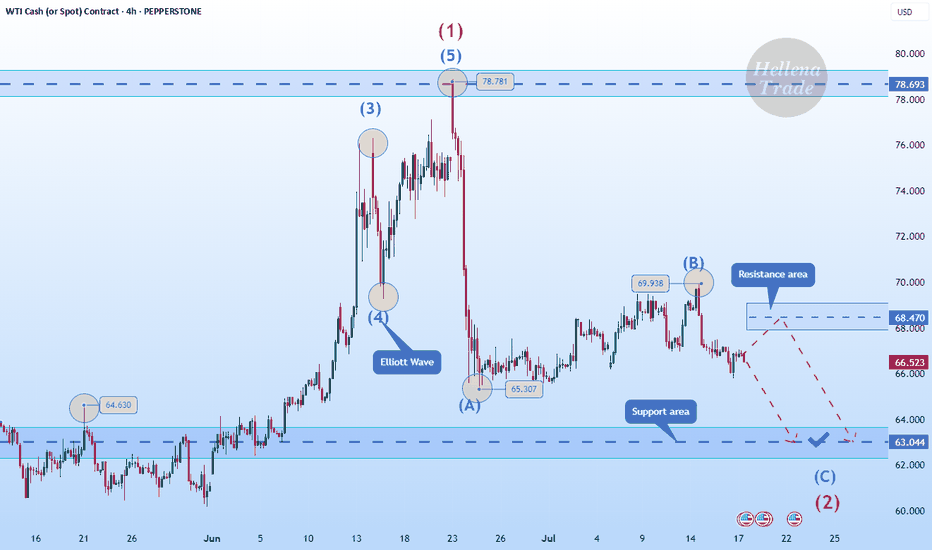

Hellena | Oil (4H): SHORT to support area of 63.000.Colleagues, I believe that wave “B” has formed at the level of 69.938, and now we expect the downward movement to continue with the aim of completing wave ‘C’ of the middle order and wave “2” of the higher order in the support area of 63,000.

It is quite possible that the price could reach the 60,000 level, but I think that for now it is worth focusing on the nearest targets.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Wavetheory

