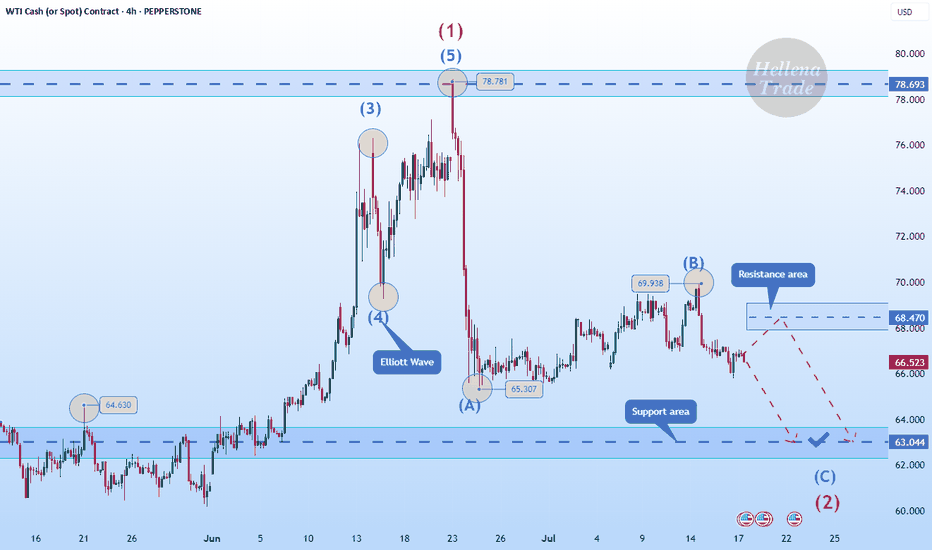

Hellena | Oil (4H): SHORT to support area of 63.000.Colleagues, I believe that wave “B” has formed at the level of 69.938, and now we expect the downward movement to continue with the aim of completing wave ‘C’ of the middle order and wave “2” of the higher order in the support area of 63,000.

It is quite possible that the price could reach the 60,000 level, but I think that for now it is worth focusing on the nearest targets.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Wave Analysis

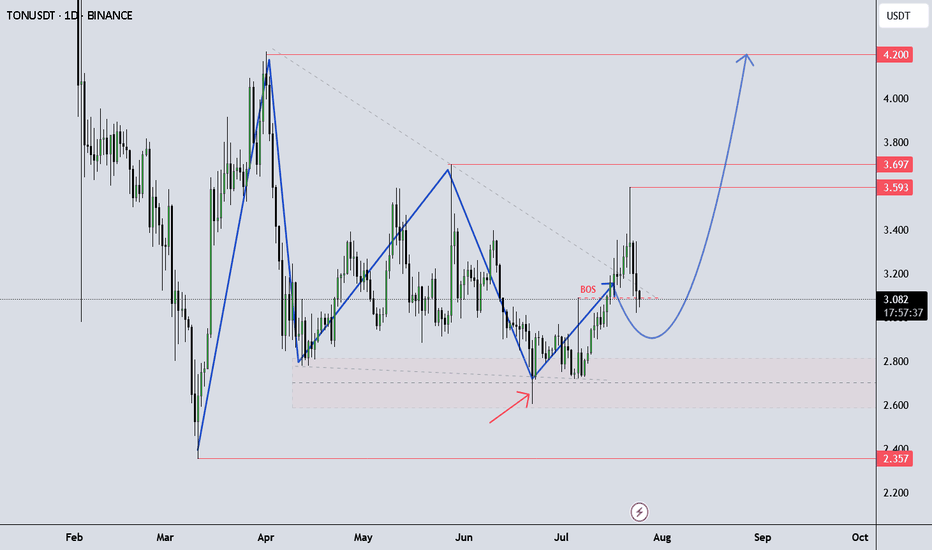

TONUSDT continue up!Looking for an Impulse Up – TONUSDT Outlook

TONUSDT is showing momentum to the upside as it continues its current structure, possibly developing another impulsive leg.

It’s important to follow your own trading plan and maintain proper risk-reward (RR) discipline.

This idea is shared for educational purposes only to support your learning.

Got questions? Feel free to drop them in the comments!

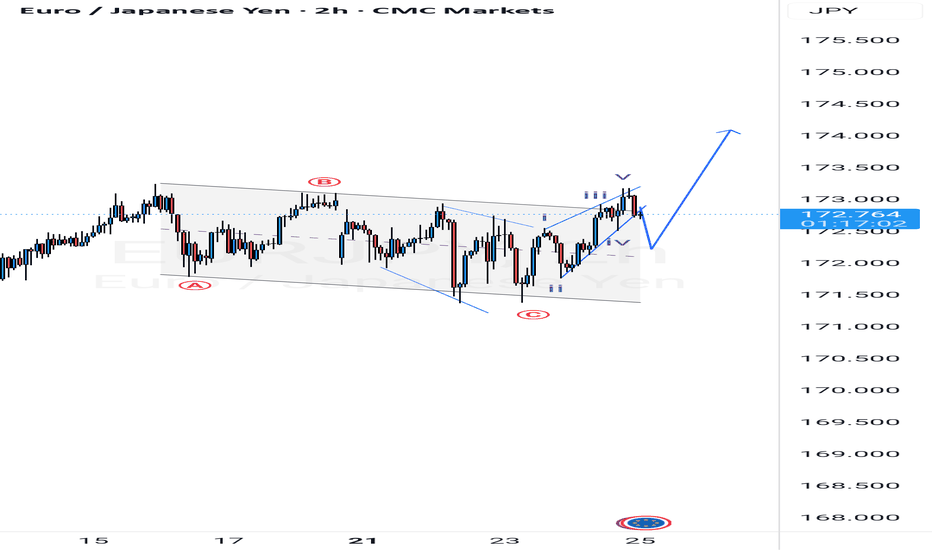

BULLISH SCENARIO EURJPY has been on a consolidation for some few days almost a week, and it looks like the asset has been printing out a flat correction for W4 before it breaks it the upside. The print out of the breakout looks like a LEADING diagonal, which leads to a new Impulse constructing W5. If all goes well we should be looking upstairs before a fall.

Don't forget to apply your trading tactics.

