ACB ready for the next step up >8.50We know how fast weed stocks move when they hit proven support lines.

One more trading day to prove 6.90-7.00 support will likely bring ACB >8.50 by 3/1. It's possible we'll see a little lag, but expected move should happen by 3/8.

Peak-to-peak, ACB has averaged 10%-20% leaps. 10% leap from previous peak of 8.34 brings us >9.00

ACB trading at 6.93 while posting this.

Weedstocks

POTN: Bullish price continuation with exit levelsDescription

PotNetwork Holdings, Inc, through its subsidiary, First Capital Venture Co., engages in the research, development, and sale of hemp-derived CBD oil products. It also engages in the pre-owned auto dealership business. The company sells its products through distributors and resellers, as well as through its Website. The company was formerly known as SND Auto Group Inc. and changed its name to PotNetwork Holdings, Inc in March 2017. PotNetwork Holdings, Inc is based in Fort Lauderdale, Florida.

Website

www.potnetworkholding.com

Setup

Learned this setup from previous prop firm trader Brian Beamish twitter.com

www.therationalinvestor.com

As always, not advice - just for analysis

APHRIA - Weekly support, resistance and trendlinesDecided to take a look at APHRIA on the Weekly (1W) chart, solely looking at:

- Macro trendlines

- Major support and resistance (i.e. major buy and sell zones)

That's it.

This is solely of interest, I suppose, to a positional trader. I am interested to see:

- Will the price action bounce against the current macro downtrend in the next few months

(this has not been tested since late 2018 and could be disputed I suppose)

It would have been a glorious positional trade to buy that major support, it wicked down beautifully into that zone.

ACB in descending channelIf it cannot break out of the descending channel we will retest lows in the next 24-48 hours.

Short play with $6.22-$6.12 target price

Canopy (CGC) update: 30-60 days downtrend?Update of previous chart on Canopy.

MACD, Parabolic Sar, RSI all looking pretty bearish and reminding me of previous chart action in the aftermath of the late 2018 price run-up.

However.. the EMAs (10 and 30) haven't crossed over, and to me that would need to happen to confirm a steep downtrend.

For now things are leaning bearish, if we see further confirmation in that direction, I'd be looking at 30 to 60 days of downtrend based on past price action.

So targeting a buy in March or April - but where would I place my buys?

+ Diagonal trendline

+ Horizontal support

Both of these seem like nice areas to put in some bids. Let's come back and see what happens.

ACNNF Buy ZoneBought last year, way too high, down 60% in my position

Realize I suck at holding 3-5 years long term

Realize I don't like to bet on biotech/pharma companies who are constantly in development stage with no sales

I find these companies sketchy with changes in management, awaiting FDA approvals, cash burn, lack of transparency on development of new drugs/trials, burns through shareholder via share dilution/fundraising

Lacks volume and interest

Hyped up and falls hard.

Looking to average down into my buy zone, make a gain and average out my losses so I can exit.

Thoughts? Feedback would be greatly appreciated

This is supposed to be along term cannabis play in Aus, touted as the Canopy Growth Corp of Australia (side note, canopy growth does own 15% of this company and has partnerships to distribute to Australia through Auscann) But I just have no idea how big of a market cap Australia is going to comprise of.

Looking to enter at critical support. Currently there is still another 20% downside until reaching major support. Would prefer to wait a bit longer to initiate another average down purchase

Canopy Growth Corporation - running out of steamThis is an update to my previously published idea on CGC with some slightly different indicators.

MACD is showing bearish crossover, this has been a solid indicator for this stock in the past when it has been trending (the fakeout was during a period of weak momentum). See the examples highlighted.

Volume is declining, what an eyesore.

With that said, the moving averages have yet to show any crossover and in fact far from it, so that is something of a conflicting signal.

There is a rather rough long term trendline (that has already been violated for a month) will be interested to see if this is respected, if so for 7 or so periods I would consider buying there. Otherwise looking to support at the 25 mark.

