ORBEX: US Air Strike Sends Oil and Gold UP!A US airstrike at the Bagdad airport killed Iranian General Qassem Soleimani’s.

Not only this is going to increase geopolitical instability in the region but it also questions the legality of the President's decision as he acted without Congressional approval!

US-Iran relations are taking a sour turn early in the year following an “extremely dangerous” attack that could set off a war.

See how oil and gold have been affected so far and how they are likely to perform in the short-term.

Timestamps

WTI 3H 01:50

GOLD 3H 04:15

Trade safe

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

WAR

PETR4 - Attack x Defense AnalysisAs a war game, there are base points to be defended by the owner.

Armies will fight to gain control of these points.

The stronger side takes the base point and attacks the next forward point.

The weak side just try to defend, back to the next base.

The points are the known resistances and supports.

Strength is measured by the result of each action.

Here comes Sun Tzu's knowledge in The Art of War.

COLD WAR 2.0 / WW3 / NUCLEAR HOLOCAUST investingThis is what a market bottom could look like.

Currently some nice rsi bullish div. Looking like it is in a bull flag. Appear to have had our capitulatory move. Fundamentally speaking we are working our way to the end of the world so we can see a catalyst like a nuclear arms race or world war breaking out. Is this chart the hourglass for humanity?

If we break the green line and can close above $11.74 this is my buy signal and the hour glass will begin.

Stop loss will be if we break the low at $10.

10% risk for possible 10x reward IMO.

Significant levels are the white lines.

Doomsday clock in a chart.

Like and follow if you don't wanna die.

G-D HELP US

15 December, the US will implement tariffs on $156B on ChinaTo offset the additional tariffs the CNY would have to depreciate - although the Chinese authorities have said that they won't pursue quantitative easing.

If there is a formal announcement to suspend or delay the tariffs, the market would expect a more positive risk reaction and that is currently being priced in. WIth the USDCNY trading around the 6.90 and below the 7.00 psychological level that was key back in the summer.

If Phase one of the deal does not pass and the tariffs go-ahead, we would expect the USDCNY to trade above the 7.100

My paradoxical impeachment trade deal tradeReasons for the paradox in this trade:

Trump's impeachment is uneventful at this moment in time

Yet this impeachment may cost him his re-election creating a possibility for easier trade negotiations

With AUD off to the highs especially with there being good data today, let's see how far this thing goes

AUDEURDespite the RBA setting a dovish when it comes to all things $AUD this spike in price action has caught my eye, enough for me to justify a pre-emptive move in the name of $AUD strength.

Trump's impeachment at the house will not have an impact because the senate where Republicans hold the majority will not vote against their own political leader (well at least that is what the general consensus is); however this does not make Trump look good in the public eye and with elections around the corner this threatens his re-election prospects.

Which is enough to garner a few smiles across the pacific in China, where a scenario of Trump not in office would surely improve Chinas seat at the table of negotiations.

Coffee is on a rise! It must be the caffeine I have just closed out a +8% trade and I am going long again.

The initial fundamentals where:

Brazillian drought

US-China trade war increasing agriculture exports out of Brazil

Weak $BRLUSD

Although some of these fundamentals are starting to wane, the technicals continue to show that Coffee has more to go

SPX, VIX and SKEWThe movement of the SPX are reflected in the VIX (volatility index) but the signal seem to arrive when the SPX index is already too advanced in the retracement. The SKEW signals earlier on. The signal from SKEW starts with lower lows, then the volatility increases and SPX dips.

Sell when the SKEW starts hitting lower highs, then BUY when the VIX index is peaking.

S&P 10 year trend, a case for 3800 upside, 600 downsideI use the S&P versus DOW and Nasdaq in order to cast a broader net across more assets however, the other markets seem to echo similar despite having choice selection of underlying assets. For the last 10 years since the recession pounded the markets, we have maintained a clear ascending channel exhibiting strong support and resistance trend lines.

The trend line held to mid-channel nicely through 2017. The USG gave corporations a $500B USD a year tax break at the beginning of 2018 and the markets rallied but still fell well short of top of channel. As we saw bolstered earnings quickly dissipate over the year, the S&P came back to its comfort zone, mid-channel until the 4th quarter when trade wars escalated and markets struggled (breaching support at levels not seen since the recession).

