Gold (XAU/USD): A Classic VSA Short Setup in PlayHey Traders,

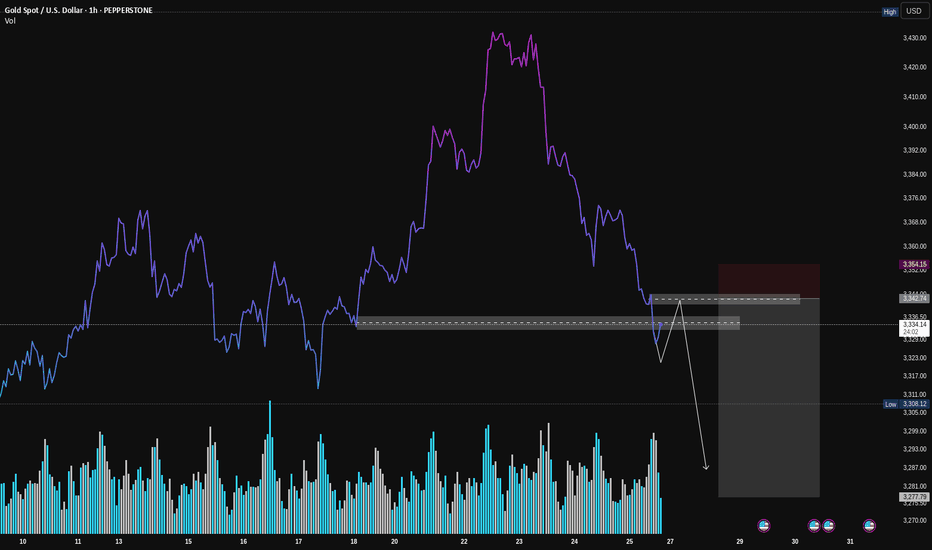

Following up on the general weakness we discussed in Gold, here's a closer look at a specific trade setup that's unfolding right now. This is a textbook example of a high-probability short setup according to Volume Spread Analysis (VSA).

Let's break down the story the volume is telling us.

1. The Breakdown: Sellers Show Their Hand

First, look at how the price broke down hard through that support level (the grey box). Notice the volume on that sharp drop? It was high. This is our clue that sellers are strong and in control. They had enough power to smash right through a level that was previously holding the price up.

2. The Retest: Buyers Don't Show Up

Now, the price is creeping back up to that same exact level. But here's the most important clue: look at the volume on this rally. It's much lower than the volume on the breakdown.

This is what VSA calls a "No Demand" rally. It’s like the market is trying to push a car uphill without any gas. It tells us that strong buyers (the "smart money") have no interest in buying at these prices.

3. The Setup: Selling into Weakness

This combination creates a classic short setup:

Logic: We are looking to sell at a level where old support has flipped into new resistance.

Confirmation: The low volume on the retest confirms the rally is weak and likely to fail.

How to Potentially Trade It

The grey box represents a high-probability entry zone. To time an entry, you could watch for a clear rejection signal right inside this zone. For example:

A "rejection candle" (like a pin bar) that pushes into the zone but gets slammed back down.

An up-bar with a tiny body and very low volume, showing buyers are completely exhausted.

Seeing one of these signs would be the final confirmation that sellers are about to take back control.

Conclusion:

This is a powerful setup because all the pieces line up: the background is weak, sellers have shown their strength, and buyers are now showing no interest at a key resistance level.

Disclaimer: This is my personal analysis using VSA and is for educational purposes only. It is not financial advice. Always do your own research and manage your risk. Good luck, traders!

Vsaexpert

Gold (XAU/USD) - Potential Liquidity Sweep Before ReversalGold has been in a strong uptrend, forming a rounded bottom pattern, which led to a breakout above key resistance. Currently, price is consolidating near the all-time high (ATH) around $3,005, suggesting a potential liquidity sweep before a larger move.

📌 Key Observations:

Rounded Bottom Formation: A bullish reversal pattern led to a breakout.

Consolidation Zone: Price is ranging just below the ATH, likely gathering liquidity.

Liquidity Sweep & Weak Highs: The chart suggests a push above the ATH to trigger stops before a potential reversal.

Projected Bearish Move: A break lower could lead to a corrective move towards $2,920 - $2,800 in the coming sessions.

⚠️ Trading Plan:

Bullish Scenario: A clean breakout above ATH with strong volume could invalidate the bearish setup.

Bearish Scenario: If the liquidity sweep occurs and price fails to hold above ATH, a strong sell-off could follow.

Traders should watch for confirmation signals before entering any positions. Stay cautious and manage risk effectively!

📊 What are your thoughts? Will gold continue higher or reverse? Share your views below!

#XAUUSD #Gold #Trading #Forex #LiquiditySweep #ATH

XAU/USD - Buy Limit Setup for a Bullish Reversal Overview

Gold (XAU/USD) is showing signs of a potential bullish reversal after a recent decline. A buy limit order is placed around the $2,911 level, targeting a move towards the $2,928 resistance zone. This setup follows a structured risk-reward approach with a stop loss below recent lows at $2,900.90.

