WDC

WDC, MACD Histogram just turned positiveThis is a Bullish indicator signaling WDC's price could rise from here. Traders may explore going long the stock or buying call options. Tickeron A.I. dvisor identified 42 similar cases where WDC's MACD histogram became positive, and 33 of them led to successful outcomes. Odds of Success: 79%. Current price $38.21 crossed the support line at $38.44 and is trading between $38.44 support and $37.84 resistance lines. Throughout the month of 09/08/20 - 10/08/20, the price experienced a +6% Uptrend. During the week of 10/01/20 - 10/08/20, the stock enjoyed a +7% Uptrend growth.

Bullish Trend Analysis

The RSI Oscillator points to a transition from a downward trend to an upward trend -- in cases where WDC's RSI Oscillator exited the oversold zone, 20 of 30 resulted in an increase in price. Tickeron's analysis proposes that the odds of a continued upward trend are 67%.

The Momentum Indicator moved above the 0 level on October 08, 2020. You may want to consider a long position or call options on WDC as a result. Tickeron A.I. detected that in 61 of 86 past instances where the momentum indicator moved above 0, the stock continued to climb. The odds of a continued upward trend are 71%.

The Moving Average Convergence Divergence (MACD) for WDC just turned positive on October 08, 2020. Looking at past instances where WDC's MACD turned positive, the stock continued to rise, Tickeron A.I. shows that in 33 of 42 cases over the following month. The odds of a continued upward trend are 79%.

WDC moved above its 50-day Moving Average on October 08, 2020 date and that indicates a change from a downward trend to an upward trend.

Following a +6.73% 3-day Advance, the price is estimated to grow further. Considering data from situations where WDC advanced for three days, Tickeron A.I. shows that in 229 of 318 cases, the price rose further within the following month. The odds of a continued upward trend are 72%.

The Aroon Indicator entered an Uptrend today. Tickeron A.I. shows that in 162 of 229 cases where WDC Aroon's Indicator entered an Uptrend, the price rose further within the following month. The odds of a continued Uptrend are 71%.

WDC WESTERN DIGITAL CORP 68.02% upside potential I have 45 Western Digital hard drives without any issues in many years. In my opinion Western Digital is the best affordable storage devices company.

8/6/2020 Morgan Stanley Lower Price Target Overweight $63.00 ➝ $58.50

8/6/2020 Wells Fargo & Co Lower Price Target Overweight $60.00 ➝ $55.00

8/6/2020 Bank of America Lower Price Target Buy $61.00 ➝ $52.00

8/6/2020 Robert W. Baird Lower Price Target Outperform $75.00 ➝ $50.00

Market Cap$11.02 billion

Annual Sales$16.74 billion

Net Income$-250,000,000

If you are interested to test some amazing BUY and SELL INDICATORS, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

Reversing PAYS OFF!! - 05/01/20 RECAPHi traders,

The other day I posted a reverse entry which happened to be a loser as well, but I told you it typically pays off.

On Friday I got to prove it when WDC didn't react the way I planned and that got me thinking if the other direction wasn't a better idea... and it was!

The Trades:

1) WDC - SHORT @38.73 - terrible fill at the break of 39, in hindsight I should've at least reduced the position right away to compensate. -0.96%

2) MRNA - LONG @49.58 - good break of a strong stock, it went some 60c in the money but then collapsed. With different risk management style it would pay off, but that's just my choice and I'm not upset at all. -0.93%

3) WDC - LONG @39.85 - and finally my reverse play that didn't deliver as much as I hoped for, but still proved to be the correct way to think about the stock. +1.2%

*In my ID trades, I risk 1% of the account per trade and go for 2% (2:1 RRR ). Sometimes I adapt a little bit as you can see in the trades' description.*

Total PnL for the day: -0.69%

Total PnL for the week: +0.40%

Good trades,

Tom | FINEIGHT

Western Digital.. Reversing Trend after $50? Short of the Year?Ok looking at the monthly where this is sitting at could definitely have some massive gains for the next WHILE. I personally think this may rally to $50, but after that if it can't hold this could completely break under and once it does... oh boy you could see a downtrend for .. well a while.

Let me know your thoughts. This will be a long LASTING trade .. I am not long except for this potential rally. Trade position assuming it does drop out the bottom sooner than expected. IF it doesn't rally a short could be in play extremely soon.

WDCGood spot for some mid range longs.

Pink area are targets for the longs.

Green zone good spot for entry. Although, if it reaches here, it may pull back further to teal before pushing to target zone. Orange line is stop loss for green zone entry.

Teal zone should be stronger. Red line is stop loss for teal zone entry.

WESTERN DIGITAL/WDC - LONG POSITIONI share my longterm expectation of this trade.

Memory prices stabilizing. This could bring great gains for this stock in the longterm view.

I am in this trade for a long time. But for those who are not in this trade yet...we got a pinbar on the 4H, which is first good sign for the entry if you still hesitate.

You can also wait for the daily candle confirmation.

WDC: Completing bottom formation ahead of earningsWDC is completing a bottom formation ahead of its earnings report due out later this month. The bottom has a shift of sentiment pattern seen in volume-based indicators. Candlesticks show pro traders are controlling the stock price as some smaller funds sell out as the bottom completes.

WDC LongPredicting price to drop slightly more to the targeted area, around $43 before rebounding, with the upper target being around $60. On the weekly, we met the same strong support of $35 in Dec 2018 as we did in 2016. We topped out just under $54 just as we did in the rebound from 2016. After topping in 2016, we pulled back to about $43 before soaring up to about $60. These two levels are acting as our lower and upper targets.

