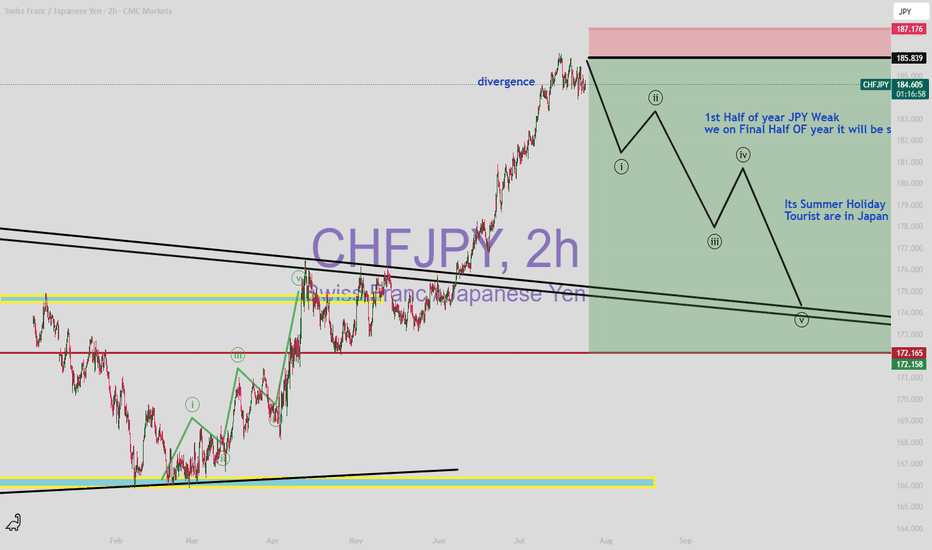

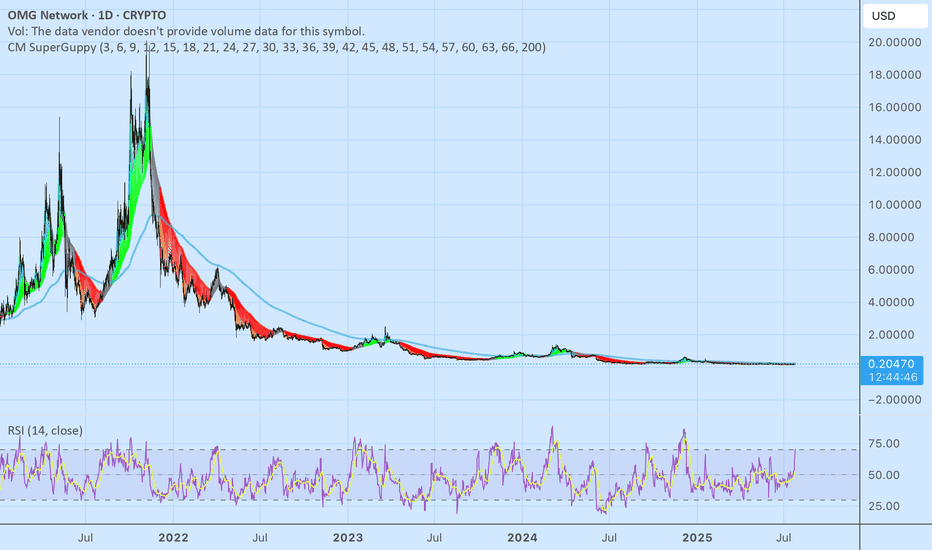

Wave Analysis

Best Meme Coins Live News Today: Latest Opportunities & UpdatesIn the fast-paced world of meme coins, today’s market presents fresh opportunities for both new and seasoned investors. With community-driven narratives dominating, identifying the best meme coins means staying updated on project fundamentals, social sentiment, and tokenomics. Here’s a detailed overview of the live scene and emerging opportunities shaping the meme coin landscape in 2025.

1. ShibaX (SHIBX): Riding the Dog-Themed Wave

Why it’s trending:

ShibaX combines the beloved Shiba Inu dog theme with practical features—NFT integration, staking, and cross-chain bridges. These elements have reignited investor interest.

Latest updates:

New staking platform launched on Ethereum and BNB Chain, offering up to 20% APY.

Roadmap reveal includes “ShibaX Arcade,” a gaming platform with meme lore-based mini-games.

DeFi integrations allowing SHIBX to be used as collateral in lending protocols.

Investor take: Strong branding with concrete utility upgrades could offer both hype-driven spikes and sustained growth.

2. BabyDoge Gold (BABYG): Rising from Origins

Why it’s trending:

A spin-off from the original Baby Doge Coin, BabyDoge Gold aims to redefine tokenomics with enhanced burn mechanisms and community engagement.

Latest updates:

Fix for liquidity token bug was addressed within 24 hours—boosting retail confidence.

Marketing campaign “Golden Paw” launched, expanding reach via YouTube and local crypto meetups.

25% token burn event announced to reduce supply and strengthen price over time.

