GBP/USD – Breakout Confirmation Across TimeframesGBP/USD – Breakout Confirmation Across Timeframes

🔹 Multi-Timeframe Bullish Setup by PULSETRADESFX

GBP/USD is showing a strong bullish shift after breaking out of a well-defined descending channel. Price reacted perfectly from the 1.33400–1.34060 demand zone and is now pushing above descending trendline resistance across the 2H and 4H charts.

This signals early signs of trend reversal, backed by confluence across intraday and higher timeframes.

📌 Trade Setup Details:

Entry: 1.34530 – 1.34550

SL: 1.34060 (Below demand)

TP: 1.35724 – 1.36000 (Upper supply zone / channel target)

The structure is clean, the R:R is healthy, and momentum favors bulls after multiple rejections at key support.

---

✅ Confluences Supporting the Long:

Descending channel breakout (2H & 4H)

Triple demand zone rejection

Break and close above minor resistance

Clean bullish momentum candle

Economic catalysts ahead (watch USD data releases 📅)

📅 July 18, 2025

📊 FOREX.com | GBP/USD (4H, 2H)

#GBPUSD #Forex #BreakoutTrade #BullishSetup #TechnicalAnalysis #TradingView #PULSETRADESFX

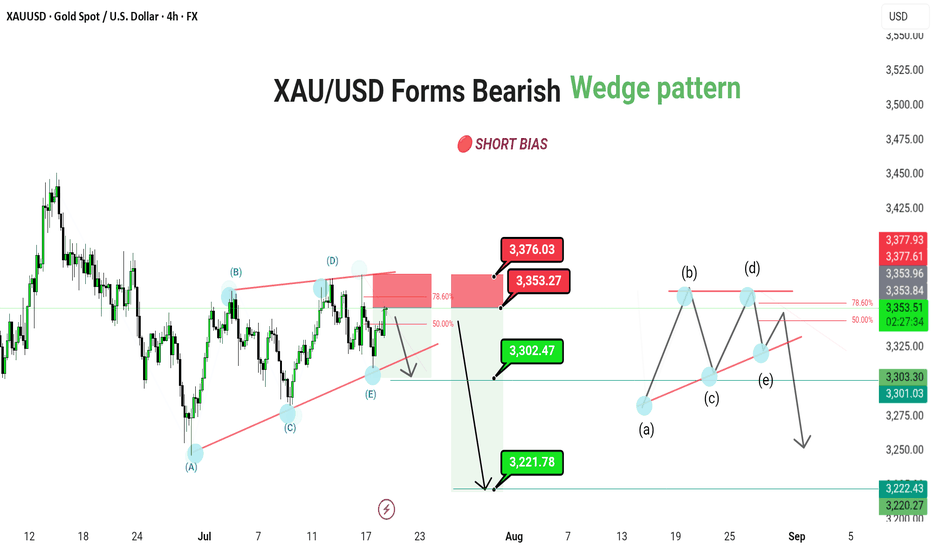

Wedge

XAU/USD Forms Bearish Continuation Triangle – Future Downside

XAU/USD (4H) | FX | Gold Spot vs US Dollar

🔴 SHORT BIAS

📅 Updated: July 18

---

🔍 Description

Gold is trading within a bearish contracting triangle, suggesting a continuation move to the downside after the recent corrective bounce. Price is currently approaching the key 3,371–3,376 resistance zone, which aligns with the 78.6% Fibonacci retracement and upper triangle boundary.

This resistance confluence could mark the termination of the (E) wave of the triangle, paving the way for a larger downward thrust. A confirmed break below 3,302 would open the door toward 3,221 as the next major target.

The structure also leaves room for a minor internal triangle (a)-(b)-(c)-(d)-(e) pattern within the broader range, reinforcing the bearish setup.

