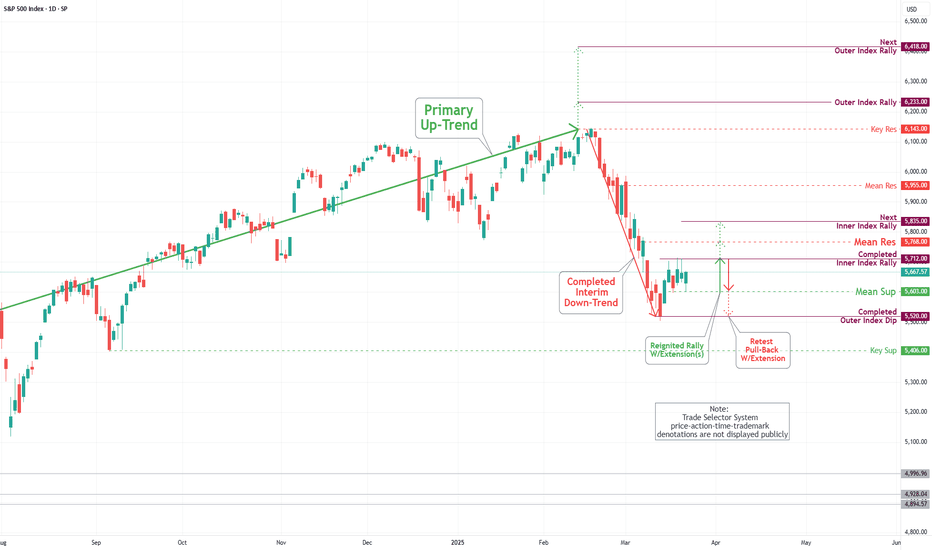

S&P 500 Daily Chart Analysis For Week of April 17, 2025Technical Analysis and Outlook:

In the recent shortened trading session, the Index recorded steady to lower prices, distancing itself from the Mean Resistance level of 5455, as indicated in the previous week's Daily Chart analysis. This trend establishes a foundation for continuing the downward trajectory, targeting the Mean Support level 5140. Should this downward momentum persist, further declines may extend to the next Mean Support level of 4970 and ultimately reach the completed Outer Index Dip at 4890.

Conversely, it is essential to acknowledge the possibility of upward momentum at the current price level, which may challenge the Mean Resistance of 5455 and extend toward the Outer Index Rally at 5550.

Wallstreet

S&P 500 Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

During the current trading session, the Index has recorded lower opening prices, thereby completing our key Outer Index Dip levels at 5026 and 4893, as previously highlighted in last week's Daily Chart analysis. This development establishes a foundation for a continuous upward trend, targeting the Outer Index Rally at 5550, with an interim resistance identified at 5455. Should this upward momentum persist, further extension may reach the subsequent resistance levels of 5672 and 5778, respectively. However, it is essential to note that a downward momentum may occur at the very significant completion target level of the Outer Index Rally at 5550, with the primary objective being a Mean Sup 5140 and retest of the completed Outer Index Dip at 4890.

Bond Yields Ripping, Will Wall Street Take Notice?Rising yields can usually be associated with a period of risk on. But seeing the 30-year treasury yield rise over 20bp in Asia while Wall Street futures cling on to their cycle lows is anything but usual. In fact, it's a bad omen of things to come.