Investor take: While still early-stage, BABYG’s quick fixes and supply-control measures are positive indicators—though caution remains necessary.

3. Floki EDU (FLOKIEDU): Meme Coin with Purpose

Why it’s trending:

Floki EDU differentiates with a strong emphasis on educational initiatives, publishing free courses about token fundamentals, security, and blockchain literacy.

Latest updates:

Partnership with a blockchain academy in India, enabling FLOKIEDU use in classrooms.

Interactive Telegram quiz bots reward users with tokens.

Pending centralized exchange listings, subject to community votes.

Investor take: Combining mission-driven goals with token utility adds long-term resilience beyond hype.

4. ElonDoge (ELDOGE): Fan-Focused Franchise

Why it’s trending:

Capitalizing on Elon Musk’s Dogecoin fandom, ElonDoge remains a cult favorite with its viral campaigns and high-yield staking pools.

Latest updates:

Limited-time pools with 150% APY to attract quick inflows.

Merchandise integration includes NFTs and apparel tied to Elon-themed meme culture.

"Space Chatter" Telegram community holds frequent AMAs, enhancing engagement.

Investor take: High-risk, high-reward dynamics—suitable for short-term momentum traders rather than long-term holders.

Final Thoughts

Despite the chaotic nature of meme coins, coherence between community strength and utility can spell significant returns. Coins like ShibaX and Floki EDU have moved beyond mere novelty, offering real functionality. Meanwhile, BabyDoge Gold and ElonDoge are high-volatility assets rooted in meme culture.

For traders, blending these project types can hedge risks. Stay vigilant, track updates, and always manage positions with discipline—this approach ensures readiness for the next meme market surge.

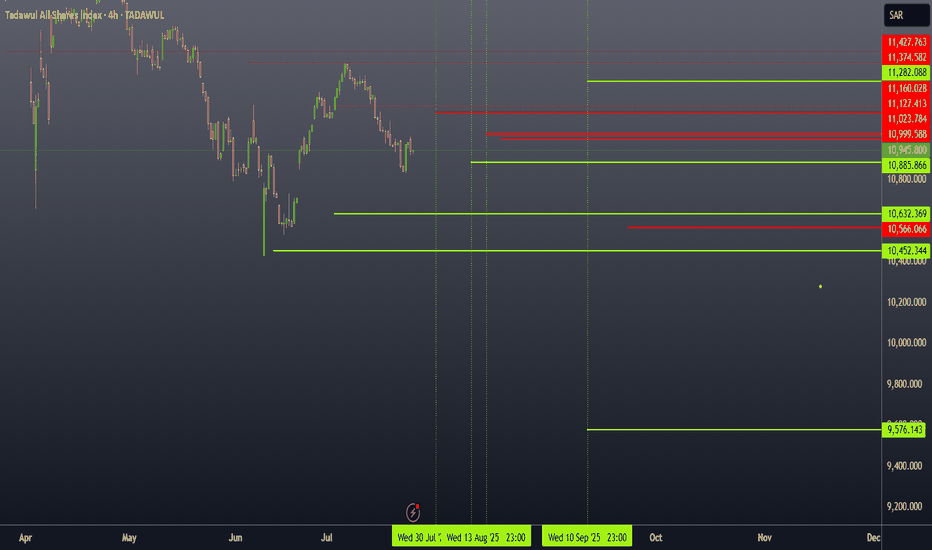

TASI Outlook: No Buy Until 11128 Break — Entry at 11282The Saudi market is currently resting on a support level, but the timing suggests we might see extended sideways movement before any significant trend resumes.

🚫 No buying positions should be considered unless the index breaks above 11128.

✅ A safer entry would be above 11282, confirming bullish momentum.

🔴 Red lines indicate resistance levels.

🟢 Green lines indicate support levels.

