IWM top is in?Little late night charting, have a nice naked chart with a couple areas of focus. Very simple and easy on the eye for bears but maybe not so much for the bulls. After a very boring fight performance from the bears since December 24th, they might be sneaking up on the bulls here. Of course this trade deal is still on the horizon but feels like a lot of this could be priced in/buy the rumor sell the news. Now of course just speculation but a possible scenario that could play out or also we could see some downward movement then some consolidation then the news arrives and we head back north. In my eyes I'm keeping it simple and I see a that a trade-able top is in the top yellow box, target would be middle yellow box. From there we bounce or we head for lower yellow box. Very simple. Zoom this daily chart into the weekly chart and you can see a huge head and shoulders pattern. Could be a scary ride from here until April so stay alert, stay safe, hedge your plays if possible, and look into weed stocks in the mean time. Thinking tomorrow will most likely be a very crazy day in the markets. Goodluck everyone.

Weed

SHORT CGC RUN!!!Run for your life... JK

In all seriousness this stock is and has been overvalued for a very long time. Charts starting to reflect this.

With the failure to break ATH weekly close its starting to form a double top formation.

Especially with this weeks candle opening below last weeks red candle it is adding to my confidence on the short.

Ultimately the target is as highlighted in the chart but it is reasonable to take profits along the way.

I will update the chart throughout the weeks.

WEED STOCKSSS:CGCCheck my CRON post for more details on positions and weed stocks in general, next leg up is here, load up and be safe in this shaky market potheads. :)

WEED STOCKSSS: ACBMy other favorite, view my CRON play posted earlier for more info on the weed stocks. Very self explanatory, load up and have fun in this shaky market my potheads :)

WEED STOCKSSS: CRONHey everyone, in my portfolio I have added a good bunch of stocks and I will be sharing my positions, very small positions via options all expiring on the 15th of March. Currently the market is a little shaky, right at the point of buyer exhaustion but also mixed with fomo of this trade deal coming out very well with China. So what am I even talking about? Well a group or sector of stocks typically do well when the market begins to act shaky and those are weed stocks and utilities. I am focusing on weed stocks as I have profited greatly before and I have also been a week early from the bottom before the huge multi day rips. The chart is pretty self explanatory, we are in a triangle of consolidation that is currently breaking out after a wild run already in January and February. CRON and ACB are of my top watch in weed plays CGC and NBEV are lagging a bit but also good to keep watch or have light positions. Goodluck and have fun!!! No targets on this just play accordingly.

WEED Symmetrical Triangle BreakoutAfter a few weeks of watching canopy and trying to short it. I've become convinced its going to produce a similar breakout from the previous rally.

Jan 9th > The first breakout started. Support began then the crowd started to rally and it produced substantial gains for longs leading into the next congestion phase.

Jan 14 - Jan 24 > The Bull flag congestion print which held selling volume and built up buying pressure to move it to a higher point.

Jan 28 - March 7th > Symmetrical Triangle Breakout - Jan 28 hit a top then 67.99 Feb 4th. Earnings were on Feb 13 which showed poor EPS however revenue was stronger than last year which is what captivated the crowd. The continued support is due to the sentiment of the overall market. Participants believe its going to the moon. April 1st stores open. There is a good reason to be optimistic about WEED/CGC and the market in general. (Fluff) Feb 15 was light due to ER mixed feelings of poor EPS and high revenue from prior earnings.

Hit a support level of $56.49 on Feb 25th. My target is within a few weeks for this to breakout like it did in October. Similar formation has formed. There seems to be strength behind canopy still. I plan to make this a mechanical trade and stick to what I've listed below.

This is my analysis I think there will be a breakout happening shortly which will push it into the 70 levels in the next few weeks. This isn't trading advice just my idea.

Call Contract expiring March 22nd Cost $3.45 Per contract. Target is $74 3 contracts

Stop price is $2.2 Delta is 0.53

Full sell of all contracts at $56.50 as this is support if it breaks then my trade is wrong.

Aurora upward trend to ATH?Not Trading Advises. only for learning. Appreciate feedback and criticism

I think Aurora is in a upward trend to its ATH price range based on the following:

• HH & LL

• RSI showing positive signals and positive momentum

• Volume increased

• Structure/Support at $9 Cad, not sure how strong the support is, and if the support is hold at $9, i interpret it as bulls have control over the stock and expect to see higher SP.

• Respecting 200 Ma, and trading over 50 Ma.