Matt Simpson, Market Analyst at City Index and Forex.com

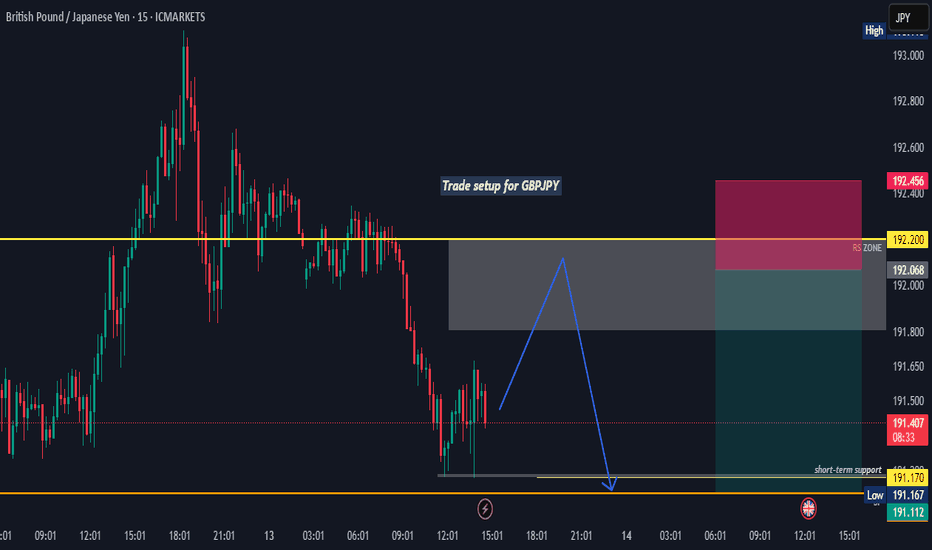

Wall Street's Difficulties: How It Impacts the Forex Market

Hello, I am Andrea Russo, Forex Trader, and today I want to discuss how the recent difficulties on Wall Street are influencing the global forex market.

The Storm on Wall Street

In recent days, Wall Street has experienced significant turbulence, with major indices sharply declining. This scenario has been driven by several factors, including:

Rising Interest Rates in the U.S.: The Federal Reserve, concerned about persistent inflation, has hinted at potential monetary tightening.

Geopolitical Tensions: Global uncertainties are unsettling investors and reducing risk appetite.

Signs of Economic Slowdown: Recent macroeconomic data have fueled fears of an imminent recession.

These elements have resulted in a decline in investor confidence, leading to heavy sell-offs in equity markets.

Effects on the Forex Market

The repercussions of this turbulence are already manifesting in the forex market. Here are the key implications:

Strengthening of the U.S. Dollar: The dollar has gained momentum as a safe-haven currency, particularly against emerging market currencies like the Brazilian real and Turkish lira.

Japanese Yen and Swiss Franc Rising: These haven currencies have seen increased demand, drawing monetary flows.

Pressure on Emerging Market Currencies: Reduced risk appetite has triggered sell-offs in the major currencies of emerging markets.

What Should Forex Traders Do Now?

In such a volatile environment, it's crucial for traders to:

Analyze the Data: Keep a close watch on U.S. economic indicators and Federal Reserve announcements.

Diversify Risk: Consider hedging strategies to reduce exposure to volatility.

Observe Safe Havens: Explore trading opportunities involving the yen and Swiss franc, which remain stable during uncertainty.

S&P 500 Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

During this week's trading session, the Index gapped higher, passing our completed Inner Index Rally of 5712 and setting a Mean Resistance of 5768. This target was accompanied by considerable reversal, ultimately causing a downward movement. On the final trading day of the week, the Index underwent a pronounced decline, resulting in a substantial drop that surpassed the critical target of Mean Support set at 5603. The Index is positioned to retest the completed Outer Index Dip level of 5520. An extended decline is feasible, with the possibility of targeting the subsequent Outer Index Dip at 5403 before resuming an upward rally from either of these Outer Index Dip levels.

Tencent Holdings LtdIs Tencent Stock a Buy Now?

Tencent posted its third quarter earnings report on Nov. 16. The Chinese tech giant's revenue fell 2% year over year to 140.1 billion yuan ($19.8 billion), which represented its second consecutive quarter of declining revenue since its IPO in 2004. Its net profit rose 1% to 39.9 billion yuan ($5.6 billion). On an adjusted basis, which excludes its investments and other one-time items, its net profit grew 2% to 32.3 billion yuan ($4.5 billion). Those growth rates seem anemic, but Tencent's stock had already been cut in half over the past two years amid concerns about China's tightening regulations, slowing economic growth, and COVID19 lockdowns. So is it the right time to take the contrarian view and buy Tencent as a turnaround play? Let's review its core businesses and valuations to decide.

Tencent generated 31% of its third quarter revenue from its video game business. Domestic games, which include its blockbuster game Honor of Kings, accounted for 73% of that total. The remaining 27% came from overseas hits like League of Legends, Valorant, and PUBG Mobile.Its domestic gaming revenue fell 7% year over year, representing its third consecutive quarter of shrinking revenue, as it grappled with tighter playtime restrictions for minors in China over the past year. Those restrictions also coincided with a temporary suspension on new video game approvals in China, which started last July and ended this April.Its international gaming revenue rose 3% year over year, accelerating from its 1% decline in the second quarter, as new games like Tower of Fantasy and Goddess of Victory: Nikke attracted new players. Unfortunately, its overseas growth still couldn't offset its declining domestic revenue.