#TASI #SaudiStockMarket #TechnicalAnalysis #TradingView #Tadawul #TASIAnalysis

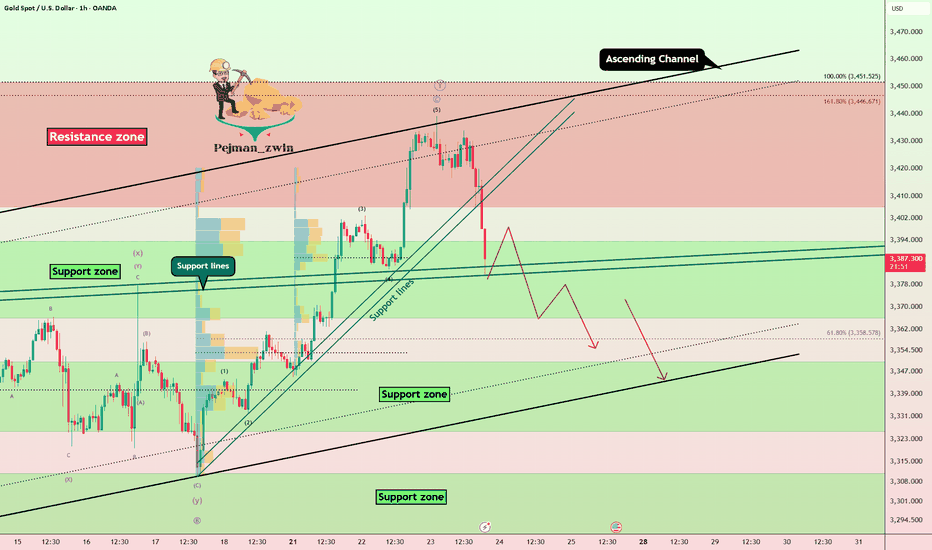

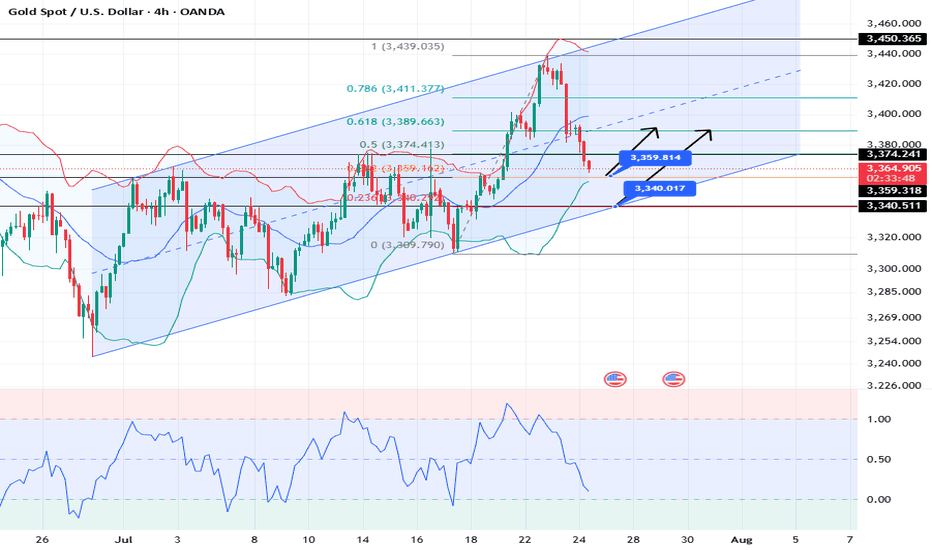

Gold Fails at Resistance, Elliott Wave Signals Deeper CorrectionGold ( OANDA:XAUUSD ) started to rise after the Richmond Manufacturing Index(Actual:-20/Forecast:-2/Previous-7) index was announced, but failed to break the upper line of the ascending channel and the Resistance zone($3,451-$3,406) .

Gold has now broken through the Support lines and is attempting to break through the next Support lines and Support zone($3,394-$3,366) .

In terms of Elliott Wave theory , it appears that the main wave Y has completed above the ascending channel.

I expect that given the momentum of gold's decline , gold will be able to break the Support zone($3,394-$3,366) and Support lines and fall to at least $3,356 . The next target could be the lower line of the ascending channel .

Note: Stop Loss (SL) = $3,423

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

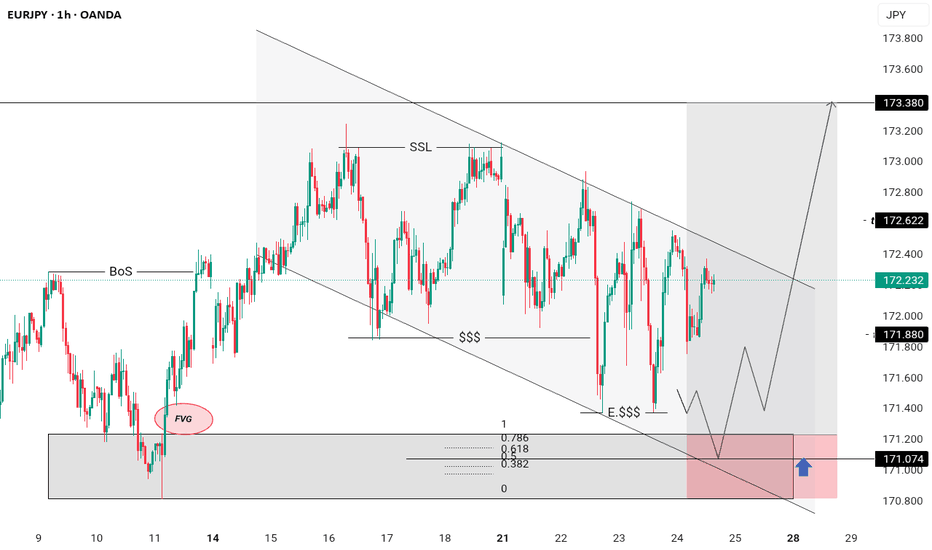

BUY LIMIT EURJPYi expect EURJPY to fall basing on ongoing bearish channel it forms , with respect to this move wednesday liquidity left overs has to swaped with efficiency fill of FVG , where we will activate our entries at 50 % FBnaccic retracement level in our POI

GOODLUCK

always use proper risk management , never riskmore than what u can afford to loose ....