SOLD 3 MILLION SHARES. $25 MILLION PROFITWE WERE AND STILL ARE BULLISH ON MICRON BUT...

OUR AVERAGE COST WAS DOWN TO AROUND $30.77 AFTER LOWERING OUR COST FROM THE HIGHER PRICES WE PAID, UPWARDS OF $59 A SHARE

THE STOCK WENT UP OVER 10 POINTS WITHIN A SHORT PERIOD OF TIME

NOW, THE NEGATIVITY RETURNS TO THE CHIP SECTOR FROM DOGS LIKE NVIDIA...WE MENTIONED IN A PREVIOUS POST NVIDIA WAS A BUBBLE AND NOW OUR POST IS COMING TO LIGHT

NVIDIA HAS LOWERED REVENUE HOW MANY QTR'S NOW? WE WERE RIGHT WHEN WE POSTED NIVIDA WAS OVER PRICED AND WE ARE STILL RIGHT TODAY!

WE CLOSED OUR ENTIRE MICRON POSITION SELLING 3 MILLION SHARES

AVERAGE COST: $30.77

PROFIT: $25.5 MILLION

WE STILL FEEL MICRON WILL TRADE UPWARDS OF $100 IF YOU HOLD THE STOCK FOR THE LONGER TERM

AS FOR THE BUYOUT, WE WOULD LOVE THE WESTERN DIGITAL / MICRON MERGER RUMOR THAT WE HEARD ABOUT COME TO LIGHT, THAT WOULD BE ONE AMAZING COMPANY COMBINED!

BEST OF LUCK TO THE LONGS!

BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED! - DON'T BE GREEDY

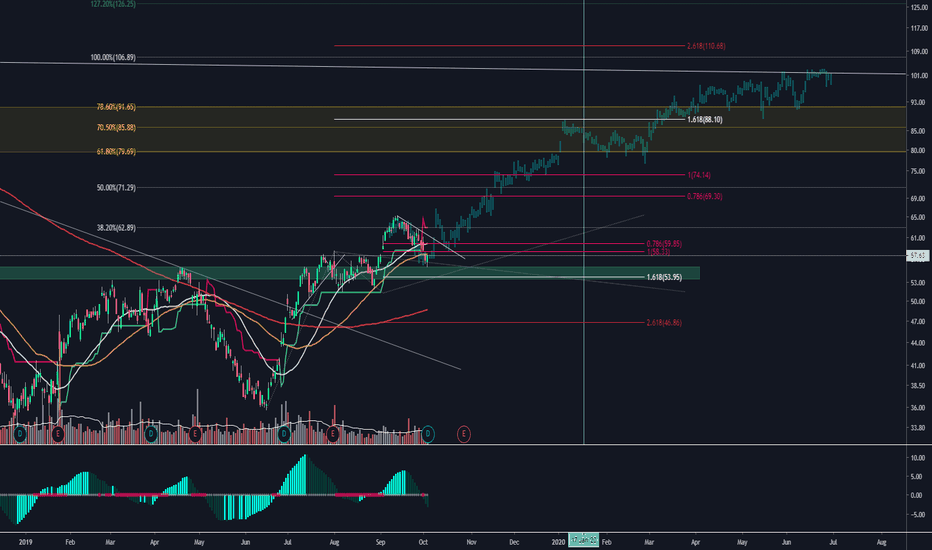

WDC Approaching Support, Potential Bounce! WDC is approaching our first support at 28.27 (horizontal swing low support, 100% fibonacci extension, 76.4% fibonacci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 47.52 (horizontal swing high resistance, 23.6% fiboancci retracement, 61.8% fibonacci extension).

Stochastic (55,5,3) is also approaching support and we might see a corresponding bounce in price.

RAISING POSITION TO 2,000,000 SHARES. UNWARRANTED SELL OFF!Folks, Fake News has Micron Bankrupt while other companies that depend on Micron products, Microsoft, Apple, Google, Amazon, Facebook, Twitter, Data Storage Services, in fact, the entire Technological Infrastructure depends on Memory and Storage to work so if Micron sales are forecast to sink by FAKE NEWS, the entire technology industry will crash with it including Cloud Computing services.

This is a case where if you have brains, you know the truth and you BUY!

Smart Money is buying Micron at these FIRE SALE prices while weak hands and manipulators are trying to push the stock down.

As it stands now, Micron is trading under 3x forward earnings, this by itself is OUTRAGEOUS Wall Street Corruption especially watching AMD triple in price on speculation.

We cannot watch the Corruption win, we are moving our position from 1,000,000 shares to 2,000,000 shares

Like we said in an earlier post, Corrupt Wall Street will make us BILLIONAIRES!

If you look at over 90% of our trades on this board, we haven't been wrong. We've made money on every trade we've closed.

A perfect example of Wall Street Corruption is the price of NVIDIA, with an E.P.S of only $6.65 - Trading over $200 a share

Even if Micron sales fall, they will still beat NVIDIA E.P.S.

The sick part of this story, Micron makes NVIDIA chips along with chips for Western Digital, IBM, Intel and many more companies.

We couldn't ask for a better Christmas Gift!

P.S. We also think, if the price of Micron stock stays down at these low levels, the company will we bought out!

With the cash flow Micron has, along with the positive / rock solid E.P.S, the company is a sitting duck for a BUYOUT at current levels.