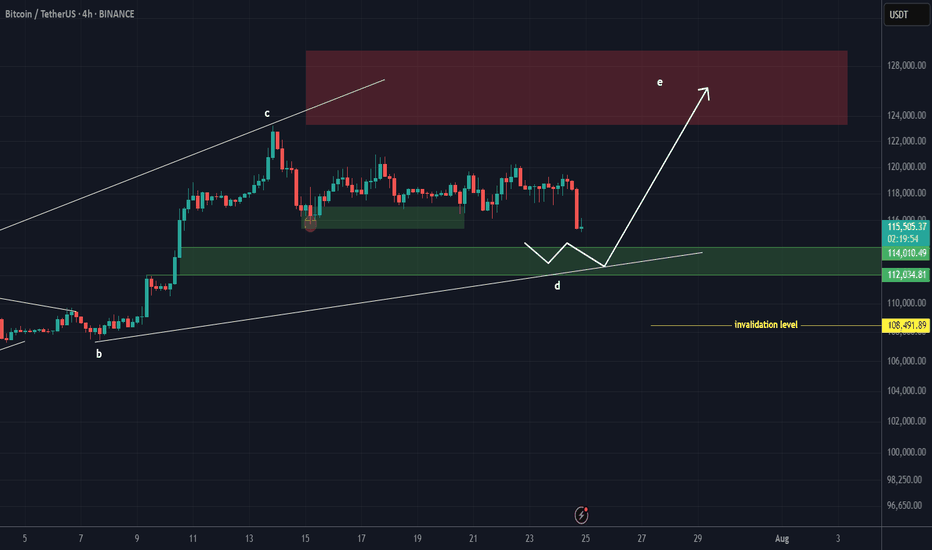

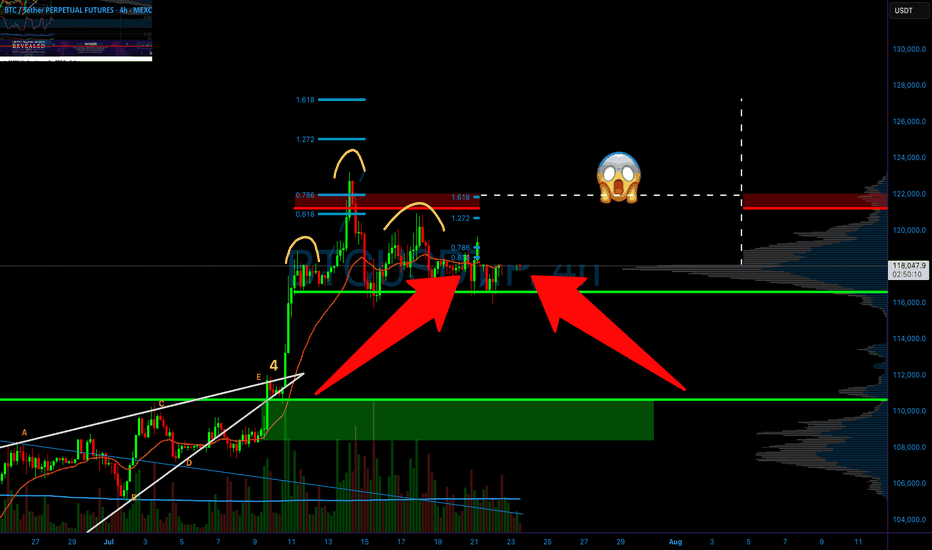

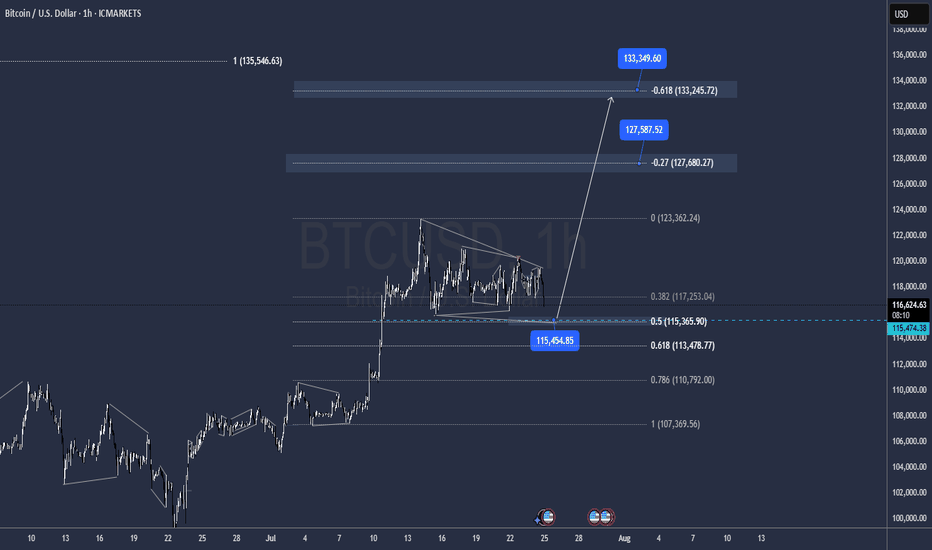

BTC New Upodate (4H)This analysis is an update of the analysis you see in the "Related publications" section

We previously stated that Bitcoin lacks the strength to move upward, and we expect the price to soon reach the green zone (114K-112K).

The price is now dropping toward this zone, which is the rebuy area.

