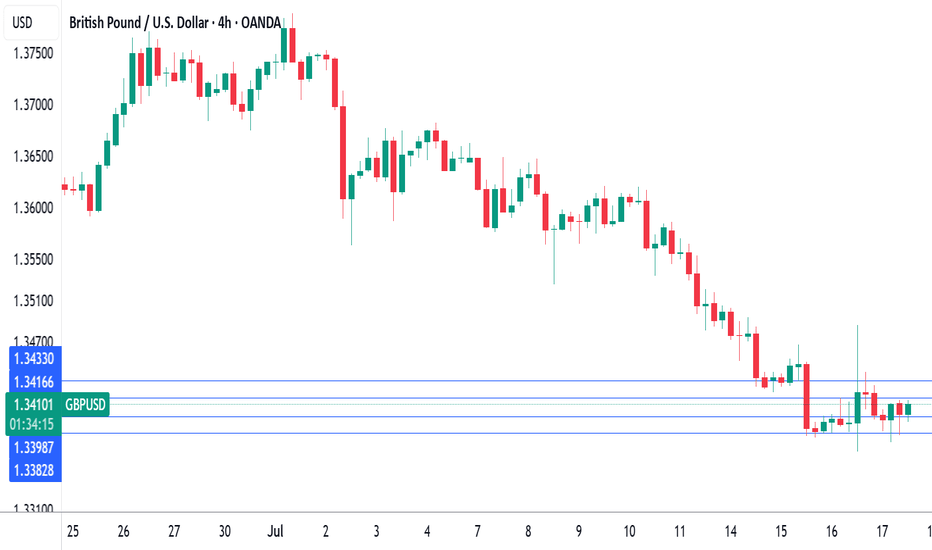

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

Wages

UK inflation heats up, Pound shrugsThe British pound has stabilized on Wednesday and is trading at 1.3389 in the European session, up 0.07% on the day. This follows a four-day losing streak in which GBP/USD dropped 1.5%. On Tuesday, the pound fell as low as 1.3378, its lowest level since June 23.

Today's UK inflation report brought news that the Bank of England would have preferred not to hear. UK inflation in June jumped to 3.6% y/y, up from 3.4% in May and above the market estimate of 3.4%. This was the highest level since January 2024 and is a stark reminder that inflation is far from being beaten. The main drivers of inflation were higher food and transport prices. Services inflation, which has been persistently high, remained steady at 4.7%. Monthly, CPI ticked up to 0.3% from 0.2%, above the market estimate of 0.2%.

It was a similar story for core CPI, which rose to 3.7% y/y from 3.5% in May, above the market estimate of 3.5%. Monthly, core CPI climbed 0.4%, above 0.2% which was also the market estimate.

The hot inflation report will make it more difficult for the BoE to lower interest rates and the money markets have responded by paring expectations of further rate cuts. Still, expectations are that the BoE will cut rates at the August 7 meeting, with a probability of around 80%, despite today’s higher-than-expected inflation numbers.

The UK releases wage growth on Thursday, which is the final tier-1 event prior to the August meeting. Wage growth has been trending lower in recent months and if that continues in the May reading, that could cement an August rate cut.

Australian dollar loses ground, jobs report nextThe Australian dollar has declined on Wednesday. In the North American session, AUD/USD is trading at 0.6441, down 0.45% on the day. This follows the Australian dollar's massive gains of 1.5% a day earlier.

Australia's wage growth accelerated in the first quarter. Annually, the Wage Price index gained 3.4%, up from 3.2% in Q4 2024 and above the market estimate of 3.2%. The gain was driven by stronger wage growth in the public sector. On a quarterly basis, wage growth rose 0.9% q/q, up from 0.7% and above the market estimate of 0.8%. This is the first time since Q2 2024 that annual wage growth has accelerated.

The higher-than-expected wage report comes before next week's Reserve Bank of Australia's rate decision. Currently, it looks like a coin toss as to whether the Reserve Bank will maintain or lower rates.

Australia releases employment data on Thursday. Employment change is expected to ease to 20 thousand in April, down from 32.2 thousand in March. The unemployment rate is expected to remain at 4.1%. The labor market has been cooling and if it continues to deteriorate, there will be pressure on the Reserve Bank to lower rates.

At last week's Federal Reserve meeting, Fed Chair Powell said that he would take a wait-and-see attitude in its rate policy. Trump's erratic tariff policy must be frustrating for the Fed, as it makes it difficult to make reliable growth and inflation forecasts.

This week's surprise announcement of a tariff deal between the US and China is a case in point at Trump's zig-zag trade policy. The two sides have been engaged in a bruising trade war and slapped massive tariffs on each other's products. Suddenly, the tariffs were slashed, leading to a sigh of relief in the financial markets. The deal is only for 90 days, and what happens then is very much up in the air.

