Wedge

Euro may bounce up from support area to 1.0950 pointsHello traders, I want share with you my opinion about Euro. Analyzing the chart, we can observe how the price initially reached the support level that aligned with the buyer zone and broke through it. After that, the Euro moved into a wedge pattern, where it reversed near the resistance line and started to decline sharply toward the support line, forming a strong gap and breaking the support once again. Soon after, the price reversed direction and began to climb, breaking through the 1.0360 level again and rising to the resistance line of the wedge. A brief correction followed, bringing the price back down to the support level. From there, the market made a strong upward impulse, breaking out of the wedge and reaching the current support area. After the breakout, the price started moving within a triangle pattern. It broke above the 1.0785 level and climbed to the resistance line of the triangle. Then, a correction took place down to the support area, followed by a quick bounce back up to the resistance, from where the price recently started to decline. Given this structure, I expect the price to complete its correction at the support area and then bounce upward, breaking out of the triangle pattern. If this plays out, I anticipate further upward movement, with my target set at 1.0950 points. Please share this idea with your friends and click Boost 🚀

USD-JPY Bearish Breakout! Sell!

Hello,Traders!

USD-JPY is trading in a

Downtrend and the pair

Broke our of the bearish

Wedge pattern then made

A retest and is going down

Now so we are bearish

Biased and we will be

Expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHZ/BTC about to score a goal?Welcome back dearest reader,

If you have been following me you're quite aware i'm very bullish on this project. Fundamentals aside the charts look amazing. And CHZ/BTC is no exception to this!

Deeper dive:

~Trendlines --> As you can see at trendline ''1'' chz has found support going way back to 2021, you can see what happened next. The bars pattern from 2021 has been copied and shows a strong impulsive move going into june. Trendline ''2'' just shows the downtrend we've been in in relation to BTC, i don't expect this to fall below legacy support ''1''.

~MFI --> The Money Flow Index (MFI) is a technical indicator used in financial analysis to measure the strength and momentum of money flowing in and out of a security, typically on a scale from 0 to 100. It combines price and volume data to help traders identify overbought or oversold conditions, often signaling potential reversals in the market. As we can see it's massively oversold and yearning for a reversal ''3''.

~Stochastic RSI --> The Stochastic RSI (Stoch RSI) is a momentum oscillator that combines the Stochastic indicator and the Relative Strength Index (RSI) to measure the RSI's position relative to its recent high-low range. It ranges from 0 to 1 (or 0 to 100 when scaled), helping traders spot overbought or oversold conditions and potential trend shifts with greater sensitivity than the RSI alone. For CHZ also in a massive oversold condition ''4''.

Summary:

~Trend has bottomed and could provide a strong move for CHZ

~MFI and stoch RSI are massively oversold.

Note: This is the CHZ versus BTC chart, this means that even if BTC trades sideways or bottoms CHZ could do well. This would coincide with BTC.D dropping.

Any questions? Ask.

~Rustle

Silver (XAG/USD) Rising Wedge Breakdown – Bearish SetupMarket Overview & Context

Silver (XAG/USD) has been in a strong uptrend, forming higher highs and higher lows over the past few weeks. However, recent price action suggests a potential shift in momentum as a bearish Rising Wedge pattern emerges. This technical pattern often signals a possible trend reversal or correction.

This analysis focuses on a 4-hour (H4) chart, which provides a medium-term perspective for traders. The market has recently encountered a strong resistance zone, and multiple price rejections indicate a potential downward move.

Chart Pattern: Rising Wedge Formation

The Rising Wedge is a bearish reversal pattern that occurs when the price moves higher within two converging trendlines. This structure suggests that while buyers are still in control, their momentum is weakening.

Key Characteristics of the Rising Wedge in This Chart:

Uptrend with Weakening Momentum:

The price has been rising, but the higher highs are becoming less aggressive.

The slope of the highs is flatter compared to the lows, which indicates declining bullish strength.

Converging Trendlines:

The price is getting squeezed between support and resistance.

This tightening range typically precedes a breakout, with a higher probability of a bearish breakdown.

Bearish Implications:

A breakdown below the wedge’s lower trendline confirms bearish sentiment.

The price could drop sharply toward the next major support level if sellers gain control.