The process of reaching the green zone has been and still is somewhat time-consuming, and during this time, it may repeatedly mislead beginners.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

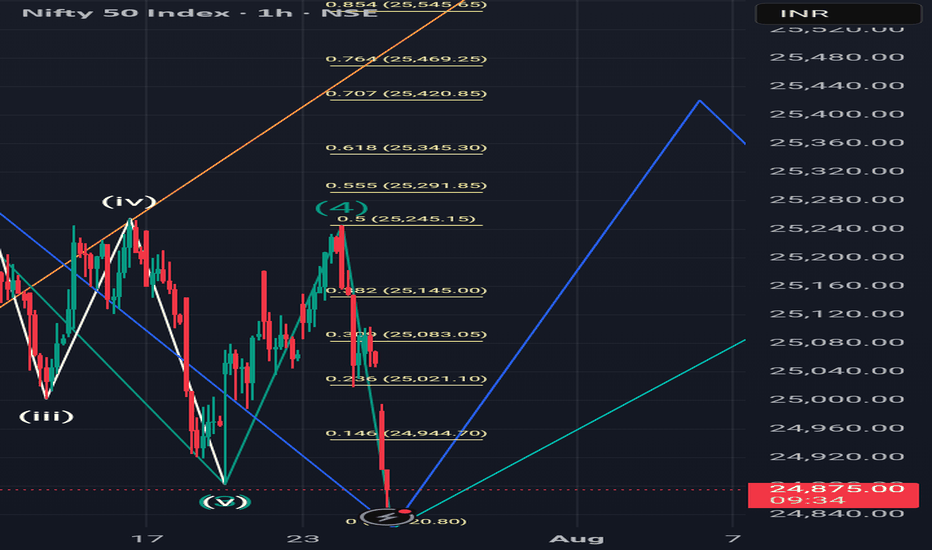

A correction ahead.If you know Elliott Wave, then you will understand this analysis. Now as you saw my last post a wave 'Y' on monthly T.F has started from 30 June. This was on a larger T.F but this analysis is on smaller T.F. Wave '1' has completed now on this T.F. and a correction ahead upto 0.618(25345) or 0.707(25420) of this enfire run as showed in screenshot.

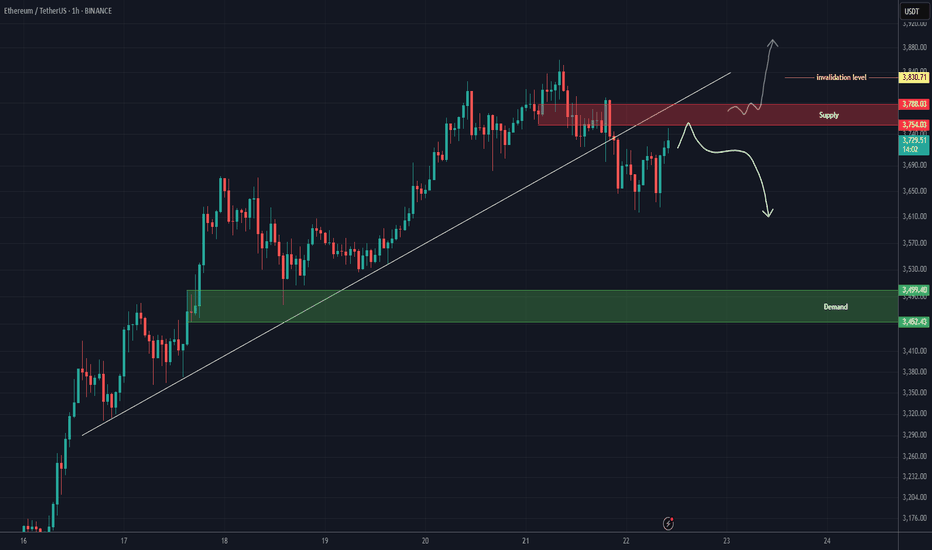

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

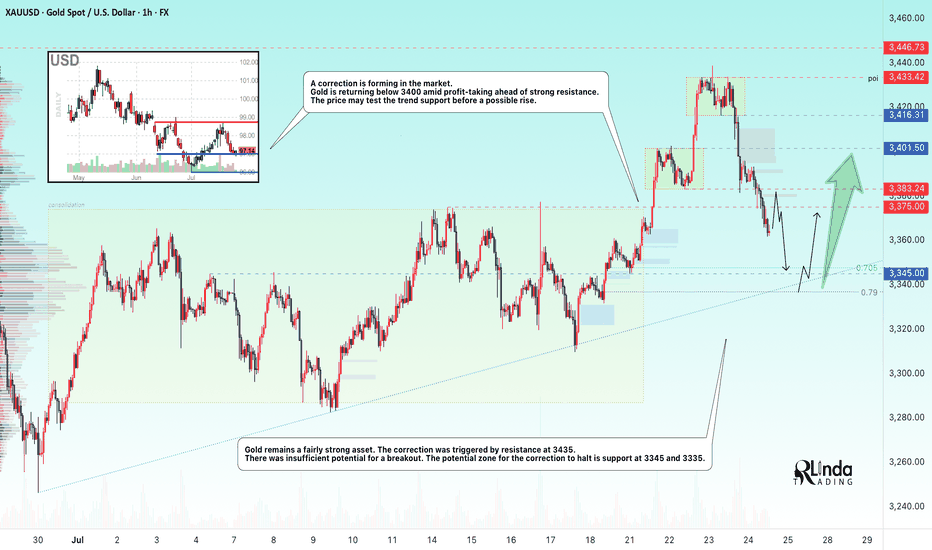

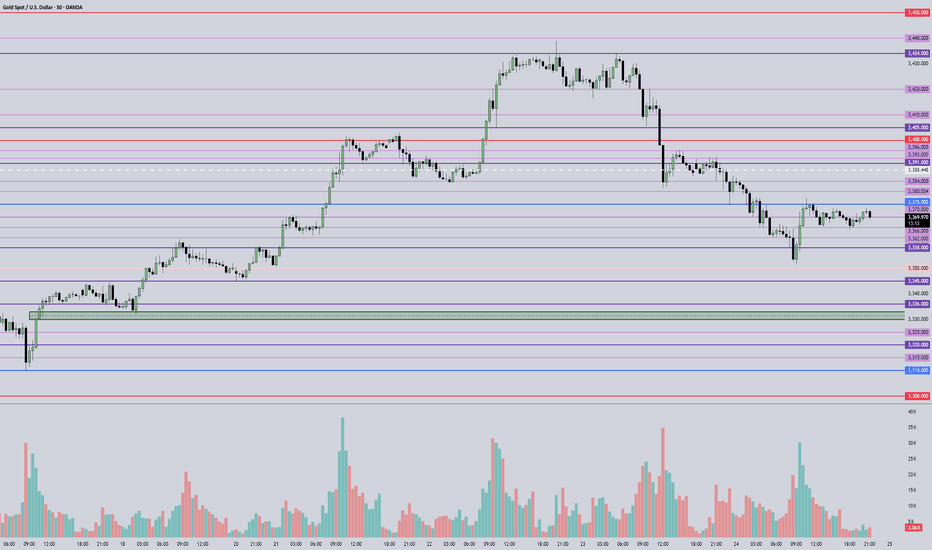

GOLD → Countertrend correction. Where will growth begin?FX:XAUUSD faced pressure in the 3430 zone, traders moved into profit-taking mode, triggering a correction. The price entered the sell-off zone...