---

📊 Technical Structure (4H)

✅ Bearish contracting triangle: (A)-(B)-(C)-(D)-(E)

✅ 78.6% Fibonacci + supply zone = ideal rejection point

✅ Internal triangle projection aligns with lower support test

📌 Downside Targets

Target 1: 3,302.47

Target 2: 3,221.78

🔻 Invalidation: Above 3,376.03

---

📈 Market Outlook

Macro View: Rising real yields and cooling inflation reduce gold’s appeal

Fed Watch: Hawkish tone supports USD, weighing on XAU

Technical View: Structure favors downside break from triangle formation

---

⚠️ Risks to Bias

Break and daily close above 3,376.03 invalidates triangle structure

Sudden risk-off sentiment or dovish Fed shift could boost gold demand

Sharp reversal in dollar strength

---

🧭 Summary: Bearish Breakout Setup Forming

XAU/USD is completing a bearish triangle structure, with price sitting just below resistance. A rejection from the 3,371–3,376 zone can trigger a breakout lower, first toward 3,302, then extending to 3,221. As always, confirmation and tight risk control are key.

---

XRP's situation+ Target PredictionThe XRP is in a Bullish phase by a Falling Wedge Pattern.

A falling wedge indicates the potential for price to reach to $3.

Note if the PRZ ZONE is broken downwards with the strength of Bearish candles , this analysis of ours will be failed.

Best regards CobraVanguard.💚

QBTS bull flag dailyBetter look at quantum computing ticker QBTS bull flag on the daily timeframe. Previous post looked at the weekly timeframe to highlight the bullish momentum. Lots of retail money piled into this one in the last few months, a breakout of this bull flag will likely be followed by a parabolic move.

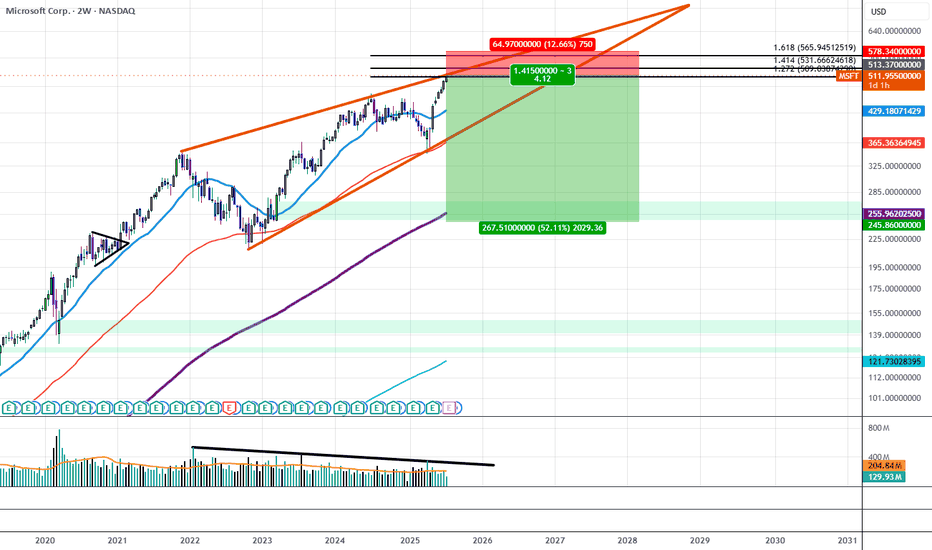

Microsoft Sees Declining Trading Volume Despite All Time HighsSince December of 2021, MSFT traded within a Rising Wedge structure that has gradually resulted in lower and lower highs in volume, at the same time IV on the Options Chain has begun to price down the strikes above $515 while Shorter Term Downside IV has begun to price up all the way out to $240.00. If this trend continues we will likely see the $515 area act as strong resistance as liquid interest above it begins to dry out.

This could be the beginning of a move to break down the wedge and trade down to the lower strikes first targeting the $365 price level and resolving around $240 near the 200 Period SMA.