Key Technical Levels & Trading Strategy

1️⃣ Resistance Zone (Supply Area) – $34.50 to $34.60

The price has repeatedly tested but failed to break above this zone.

This confirms that sellers are active in this area, leading to multiple rejections.

A strong supply zone, making it an ideal stop-loss placement for short trades.

2️⃣ Support Level (Demand Area) – $30.50 to $30.60

This level has acted as major support in previous price action.

If the breakdown occurs, this is the primary downside target for sellers.

3️⃣ Stop Loss – $34.61

Positioned just above resistance to minimize risk exposure.

Ensures that if price moves against the trade, losses are contained.

Trading Plan & Execution

📉 Short (Sell) Setup – Bearish Breakdown Expected

✅ Entry: A confirmed breakout below the rising wedge’s support trendline (~$33.50 - $33.80).

✅ Stop Loss: Placed slightly above $34.61, ensuring risk control.

✅ Target: $30.56, aligning with previous support zones and technical projections.

Risk-Reward Analysis

Entry at breakdown (~$33.50)

Stop loss (~$34.61) – Risk: ~1.1 points

Target (~$30.56) – Reward: ~2.9 points

Risk-to-Reward Ratio: ~1:3, making this a highly favorable short setup.

Confirmation Signals to Watch Before Entering a Trade

📉 Break and Retest of Support as Resistance

If price breaks below wedge support and retests it as new resistance, it strengthens the bearish case.

📉 Volume Spike on Breakdown

A sharp increase in volume when breaking support confirms strong selling pressure.

📉 RSI Divergence (Bearish Signal)

If the Relative Strength Index (RSI) shows lower highs while the price makes higher highs, it suggests momentum weakness and a pending breakdown.

Potential Trading Scenarios

📌 Bearish Scenario (High Probability) – Breakdown Confirmation

If the price breaks below the wedge’s lower trendline and closes below $33.50, it will likely accelerate downward toward $30.56. Traders should enter short positions and hold for the target while managing risk with stop-loss levels.

📌 Bullish Scenario (Low Probability) – Invalidating the Pattern

If the price breaks above $34.60 and holds, the rising wedge pattern is invalidated. This would signal continued bullish strength, and traders should avoid short positions.

Conclusion & Final Thoughts

✅ The Rising Wedge Pattern suggests a potential bearish reversal in Silver (XAG/USD).

✅ If the price breaks the lower trendline, a drop toward $30.56 is highly probable.

✅ Traders should wait for confirmation signals before entering a trade.

✅ Risk management is crucial, with a stop-loss above $34.61 to minimize exposure.

🔹 This setup presents a strong risk-to-reward opportunity, making it ideal for traders seeking short positions in Silver.

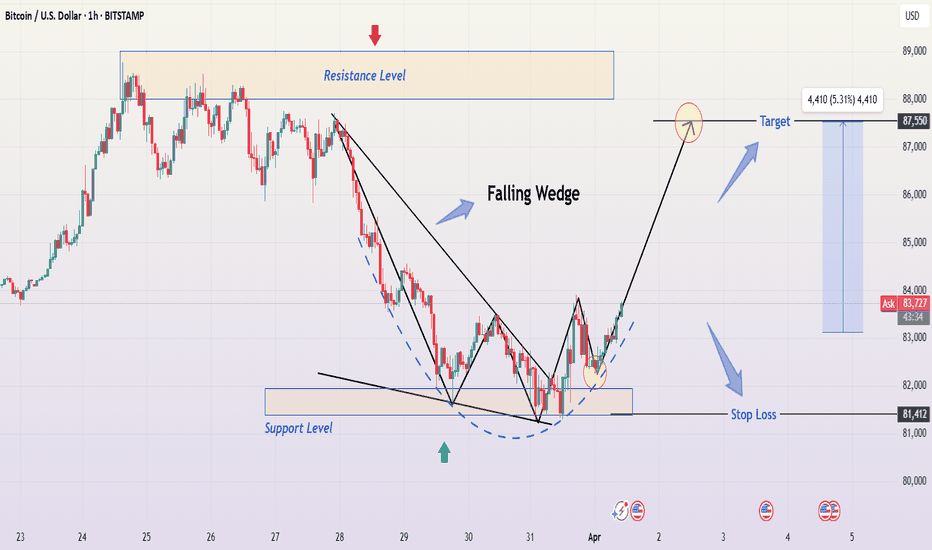

Bitcoin (BTC/USD) 1-Hour Chart Analysis – Professional BreakdownThis BTC/USD 1-hour chart showcases a falling wedge breakout, indicating a potential bullish reversal after a downtrend. The analysis suggests that Bitcoin could move toward its next resistance target of $87,550, offering a profitable long setup for traders. Let's analyze the chart in detail.

