Wavecount

Gold is Nesting... Have updated the counts since my last post.

I believe we have a series of ones and twos since the 15th May low...

Once we start moving into the third of the third of the third, US Indices will commence either a correction or another bearish leg.

Have been long Gold and will be holding my positions.

Hellena | EUR/USD (4H): LONG to the resistance area 1.16000.Good afternoon colleagues! In the coming week I expect the upward movement to continue in wave “3” of the higher order. I believe that a small correction to the support area of 1.2176 and then rise to the resistance level of 1.16000 is possible.

There are two possible ways to enter the position:

1) Market entry

2) Pending limit orders.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

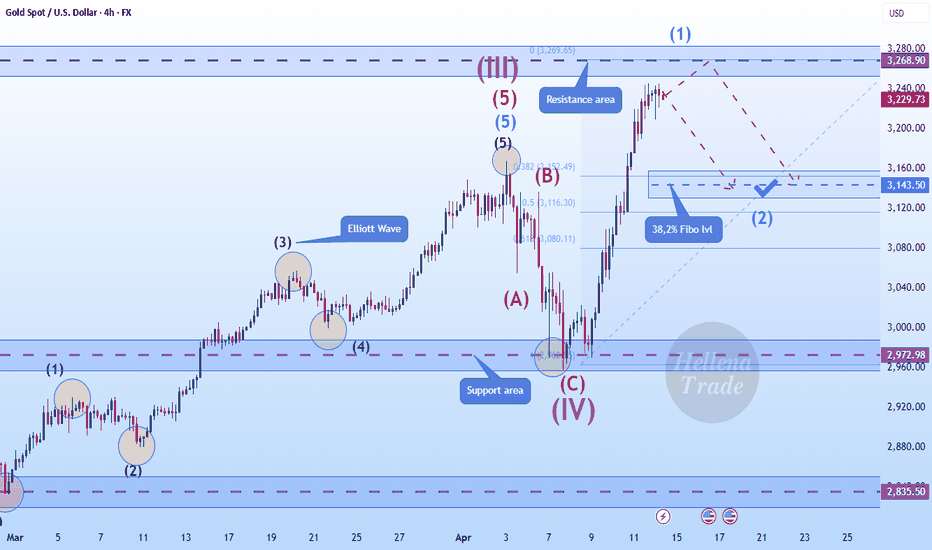

Hellena | GOLD (4H): SHORT to 38.2% Fibo lvl 3143.50.Dear colleagues, I expect a correction in the coming week. Wave “V” has started its development and now I think that wave ‘1’ of medium order is completing its development and I think that the correction in wave “2” will last until the area of 38.2% Fibonacci level 3143.50.

There are two possible ways to enter the position:

1) Market entry

2) Pending limit orders.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

XAUUSD Gold Spot Wave Analysis Elliott neoWaveThe gold chart is nearing the end of wave D and we should expect a price correction to complete wave E towards $2530 soon, but there may be a smaller upward wave remaining.

First entry: 2700

Possible second entry: 2740-2750

Stop loss: 2775

Take profit: 2530

This offer has a risk/reward ratio of around 3

Make sure to involve less than 2-3% of your total capital and stick to money management principles

This is just a suggestion for consideration

BTCUSD ELLIOTT WAVE ANALYSIS (( NEOWAVE ))The trend seems to have ended in this timeframe /

Currently, the trend seems to be continuing. I do not recommend trading until the trend ends in this timeframe and lower targets

Make sure to involve less than 2-3% of your total capital and adhere to money management principles

This is just a suggestion for consideration

Gold, strong support coming inHello everyone,

after the election in the US Gold started a sharp pullback and lost 9% within 2 weeks.

Now the price reached very strong support zones, built from former consolidations. These zones also match with order blocs on the weekly, 4H and 1H time frame (not shown on the chart).

The RSI is highly oversold and the drop was the biggest one this year. All in all I think it's time for a correction at least.

According to the Elliot wave theory we finished three waves down, the C wave was formed by a five wave move which is very common on five waves. If you are interested in the micro count, let me know in the comments.

The orange area shows the potential resistance for the larger B wave. The green support zone should ideally hold to keep the bullish trend alive and the upper zone shows the fifth wave targets. The price could easily extend to 3000 dollar before a major correction should come.

