) V pattern

It has a lot more to go up if you look at the monthly chart

JNJ Long, V Pattern and Fib 0.382 RetracementV Pattern,

Fib 0.382 retracement

Demand zone is not confirmed yet.

Estimate: Gap Up (G1) above EMA144

Earning will not affect this trade.

Entry: 140.5

Stop: 137.5; Below Demand zone

Target: 155.5; risk/reward=1:5

This is a trading school homework. I need few months to practice trading plan.

If you like it, thank you for your support. Please use SIM/Demo account to try it, until my trading plans get high winning rate.

GLD Prepare to Long, V Pattern calculation V Pattern (XYABCD) FIB# calculation

YA= XY * 1.618 (also could be 1.13, 1.272)

AB= YA * 1.272 (also could be 0.786, 1.13,1.618)

BC= AB * 0.382 (also could be 0.5, 0.618 )

XD1= 1.618 extension of XY

XD2= 2.24 extension of XY

XD3= 3.16 extension of XY

I will create detailed trading plan according to following price action:

1. If Price goes into demand zone at least 10%

2. if any Reversal candle in demand zone

3. if any faulse breakout

4. If down trendline break near demand zone

5. If a breakaway Gap near demand zone

6. If Bounce up and cross over SMA8

I created similar V Pattern projection on SPY 3/27/2020. It had been proved by market price action.

See the linked Related Idea.

STATUS 4H UGLY DOUBLE BOTTOM LONG TRADE Step #1: Identify two bottoms where the second bottom is at least 5% higher than the first bottom

The first step is to identify the correct price structure of the ugly double bottom pattern. Basically, we need two bottoms where the second bottom is higher than the first one. In other words, the price needs to make a higher low.

The second bottom also needs to be between 5% and 20% higher than the first bottom. This trading rule will ensure we’re not developing a double bottom pattern. Secondly, it will ensure the downswing leg before forming the second bottom has a proper length.

There is one more critical element that needs to be satisfied. This brings us to the second step of our day trading cryptocurrency strategy.

Step #2: Bottom 1 needs to develop a “V” shape type bottom

The key to this reversal setup is the shape of the first bottom. The bottom 1 price structure needs to be a “V” shaped bottom.

The identification guidelines of the V-shaped bottom are quite easy.

The price needs to drop in a straight line, and then it reverses and moves up at a slightly steeper slope or at least at the same speed as it fell.

The good thing is that we don’t need to spot this reversal pattern on a real live feed as they happen, we can look in hindsight and have the time to validate them.

Next, we’re going to outline what key condition needs to be satisfied with our entry strategy and how to buy Status SNT.

Step #3: How to buy Status SNT: Buy after we break above the highest point between the two bottoms.

The ugly double bottom pattern is confirmed once we break above the highest point between the two bottoms. That’s also the moment when you would want to buy Status SNT.

A break above the highest high between the two bottoms will also mark a break in the price structure. Once we break above point B, the price is making a higher high. This, paired with the previous higher low means we can safely assume the market is in the process of establishing a new bullish trend.

This reversal setup indicates that catching a falling knife can work, but you need to be patient until all requirements fall into place and only then pull the trigger.

This brings us to the next important step we need to establish for our day trading cryptocurrency strategy, which is where to place your protective stop loss.

Step #4: Place your protective Stop Loss below the second bottom

As we’ve suggested earlier, you can adopt different strategies to manage your risk, but for the purpose of this example, we’re going to highlight one effective way to hide your stop loss. Here is another strategy on how to apply technical analysis step by step.

Place your stop loss below the second bottom!

Alternatively, you can place your stop loss below the bottom 1, but this requires using a wider SL.

Step #5: Take profit at the 1.272 Fibonacci extension level

For our exit strategy, we’re going to use the Fibonacci extension toll. You can establish accurate profit targets with the help of the Fibonacci extension tool. We’re going to use the two bottoms and the highest high between the two bottoms as reference points to draw the Fibonacci extension lines.

As a day trader, you only need one good trade to succeed in this business. Just imagine how much you can accomplish with one good trade per day.

**Note: The above was an example of a BUY trade using the best Status SNT cryptocurrency strategy. Use the same rules for a SELL trade – but in reverse

BTC update This is update to my previous Idea regards BTC. Based on this chart I assume that 1000$ mark was defended and strong bullish trend should continue for some more time. BTC is making new highest highs while I'm posting this Idea(well at least on this chart). I strongly believe that the BTC will hit 1700 1800$ mark some time in the future. I also believe that 3000$ is very probable as well but I'm not sure when it will happen. I marked strong support/resistance close to 1300$(blue rectangle). This area should be tested and then BTC should move north. Recent informations regarding BTC future didn't change strong bullish trend that much.

Please don't take it as a trading advice it is just my thought.

BTC V pattern idea correctionIt is correction to previous chart as the angles were not correct and it looked slightly different as intended. I'm not sure if the angles are changing position as the price changes so I corrected it and let's see if this one will change shape too.

It is hard for me to predict where BTC could go in next weeks or months. I tried to apply known to me tech. analyse but recent movements don’t fit to any of them. I found just one which could be used for “predictions” and it is called V-Pattern. I placed it on the chart(two rays deviated 60 degrees) . This pattern gives us place where we could see some interesting price action. It is marked with blue rectangle .

Fact that 200 Ema pushed price higher with ease above 1000$ mark makes me think that the bullish mode for BTC is still in play.

It is just a thought and it shouldn't be treated as a trading advise