EM Equities Bottom Call

Valuations are attractive on an absolute and relative basis.

Cross-asset breadth for EM assets (stocks/bonds/FX) making a sharp move higher from washed-out levels.

EM central banks are collectively pivoting from rate hikes to cuts, which supports EM assets.

China is moving towards a larger stimulus as the property downturn deepens and the economy slows further.

Technically, the chart shows a bullish RSI divergence and a double bottom 'h' pattern occurring near the apex of a massive 10-year symmetrical triangle.

Extreme and lingering pessimism marks a reset in sentiment and a contrarian signal.

Market consensus: The Fed is done with rate hikes and the USD has peaked.

Note: Despite cheap valuations, clear downside risks are intensifying as stimulus-hesitance and bad karma continue.

In summary, given the macro catalysts, valuation story, sentiment reset, and promising technicals, an inflection point is appearing. While I refuse to invest in China for personal reasons, it would be wrong to ignore the upside and indeed what is different this time.

VWO

VWO - following the forecasted trendVWO is finishing a leading diagonal first wave out of the the contracting triangle as forecasted in the April 5 post. It should continue its positive trend ahead with minor corrections on the way. The possible end of minute wave v of minor 1 should be at around 39. After this minor 2 wave should retrace to around 35 before the up trend continues. If prices crosses the lower leading diagonal channel, the odds are that minor 2 correction is already happening. FOLLOW SKYLINEPRO TO GET UPDATES.

VWO - FTSE Emerging Markets ETF - poised for growthVWO just seems to have completed a bullish primary triangle what is the end ov cycle wave IV. In this case, the etf should offer long-term growth ahead. The probable end of cycle wave V up is a growth similar to highest leg of the triangle. This would push the index to around 70, more than double the current value in the long term. FOLLOW SKYLINEPRO TO GET UPDATES.

US vs. Emerging MarketsThe best-performing markets tend to flip flop every decade or so. For example, in 2000-2010, emerging markets outperformed US markets. In the following decade (2010-2020), US markets significantly outperformed and emerging underperformed. This concept is known as reversion to the mean - valuations get stretched in one direction, and eventually, it is bound to reverse to the historical mean.

If we use Total Market Cap/GDP a metric (warren buffet's favourite metric for valuing the entire stock market), and this concept of reversion to the mean to get exact numbers for expected returns, here is what we get:

Estimated Annualized Return (Next 10 Years, source: gurufocus.com)

United States: 1%

Emerging Markets: 23%

Estimated Total Market Cap to GDP (Current, source: gurufocus.com)

United States: 122%

Emerging Markets: 40%

Once this current recession/crash is over, I expect sideways movement and slow recovery for US stocks., vs. explosive growth for emerging markets similar to the 2000s.

TL;DR: US market bad. Emerging markets good

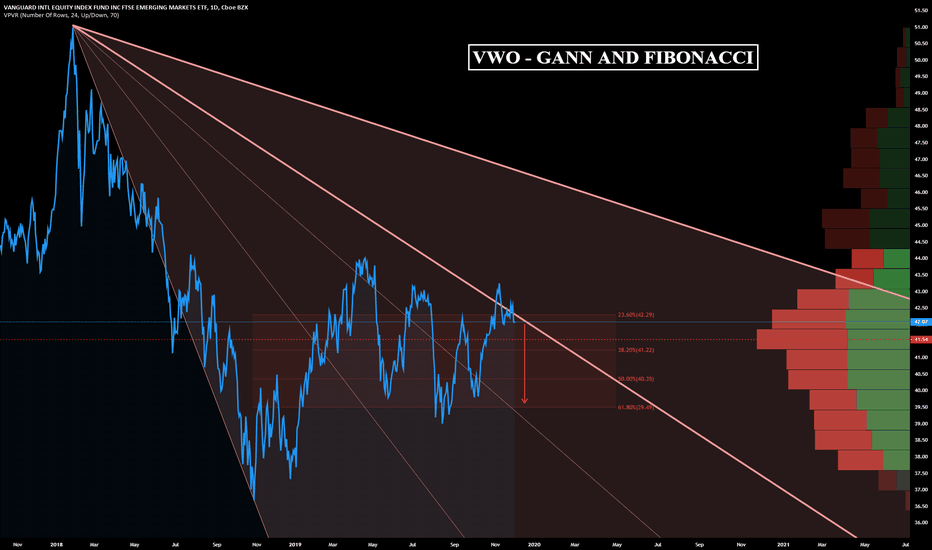

VWO - DAILY CHARTHi, today we are going to talk about Vanguard FTSE Emerging Markets ETF and its current landscape.