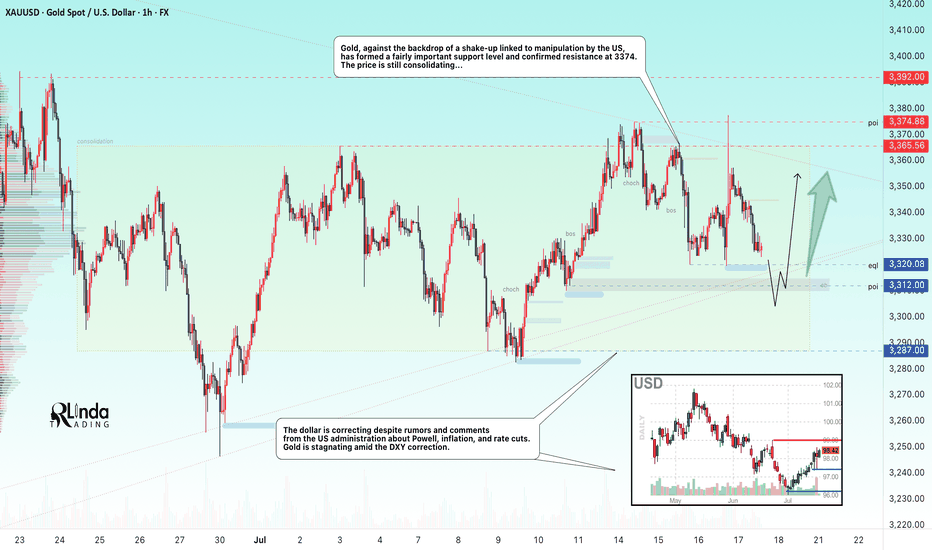

GOLD → The triangle is contracting. Retest of support...FX:XAUUSD tested a local high of 3375 but quickly returned to consolidation. The reason is manipulation by the US administration related to Powell, inflation, and interest rates...

Demand for gold has risen sharply amid global risks: Trump's aggressive tariff plans, strong inflation, and uncertainty about the Fed's actions have increased interest in defensive assets. Despite the temporary strengthening of the dollar, gold remains a popular hedging instrument. Technical analysis also points to a bullish outlook. However, growth potential is limited until the Fed clarifies its interest rate policy

Technically, on the D1 chart, it is clear that the price is consolidating, with the range continuing to narrow. Due to the bullish factors listed above, we can expect growth to continue. However, it is difficult to say where and when the growth will begin due to the uncertainty factor. All attention is on the support at 3320-3312, the triangle support, as well as the consolidation support at 3287.

Resistance levels: 3365, 3375

Support levels: 3320, 3312, 3287

Since the opening of the session, the price has spent part of its daily range, so there may not be enough potential for the decline to continue. A false breakdown of support and consolidation of the price above the key zone may attract buyers, which will trigger growth towards resistance.

Best regards, R. Linda!