• By and large $ 175 millions Cad in revenue Q4/Q1 2019/2020, by and large $700 millions – $ 1.2 Billions Cad Revenue 2020. ( PE 10 on today's price ) and expected to grow in to a Billion dollar quarterly revenue company,

• Aurora is getting traction in the media. Buy rating.

• Cannabis market is getting more love every week, being talked about more and more, many times a week on Yahoo Finance, and Aurora is often mentioned.

• Higher marginal products coming online

Target: $12-$13.

If the price drop under $9 Cad, trade is not viable. ( my rule )

Disclosure: Aurora is my biggest holding, resp 30%. Planing to hold for life if the company continues to grow.

Not Trading Advises.

CRON Short TSX Re-test of $25 is coming. Lets see if it penetrates.

Double top formed after CGC ER catalyst move.

Great short entry at $24.80 if confirmation wanted and a more aggressive strategy at this level toward $25 if fade strategy is in play.

I am shorting 200 shares at 27.32 holding till $25 to fade if it breaks through I'll add. Stop is at $27.60.

I think Canopy Growth will retest its support in the coming week

I think Canopy Growth will retest its support in the coming weeks. Much based around the accounting error and no short term catalyst to move the SP higher from a already high SP, price near ATH. I think Canopy Growth will find support around $48-55 Cad or as low as $40 Cad, depending on more factors then only Canopy.

And with positive news around the Cannabis market not having a significant impact on the share price, i believe it impact the sentiment to become more positive towards Cannabis market, see it with a little bit less risk.

And with risk in mind, i think most well known companies have there share price reflecting the risk in the market rather then the potential of the market.

When the shift comes from investing for the potential rather then the risk. I think the good companies will have lower volatility and a steady SP and healthy technical moves. Rather then this risk investing climate, with high volatility, fast up and down moves and SP destroyed in a couple of days/weeks.

Based on the belief stated above, i think the SP will move down from 60 range to 40-50 range depending on sentiment/ things unknown to me.

And from there trade in an range until a leg up or down, or a shift in the sentiment.

ACB ready for the next step up >8.50We know how fast weed stocks move when they hit proven support lines.

One more trading day to prove 6.90-7.00 support will likely bring ACB >8.50 by 3/1. It's possible we'll see a little lag, but expected move should happen by 3/8.

Peak-to-peak, ACB has averaged 10%-20% leaps. 10% leap from previous peak of 8.34 brings us >9.00

ACB trading at 6.93 while posting this.

CGC triangle formationThere is no stopping the weed train, at least in the Canada's 9 billion weed market. CGC went from $20's in dec to $50 this month. And I can see a triangle formation on chart. Maybe a breakout in upper 50's next week?

ACB in descending channelIf it cannot break out of the descending channel we will retest lows in the next 24-48 hours.

Short play with $6.22-$6.12 target price

Bitcoin temporary bull run coming!Hello traders,

Looking at the daily chart for marijuana stock, WEED, we see that bulls are started to do profit taking. As a matter of fact, we see majority of marijuana stocks (CRON, N, ACB, APHA) just reached temporary top and looking to consolidate in next few days/weeks.

What I want you to notice is that marijuana stock and bitcoin has inverse relation, aka when weed stock goes up, bitcoin goes down, and vise versa (see highlight region). If people start to taking profit from marijiana stock, most likely we will start to see money inflow into the crypto market. My chart looks a little bit messy, but my temporary target is $3600.

Happy trading!