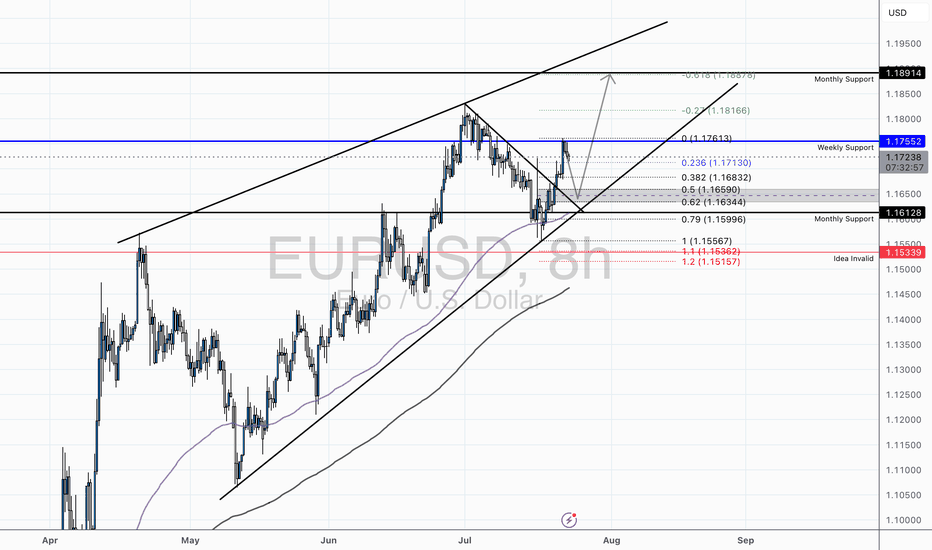

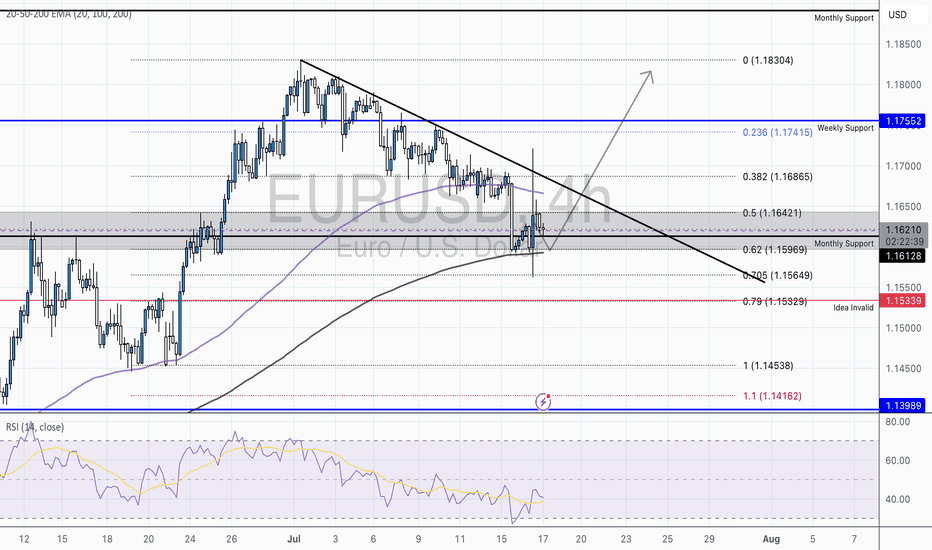

EUR/USD - Holding Bullish Structure Above Key Fibs and TrendlineTechnical Overview:

EUR/USD continues to respect its ascending channel structure, currently rebounding from the lower trendline support while trading above the 50 EMA and 200 EMA. After a healthy retracement to the monthly support (1.16128), the pair has shown strong buying interest, supported by bullish RSI divergence from oversold conditions on the 8H chart.

Key Levels:

Support Zone: 1.1613 – 1.1634 (Fib Cluster + Channel Support + Monthly Support)

Resistance Zone: 1.1755 (Weekly Resistance) followed by 1.1816 (0.27 Fib Extension) and 1.1887 (0.618 Extension)

Invalidation Level: Below 1.1533 (1.272 Fib + Structural Breakdown)

Confluences:

Price broke above a descending correctional trendline, indicating a potential bullish continuation.

Multiple Fibonacci levels (0.382, 0.5, 0.618) have stacked around the previous consolidation area, increasing probability of a sustained move.

RSI bounce from below 40 suggests short-term momentum reversal.

Trade Idea:

We may see a minor pullback into the 1.16344–1.1659 area before a potential continuation higher. Conservative bulls may wait for a retest of this zone with a bullish engulfing or pin bar confirmation before entering long.

Targets:

First target at 1.1755 (prior weekly resistance)

Second target at 1.1816 (Fib extension)

Final target near 1.1887 (major resistance / upper channel boundary)

Risk Management:

A break and close below 1.1533 would invalidate the bullish setup and signal potential bearish pressure returning to the pair.