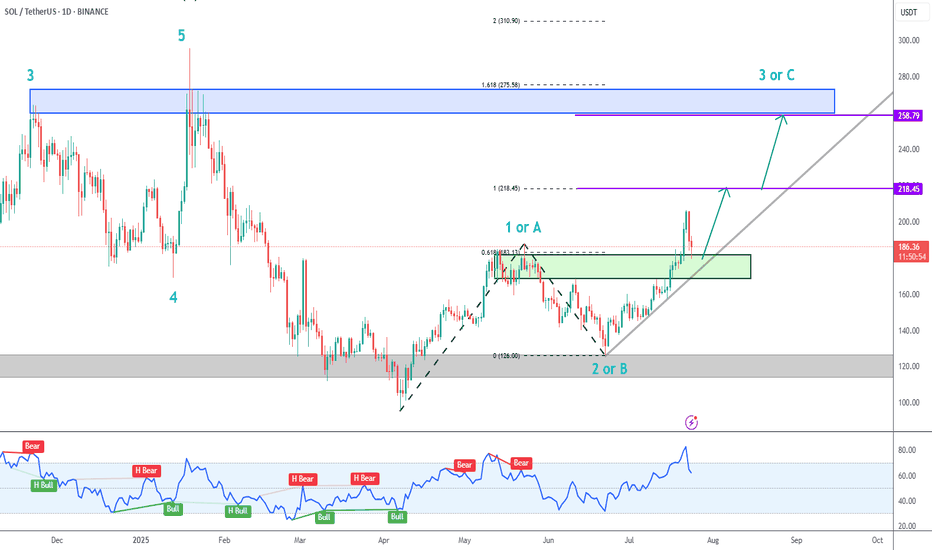

SOL Uptrend Update➡️ Solana has been correcting for the last couple of days, but the trend is clearly up.

➡️ There are 2 confluence factors that should give price support: the gray ascending trendline and the green zone.

➡️ Initial Targets (purple lines) are:

218.45 (100% extension)

258.79 (beginning of blue potential supply zone)

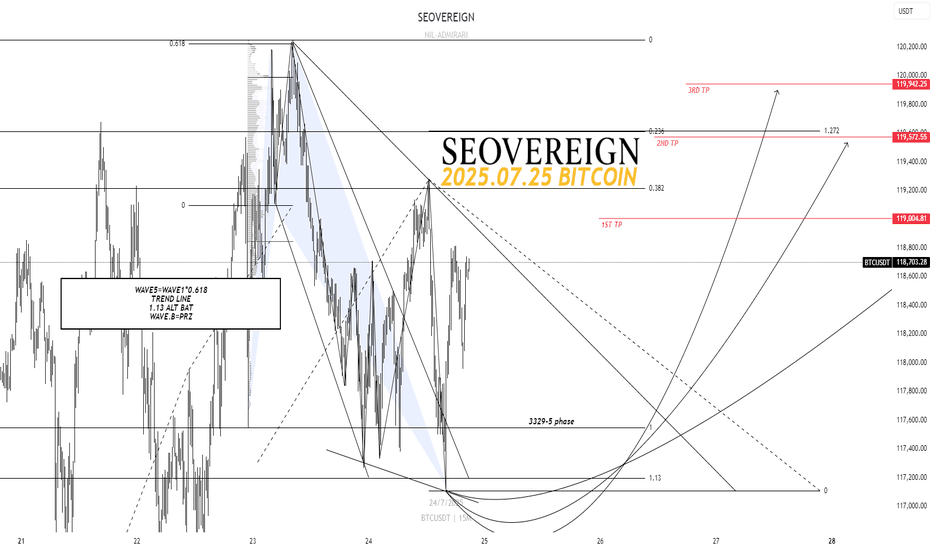

[SeoVereign] BITCOIN BULLISH Outlook – July 24, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello.

This is SeoVereign.

I am still holding the long position that I suggested in the idea posted on July 9th.

Regarding the upward trend that started around 107,200 USDT, I have consistently maintained my position without much doubt until just before posting this idea, as there were no clear signs indicating a decline.

However, at the time of writing this idea, some elements suggesting downward pressure are gradually being detected. Nevertheless, this idea is constructed around the upward scenario. The reason is that, as mentioned in this idea, a ‘single upward move’ is expected to occur with relatively high probability. Whether this rise leads to a trend reversal or serves as a precursor to a downturn will likely depend on how the chart unfolds.

The average TP (target price) is set around 119,300 USDT.

As always, I will carefully observe how the chart develops over time and will update with further explanations that organically integrate the detailed interpretations and grounds of this idea accordingly.

Thank you.

