THE WEEK AHEAD: CHWY, LULU, COST, ORCL EARNINGS; EEM, VIXEARNINGS:

It's a fairly light week for earnings, but there is some highly liquid underlyings to play for volatility contraction:

CHWY (--/74): Monday, After Market Close.

LULU (64/42): Wednesday After Market Close.

COST (44/23): Thursday, After Market Close.

ORCL (42/26): Thursday, After Market Close.

Pictured here is a CHWY January 17th 21 short put at the 20 delta, paying .78 at the mid price as of Friday close with a 20.22 break even. In this particular case, I'm not looking to play earnings for volatility contraction, but waiting for earnings to pass, as well as lock up to end, which is supposed to occur on the 11th (Wednesday) with a whopping 83% of outstanding shares subject to lockup. Depending on what happens with the share price at the end of lock up, as well as implied volatility, I will look to put on a play thereafter.

The only other play I'm potentially interested in is LULU, where the January 17th 190/200/260/270 iron condor is paying 2.61 with delta/theta metrics of -1.69/5.35. It's not a one-third the width setup, but LULU has had a tendency to move, so my inclination would be to go wider to stay clear of potential friskiness.

EXCHANGE-TRADED FUNDS:

UNG (55/54)

TLT (44/13)

USO (21/30)

GLD (19/10)

GDXJ (18/27)

With the possible exception of UNG, shorter duration premium selling isn't ideal here, with rank below 50% and 30-day below 35%.

As an interesting aside, however -- compare and contrast premium selling in UNG and USO versus trading /NG and /CL directly, using at-the-money short straddle pricing:

UNG January At-the-Money Short Straddle: 2.68 versus 18.03 (14.9%)

/NG January At-the-Money Short Straddle: .309 versus 2.25 (13.1%)

USO April At-the-Money Short Straddle: 1.75 versus 12.32 (14.2%)

/CL March At-the-Money Short Straddle: 6.76 versus 59.07 (11.4%)

BROAD MARKET:

EEM (8/16)

QQQ (7/16)

IWM (6/16)

SPY (2/13)

First Expiries in Which At-the-Money Short Straddle Credit Exceeds 10% of Value of Underlying:

EEM: June: --4.48 versus 43.07 (10.4%)

QQQ: June -- 21.49 versus 205.00 (10.5%)

IWM: September -- 20.05 versus 162.83 (12.3%)

SPY: September 34.46 versus 314.87 (10.9%)

As with the exchange-traded funds, short duration premium selling isn't paying here, so your choices are to hand sit or sell in higher implied volatility expiries farther out in time. I've been largely opting for the latter, while simultaneously exercising some restraint as to sizing, since the last thing you want to do is tie up buying power with longer-dated setups, only to have literally nothing left over to take advantage of shorter duration volatility pops. Secondarily, I've been managing these longer-dated setups more aggressively, taking them off in profit in many cases a good deal short of 50% max.

FUTURES:

/6B (60/12)

/NG (55/58)

/CL (21/29)

/6E (20/5)

/GC (19/10)

As with the exchanged-traded funds, volatility is in natty and oil with /NG paying in short duration (January). One thing I noticed is that /CL expiry-specific premium selling doesn't necessarily lend itself to going longer-dated (at least at this moment in time) since implied is about the same regardless of where you go (i.e., January: 28.9%; February: 29.5%; March: 29.3%), so all you're basically getting paid for is duration, as compared to -- for example -- expiry-specific implied in SPY, which generally increases incrementally over time (i.e., January: 14.5%; February: 15.7%; March: 16.8%, etc.). This is not necessarily a bad thing, just an observation of what you're getting by going out farther in time with /CL options versus other instruments that have a sort of expiry-specific implied volatility "term structure."

VIX/VIX DERIVATIVES:

VIX finished Friday at 13.62, with /VX futures contracts trading at 16.32, 17.51, 17.63, and 18.19 in January, February, March, and April respectively. Consequently, the contango environment remains productive for term structure trades in those expiries, although it's apparent that you won't get much trading February over January due to the fairly small differential between where those two contracts are trading at the moment. In practical terms, the February 17/19 short call vertical is paying .65 with a 17.65 break even versus 17.51; the March 17/19, .65, with a 17.65 versus 17.63. In other words, it doesn't pay to go longer in duration (February versus March) here ... .