Japanese yen tumbles to five-week low on US-China tariff dealThe Japanese yen has started the week with sharp losses. USD/JPY is trading at 148.18, up 1.9% on the day. Earlier, the yen strengthened to 148.59, its strongest level since April 3.

The US and China have reached an agreement to slash tariffs on each other's products for 90 days. This would be a major de-escalation in the bruising tariff war between the world's two largest economies. Under the agreement, the US and China will slash tariffs by 115%, leaving US tariffs on China at 30% and China's tariffs on the US at 10%.

The tariff agreement has boosted risk appetite, sending global stock markets higher. The deal has weighed on safe-haven assets like the yen, which is sharply lower on Monday. Gold, another safe-haven, has plunged 3.1% today.

In Japan, household spending and wage growth were down in March. Household spending decelerated to 0.4% m/m, down sharply from 3.5% in February. Average Cash Earnings declined to 2.1% y/y, down from a downwardly revised 2.7% a month earlier. There was more bad news as service-sentiment for April eased, reflecting concern over US tariffs.

These numbers support the case for the Bank of Japan to continue its wait-and-see stance before raising interest rates. The BoJ wants to see inflation remain sustainable at 2%, which will require higher wage growth and stronger consumer spending.

Over the weekend, a host of Fed members made public statements. New York Fed President John Williams and Fed Governor Adriana Kugler both noted that current rate policy was in an appropriate place and suggested patience was needed. This message echoed Fed Chair Powell's remarks at last week's FOMC meeting, when he said the Fed would take a wait-and-see attitude due to the uncertainty over US tariffs.

USD/JPY has pushed above resistance at 146.83 and 147.48 and is testing resistance at 148.47. Above, there is resistance at 149.04

146.11 and 145.36 are the next support levels

Japan's GDP revised downwards, yen swingsThe Japanese yen is showing movement in both directions today. In the North American session, USD/JPY is trading at 147.37, down 0.03% on the day.

Japan's GDP expanded 2.2% y/y in the fourth quarter of 2024, lower than the initial estimate of 2.8%. The revision was expected to stay largely unchanged but was pushed lower due to a decrease in inventories and consumption.

The GDP downward revision follows other soft data which points to weakness in Japan's economy. Household spending slumped 4.5% m/m in January. This was a sharp reversal from the 2.3% gain in December and missed the estimate of -1.9%. Annualized, household spending rose 0.8%, below the 2.7% in December and the market estimate of 3.6%. On Monday, the wage growth report indicated that real wages declined by 1.8% in January, after two months of growth.

How will the Bank of Japan react to the string of weak data? The annual wage negotiations are close to the end and the BoJ has urged companies and workers to reach a deal that significantly raises wages. This would boost growth and consumption and help keep inflation sustainable at the BoJ's 2% target.

The unions are asking for an average wage hike of 6%, up from 5.85% last year and the highest in more than 20 years. Last year's wage agreement led to the BoJ raising rates for the first time since 2007 and this year's wage deal could pave the way for another rate hike. The BoJ holds its next meeting on Mar. 19, five days after the wage settlement will be announced. The BoJ isn't expected to make a move next week but investors are circling April or May as potential rate-hike meetings.

There is resistance at 147.30 and 147.97

146.59 and 145.92 are the next support levels

Surging yen hits 5-month high, wage data mixedThe Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.07, down 0.766 on the day. Earlier, the yen strengthened to 146.72, its best level since Oct. 4, 2024.

Japan's wage data for January was mixed. Base pay for Japanese workers jumped by 3.1% y/y but more importantly, inflation-adjusted real wages declined by 1.8%. This follows two consecutive months of gains and signals that inflation has outpaced growth.

The wage report was released just days before the end of annual wage negotiations at Japan's largest companies. The largest labor union in Japan is demanding large wage hike of 6% and the Bank of Japan wants to see a strong rise in wages in order to keep inflation sustainable at the 2% level.

The BoJ has urged companies and workers to reach a deal that significantly raises wages. The central back meets next week and is widely expected to keep interest rates unchanged. Still, the Bank has signaled it plans to continue raising rates during the year.

In the US, nonfarm payrolls rose to 151 thousand in February, up from a downwardly revised 125 thousand in January but shy of the market estimate of 160 thousand. The unemployment rate rose to 4.1% from 4%. Wage growth eased to 0.3% m/m from a revised 0.4% in January, in line with expectations. Annualized, wages ticked higher to 4%, up from a revised 3.9% in January but below the market estimate of 4.1%.