As a result, Tencent's total VAS (value-added service) revenue which includes its gaming divisions, social media platforms, and streaming media subscriptions -- declined by 3% in the third quarter but still accounted for more than half of its top line. This core business might gradually stabilize as Tencent expands its international gaming business, but it will likely remain under intense pressure as long as the Chinese government continues to scrutinize the gaming industry.

200$ was one of the biggest support and great opportunity to buying the dip. 300-320$ is a big resistance level for tencent and if bulls win that battle then 350$ is next but

can we back 250 or even 200$ again? YES

Trump's Auto Tariffs Shake Things Up on Wall StreetTrump's tariffs are clearly not going away. In fact, he's upped the ante with a 25% tariff on all non-US cars, vowed to target pharmaceuticals and promised more are to come on April 2nd. Given the dire weakness in consumer sentiment data, I suspect Wall Street indices may have seen a swing high.

Matt Simpson, Market Analyst at City Index and Forex.com

Lockheed Martin 1W Possible Scenario 1WTechnical Analysis 1W

The chart shows a second breakout of the weekly trendline, which could increase downside pressure on the price.

Key Levels:

- Support: $393.08 (0.236 Fibonacci), $324.65 (0 Fibonacci)

- Resistance: $439.70 (0.382 Fibonacci), $471.48 (0.5 Fibonacci), $500.00 (0.618 Fibonacci)

Indicators signal weakness, suggesting a potential continuation of the downtrend.

Fundamental Analysis

Lockheed Martin is one of the world's largest defense contractors, specializing in aerospace, defense, and security. The company is known for producing the F-35 fighter jet, missile defense systems, and space exploration technologies.

Key Factors Affecting the Stock:

Financial Performance:

- Strong revenue growth supported by high government defense spending

- Solid backlog of contracts, ensuring future revenue stability

- However, potential budget constraints or shifting defense priorities could impact future earnings

Macroeconomic & Geopolitical Factors:

- Rising global tensions (Ukraine, Middle East, Indo-Pacific) drive higher defense budgets worldwide

- US interest rates and inflation may affect long-term government contracts

- Potential NATO expansion and Indo-Pacific security agreements could bring new contract opportunities

Competition & Industry Risks:

- Competes with Boeing, Northrop Grumman, Raytheon, and General Dynamics

- Cost overruns and supply chain disruptions could pressure profit margins

- The US government's shift to AI-driven warfare and cyber defense might change future contract allocations

Conclusion:

A breakdown below $393.08 could open the way toward $324.65, signaling a deeper correction. To regain an uptrend, the price must reclaim the $439.70 resistance level.

Wingstop Inc. (WING) 1WTechnical Analysis 1W

The chart shows a breakout of the weekly uptrend line, signaling potential further downside.

Key Levels:

-Support: 206.49 USD (0.382 Fib), 152.93 USD (0.236 Fib), 66.36 USD (0 Fib)

- Resistance: 249.78 USD (0.5 Fib), 293.07 USD (0.618 Fib), 354.70 USD (0.786 Fib)

Indicators suggest weakness.

Fundamental Analysis:

Wingstop specializes in chicken wings.

Key Factors:

- Financials: Revenue growth, but high valuation increases correction risk

- Macroeconomics: Interest rates impact consumer spending

- Competition: Pressure from McDonald's and KFC

Conclusion: A break below 152.93 USD could lead to 66.36 USD. Bulls need a recovery above 249.78 USD for trend reversal.

S&P 500 Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

During the course of this week's trading session, the S&P 500 achieved the designated target for the Inner Index Rally at 5576, which occurred midweek. This target was accompanied by considerable volatility, ultimately hindering upward movement. On the week's final trading day, the index experienced a notable decline, resulting in a significant drop that reached our critical target, Mean Support, at 5603.