NVDA Wave Count: Wave 3 Targets Above $125, Breakdown Below $123Hey traders, it’s Mindbloome Trader here with an NVDA wave count from the 4-hour to 30-minute chart. If we break above $125, we’re aiming for wave 3 on the upside. But if we drop below $123, we could see more downside action. Stay sharp and trade what you see!

Nividia: Will we reach 128.70 ? I Believe We CAN Good morning Traders

MB Trader here checking into see how everyone is going

So the game plan today is:

1) Do some wave counting; we all love a little bit of wave counting to figure out where we are in the market

2) Do some projections figuring out where are we going up ?

3) Do some micro projections to figure out the different areas of resistance and where that will be

Enjoy traders and remember I love your comments, feedback and anything else you want me to make videos on

Happy Hunting For Those Trades

Remember trade what you see not what you assume

MB Trader

XRP's Wave 2 is nearly complete. A BIG MOVE IS COMING!XRP is getting close to completing the 2nd Wave of the 5 Wave move to the upside after breaking out of the Cup & Handle formation that I identified in my earlier posts these past few months. It looks like we could see a turn around, and the start of the 3rd Wave around, or shortly after the eclipse.

Good luck, and always use a stop-loss!

Flare wave count could be indicating a major drop incoming!The current wave count on FLR could be indicating that a big drop is incoming. If price fails to get above the top box, then it will likely come down to the range of the lower one. However, if it breaks through the upper box, then that area could act as a launching pad for much higher prices. We will have to watch and see how it plays out over the next few days and reassess.

Good luck, and always use a stop-loss!

BItcoin: Recent history relative to priorOn the basis of earlier probabilistic map (which captured how price is being governed by golden rule on a bigger scale) , I'd look for same relationship to interconnect the chart on the short-term too. So at this point it's also important

One of the earlier significant price developments would include the fact of bottoming late 2022 after the fall of -77%. Since currently the price is way above those levels, it allows the use of the line which connect covid and 2022 bottom. We also established that connection of two bottoms defines the wavelength 983 Days, thus the direction of that line can be used as axis of deviation plotted with fibs.

The direction of the fall of -77% can be used to define the frequency of cycles from late 2022.

Together they produce another interference patten that defines the uncertainty of the market. (Just to recap: The direction of fibs with shallow angle defines Price Deviation. Steep angle of direction defines the Time aspect of the waves. The steeper the angle the more it relates to timing.)

GBPUSD WEEKLY ANALYSIS SELL OPPORTUNITY Complement of the season to you all. I guess this will be my last analysis for this year, i believe this year was a wonderful year to many traders, if this year was not good for you i want you to put a smile on your face because i gate something nice for you on GBPUSD going to next year. The chart 📉 before you is GBPUSD WEEKLY chart you will clearly see that wave 1 and 2 is formed already waiting for the wave 2 complete then start the wave 3. The wave 3 is the longest and the sweet wave to make easy money 🤑🤑 so I want you to put this pair on your watch list and let make money together next year. Happy new in Advance 🎄🎇🎇🎇🤗

XAUUSD Wave Count, Daily Time FrameHello trader, OANDA:XAUUSD is at the beginning of wave 3 of downward wave C. If the fundamental conditions are in favor of the US dollar and against gold (like right now). The chart moves according to the wave count.

The micro wave counts may change slightly during the movement of the chart, but the ultimate goal of wave C is the 61.8 Fibonacci range or the price range of 1792-1778.

NZDJPY LAST WAVE DROPNZDJPY has been bearish since early July but started the trend with a possible leading diagonal which comprises of 5 waves and 3 sub-waves to it. Considering the diagram above, we are done with the waves 1, 2, 3, and 4 going for the completion of the last wave (wave 5). Wave A and B are done and price also going for wave C after which we can witness a big correction.

For now, lets see ow it plays out with a target of 410 pips from breakout.

WAVE 1 = 5 WAVES

WAVE 2 = 3 WAVES

WAVE 3 = 5 WAVES

WAVE 4 = 3 WAVES

WAVE 5 = 5 WAVES

BNBUSDT up-to-date potential expanded ending diagonalPotential expanded ending diagonal scenario for this asset. Price action is likely heading downward to made an interesting and profitable 3th wave of the expected bearish impulse wave 3 of that triangle / megaphone hypothetical scene. Key levels for watching on that 30m chart, plus Chaikin Money Flow divergences. Bear flag breakdown expected for soon on 4h chart - linked below.