As before, I'll look to put on bullish assumption plays in VXX or UVXY at extreme lows (these setups don't work well in VIX directly due to /VX term structure) and add bearish assumption in VIX, VXX, and/or UVXY on VIX pops to greater than 20 on top of any VIX term structure trades that I'm working ... .

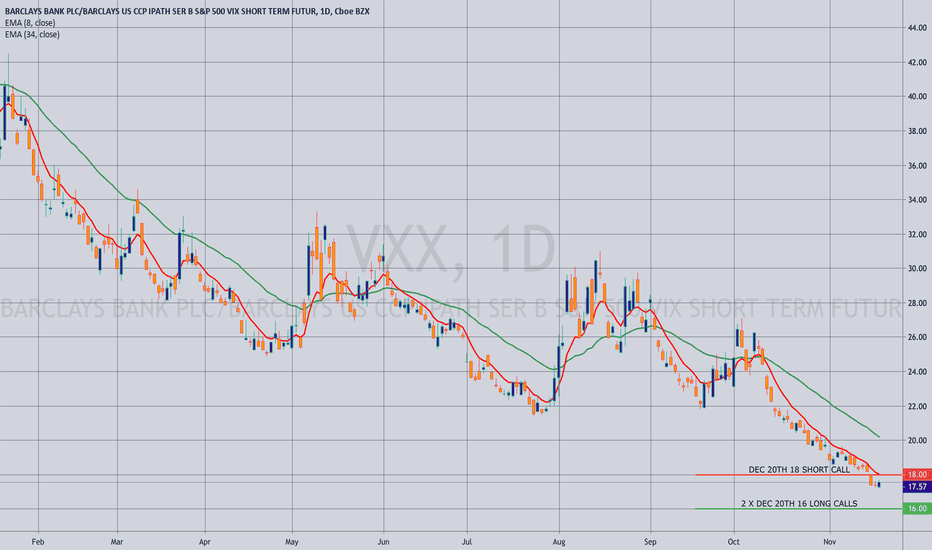

VXX

OPENING: VXX DEC 20TH 16/18 "ZEBRA"I've dicked around long enough waiting to put something on at or near VIX lows, and I like this particular setup here, although I obviously didn't catch things at VIX lows.

Metrics:

Max Profit: Undefined/Infinite

Max Loss: 3.03 ($303)

Break Even: 17.51 versus 17.57 spot

Delta: 98.9

Theta: -.83

Notes: With the classic "Zebra", you're looking for a setup in which the short option "pays for" all of the extrinsic in the longs, resulting in a break even at or below where the underlying is currently trading. Given the delta metric, you're basically in synthetic long stock. The max profit is "theoretically infinite," with the long call vertical aspect of the setup converging on max at >18 and the additional long call converging on an instrinsic value where the underlying is trading.

Naturally, a monstrous pop would be nice, but will probably money, take, run at the earliest opportunity. From a trade management standpoint, this is basically "unmanaged" -- i.e., it works or it doesn't ... .

Where to sell VXX hedgesMembers of Fundamental Trends recently took hedging positions using $VXX. Some own short-term VXX calls, others the VXX ETN. A very simple analysis of the VIX index shows that a target range for a rise in volatility would be about 18-25 on that index. Using simple Bollinger Bands and exponential moving average is all it takes along with a knowledge of history. Our plan is to start scaling out of positions by selling every couple points starting at 18 for VIX and the corresponding prices for VXX.

This was the prelude to opening this trade a week ago:

Hedging and shorting are incredibly difficult to do. That's not only due to having to be very good at picking spots, but the securities work against you the longer you hold.

For most people hedging and shorting is a bad idea. While you can hit home runs doing it, there are a lot of strikeouts. Think Dave Kingman if you're an old time baseball fan. He hit some home runs, but also struckout a lot. He was actually one of the first "launch angle" hitters without even knowing it. And, he did not end up in the Hall of Fame - like most short investors and hedge fund wannabes.