1️⃣ Market Context: Understanding the Trend

📉 Previous Downtrend

Before the wedge formation, Bitcoin was in a strong downtrend after reaching a resistance level near $87,000–$88,000.

Sellers took control, creating lower highs and lower lows, forming a descending wedge pattern.

The price declined sharply, reflecting profit-taking, increased supply, and weak demand.

📊 Current Market Setup

Bitcoin found strong support around $81,412, a level where buyers have stepped in multiple times.

The price action compressed into a falling wedge, a classic bullish reversal pattern, indicating that bearish momentum was weakening.

The breakout from the wedge suggests that bulls are regaining control, signaling a potential uptrend.

2️⃣ Key Technical Levels & Market Structure

🔹 Resistance Level ($87,000–$88,000)

This zone has acted as a strong supply area where Bitcoin previously struggled to break through.

If Bitcoin approaches this level again, a break and retest scenario would be ideal for further continuation.

🔹 Support Level ($81,412)

This area has provided multiple bounces, confirming it as a demand zone where buyers are actively defending.

A break below this support would invalidate the bullish setup and could lead to a downward move.

📍 Breakout Confirmation

The falling wedge breakout is confirmed by bullish price action and strong buying pressure.

Bitcoin is now forming higher lows, indicating a potential trend reversal.

3️⃣ Technical Chart Pattern: The Falling Wedge

📌 What is a Falling Wedge?

A falling wedge is a bullish pattern that forms when price consolidates between two converging downward-sloping trendlines before breaking out upward.

✅ Characteristics of a Falling Wedge in This Chart

Series of lower highs and lower lows, forming a contracting price range.

Decreasing bearish momentum, seen by smaller candles near the support zone.

Bullish breakout with strong momentum, signaling a reversal.

💡 Implication:

A breakout from a falling wedge often leads to a strong upward move, especially if volume supports the breakout.

4️⃣ Trading Setup & Strategy

📍 Entry Strategy

A confirmed breakout above the wedge with a strong bullish candle.

A pullback and retest of the breakout level can provide a high-probability entry point.

🎯 Target Levels

Primary Target: $87,550 (Projected based on wedge height).

Extended Target: Above $88,000 if momentum continues.

🛑 Stop-Loss Placement

Below the support zone at $81,412 to minimize risk.

If Bitcoin falls below this level, it invalidates the bullish setup.

5️⃣ Risk & Considerations

⚠️ Potential Risks to Watch

Fake Breakouts: If BTC fails to hold above the breakout level, it could result in a bull trap, causing a price reversal.

Market Volatility: Crypto markets are highly volatile, and external factors (such as macroeconomic news or regulatory updates) could impact price movements.

Resistance Pressure: The $87,000–$88,000 zone could act as a strong resistance, leading to possible consolidation before a decisive move.

✅ Risk Management Tips:

Keep a tight stop-loss below key support.

Adjust position size based on volatility.

Wait for confirmation before entering trades to avoid false breakouts.

6️⃣ Conclusion: Bullish Bias but Caution Advised

📈 Bitcoin is showing signs of a potential uptrend after breaking out from the falling wedge pattern. However, traders should watch for a confirmation of strength before entering long positions.

Key Points to Watch:

BTC needs to hold above $83,500 to sustain bullish momentum.

A strong candle close above $85,000 will further confirm bullish control.

The $87,550–$88,000 resistance zone will be a crucial test for the next move.

🚀 Bullish outlook remains valid unless BTC drops below $81,412.

