Weedstock

ACB Long Term SetupLooking to fill the lower GAP as well as retest lows. If it can maintain support at that level, might see a nice move to the top.

Consolidation Period Like how CGC is Reacting to Markets Crazy violent moves it is doing fine consolidating holding support of 20 ema while it hasn't found the volume to breakthrough the shorter resistance and hold there is strong support and no one bailing no mater what traders are doing i feel it should do well into earnings. as far as earnings they will not be looking so much at numbers as to forecast and i think Klien is making all the smart moves this is not being ran by stoners there is a serious numbers man in charge but i don't bet solely on numbers and balance sheets i was a fan of Blackstone in the low 20's several years ago when know one was interested Steve has Proven everyone wrong and so will Dave. watch the BBTighten if i where to trade Bollinger Band line, in the past upon heavy volume the 15min chart showed great entry right before it crossed on heavy volume usually made tremendous move...

3rd Quarter 2020 Bullish WEED Case StudyHey there Traders,

Attached is my prediction for $WEED over the course of 2020,

There was a lot of sell pressure in 2019 that has cooled off over the past few weeks. I assume the cool off phase/re-accumulation zone will continue for the first half of 2020 followed by a bullish climb near the 2nd half of 2020

WeedMD should bounceWeedMD should recover after almost 1year long downtrend, despite drop in sales they are shortly after harvest, I suspect lots of new buds are already in curing, soon ready for sales. On the top of that lfpress.com

This price range looks like great entry for long term position, however short term rapid recovery would be well deserved.

ACB Long ATM StraddleCannabis stocks have the possibility to move a lot in a short period of time, as regulatory changes on whims have huge impact on the market size to which Cannabis companies can sell their products. Although our stance is that the cannabis industry is likely to become even more volatile as more regulatory developments and sector-wide shake-outs leave only the leading firms, the reason we are particularly interested in the ACB long straddle is because of the low IVR.

We are entering into a near-the-money straddle on $ACB by longing the July calls and puts with a strike of $7.50, for a $.70 debit. The breakevens are below 6.80 and above 8.20. As a long straddle, the maximum loss occurs if the stock price S is at the strike k of 7.50 at maturity in July. Taking long positions on both of these options is very cheap because the implied volatility is subdued -- with an Implied Volatility Rank of 4.3.

Also, Aurora in particular has not joined big partnerships, contrasting the alignments with Canopy Growth ($CGC) and Constellation Brands ($STZ), Cronos Group ($CRON) and Altria ($MO), Tilray ($TLRY) with Anheuser-Busch InBev (BUD) and Novatris ($NVS), and HEXO($HEXO) with Molson Coors ($TAP). Announcement of any partnership, which is likely as billionaire private equity specialist Nelson Peltz recently joined with the intent to line up possible partners, would have a huge impact on the stock price. In January, Aurora Chief Corporate Officer Cam Battley told Business Insider that he would be looking to release “hemp-derived CBD strategy” into the U.S. market in the “next few months” in January. Five months later, we still don’t know what the surprise is. It could come within the next few months.

Bitcoin temporary bull run coming!Hello traders,

Looking at the daily chart for marijuana stock, WEED, we see that bulls are started to do profit taking. As a matter of fact, we see majority of marijuana stocks (CRON, N, ACB, APHA) just reached temporary top and looking to consolidate in next few days/weeks.

What I want you to notice is that marijuana stock and bitcoin has inverse relation, aka when weed stock goes up, bitcoin goes down, and vise versa (see highlight region). If people start to taking profit from marijiana stock, most likely we will start to see money inflow into the crypto market. My chart looks a little bit messy, but my temporary target is $3600.

Happy trading!

TLRY Tilray Bullish Signal- CANNABIS STOCK IG: @BULLRINGANALYSIS

Tlry is a very interesting pick here. Early stages of company growth but, descending triangle pattern is meeting major resistance level. Bullish signal from this pick, but could be interesting to see what happens at this intersection point. RSI is also in interesting position for growth as well.

not financial advice

ITHUF (iAnthus) Pump coming ahead?- CANNABIS STOCKIG: @BULLRINGANALYSIS

seeing channel breakouts over the past few trading months

RSI is is good position for forward growth in the short term

we can see this price drop to it's second support level (upward trending), and then possibly bullish movement

