Equity outlook Restrictive policy and geopolitical risks raise the odds of a global recession

What a difference a year makes. 2022 saw the ‘reopening’ of markets from the COVID pandemic evolve into a ‘recession’. Margaret Thatcher put it succinctly on 27 February 1981 – “The lesson is clear. Inflation devalues us all.” Monetary policy has been on the most pronounced tightening campaign in decades as inflation progressed from being transitory to potentially permanent due to the energy crisis.

Politics is driving economics, not the other way around

In the pre-war global economy, globalisation was an important source of low inflation. A large amount of global savings had nowhere to be deployed, rendering interest rates lower on a global basis. However, post-war, global defence spending has risen to a level not seen in decades as national security consumes government’s agendas. There will be vast opportunity costs involved, tied to the increase in world military spending. We expect the rate of globalisation to take a back seat, as Europe would never want to be as dependent on Russian energy as it is today. In a similar vein, the US does not want to fall privy to the same mistake Europe made and will aim to strengthen ties with Taiwan in order to ensure the smooth flow of chips.

National security is inflationary

We are in the midst of a war in Europe, owing to the brutal battle being waged by Russia in Ukraine. While the war is centred in Ukraine, the reality is we are all paying the price of this war by allowing it to continue. There is another war brewing in the background that we must not fail to ignore. The United States’ deepening ties with Taiwan is aggravating China.

The Taiwan issue remains sticky. Taiwan’s role in the world economy largely existed below the radar, until it came to prominence as the semiconductor supply chain was impacted by disruptions to Taiwanese chip manufacturing. Companies in Taiwan were responsible for more than 60 percent of revenue generated by the world’s semiconductor contract manufacturers in 20201. Tensions between Taiwan and China could have a big impact on global semiconductor supply chains. The United States’ dependence on Taiwanese chip firms heightens its motivation to defend Taiwan from a Chinese attack. The desire for control of technologies, commodities, and straits is paving the way for economic wars ahead.

China needs to get its house in order

The economic headwinds that China faces are multifaceted. Unfortunately, policy easing from China in H1 2022 has been insufficient to arrest the extent of the slowdown. Of late, China’s State Council stepped up its economic stimulus further by announcing a 19-point stimulus package worth $146 billion (under 1% of GDP) to boost economic growth2.

The property markets continue to deteriorate. The problem stems from a lack of financing among many developers that is needed for construction of their residential projects. All of this came about from the central government’s decision in 2020 to introduce the ‘three red lines’ policy to rein in excessive borrowing in the real estate sector. Vulnerable property developers are struggling to secure capital to sustain their businesses. Alongside, demand for housing has deteriorated due to intermittent COVID lockdowns, weakening economy, and doubts over developers’ ability to deliver completed housing units.

However, the weakness in China’s economy extends beyond the property sector with rising unemployment and energy shortages. Chinese earnings growth since Q3 2019 has lagged the rest of the world. China has also suffered significant capital outflows, owing to its adherence to COVID-zero. This has set back its rebalancing towards a consumption-driven economy, rendering China to remain more addicted to export-led growth. However, export demand has begun to weaken as the rest of the world slows.

US is in the early innings of a recession

The US economy appears a safe haven amidst the ongoing energy crisis as it is less exposed to the vagaries of Russian oil supply. It also recovered faster from the pandemic compared to the rest of the world. The labour market remains strong as jobs continue to be added, wages accelerate, consumption has continued to grow (albeit more slowly), and unemployment remains at a five-decade low. Despite the recent upswing in GDP growth, caused by noise in the foreign trade numbers and technicalities in inventory data, the big picture of a slowing economy in the face of aggressive monetary tightening remains intact. There are mounting signs of slowing too, especially in the housing sector owing to the rapid rise in mortgage rates.

Earnings in 2022 have reflected the challenging environment being faced by US corporates with earnings growth for companies grinding down to 3.17%3.The more value-oriented sectors such as energy, industrials, and materials continue to outperform. Looking ahead, earnings revision breadth for the S&P 500 Index are in deeply negative territory suggesting downside is coming from an earnings growth standpoint.

Core inflationary pressures remain concerning, especially housing rents and medical inflation – components that are typically much stickier compared to goods and transport inflation. The stickier high services inflation reflects strong labour market dynamics as services are labour intensive and housed domestically. The Federal Reserve (Fed) appears unwilling to declare victory in its war against inflation. As we look ahead, it’s clear that the Fed’s role in quelling inflation without tipping the economy into recession will take centre stage.

Harsh winter ahead for Europe

Europe is heading for a recession in response to a strong external shock. Gas flows from Russia to Europe have declined substantially to 10% of their levels in 2021, causing gas prices to spike. The Russian war in Ukraine is showing no signs of abating, with Russia deciding on a partial mobilisation after a rather successful Ukrainian counter-offensive. These higher energy prices are squeezing real disposable income out of consumers and raising costs higher for corporates, causing further curtailment of output. The energy driven surge in headline inflation to 10.7% year on year4 has sent consumer confidence to a record low, leaving Europe in a bind.

Fiscal policy in focus

The European Union (EU) aims to define the direction and speed of Europe’s energy policy restructuring through REPowerEU strategy. However, crucial energy policy decisions have been taken by EU countries at national level. In an effort to shield European consumers from rising energy costs, EU governments have ear marked €573 billion, of which €264 billion has been set aside by Germany alone. In most European countries, both energy regulation and levies are set at the national level. The chart below illustrates the funding allocated by selected EU countries to shield households and firms from rising energy prices and their consequences on the cost of living.

No pivot yet from the ECB

We experienced a decade of almost no inflation and quantitative easing in Europe. We have now entered a phase in which the European Central Bank (ECB) has gone ahead with its third major policy rate5 increase in a row this year, thereby making substantial progress in withdrawing monetary policy accommodation. The ECB remains eager to have policy choices dominated by risks, rather than the base case, owing to which more rate hikes are coming. If Eurozone inflation continues surprising to the upside, the ECB will have to continue raising rates and determine when to activate the Transmission Protection Instrument (TPI) to support the periphery. We expect the ECB to take the deposit rate to 2.5% by March, as it continues to see risks to inflation tilted to the upside both in the short and long term.

A tightening cycle into a slower-growth macro landscape has never been helpful for equities. European equities are faced with an extremely challenging backdrop ranging from high energy prices, growing cost pressures, negative earnings revisions estimates, and cooling growth. Amid the sell-off in equity markets in the first half of this year, European equities currently trade at a price-to-earnings ratio of 14.3x, marking the steepest discount versus its long-term average of 21x compared to other major markets. The risk of a recession to a certain degree is being priced into European equity markets.

Conclusion

In our view, the global economy is projected to avoid a full-blown downturn; however, we expect to see a series of individual country recessions take shape at different points in time. Evident from recent data, the downturn in the US is expected in the second half of 2023 whilst the Eurozone and United Kingdom will enter a recession by Q4 this year. Contrary to the rest of the world’s key central banks, China and Japan are expected to keep monetary policy accommodative which should help buffer some of the slowdown. Given the highly uncertain environment, investors may look to consider US and Chinese equities, whilst potentially reducing weighting towards European equities. Across factors, we continue to tilt to the value, dividend, and quality factors given the expectations for weak economic growth, higher rates, and elevated inflation.

WAR

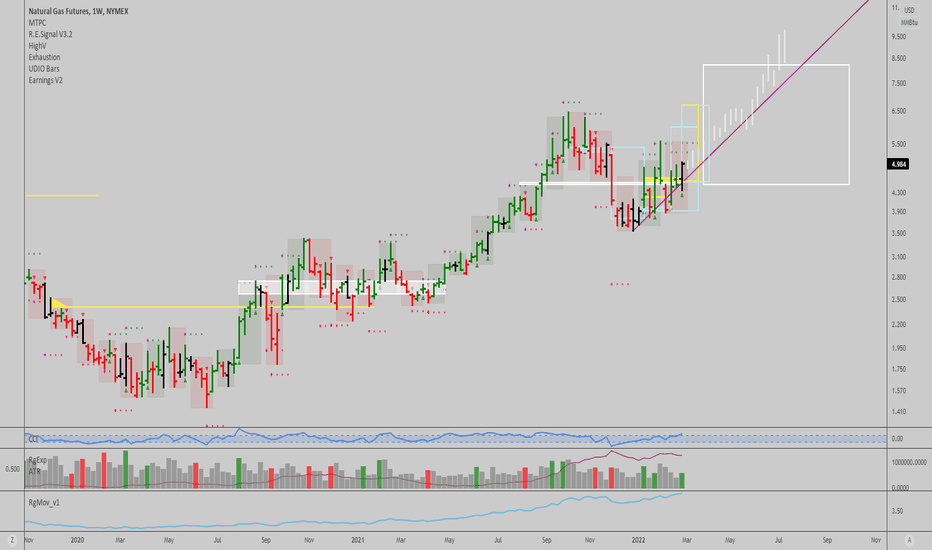

NGAS BULLISH TREND REVERSALNGAS - As observed in previous heating seasons across EU, US, and Central Asia, there is a strong possibility of raising the demand for Natural Gas, instabilities in delivering, producing, and trading the blue fuel may soon lead to a not-so-cheerful holiday season in the EU and the UK. Panic is raising and if Russia decides to continue cashing on that fear, we might see new highs concurred on the spot market.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

XAUUSD : 🔴 Retail Sales Effect 🔴There will be Retail Sales m/m & Core Retail Sales m/m announcements today , so , let's find out what will be the possible effects of it on the market !

🔴 USD : Retail Sales m/m

🔴 USD : Core Retail Sales m/m

📝 Usual Effect : 'Actual' greater than 'Forecast' is good for currency !

📒 Why Should We Care ? It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity !

📝So , If the Actual would be less than forecast can cause another pump for Gold and the fall of DXY and if 'Actual' announces greater than 'Forecast' is good for currency and bad for gold ! so let's wait and see ! the price is in a Supply zone now and we have to see if it will be broken or what !

Follow me for more analysis & Feel free to ask any questions you have, I'm here to help.

⚠️ This Analysis will be updated ...

👤 Arman Shaban : @ArmanShabanTrading

📅 11.16.2022

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better ❤️

EUR/USD : Poland's War effects As you can see, Euro/Dollar is still fluctuating in the mentioned range and you can see the effects of the risk of war and the missiles fired at Poland on the chart. These days, in addition to macroeconomic factors, the market is suffering from systematic risk. War also has a huge impact and This makes us deal with our trades and analyzes with more care and management in these times!

Follow me for more analysis & Feel free to ask any questions you have, I'm here to help.

⚠️ This Analysis will be updated ...

👤 Arman Shaban : @ArmanShabanTrading

📅 11.16.2022

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better ❤️

Lockheed Martin Bull PennantThis is a monthly chart of the defense company Lockheed Martin (LMT).

As you can see, a bull pennant is appearing.

In my experience, I have found that the most valid bull flags or pennants usually retrace back to the Golden Ratio (0.618), then bounce and continue higher (see below chart).

When this occurs, the measured move up is typically one full Fibonacci spiral from this retracement level, which usually occurs over a period of time that is about the same as the period of time it took the bull flag or pennant to form (see below chart)

The above chart suggests that LMT could climb into the 500s or as high as about 600 by the second quarter of next year. The best time to enter a trade would probably be after the seasonal volatility ends, and after a breakout occurs on some lower timeframe.

From a regression standpoint, this bull pennant formed when price rose from the mean to the 1 standard deviation, and retraced to the 0.5 standard deviation. If it pans out, the measured move may reach one full standard deviation higher (to the 1.5 standard deviations). See below chart.

To learn more about the log-linear regression channel that I used here, you can check out my prior post that described it in more detail:

Obviously, anything can happen. Not trading advice. Please do your own research and trade at your own risk. If you disagree, I welcome respectful comments and charts below.

Disclosure: I have no trade position in LMT and do not plan to open any trade at the current time.

USD Index Recession Depression and TransgressionGood Morning All ,

It has been a long while since I posted, but it has also been along time since I have been active in trading as well. i squared off my positions and just been speculating and watching the craziness that continues to unfold. For some of the OG Traders out there you might have come across my stuff in the past, but for some of the new guys new to trading what a time to be alive. To re-itterate some points I have made in the past I am not political I consider myself a centralist with right sided tendencies. (because of my views about business and taxes) . this post will be rudimentary in aspects for people that live here in the US. So if not interested then skip the italicized section.

okay, what we have here is the dollar index, and its basically a measure of strength of the US' economy against 8 other countries. Now, I live in the US and here is a very basic political breakdown of our political system

republicans- it's the political conservatives of the country and business liberal. Meaning that they hold traditional values when it comes to policies and encourages borrowing for business growth and borrowing for political agenda.

Democrats- it's the political liberals of the country and business conservative. Meaning they hold progressive policy values and encourage high taxation to fund their political agenda.

We need both in the US to keep the balance to much right sided-ness we fall into a communists like state and too much left sided nss and we fall into the hands of socialism. so a health mix of both is needed to keep us in check.

Now, the world is coming into hard times because of the US' liberal fiduciary policies as of late and now we are trying to reel that back. The US is the world reserve and will continue to be for the foreseeable future, and the reason i say that is I don't see the world entrusting China to report the truth of the Yuan's value if it were to become the reserve currency of the world. I know a lot of people think that china is the next super power to rise and become the reserve status of the world, but until they become more transparent i don't see it happening. The only country I see rising to take that spot is the UK. They have the second largest FREE trade economy of the world, and could potentially return to the reserve status. The EU stands a chance, but I don't see Germany being able to support the world economy that would be required to make the EU possible. Basically, which demon do you want to deal with, because none of the options are ideal.

Now, if some of the EU countries that takes from the Euro really step their game up and produced for more the euro instead of take then they could become a viable option too, but as far as china I just don't see the world entrusting them to hold that type of power. I mean their housing market is currently a Ponzi Scheme, and their having to use military force to keep citizens from breaking into the banks to get their money back out. The US' SEC a year or two ago placed harsh restrictions and banned a lot of Chinese companies from the US open tradable market, because they were cooking their books and inflating earnings and deflating expenses, and rumor has it that the chinese government knew about it and allowed it, to continue to boost their economy via foreign monies.

Back to the Dollar, the Dollar index has an inverse relationship with the NASDAQ, S&P 500, and the Dow Jones Industrial Average.

Why?

Because, the DXY is a visual representation of the current status of the Economy. When the dollar was in the 8X's the last two years times were good, people were making a lot of monies while spending and living the good life?

Why? because the Fed made money cheap. So, the cost of doing business was cheap profits were just as large as the margins. So, business operations got fat in the sense of a CEO or C-Suite personnel needing 2-3 assistants and having bean counters to double check the primary bean counters. Now, Powell has consistently held to his target inflation rate of 2% its all over the FED's website and echoed in his speeches. which is the reason of his 75 base point interest rate hikes.

What I see coming is another Great Depression. Because for many of the technical traders in the world there is more to a company than numbers on a chart. Investors large and small make monetary contributions to these companies in return for returns. well during COVID-19 money flooded the market and business were able to continue to run. Since the beginning of COVID I knew a lot of businesses were in trouble because they were publicly reporting inflated numbers to the SEC, and the SEC TOOK THEM?!?! So it looked like these businesses were doing way better than they actually were, and now their board of directors and shareholders expect them to continue to run at that level.

Now, that money is drying up and these businesses are about to lose their funding from both ends. On one end their investors (already starting) are squaring off their positions. So, one way to prop up the facade of success is to do massive layoffs to trim the fat. Run the business very lean. That doesn't boost revenue that really just stabilizes the load. putting a plug in a hole on a boat as it were. These massive layoffs lead to lower GDP and two consecutive reports of shrinkage equals a recession.

The Fed Continues to raise interest rates making the dollar expensive to do business. When someone looks at a business' 10K and finds their balance sheet or earnings they will see massive amounts of debt. this debt is typically owed to a major lending institution. These loans, though not designed for the purpose, they are used to fund operations and growth. good businesses have cash on hand to pay off loans in times of hardship and inexperienced leaders are frivolous with the tax-free money. When this money becomes more expensive businesses can no longer afford to take loans out and are forced to remain the same, shrink, sell-out to a competitor, or go out of business all together.

part of the problem is that it now keeps people working because they lost 10-12 years out of their 401k due to the stock market correction, students coming out of college with massive amounts of student loan debt and are forced to take a job making 10-15 dollars an hour with student loan payments being around 300-1000$ a month which will lead to defaults because they cant afford to live alone, and are going to move back in with their parents. and hopefully their parents are not retired, because if so they're going to have to help their family with utility bills and mortgages and care less about their student loans. much less if their parents don't make the cut at work due to the layoffs.

Now, this causes a major problem because those once employed people are now jobless and can no longer keep their payments to their mortgage company. And now these mortgage backed securities are going to start imploding on the people that bought them and repeat 2008.