Trade Setup

📍 Buy Limit: $2,911 (Key support zone)

📍 Stop Loss: $2,900.90 (Below recent lows for risk management)

📍 Take Profit: $2,928 (Major resistance zone)

📍 Risk-Reward Ratio: 1:2+

Technical Analysis

🔹 Support Zone: Price is testing a demand area where buyers previously stepped in.

🔹 Bullish Structure: After a sharp sell-off, gold is attempting a recovery.

🔹 Potential Reversal: Expecting price to trigger the buy limit before rallying towards resistance.

🔹 Volume Confirmation: Watching for increasing bullish volume near the entry.

Trade Plan

1️⃣ Wait for price to reach the buy limit zone (~$2,911).

2️⃣ Monitor price action for bullish confirmation (e.g., bullish engulfing, rejection wicks).

3️⃣ Ride the move towards the take profit zone (~$2,928).

4️⃣ If structure shifts bearish, adjust SL accordingly.

🔥 Gold remains volatile, so risk management is key! Watch for market reactions at key levels before entering the trade.

📊 Like & Follow for more gold trade ideas! ✅

GBP/USD - Weekly Liquidity & Fair Value Gaps AnalysisOverview

The British Pound (GBP/USD) is currently trading around 1.2652, showing a bullish recovery after sweeping weekly sell-side liquidity. Price has reacted from a weekly fair value gap (W.FVG) / BISI and is approaching key resistance levels.

Key Levels & Liquidity Zones

📌 Weekly Sellside Liquidity: Taken, leading to a bullish reversal.

📌 Weekly Buy-side Sweep: Possible target around 1.2774 (50% retracement).

📌 W.FVG // BISI (Bullish Imbalance Sellside Inefficiency): Acting as support.

📌 W.FVG / SIBI (Sell-side Imbalance Buy-side Inefficiency): A potential rejection zone around 1.2774.

Technical Outlook

🔹 Bullish Reversal: The price has bounced from key liquidity zones, suggesting further upside.

🔹 Fair Value Gaps (FVGs): The market has filled some inefficiencies but still has upside targets.

🔹 Potential Scenarios:

A continuation towards 1.2774 (weekly resistance & FVG fill).

A possible rejection at that level before resuming the trend.

Trade Plan

✅ Bullish Bias: Looking for pullbacks into support (W.FVG) for long opportunities.

❌ Bearish Confirmation: Rejection from 1.2774 could signal a retracement.

📊 Risk Management: Stop-loss placement below recent structure lows.

🔥 Watch these liquidity sweeps and fair value gaps for potential trading opportunities!

📌 Like & Follow for more trade ideas! 🚀

Snoflake [SNOW] Wyckoff Bullish PatternsVery fundamental company. The last consolidation after very large drops is a good prognosis for an upward exit. It is necessary to focus on Wyckoff Wave Volume, which decreases at the bottoms. This means a decrease in selling pressure. There were two shafts with a very large purchase volume and a wave marked with volume 200. It was a very large sale that did nothing to the price. This sale was absorbed by buyers.

This security has typical accumulation features. In my opinion, it is on BUY with a target of $ 140/150

For more analyses using price and volume and the Wyckoff method, subscribe to the profile

INTC Swing Ling Aggressive Counter Trend TradeAggressive Counter Trend Trade 12

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Daily Chart Context

- short impulse

+ biggest untested volume T1

+ biggest volume Sp

Hourly Chart Context

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

ARBUSDT Long Investment Trend Trade 3RTrend Trade 3R

+ long impulse

+ support level

+ volumed expanding T2 level

+ 1/2 correction?!

+ biggest volume Sp

+ weak test

+ below first bullish bar closed level entry

Monthly Context

+ long impulse

+ JOC level

+ support level

+/- 1/2 correction?

Calculated affordable stop loss

1 to 2 R/R take profit

INTC Long Day Conservative Counter Trend Trade Conservative Counter Trend Trade 12.1

+ long impulse

- volumed expanding T2

- 1/2 correction

+ support level

+ biggest volume manipulation

+ closed above support level

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Hourly Context:

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

Daily Context

- short impulse

+ biggest untested volume T1

+ biggest volume Sp

Monthly Context

+ long impulse

+ SOS level

+ support level

+ 1/2 correction

AMT Long Invest Conservative Trend TradeConservative Trend Trade 11

+ long impulse

+ SOS level

+ 1/2 correction

+ biggest volume Sp

Calculated affordable stop loss

1 to 2 R/R taket profit

Monthly Context

+ long balance

+ biggest volume expanding ICE

+ 2Sp- (previous bar touched ICE)

+ test

I'll see how market goes and can take potentially 1/3 at 1 to 2 R/R

1/3 at Daily resistance

1/3 at Monthly 1/2 of range

HSBC Day to Investment Conservative Trend TradeConservative Trend trade 7F

+ long balance

+ ICE level

- support level

+ 1/2 correction

+ biggest volume 2Sp+

Calculated affordable virtual stop loss

Take profit:

+ 25% 1/2 R/R

+ 75% T1 of Monthly

Hourly Context

+ long impulse

Daily Context:

+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ biggest volume 2Sp+

Monthly Context:

+ long impulse

+ SOS level

+ 1/2 correction

+ support level

+ 2Sp- + test"

LMT Long Aggressive CounterTrade 3FAggressive CounterTrade 3F

- short impulse

- unvolumed T1

+ biggest untested volume 2Sp-

+ decreasing volume test

+ first bullish bar closed entry

Calculated affordable stop loss

1 to 2 R/R take profit

Daily chart context

- short impulse

- volumed T1

Monthly chart context

+ ICE level

+ biggest volume 2Sp+

+ weak test

PFE Consevartive Trend TradeConservative Trend Trade 1F

+ long impulse

+ JOC test level

+ 1/2 correction

+ biggest untested volume Sp

Calculated affordable stop loss

(virtual if it hits the alarm I'll put a limit order

to break even and if it doesn't reach it

I'll HODL with dividends till original take profit)

1 to 2 R/R take profit

with possible extension to 1/2 for monthly range

Monthly context

+ long balance

- expanding ICE

+ 1/2 correction

+ biggest volume manipulation without result

PEP Conservative Trend Trade LongConservative Trend Trade 2R

+ long balance

+ 1/2 correction

+ support level

+ biggest volume Sp

Calculated affordable virtual stop

(if price will hit SL level, I'll move TP to break even

and if it will not activate, will HODL

and receive dividends till it recovers)

1 to 2 R/R take profit

Monthly context

+ long balance

+ ICE level

+ support level

+ biggest volume 2Sp-

+ test

SEIUUSDT.P Conservative Trend Trade 5RConservative Trend Trade 5R

+ long impulse

+ SOS level

+ 1/2 correction

+ volumed 2Sp+

+ weak test

+ first bullish bar closed entry

Calculated affordable stop loss

1 to 2 R/R take profit

with possible extension to 1H chart

Hourly chart context

- short impulse

+ volumed T1

+ biggest untested volume 2Sp-

+ uncompleted test into 1/2

+ support level

+ Day support level

FTMUSDT.P Aggressive Trend Trade LongAggressive Trend Trade 4R

- short impulse

- unvolumed T1 level

+ support level

+ biggest volume 2Sp-

+ 1/2 corrected weak test

+ first bullish bar closed similar level entry

Calculated affordable stop loss

1 to 2 R/R take profit

Monthly chart context

+ long impulse

- expanding ICE level

I'm a bit concerned T1 doesn't have volume = price can spring biggest volumed spring before turning long. Will see!

PFE long Hourly chart Conservative Trend TradeConservative Trend Trade 1F

+ long impulse

+ JOC test level

+ 1/2 correction

+ biggest untested volume Sp

Calculated affordable stop loss

1 to 2 R/R take profit with possible extension to 1/2 for monthly range

Monthly context

+ long balance

- expanding ICE

+ 1/2 correction

+ biggest volume manipulation withou result

AAVEUSDT.P Aggressive Trend TradeAggressive Trend trade 1R

- long impulse

+ resistance level

+ biggest untested volume T1

+ biggest untested volume 2Ut-

+ weak test

Calculated affordable stop loss

1 to 2 R/R take profit

1D context

+ short impulse

+ SOW test / T2 level

+ resistance level

+ 1/2 correction

+ first bar didn't close above

10% of the of trading account to mitigate risk.

USD JPY Absorbtion Hello Everyone i just want to share my VSA (Volume Spread Analysis ) to you people so you can understand that how beautifully volume and spread works and as you can see I have shared D1 chart analysis Price has break the level with increasing volume which we called absorption and now we have to wait for the price to come at support with low volume and in the near of support make Test / Shake out sign of strength and after that we can enter in the market with long position up to the resistance level is marked.

have a nice weak ahead

Put your SL below the absorption bar when price will came to retest , so your SL will be smaller and reward will be higher.

APEPERP - Positive dynamics.Exit from the trade at the extreme support point at 2.88 shows the positive dynamics of the resumption of buying. Let's keep watching.

If you liked the idea, please like it. This is the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and make yourself and your

your loved ones.

Continuation of this idea

#EURUSD #long after #professionalbuying and a test #VSALite

EURUSD long after professional buying and a test VSALite

Trade strategy using the Tradeguider VSA Lite software. Papertrade on Tradingview, placing the trade with real money on Activtrades (FX Markets).

Checklist:

• Signal of professional buying at 03:30 17/11/2021

• Successful test at 21:30 17/11/2021

• Stop placed at 1.1252

• 4 consecutive short term indicator green bars

• Entry on a bar that closed on it’s high

• No previous price action at this level for a few days

• A background of strength

Management of the trade in accordance with my trading plan on 15 mins