Hashtags for TradingView Idea

#Bitcoin #BTCUSD #CryptoTrading #TechnicalAnalysis #FallingWedge #CryptoSignals #TradeSetup #TradingStrategy

XAUUSD Bearish Breakdown: Riding the Rising Wedge to Profit1. Chart Pattern: Rising Wedge (Bearish Reversal)

The Rising Wedge is a technical pattern that occurs when price makes higher highs and higher lows within converging trendlines. This pattern is considered bearish, as it usually precedes a breakdown when price fails to sustain the higher levels.

The pattern is clearly visible as price moves within two upward-sloping black trendlines.

The narrowing range suggests that buying pressure is weakening, and sellers are gaining control.

A confirmed breakdown occurs when price breaks below the lower trendline, indicating potential further downside.

2. Key Technical Levels

Resistance Level (Highlighted in Beige, Top Box)

This area represents a strong supply zone where price has struggled to move higher.

Each time the price reaches this level, selling pressure increases, pushing the price lower.

The chart labels this as the Resistance Level, suggesting a potential reversal zone.

Support Level (Highlighted in Beige, Lower Box)

This is the previous demand zone, where price has rebounded multiple times.

Once price reaches this level, buyers may attempt to push it higher.

However, if this level fails to hold after the breakdown, further downside is expected.

Stop Loss Level (~3,150)

The stop loss is placed just above the recent highs.

If price moves beyond this level, it would invalidate the bearish setup.

Traders use stop losses to limit risk in case the market moves against the position.

Target Level (~3,080)

This is the projected downside target based on the height of the wedge.

A measured move (calculated from the highest to the lowest point of the wedge) aligns with this target.

It represents a potential 1.78% decline from the breakdown level.

3. Price Action & Trade Setup

Breakout Confirmation:

The price broke below the lower trendline, confirming a wedge breakdown.

The bearish momentum suggests sellers are in control.

Entry Zone:

A good short-selling opportunity is identified after the breakdown and potential retest of the lower trendline.

Risk Management:

Stop loss at 3,150 (above resistance).

Profit target at 3,080 (expected support).

This gives a favorable risk-to-reward ratio.

4. Market Psychology Behind the Pattern

Rising Wedge Psychology:

The pattern forms as buyers push price higher, but each new high has weaker momentum.

Eventually, selling pressure outweighs buying interest, leading to a breakdown.

Resistance & Support Psychology:

The resistance area acts as a supply zone where big traders sell their positions.

The support zone may hold temporarily, but if it breaks, panic selling could accelerate the decline.

5. Possible Scenarios After the Breakdown

Bearish Case (Most Likely Outcome)

Price continues downward after breakdown.

It reaches the 3,080 target with increased selling momentum.

Confirmation of a bearish reversal pattern.

Bullish Case (Invalidation of Setup)

Price reclaims the wedge and moves back above resistance.

It invalidates the bearish breakdown, stopping out sellers.

A potential bullish continuation toward new highs.

Final Thoughts

This chart presents a high-probability short trade based on the Rising Wedge breakdown and resistance rejection. Traders can manage risk by setting a tight stop loss above resistance while aiming for a target at the next key support zone. The pattern suggests a bearish sentiment in the short term, favoring sell setups over buying opportunities.

Would you like me to add further insights, such as Fibonacci levels or RSI analysis, to strengthen the trade idea? 🚀

NZD/USD at Risk of Retesting Yearly LowsThe Kiwi is clinging to uptrend support within a broader rising wedge, with selling pressure reemerging at .5680 despite Monday’s late recovery.

A clean break below the uptrend could see bears target .5650, the low from Monday. A move through that level would put .5600 in focus as the next downside target.

Momentum signals reinforce the bearish case—RSI (14) and MACD continue to trend lower into negative territory, favouring selling rallies and downside breaks.

If the price were to fail beneath the uptrend again and reverse back above .5680, the bearish bias would be invalidated for now.

Good luck!

DS

USD/CAD breaks out of falling wedgeUSD/CAD closed higher for a fourth day on Monday, on the even of Trump's liberation day. It also accelerated away from its 50-day EMA after establishing support around its 100-day EMA last week.

This has also seen USD/CAD break trend resistance, and a falling wedge pattern now appears to be in play. This suggests an upside target near the 1.4550 cycle highs.

Bulls could seek dips towards the 50-day EMA and retain a bullish bias while prices remain above last week's low.