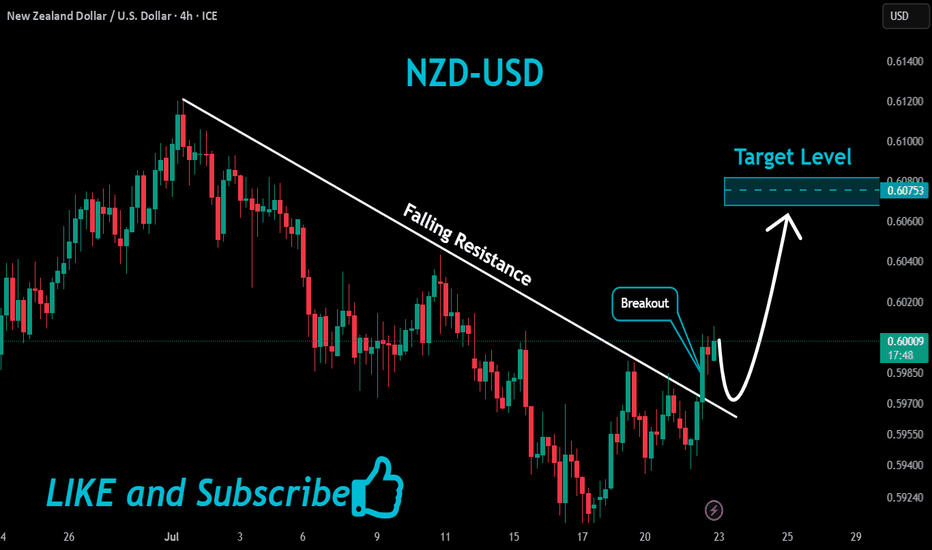

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

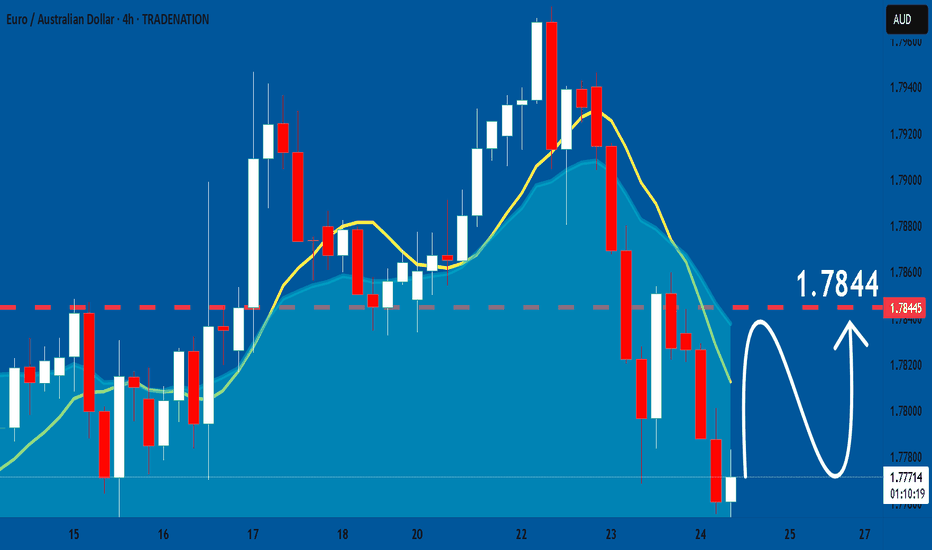

EURAUD: Bullish Forecast & Outlook

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURAUD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