The employment report was decent but the threat of US tariffs continues to cloud the economic outlook. If trade tensions escalate, the Federal Reserve may have to adjust its rate path, depending on how tariffs affect inflation and growth.

USD/JPY has pushed below support at 147.26 and is testing support t 147.26. Next is support at 1.46.48

148.51 and 148.98 are the next resistance lines

Pound slips as UK payrolls slideThe British pound continues to show sharp swings this week. After a spectacular 1.3% gain on Monday, GBP/USD has reversed directions and is trading at 1.2233 in the European session, down 0.68% on the day.

The UK payrolls report, a reliable indicator of employment growth, showed a sharp decline of 47 thousand m/m in December 2024. This was the largest decline since Nov. 2020 and follows a revised -32 thousand in November. The back-to-back declines are a result of the government's new payroll taxes in the budget, which is causing businesses to release workers. Wage growth (excluding bonuses) remains hot and increased to 5.6% in December, in line with the market estimate and higher than the 5.2% gain in November.

While the weak employment data will be a headache for the UK government, it supports the case for the Bank of England to cut interest rates in order to kick-start the flagging economy. The BoE held rates in December and meets next on Feb. 6, with a quarter-point cut priced in at 85%. Inflation has remained sticky and the jump in wage growth is a reminder of the upside risk of inflation. The BoE may be looking at rate cuts in the coming months but it will have to do so cautiously, ever mindful of inflation.

In the US, the strong nonfarm payrolls report for December is raising the possibility that the easing cycle may be over. The Bank of America doesn't expect any rate cuts in 2025 and says the risks for the next move are tilted towards a hike. The Fed started the easing cycle with a bang in September 2024, chopping rates by a half-point, but the strong economy means Fed policy makers may have to consider rate hikes in 2025.

GBP/USD has pushed below support at 1.2278. and is putting pressure on support at 1.2211

1.2395 and 1.2462 are the next resistance lines

AUD/USD stabilizes after post-NFP slideThe Australian dollar has started the week quietly. In the North American session, AUD/USD is trading at 0.6151, up 0.07% at the time of writing. Earlier, the Australian dollar fell as low as 0.6130, its lowest level since April 2020.

It was another rough week for the Australian dollar, which declined 1.7% last week. The Aussie can't find its footing and has plunged 10.4% in the past three months.

Strong US nonfarm payrolls sends Aussie tumbling

The week ended with a surprisingly strong US jobs report. In December, the economy added 256 thousand jobs, the most since March 2024. This followed a downwardly revised 212 thousand in November and easily beat the market estimate of 160 thousand. The unemployment rate eased to 4.1%, down from 4.2% in November. Wage growth also ticked lower, from 4% y/y to 3.9% and from 0.4% to 0.3% monthly.

The upshot of the jobs report is that the US labor market remains solid and is cooling slowly. For the Federal Reserve, this means there isn't much pressure to lower interest rates in the next few months. That will suit Fed policy makers just fine as it awaits Donald Trump, who has pledged tariffs against US trading partners and mass deportations of illegal immigrants. Either of those policies could increase inflation and the Fed will try to get a read of the Trump administration before cutting rates again. The latest Fed forecast calls for only two rate cuts in 2025 but that could change, depending on inflation and the strength of the labor market.

The strong employment numbers boosted the US dollar against most of the majors on Friday and the Australian dollar took it on the chin, falling 0.8%, its worst one-day showing in three weeks. With interest rates likely on hold in the near-term and and high tensions in the Middle East, the safe-haven US dollar should remain attractive to investors in the coming months.

AUD/USD tested resistance at 0.6163 earlier. Above, there is resistance at 0.6188

0.6121 and 0.6096 are providing support

SPX Hours needed to buy 1 shareHow expensive is the market? The average wage earner has to work 167 hours to buy 1 share of the S&P 500.

A new historic all-time high!

The markets are crazy expensive!

The inflation no one shows you or talks about is driven by massive deficits and cheap money.

Extreme Caution is in order!

Pound steady after hot UK wage growth, CPI nextThe Canadian dollar continues to lose ground. In the North American session, USD/CAD is trading at 1.4315, up 0.48% at the time of writing. The Canadian dollar has declined 2.2% in December and is trading at its lowest level since mid-March.

Canada's inflation eased to 1.9% in November, down from 2% in October and shy of the market expectations of 2%. However, the trimmed-mean core rate remained unchanged at 2.7%, higher than the market estimate of 2.5%. This is above the Bank of Canada's target of 2% and will complicate plans to continue to lower interest rates.

The BoC has been the leader among major central banks in lowering rates, with five rate cuts since June for a total of 175 basis points. The central bank chopped the benchmark rate by 50 basis points to 3.25% last week but indicated in the rate statement that it expected a "more gradual approach to monetary policy", which means we can expect 25-bp increments in rate cuts if there are no surprises in inflation or employment data.