THE WEEK AHEAD: HD, LOW, TGT, GPS, M EARNINGS; /NG, VIX, VXXEARNINGS:

HD (24/21) (Tuesday Before Market)

LOW (68/35) (Wednesday Before Market)

TGT (66/37) (Wednesday Before Market)

GPS (60/53) (Thursday After Market)

M (97/67) (Thursday Before Market)

Pictured here is an M short straddle at the 17 strike in the December cycle, paying 2.73 with 14/72/19.73 break evens, and delta/theta metrics of -4.49/3.77. Look to put on a play on Wednesday before the end of the New York session.

In second place for ideal volatility contraction metrics is GPS (60/53). As with M, I would short straddle here, with the December 20th 18 paying 2.22 with 15/78/20.22 break evens, and delta/theta metrics of 1.29/3.06.

EXCHANGE-TRADED FUNDS:

TLT (42/12)

EEM (40/17)

SLV (29/20)

EWZ (26/27)

FXI (26/19)

... with the first expiry in which the at-the-money short straddle pays more than 10% of the value of the underlying: TLT, January '21; EEM, June; SLV, July; EWZ, March; and FXI, May. Both the rank/implied metrics, as well as the short straddle value metric indicate that it's probably a good time to hand sit on selling shorter duration premium here.

BROAD MARKET:

With VIX finishing the week at 12.05, volatility is at or near 52 week lows here in all the majors: SPY's in the 6th percentile; IWM in the 4th; and QQQ at 0.

The first expiry in which the at-the money short straddle pays greater than 10% of the value of the underlying: SPY, Sept; IWM, June; and QQQ, June. Both the rank/implied metrics, as well as the short straddle value metric indicate that it's probably a good time to hand sit on selling shorter duration premium here.

FUTURES:

/6B (63/11)

/NG (40/59)

/ZS (30/20)

/SI (29/19)

/CL (24/33)

As I may have mentioned last week, it's no surprise that /NG volatility is frisking up here. Generally, I play natty for seasonality, so look to get in with something bullish assumption at seasonal lows/peak injection, bail out of the long delta position in January or February depending on how Mother Nature feels, and then look to ride the elevator down in the opposite direction with a short delta position. I'm not keen on selling nondirectional premium (e.g., iron condors), particularly given what natty did last winter, so am sticking with my traditional, no-nonsense seasonality play.

Another item of note: GVX (gold volatility) has dropped substantially here, finishing the week at 11.22, in the 23rd percentile for the year ... .

VIX/VIX DERIVATIVES:

As previously mentioned, VIX closed the week at near 2019 lows (12.05), with the December, January, and February /VX contracts trading at 15.09, 16.60, and 17.50, respectively. Consequently, VIX term structure trades are still viable in the January and February expiries, but would probably beg off a December setup in the absence of a pop that runs that contract up to >16; the 16 strike is generally the lowest I will go with the short option leg of a VIX term structure trade.

As far as derivatives are concerned, this definitely isn't the place to be adding shorts. While it may be that VIX hangs out at these levels for a lengthy period of time, shorts are most productive on VIX pops -- not at VIX lows, even if contango and beta slippage are really working in shorts' favor here. As we all know, both the current steep contango and low VIX levels can evaporate in a heartbeat. If anything, this may be one of the rare occasions to consider a small bullish assumption trade (e.g., a VXX December 20th 15/17/17/19 "Super Bull,"* paying a .20 credit, with max profit/loss metrics of 2.20/1.80 and a break even of 16.80 versus the 17.40 where VXX is currently trading).

* -- A 15/17 short put vertical combined with a 17/19 long call vertical.

VIXY - Reversal Area - Bannana/Shoe PatternI have heard this pattern be called a "shoe" or a "bannana".

Downward straight trendline with curved supporting line (more than 3 points of contact).

Pattern repeats in VIXY chart as seen.

Bullish reversal is short 7-10 days.

We are currently in the bottom of the bannana, ready to breakout.

RSI shows wedge pattern as well, indicating breakout in RSI. We are close to all time low RSI.