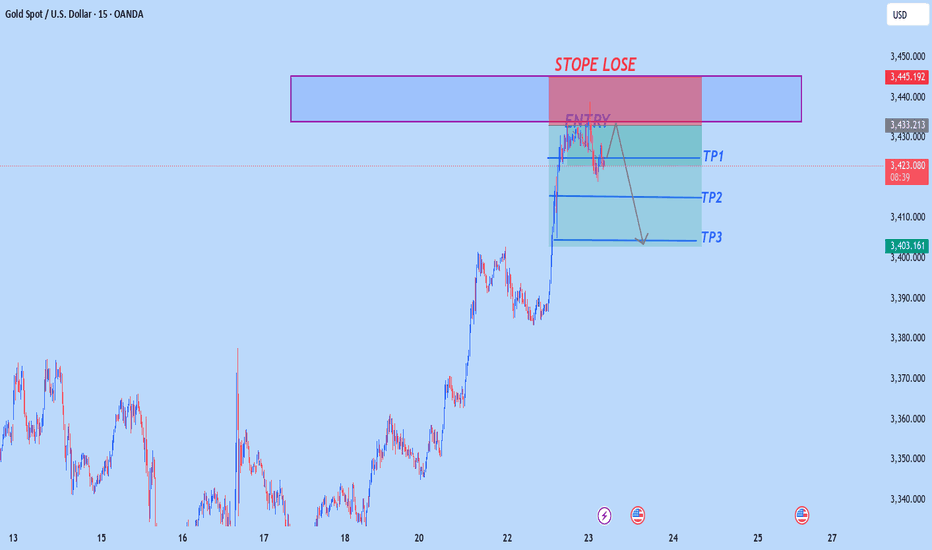

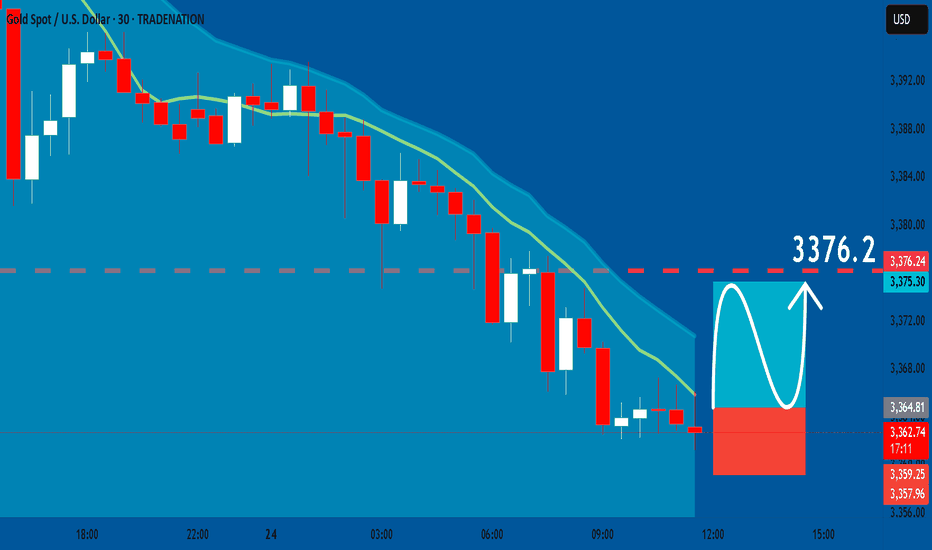

GOLD: Bullish Continuation & Long Signal

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3364.8

Sl - 3359.2

Tp - 3376.2

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

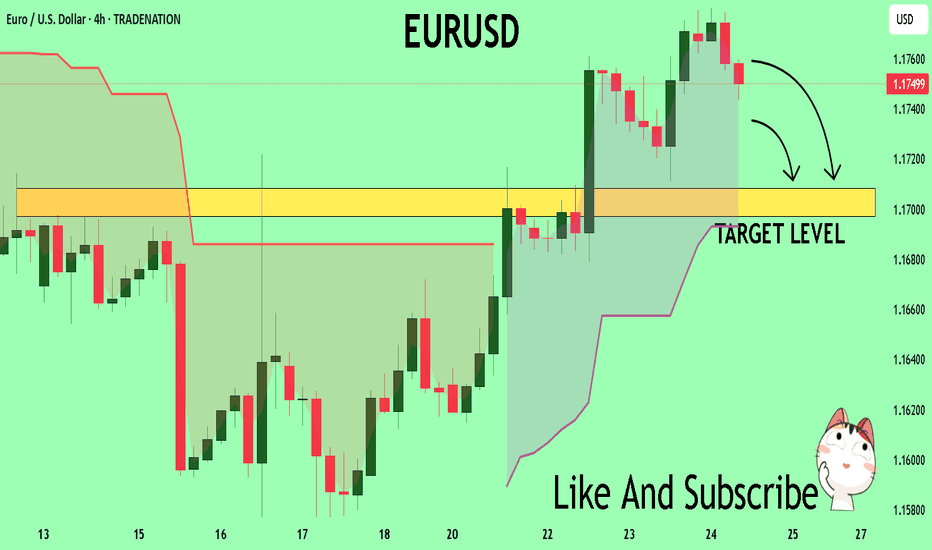

EURUSD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for EURUSD below:

The instrument tests an important psychological level 1.1751

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1708

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

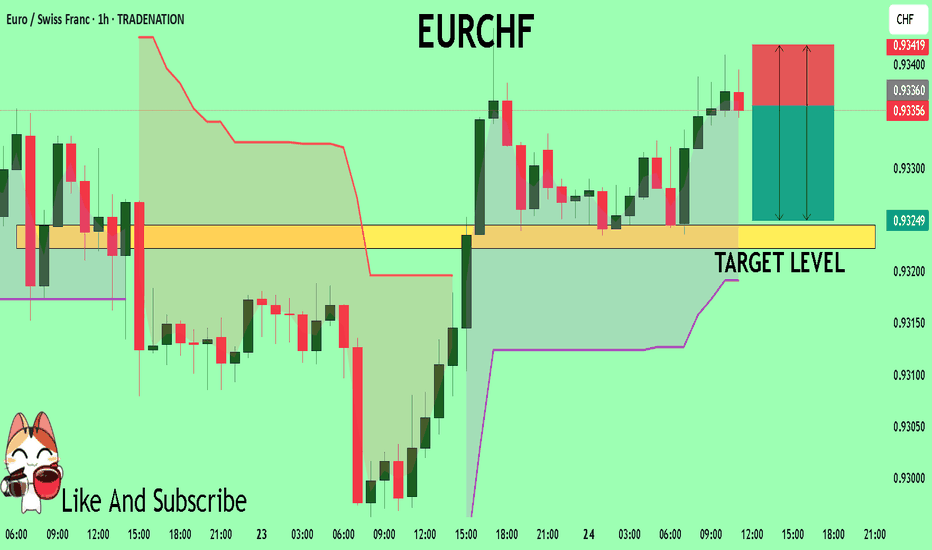

EURCHF Trading Opportunity! SELL!

