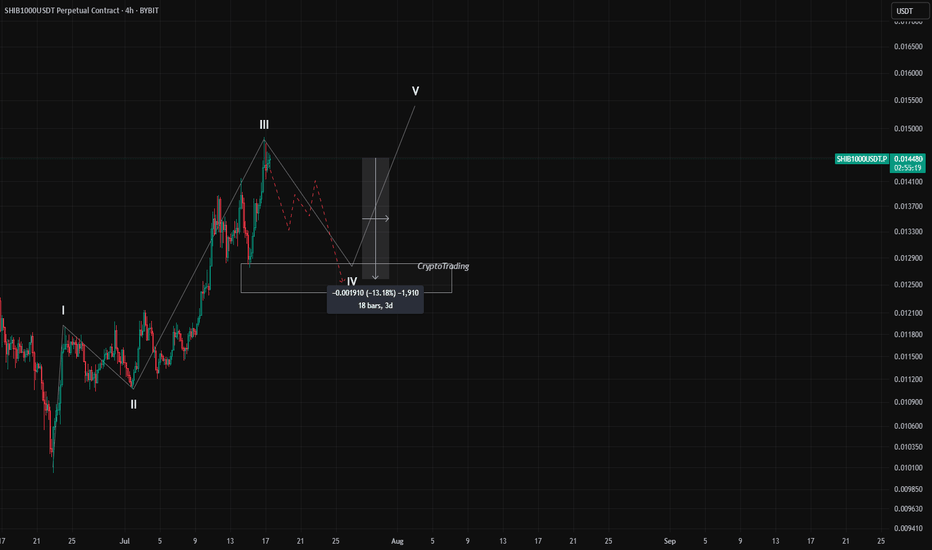

SHIBUSDT 4H Potential 10% Drop – Wave 4 Incoming? Hey traders,

On the 4H timeframe, SHIBUSDT seems to be completing Wave III of a classic 5-wave impulse structure. We can clearly identify:

- Wave I and II behind us

- Wave III topped out recently with a strong push upward

- Now expecting a Wave IV correction to unfold

What supports this setup:

- Wave II was an irregular correction (note how Wave B pushed above Wave A).

- According to Elliott Wave alternation rules, if Wave II is complex/irregular, Wave IV is likely to be a simple ZigZag (ABC) correction.

- Zigzags are typically sharp and quick, which fits the momentum of the current market structure.

🕵️♂️ What’s next?

- The potential correction target lies in the marked rectangle zone (around -10% to -13% drop

from the recent top).

- On lower timeframes (like 7min or 10min), we’ll be watching for a support break to confirm

the start of Wave IV.

- If the support is broken with confirmation, that may offer an opportunity to enter a short

position — as long as it fits within the personal risk parameters.

📌 Disclaimer: This is not financial advice. Trading is risky — always manage your risk, do your

own research, confirm your setups, and never blindly follow others. Stay safe and smart.

🧠 Are you planning to catch this correction? Or waiting for the final Wave V? Let me know in the comments 👇

Waveanalysiss

C98USDT – Potential Impulse Wave 3 in Progress? | Elliott WaveHello traders! 🚀

Sharing a fresh Elliott Wave setup I'm currently monitoring on C98USDT (4H TF). The price structure is unfolding clearly and may be in the early phase of a classic 5-wave impulse.

After an impulsive move up completing Wave (1), the market corrected in a textbook ABC pattern down into a key demand zone, finishing Wave (2). We’re now seeing strong bullish momentum suggesting the beginning of Wave (3) – the longest and most aggressive wave in Elliott theory. ⚡

Trade Setup:

🟢 Entry Zone: 0.043 – 0.046

🔴 Stop Loss: 0.03913

🎯 Target Price: 0.05955

💡 Note: Always manage your risk and confirm with your own analysis before entering any trade.

Let me know your thoughts and wave count below! 👇

Happy trading! 🚀

KSMUSDT D – Start of Wave 3? After a clear 5-wave impulsive move up, KSMUSDT seems to have completed a deep ABC correction, potentially marking the end of Wave 2.

📉 Wave 1: We had a clean five-wave move from the bottom, which fits classic Elliott Wave structure.

📉 Wave 2: The correction that followed was much deeper than the ideal Fibonacci retracement zone. However, crucially, it never violated the low of Wave 1, which means it still holds valid under Elliott Wave rules. The correction unfolded as a textbook ABC pattern, with Wave C digging deep into the previous structure — showing panic selloff and possibly a final capitulation.

🔄 Key Development Now:

The resistance trendline of the correction has just been broken, suggesting potential momentum shift. This could mark the beginning of Wave 3, which is typically the strongest and most impulsive wave in Elliott Wave theory.

📈 Potential Target for Wave 3: Around the 39.5.80–42.00 area based on Fibonacci projections, but this is an early assumption and requires confirmation by price action and volume.

⚠️ Important Risk Note:

Despite this bullish technical setup, the current market remains risky. The bounce is fresh, and confirmation is still lacking. There's still the possibility of a deeper retest or invalidation of this count if price closes below the base of Wave 1.

🧠 Trade Plan:

- Wait for follow-through confirmation.