In an effort to prevent the stock markets from turning, the feds started printing money (QE) & reduced the prime interest rate 3 times this year(2019). These are tools we had last relied on heavily during the height of the recession. With each rate cut, we see a small and repeatedly diminishing wave up. It appears as though, despite all the fuel the government is feeding the market, it just doesn't seem to be enough.

There have been a lot of false alarms for a trade deal between the worlds two largest economies but once its inked, it has a high probability of fueling the fire. There is a great chance that an America/China trade deal along with significant reductions in global tariffs could catapult the S&P to 3800 for 25% gains from today's value (along with global markets). It looks like the US has to make a trade deal with China soon to prevent the markets from souring on us.

In the event a trade deal isn't inked soon, it seems like the bears may take over and who knows how far the markets will retrace - 40%(S&P@1800), 50%(S&P@1500), 60%(S&P@1200)? How about this, scary (possible not probable), definite possibility >>> We may be seeing an overall downtrend forming, indicated with a light grey line at the bottom of the chart. If this a hard trendline forming, we could see S&P spiral out of control down to 500-600 before it finds support.

Disclaimer: I am currently holding S&P ETF options and see a great opportunity to straddle here.

Bearish Idea on FTSE China A50 by ThinkingAntsOk4H CHART EXPLANATION:

We observe that price has bounced at the Daily Top level and was rejected strongly. We are waiting for a breakout of the Ascending Trendline to take short positions here. In the short term, the potential targets are the Support Zone, and the main ascending Trendline.

SPY short term fallToo much uncertainty with the US economy, combined with negative pointing indications. Definitely going down short term. 2 possible rally points for Monday, either the 297 support line, or the next 296 support line. If both of these fall, then it will be a very very very hard climb back up. I wouldn't go long on SPY for a while, just to be safe.

DxY 2020This Possibility Source in My DowJons Idea

My Unconsciously Forecast Considering the technical and fandamental is inaction for Dow and Dxy in 2020

Challenges Related to Electronic Companies

Economic War

Supply and demand of weapons and arms sales

US sanctions on big countries like Iran

annnnnnnnnnnnd its very impotant >>>>>>>>>>>>5G<<<<<<<<<<<<<<< technology we most see america can sell this Equipment in euro and asia

Great contribution of economic war is >>>>5G<<<<<

ORBEX: Syria Operations Weaken TRY, Brexit Looks Good Pre-SummitIn today's #marketinsights video recording I analyse #USDTRY and #EURGBP #FXMinors!

Turkish Lira Under Pressure on:

- Risk of sanctions

- Launch of military operations in Syria

- Bank charges for money laundering and fraud

- Breather short-term amid US Retail Sales

Pound Higher on:

- Negotiations optimistic ahead of EU Summit

- BoJo's attempts to get deal through better than May's

- New customs border in the Irish sea; proposal

- EU likely to agree on that deal, then through parliament

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

WAR WITH IRAN AND SLOWING US ECONOMY || The Higher We Climb...I could've titled this one as "what goes up must come down" and all that BS.. But the point is clear, RECESSION is not a possibility anymore.

FED lowering rates just to keep economy afloat.

FED had to make emergency injection of more than $125B over the past 3 days. JUST TO KEEP THOSE RATES BELOW 2.25%!!!!!!!!!!!!!!

RECESSION fears keep on rising.

Strange shit is going on with Middle East (more strange than usual).

If war with IRAN won't start till the end of the year, U.S. economy is fucked. I think it's not a secret that the key basis of U.S.' economy is WAR, proxy-war for natural resources kept U.S. economy and all your precious indexes up and going for almost two decades.

It's time for U.S. to double down on their way of doing business by starting yet another WAR or rip the consequences...

