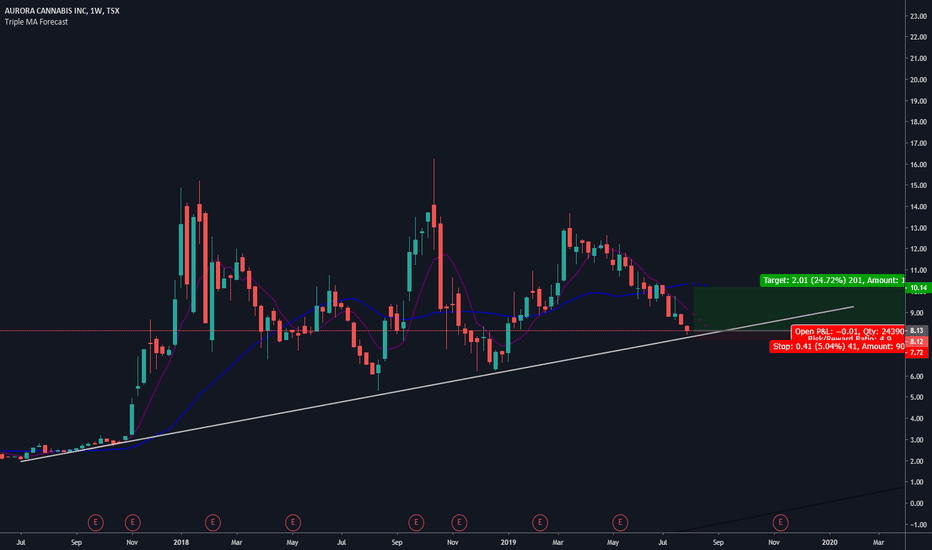

ACB Trendline Bounce TradeACB appears to be in a good buy spot here- This stock along with many of the marijuana names have been beaten up in the last few weeks/months.

The price is on/near the diagonal bullish trendline it has respected for a long period. Although it is not the strongest of trendlines with only 3 real bounces. I do think the risk meets tbe reward here.

Im looking at a trade just under 5:1.

Close any weekly candle close below the trendline. Take profit at the moving average. If it breaks the moving average in a strong way I will update my price targets.

Happy Trading :)

Weedstocks

Can Tilray Get Back to over $100?Looking at Tilray with the MACD and Megalodon indicators, we can see a buy signal on the daily for Tilray. Something that we've seen only twice before, both times being the start of significant rise. The Daily MACD doesn't have as much room to turn as did previous signals, however it does look a lot sturdier and supportive. As of right now though, we cannot chase this stock. Looking at the shorter time frame we can see a strong sell signal from the Megalodon. So while I am feeling confident about Tilray in the long term, we must wait for a short term correction to find our buying opportunity.

The Megalodon indicator uses a machine learning algorithm, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! You will also receive real time buy and sell signals for the stock market, cryptocurrency, as well as forex markets! We also busy completed our cryptocurrency automated trade bot. It trades for you, using our backtested indicator with phenomenal results! So try it today!!!

$WEED support lost, will the channel hold? #WEED #CGCOh well, were definitely expecting more energy from around here but now it seems to be that the support that has been holding the price on right course since December '17, is lost. This channel where the price bounced a tiny bit right now has also been tested few times earlier. Not looking that impressive here, for me at least. If this channel is lost, we may see this stock around sub 40 CAD and then maybe even sub 30 CAD. Seems crazy with all this legalization just keep on spreading that the price would see stupidly cheap prices but maybe still lower from here a bit. Direction will chance soon - after the market has done what has to be done.

IIPR possibly maybe could be 5jul2019 @cryptoknee Triangles are tricky. Converging TL and dropping volume can make a pennant or whatever but EW triangles have rules... cant get a super clear count of the interior waves, so its iffy for me. IF it is a triangle, 1:1 the width of the larger part of triangle off the termination of the E wave is the usual trust out of the triangle....or an extended 5th wave! who knows..

mmen mmnff 21july2019 @cryptokneepos bear ABC it done it going down. New lows. Another count may unfurl, not super clear on what the move down would be, could be an impulse not complete, could be some kind of ZigZag Combo, looking for #ClairityofCount bull div

CWEB update 15july2019 @cryptoknee $cweb update...this is the bear count. Soooo, hit the upper Channel line, channels perfect no matter which anchors you pick btw, sup/res hit, reject off of .50, almost hit 1.217 of A, but has not crossed into wave "A" territory...not gonna call it done yet, but... #potstocks #weedstocks

zyne 7july2019 @cryptoknee IF this impulse has more legs, looking at the golden box for a reaction. if we miss or blast trough, recount and reconsider what this is, this is 1 of many possibilities

KHRN 7july2019 @cryptokneepossible count, need a strong green reaction pretty soon here to validate this count. 1. by SR, 2. converging TL 3. A:C = 1:1.618 4. in GZ 5. Bull div on daily.

cweb 7jul2019 @cryptokneewoozers its on a run! Im a bit hesitant to say ATH are near, have to break some key resistances, MO. ABC and 123 are basically the same thing, one must relay on context of count and of course see what the retracement is after the C,3. C waves in ZZ tend towards 1:1 of A but can go 1.272 or 1.618. 3s most common fib projection is 1.618 but of course just need to be the longest of the motive waves. 1st step is to see where it stops and retraces and assess from there. Slight Bear div on 4hr. still with in channel, nearing 50,.618 of larger correction. Nearing a pos c/3 fib projections. bounced outta .50-.618 zone.

cura 5july2019 something @cryptoKneeClosed the gap, in the GZ, fibs lininging up, bull DIV... not asking for ATH but some kinda reaction would be awesome! Never know.

mmen 5july2019 couple countsfew possible counts here, ABC it done it going down. 1 2 and the 3rd is going down for the 4. or 1 2 and it is putting in the 4 of the 3

CGC - Elliott Wave analysis - At a cross road6/29

- what could have been the beginning of the 3rd wave starting in mid April failed to materialize as price action headed into a descending triangle. Therefore I had to re-position the count of Wave 1 to April 30

- With the re-positioned count, we are currently in Wave 2 nearing the end of another descending triangle. If this holds true, we expect price to move up in a thrust to Wave 3.

- Invalidation Point: $25.26 if Wave 2 retraces all of Wave 1, this count is no longer valid and we are likely in Wave (c) of a corrective cycle.

- Confirmation Point: $80.23+ price breaks above the length of Wave 1 such that Wave 3 is not the shortest wave.

ACRGF - Elliott Wave Count - Short Term Bearish7/2

- Overall it appears ACRGF started it's life in a Triple three: Zig Zag, Triangle, Zig Zag pattern and currently in it's last leg for completion.

- Next level of support at 15.84, then 11.99

- ACRGF may buck the current downtrend if it is able to break through upper trendline

ACB getting ripe with potential to double over next few monthsNice cup and handle formation. Looking for break of recent downtrend line to enter. This name has potential to more than double by year end. Monthly chart confirms the time is near.

KHRN - Elliott Wave Forecast - Possible Support Bounce Up Entry6/25

- Several counts indicate an upcoming bullish wave (V)/b

- Recent price action holding above 2.20, for a 61.8 golden pocket reversal in wave (IV)/a

- Confirmation - Price break above previous high of $2.89 to confirm an uptrend.

- Invalidation - Price breaks below 1.23 into Wave I territory

- RSI shows recent gathering of bullish momentum trying to break above 40

SNN - Broke through last support - No sign of reversal yet- Price broke below previous all time low of 2.85 closing at 2.56

- Next level of resistance at 1.45

- RSI is weak below 40

- No signs of reversal just yet