GBPUSD Price Action Analysis | Sell Setup Below 1.36106In this GBPUSD market overview, we break down recent price action following yesterday’s strong bullish rally from the momentum low. The session was highly emotional across major forex pairs, which is typical when a major wave structure reaches its end. This often results from incomplete auctions on one side of the market, causing order flow imbalances that drive sharp price movements.

The key price level we're watching on GBPUSD is 1.36326. Price approached this zone with momentum, and the rejection at 1.36267 triggered a classic TCP (Trend Changing Pattern), followed by a single upside break, confirming exhaustion at the highs.

📉 Sell Setup:

According to the Waves of Success execution model, the best short entry is below 1.36106, in alignment with the prevailing bearish structure.

⚠️ Alternative Scenario:

We are not looking for long setups on GBPUSD at this time — our bias remains bearish unless significant structure changes occur.

This analysis combines wave structure, trend confirmation patterns, and institutional price levels for a professional, risk-managed approach.

🔑 Key Levels:

Resistance: 1.36326

Rejection High: 1.36267

Sell Trigger: 1.36106

Wavestructure

MSTR: Mid-term and Macro Price Structure As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105)

(see. recent idea on BTC price structure)

If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR price rising above 344, the odds are shifting to a more pronounce bounce to 400-460 resistance levels.

Weekly chart:

From a macro perspective:

as long as price remains below the 460 level, I consider the bullish trend since 2008 lows to have topped in November 2024, with current price action unfolding as part of a larger corrective Wave c.4 structure. Otherwise, If price reclaims ATH the door opens for an extension to 780-1280 resistance levels.

Monthly chart

Recent idea on BTC:

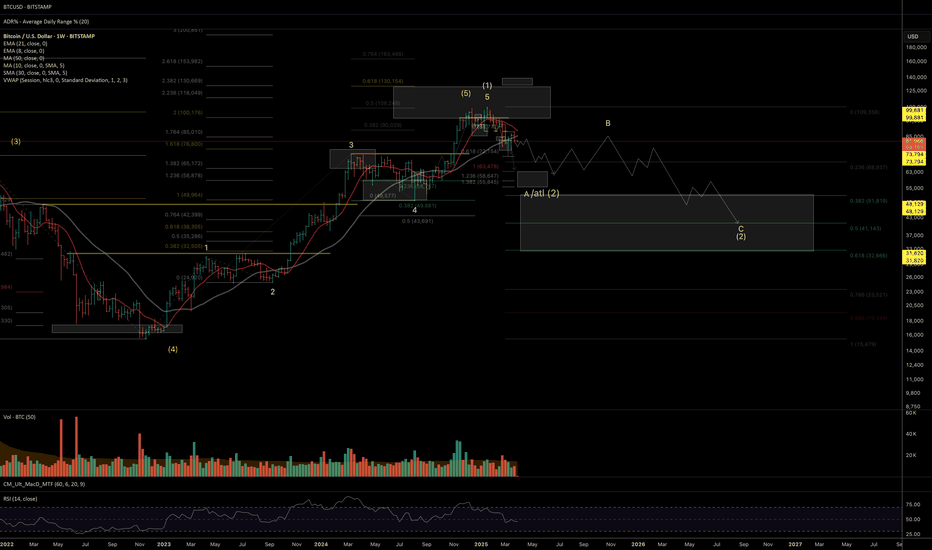

BTC Mid-Term Outlook: Key Levels & Wave StructureAs long as March lows hold, there remains a technical possibility for one more wave up toward the 130K resistance zone. However, given the corrective three-wave structure of the recovery (rather than an impulsive five-wave move), I am now leaning toward the mid-term top being in place at January highs.

If price remains below last week’s high, my operative scenario favors one more leg down to the 64K–55K–51K macro support zone. If the downside scenario unfolds, it would still be technically valid for the entire corrective wave (2) to complete within the support zone mentioned, especially considering the underlying fundamental strength of the asset.

Should price break above last week’s high in the coming weeks, the odds shift in favor of a renewed uptrend, potentially reclaiming ATH and targeting 130K.

The super-macro structure that I'm following as an operative wave count, assumes multi-decades bullish cycle, with the next long-term expansion phase expected once price establishes a firm bottom in the discussed support zone:

Wishing you successful trading & investing decisions. Thank you for your attention!

PS: The wave structure of BTC, proposed in March 2024 idea, has fulfilled itself:

GBPUSD Setup: Bullish Wave Structure & Fibonacci Buy ZoneThe GBPUSD has stabilised after a significant downward move. A completed bullish wave structure has emerged, with Wave 4 failing to break above Wave 3. This indicates a potential buying opportunity from the Fibonacci buy zone.

On the 15-minute chart, we can consider going long using the MSL pattern (Lower Low, Low of Day, Higher Low & Higher Close) as a confirmation signal.

