VZ

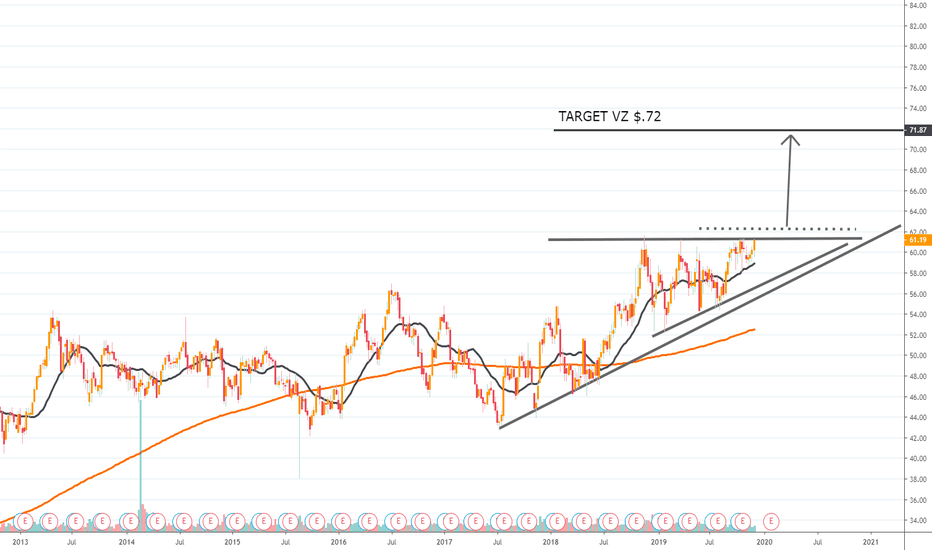

VERIZON COMMUNICATION (VZ): Reversal Clues

hey traders,

it looks like the breakout above the previous structure high in December was false!

the market was trading about 1 week above 61.0 resistance and then dropped.

Now it looks like the market is forming a classic reversal pattern - head and shoulders pattern.

currently, the price is completing the right shoulder.

I suggest setting the alert below the neckline level.

Being broken it gives us a perfect selling opportunity.

key levels will be 55.55 / 53.0

VERIZON - DAILY CHARTHi, today we are going to talk about the Verizon Communications Inc. and its current landscape.

Verizon Communications Inc. enters in the spotlight of the market as T- Mobile has announced that John Legere will leave the seat of CEO of the company, been replaced by Mike Sievert in April 2020. The former CEO that has been leading the company since 2012 will remain a member of the board. Its replacement Mike Sievert is the current president and chief operating officer (COO). The transaction period seems set to be smooth as Legere will assist with the acquisition process of its rival company Sprint, that it's controlled by Softbank that also holds control of WeWork, where Legere its quoted to be the new CEO. The acquisition of Sprint (an $26 billion deal) makes the T-Mobile step up its potential of competition in the Telecommunications Sector, possibly imposing a reducing of market share for Verizon Communications Inc.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

Daily VZ forecast timing analysis by Supply-Demand strength21-Jun

Investing strategies by pretiming

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: About to begin a rebounding trend as a downward trend gradually gives way to slowdown in falling and rises fluctuations

Today's S&D strength Flow: Supply-Demand strength has changed from a strong selling flow to a suddenly strengthening buying flow.

View a Forecast Candlestick Shape Analysis of 10 days in the future: www.pretiming.com

(You can easily create a trading plan.)

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ -1.2% (LOW), -0.8% (CLOSE)

%AVG in case of rising: 0.9% (HIGH) ~ -0.5% (LOW), 0.5% (CLOSE)

%AVG in case of falling: 0.3% (HIGH) ~ -1.6% (LOW), -1.3% (CLOSE)

Price Forecast Timing Criteria: Price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

VZ with Mixed Fundamentals and Weak TechnicalsFundamentals:

Verizon reported earnings for Q1:

EPS for 2018-Q1: 1.17

Estimated EPS before earnings: 1.17

Actual EPS: 1.20 a

Surprise: + 2.56%

Revenue stayed at 32.1B, barely missing consensus.

Technicals:

RSI(14) @40.5, reaching lower lows (specifically on the following dates: 2-apr,9-apr,17-apr,23-apr)

SRSI(14) @0

MACs @.26 > MACD @.01

CCI(10) @-200

Resistance level: 60.8

Support level: 53

I would be very cautious trading this. Wait until CCI(10) reaches -100, and RSI above 56 to go LONG.

VZ: Defied Dow sell-off Friday with pre-earnings runVZ was one of the 4 Dow 30 components that defied the huge DJIA sell-off on Friday.

The communications company is riding higher on 5G technology coming to market and has a pre-earnings run underway, which means the stock is on the radar of the pro traders.

IHS potential VZ - Bullish to $64 rangeVZ has a bullish Inverted Head and Shoulder formation that could potentially see price move as high as $70.00

expect some sideways action next few weeks, with a clear break after.

tight stop loss maybe a good idea to practice here, market looks on edge of massive correction.