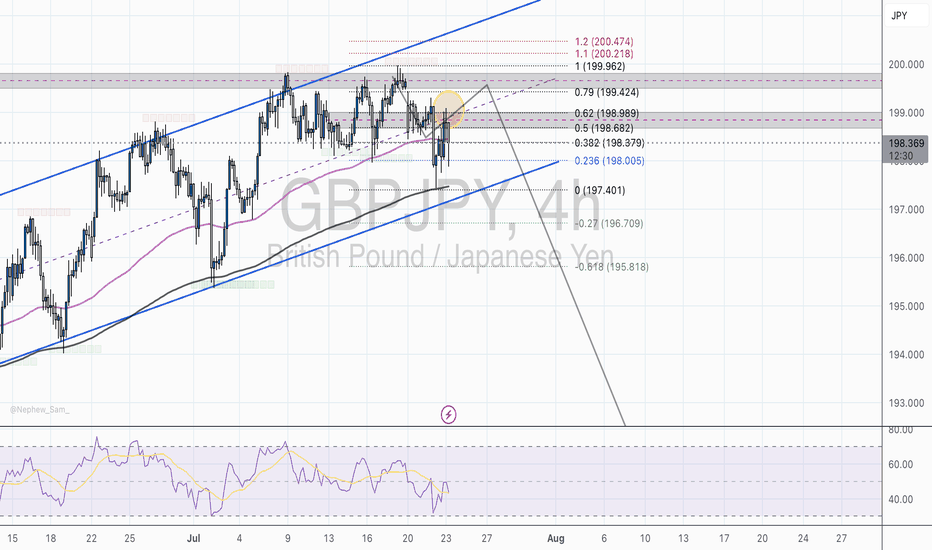

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

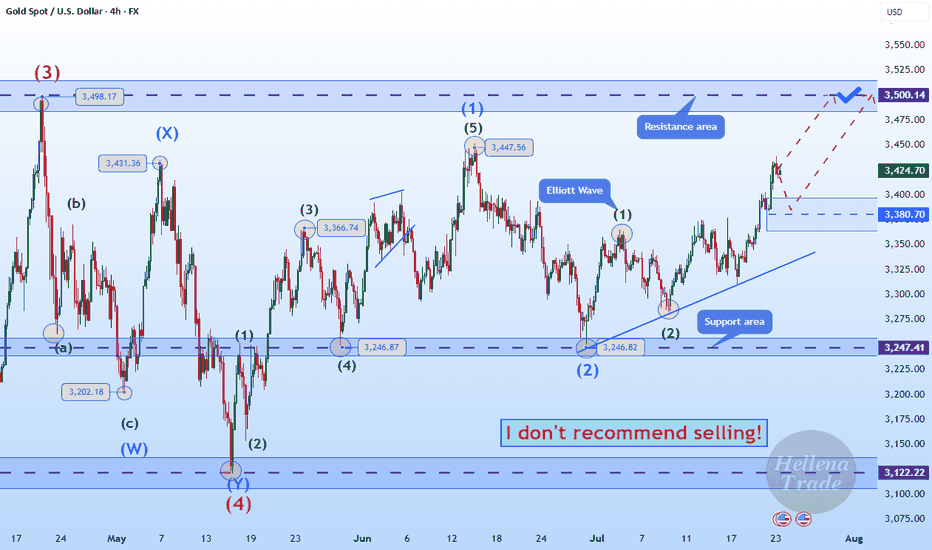

Hellena | GOLD (4H): LONG to resistance area of 3498 (Wave 3).The price continues to move in a bullish direction, and I believe that now is the time to pay attention to the medium-term wave “3.” It is actively developing, and I believe that the target should be set at the maximum area of the higher-order wave “3” — the resistance area of 3498.

This is the nearest target, which carries significant weight.

Overall, the upward five-wave movement is developing according to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

GBP/USD — Potential Bullish Reversal Setup | Long Bias Above Sup🧠 Thesis:

GBP/USD is showing early signs of a potential bullish reversal from a key confluence zone. While price has recently tested short-term descending channel, we’re currently testing a strong ascending trendline support and prior demand zone. This setup offers a favorable long-risk scenario — so long as price remains above 1.3335 (invalid level).

🔍 Technical Breakdown:

Descending Channel: Price has been in a corrective downward channel since early July. This pullback appears orderly and corrective rather than impulsive.

Support Zone: We are seeing strong reactions from the 1.3400–1.3440 area, which aligns with:

Previous consolidation zone (mid-May).

200 EMA on the 4H.

Long-term ascending trendline support (from April lows).

Bullish RSI Divergence: RSI is testing oversold territory (~32) with potential for bullish divergence forming — a classic early signal for a bounce.

EMA Cluster: 50 EMA has been breached but price is testing the 200 EMA as last-resort dynamic support. If held, this further adds to the bullish case.

🧭 Scenarios:

✅ Bullish Bias (Preferred)

If price holds above the trendline support and breaks out of the descending channel, we could see a bullish impulse toward:

🎯 TP1: 1.3600 (prior structure)

🎯 TP2: 1.3770 (trendline extension & fib confluence)

Confirmation trigger: Break and close above 1.3500 resistance (channel breakout).

❌ Invalidation:

A decisive break below 1.3335 (marked in red) invalidates this idea and shifts bias back to bearish — potential deeper pullback toward 1.3200s.

⚠️ Risk Management:

Entry zone: 1.3430–1.3450 (near support)

Stop loss: Below 1.3335

Risk-reward: >2.5:1 on a successful breakout

📝 Conclusion:

This is a classic trend-continuation play with clean structure and a logical invalidation point. The market is offering a textbook “buy-the-dip” scenario off strong multi-timeframe support. Patience is key — wait for confirmation before sizing in.

EUR/USD – Falling Wedge at Major Fibonacci Zone | Bullish ReversAfter a strong mid-June rally, EUR/USD has pulled back into a key fib cluster, showing early signs of reversal from a classic falling wedge pattern — often a precursor to bullish breakouts.