My dear subscribers,

EURCHF looks like it will make a good move, and here are the details:

The market is trading on 0.9335 pivot level.

Bias - Bearish

My Stop Loss - 0.9341

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.9324

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

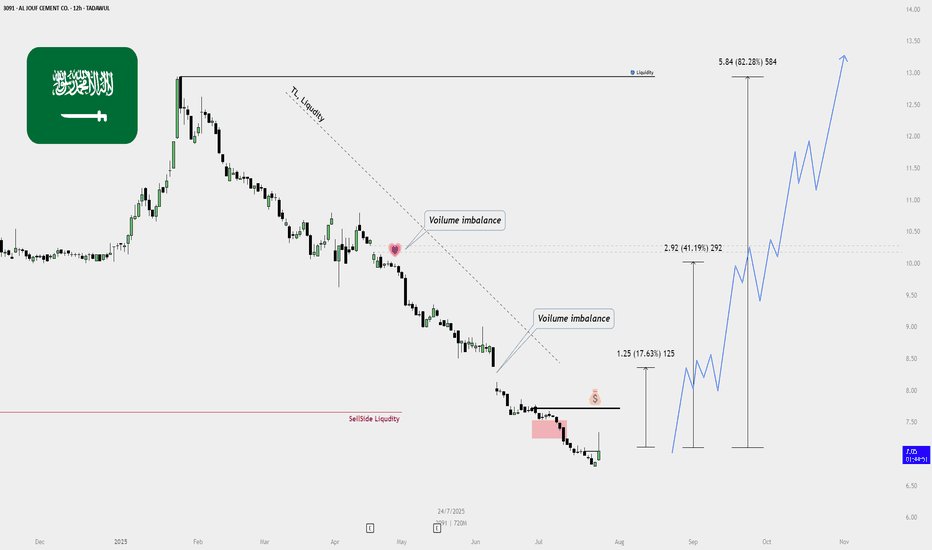

AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)📈 AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)

✅ Current Status:

Price: 7.09 SAR

Action: Initial entry taken — some shares added to My portfolio.

🔍 Technical Overview:

Sell-side Liquidity Cleared:

Previous lows taken out, triggering liquidity sweep.

Strong reversal suggests potential shift in market sentiment.

Volume Imbalances (Voids):

Bullish targets marked based on unfilled volume gaps:

📍 Target 1: 8.34 SAR (➕17.63%)

📍 Target 2: 10.01 SAR (➕41.19%)

📍 Target 3: 12.93 SAR (➕82.28%)

Trendline Liquidity Above:

Long-term descending trendline can act as a magnet for price, drawing it upward.

Bullish Confirmation:

Price has reacted from a bearish fair value gap.

Clean bullish engulfing and strong volume — suggests start of reversal.

🎯 Buy Strategy Breakdown:

Step Action

✅ Partial buy/entry completed (accumulation started)

📉 Wait for small pullback or bullish continuation to add more

🛡️ Stop Loss: Below recent swing low (around 6.50 SAR)

🚀 Targets: TP1 – 8.34, TP2 – 10.01, TP3 – 12.93

🔁 Re-evaluate plan if price closes below 6.70 with volume

Pi Network Faces Scrutiny as Market Cap Hits $3.4BPi Network, the mobile-first crypto project that attracted millions of users with its "mine-on-your-phone" concept, is facing growing scrutiny as its market capitalization has surged to $3.4 billion, despite lingering concerns over its actual utility and use cases. As hype continues to propel its valuation, the community and broader crypto market are demanding answers: What can Pi really do?

Background and Growth

Launched in 2019 by a team of Stanford graduates, Pi Network aimed to democratize cryptocurrency mining by enabling users to earn tokens on their smartphones without expensive hardware. Through aggressive referral-based marketing and a user-friendly interface, it reportedly attracted over 50 million users globally.

However, after years in beta and a still-limited mainnet release, the Pi token is not yet fully tradable on major exchanges, and its price remains speculative. Despite that, Pi's market cap is estimated at $3.4 billion based on limited OTC (over-the-counter) trading and projected supply metrics.

Utility Concerns Intensify

With a large user base and growing token valuation, the pressure is on for Pi Network to deliver tangible value. Key concerns include:

Lack of utility – Most users cannot use Pi to pay for goods or services in real-world scenarios.