I was able to use a bullish Put Credit Spread here for 5 contracts 12/20/2019 14/19 spread ($3.83 each) and take an upfront credit of $1925 for $575 risk.

IV is over 60 for both put options in the spread.

Theta works positively for us here and we should see VIXY spike during Christmas.

This trade has over 70% probability of success based on the numbers. Please see the videos below and do your own research.

For excellent free training on options (Options Industry Council) www.optionseducation.org

How Theta works positively for us as sellers - www.youtube.com

Bullish Put Credit Spread - www.youtube.com

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY and short AAPL.

THE WEEK AHEAD: CRON, TLRY, CGC EARNINGS; EWZ; VIXHIGH RANK/IMPLIED EARNINGS:

CRON (32/82) (Tuesday Before Open)

TLRY (50/97) (Tuesday After Close)

CSCO (44/27) (Tuesday After Close)

WMT (48/23) (Thursday Before Open)

NVDA (24/43) (Thursday After Close)

AMAT (17/34) (Thursday After Close)

CGC (95/87) (Thursday Before Open)

JC (30/43) (Friday Before Open)

Notes: Looks like it's the "Week of Weed" with CRON, TLRY, CGC announcing and all in states of high implied/high rank ... . If you're hesitant to go into single name here, MJ (47/51) has decent rank/implied metrics, although it's less liquid than I would like.

EXCHANGE-TRADED FUNDS:

TLT (56/12)

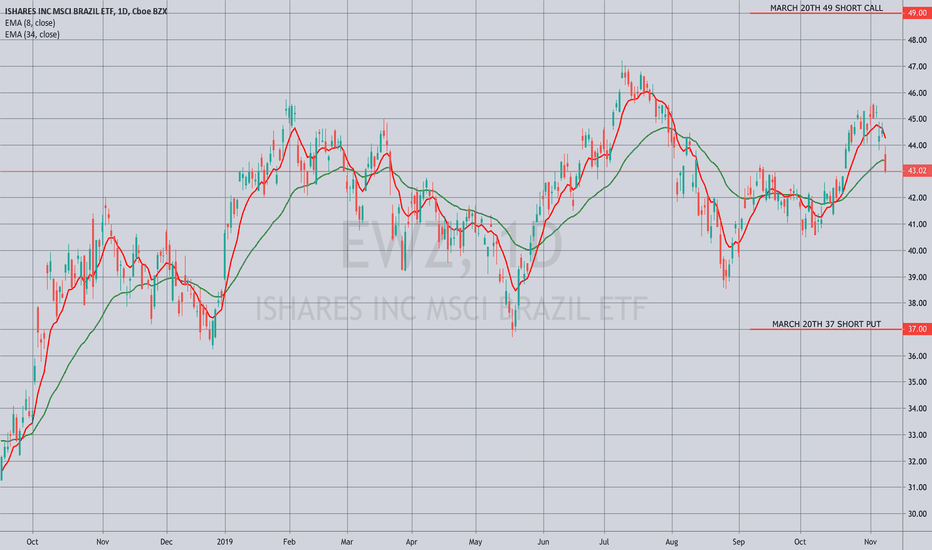

EWZ (47/28)

SLV (44/22)

GDXJ (37/31)

GLD (34/11)

EEM (33/16)

First Expiries In Which At-the-Money Short Straddle Pays >10% of Stock Price:

TLT: January of '21

EWZ: March: 5.64 verus 43.02 (13.11%)

SLV: April: 1.72 versus 15.70 (11.0%)

GDXJ: January: 3.99 versus 36.33 (11.0%)

GLD: January of '21

EEM: June: 4.97 versus 43.68 (11.4%)

Notes: Pictured here is an EWZ delta-neutral short strangle camped out at the 20 delta in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. Paying 1.61, it has break evens of 35.39/50.61 with delta/theta metrics of -.36/1.49; .40 at 25% maximum; .80 at 50%.

BROAD MARKET:

Broad market premium selling simply isn't paying here in short duration (an understatement).