The emerging markets today can face an increase of volatility and perhaps pessimism as Trump's stated that will reinstate Steel and Aluminum tariffs for Brazil and Argentina since, in his perspective, both countries are devaluating their currencies to be "unfairly" competitive in the sale of agricultural goods, which is negative for U.S farmers. We must remember that since the beginning of the Trade War, China has stepped into the gas pedal in buying Brazilian agricultural goods, and the Brazilian currency has reached new record lows against the U.S dollar, which theoretically bases Trump's argument. This could be bad news for the market if imply a new Trade War front against these Latam countries, that doesn't have China firepower to sustain a tariff battle against the U.S.

Trump's movement could be clearly interpreted as an endeavor to take these competitors of the road, to try to suffocate China's lifeline of agricultural goods, and maybe force them to become more friendly with the idea of expanding their spending on U.S agricultural goods.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

BTC Directly Linked to Emerging MarketsThere are many on this site that are claiming to know where BTC and other cryptos are heading in the short to intermediate term. The only issue? Their analysis is absolute hogwash.

This chart shows the Vanguard Emerging Market index (which shows a diversified performance of equities in many of the emerging markets). Notice the stark similarity.

As you can see, BTC has traded very closely to the emerging markets index fund, and this should be no surprise to anyone because a plethora of reasons, but, I believe, most notably the fact that adoption rates in emerging markets are much higher than that of the United States.

One of the highest BTC adoption rates is in China. Notice when BTC begins to peak - right around the end of December. To refresh your memory, this is the time when everyone around the world started to notice that President Trump was not, as many as stated, bluffing about tough trade talks with China and the rest of the emerging markets. Thus, China and the rest of the emerging market economies being to have fear and uncertainty thrust into their everyday life.

What is the first thing that people want to do when they have uncertainty? Stockpile the one thing that they know will allow them to eat, live, and pay for expenses - cash.

That leads us to the next logical decision of what assets to liquidate to get this security. I feel that many believed that the untested, unproven and uncertain BTC was the first asset on their list.

So I have a theory, what does it all mean?

For one it means that while Technical Analysis can be very helpful in making decisions, the psychological analysis of investor's willingness to buy and sell of security may be a better means of predicting what kind of growth BTC can see. Boom and busts are something that have been heavily studied throughout our financial markets, and it may be a good idea to apply some of the things we have learned about nearly every other financial market to BTC.

My underlying point is that we have to start thinking of BTC as a truly speculative investment. It is something that many who got involved did not do so for the long-term gain, but instead the short-term gain. Will it become a world currency one day? I think so. Should we treat BTC with the same kind of legitimacy that "world currency" demands? Absolutely not.

So, what needs to happen to see another bull run?

1. Emerging Markets need to may a rebound, and fast! For every day that emerging markets and, to an extend, China is down continues to put downward pressure on BTC. No matter what happens, if the primary adopters of BTC don't want to take risks anymore then BTC will continue to consolidate downwards.

2. We need trade certainty. China and the United States and other emerging markets need to take an ambiguous trade situation and at least make clear what the relationships are going to be in the future. Uncertainty will nearly always slaughter everyday investors' appetite for high-risk and speculative investments. As of right now, BTC falls in these categories.

3. There needs to be more adopting and a fight against ignorance in countries that have low adoption rates. The United States is one of the worst adopters of BTC and other alt coins, and it's very hard to see why. Nearly all of the biggest technology companies and technological advances have occurred in the United States. If BTC owners are seriously concerned with bringing awareness and adoption, then maybe some of them should start to open their pocketbooks and liquidate some of their reserves to pay for strong marketing campaigns to convince those who are either on the fence, ignorant, or who have maybe never even heard of BTC to add the investment into their nest egg. Unless this campaign becomes a reality, many citizens will always know BTC as a busted bubble and not a serious investment.

If the above can happen and investor sentiment can turn around, so can BTC. But until these things begin to happen, don't take anyone's TA as gold and expect BTC to magically rise as it did before. Many markets work the same way, and now we are starting to find that BTC is no different.