US retail sales sparkled, another sign that the US economy remains robust. Retail sales jumped 3.8% y/y in November, following an upwardly revised 2.9% in October. This was the highest annual gain since last December. Monthly, retail sales rose 0.7%, above the upwardly revised 0.5% gain in October and the market estimate of 0.5%.

US consumers have opened their wallets for the holiday season and motor vehicles and online sales helped drive the gain. The strong retail sales report didn't change expectations for a rate cut on Wednesday, which stand at 99%, according to the CME's FedWatch.

US PMIs on Monday pointed to a mixed bag. The Services PMI rose in December to 58.5 from 56.1 in November and above the forecast of 55.7. This was the highest level in over three years as the services economy is showing impressive expansion. The manufacturing sector is in dreadful shape and weakened to 48.3, down from 49.7 in November and below the market estimate of 49.8. Output and new orders are down as the demand for exports remains weak.

USD/CAD is testing resistance at 1.4289. Above, there is resistance at 1.4343

1.4191 and 1.4137 are the next support levels

Pound higher as Services PMI rises, job report nextThe British pound has moved higher on Monday, after declining 1% last week. In the European session, GBP/USD is trading at 1.2747, up 0.30% on the day.

The UK Services PMI rose to 51.4 in December, up from 50.8 in November, which was a 13-month low. This beat the market estimate of 51.0, but points to weak business activity as demand for UK exports has been weak and confidence among services providers remains subdued.

UK manufacturing is mired in a depression, and the PMI fell to 47.3 in December, down from 48.0 in November and shy of the market estimate of 48.2. This marked the lowest level in eleven months, as production and new orders showed an accelerated decrease.

The weak PMI data followed Friday's GDP report, which showed a 0.1% decline for a second straight month in October. This missed the market estimate of 0.1%. GDP rose just 0.1% in the three months to October.

The UK releases employment and wage growth numbers on Tuesday. The economy is projected to have lost 12 thousand jobs in the three months to October, after a sparking 200 thousand gain in the previous report. Wages including bonuses is expected to climb to 5% from 4.8%.

The Bank of England meets on Thursday and is expected to hold the cash rate at 4.75% after cutting rates by 25 basis points in November. The economy could use another rate cut but inflation remains a risk to upside, with CPI climbing in October to 2.3% from 1.7%. The BoE will be keeping a close eye on wage growth, which has been a driver of inflation.

The US releases PMIs later today. Manufacturing remained in contraction territory in November at an upwardly revised 49.7 and there is optimism that the new Trump administration's protectionist stance could benefit US manufacturers.

The services sector is in good shape and improved in November to 56.1, up from 55.0 in October. The uncertainty ahead of the US election is over and lower interest rates have contributed to stronger expansion in services.

GBP/USD is testing resistance at 1.2638. The next resistance line is 1.2668

1.2592 and 1.2562 are the next support levels

GBP/USD steady as UK wage growth eases, GDP nextThe British pound has edged lower on Tuesday. In the North American session, GBP/USD is trading at 1.3055, down 0.14% on the day.

UK wage growth eased in the three months to July, an encouraging sign for the Bank of England as it looks to continue lowering rates.

Average earnings excluding bonuses climbed 5.1% y/y, down from 5.4% in the previous period and in line with the market estimate. This was the lowest level since June 2022. Wage growth is moving in the right direction but is still much too high for the BoE’s liking as it is incompatible with the target of keeping inflation at 2%.

The UK labour market remains strong, as the unemployment rate edged down to 4.1%, down from 4%. The economy created 265 thousand jobs in the three months to July, up sharply from 97 thousand in the previous report and blowing past the market estimate of 115 thousand. The solid data means that the BoE isn’t under pressure to cut rates next week, and the markets are looking at another cut in November.

The UK economy gets a report card on Wednesday, with the release of GDP for July. The economy flatlined in June and rose just 0.6% in the three months to June. Another weak GDP release could put pressure on the British pound.

Investors will be keeping a close eye on Wednesday’s US inflation release. The Federal Reserve is now focused on employment now that inflation is between 2% and 3%, but a CPI surprise could shake up the markets and change market pricing for a Fed rate cut. The odds of a 50-basis point cut have been slashed to 29%, compared to 59% on Friday.

There is resistance at 1.3167 and 1.3225

1.3069 and 1.3011 are providing support

Yen extends gains on solid wage growth, consumer spending nextThe Japanese yen has posted gains on Thursday. In the North American session, USD/JPY is trading at 143.27 at the time of writing, down 0.33% on the day. The yen continues to pummel the US dollar and is up 1.9% this week. Since July 1, the yen has surged a massive 10.7%.

