BTC/USDT DIVERGENCE AND FALLING WEDGEBy Completing The Falling Wedge Lattern We expect the price to cross over 40k and 41k Retraces

Beside the Chart pattern Confirmation for Increasing The Market Cap of BTC

We have a divergence In Relative Strength Index Indicator which is a sign For Breaking out 40k Retracement.

This is not Financial Advice

W-patterns

CADCHF Watching For A Buy TradeHey Purpose Trade

I pray all is well with you today. Let's talk about CADCHF. CADCHF is creating higher highs and lows on the daily timeframe. I do not want to sell against this trend on the daily timeframe so I am anticipating a buy as long as price can stay above 0.74733.

No sells are in my view on this pair. My next Take Profit will be back up to daily highs and beyond. This will be a short term swing trade I will hold for a few days.

Thank you for taking the time to read my analysis. If you have questions or care to comment feel free to do so. Please be kind as kindness is free and good for the heart.

Safe trading this week.

-----------------------

Beware of scammers impersonating me. I will never contact you first on my official platforms to sell you anything. Nor do I ask for you to open an account and deposit money for me to trade. I am an educational educator only.

XAUUSD - GOLD - At critical level!!A look at OANDA:XAUUSD this week and we find that we are still looking for more down side.

There has been a 120+ point drop into 1872 and the first decent rally back has seen it stop right on the 382 and fall away into the 50-61.8% area from that rally. We are now at the point where we have 2 options.

1. It continues lower from here towards 1820-1830 completing the bigger pattern @ the 61.8% level from last years August low.

2. It bounces up from here back to the 1950 area where it would turn to create another ABCD pattern finishing at the 1820-1830 area again.

The other option is that we break those levels and head towards the high 1700s, but I will look at that later once we get the info in to make that call.

Also on May the 9th there is a Major CIT window which is likely to decide the direction for the rest of the month. So a move up into that time would start the move lower and a move lower into that date would see a reversal higher.

Something to keep an eye on over the coming weeks.

I hope this helps. Enjoy the week!! 👍👍

Market Unpredictability This is a perfect example of the market sometimes not going your way. I shorted on the first bearish flag thinking of course that this is one of the strongest indicators of market direction and I got burned (lost a little money). My mistake: Not looking for other signals. In this case the 20ema crossed over 50ema sending the price up. Sometimes you have to look at more than 1 indicator or pattern, this isn't always the case but it is better to have 2 signals than one.

The second time both the indicator and chart pattern aligned perfectly together and as a result the market dropped as expected.

I want to be clear that you should never jump back in so fast in a trade, personally after a loosing trade I step back for a day or two or trade another pair. But in this case the analysis was strong and it led me to some profits.

The market is always going to do what it wants, all we can do is analyze, prepare our risk management and execute.

Bitcoin Pump - What does this mean for BTC?Hello Traders!

First off, If you have any questions feel free to comment or message me. I know trading can be difficult and I would rather you message me about a trade setup than make a mistake and lose out. I'm pretty good about replying so I'll try and get back to you as quick as I can!

**As I'm sure you are aware, Bitcoin had a nice pump today from the $38K region almost up to $41K at the time of this post. And I bet you're wondering what the heck does this mean for BTC?!

- Well the truth is, we really don't know yet...

- With trading you want to see clearly defined chart formations, patterns, directional bias, levels hit, etc. As of right now on the micro we really don't have a clear picture.

- It's hard to make a high probability prediction for the micro when BTC is ranging like this.

**So then how to we make an accurate prediction in a situation like this!?

- When you have no clear direction bias on the micro, the easiest way to try and make sense of it all is to zoom out and take a look at the Macro time frame.

- Look at the 4 Hour and/or Daily chart and analyze the chart from the macro perspective.

**What's next for BTC?

- Zooming out we can see that BTC has been in an overall downtrend, creating lower lows along the way.

- This morning BTC was sitting below the support level it's been trading on for the past week or so, it broke above today (which is bullish) however if it closes back below it on the daily that is another bearish signal.

- Since January on the macro BTC has been trading in a Bear Flag formation (Bearish) and since the $48K high a couple weeks ago has been nearly in a non stop downtrend. - 16 of the last 19 days have been Red!

- Without going into too much more detail, the fact remains... the probabilities favor further downside continuation.

**Now it's possible that BTC continues this rally for a couple more days, but until the 50MA + the $43K local resistance is broken and confirmed above, BTC is Bearish and expect downside continuation.

^^Possible Position Entries^^

- Right now I am not in any open positions, I'm waiting to see what happens over the coming days.

- 2 Levels that I have my eyes on are the $43K resistance for a possible short, and the $37K support for a possible long.

--Final Note--

- The analysis that I do are for the current market conditions at the time of creating the posts. The market changes on a daily basis and so do the trades/setups that I post. I will try to start and add any invalidating factors or create an update post for any trade setups that are no longer valid.