Entry Point: 1.26303

Stop Loss: 1.2610

Target: 1.2710

Stay disciplined and manage your risk accordingly.

Intraday Analysis: CADJPY Forecast and Trade SetupThe overall trend on the major timeframes for CADJPY remains bullish, despite a breakdown continuation observed last week.

Current Market Overview:

The lower timeframe (M5) printed a bullish wave structure this morning.

We anticipate a corrective move below 105.76.

In the short term, a potential downside reversal is expected.

Trade Setup:

Look for shorting opportunities below 106.34, targeting a break below 105.77.

If price action breaks below 105.77, we can consider buying opportunities, aligning with the larger bullish trend.

Key Levels to Watch:

Sell Point : 106.34

Buy below : 105.77

WAVES: Massive 530% Gain at 10x LeverageTrade Overview:

WAVES surged to remarkable highs on the 4-hour timeframe. Utilizing the Risological Swing Trader , this long trade setup captured an extraordinary 530% gain at 10x leverage.

Key Levels:

Entry Price: $0.9990

Stop Loss (SL): $0.9565

Take Profit Targets:

TP1: $1.0520 ✅

TP2: $1.1375 ✅

TP3: $1.2230 ✅

TP4: $1.2755 ✅

WAVES/USDT Analysis:

The Risological Green Lines accurately depicted strong bullish momentum, allowing traders to trail the uptrend confidently. WAVES not only met all targets but exceeded expectations, reflecting robust market dynamics.

Outlook:

With such significant momentum, traders may keep monitoring WAVES for potential continuation patterns or retracements. This trade showcases the reliability of the Risological system for spotting high-profit opportunities.

Trends and Potential Trades in GBPUSD, EURUSD, and USDJPYThis morning's analysis focuses on the current state of play in GBPUSD, EURUSD, and USDJPY.

The overall trend for the USD remains downward, and this week has seen a continuation of that trend.

GBPUSD & EURUSD

In the short term, there is potential for a sell trade (Secondary Trend) as a retracement of the recent bull run towards the buy zone of the bullish wave.

USDJPY

We have observed a strong downward move to T1, and price action on the 15-minute chart suggests a potential buying opportunity after liquidity was grabbed at the low of the Tokyo session.

Buying USDJPY (Secondary Trend) is a possibility, as the wave structure 2 is approaching its low, with wave 3 correction expected to be the next phase.

Happy Trading!

GBPUSD- Trend Continuation setupSuccessful trading is knowing what to do and doing what you know. The knowing part is very simple but the doing part is not easy that is why most people struggle in trading.

This afternoon, during the New York session, my focus is on GBP/USD. We are buying based on the H4 timeframe, where the wave structure remains bullish since the price hasn’t closed below 1.30877.

Another confirmation comes from the H1, which has only shown three waves down so far. While a fifth wave may appear, it’s likely to be a higher low following the current upward move on the M15 chart.

As long as the M15 stays above the New York session opening range, we will continue buying.

Happy Trading!

GBP/JPY - Price is the leading IndicatorToday we are looking at GBP/JPY 5 Minutes timeframe.

Based on the price structure, we believe that the high probability direction in the short term is downtrend.

We have seen an ABC (Corrective) wave after the Low of Friday was made.

Key Structures to note:

Structure 4: 200.022 Downtrend continuation reversal point.

Structure 2: 200.674 Downtrend Violation Structure.

Always Think in Probability:

As traders, you must be careful to align your behavior and expectations with the following principles:

- Anything can happen

- An EDGE is only an indication of one thing happening over another

- There is a random distribution between wins and losses

- You don't need to know what will happen in order to make money in trading.

GBPJPY Strong Reversal & GBPUSD UpdateThe Japanese Yen(D) is going through the B to C leg of its correction, which we saw in the yen pairs in the last 24 hours. The GBP/JPY is our pick for a long trade because it has a more technical-bullish outlook than most other yen pairs.

More info in the video.

GBP/USD

The cable broke higher yesterday above 1.2634 , the limit for any downtrend continuation. The violation of this point invalidated the expected downtrend continuation trade.

We must wait for the price to conclude the current rally before we can act on a new position in the cable.

Forex Weekly Trade planning sessionPlan your trades and trade your plans. Today we have the following rankings on the indexes:

@DXY ++VE

@EXY -VE

@AXY --VE

@SXY ++VE

@JXY --VE

@BXY --VE

@CXY --VE

@ZXY --VE

Based on the above rankings, we came up with the following pairings.

BUY PAIRS: USDJPY, USDCAD, CHFJPY,

SELL PAIRS: AUDUSD,GBPUSD,NZDUSD,GBPCHF,AUDCHF

The idea is to trade in the direction of the wave structure as long as the structure is not disturbed or violated, your high probability trade is to trade in the direction of the trend after a secondary trend (Pullback).

Important trend change facts you must know:

A trend will not change easily, it takes a great deal of time and effort for a trend to change.