Technical Breakdown:

📉 Descending Trendline

🔍 Fibonacci Confluence:

Price is reacting from the 0.5-0.618 – 0.705 zone (1.16421-1.15969), aligning perfectly with historical demand and the golden zone of the fib retracement.

Just below sits the 0.79 fib (1.15339), which also marks our invalidity level for this idea — a deep but powerful retracement if tested.

💡 RSI:

While still below 50, it has created a hidden bullish divergence between July 12–17, hinting that momentum is flipping back to bulls.

🧠 Educational Insight:

This setup combines Trendlines, Fibonacci retracement theory, and EMA dynamics to build a multi-layered trade thesis — the type of confluence we look for at Wright Way Investments.

Price doesn’t just reverse because it hits a fib level. But when structure, EMAs, and RSI align — the odds increase significantly.

📈 Trade Setup (Idea-Based, Not Financial Advice):

Long Entry Zone: Current area (1.159–1.161), with confirmation above 1.1626

Invalidation: Clean break & close below 1.15339

Target Zones:

🎯 TP1 – 1.1642 (50 fib & retest zone)

🎯 TP2 – 1.1686 (38.2 fib)

🎯 TP3 – 1.1755 (Weekly Resistance)

📌 Summary:

EUR/USD is forming a textbook reversal setup, supported by fib precision and EMA alignment. Patience is key — but the ingredients are here for a strong bullish continuation.

Hellena | GOLD (4H): LONG to resistance area of 3397 (Wave 3).Dear colleagues, my previous forecast remains valid, but I have decided to update it.

At the moment, I still think that wave “3” of the medium order continues its upward movement.

At the moment, I think that the small correction in wave “2” is ending and we will see a continuation of the trend. I see the resistance area of 3397.94 as the target. The main thing is to overcome the local level of the small wave “1” at 3366.37.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to the resistance area 1.18280.The previous idea was aimed at updating the maximum of 1.18280, but the correction turned out to be too deep.

Therefore, I am proposing a new idea. I believe that wave “3” has formed, and now we should see the completion of the correction in wave “4,” after which I expect to see an upward movement in wave “5.” My target is at least the high of wave “3” — the resistance area of 1.18280.

As for the correction, I think it could reach the 1.15459 area, but I recommend working with pending orders.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

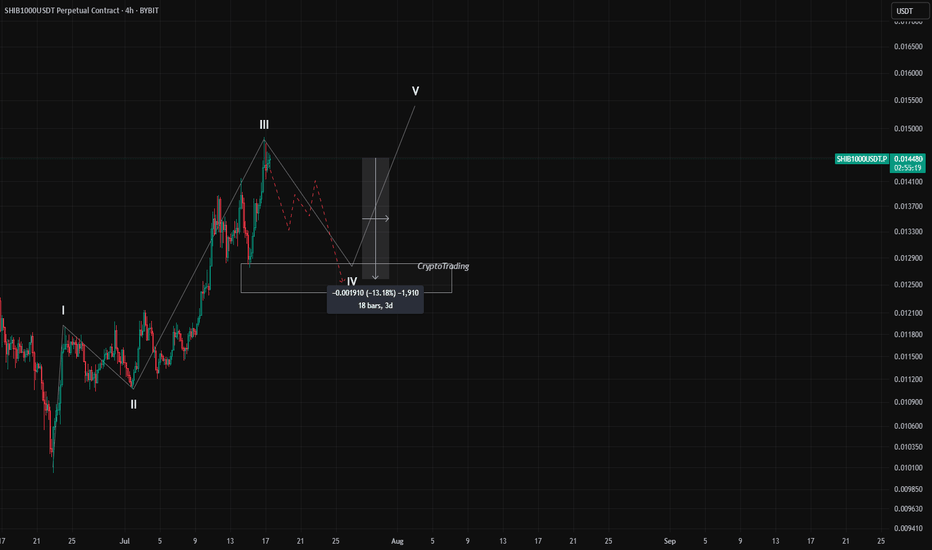

SHIBUSDT 4H Potential 10% Drop – Wave 4 Incoming? Hey traders,

On the 4H timeframe, SHIBUSDT seems to be completing Wave III of a classic 5-wave impulse structure. We can clearly identify:

- Wave I and II behind us

- Wave III topped out recently with a strong push upward

- Now expecting a Wave IV correction to unfold

What supports this setup:

- Wave II was an irregular correction (note how Wave B pushed above Wave A).