Best of Luck Trading!

US30 - BreakdownUS30: My bias on US30 is short markets. This idea is supported by the Corrective Phase that we are currently trading in, in the W1 timeframe down to the D1 timeframe. On the H4 timeframe, I'm able to see even a much more more bigger structure, as I've applied pattern separation; I am able to see that price has broken the middle section and shooting for the lowest low. However, I'll only participate in this trade when the market presents for me a correction in form of a continuation pattern.

Like, and Comment your thoughts !

ETHUSDT is testing the weekly support The price bounced to 0.618 Fibonacci level on the daily timeframe (2900) and now the market is testing the previous daily support case for new resistance.

on 4h Timeframe, the price created two M patterns and the price is testing the second neckline above the 3100

How to approach?

IF the price is going to lose the weekly support and retest it as new resistance According to Plancton's strategy , we can set a nice order

Be aware to False breakout

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

Ethereum Bearish Case - Next Target $2,700?Hello Traders...

Here is my technical analysis for Ethereum.

-1st) As you know ETH's performance depends upon BTC for the most part. In the short term I'm expecting BTC to bounce to $42,300 roughly. In which case ETH would probably bounce as well and invalidate this TA. But in the case that BTC does not bounce and drops to $36K-$37K, the probabilities favor ETH following this trajectory.

-To start, ETH played out the bear flag I spoke about the other day beautifully, exactly as expected. That but only confirmed ETH's bearish momentum. There are many more signals that are giving me the opinion that the next target for ETH will be about $2,700.

-I won't go into too much detail, you can view my notes on the chart above. The main things to note are:

1) ETH has been trending between a descending channel. If this trend continues it will lead straight to that Major support at $2,700.

2) ETH closed below the EMA 50 which is a strong Bearish signal.

3) ETH closed below a minor support line. The fact that support line didn't hold and ETH easily broke through signals that the bears are in control.

4) Lastly, there really aren't any strong support lines between where price is now and $2,700. If ETH starts to trend down there will be nothing major to stop ETH from hitting the $2,700 level. Once the bears take control it won't be difficult for them to drive price down until the bulls step back in at the $2,700 major level.

-Either way however ETH gets there I"m expecting it to hit the $2,700 level in the near future.

-What can we expect from ETH at that level?

-More than likely I will open a long position once ETH hits that level. The probabilities should favor ETH getting at least a 5% - 7% bounce and potentially more.

Happy Trading and Good Luck!

How To : Chart Formations Critical Second Top & Bottom Entry Hi Traders and Investors

This video is a follow up from my previous posting dealing with shifts of momentum.

This time we are looking to add an additional synergy - the second touch in a chart formation - which can be found in Double Tops, Double Bottoms and head shoulder formations. Correctly using the second touch on the chart formations has allowed me to avoid many mistakes in my evaluating my trades and I hope that it will help you in evaluating your trades.

When you look at the Double Top and Double Bottom chart formations, you will notice that high frequency trading and algorithms trading will often create the formation of a second top to the same level as the first top or slightly higher by taking stops pilling at the first top . At this point, you want to wait for the synergies to come into play and use your tools to look for a shift in momentum on the 2nd top touch see video.

Waiting for the shift in momentum to occurs after the second touch, is a critical piece of of information that will prevent you from taking trades that are likely to be stopped out on the first test.

Hope it helps have a great week end

Marc

#BTC/USDT 1D UPDATE BY Trader_SL #BTC/USD Chart Update

2022/04/13

1D TIME FRAME

As you see in the chart, BTC is trading inside a rising channel and currently sitting at the lower level of the channel. In the past scenarios, we have seen BTC bounce many times after hitting the lower level of this channel also we can see Bitcoin now is with hidden bullish divergence So I'm expecting a bounce in the market from this level and making another Higher low.

If any daily candle closes below this channel then this scenario becomes invalidated. Let's see. I'll update you.

This is not a piece of financial advice.

Do hit the like button if you like it and share your charts in the comments section.

Thank you!

XAUUSD Overall Bullish

Good Afternoon traders we are looking for the massive pennant formation to continue to the upside.

Will be looking to add additional positions around g 1940-1942, looking for gold to move into the 60's and potentially the 80's depending on how we see it react once reaching 1960.

As always trade proper RR live to trade another day. Let's make some money guys.

Thank you for watching.