On Thursday, gold is trading below $3400 as traders assess progress in US-EU trade talks and await preliminary PMI data from the US and the EU. These indicators could influence expectations for Fed and ECB rates. Optimism is being bolstered by reports of trade agreements between the US and Japan and other countries. The ECB is expected to keep rates unchanged, while the probability of a Fed rate cut in September is estimated at 60%. Investors are also watching Trump's conflict with Powell amid his visit to the Fed. Technically, the daily market structure is not broken, and a correction is forming within acceptable limits.

Based on the current direction, the market may test the intermediate bottom: trend support, the 3345-3320 area.

Resistance levels: 3375, 3383, 3400.

Support levels: 3345, 3320

A retest of resistance at 3375-3383 is possible. If the bears keep the price below this zone, the metal may continue its correction phase towards the zone of interest indicated on the chart. Local sell-offs have not yet broken the bullish daily structure.

However, the absence of a downward impulse and consolidation in 3375 - 3383 with a subsequent breakout of local resistance could increase demand again, which would generally lead to premature growth to 3400 - 3435.

Best regards, R. Linda!

BITCOIN IS CREATING A SECRET PATTERN! (Huge move incoming?!)Yello paradisers! I'm describing to you what's going on with Bitcoin right now. We are creating a secret pattern that is forming, and once its neckline is reclaimed, we are going to have a huge movement.

In this video, I'm sharing with you the most important support and resistances on multiple time frames. We are describing Elliott wave theory wave count, and taking a look at candlestick patterns. We are talking about confirmations necessary for bullish and bearish cases. I'm explaining to you what the professional trading signals need for long-term profitability.

Some of the points are great risk-reward ratios. I'm talking about that in the video. One of them is taking only the highest probability trade setups, and having the patience and discipline to wait for them.

I'm talking about proper strategy which is needed, and systemology in your overall trading and how important it is. Here on TradingView, I'm describing to you the overall bias I have on Bitcoin right now.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

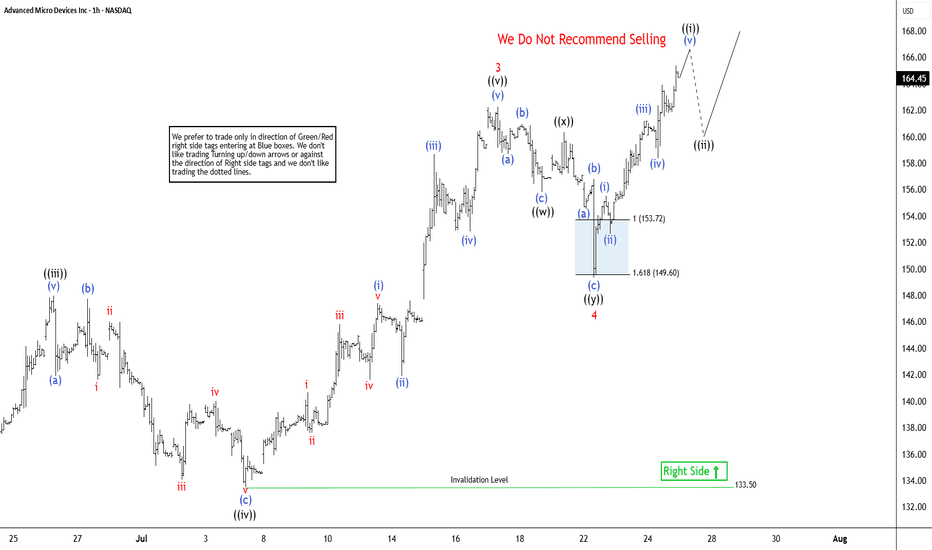

Elliott Wave Outlook: AMD Expects Pullback Soon Before RallyThe Advanced Micro Devices Inc., (AMD) favors rally in impulse Elliott Wave sequence from 4.09.2025 low & expect upside in to 168.36 – 190.36 to finish it. Impulse sequence unfolds in 5, 9, 13, 17…., swings & ends with momentum divergence. In daily, it ended pullback in 3 swings at 75.22 low in blue box area from March-2024 high. It is trading higher in nest & expect 13 swings to finish the impulse ((1)) before correcting next. Currently, it favors rally in 7th swing in daily & expect end soon in to 165.63 – 179.16 area before correcting in (4) as 8th swing. In 4-hour, it ended (1) of ((1)) at 97.91 high, (2) at 83.75 low in 4.21.2025 & favors rally in (3) as extended wave. Within (3), it placed 1 at 122.52 high, 2 at 107.09 low, 3 at 162.36 high, 4 at 149.34 low of 7.22.2025 & favors rally in 5. It is showing higher high since April-2025 low.

Below 3 high of 162.36, it ended 4 pullback in double three correction at 149.34 low. It ended ((w)) at 155.81 low, ((x)) at 160.34 high & ((y)) at 149.34 low. Above 4 low, it favors rally in ((i)) of 5 in to 165.44 – 170.43 before correcting next. Within ((i)), it ended (i) at 155.53 high, (ii) at 152.66 low, (iii) at 161.20 high, (iv) at 158.36 low & favor higher in (v). It appears three swings in (v) & expect pullback before final push above 161.52 low before correcting in ((ii)). Alternatively, the current cycle from 4 low can be 5 of (3) before it corrects in (4). In either the case, the next pullback should remain supported. In 4-hour, it is trading in 11th swing & expect pullback in 12th swings later before final rally. We like to buy the pullback in 3, 7 or 11 swings at extreme area for the upside in ((1)).

Bajaj Healthcare Ltd can move for 5th wave upBajaj Healthcare Ltd: #BAJAJHCARE

Above 3-Year Range: The current price action is holding above a multi-year sideways range, signaling a potential transition out of consolidation.