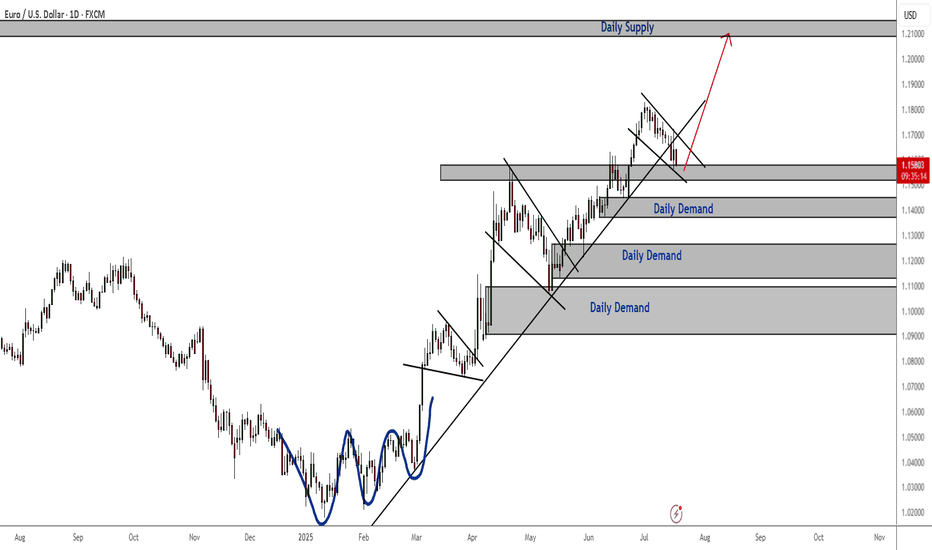

EURUSD Bullish Continuation Patterns and Consistent Demand The bullish continuation patterns and the consistent daily demand zones indicate that the trend is still bullish despite last week's bearish correction.

Price is currently reacting to a daily support zone. To confirm going long, especially long term, I recommend waiting for the current falling wedge to breakout and retest and then ride the bullish momentum to daily and weekly supply zones.

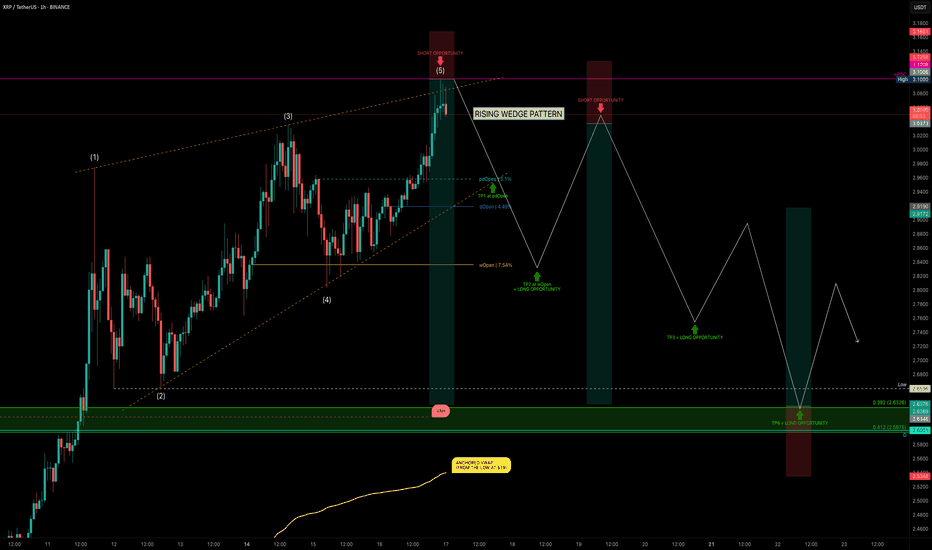

XRP Hits $3.10 — Rising Wedge or Ready to Fly?XRP has been on a strong run over the past 24 days, rallying from $1.90 → $3.10 — a +62% price increase. But after hitting key resistance, is XRP about to correct, or will it break out further? Let’s dive into the technicals.

🧩 Market Structure

Rising Wedge Pattern:

The current market structure resembles a rising wedge, with XRP likely completing wave 5.

Rejection Zone Hit:

Price tapped the nPOC at $3.10 and rejected — providing a clean short opportunity.

📉 Key Support Levels & Confluences

Taking the full 24-day bullish move:

0.382 Fib Retracement: $2.6326 — aligns with liquidity pool below the $2.6596 swing low.

226-day Trading Range VAH: ~$2.62 (red dashed line) — adds confluence.

Daily Level: $2.60 — further support.

Anchored VWAP from $1.90 Low: ~$2.54 (rising over time).

✅ Conclusion: The $2.66–$2.60 zone is a critical support area and offers a solid long opportunity.

Trade Setups

🔴 Short Setup (After Breakdown Confirmation):

Wait for a sell-off & breakdown of the wedge.

Ideal entry: retest of the lower wedge edge, ideal short entry would be between 0.618–0.786 fib retracement.