Consequently, the index is now poised to target a retest of the Inner Index Rally level 5712, with a subsequent potential target identified at the Mean Resistance level 5840. It is essential to consider that upon reaching the Inner Index Rally target of 5712, a decrease in the current price level is anticipated, which may lead to a retest of the Mean Support at 5601. Furthermore, an extended decline is possible to revisit the completed Outer Index Dip at 5520 before the resumption of an upward rally.

S&P 500 Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

During the recent weekly trading session, the S&P 500 reached the designated target of the Outer Index Dip at 5576, showing considerable volatility. On the last day of the trading session, the index experienced a significant rebound, leading to an impressive upward trajectory from that position. As a result, it is now aiming for the Inner Index Rally target set at 5712, with a potential subsequent target identified at the Mean Resistance level of 5840. Therefore, upon reaching the Inner Index Rally target 5712, or if there is a decline from its current price level, the index is expected to retest the completed Outer Index Dip at 5521, potentially reinstating the upward rally.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

S&P 500 Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the recent weekly trading session, the S&P 500 successfully retested the Mean Resistance level of 5967; however, it subsequently experienced a significant decline. This decline brought the index back to the Mean Support level of 5860 and further down to the next major Key Support level of 5710. After this downturn, the index established a new critical support level at 5683. It is now positioned to target the Mean Resistance level of 5840. Should the index initiate an upward movement from its current position and successfully surpass this key resistance, it may continue to ascend toward the subsequent Mean Resistance level of 5955.

Conversely, suppose the index experiences a decline from the retested level of 5840. In that case, it will likely target the Mean Support level of 5683, with a further descent to an Outer Index Dip of 5576.

SPX500 is heading to a major correction.Just reading the charts—and if history repeats itself, we’ve entered a weekly MACD and RSI downtrend.

I called this for Bitcoin a month ago, and some argued it could be invalidated. Now, we can see that’s nearly impossible.

Macro Outlook

The economy is in bad shape—you see the news.

Trump’s tariffs are scaring investors for a good reason. He wants to avoid money printing and tighten supply, but how will companies and institutions get cash? By selling their stocks.

No more free money—profits will have to come from selling assets, which will intentionally crash the market under Trump’s policy.

Cycles & Recession

We’re at the end of a cycle—everything is overbought and needs a reset before moving higher.

We’re in a recession, even if no one wants to admit it.

Conclusion

📉 Target price: 4850

📅 Estimated bottom: September 15, 2025

Expect volatility, occasional pumps, but on a weekly scale, the trend is down—unless something drastic happens. Q3 and Q4 will be bullish.

🚨 DYOR!

S&P 500 Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

In the recent weekly trading session, the S&P 500 did not succeed in retesting the Mean Resistance level of 6082. Instead, the index experienced a notable decline, reaching the Mean Support level of 5939 and narrowly approaching the Key Support level of 5827.

Following this downturn, a significant rebound occurred, resulting in the establishment of a new Mean Support level at 5860. The index is now positioned to target the Mean Resistance level of 5967. Should the index initiate an upward movement from its current level and successfully surpass the critical Mean Resistance of 5967, it may continue to rise toward the Mean Resistance level of 6032, potentially reaching the Key Resistance level of 6143.

Conversely, if the index declines from its present position, it may create a retest pullback to revisit the Mean Support level of 5860 before resuming further upward momentum.

S&P 500 Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

In the most recent weekly trading session, the S&P 500 surpassed our completed Outer Index Rally threshold of 6120, rendering the Key Resistance at this level obsolete. Nevertheless, following a significant price reversal, the index breached the Mean Support level of 6049 and is approaching the critical support level established at 5995. The index could decline further, potentially reaching the Mean Support level of 5939 and the Key Support at 5827.

Should the index initiate an upward movement from its current position or the Mean Support level of 5995, it may ascend to the newly established Mean Resistance level of 6082, potentially extending toward the Key Resistance level of 6143.

S&P 500 Daily Chart Analysis For Week of Feb 14, 2025Technical Analysis and Outlook:

During the recent weekly trading session, the S&P 500 effectively reached and tested the critical Key Resistance level at 6083. It retested the completed Outer Index Rally at 6120, indicating a potential continuation of the bullish trend toward the intermediate target of 6233. However, a market pullback is anticipated due to this price action. Current analyses suggest that the designated downward target is set at the Mean Support level of 6049, with potential extensions to 5995, 5936, and the Outer Index Dip at 5878.