Support Zone: Price is consolidating above a significant support zone (₹480–₹500), a level that has historically shown resistance and limited downside from here.

Momentum: Short-term technical indicators, such as RSI, are showing a recent turn higher from the mid-range, indicating renewed buying momentum and a potential upswing.

Swing Trade Setup

Why the Chart Looks Good for a Swing:

Strong Base at Support: With price respecting major support and avoiding breakdowns, risk is relatively contained for new positions.

Clear Entry-Stop Structure:

Entry: Around the current levels, above ₹480–₹500 support.

Stop-loss: Just below the ₹460 zone, which is well defined by recent market structure.

Upside Potential: Price has room to test higher resistance areas, notably first toward ₹600+ and eventually ₹800 if momentum sustains.

Momentum Shift: Oscillator bounce from oversold/mid-levels supports the case for a swing move up.

Risk Considerations

Resistance Overhead: Price faces nearby resistance at ₹600 and major resistance near ₹800. Watch for momentum to ease if these levels are approached quickly.

Volume Confirmation: A breakout above ₹600 with strong volume would offer the most reliable swing confirmation.

Invalidation: A decisive break below ₹460 on a closing basis would invalidate bullish swing structure and signal caution or exit.

Elliott Wave Analysis – XAUUSD July 25, 2025📊

________________________________________

🔍 Momentum Analysis

• D1 Timeframe: Momentum is declining. Based on the current pace, it’s likely that only 1–2 more daily candles are needed before momentum enters the oversold zone → suggesting one more potential downward leg.

• H4 Timeframe: Momentum is about to turn bearish, indicating we might see a sideways movement or a slight drop in the short term.

• H1 Timeframe: Momentum is currently falling. By the end of the current H1 candle, momentum will likely enter the oversold zone → potential for a bullish reversal soon.

________________________________________

🌀 Elliott Wave Structure

• A clear 5-wave Wave A has already formed with no irregular patterns, so I’m expecting Wave B (black) to unfold as a 3-wave structure.

• Within this black Wave B, price is now developing Wave B (blue), meaning Wave A (blue) has already completed. Looking at the lower timeframe, I can identify a 5-wave structure → suggesting a zigzag correction in the form of 5-3-5 for black Wave B.

• Target for Wave B (blue): The 3360 area – this is a support level and also aligns with Fibonacci confluence, making it a strong candidate for the end of Wave B (blue) and a potential reversal zone.

• If price respects the 3360 level, then projected targets for Wave C (blue) would be around 3386 or 3402.

• However, if price breaks below 3351, the current wave count becomes invalid. In that case, we will shift to an alternate scenario and look for a buy opportunity near the lower edge of the triangle (c)-(e) and other confluence support zones.

________________________________________

🔄 Combining Momentum & Wave Structure

• D1 momentum shows weakening in this downward move, and the lower boundary of the triangle (c)-(e) is a prime area to look for the end of Wave e.

• Ideally, we want to see:

o A short-term bounce upward aligning with H1 momentum reversal to complete Wave C (blue).

o Then a confluence with H4 momentum turning bearish, indicating possible trend continuation or reversal.

________________________________________

📌 Trade Plan

• For experienced traders:

Watch closely around 3385 and 3401 for reversal signals to enter Sell positions.

• For beginners, I recommend the following limit setup:

o SELL ZONE: 3399 – 3402

o SL: 3501

o TP1: 3374

o TP2: 3351

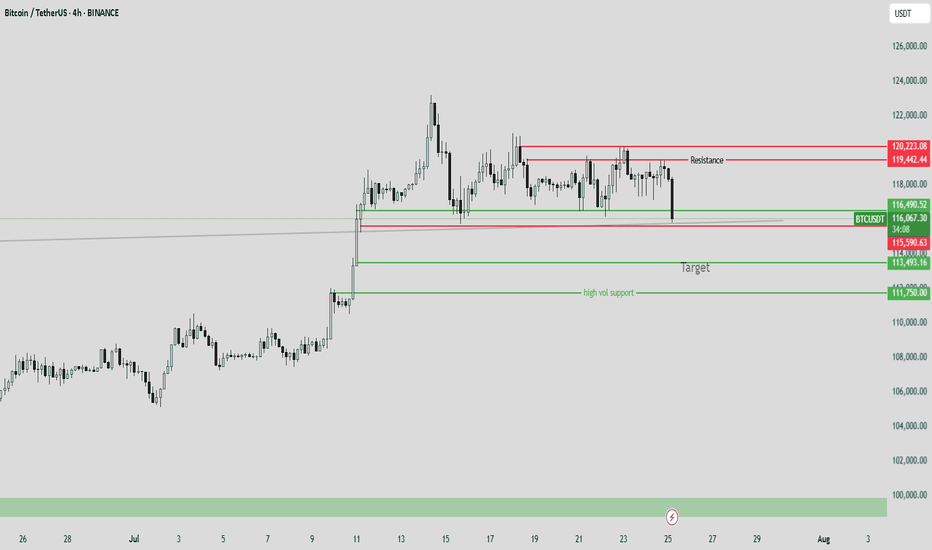

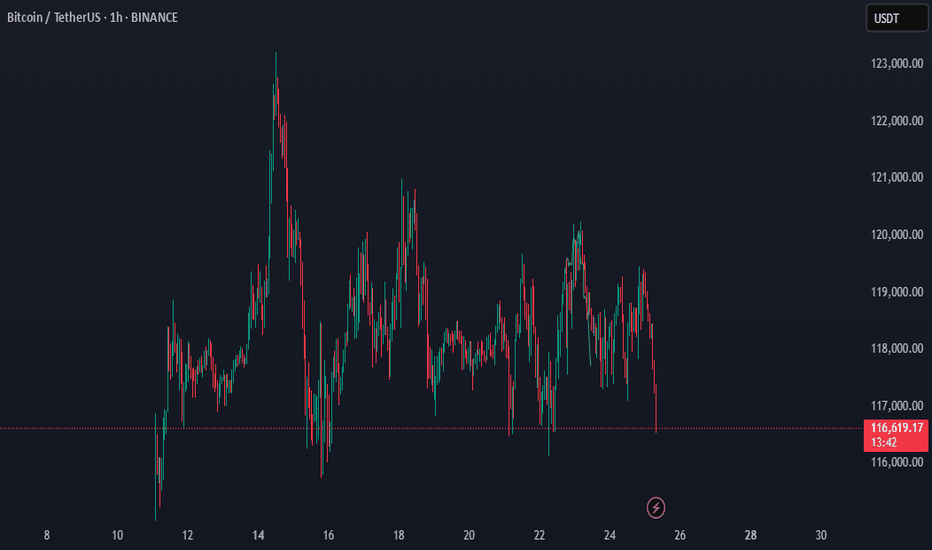

BITCOIN Indicates Consolidating Moves Before StronBitcoin (BTC) Market Analysis Report