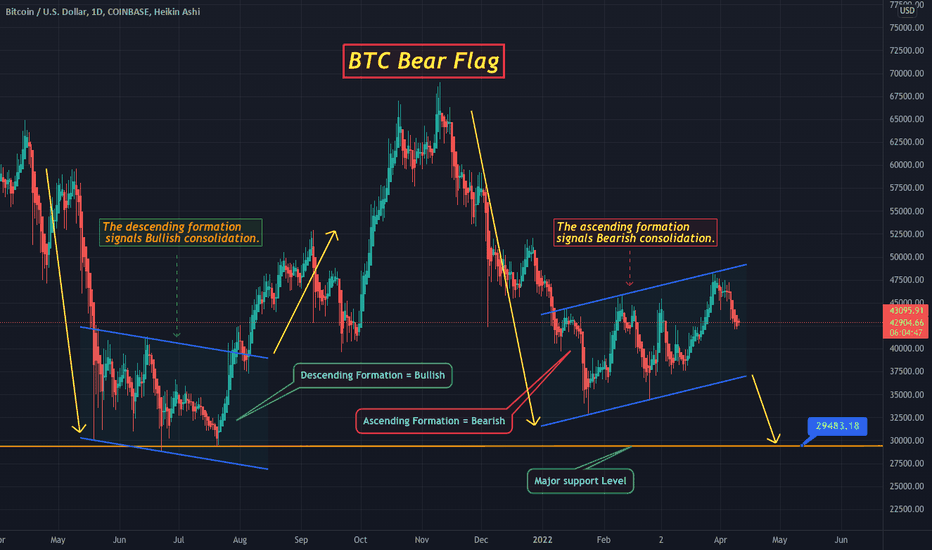

Bitcoin Bear Flag - What this means for Bitcoin's Future...Hello Traders,

Today I will be discussing the formation of a Bear Flag and what this means for Bitcoin.

- As you can see on the chart BTC has been consolidating in an "Ascending" parallel channel since January.

1) An ascending formation is typically a Bearish signal.

2) In conjunction with the downtrend from the highs at $69K in November, this creates a bear flag.

- Now I'm sure some of you may be wondering... Well BTC consolidated last year in a channel before the massive pump to $69K, so won't Bitcoin do the same this time? - The answer is no.

- Last year Bitcoin consolidated in a "Descending" channel which is typically Bullish.

- As expected BTC pumped coming out of that Bullish consolidation.

- This time BTC has created a Bear Flag and has a much higher probability of continuing lower before hitting previous ATH's.

So what does this mean for BTC? Here are the 3 possibilities I see playing out..

1) (Highest Probability) BTC retests the $36K support level

2) (Medium Probability) BTC retests the $29K support level

3) (Lowest Probability) BTC retest the $20K support level.

I want to emphasize... Patterns have a certain probability of playing out. Bear flags have a relatively high probability of playing out and BTC has formed a textbook Bear Flag. This means the probability of BTC breaking down and even hitting $20K are still relatively high. Sometimes you have to zoom out and look at the bigger picture. I'm sure a lot of you will be discouraged by this, but think of how incredible it would be to accumulate BTC back at $20K!?

Good luck everyone and happy trading!

BTC for funThis is the same chart I posted earlier

I've watch more times like this that I can count, I thought it might be fun to see if I could predict how it would move.. (there's no doubt that the chart will have inaccuracies)

This chart isn't in any way to be taken very seriously or traded around.. Just seeing how accurate I can get, and posting this publicly gives me added pressure....

Good luck and best regards

The BTC Bart Sucks - We have better things to do with our timeDid you have been there the BART (Simpson pattern) of course bitcoin isn't new to the game on this pattern, probably as old as time itself (not scientific, don't sweat me chart champions :)

... ultimately it's the "Gartley Classic 22" pattern.. You end back where you started... if I wasn't trading with sinful amounts of leverage I wouldn't care at all..

(really care with leverage either-- other than I have to pay constant focused attention to what's happening)

XABCD Pattern, Short trader with good probabilityThis pattern indicated that the NZD/JPY could drop nicely this week, looking at the daily chart, and it could bring some decent profits.

But of course, this is just basic technical analysis.. 100% accurate, detailed, and precise trades are forever available to our wonderful clients.

We will update the idea on our blog's analysis section so we can help you remove stress and risk from it :)

Trading by yourself carries a ton of risk, it's best to leave it to professionals to handle the risk for you.

Bank nifty long position Hi Everyone... Hope you all are doing good....

So let's talk about today's trade as you all know from last few days market gives us a gap up opening and after opening market moves in a short range....

So how we have to work in banknifty let's see...

Conditions...

1. There is a strong resistance at the level of 36600 so if banknifty break this level and give us closing above the level then go for the CE and the tragets are 36800, 37000 and the last one is 37300

2. If banknifty breaks the previous day low which is 36300 then go for the PE and the target is 36100, 36000 and the last one is 35800

Hope you all are understand the levels and please follow and like for daily updates.

GBPUSD : STRONG BULLISH MOVE

Hello traders.

GBPUSD had created a beautiful M structure previously and now has retested (Retraced to) the neckline of the M structure and shown above.

Rejection of the necklines, shows a clear and strong indication of continuing bullish movement.

Short your positions from MO day session opening and hold it for a long period of time with Targeted price 1.27555