🟢 Long Setup:

Entry Zone: $2.66–$2.60

SL: below VWAP line

Target: Fib 0.618 as TP

🧠 Educational Insight: Rising Wedges Explained

A rising wedge is a bearish pattern, often signalling weakening momentum as price climbs within narrowing highs and lows.

Key points:

➡️ Volume typically declines as the wedge matures.

➡️ Breakdown below the lower wedge edge often triggers stronger sell-offs.

➡️ Retests of the broken wedge support turn into ideal short entries.

Pro tip: Combine wedge patterns with fib retracement zones and VWAP levels for higher-confidence setups.

Watch for wedge breakdown confirmation before shorting.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

ABT can potentially 4x in value reading up from the wedge its inThe smaller pink dotted measured move line is for the inv h&s pattern its formed inside the wedge with the top trendline of the wedge doubling as the invh&s pattern’s neckline. Hitting that smaller target is more or less a 2x from current price action. If we hit the full falling wedge target that’s a 4x from where it is currently. *not financial advice*

GOLD → Borders are shrinking. Consolidation continues...FX:XAUUSD is adjusting amid controversial CPI data and confirming the local bearish market structure. The PPI is ahead, and gold is consolidating, with its boundaries continuing to narrow...

Gold is recovering slightly but remains under pressure amid rising bond yields and a stronger US dollar. Higher inflation in the US reduces the chances of a quick Fed rate cut. Traders are cautious ahead of the PPI data release. If producer inflation exceeds forecasts, the dollar may rise again, putting further pressure on gold

Technically, we see consolidation in a symmetrical triangle pattern. Trading within the consolidation has a negative side - low volatility and unpredictable movements. The purpose of such movements is accumulation. However, decisions can be made based on relatively strong levels. In the current situation, we are seeing a rebound from 0.5 Fibonacci (I do not rule out a retest of the 0.7 zone before correction). The price may head towards the liquidity zone of 3322 before rising to the upper boundary of the consolidation and the zone of interest of 3350-3360.

Resistance levels: 3345, 3353, 3369

Support levels: 3322, 3312, 3287

The problem is that the price is in a consolidation phase. That is, technically, it is standing still and moving between local levels. You can trade relative to the indicated levels. Focus on PPI data. At the moment, gold is in the middle of a triangle and is likely to continue trading within the boundaries of a narrowing channel due to uncertainty...

Best regards, R. Linda!

DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

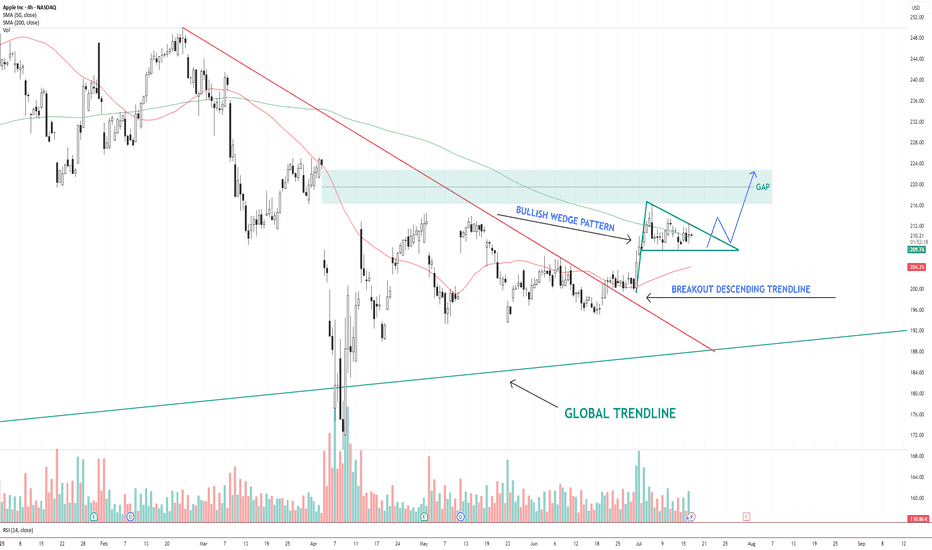

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting as the next upside target.