Summary and Conclusion

Bitcoin (BTC) is currently trading around $117,000 to $118,000, showing a slight pullback from its recent all-time high near $123,000. The market sentiment is moderately bullish but cautious, with technical indicators signaling some overbought conditions and short-term consolidation. Institutional interest appears to be cooling off slightly, as evidenced by recent outflows from Bitcoin ETFs, while accumulation continues across various investor tiers, including whales and retail holders.

Key resistance is near $119,400-$120,000, and support lies around $117,200-$116,900. The market is in a "perfect accumulation" phase, with strong buying support despite some profit-taking. The Fear & Greed Index is at 70, indicating greed but not extreme euphoria.

Recent news highlights a mixed picture: Bitcoin remains dominant and stable, but altcoins are gaining some momentum. Institutional flows are shifting somewhat from Bitcoin to Ethereum and other altcoins. Experts predict potential for Bitcoin to reach $200,000 to $250,000 later this year, driven by macroeconomic factors like credit expansion and fiat inflation.

Detailed Analysis

1. Price and Market Data

Market Type Last Price (USD) 24h Change 24h High 24h Low 24h Volume (USD) Funding Rate (Contract)

Spot 116,959.8 -1.65% 119,498.4 116,946.6 1.43B N/A

Contract 116,962.7 -1.65% 119,492.9 116,935.5 8.91B 0.0001

Bitcoin is consolidating below $120,000 after reaching a peak of $123,218 on July 14.

Trading volume remains robust, indicating active market participation.

2. Technical Indicators

Bullish Signals: No strong bullish technical indicators currently detected.

Bearish Signals: RSI indicates overbought conditions, suggesting short-term caution.

Support and Resistance:

Resistance: ~$119,416.6

Support: ~$117,227.4

MACD and other momentum indicators show indecisiveness, implying possible sideways movement or minor corrections before the next major move.

3. Market Sentiment

Fear & Greed Index: 70 (Greed)

Investor sentiment is bullish but tempered by profit-taking and cautious positioning.

ETF flows show a recent reversal with $68 million outflows from Bitcoin ETFs, ending a 13-day inflow streak.

Ethereum and altcoins are attracting more inflows, signaling a rotation in institutional interest.

4. Recent News Highlights

Bitcoin remains dominant but has been mostly stagnant below $120K, while altcoins struggle for momentum.

Institutional investors are shifting some capital from Bitcoin to Ethereum and other altcoins.

Bitcoin is in a "perfect accumulation" phase, with all investor tiers building positions despite some whale transfers.

Experts like Arthur Hayes predict Bitcoin could reach $250,000 by year-end, driven by credit expansion and macroeconomic factors.

Network activity shows a slight dip in active addresses, indicating a short-term pause.

Support levels around $116,952 and $114,354 are critical to watch for downside risk.

Bitcoin's dominance remains strong at around 61%.

5. Outlook

Short-term: Bitcoin may continue to consolidate between $117,000 and $120,000, with potential minor pullbacks due to overbought RSI.

Medium to Long-term: Positive macro factors and accumulation trends suggest potential for new highs, possibly targeting $150,000 to $250,000.

Watch for a breakout above $120,000 to confirm bullish momentum continuation.

Monitor ETF flows and on-chain activity for signs of renewed institutional interest or caution.

Recommendations for Traders and Investors

Traders: Consider cautious trading around current levels, watching for RSI and MACD signals for entry/exit points. Be mindful of resistance near $120,000.

Investors: Accumulation phase suggests good opportunities for long-term holding, especially if Bitcoin holds above $117,000.

Risk Management: Keep stop-loss orders near support levels to mitigate downside risk in case of a correction.

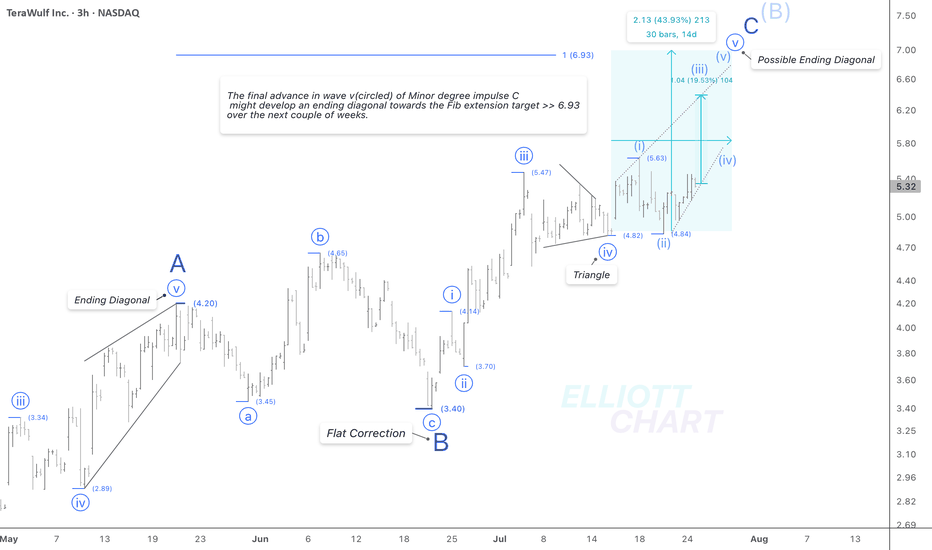

WULF / 3hWave Analysis >> While the current outlook on WULF remains consistent with previous analysis, the internal structure of wave v (circled) suggests the potential development of an ending diagonal in the final leg of Minor degree wave C.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