No open mainnet – While a “closed mainnet” has launched, the network still lacks full public blockchain access, hampering transparency and developer participation.

Centralization – Pi’s governance and decision-making remain opaque, raising questions about decentralization and long-term sustainability.

No listings on major exchanges – Without real-time market discovery, token valuation remains speculative and potentially misleading.

Community Reaction

Many early adopters continue to support Pi, viewing it as a long-term project that needs time to mature. Some local communities even organize Pi-based bartering systems. However, critics argue that without real-world use cases, Pi remains a glorified points system rather than a functional cryptocurrency.

The disconnect between market cap and utility has fueled concerns of a speculative bubble. In fact, some compare Pi to past projects like BitConnect, which promised much but delivered little.

The Road Ahead

To maintain its momentum and justify its valuation, Pi Network must:

Open its mainnet to public interaction and developer contributions.

Secure listings on reputable exchanges to enable transparent price discovery.

Establish real-world utility, such as integration with e-commerce, payments, or DeFi applications.

Improve transparency around tokenomics, governance, and long-term roadmap.

Failure to address these areas could result in an erosion of community trust and capital flight to more proven projects.

Conclusion

Pi Network’s $3.4 billion market cap is both impressive and problematic. It highlights the power of community-driven growth but also underscores the risks of hype-driven valuations. As the crypto market matures, utility—not just marketing—is what will determine long-term success. For Pi, the clock is ticking to move from potential to performance.

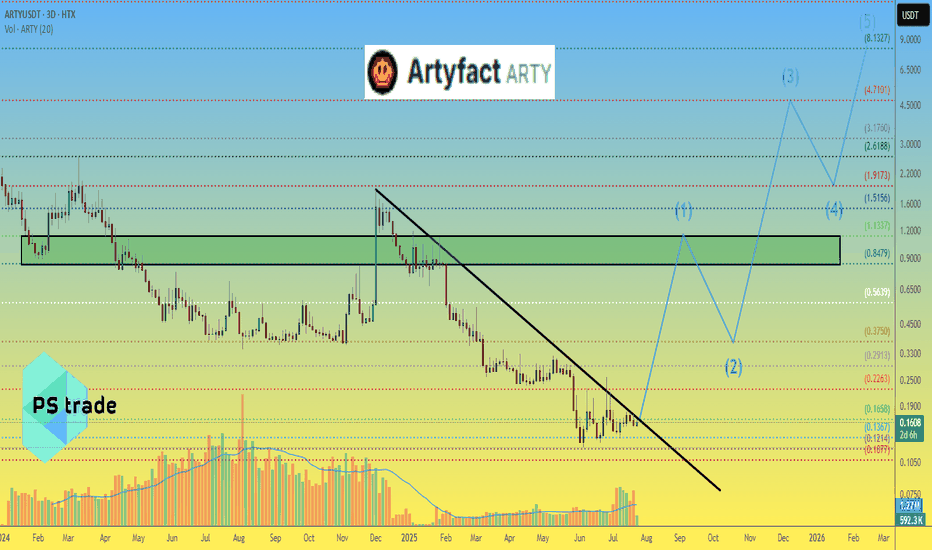

Artyfact ARTY price analysisWhile the entire crypto market is falling, we have come across a coin that is holding up very well - #Arty

#Artyfact is a Web3 Metaverse from the GameFi sector that recently launched a Play-and-Earn mode where players will only buy gaming NFTs for #Arty, i.e., high demand with limited supply.

◆ More than 90% of the coins have been unlocked and are in circulation.

◆ The total capitalization is $3.5 million.

◆ There are no futures trading pairs, only spot trading, i.e. there is no possibility to shorts and dump the price.

Tokenomics and the factors around it look promising.

🕯 If we look at the #ArtyUSDT chart, we can see that the price is pinned to the trend line, and we just need to wait for an impulsive and volumetric breakout.

If we forecast a possible 5-wave upward trend, it could look like this:

1️⃣ - $0,85-1,15

3️⃣ - $4,70

5️⃣ - $8,00

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

XAUUSD: Market analysis and strategy for July 24.Gold technical analysis:

Daily chart resistance 3440, support 3310

4-hour chart resistance 3390, support 3340

1-hour chart resistance 3375, support 3360.

Yesterday, according to news, the United States and the European Union were close to reaching a trade agreement, which led to the recent risk aversion sentiment to subside, and the bulls took profits. The gold price has fallen by nearly $80 from its peak.

From the current power comparison, the bears are temporarily dominant. Since yesterday, the candlestick chart of the 4-hour chart has completed 6 candles today (2 of which are sideways and 4 are falling sharply). It is expected that it will not rebound until today's NY market trading session.

Gold may reach 3359 or even 3340. At that time, we will observe the stabilization of the candlestick chart. Once the downward momentum is exhausted and it starts to close higher, we can buy. The upper pressure is 3380/3400.

Buy: 3359near

Buy: 3340near

Sell: 3380near

Sell: 3400near