Average cash earnings in Japan rose 3.6% y/y in July, down from 4.5% in June, which was the highest since January 1997. Still, this beat the market estimate of 3.1%. Wages are a key factor as to how soon the Bank of Japan could raise interest rates.

Inflation has been moving higher but the BoJ wants to see increased wage growth as well in order to achieve the Bank’s target of sustainable inflation at 2%. Japanese firms agreed to a huge wage increase of 5.1% for 2024 and this is being reflected in solid wage growth.

Japan’s economy is showing signs of recovery and consumers are opening their wallets. Household spending will be released early Friday and is expected to rebound with a gain of 1.2% y/y in July, following a 1.4% decline in June.

In the US, all eyes are on Friday’s employment report, specifically nonfarm payrolls. After a lower-than-expected gain of 114 thousand in July, the markets expect a gain of 160 thousand in August. The weak July numbers triggered a meltdown in the financial markets and investors remain uneasy.

The Federal Reserve is poised to deliver a milestone rate cut on Sept. 18. The likelihood of a 25 bps cut stands at 61% and a 50 bps cut at 39%, according to CME’s FedWatch and these odds could change after the US employment report.

USD/JPY has pushed below support at 143.57 and tested support at 142.91 earlier

There is resistance at 144.10 and 144.76

British pound calm ahead of UK jobs reportThe British pound is drifting on Monday. GBP/USD is trading at 1.2768 early in the North American session, up 0.08% on the day.

The UK releases the employment report for the three months to June and we could see signs of a cooling labour market. Annualized average earnings including bonuses, which has hovered between 5.5%-6% all year, is expected to fall sharply to 4.6%. The previous reading came in at 5.7%, the lowest since September 2022.

The unemployment rate has remained unchanged at 4.4% for the past two readings, the highest since September 2021. Unemployment is expected to nudge up to 4.5% in the three months to June. This would signal that the labor market is weakening and would make

If wage growth declines and the unemployment rate rises in tomorrow’s report, it would support the case for the Bank of England delivering another rate cut, perhaps as soon as next month. The BoE meets on September 19, just one day after the Federal Reserve is widely expected to cut rates by at least a quarter-point. The BoE joined the central bank trend of cutting rates earlier this month when it lowered rates by a quarter-point to 5%. We have entered a new phase of the central bank cycle, with most of the major central banks having already lowered rates.

The Federal Reserve will almost certainly lower rates at the September meeting, but by how much? Just one month ago, the markets had priced in a quarter-point cut at 90%, according to the CME’s FedWatch, but then the US posted some weak numbers and the financial markets sank. This has boosted the likelihood of a half-point cut, which on Friday was around a 50/50 split with a quarter-point cut.

Still, not everybody who has a say is urging a rate cut. Fed Governor Michelle Bowman, a voting member on the FOMC, said on Friday that she is hesitant about cutting rates, since inflation is “uncomfortably above” the 2% target and the labor market remains strong.

GBP/USD is testing resistance at 1.2779. Above, there is resistance at 1.2801

1.2753 was tested in support earlier. The next support level is 1.2731

AUD/USD gains ground ahead of wage growthThe Australian dollar has posted gains on Tuesday. AUD/USD is up 0.19%, trading at 0.6620 in the North American session at the time of writing.

Australia’s wage growth for the first quarter is expected to remain unchanged. Wages rose 4.2% in the fourth quarter of 2023, the highest since 2009, with most categories showing increases. On a quarterly basis, wage prices rose 1.9%, which was the lowest gain in three quarters. If the release is not within expectations, we could see a reaction from the Australian dollar.

Is the Reserve Bank of Australia considering a rate cut? The central bank hasn’t shown any rush to shift policy and held rates at 4.35% for a fourth straight time at last week’s meeting. The RBA has stressed that rate policy will be data-dependent and has made the battle against inflation its top priority.

A rate cut isn’t coming until inflation falls and the RBA doesn’t expect inflation to fall within the target range of 2-3% before 2025. Inflation has come down to 3.6% but the last phase of getting inflation within target could be the most difficult part, as the Federal Reserve has discovered. Unless inflation surprises with a sharp drop in the coming months, a rate cut is unlikely before November or early 2025.

Federal Reserve Chair Powell speaks at an event in Amsterdam later today and the markets will be looking for hints regarding a rate cut. The Fed has delayed plans to cut rates as the US economy remains resilient and inflation has unexpectedly accelerated. The US releases April inflation data this week and a drop in inflation would increase the likelihood of a rate cut in September. The US releases PPI is expected to remain unchanged at 2.4% in April while CPI is projected to ease to 3.6%, down from 3.8% in April.