- According to Elliott Wave alternation rules, if Wave II is complex/irregular, Wave IV is likely to be a simple ZigZag (ABC) correction.

- Zigzags are typically sharp and quick, which fits the momentum of the current market structure.

🕵️♂️ What’s next?

- The potential correction target lies in the marked rectangle zone (around -10% to -13% drop

from the recent top).

- On lower timeframes (like 7min or 10min), we’ll be watching for a support break to confirm

the start of Wave IV.

- If the support is broken with confirmation, that may offer an opportunity to enter a short

position — as long as it fits within the personal risk parameters.

📌 Disclaimer: This is not financial advice. Trading is risky — always manage your risk, do your

own research, confirm your setups, and never blindly follow others. Stay safe and smart.

🧠 Are you planning to catch this correction? Or waiting for the final Wave V? Let me know in the comments 👇

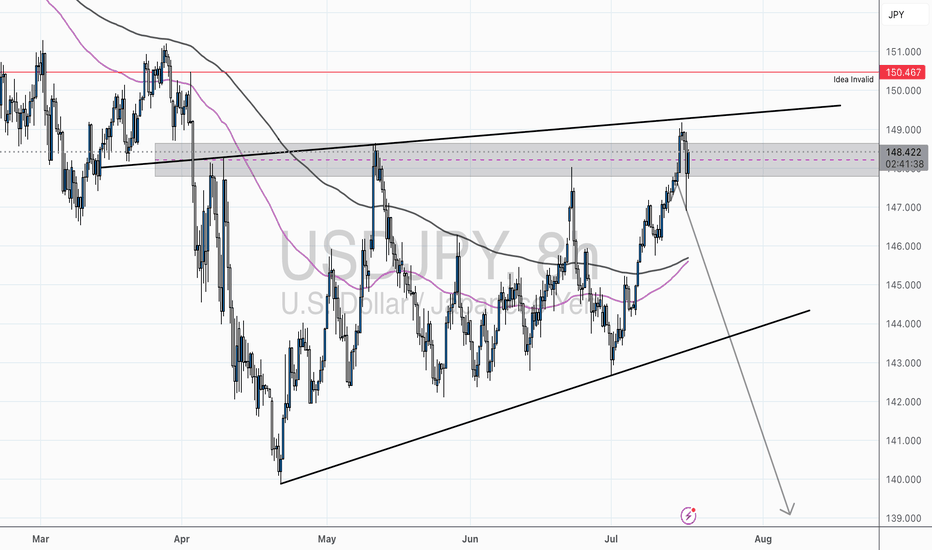

USD/JPY – Rising Wedge Meets Major ResistanceChart Overview:

USD/JPY is printing a textbook rising wedge formation, typically a bearish pattern—especially when occurring at the top of a major move.

What makes this setup compelling:

Price is testing the upper wedge resistance near the 148.50–149.00 region, a historically reactive zone.

There’s clear confluence with the 200 SMA, horizontal resistance, and wedge structure—all signaling potential exhaustion.

🔍 Key Technicals:

Resistance Zone: 148.00–149.00 (Highlighted Supply Zone)

Rejection Candle Pattern: Recent upper wick shows rejection and buyer fatigue

Bearish Divergence on RSI (14): Price made higher highs, RSI printed lower highs — a classic warning signal

🧠 Educational Note: Rising Wedge Patterns

A rising wedge is a bearish reversal pattern, especially potent when it forms after an extended rally. The structure narrows as buyers lose steam, leading to a likely breakdown once support is breached.

Pro Tip: Always confirm a wedge breakdown with a close below support + volume spike or bearish engulfing.

🔄 Invalidation:

This idea becomes invalid above 150.467, where the wedge breaks upward and price potentially enters a new bullish phase. Marked clearly as “Idea Invalid” on the chart.

🧠 Final Thoughts:

This chart combines price action, pattern structure, RSI divergence, and SMA confluence — a high-probability scenario favored by elite traders. If you trade based on confirmation rather than prediction, this could be a setup to watch closely.

🗣 Drop your thoughts or questions below!

💬 Let’s learn and grow together.