The time required for a trend to change is very relevant to how long the ongoing trend has been in play.

The duration of a trend change will be greater than half of the period of the changing trend. Sometimes it is equal to the time the trend has been ongoing.

Trend Continuation - CADJPY Wave STructure AnalysisHey Traders,

This is my take on the CADJPY Looking at the 1HR and the 15 Mins timeframes.

Momentum precedes prices! When there's an ongoing primary trend and a completed wave structure, wait for the price to be discounted/pullback.

This discounting in price gives us a piece of important information, we can deduce whether the price will continue the primary trend or the trend will change in the opposite direction. The only tool that gives us this information is the price by counting the wave structure.

As long as the primary trend structural point is intact, the trend is intact and we can trade safely in harmony with the market.

This is not theory, it is practical, but the application is psychological.

CADJPY SHORT KEY LEVELS

Stop Loss:114.88

Target 1: 112.18

Target 2: 110.59

Forex Weekly Planning Session 28 Apr, 2024Plan your trades and trade your plan. The weekly planning session is one of the most important things you can do as a trader.

In this session, I analysed the Currency Index basket of the USD, EUR, GBP, CAD, CHF, AUD, NZD, and JPY.

The strength lies with the USD, the rest are still in a confirmed downtrend.

GBP/USD Follow upA quick Follow-up on the GBP/USD Long Trade.

We have reversed the position at 1.2448 a test of the structure 2.

Technically, the trend is still down and a failure to trade above the structure 2 makes the GBP/USD still bearish.

The last Bullish wave 4 to 5 has given us a short setup using the Fibonacci. This is a high-probability setup for a strong reversal (short) or a downtrend continuation setup.

Initial Target 1.2347, If the price breaks below 1.2330, the downtrend will continue.

Stop Loss: 1.2473

Wave STructure Analysis | GBP/USD M15The rally that happened in the Cable due to the news has seen a follow-through that created the Bullish MH3 (Green Wave). This trend however has been weakened by the pullback of Structure 4. This price has traded below the prior Structure 2. Having said that, the price is still firmly trading in the Buy Zone of the Fibonacci measured from the low to the high of 3.

The high probability direction is still bullish based on the current setup. Below 2DL we will stand aside, which also corresponds to the 0.618% retracement of the current bullish wave.

Target 1: 1.2500

Target 2: 1.2529

Stop Loss: 1.2430

WAVESUSD 1WWAVES ~ 1W 📈

#WAVES This Resistance Line will be broken in the near future. Make purchases gradually from here, with a target of at least 20%++

Gold Bearish Development From the chart, we can see that the price is moving within

a bearish channel for the the past weeks.

Price already created a strong resistance zone near 1968 and continue to hold which is a clear indication that this bearish movement will hold.

The last zone of support will be near the base of the channel after completion of the bigger WXY and it's internal degree abc.

hold your short position or open a short position at a god entry point with your target at 1888.36

Good luck

CADJPY Trend Change, GBPUSD downside continuesToday, we are focusing on the CADJPY chart as we observe the final stages of the wavestructure. The recent pullback from the previous momentum high (3) has formed a significant pattern known as the structural failure, indicating a potential shift in the trend.

Considering our trading rules, we have patiently awaited the completion of the wavestructure (5). Now, we have identified a sell pattern known as the Market Structure High, characterized by a formation of three candlesticks at point (5).

Shifting our attention to the GBPUSD, we can see that it is currently experiencing a downtrend, with the price trading below the Momentum low (5). No trend changing pattern has emerged yet, suggesting that we should anticipate further downside movement in the cable.

Enjoy trading!

GBPUSD Long now to short laterThe GBPUSD picture shows a downward bias, but we need to complete the ongoing upward trend first. A bullish wavestructure has been observed, but it is not yet finished.

Based on the wave count, we anticipate a Higher High above the current day's high before considering a strong short position.

For a long continuation trade, a good entry point would be around the 2DH (1.2395), which is the closest buy point. The stop loss level can be set at 1DH (1.2372), which also coincides nicely with the 0.618% retracement level from the high to the low.

Enjoy the trading!

USDJPY More Downside expected in the short termThe USDJPY has to retrace some of the impulse to the upside, we have seen wave structure 0,1,2 and 3, this is an ideal opportunity to enter short at wave structure 4 expecting Lower low 5.

The price from ML 3 to 4 is a deep retracement of 76.4% of the last decline, knowing this we will target the T1(137.81)

Stop Loss: 138.55.

Enjoy!

AUDUSD Sellers are back!A quick update on the CADJPY Buy trade, expectation is for higher prices into the Sell Zone.

AUDUSD has rallied and this type of Rally is a BUY to SELL Setup. The Daily chart indicated that the long term sellers are now in the market and the move from Monday to the current area is a Pullback.

Sell is the Call and we will use .6754 as the stop loss.

Enjoy!