AUD/USD tested support at 0.6602 earlier. Below, there is support at 0.6559

0.6645 and 0.6688 are the next resistance lines

USD/CAD dips as Canadian employment shinesThe Canadian dollar has climbed higher in the North American session after the release of Canada's December employment report. In the North American session, USD/CAD is trading at 1.3432, down 0.20%.

Canada usually posts employment reports on the same Friday as the US, but had the stage all to itself today, as the US posted its job report last week. The news was good as employment jumped by 37,300 in January, smashing the market estimate of 15,000. The December reading was revised upwards to 12,300 from the initial estimate of just 0.1 thousand. The unemployment rate ticked lower to 5.7%, down from 5.8% in December and below the market estimate of 5.7%. As well, average hourly earnings eased to 5.3% y/y in January, compared to 5.7% a month earlier.

The Bank of Canada will be carefully monitoring the jobs data. Employment growth jumped, which points to a stronger labour market, but at the same time wage growth dropped. Wages are a key driver of inflation and today's decline will support the BoC continuing to pause and not cut rates until the middle of the year or later.

The BoC is content to continue its "higher for longer" stance and let high rates continue pushing inflation lower. The central bank's top priority remains bringing down inflation to the 2% target, but businesses and consumers, especially homeowners, are groaning under the weight of elevated rates and are looking for some relief from the BoC.

The Federal Reserve continues to push back against rate cut expectations in March. This week, a host of Fed members delivered the message that inflation is heading lower but the Fed remains cautious and isn't yet ready to lower rates, as the battle against inflation is not yet won. The markets have taken note of the Fed’s pushback and have pared expectations of a rate cut in March to 17%, down from over 70% in December, according to the CME’s Fed Watch tool.

USD/CAD tested support at 1.3434 earlier. Below, there is support at 1.3392

1.3509 and 1.3551 are the next resistance lines

GBP/USD eyes UK wage growthThe British pound has started the week with slight losses. In the European session, GBP/USD is trading at 1.2725, down 0.21%.

The UK will release employment data on Tuesday and the spotlight will be on wage growth. Over the past few months, wages have been falling and the Bank of England would like to see that trend continue as wages have been driving inflation. Average earnings including bonuses dropped to 7.2% in the three months to September, down from 7.7% in the previous release. The market estimate stands at 6.8% for the three months to October.

The UK economy is in trouble, although there was some good news on Friday, as November GDP rebounded with a gain of 0.3% m/m after a 0.3% decline in October. Retail sales drove the gain as shoppers took advantage of Black Friday sales late in November. Still, the probability of a recession, which is defined as two consecutive quarters of negative growth, remains high. The economy declined by 0.1% in the third quarter and a fourth quarter of negative growth would mean that the economy is technically in a recession. Even if a recession is avoided, the economy has flatlined and isn't showing any growth.

The lack of economic growth puts the Bank of England in a dilemma. The central bank has sharply raised interest rates in order to curb high inflation and significant progress has been made. A year ago, inflation was in double digits, galloping at a 10.1% clip. Inflation has fallen to 3.9%, which is still double the 2% target. Governor Bailey has pushed back against rate cuts and insisted that the BoE would maintain a 'higher for lower' rate path, but lowering rates would increase economic activity and lessen the likelihood of a recession. The BoE has maintained the cash rate at 5.25% three straight times and meets next on February 1.

GBP/USD is testing support at 1.2721. Below, there is support at 1.2687

There is resistance at 1.2753 and 1.2787

Japanese yen takes a tumbleThe Japanese yen is down sharply on Wednesday. In the North American session, USD/JPY is trading at 145.74, up 0.86%.

Japan's wage growth was a major disappointment in November, with a meager gain of 0.2%. This follows the October reading of 1.5% which was also the estimate. This marked the lowest gain since December 2021. The weak wage data will support the Bank of Japan in maintaining its ultra-loose policy. Governor Ueda has hinted at a shift in policy but has stressed that won't happen before inflation is sustainable at 2%, backed by higher wage growth. The BoJ is looking ahead to the annual wage negotiations in March. If workers win significant pay raises from employers, that could set the stage for the BOJ tightening interest rates in April.

The US dollar has looked sharp early in 2024, despite the Fed pivoting sharply and signalling that it plans to raise rates this year. The dollar has surged 3.3% against the yen in January, after a 4.85% decline in December. Last week's nonfarm payroll report was stronger than expected, providing support for the Fed to maintain rates in restrictive territory until inflation falls closer to the 2% target.

This 'higher for longer' stance was reiterated by Atlanta Fed President Bostic on Monday, who stated that he had a "natural bias to be tighter" and anticipated two rate cuts by the end of the year, with an initial one in the third quarter. This is a far cry from market expectations of up to six rate cuts this year, starting in March.