XAU/USD 1H – Bullish Breakout in Play | Eyes on 3,400+XAU/USD has officially broken out of a falling wedge pattern, triggering a classic bullish continuation setup. The rejection off the 0.618–0.705 fib retracement zone ($3,280–$3,290) acted as a powerful launchpad, pushing price above the mid-structure confluence and EMAs.

✅ Key Technical Highlights:

Structure Break: Clear bullish breakout from descending wedge + EMA crossover confirmation (20/50 over 200).

Fibonacci Anchors: Price respected the golden pocket (0.618–0.705), now aiming for full fib extension targets.

Targets:

🎯 TP1: 3,397 (-0.27 fib)

🎯 TP2: 3,440 (-0.618 fib / upper wedge trend-line resistance)

Support Zone: 3,304 – 3,319 (0.5–0.382 fib zone), now acting as fresh demand area.

RSI: Rebounding from 50 with momentum, no divergence, suggesting room for continuation.

🔔 Bullish Scenario:

As long as price holds above the breakout retest zone (≈3,336), momentum favors the bulls with high probability toward 3,400+. Clean higher highs and higher lows confirm trend alignment.

⚠️ Invalidation Level:

Break and close back below 3,304 would shift this from breakout to fakeout — watch for bearish pressure toward 3,280 if that occurs.

📌 Wright Way Outlook:

Momentum is on the side of the bulls. With fundamentals aligned and structure broken, this setup favors precision swing entries with clean RR.

Stay patient, stay tactical. Trade the Wright Way.

USD/JPY – Major Reversal Zone | Potential Top FormingUSD/JPY has entered a critical supply zone near 148.700 an area that has historically acted as strong resistance. The confluence of trendline rejection, overextended RSI, and multiple moving average rejections suggest a potential short-term top is forming.

🔍 Technical Breakdown:

Macro Pattern: Price is forming a broadening wedge with repeated rejections from the upper resistance trendline (multi-touch).

Supply Zone: The 148.400–148.700 range has acted as a liquidity grab zone historically — current reaction is showing early signs of exhaustion.

Bearish Confluence:

Price stalling below upper wedge resistance.

RSI sitting near overbought territory (68.75) with bearish divergence brewing.

200 SMA overhead and flattening, acting as dynamic resistance.

🎯 Trade Outlook (Short Bias):

Idea Triggered: If price fails to break and close above 148.700 with strong bullish volume, sellers are likely to step in.

Target 1: 144.200 (mid-wedge support)

Target 2: 139.000 (base of structure & ascending trendline)

Invalidation: Daily close above 148.70–149.00 — would indicate potential continuation to new highs.

🔔 Watch For:

Bearish engulfing or rising wedge breakdowns on lower timeframes (4H / 1H).

RSI divergence confirmation.

Volume drying out near resistance.

📌 Wright Way Insight:

This is a high-probability fade setup at a well-defined resistance zone. Unless bulls break structure convincingly, momentum is likely to shift down — favoring strategic short entries.

Let the chart speak. Don’t chase — trade the reversal, trade the Wright Way.

COIN long -- currently in Wave 3 of 5 wave advance I've been using Elliott Wave Theory to look at COIN's price action. We seem to be in the middle of Wave 3.

- Wave 1: April 7, 2025 to May 22, 2025

- Wave 2: May 23, 2025 to June 13, 2025 - we pulled back right below the 23.6% Fibonacci retracement level with ~$244 serving as support.

- Wave 3: June 14, 2025 - now. The third wave usually has 5 distinct sub-waves. As of July 7, 2025 We appear to be in the 3rd sub-wave of wave 3. Using the upper channel line, price target for this wave is around $408-$410. Quite possible if we see BTC move up explosively, which also seems imminent given the highest weekly close on July 6, 2025.

COIN is a very volatile stock that has explosive moves to the up and downside. I think we still have more room to run in this current wave 3--even beyond sub-wave 1 peak at $380.

Hellena | EUR/USD (4H): LONG to the resistance area 1.20000.Colleagues, I believe that the upward impulse is not over yet. Wave “3” of the higher order and wave “3” of the lower order are just completing their movement, and I think that at the moment it is worth looking at the resistance area of 1.20000.

This is a very attractive psychological level where wave “3” could complete its upward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

BTC/USD – Pullback Before Moonshot?4H Outlook by WrightWayInvestments

Bitcoin just delivered a textbook breakout from the descending channel and is currently consolidating above the breakout trendline. This is a critical zone where market participants are deciding between continuation or a retest.