FUTURES:

/6B (72/9)

/NG (74/60)

/SI (44/21)

/GC (34/12)

/ZS (32/20)

Notes: Natty is frisking up, which should be no surprise. Having put on a bullish assumption seasonality play in UNG way back in August at lows, I'm just waiting for things to top out in January or February before doing something in the other direction.

VIX/VIX DERIVATIVES:

Term structure trades* in VIX remain viable for the December, January, and February expiries with the correspondent futures contracts trading at 16.05, 17.33, and 18.07 respectively.

On the other end of the stick, continue to consider a VXX Super Bull or similar setup to potentially catch a modest volatility expansion running into the end of the year without sticking your entire pickle in the grinder, particularly if VIX continues to trundle along at 2019 lows: the December 20th 16P/-18P/18C/-20C pays a small credit (.17), has a 17.83 break even versus spot of 18.64, and max profit/max loss metrics of 2.17/1.87, with max being realized on a finish above 20, which does not exactly require a massive pop from here.

* -- Generally short call verticals with break even near where the correspondent /VX futures contract is trading (e.g., the December 20th 15/18, paying .90, with a 15.90 break even versus the December /VX contract trading at 16.05; the January 22nd 16/19, 1.00, with a 17.00 break even versus 17.33; February 19th 17/20, with an 18.00 break even versus 18.07).

TRADE IDEA: VXX -16P/+18P/+18C/-20C SUPER BULLI'm not hugely fond of going long volatility, particularly in an instrument that gets routinely battered by contango and/or beta erosion.

With VIX closing in on its 2019 low, however, it may be time to consider one.

Pictured here is a VXX "Super Bull" made up of a 16/18 short put vertical and a 18/20 long call vertical. As of Friday close, it pays a small .11 credit, has a 2.11 max profit, a 1.89 max loss, and a break even of 17.89 versus 18.87 spot, with max profit assuming a finish above 20.

You can also go smaller -- the 17/18/18/19 pays .07, has a max profit of 1.07, a max loss of .93, and a break even of 17.93.

Look to manage aggressively starting at 25% max ... .

$VXX So looks like it might bounce up to $28 which is about where the EMA50 on the weekly time frame. Do you use the EMAs? I have set mine to 20 and 50 as there is a lot of price action interaction with these settings. (EMA - exponential moving average)

Also I have no fucking idea how this instrument works, im just noticing a pattern with that EMA which would be my target (to ride to that EMA or last high or low or S/R line. Generally thats how i set my targets

The market looks good until this hits 10Good day folks,

VXX is trading in a range from 10 to 55. The RSI is falling and the VI is bearish. 30 was tested a few time and couldn't hold, so I believe VXX will continue to fall until it reaches 10. Ofcourse, if it reaches this price I will load a few shares.

Volatility falling, I think the US market will continue to rise for the next few months.

Thank you,

Two alternatives to trade $VIXVIX Alternatives:

The chart shows two investable alternatives to trade the $VIX, these assets are $TVIX and $VXX.

FOMC tool - 40% NO-CUT Using the FOMC tool, we see a:

25 basis points rate-cut --> 58.8%

NO rate-cut --> 41.2%

To get these rates:

www.cmegroup.com

Tomorrow's volatility will surely grow, even if the FOMC cuts rates; with these percentages, we can expect J. Powell to suggest no more cuts in the future.

You can also expect Trump to fight this, hard.

**FOMC meeting to take place in 26 hours.

Double Breakout Setup for Volatility ProductsVXX, VIX, TVIX, VIXY, etc all consistently banging against a descending diagonal trend line, meanwhile also printing an inverse head & shoulders pattern. A break above neckline or DTL suggests a massive move higher for volatility, which spells trouble for equities and indices.

THE WEEK AHEAD: BIDU EARNINGS; GDXJ, EEM, VIX/VXX/UVXYEARNINGS

BIDU (97/55) announces earnings on Monday after market close, so look to put on a play in the waning hours of the New York session ... .

Pictured here is a September 80/120 short strangle paying 1.65 as of Friday close with delta/theta metrics of 1.57/8.07. You can naturally go defined risk, but you'll have to go in a smidge tighter with the shorts to collect one-third the width of the wings and being surgical with your strikes will be tough with 5-wides in that expiry. The September 20th 80/85/110/115 is paying 1.62 with delta/theta metrics of .26/3.20.