Matt Simpson, Market Analyst at City Index and Forex.com

USDJPY → Key Level Retest. Attempt to change the trend FX:USDJPY in the correction phase is retesting the previously broken boundary of the downtrend. The market is trying to break the trend on the background of the dollar correction

The dollar is having a rather difficult life because of economic and geopolitical nuances regarding the USA, as well as high inflation. Against this background, the index may continue a deeper correction, as the rhetoric of interest rate cuts may be prolonged, which may put pressure on the markets.

The currency pair tried to overcome the downtrend resistance earlier and succeeded, but this is not enough for a trend change, it needs confirmation.

Support levels: 148.92, 148.21

Resistance levels: 150.16, 150.95

If the bulls hold the defense above 148.92 - 149.5, we have a good chance to catch a trend change. It will be the readiness to go to the resistance of 150.16 range, and the breakout of this level and price fixation above it will be the confirmation of the trend change

Regards R. Linda!

Be careful with SONIC !!!Finally, the price broke the wedge, and the price experienced a significant drop. I think now is the time for SONIC to rise again to 0.27 . STRONG SUPPORT 0.382=0.21 TO 0.23.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

MarketBreakdown | EURUSD, GBPUSD, USDJPY, AUDUSD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

For the last 2 weeks, EURUSD shows a strong bearish momentum.

The price managed to break and close below a key daily support cluster.

A strong bearish reaction that followed after its retest confirms a strong

selling pressure.

I think that the pair has a potential to drop lower this week.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

In comparison to EURUSD, GBPUSD looks very stable.

The pair is consolidating within quite a wide range on a daily.

For now, probabilities are high that sideways movement will continue.

Consider trading the upper and lower boundary of the underlined channel.

Alternatively, a breakout of one of the underlined structures will give you a strong

bullish/breaish signal.

3️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

Looks like the market is returning to a mid-term bearish trend.

The price is currently breaking a support line of a bearish flag pattern.

A daily candle close below its support will provide a strong bearish confirmation.

4️⃣ #AUDUSD daily time frame 🇦🇺🇺🇸

I see a completed head & shoulders pattern on a daily.

The price is currently breaking its neckline.

A daily candle close below that will provide a strong bearish confirmation

and suggest a highly probable bearish continuation.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/GBP Bullish Breakout from Falling Wedge – Buy Setup!Introduction

This EUR/GBP 4-hour chart analysis presents a high-probability bullish trading setup based on a falling wedge breakout. A falling wedge is a reliable bullish reversal pattern, signaling that selling pressure is fading, and buyers are regaining control. The price has now broken out of the wedge, confirming potential upside momentum.

This setup provides a well-defined entry, stop-loss, and target level, allowing traders to capitalize on the bullish breakout while maintaining a proper risk management strategy.

1. Chart Pattern: Falling Wedge (Bullish Reversal)

The primary pattern on the chart is a falling wedge, which is a bullish reversal pattern that forms after a downtrend. It is characterized by converging downward-sloping trendlines, indicating that sellers are gradually losing momentum.

🔹 Key Characteristics of the Falling Wedge Pattern:

Lower highs & lower lows within a narrowing price range.

Decreasing selling pressure, indicating a potential shift in trend.

A bullish breakout above the upper trendline confirms a reversal.

Typically followed by a strong price surge, aiming for previous resistance levels.

The price action confirms this pattern as it broke above the wedge's upper boundary, signaling the start of a bullish trend.

2. Key Technical Levels & Market Structure

🔹 Resistance Level (Target) – 0.84183

This level marks a previous strong resistance zone, where the price faced rejection multiple times.

It serves as the primary profit-taking area for this setup.

A successful breakout and close above this level could lead to further upside movement.

🔹 Support Level – 0.83154

This is the major demand zone where price previously bounced.

Strong buying pressure emerged at this level, leading to the recent breakout.

It serves as an important level to define risk and set stop-loss orders.

🔹 Stop-Loss Placement – Below 0.83154

A stop-loss is placed slightly below the support zone, ensuring a logical exit if the market reverses.

This prevents unnecessary losses while allowing room for normal price fluctuations.

🔹 Entry Point Consideration

Ideal entry: Around 0.83700, just after the breakout confirmation.

Confirmation: A strong bullish candle closing above the wedge.

3. Trade Execution Plan: Long Setup

📌 Trade Idea – Bullish Setup

📈 Buy Entry: 0.83600 – 0.83700 (After wedge breakout)

🎯 Target: 0.84183 (Major resistance level)

❌ Stop-Loss: 0.83154 (Below support level)

🔄 Risk-to-Reward Ratio (RRR): ~1:1

📊 Risk Management Strategy

Trade with discipline: Never risk more than 1-2% of your capital per trade.

Adjust position size: Based on risk tolerance and account balance.

Use trailing stops: To secure profits if price continues upward.

4. Market Sentiment & Price Action Analysis

Prior Uptrend: The price previously had a strong bullish rally, indicating overall bullish strength.

Corrective Move: The market entered a falling wedge correction, allowing for a healthy pullback before resuming the trend.

Breakout Confirmation: The breakout above the wedge's upper trendline confirms bullish momentum.

📊 Factors Supporting a Bullish Move:

✅ Breakout confirmation above the wedge pattern.

✅ Higher buying volume supporting the move.

✅ Support level holds strong, preventing further downside.

5. Trading Psychology & Risk Considerations

⚠️ Key Considerations Before Entering the Trade:

✔ Wait for confirmation – Ensure a strong breakout candle before entering.

✔ Avoid chasing the price – Enter at a reasonable pullback level post-breakout.

✔ Monitor economic events – Watch for news that could impact EUR/GBP volatility.

✔ Follow a strict risk-reward ratio – Stick to your predefined stop-loss and target.

6. Conclusion – Bullish Outlook

This falling wedge breakout on EUR/GBP suggests a bullish reversal, offering a high-probability long trade setup. The price is expected to move towards the 0.84183 resistance level, with 0.83154 as the key stop-loss level.

✅ Bias: Bullish

🎯 Target: 0.84183

❌ Stop Loss: 0.83154

📊 Risk-to-Reward: ~1:1

📌 TradingView Idea Title & Description

Title:

🚀 EUR/GBP Falling Wedge Breakout – Bullish Move Incoming!

Description:

📈 Bullish breakout confirmed! EUR/GBP has broken out of a falling wedge, signaling a trend reversal. A long position above 0.83600 targets the 0.84183 resistance level with a stop-loss at 0.83154. Watch for strong bullish momentum! 📊💹

💡 Risk Management: Stick to your stop-loss, and don’t chase price action. Manage your trade wisely! 🔥

XAG/USD Rising Wedge Breakdown To Bearish Trade Setup1. Overview of the Chart

This chart represents Silver (XAG/USD) on the 4-hour timeframe from the OANDA exchange. The price action has formed a Rising Wedge pattern, which is a classic bearish reversal formation. This suggests that a potential breakdown could lead to a significant decline in price.

2. Chart Pattern: Rising Wedge Formation

A Rising Wedge consists of a narrowing price range with higher highs and higher lows, but the slope of the support line (bottom trendline) is steeper than the resistance line (top trendline).

This signals weakening bullish momentum, as buyers are struggling to push the price higher, and sellers are stepping in.

Rising Wedges typically break downward due to the loss of buying strength.

3. Key Technical Levels and Market Structure

A. Resistance Level (Highlighted in Beige Box - $34.50 to $34.80)

This zone has acted as a supply area, where price struggles to break higher.

The price touched this level multiple times, failing to hold above it, which increases the probability of a reversal.

B. Support Level (Highlighted in Blue Box - Around $33.50)

This is a critical short-term support where buyers previously stepped in.

A break below this zone would indicate a confirmation of the wedge breakdown and further downside potential.

C. Stop Loss Level (Marked at $34.80)

Placed above the resistance zone, ensuring protection if price invalidates the pattern and moves higher instead.

This aligns with a logical risk-management strategy to minimize losses if the setup fails.

D. Bearish Breakdown Projection & Target (Marked at $30.46)

The projected target aligns with previous structure support, meaning price may find buyers around this level.

This level is determined by measuring the height of the wedge and projecting it downward from the breakout point.

4. Trading Strategy & Execution Plan

📌 Short (Sell) Trade Setup:

Entry:

Enter a short position once price breaks below the lower trendline of the wedge with strong bearish momentum (e.g., a big red candle closing below support).

A possible retest of the broken support could provide a second entry opportunity.

Stop Loss:

Set at $34.80, above resistance, to ensure the trade is protected against invalidation.

Take Profit (Target):

First target: $32.50 (psychological level and minor support).

Final target: $30.46 (major support and full pattern breakdown projection).

5. Market Psychology & Confirmation Signals

Why This Setup is Bearish?

Price action shows higher highs but with decreasing strength, signaling bull exhaustion.

The Rising Wedge is a well-known bearish structure, and its breakdown typically leads to a strong sell-off.

Volume confirmation: If the breakdown happens with high volume, it strengthens the bearish case.

What to Watch For?

A decisive bearish candle closing below the wedge support confirms the short setup.

If price retests the broken trendline and fails to reclaim it, it provides a second opportunity for entry.

Avoid entering if price consolidates near resistance instead of breaking down.

6. Conclusion: Bearish Bias & Trading Edge

The Rising Wedge formation suggests that Silver is losing bullish momentum and could break down.

Key levels and structure provide a well-defined trade setup, ensuring a good risk-to-reward ratio.

Traders should wait for a confirmed breakdown before entering a short position.

📉 Bearish Outlook – Price likely to drop toward $30.46 target

⚠️ Risk Management is crucial – Stop Loss at $34.80

🎯 Breakdown confirmation needed before entering short positions

Would you like me to refine any part or add more insights? 😊

Bitcoin (BTC/USD) Breakdown – Rising Wedge Signals Further Drop!1. Chart Overview

This 4-hour BTC/USD chart from BITSTAMP presents a well-defined Rising Wedge pattern, which is a bearish reversal structure typically signaling an upcoming price decline. After a strong upward movement, Bitcoin formed a wedge pattern with higher highs and higher lows converging. This indicates weakening bullish momentum, leading to a confirmed breakdown.

2. Key Technical Elements & Market Structure

A. Rising Wedge Formation (Bearish Pattern)

A rising wedge is a bearish reversal pattern that appears after an uptrend, showing gradually weakening buying pressure.

The chart shows that price action was following an upward sloping support and resistance trendline.

The higher highs and higher lows formed within the wedge indicate a loss of bullish momentum.

Eventually, the price broke below the lower trendline, confirming a bearish breakdown.

B. Breakdown Confirmation

A decisive bearish candle broke below the wedge's lower trendline, confirming the downward move.

After breaking down, the price attempted a small retest of the wedge’s support, which has now turned into resistance.

This successful rejection from the previous support adds to the bearish confirmation.

C. Support & Resistance Levels

Resistance Level ($88,547):

This zone acted as a strong supply area, where previous bullish moves were rejected.

If BTC/USD attempts to recover, this area may provide selling opportunities.

Support Level ($79,193):

This is the next downside target, aligned with previous price consolidation zones.

A break below this support could trigger further selling pressure.

3. Trading Setup & Strategy

A. Short Trade Setup

Entry Point: After BTC/USD confirmed the breakdown of the rising wedge.

Stop Loss: Placed slightly above the $88,547 resistance level to limit risk.

Target Price: A decline towards $79,193, which aligns with the previous major support zone.

B. Bearish Market Sentiment

BTC/USD is currently trading below the wedge, reinforcing bearish bias.

A successful retest of the broken wedge support would validate further downside continuation.

If price remains below the $85,000 level, sellers are likely to maintain control.

4. Market Outlook & Next Price Action

Bearish Scenario

If BTC fails to reclaim the wedge breakdown level, further downside is expected.

A breakdown below $80,000 psychological level could increase selling momentum toward $75,000-$77,000 levels.

Volume analysis suggests that selling pressure is increasing.

Bullish Scenario (Invalidation)

If BTC/USD reclaims the $88,547 resistance and closes above it, the bearish bias could weaken.

Bulls need to break above the rising wedge resistance trendline for a reversal.

5. Conclusion & Trading Plan

The Rising Wedge pattern breakdown confirms a bearish outlook for BTC/USD.

The risk-reward ratio for a short trade is favorable, targeting a move down to $79,193.

Traders should watch for volume confirmation and trend continuation signals before entering.

Key Takeaways

✅ Bearish Bias confirmed after the Rising Wedge breakdown.

✅ Short Position setup with entry, stop loss, and target defined.

✅ Resistance at $88,547 - Failure to break above it strengthens the bearish case.

✅ Target at $79,193 - A strong support area where buyers may step in.

6. Tags for TradingView Post

#BTC #Bitcoin #Crypto #TradingSetup #TechnicalAnalysis #CryptoTrading #BearishPattern #RisingWedge #Breakdown #ShortTrade #PriceAction #SupportResistance #MarketAnalysis

Would you like any further refinements or additional insights? 🚀

Clarkson PLC Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Clarkson PLC Stock Quote

- Double Formation

* ((Wedge Structure)) | Completed Survey

* ABC Wave Feature | Range & Retest Area | Subdivision 1

- Triple Formation

* (20 EMA Settings)) | Short Set Up | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic Settings

- Position On A 1.5RR

* Stop Loss At 3.770 GBP

* Entry At 3.500 GBP

* Take Profit At 3.700 GBP

* (Downtrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

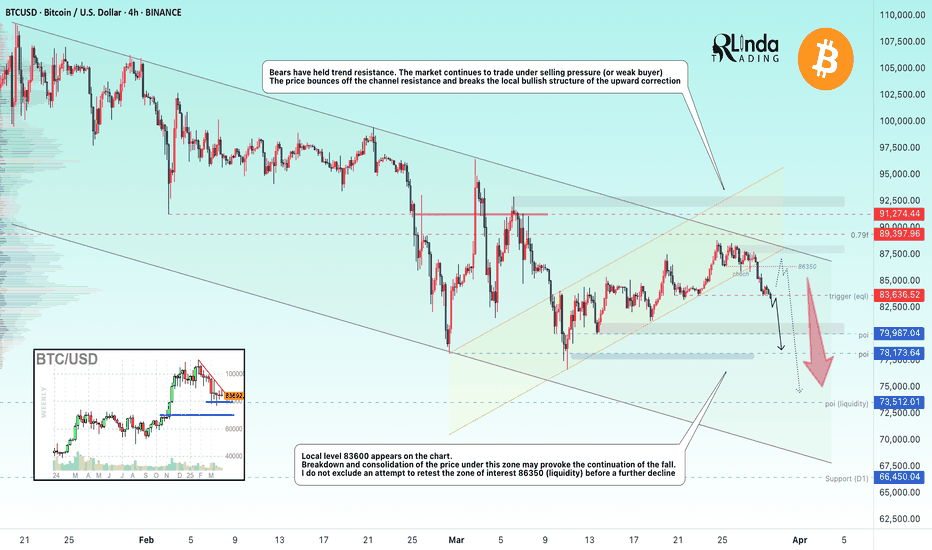

BITCOIN → Break of the bullish structure. Moving to 78-68KBINANCE:BTCUSD has been slowly recovering for the last two weeks, but failed to overcome the resistance. The bears held the trend. The price is breaking the local bullish structure and preparing for a strong fall.

Bitcoin's fundamental background is weak, expectations were not met by the crypto summits, nor by any major announcements or hints of a crypto reserve. The crypto community still didn't get what they expected from Trump. The strong drop was triggered by the SP500 index falling, driven by rising inflation, reduced consumer pressure and new trade tariffs. These factors have contributed to increased uncertainty in the markets, prompting investors to move to safer assets such as gold and government bonds

Technically, the price has been in consolidation (correction channel) for two weeks and after breaking the support of the figure, the price entered the realization phase within the global downtrend.

Resistance levels: 85300, 86350, 89400

Support levels: 83600, 81270, 79980, 78100

Emphasis on the support at 83600. The price fixing under this zone may provoke further fall to 80-78K. But I do not exclude the fact that a small correction to the zone of interest is possible (to capture liquidity) before a further fall to the previously identified key zones of interest.

Regards R. Linda!

USDCAD: Bullish Outlook For Next Week Explained 🇺🇸🇨🇦

There is a high chance that USDCAD will keep rising next week.

A test of the underlined blue support triggered a strong bullish reaction

and a breakout of a resistance line of a falling wedge pattern.

I think that the pair may rise and reach at least 1.4357 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.