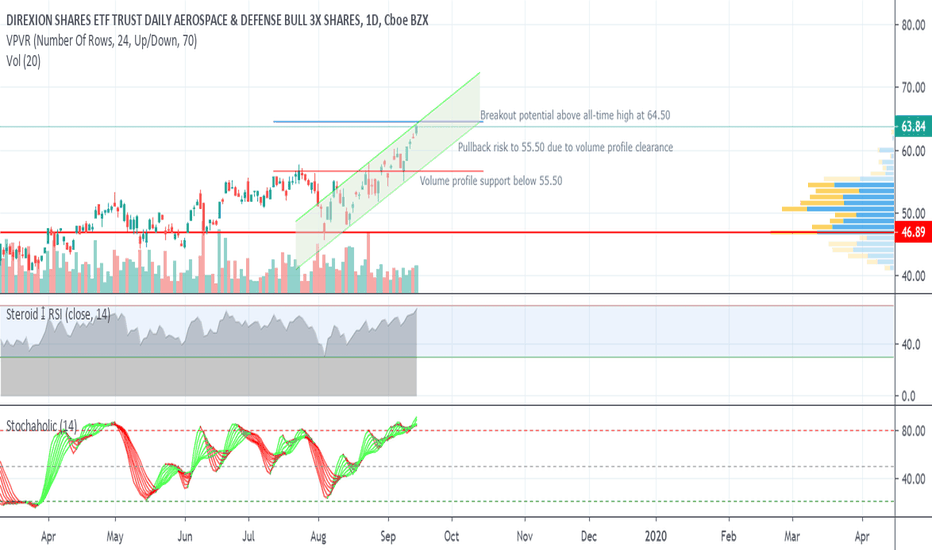

Defense and aerospace stocks could get breakout to new highsOne of the items on my watch list is DFEN, the Direxion Daily Aerospace and Defense Fund. This ETF tracks companies like Boeing that would supply the US government with jets and drones in the event of a war with Iran. I'm not buying the fund yet, because it's at the top of its month-long parallel channel, and it's very close to its all-time high at 64.50, without much support on the volume profile. However, if it does start to look like we're going to war with Iran, I think we may see a breakout. I am watching closely to buy any breakout above either the parallel channel or the all-time high.

XRP/BTC trade warThis trade war seems to be going Chains way. But that can only be sustained for so long. Another super power is on its way.

Prepares a long waited strong move is on the horizon, as XRP ledge will convey the gold trade with GBI not BTC

Scan my profile for free XLM and 10k Zi CCO Airdrop

Nzd.Chf Buy zoneNZD fundamentally is pretty weak, with all 5 of its major trading partners facing some form of political/financial upheaval. This is important to know because NZD economy is compromised in large part of its exports. However, data has shown that New Zealand has been becoming a favorable investment due to its free market policies that have kept the financial sector pretty solid.

China's market, which is affecting NZD the most and is her main trading partner, gateway at Hong Kong has seen protest that have been slowly turning more ambitious. This has helped NZD turn south, as well as the Chinese yuan. However with all eyes on Hong Kong from the international community I truly hope China will play it safe and back off a bit for a while.

War must be good for business, LMT Target 385-390 USDHey All,

When wall street and some fo the major NYSE and Nasdaq listed companies are experiencing a slight turmoil, Lockheed Martin (LMT) stands head and shoulders above them all which hints that there might be stuff in play that might not be obvious to us, mortals. Yet the expectations are priced in and it looks like USA's war machine is being lubed up right about now.

Wall Street was expecting big things from Lockheed Martin's (NYSE:LMT) first quarter, and the company more than delivered. Lockheed reported earnings of $5.99 per share, easily beating the $4.32 consensus estimate and well above the $4.02 per share it earned a year prior. The company also reported a massive backlog and stronger-than-expected operating margins, and raised its outlook for the full year.

Another year ahead and investors are again expecting great things from LMT and judging from the price trajectory, and overall strength of the trend I suspect that we will see a surge of the company's stock price and new levels of 385-390 USD per share.

Keep that war machine lubed up and enjoy your earnings!

Cheers

Archie

BTC - Short updatePlease see previous idea for in more in depth logic.

As kind of expected, the price reached and rejected off the 4.618 advancement.

From here, BTC has the potential of turning bullish again once the daily crosses over the 2/1 line. Potentially within a couple days from now.

That could cause it to make another run at breaking 14k

But until a breakout is confirmed, the trend suggests bull trapping be happening.

Good luck!