Key levels:

Support: $206 (wedge base / 50 SMA)

Resistance: $216–$224 (gap zone)

Trend structure: Bullish consolidation after breakout

A clean breakout from the wedge with volume could trigger a continuation move toward the gap zone.

📌 Watching for confirmation and potential entry on a breakout + retest.

This is not financial advice. Always do your own research.

Euro may fall to support area and then start to growHello traders, I want share with you my opinion about Euro. The price previously moved inside a wedge formation, where it tested the buyer zone and showed a strong reaction from this area. After that, the pair broke out upward and started to trade inside an upward channel, building momentum and forming a clear bullish structure. Later, the price created a pennant pattern, often considered a continuation signal. But before continuing the upward trend, I expect the Euro to first exit from the pennant and decline toward the support area. This zone was previously resistantce, and now it may turn into a strong support. Now the price is trading near the pennant resistance, but I don’t expect a breakout right away. The market needs to correct before it resumes the uptrend. Once the price reaches the current support level or slightly lower, it may find demand again and bounce. That’s why I expect the Euro to retest the support zone and then grow further toward TP 1 - 1.1850 points. This target aligns with the upper border of the upward channel and would complete the continuation move after the pennant breakout. Given the previous structure, bullish momentum, and patterns on the chart, I remain bullish after the correction and expect the price to rise from the support zone. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

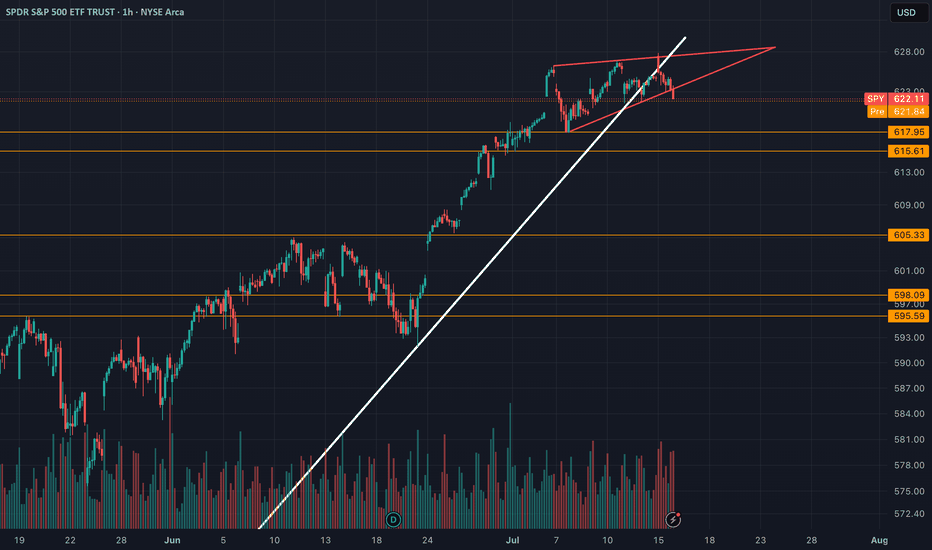

SPY (SP-500) - Rising WedgeYesterday we had a breakdown of the rising wedge on SPY. I draw out some important levels to look out for coming days/weeks. The trendline since april has also been broken. ICEUS:DXY is breaking out to which is increasing the risks for a "Risk off" scenario in tech stocks and crypto.

Nothing here should be interpreted as financial advise. Always do your own research and decisions.

1INCHUSDT - fear zone, return to the channel, growth potential1inch - is a decentralized exchange (DEX) aggregator that combines multiple DEXs into a single platform, aiming to provide users with the most efficient routes for swaps across all platforms.