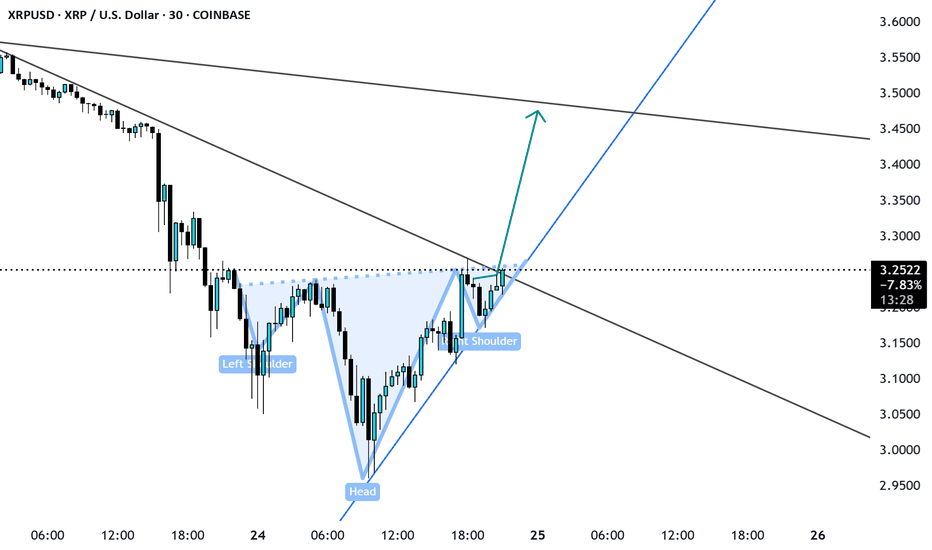

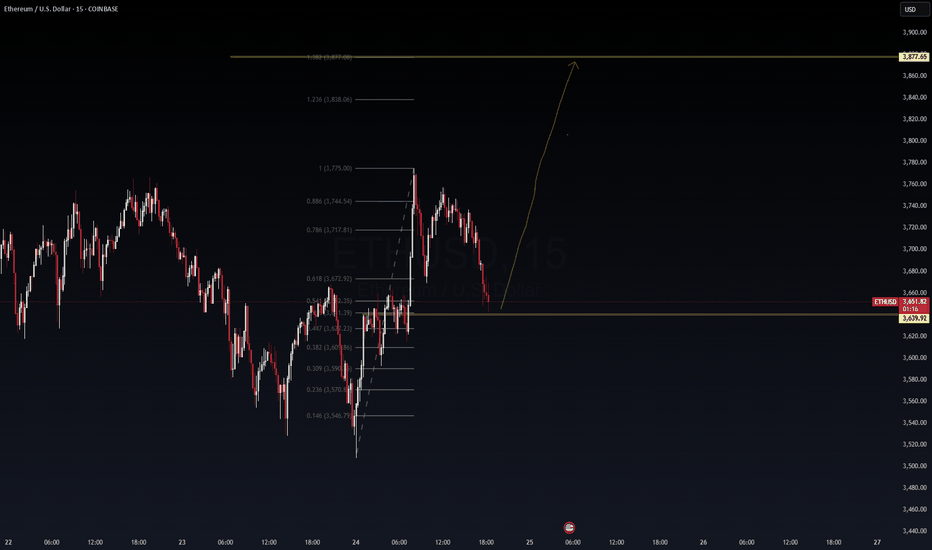

ETHUSD – Long Setup Activated | VolanX Protocol AlertEthereum (ETHUSD) is displaying strong bullish intent after reclaiming the VolanX Alert Line (~$3,659). Price action is forming higher lows with BOS (Break of Structure) signals, indicating that smart money is accumulating before a potential continuation rally toward the premium zones.

Key Levels & Zones:

Entry Zone: $3,660 – $3,680 (retest of equilibrium/alert line)

Target 1: $3,767 (weak high zone)

Target 2: $3,875 (premium zone)

Target 3: $4,000+ (extended bullish target)

Invalidation: Close below $3,620 (discount zone breach)

Rationale:

CHoCH → BOS → Retest Pattern: Multiple change-of-character moves followed by a BOS above $3,705 signal bullish market structure.

Liquidity Hunt Completed: Price swept the $3,540 discount zone and rebounded sharply, confirming smart money entry.

OPEX Volatility Catalyst: With options expiration tomorrow, volatility could drive ETH toward key liquidity zones. Favoring long bias as buy-side liquidity builds above $3,750.

Volume Surge: Breakout volume on 15m and 1H charts suggests institutional participation.

Trade Plan:

Long Entry: On a successful retest of $3,660–$3,680 zone with strong bullish candle confirmation.

Stop-Loss: Below $3,620 (structure invalidation).

Targets: Scale out at 3,767 → 3,875 → trail above $3,900.

Risk-Reward: ~1:3 or better, depending on execution and trailing strategy.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Trade responsibly and use proper risk management.

July 25, 2025 - XAUUSD GOLD Analysis and Potential OpportunitySummary:

The downtrend continues, with 3350 providing some support — though not strong enough to indicate a solid reversal. Watch for a retest of this level; if 3350 breaks, bearish momentum may resume. For now, price is ranging between 3365–3375. Continue to trade the range with a sell-high, buy-low mindset.

• Break below 3365 → look to short on pullbacks.

• Break above 3375 → switch to buying on dips.

🔍 Key Levels to Watch:

• 3434 – Resistance

• 3420 – Resistance

• 3405 – Key resistance

• 3400 – Psychological level

• 3384 – Resistance

• 3375 – Key resistance

• 3364 – Support

• 3358 – Support

• 3345 – Strong support

• 3336 – Support

• 3330 – Support

📈 Intraday Strategy:

• SELL if price breaks below 3365 → target 3362, then 3358, 3351, 3345

• BUY if price holds above 3375 → target 3380, then 3385, 3390, 3396

👉 If you find this helpful or traded using this plan, a like would mean a lot and keep me motivated. Thanks for the support!

Disclaimer: This is my personal view, not financial advice. Always use proper risk control.