This is just the inherit fallout of these type of securities. I mean i understand their purpose, which is used to get back money to keep the velocity of money up, but no matter the credit score if a person loses their job and can not find work then payments are going to be missed.

this will ultimately lead to a depression.

what saved us last time from a depression was the US " FOUND " weapons of mass destruction and we launched an all-out attack on Iraq. and then when we finally "FOUND" said weapons we then decided to focus our attention on the people that attacked us on 9/11. But, this is not the only time the US used war to re-bound out of a depression, WW1 aka the great war ramped up our economy and we were magically out of a depression and then shortly aft Dub Dub 1 we found ourselves in Dub Dub 2. the pattern is repeated over and over in our history. the cold war got us out of the stink in the mid 80's with the cold war, and gulf war in the 90s.

will the US find Hillary Clinton's Emails in China and now we go to war with china? Who Knows. (this was sarcasm)

I think we need a business savvy executive whether man or woman to be elected as president and get the country back on the rails. We need good monetary policy in place, we need to support small business here in the states to keep big businesses from becoming monopolies and drive prices down. we need more diversity in the economy. Because a more diverse economy = a cheaper place to live.

with all of that being said I forsee dollar to continue to get more and more expensive with the minimum being 12X.xx, median being in the 14X.xx and the maximum being somewhere around 15X.xx. I see interest rates forcing everyone's hand to show what their hiding. I see weak businesses going under, smart strong businesses staying afloat and will grow exponentially when the storm passes.

another potential thing is that the FED might think they over extended and might bump interest rates down or keep them the same for a brief time (this is a temporary fix), but I still see them raising rates to get back to 2%.

this is not financial advice, but my play book is to continue to sit on liquid cash and I would say a good indicator for me to jump back in is to see 4 or 5 maybe even 6 Fed meetings where the interest rates remain unchanged or begin to drop consecutively. So gather all your pennies, begin to live lean, and when the fed begins to keep interest rates unchanged begin to look at who is still walking around Wall St. and think about investing with them.

i do think if the US votes with their intelligence and not their emotions we can avoid all of what I wrote. and I truly do hope I am wrong!

@TayFx crazy to see man how two years ago we were called perma-bears and crazy and now we look like Wall St. prophets. LOL Hope all is well bud! HMU when you get a chance!

Gold a beginning of a crash? | Market outlookConfident support for the instrument is provided by the fact that investors flee from risk against the backdrop of a noticeable deterioration in the situation in Eastern Europe. Early in the morning, Russian President Vladimir Putin authorized a special military operation on the territory of Donbass. Today, a large block of macroeconomic statistics from the US is expected to be published, but it is possible that investors will leave it without due attention. An exception, perhaps, can only be annual data on GDP dynamics for Q4 2021. At the same time, these will be only updated data, and in case of minor changes, the market reaction will obviously be restrained.

Cup And HandleWhat do we have?

1) A pattern beloved by all boomers - Cup and Handle

2) Money printing because of covid and war

3) Mass draft and mobilisation of russian citizens who was serving in the army (90% of them did) happening since today

4) Potential North Korea and Russia Alliance to revenge for Korean War

5) Maximum panic and end of the world in the head of traders is possible, 69% chance

Something is going to break, DXY or SPX500 take your pick IIDecision time, eminent, could not stress it more, options:

1. The DXY topped, it will break down slowly but respecting a downwards path, like oil has done, in this case the SPX500 will break up.

2. Otherwise the SPX500 will break down and it will be in a massive recessionary 2008 move downwards, breaking the June lows and, a sign that something has gone sour in the street economy, but it has to be something big, it can also be another war, and trouble is coming in the next months/years

XAUUSD SHORT TO 1747A possible shorting opportunity on Gold down towards our buying zone. On the smaller timeframe, Gold has completed a 5 wave move, so I am now expecting a pullback down towards 1746 in order for market to fill the imbalance.

A nice 500 PIPS (2.85%) possible gain from this sell opportunity.

Drop a like and follow if you agree, or do let me know what you think!

BTC Relief Rally to 27k incoming?Here's just a quick look at the weekly BTC chart (Not a detailed analysis):

The market has held the 22.5k level very well and a relief rally to 27k is expected at this level before we see more downside! The downside concerns arise from the China - USA tensions, and if Taiwan gets attacked by China, we may see massive south-going price action. Trade safe!

-------------------------------------------

What Is a Wedge in the context of trading?:

"A wedge is a price pattern marked by converging trend lines on a price chart. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. The lines show that the highs and the lows are either rising or falling and differing rates, giving the appearance of a wedge as the lines approach a convergence. Wedge-shaped trend lines are considered useful indicators of a potential reversal in price action by technical analysts.

Key Takeaways for Falling wedges:

1. Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods.

2. The patterns may be considered rising or falling wedges depending on their direction.

3. These patterns have an unusually good track record for forecasting price reversals."

-------------------------------------------

If you like the content, then make sure to comment and like the post :D

Follow me for daily profitable trading setups

BTC dictates the market. If BTC falls, then Alts will fall as well. Trade safe!

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.