📍 CoinMarketCap : #160

📍 Twitter(X) : 1.3M

The coin has already been listed on exchanges during the distribution phase of the cycle and was partially sold off in waves. Then, in line with the overall market, it declined to more reasonable accumulation prices, shaking out small investors and those who entered positions on positive news.

The price has been moving within a horizontal channel for a couple of years, and the channel’s percentage range reflects the coin’s liquidity. Currently, the coin is in a fear zone, at its lowest price levels. In moments like this, very few people have funds left to accumulate positions, as they’ve already been trapped by optimistic bloggers and a positive news background earlier.

Many were wiped out recently due to a breakdown and consolidation below the previous support of the inner channel, and now there's emptiness and fear below. What’s happening now is an attempt to return back into the inner channel. If this zone holds, the channel targets may be realized.

Resistance zones where the price may react are marked on the chart. Potential final downside wicks are also indicated. It’s important to allocate funds wisely for position building and use proper percentage distribution, according to your own experience!

______

📌 Not financial advice. Observing structure and recurring phases.

Operate within your strategy and with an awareness of risks.

NZDCHF → Pre-breakdown consolidation on a downtrendFX:NZDCHF is forming a pre-breakout consolidation amid a downtrend. Focus on support at 0.4759. Global and local trends are down...

On July 10-11, the currency pair attempted to break out of the trend. In the chart, it looks like a resistance breakout, but technically it was a short squeeze aimed at accumulating liquidity before the fall. We can see that the price quickly returned back and the market is testing the low from which the trap formation began. The risk zone for the market is 0.4759 - 0.475. In simple terms, this is a bull trap against the backdrop of a downtrend. The NZD has passed through the risk zone. At this time, the currency pair is forming a pre-breakout consolidation relative to the support level of 0.4759 with the aim of continuing its decline.

Support levels: 0.4759, 0.4753

Resistance levels: 0.477, 0.4782

A breakout of the 0.4759 level and consolidation in the sell zone could trigger a continuation of the decline within the main and local trends.

Best regards, R. Linda!

COTI - Crazy Breakout Soooooon- COTI is trading inside the falling wedge pattern

- Price is currently nearing the resistance trendline,

- A clear breakout of this trendline will push the price higher

- we will enter a long trade after the breakout

Entry Price: 0.06696

Stop Loss: 0.03793

TP1: 0.07746

TP2: 0.10366

TP3: 0.14599

TP4: 0.25150

Don't forget to keep stoploss

Cheers

GreenCrypto

NEAR - Breakout from falling wedge pattern- Near has successfully broken out from the falling wedge pattern and now heading towards the next minor resistance around 3.6 range

- breakout from the minor resistance should push price towards the 9$ range

Entry Price: 2.57

Stop Loss: 1.66

TP1:2.935

TP2: 3.256

TP3: 3.986

TP4: 5.461

TP5: 7.102

TP6: 8.948

Stay tuned for more updates.

Cheers

GreenCrypto

GOLD (XAUUSD): Mid-Term Outlook

Analysing a price action on Gold since March,

I see a couple of reliable bullish signals to consider.

As you can see, for the last 4 month, the market is respecting

a rising trend line as a support.

The last 4 Higher Lows are based on that vertical support.

The last test of a trend line triggered a strong bullish reaction.

The price successfully violated a resistance line of a bullish flag pattern,

where the market was correcting for almost a month.

A strong reaction to a trend line and a breakout of a resistance of the flag

provide 2 strong bullish signals.

I think that the market may grow more soon and reach at least 3430 resistance.

An underlined blue area will be a demand zone where buying orders will most likely accumulate.

❤️Please, support my work with like, thank you!❤️

LONG ON GBP/USDGU is currently in its pullback phase of its uptrend.

We have a nice sell side Liquidity sweep being completed at this moment.

Price should now tap into previous demand that broke a high to repeat history and rise again.

Very Nice Setup over 300 pips on the table to the previous high/supply zone.