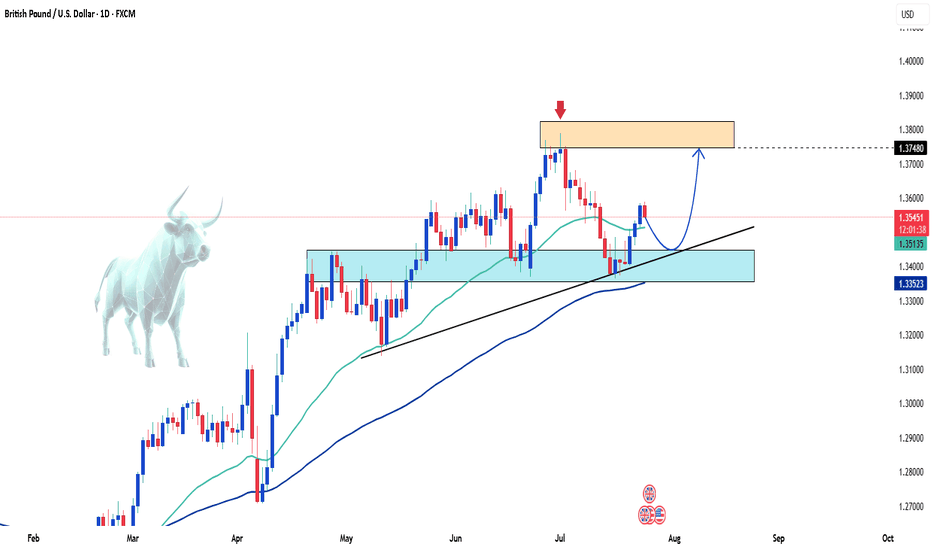

GBPUSD Rebounds Strongly – Is the Uptrend Ready to Resume?Hello traders!

On the D1 chart, GBPUSD is showing a strong recovery after bouncing off the support zone around 1.33500–1.34500. This rebound happened right at the ascending trendline and the confluence with the EMA, reinforcing the strength of the bullish zone.

The overall bullish structure remains intact. As long as price stays above the trendline, I expect GBPUSD to continue its move toward the resistance area near the recent highs.

My strategy is to look for buying opportunities around the support zone or after a confirmation signal from price action following a minor pullback.

Good luck and happy trading!

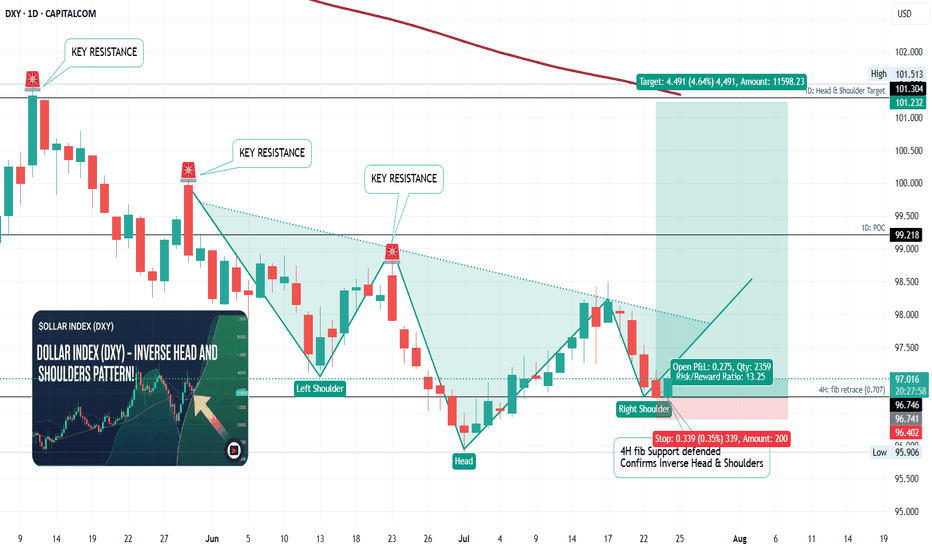

Dollar Reversal? Inverse Head & Shoulders Spotted!Is the Dollar Index bottoming out? I break down a potential Inverse Head and Shoulders pattern forming on the DXY chart — a classic reversal setup that could signal a major trend change. See as I analyze the key neckline breakout zone, potential upside targets and golden zone fib support defended confirming the pattern.

I hope you find this informative. Thank you for the boosts, comments and discussions of the idea. Cheers and best wishes on every trade

# USDCHF, #AUDUSD, #USDJPY, #EURUSD, #GBPUSD Forex pairs

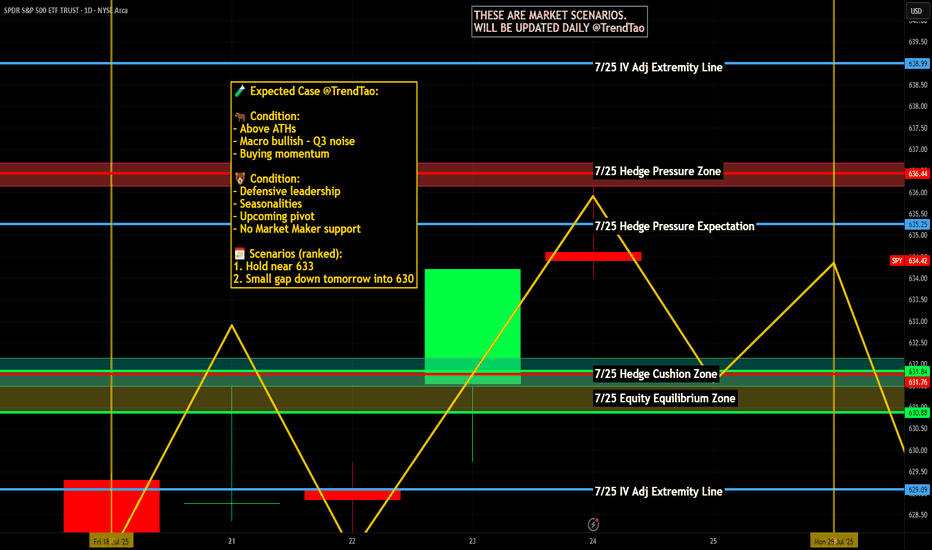

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis