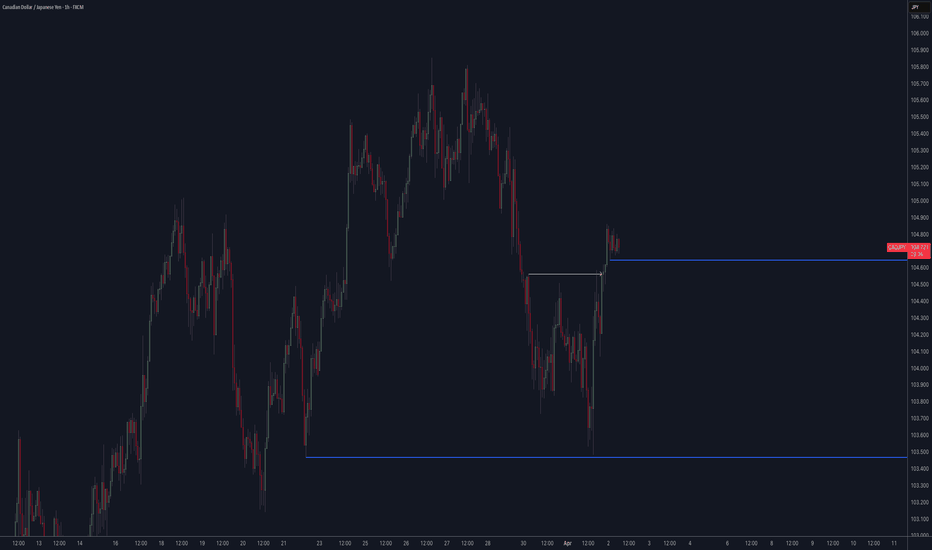

W-patterns

USD/JPY - What to expect as price consolidates above support?Introduction

The USD/JPY pair has been in a clear daily downtrend, marked by a bearish market structure and strong downside momentum. Sellers remain firmly in control, consistently driving prices lower as the pair respects the prevailing trend. Each failed recovery attempt only reinforces the bearish structure, suggesting that the path of least resistance continues to be to the downside.

FVG

Following the most recent drop, the pair is now consolidating just above a key support level. A short-term relief bounce toward the 4-hour Fair Value Gap (FVG) wouldn't be unexpected. This particular FVG, formed during the last leg down, remains unfilled — and such gaps are often revisited before the trend resumes.

Confluences

Notably, this FVG aligns with the Golden Pocket Fibonacci retracement zone (0.618–0.65), adding further confluence and making it a potentially strong resistance area. If price does retrace into this zone, it could face significant selling pressure and resume its move back toward the daily support zone.

Conclusion

While a bounce from daily support is possible, I expect USD/JPY to encounter resistance at the 4H FVG level. This could cap any recovery attempts and signal a continuation of the broader bearish trend.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Learn These Patterns And You'll Never Regret ItEVERYTHING ON THE TRIANGLE PATTERN

a triangle chart pattern involves price moving into a tighter and tighter range (like a consolidation phase which has a triangle-like shape) as time goes by and provides a visual display of a battle between bulls and bears.

The triangle pattern is generally categorised as a “continuation pattern”, meaning that after the pattern completes, it’s assumed that the price will continue in the trend direction it was moving before the pattern appeared.

note: the triangle pattern depends on the trend however don't hold on to that thought since fake-outs are possible. the point i am trying to make is that you should not be obsessed with which direction the price goes, but you should be ready for movement in either direction.

there are three triangle patterns:

a) the ascending (upward slope consisting of higher-lows and a consistent resistance),

b) descending (downward slope consisting of lower-highs and a consistent support)

c) symmetrical (equal slopes the market is forming lower-highs and higher-lows)..

the triangle is different from a wedge. however, a wedge can be in a triangle or better put the general formation of a wedge is a triangle-like shape (in some cases).

point to note:

• you need at least two points (bullish or bearish) to connect for a triangle to be considered, and a consistent support or resistance.

• the volatility of price of any instrument decreases when there's a triangle pattern and increases on breakout of the pattern.

• measuring the size of the triangle can serve as a good profit target (will explain in meeting)

• keep an open mind at all times.

📝..

OptionsMastery: This is the "h" DayTrading Pattern.This is the "h" pattern. A highly successful daytrading pattern!

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

USD/JPY - Bearish breakdown signals further downside potential!The USD/JPY pair has been experiencing a clear daily downtrend, characterized by a bearish market structure and strong downward momentum. Sellers have remained in control, pushing prices lower as the pair continues to respect the prevailing bearish trend. With each failed attempt at recovery, the market structure reinforces the dominance of sellers, signaling that the path of least resistance remains to the downside.

Despite this overall downtrend, the 4-hour timeframe recently exhibited a rising channel, where price action formed higher highs and higher lows, suggesting a temporary bullish retracement within the larger bearish structure. However, this channel has now been broken, signaling a potential shift back toward the primary trend. A break of this nature often suggests that the bullish correction has exhausted its strength, and sellers are regaining control to push the price lower once again.

Following the breakdown of this rising channel, the price has failed to reclaim previous highs, instead forming a lower high—a strong indication that bearish pressure is resuming. Given this development, there is a significant possibility that USD/JPY could retrace toward key technical levels, such as the Golden Pocket (between the 0.618 and 0.65 Fibonacci retracement levels) or even the 4-hour Fair Value Gap (FVG) around 145.00.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

BTC Weekly Chart Update📉 CRYPTOCAP:BTC Weekly Chart Update

It looks like a double top pattern is clearly forming on the BTC weekly chart — and honestly, doesn't it remind you of a similar structure we’ve seen before? 👀

Patterns like these often signal potential trend reversals, so this is definitely a chart to watch closely.