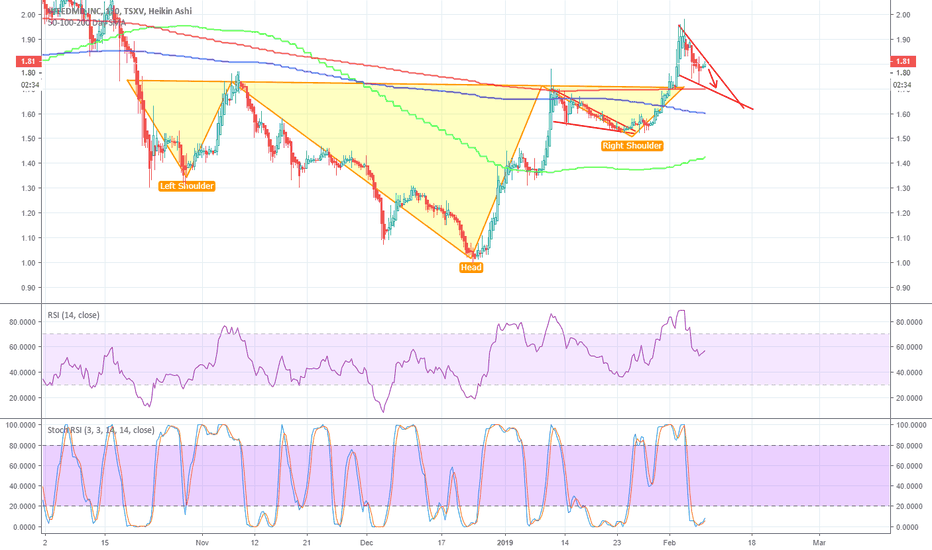

WeedMD Slight Pullback Then LongBurst through H&S and previous resistance, forming bull flag. WEED closed +1.5% today, with WMD closing -0.5%. Divergence between these two never last. Likely pullback to 200D SMA (last support), before breaking through bull flag.

CGC breaks trend on hourly and 4HCGC lost the hourly uptrend and subsequently the 4H. After a move of almost 50% this will now retrace and needs to find a new base of support.

Canopy GrowthI believe the majority of cannabis investors are retail investors with low knowledge about the market and there company(s) of choice, with a hope of becoming rich fast and without pain. I see reports about cannabis investors that says investors are young people, and talks on yahoo about young investors in the cannabis space. I have followed the charts closely since mars 2018, when most retail hype started to come around, and people in my surrounding start to talk about cannabis. And for most part it, it looks the same, Big gains under some time and then selloff for some time after, and the sellers i believe are the buyers wanting to get rich fast, which is probably 90% of young investors mindset. The selling is under much lower volume then the buy up.

And with no new news on sale or progress in the US that indicates a higher valuation for the companies already high valuation compared to revenue and earnings, i can easy see "smart money" just waiting for price to slowly come down and then start to buy. I believe if the industry were to get a higher valuation the price will continue to climb higher and stabilize with smaller movements. Not continue to sway 10-15 % or more per week, for me that indicates a market without serious players, and more a environment where the big players sees a opportunity to make big money without risking not getting a good price for the stock, there is room and time to play the markets. But the time is counting down as the companies gets better sales figures, and really show its a viable business model. Given the fact the companies is losing millions on there operational side of business. And only time will tell what company will survive until breakeven. And the really big money will start pouring in..

If the volatility in the stocks get lower and trade in a tighter range, in a slow and steady climb, that indicates for me that the markets players is starting to buy up the stocks and is anticipating a higher valuation of the cannabis industry/company. And with growth slowing down on many sectors like tech and more, cannabis industry will become a good place for growth investors, looking for growth during a slower economy.

With all the negative news coming out on the cannabis sector, specially on the big player on over valuation or right out scams, when the real trouble in this young industry is to pick a company that will survive and flourish, its not that the cannabis industry not will create big winners. So, the impotence of getting in early is not that important and there is no early getting in now, the valuations is high for all companies until they produce much better numbers, most companies in the industry have valuations when they are running at 2019 full year capacity, and some with a premium, etc Canopy and Cronos, as people view them having a competitive edge with the investment of Constellations brands and Altair, where the cash injection they revived and partnership it gain it enables them for bigger and better business opportunities where they can make massive profits and it protects investors from the risk of the company running out of money, a premium investors are willing to pay in this new and high risk market. Where companies without partnerships have a higher risk to them of needing to issue new shares for capital or face bankruptcy. As so price is lower and the reward is higher.

When companies start to show strong signs of breakeven with strong revenue growth the price of the stock will skyrocket, as it shows investors with lower risk profile, where the most money is, will start to pour into the market and specific companies. Until then the market will continue to move money from the impatience investor to the patience investor.

So with that said:

Canopy growth are now trading in there ATH range, after a strong January, and nothing really new information beside a 60 Cad $ rek and the stock become cheap at a point, with heavy buy volume to follow, and the price increased almost 100 % from lows of late 2018. So if the price on Canopy is going to be higher i want to see a slow and steady climb from here to 70 ish. With a possible pullback to 60 range before continuation of the uptrend.

With many days of good gains and the market is still being played price will drop below 60, and buying will comeback at lower 50 range, where it can do two things, continue to trade in a range of start to trade higher.

Only for educational purposes.

NBEV about to break out?Been looking at this ascending triangle formation for a while. Not a pro at charting but looks about right?