USD/JPY has pushed above resistance at 144.93 and 145.37. Above, there is resistance at 146.13

There is support at 144.17 and 143.73

Australian dollar on a roller-coaster, US NFP loomsThe Australian dollar is trading quietly on Friday. In the European session, AUD/USD is trading at 0.6611, up 0.14%.

It has been a roller-coaster week for the Australian dollar. After declining 1.88% early in the week, the Aussie rebounded on Thursday and gained 0.80%. Today's US nonfarm payrolls report could result in further volatility from the Australian dollar in today's North American session.

All eyes are on the US nonfarm payroll release later today. After falling sharply in October to 150,000 from a revised 297,000, nonfarm payrolls are expected to rebound to 180,000. If nonfarm payrolls are weaker than expected, speculation of a Fed rate cut will rise, while a hot report would undermine market confidence that a rate hike isn't too far away.

Outside the headline data, average hourly earnings will be closely watched, as wage growth is a key driver of inflation. The consensus estimate for average hourly earnings in November stands at 0.3% m/m, compared to 0.2% in October. A higher-than-expected reading could generate a market reaction and give the US dollar a lift.

Australia's largest trading partner is China and the slowdown in the world's second-largest economy will likely dampen Australia's economy. China's economic woes were reflected in this week's Australian GDP, which posted a weak 0.2% gain for the third quarter, compared to the 0.4% gain in Q2. Notably, exports dropped for the first time since Q1 2022.

China's economic slowdown has resulted in disinflationary pressures. Chinese CPI decreased 0.1% in October and another 0.1% decline is expected in the November release on Saturday. If China's economy continues to weaken, demand for Australian exports could fall even further and that could weigh on the Australian dollar.

AUD/USD is testing resistance at 0.6603. Above, there is resistance at 0.6639

0.6530 and 0.6494 are providing support

AUD/USD soars on US inflation, Aussie employment nextThe Australian dollar is unchanged on Wednesday, after massive gains a day earlier. In the European session, AUD/USD is trading at 0.6505.

Australian wage growth climbed 1.3% q/q in the third quarter, matching the consensus estimate and above an upwardly revised 0.9% gain in Q2. This was the highest gain since records started in 1997, but the spike was largely due to an increase in minimum wage and a pay rise for elderly care workers.

The unusual confluence of factors behind the strong wage growth print meant that it had little effect on market pricing of a rate hike. The markets have priced in a pause above 90% at the Reserve Bank of Australia's next meeting on December 5th. The RBA raised rates earlier this month after four straight pauses but the hike was considered dovish by the markets and the Australian dollar took a tumble following the decision.

Australia releases employment data on Thursday, with the labour market continuing to show resilience. The economy is expected to have added 20,000 jobs in October, compared to 6,700 in September. The RBA will be keeping a close eye on consumer inflation expectations, which is expected to fall in October from 4.8% to 4.1%.

The US inflation report was only a bit lower than expected, but the US dollar was pummelled on Tuesday with sharp losses against the major currencies. The Australian dollar soared, gaining 2% against the greenback. Monthly, headline inflation was unchanged in October for the first time in 15 months, with lower gasoline prices helping to push inflation lower. On an annual basis, headline inflation fell from 3.7% to 3.2%, below the market consensus of 3.3%. Core inflation inched lower to 4.0%, down from the September reading of 4.1% which was also the market consensus.

AUD/USD is putting pressure on resistance at 0.6526. Above, there is resistance at 0.6592

0.6476 and 0.6408 are providing support

USD/CAD steady ahead of Canada, US job reportsThe Canadian dollar is showing little movement on Friday. In the European session, USD/CAD is trading at 1.3740, up 0.03%.

The week wraps up with US and Canadian employment reports, which could mean volatility from the Canadian dollar during the North American session.

The US releases nonfarm payrolls, which had a massive September and crushed expectations with a gain of 336,000. The markets are projecting a modest gain for October, with a market consensus of 170,000.

The ADP Employment Change report, which isn’t considered a reliable gauge for nonfarm payrolls but is still closely watched, posted a weak gain of 113,000 in October, well below the market consensus of 150,000 and following the September reading of 89,000. Will nonfarm payrolls follow suit or will we see another hot release?

The US dollar has declined against the majors since the Federal Reserve's decision to maintain interest rates for a second straight time. Fed Chair Powell tried to sound hawkish and reiterated that rate hikes remain on the table, but the markets are in a dovish mood and believe that rates may have peaked.