EXCHANGE-TRADED FUNDS

Precious metals keep on grinding in a high implied volatility state for yet another week, with the ideal rank/implied metrics remaining in GDXJ and nearly ideal ones in GDX:

GLD (80/16)

GDXJ (77/38)

SLV (77/25)

TLT (76/17)

GDX (72/33)

BROAD MARKET

EFA (53/17)

EEM (52/22)

IWM (36/22)

SPY (35/18)

QQQ (27/22)

Since I don't have anything on in EEM, I may consider putting on something longer-dated there. Using the delta neutral at-the-money short straddle test and looking for a setup that pays greater than 10% of the value of the underlying, it looks like I would have to go out to January where the 40 short straddle is paying 4.54 versus 39.54 the shares were trading at as of Friday close.

The January 17th 40 short straddle pays 4.54 with break evens at 35.46/44.54 and has delta/theta metrics of 1.96/1.13 and a 25 max of 1.13; the 16 delta 34/44 short strangle pays 1.05 (.52 at 50 max) with break evens of 32.05/45.05 and delta/theta metrics of -.15/.86. I'm fine with either, but there's something to be said for having room to adjust without going inverted with the short strangle.

VIX/VIX DERIVATIVES

VIX finished Friday at 18.47 with the /VX term structure still in backwardation from September to December, with the August contract settling next week.

I will continue to look to add at-the-money bearish assumption setups (short call verticals or long put verticals) in VIX in the front month (September) should we get additional pops to >20 and/or the same type of setup in UVXY and VXX using VIX levels as a guide. As of Friday close, the VIX September 18th 18/21 short call vertical was paying 1.10 at the mid with a break even of 19.10 versus 18.47 spot, but will probably wait for another pop to >20 to put on a similar setup.*

* -- Short call verticals: short in the money, long out of the money, paying one-third the width of the spread. Long put verticals: short out of the money, long in the money, paying less than one-third the width in debit. Short call verticals with the same strikes as a long put vertical have the same risk, so it's a matter of taste and/or the practicalities of having a bunch of different plays on in the same expiry as to which you use. For example, you can layer on same strike long put verticals over short call verticals without inadvertently "stepping on" the short call verticals you have on. As compared to VIX options -- which settle to cash, with UVXY and VXX, there's naturally some assignment risk, so I lean toward short call verticals in those particular instruments, since I'd rather be short shares if assigned.

THE WEEK AHEAD: ROKU EARNINGS; GDXJ; VXX, UVXYA real quick and dirty here between checking off items on the honey-do list ... . Here's the cream of the crop:

ROKU (83/94) announces earnings on Wednesday after market close and with rank/implied greater than 70/50, it's an ideal play for volatility contraction post-announcement. The pictured setup is a September 20th 75/80/135/140 iron condor, paying 1.67 at the mid price (one-third the width of the wings). Look to take profit at 50% max (.83/$83 assuming a mid price fill).

Taking the top spot again this week for rank/implied among the exchange-traded funds is GDXJ (92/37) with the >70% probability of profit September 20th 36/45 short strangle paying 1.31 (.75/$75 at 50% max) and delta/theta metrics of 2.02/3.16.

Lastly, with the pop in volatility last week, consider a bearish assumption play in either VXX or UVXY (i.e., either short call verticals or long put verticals) with the short leg in the money, the long out and that pays at least one-third of your spread in credit (or for which you have to pay less than two-thirds the width in debit). For example, the VXX Sept 20th 25/27 short call vertical is paying .67 at the mid price with a break even at 25.67. Conversely, the VXX Sept 25/27 long put vertical costs 1.36 to put on with a 25.64 break even and a max profit potential similar to that of the same-strike short call vertical (.64/$64). For the bolder at heart, the VXX Sept 22/24 long put vertical costs .95 to put on, making it a risk one/make proposition on the notion that volatility implodes fairly quickly back to its pre-pop levels, taking the VIX derivatives with it.