Do you see the similarity with the previous one? Let me know your thoughts in the comments 👇

🔴 Bearish scenario could continue unless we break above key resistance.

EURO - Price can exit from pennant and drop to $1.0650 pointsHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some time ago price made strong upward impulse and broke several resistance levels on its way to the top.

Then it started to consolidate and formed a pennant pattern with a series of lower highs and higher lows.

Price touched upper boundary of the pattern and bounced down, showing weakness near resistance zone.

Recently Euro broke through the pennant support and tested $1.0790 level from above with no strength.

Now it trades slightly above the breakout point and stays below key trendline and local resistance area.

In my opinion, Euro can continue to decline and reach $1.0650 support level, exiting from pennant in the coming days.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

EUR/USD Weekly Forecast: Rising Wedge Breakdown & Bearish TargetChart Overview:

The provided EUR/USD daily chart displays a well-structured Rising Wedge pattern, which eventually led to a significant bearish breakdown. The analysis highlights key levels, including resistance, support, stop loss, and a downside target, all of which contribute to a well-planned trade setup. The market structure suggests a strong bearish continuation, targeting lower price levels based on technical projections.

1. Chart Pattern: Rising Wedge Formation & Breakdown

A Rising Wedge is a bearish reversal pattern that forms when price creates higher highs and higher lows, but the slope of the trendlines indicates weakening bullish momentum. This pattern is often a signal of upcoming bearish price action once a breakout occurs.

Pattern Breakdown Analysis:

The price moved inside the wedge, showing a gradual upward trend with declining momentum.

Upon reaching a key resistance level, price faced strong rejection (marked with a red circle).

The bearish breakdown below the wedge confirmed the pattern, leading to a sharp decline.

A retest of the broken wedge followed before continuing downward.

This confirms a classic bearish trend reversal, making it a strong technical setup.

2. Key Levels and Trade Setup:

🔹 Resistance Level (Major Supply Zone)

The resistance zone (highlighted in beige) acted as a strong supply area, where buyers lost control.

Price reached this resistance multiple times but failed to sustain above it.

A bearish reversal initiated from this level, marking the beginning of a downward trend.

🔹 Support Level (Key Demand Zone)

The support zone (also highlighted) represents a major demand area where price previously reversed.

This level aligns with historical price action, making it a critical area to monitor for potential reactions.

🔹 Stop Loss Placement

A stop loss is placed above the previous high within the resistance zone to protect against false breakouts.

If price invalidates the breakdown and moves above this level, the bearish setup would no longer be valid.

🔹 Price Target Projection

The breakdown suggests a potential drop towards 1.00874, as indicated by the 100% measured move.

This aligns with previous historical support, making it a realistic downside target.

3. Trade Execution Plan: How to Trade This Setup?

📌 Entry Strategy:

Traders can enter short after confirmation of the breakdown and a potential retest.

A sell position can be initiated around the resistance turned support after a pullback rejection.

📌 Stop Loss Strategy:

A stop loss should be set above the resistance zone (around 1.12208) to minimize risk.

This ensures protection against a bullish breakout invalidation.

📌 Take Profit Strategy:

The first take profit target is set at the support level near 1.04498.

The final take profit target is at 1.00874, which aligns with the full measured move projection.

4. Conclusion & Market Sentiment

🔸 Bearish Market Bias – The breakdown of the rising wedge confirms strong bearish momentum.

🔸 Key Resistance Held Strong – The price was unable to break above, confirming seller dominance.

🔸 Downside Target Aligns with Previous Support Levels – A confluence of technical signals supports further decline.

Final Thought:

This chart presents a high-probability bearish trade setup in EUR/USD. The combination of a rising wedge breakdown, clear resistance rejection, and a defined downside target makes it an ideal short-selling opportunity. Traders should watch for price action confirmations and risk management strategies before executing trades.

🚨 Risk Disclaimer: Always apply proper risk management and confirm signals before trading. Market conditions may change, so monitoring price behavior is crucial for trade adjustments.

BTC - Is BTC going lower?Since the end of January 2025, BTC has been in a downtrend. However, over the last couple of weeks, BTC has been following an upward trend (rising wedge). This rising wedge has now been broken, as it tested the downward sloping trendline that has been in place since the end of January.

On the daily timeframe, the Stochastic RSI is crossing down from the overbought zone, indicating that the momentum is shifting to the downside. This suggests that bearish pressure could persist in the coming days or even weeks.

While it is possible that BTC could recover from this level and target higher prices. however, my base case is that BTC will continue to form a bearish structure over the next few days or weeks, potentially making a higher low or even a lower low. Time will reveal how the price action unfolds. Until then, the bias remains bearish unless proven otherwise.

It is important to be aware of your risk management when opening positions at this moment, as market conditions can be volatile and unpredictable.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

What is a Swing Failure Pattern? - Basic explanation!A Swing Failure Pattern (SFP) is a technical chart pattern often used in price action trading to identify potential reversals in the market. It is typically seen on candlestick or bar charts in the context of trend analysis.

The basic idea behind a Swing Failure Pattern is that the price temporarily breaks above or below a previous swing high or low, but fails to sustain that move and reverses direction quickly. This indicates a potential shift in market sentiment, and it can be a signal for a trend reversal or breakdown.

When is it a SFP?

- In needs to sweep the previous low

- It has to close the candlestick above the previous low. So only a wick down When the price closes the body of a candle below the last low, it will not be considered an SFP. In this case, it is highly likely that the trend will continue in that direction.

The SFP can occur across various timeframes, from lower to higher timeframes.

Example on the daily timeframe

Here, we see two SFPs: one to the upside and one to the downside.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!