- Manage risk carefully — this is an early entry scenario.

- A stop below the recent low (~11.30) would be logical for this wave count.

📊 What do you think? Is this the beginning of a powerful Wave 3, or just another fakeout?

💬 Drop your thoughts or alternate wave counts in the comments!

EUR/USD Elliott Wave Outlook – Expanded Flat Playing Out?EUR/USD appears to be unfolding a classic expanded flat correction for wave (4):

Wave A formed as a 3-wave zigzag

Wave B retraced beyond the start of A — a key trait of expanded flats

Now looking for a 5-wave C-leg decline toward the 1.1122 – 1.1002 area

Aligned with 1.0–1.618 extensions of A

RSI + MACD divergence adds bearish confirmation at the B top

Potential bullish reversal zone into late June / early July

As long as price holds below the B high (~1.1650), the bearish path in wave C remains in play.

📍 Target zone: 1.1122–1.1002

📈 Bias: Bearish short-term, bullish long-term (wave 5 up next)

DEEP 2H AnalysisHey traders! 👋

I’m watching a potential Wave 3 impulsive move forming on DEEP/USDT that could present a strong bullish opportunity. Let’s break it down 👇

🔹 Structure Overview:

We’ve completed a five-wave impulse upward (Wave 1 ✅), followed by an irregular corrective Wave 2 (ABC correction). This setup opens the door for a classic Elliott Wave 3, which tends to be the strongest leg in the sequence.

🟩 Entry Zone: 0.195 – 0.205

🎯 TP: 0.256

🛑 SL: 0.182

⚖️ Risk/Reward Ratio: 1:3

📌 Remember:

Take care of your risk and money management. Always size your positions according to your plan.

💬 What do you think? Does this count look solid to you, or are you seeing a different wave scenario? Drop your thoughts below ⬇️

$TSLA Sales Slump but is Support Near?Is Tesla ( NASDAQ:TSLA ) facing a sales slump and an overpriced valuation? In this video, we dive into the latest Tesla stock analysis, starting with the declining sales numbers and why the current valuation might be raising red flags for investors. We then break down the weekly chart, spotlighting a potential breakdown retest as NASDAQ:TSLA price nears key support levels around the 243 weekly SMA. What was once resistance could now flip to support—find out how! Zooming into the daily chart, we explore the 280 price level where the 200 SMA is and outline a possible 5-wave pattern completing at 243, followed by a correction toward Goldman Sachs’ 320 target and Bank of America’s 380 forecast. But could a deeper drop to 200 be on the horizon? Get the full technical analysis, price targets, and insights to navigate NASDAQ:TSLA ’s next move in this must-watch stock market update!

Dollar vs. Yen - Long Term Swing Trading Idea - 08-th Jan 25'USDJPY from 20-th Dec' 2024 to 6-th Jan 2025 created A-B-C-D-E formation which is 4-th wave.

Then from 156.25 area till 158.55 created 5 waves and finished the trend.

Our expectations for the next few days are the price to retrace at least 250 pips till zone of 156.00 and there will find support. Long term idea is to reach 153.00 level in period of one month.

EURUSD is at weakest and creating a swing low at levels over 1.0250-1.0300. If EURUSD bounce back to 1.0600 that will confirm the USDJPY trading idea for weaker dollar in next few weeks.

Trading idea parameters are as follows.

Entry: 158.50

Stop 159.50

Target 153.20

USDJPY: Bearish Break in FocusHello Traders,

Below is my analysis of USDJPY currency pair from H1 perspective.

Trend & Sentiment

USDJPY is in a strong downtrend, forming lower highs and lows. The recent break below 153.819 confirms bearish momentum, with sellers firmly in control.

Key Levels

Resistance: 153.962 (Minor), 154.653 (Major)

Support: 153.276

Possible Movement

Bearish Continuation: Likely toward 152.466 (target) as long as the price stays below 154.653.

Retracement Risk: Minor resistance at 153.962 may cap any short-term bounces.

Reversal Signal: A break above 154.653 could shift momentum to bullish.

Conclusion

The outlook remains bearish with a focus on 152.466, while resistance at 154.653 defines the trend's invalidation point.

Do let me have your thoughts.

Cheers and happy trading!

#USOIL Next Move By We Trade Waves (21 Jan 2024)Hey Traders, This is USOIL Analysis and update for all of you.

What we can see is market to make one small up move, complete the complex structure and fall.

If you have missed our last stream on TradingView, you can watch the recording here:

www.tradingview.com

DO NOT JUMP IN - Jumping in without using stop loss or risking big or following anyone blindly leads to big losses, never do that. Always wait for your setups and use proper risk management!

If you want us to post more charts, setups and explain more about the next move, make sure to follow us, like and comment.

We are sharing our point of view on what could be the next move in the markets based on our We Trade Waves wave analysis concept so this is a directional bias and not signals...

DO NOT FORGET "We Trade Waves" 4 GOLDEN RULES:

1) Do not over-risk

2) Do not over-trade

3) Do not trade without stop loss

4) Never ever add to losing position

DISCLAIMER: We Trade Waves is not a signal service. Instead, it involves sharing our perspective and detailed analysis based on our unique wave analysis concept. We cannot be held responsible for any financial gain or loss that may result from following our analysis.