🧠 Technical Breakdown:

🔹 Breakout Confirmation – Clean bullish breakout above channel resistance

🔹 Ascending Trendline Support – Currently being tested

🔹 Fibonacci Reload Zone – Between 0.382–0.618 (🟦 $105,853–$102,942)

🔹 Bullish Scenario – Potential higher low before aiming for major fib extension

🔹 Target Zones:

• TP1: $110,525

• TP2: $113,827

🧭 Game Plan:

A retracement into the fib support zone ($104K–$102.9K) offers the highest RR for long entries, ideally on bullish candlestick confirmation + volume spike. A break and close above $108.5K could negate pullback expectations and signal direct continuation.

🔔 Final Note:

Volume expansion on breakout + controlled retrace = power setup.

Let the market come to you — high-probability zones don’t chase.

XAU/USD 4H – Retracement or Rejection? Key Levels to WatchGold bulls made a strong push out of the descending channel, but now the real test begins. The market is currently in retracement mode after a sharp impulse, and the next move will be decisive.

🔹 Channel Breakout & Retest in Play:

Price broke out of the descending channel with momentum and hit the $3,357 region before pulling back. We're now hovering around the 0.236 Fib at $3,331 — with the 0.382 and 0.618 Fib zones below offering potential long entry confluence.

🔹 Fibonacci Cluster Support Zone:

Between $3,314 – $3,287 lies a high-probability demand zone, where multiple Fibonacci levels converge with the broken channel top. This area also aligns with the 50 EMA, creating a pocket for bullish continuation — if held.

🔹 RSI Divergence to Watch:

RSI shows signs of slowing bullish momentum after peaking, which suggests this retracement could deepen toward the 0.5–0.618 levels before any meaningful bounce. A bullish RSI reversal in this zone would confirm re-entry.

📌 Scenario 1 – Bullish Continuation:

Price finds support between $3,314–$3,287

Momentum kicks in for a leg up toward $3,388

Final TP at $3,427 (Fib -0.618 extension)

📌 Scenario 2 – Rejection and Deeper Drop:

Failure to hold the 0.5 zone flips the bias bearish

Watch for re-entry back into the previous channel

Next downside target: $3,251 and potentially $3,233–$3,221 (Fib + extension)

💡 Elite Insight:

The pullback is not the risk — entering without a plan is. This is the zone where patience meets precision. Let the levels do the work.

XAU/USD – Bullish Reversal in Motion? Watch the Breakout ZoneGold just gave us a critical reaction off a key confluence zone — and bulls might finally be waking up. Here's the breakdown:

🔹 Falling Wedge Breakout:

Price respected the wedge support beautifully around the 0.382-0.5 Fib retracement and has now closed above the upper descending trendline. The falling wedge is a bullish reversal pattern, and we may be witnessing the early stages of a trend shift.

🔹 EMAs Realignment Pending:

Price is now testing the 20 and 50 EMAs — a clean break and close above them would likely trigger algorithmic momentum back into bullish continuation, especially if we see a flip of the 0.382 Fib at $3,324 as support.

🔹 Upside Targets:

* TP1: $3,372 (0.236 Fib)

* TP2: $3,450 (previous structure high)

* TP3: $3,539 (full range expansion)

🔹 Invalidation Below:

A break back inside the wedge and below $3,285 would invalidate the bullish bias and likely open the path to deeper correction toward $3,251 or even $3,217.

📌 Key Insight:

The best trades aren’t about prediction — they’re about preparation. This setup is all about reacting to price as it confirms. Let the market tell you when it’s ready to move, then strike with confidence and precision.

💡 Watching for bullish retest + volume confirmation before entering long.

Hellena | SPX500 (4H): LONG resistance area of 6176 (Wave 1).Colleagues, the previous forecast remains essentially unchanged, and the target is still 6176, but I think the forecast can be updated because the price has been flat for quite some time.

I still expect the upward movement to continue in the large wave “1” and in the medium-order wave “5”.

A small correction to the support area of 5873 is possible.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to the resistance area 1.17300.Colleagues, I believe that the upward five-wave impulse is not over yet. At the moment, I see the formation of wave “3” of the lower order and wave “3” of the middle order, which means that the upward movement will continue at least to the resistance area of 1.17300. This area is located between two levels (1.16529-1.18252) of Fibonacci extension.