Increase in adoption as legalization increases in early 2019. Analyst EPS estimate increase in future

not financial advice

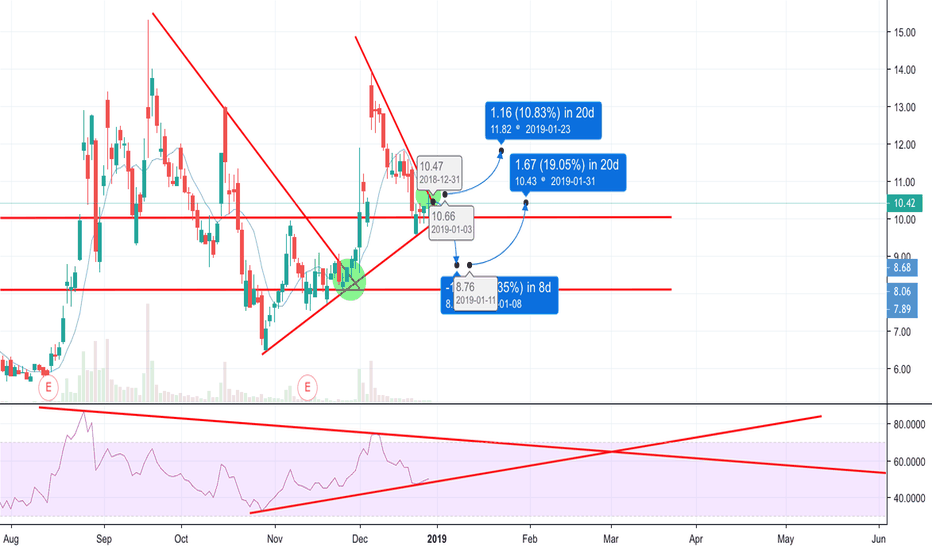

Will Canopy Growth (TSX:WEED) Give Us an Early Christmas Gift?Like many stocks on the TSX, Canopy Growth Corporation has had a choppy November. The wild swings make for some very fun trading, but quite a bit of risk if you're not interested in holding bags.

Here are four trades picked up by our AllTradeSignals Volume Pressure Gauge over the past couple of weeks:

Trade #1 - 40% gain in 8 days

Trade #2 - 2.5% gain in 30 minutes (!)

Trade #3 - 8.5% gain in 20 hours (!)

Trade #4 - ... where will we end up?

Although 50% in gains in 3 trades is already a solid November... where will trade #4 take us?

For me, I'm all for setting a tight stop loss on this one. No looser than -5% should keep us safe for any immediate swings.

What do you think?

Interested in the AllTradeSignals Volume Pressure Gauge ? Get in touch with us here on TradingView!

The Roller Coaster: Getting High (and Low) with AphriaAs with many of the TSX equities, Aphria has been swinging like crazy in November. Volatility is where the money is made, so let's take a quick look at some opportunities that our favorite marijuana stock has presented.

Here are three trades picked up by our AllTradeSignals Volume Pressure Gauge over the past couple of weeks:

Trade #1 - 30% gain in 8 days

Trade #2 - 3.5% gain in 30 minutes (!)

Trade #3 - 8.5% gain in 1 day (!)

Don't be like some of the crazy folks on /r/weedstocks -- be sure to set trailing stops and stop losses when you invest in volatile equities like this one!

Interested in the AllTradeSignals Volume Pressure Gauge? Get in touch with us here on TradingView!

CGC Stock Jumped 7.68% Yesterday Nov 6, 2018, Why?What is the News Catalyst that is Causing Canopy Growth Corp Stock (CGC) to Move up the Charts So Rapidly?

The catalytic news that could’ve catapulted Canopy Growth (NYSE: CGC) stock has finally come and has catapulted the stock to a whopping 7.68% gain today November 6, 2018 1:34pm, ET.

As a result of this catalytic news CGC looks like it is heading toward 55.91 and possibly higher (55.71, 56.56, and 57.41 are possible targets) before a reversal becomes inevitable. In fact, $71.90 per share is the next target that is possible if the stock continues its hyperbolic move up the charts.

This price target however, may take a little longer to achieve simply because CGC holders like to take profits when the time is right. So, there could be a profit-taking time that presents itself way before the $71.90 per share price point is reached. In fact, there are a few price points that could appear above the $57.41 price level. They are $69.35, $70.02, and $71.05. In fact, those prices are not at all arbitrary, they have some credence behind them. Our trading strategy has a very high level of reliability.

There could be many price levels above our original support zone of $36.71. Therefore, we would buy the stock if it gets to $36.71 and sell it when it gets to our hypothesized support zone of 44.88 or anywhere close. In past analysis, we have noted that point.

Click here to see the entire article.

Disclaimer: (c) Mstardom, Inc., Mstardom Finance does not provide investment advice.