If the nonfarm employment release follows ADP and misses expectations, it would likely mean the end of the current tightening cycle and I would expect the US dollar to decline after the release. Conversely, a strong non-farm payrolls report would support the Fed's stance that rate hikes remain on the table and would likely translate into strong gains for the US dollar following the release.

The Fed will also be keeping an eye on wage growth, a driver of inflation. Wages rose 0.2% m/m in September and the market estimate for October stands at 0.3%. On an annualized basis, wage growth is expected to ease to 4.0% in October, down from 4.2% in September.

Canada's employment is projected to ease to 22,500 in October, compared to 63,800 in September, which marked an eight-month high. The labour market has remained strong despite the Bank of Canada's aggressive tightening, and a weak employment reading would boost the case for another pause from the BoC and could weigh on the Canadian dollar.

1.3730 is a weak support level. Below, there is support at 1.3660

There is resistance at 1.3805 and 1.3950

USD/CAD - Canadian dollar stops nasty slideThe Canadian dollar has steadied on Thursday. In the North American session, USD/CAD is trading at 1.3728, down 0.12%.

The Canadian currency has stabilized after a nasty four-day slide, in which it declined 1.9%. The US dollar continues to look strong against the majors, as "US exceptionalism" continues to make the greenback attractive to investors.

The Canadian dollar is also getting squeezed by falling oil prices, as oil is a major export for Canada. Crude oil prices slid around $5 on Wednesday, its biggest daily drop in over a year, and fell further on Thursday before recovering. The rise in bond yields, which have raised fears of a global economic slowdown are weighing on investor sentiment towards oil.

On the economic calendar, the Canada Ivey PMI eased slightly in September to 53.1, down from 53.5 in August, but easily beat the market consensus of 50.8. The PMI has indicated expansion in economic activity in eight out of the past nine readings. As well, the job creation component rose from 58.5 to 54.8 in August, marking a six-month high.

These are encouraging figures for the Canadian economy, which has run into some headwinds, such as a flatlined GDP in August. Canada's economy contracted in the second quarter, and a repeat in Q3 would indicate a technical recession.

The Canadian dollar could show some volatility on Friday, with the US and Canada both releasing employment reports for September. Canada is expected to have added 20,000 jobs in September, which would be half of the gain in August of 39,900. The Bank of Canada will be keeping a close eye on wage growth, which is projected to rise to 5.5% y/y, compared to 5.2% in August.

All eyes will be on the US nonfarm payrolls, which is showing signs of cracks, with three straight releases below the 200,000 mark. The August release came in at 187,000 and the consensus estimate for September stands at 170,000. Wage growth is expected to tick up to 0.3%, compared to 0.2% in August. An unexpected reading in the NFP or wage growth reports could have a significant effect on the US dollar on Friday.

USD/CAD faces resistance at 1.3806 and 1.3864

1.3695 and 1.3638 are the next support lines

GBP/USD rises ahead of UK retail salesThe British pound has extended its gains on Thursday. In the North American session, GBP/USD is trading at 1.2772, up 0.32%.

The UK will wrap up a busy week with retail sales on Friday. The July report is expected to show a decline in consumer spending. Headline retail sales are expected to fall by 0.5% after a 0.7% gain in May and core retail sales are projected to decline by 0.7% after a 0.8% increase in May. The June numbers were higher than expected despite high inflation, helped by record-hot weather. Will the July data also surprise to the upside?

The UK consumer has been grappling with the highest inflation in the G7 club, which means shoppers are getting less for their money. This has dampened consumption, a key driver of the economy. Energy prices are lower, thanks to the energy price cap, but food inflation continues to soar and was 17.4% y/y in June. Consumer confidence has been mired deep in negative territory and the GfK consumer confidence index, which will be released later today, is expected at -29, almost unchanged from the previous release of -30 points.

The Bank of England would like to follow some of the other major central banks that are in a pause phase, but the grim inflation picture may force the BoE to keep raising interest rates, which could tip the weak economy into a recession.

Wage growth jumped to 7.8% in the three months to June, up from 7.5% in the previous period. In July, headline CPI fell to 6.9%, down sharply from 7.9%, but core CPI remains sticky, and was unchanged at 6.9%. The data points to a wage-price spiral which could impede the BoE's efforts to curb inflation.

The Federal Reserve remains concerned about high inflation and said that additional rate hikes might be needed, according to the minutes of the July meeting. At the meeting, the Fed raised rates by 0.25%, a move that was widely anticipated. Most members "continued to see significant upside risks to inflation, which could require further tightening of monetary policy". At the same, time, members expressed uncertainty over the future rate path since there were signs that inflationary pressures could be easing.

GBP/USD is testing resistance at 1.2787. The next resistance line is 1.2879

1.2726 and 1.2634 are providing support