Voyager Therapeutics' ($VYGR) Breakthrough

In a groundbreaking move within the biotechnology sector, Voyager Therapeutics recently announced a strategic licensing deal with Novartis, catapulting its shares up by an impressive 35% in premarket trading. The collaboration involves Novartis making an upfront payment of $100 million to gain exclusive access to Voyager's cutting-edge RNA-based screening platform and to advance a promising gene therapy candidate targeting Huntington's disease (HD). This alliance not only signifies a significant financial boost for Voyager but also opens up a pathway to revolutionize the treatment landscape for Huntington's disease.

Key Deal Highlights:

The $100 million upfront payment from Novartis is a testament to the immense potential perceived in Voyager's technology and the promising gene therapy candidate currently in the pre-clinical stage for Huntington's disease. As part of the agreement, Voyager stands to receive substantial milestone payments, amounting to up to $1.2 billion, reflecting Novartis' confidence in the successful development and commercialization of the therapy. Furthermore, Voyager is entitled to tiered royalties on global net sales of products utilizing its RNA-based screening platform, providing a long-term revenue stream.

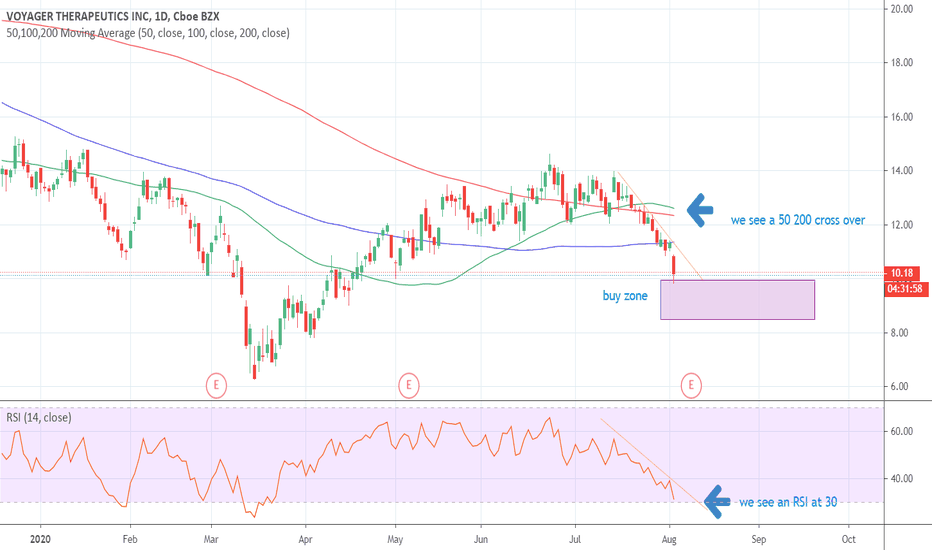

Technical Analysis Signals Positive Momentum:

From a technical analysis perspective, Voyager Therapeutics has broken through the ceiling of a falling trend channel in the medium to long term. This breakout suggests a potential shift in the stock's trajectory, signaling either a slower descent initially or the initiation of a more horizontal development. The stock currently finds support at $8.00 and faces resistance at $10.80. Positive volume balance indicates a strong presence of aggressive buyers, while sellers appear to be more passive, further strengthening the stock's position.

Why Buy Voyager Therapeutics Stock Now:

1. Strategic Partnership: The collaboration with Novartis positions Voyager as a key player in the gene therapy space, validating the potential of its RNA-based screening platform.

2. Financial Boost: The $100 million upfront payment and the possibility of up to $1.2 billion in milestone payments underscore the financial viability and growth potential of Voyager Therapeutics.

3. Huntington's Disease Focus: With a gene therapy candidate specifically targeting Huntington's disease, Voyager is addressing an unmet medical need and contributing to advancements in treating genetic disorders.

4.Technical Breakout: The technical analysis signals a positive momentum shift, suggesting a potential upward trend. The stock's support at $8.00 and resistance at $10.80 provides a clear framework for potential gains.

Voyager Therapeutics' recent licensing deal with Novartis has injected new life into the biotech firm, sparking optimism among investors. The financial infusion, strategic partnership, and positive technical signals make Voyager an attractive prospect for buyers seeking exposure to the rapidly evolving field of gene therapy. As the company advances its pre-clinical gene therapy candidate for Huntington's disease, investors stand to benefit from the potential growth and transformative impact of this collaboration on the future of genetic disorder treatments.

VYGR

VYGR - Buying zones or Falling knife?VYGR has been showing for a while that the momentum is dying.

Although MACD may show some signs of reversals in coming weeks but since BTC doesn't look very strong as of now, I could deduce that it will have some effect on VYGR.

The VPVR on the right side is showing the same as there has not been much volume traded between here and $9 level.

Let's hope it bounces from here, if not, then the next level of support is between $8 - $9

Currently, it is at a good level to add some amount if you are doing dollar cost average but frankly I would rather wait to see the reversal in the pattern.

I wouldn't want to catch a falling knife.

voyager therapeutics could jump up on another surprise earningsVoyager therapeutics could jump up on another surprise earnings

The 50 day Moving average is below the 100 and 200 day moving - volume is up

and earnings have amazing earnings up 60% and 1300% these last few quarters so.... it might turn around - I am not buying at this price though.

How long can you out perform with your stock falling ?

I don't know.

Voyager will liftoff soonVYGR has reached a strong support area while the RSI has had higher lows indicating accumulation. The MACD is also increasing and is almost positive.

Expecting the price to increase steadily soon.

Look out for the bull cross of EMA9 of EMA21. This will accelerate the price rise.

The next earnings are on Feb 26.

Seismic shift incomingDark pools may be responsible for recent overselling w/2 near-term catalysts: 4/25 (presentation of its Phase 1b PD drug results at AAN Annual Meeting), 5/11 (earnings). Its PD (VY-AADC01) will shake the market if its phase 1b results can be replicated. Price should correct to $14-15 after a couple weeks. NASDAQ:VYGR