A correction is possible — be careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

USD/CHF – Rejection at Key Fib Confluence, Bearish Continuation We’re seeing a beautiful textbook rejection off the 0.79Fib zone (0.8200), precisely where price tapped into a previous structure break and minor supply block. Price surged into the red zone, wicked just above the 200 EMA, and was instantly met with heavy sell-side pressure — a strong signal of institutional distribution.

📌 Technical Confluences at Play:

Price failed to break the 200 EMA cleanly — acting as dynamic resistance.

0.79 Fib levels aligning with prior supply.

Rising wedge structure broken to the downside.

Entry candle printing a solid engulfing rejection — institutional footprint.

📉 Target Zone:

Primary TP sits at the 0.236 Fib level (0.8101), but the full measured move of this wedge gives us a final downside target near 0.8038, with intermediate stops at key Fibs. Invalidation above 0.82294

🧠 Trader’s Insight:

“Patience is power. You don’t chase moves, you position for moments.”

Let the market come to your zone of interest, validate your thesis, and then strike with precision. The best trades come from areas where multiple confirmations stack in your favor.

📉 Trade Plan:

Entry: 0.81933 rejection zone

TP1: 0.8130

TP2: 0.8101

Final TP: 0.8038

SL: Above 0.82294 (tight invalidation)

@WrightWayInvestments

@WrightWayInvestments

@WrightWayInvestments

Hellena | GOLD (4H): LONG to resistance area of 3500 (Wave 3).Colleagues, the correction did take place and was quite deep, as I wrote earlier.

However, I am leaving my target unchanged—the resistance area and the maximum of wave “3” of the higher order at 3500.

The waves remain in their previous places, because none of the rules of wave analysis have been violated.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

USD/JPY – Bearish Symmetrical Triangle Break Incoming?USD/JPY is currently consolidating within a well-defined symmetrical triangle, respecting both the ascending and descending trendlines with clean touches. This structure typically precedes a volatile breakout, and the technical confluence here favors a bearish resolution.

🔍 Technical Breakdown:

Price failed to hold above the 0.5 Fib level of the recent swing high at 145.377, getting rejected by both the 200 EMA and the triangle resistance zone.

Currently testing the 0.382 retracement (144.607) — a break here opens the door for a drop to the 0.236 level (143.653) and potentially deeper into previous demand.

Volume compression and EMA clustering further support an imminent breakout move.

📐 Bearish Confluences:

Rising wedge/symmetrical triangle pattern showing exhaustion.

Strong rejection at the equilibrium of the range.

EMAs acting as dynamic resistance.

Major fib cluster from previous bearish leg aligning with triangle apex.

🎯 Targets:

TP1: 143.653 (0.236 Fib)

TP2: 142.111 (local low)

TP3: 140.347 (-0.27 Fib extension, full measured move of triangle)

❌ Invalidation:

Clean break above 145.526 (mid-structure + fib zone) would neutralize the setup.

💬 Market Context: Watch closely for a breakout confirmation. Smart money may sweep short-term liquidity before a decisive drop. Stay nimble, and remember — structure always tells the story.

XAU/USD – Wave 3 in Motion?We’re currently monitoring what appears to be a textbook Elliott Wave 1-2 structure, with Wave (2) bottoming near $3,293. Price has since pushed up and consolidated above the 0.5–0.382 retracement zone, holding firm at key EMAs and structure.

🔍 Key Technical Highlights:

Wave (1): Clean impulsive structure.

Wave (2): Corrective decline finding strong support at $3,293.

Current consolidation suggests accumulation before potential Wave (3) breakout.

Confluence of Fib extensions & upper trendline project Wave (3) towards $3,484, aligning with the -0.27 extension.

🧠 What I’m Watching:

Break and retest of the $3,400–$3,415 level (0.236 Fib) to confirm bullish continuation.

Holding above $3,372–$3,390 (the golden pocket and 0.5/0.382 zone) is key to maintaining the bullish bias.

A clean break below $3,353 invalidates this immediate structure.

📈 Bias: Bullish

🎯 Next target: $3,484

⛔️ Invalidation: Break below $3,350

💬 Let me know your thoughts. Are we about to ride Wave 3, or will gold give us one more dip before lift off?