Trade with care

We Trade Waves Team

Follow me: Gold rebounds weakly, pay attention to the 1946 regioYesterday the whole world was bullish, but I was still bearish, and I reminded you yesterday that gold was shorted at 1970, and the target was 1950, and gold really rebounded to 1970 at the highest, and then began to fall to 1939 at the lowest.

Today gold is slowly oscillating upwards, which is what I expected. Currently bullish in the short term, stop loss 1930, short term is expected to be above 1950, take profit 1955, wait for the opportunity to rebound to 1952-1955 short, target expectation 1940, stop loss 1960

Next, I will continue to provide more trading signals, follow me!

ZECUSDTTurkish description is below.

Im expecting a bull rally for zecusdt to hit 305 usd between 6 March and 1 May 2023. This comes from end of Wave C which made ending diagonal as shown on the chart.

Note that this post should not be considered as financial advise.

6 Mart ile 1 Mayis arasinda ZECUSDT paritesinin 305 dolar olmasini bekliyorum. Bunun sebebi C dalgasi biten diyagonal olarak yapmasidir.

Yatirim tavsiyesi degildir.

BTCUSDT ZIGZAG heading to 19600USDTBTCUSDT entered in a downtrend on a corrective intermediate Zig-Zag pattern, in which minor wave-(A) is potentially aiming the greater demand @ 19600. A swing trading plan can be made easily based on supply and demand theory, avoiding to trade in the grey sectors, so-called equilibrium zone.

BTCUSDT Complex C - Multi Wave in an Ending DiagonalBTCUSDT made a beautiful corrective C-multi-wave pattern, which surprise terminus finished with an 5th wave leg-up that surpass the trend-line, after an ABCDE triangle. In the Wyckoff Method narrative we can call it an upthrust movement in phase c of a distribution. About the wave count, the entire triangle is an contracting ending diagonal of a corrective wave C, in which we can see a multiple pattern that confused the prediction. After the "thrust" the price action should return to the break point, characterizing a "false break". It's common in C-legs, when the triangle occurs, that it's exceed the break-point. In this case, price reached the weekly supply, interacting with AVWAP from ATH. Now the bears are slowly take control. I'm expecting 18% drawdown of a downtrend till the wave 3 of a potential impulsive downward.

BTCUSDT A Head & Shoulders to builtBTCUSDT have a Head & Shoulders pattern to built in a Zig Zag downward, in which a wave 1 can be expected for an 2-D swing trade as a breakdown from the micro symmetrical triangle is expected. Thereby, a new supply target will expecting for a reaction. This will be an increase of confidence for the sell-side. Displayed on this H4 chart: daily LSMA (least squares moving average) resistance plus AVWAP (anchored volume weighted average) from peak of wave (ii) of this ending diagonal (as showed on my actual cyclical wave analysis). Technicals: serious divergences on Commodity Channel Index and Chaikin Money Flow suggesting a condition to a dip soon. Overbought condition.

FILUSDTAccording to the price chart, it is located in the overlapping area of the Fibonacci price levels. And also the price is near a static resistance and a support trend line.

According to the price pattern on the chart, the price is "probably" at the end of its corrective pattern. In my opinion, this correction pattern should end between the 11th and 13th of March.

And the least I expect after the correction pattern ends is for the price to rise to the top of wave A or 1.

But the main targets of this price increase are respectively $20 (100% Fibonacci extension of wave A or 1 from the bottom of the corrective pattern) and $46 (162% Fibonacci extension).

And finally I see $183 (Fibonacci extension 262%).

GBPCHF- more buying pressure don't missHey Everyone,

in this analysis, GBPCHF has moved within the correction currently which looks bullish for some days now, and it's currently forming a correction after an impulse. The initial phase will be an impulse>>correction>>impulse.

that is i'm expecting a bullish impulse to form.

WHAT ARE WE EXPECTING:

# look for a lower time frame continuation correction to ride the trend.

HOW DO WE ENTER:

# on a break of trendline either the continuation correction or top break of line

OUR STOP LOSS LEVEL:

# when the pattern change(bearish pattern form)

POSSIBLE TARGET:

3:1 rr to top of the arrow

THANKS FOR READING.

AS ALWAYS TRADE SAFE AND STAY SAFE!!!

GBPUSD ShortThe GBP/USD currency pair has exhibited potential for a short position following an upward movement of over 250 pips from the previous projection, resulting in an attractive risk-reward ratio of 1:5.

The pair displayed characteristics consistent with manipulation by market makers during the early hours of the London trading session. This could potentially indicate an effort to entice less experienced traders to enter long positions. Based on the analysis of technical indicators, the GBP/USD is currently in a zone where both bullish and bearish movements are possible. However, considering the rejection of the zone by the price action, a bearish outlook is favored. A close below the 13-day exponential moving average will serve as confirmation for a short position entry.

Conversely, if the price closes above the level of 1.24212, the bias will shift to bullish. The short-term target for this trade is 1.23245, while the medium-term target is 1.22886.