The original trading idea still stands, curious as whether the trendline is invalidated, definitely looking bearish for coming weeks.

HUGE - a better look at the trendThis is an update of my previous idea on HUGE.

As you can see it was a bubble, went 5X and then corrected steeply.

Now trading in a tight range. Has tested the support 3 times... bit worried that support will break as more buyers are absorbed.

Huge volume on this candle but that wasn't enough to see an uptrend the last time there was major volume.

All in all, one to watch but not looking for an entry right now, a rather muddy chart for me.

ACB update on the hourlyQuite the fight going on today in the MJ sector.

As expected we started the day bearish which was hinted premarket and injected with bearish news on the European growth outlook. Bulls however vigourously defended the low of the pullback and bought the gap down on serious volume. Bears did nog get much follow through on the pushback.

Most likely scenario is to consolidate on the hourly now to clearly establish the new higher low as with volatility of the past few days levels are not clear. If bulls manage to break high of the consolidation that will result in another leg up which will show how strong the bulls currently are. I expect a lower high to form first just below the last daily high. With a strong close, friday will be an interesting day and nervousness will be pushed to the shorts in this stock.

FSD Pharma breaking downtrend, early signs of next wave cycleI've been following this stock for quite some time. As with most MJ stocks, this stock has been subject to hype/pump&dumps in the run up to legislation in Canada october 2018. After that we have seen a big retracement and correction to the current level where FSD has bottomed out. Change in the daily uptrend is marking the start of the next cycle according to my system and analysis and this provides.

What I especially like about FSD Pharma / Huge is management's approach which adheres to a zero-debt capital structure (to include debt in its capital structure is the reduced cost of capital). As this company is still maturing and yet has to receive a sales license, it is hard to gain insight in the financial strength of the company. However management's approach is non dillutive to shareholders and envisions structured growth. These stocks commonly show a pattern in which the bottom (support) is solidified and rises up to push through resistance eventually without crazy volatility. This bottom rise will not result in a cealing but a higher base. As the base rises, so does the sealing and the depth of the upper trading range.

At current levels FSD Pharma is really interesting at this price given it is now starting an uptrend. Personally I will be adding to my position in the buy zone, selling tranches when we reach the supply zone.

Please note this is not investment advice, just my analysis and vision on where this stock may go in the near future. Always do your own research, don't buy off of random tips on the Internet.

Peace

The Green Organic Dutchman idea - lovely setup for a 40% moveThis one seems like a bit of a no brainer for a 40% move before retracement.

10 day MA has flipped from resistance to support

RSI is telling a similar story

Volume has increased steadily over days

Sell when it touches the 'first trouble area' in the nearest overhead resistance.

Invalidated if it dipped back down to the local support, or 10 day MA failed to hold as support.

Charting #weedstocks - Macro view 7 Feb 2019New to #weedstocks, my experience is in trading crypto for 2 years.

I am charting the HMMJ as a macro benchmark of the whole #weedstocks market.

Experimented with a few different indicators here, the principle was to find indicators that would have been reliable over the last 18 months.

Settled on:

MA's (10 and 30), looking for crossovers to signify a change in trend

Good old RSI

Volume (not currently pictured)

Clean charts approach, I want to minimise distractions and focus on the big picture.

What I am getting from this:

- #weedstocks tend to yo-yo, with short bursts of uptrend followed by prolonged declines. Expect this to continue in 2019 - but the pace might be different this year, it would be a mistake to assume it will trend in the same time intervals

- I am looking for MA crossovers over a certain number of periods

- RSI was clearly oversold in the last few days, would have provided a great indication of the current correction

- As long as price is above the 10 MA, I think we're in bullish territory

Will be good to see if this is borne out by the next few weeks.

The ideal place to get in would be on support, at the point of a crossover. Yes, there have been fakeouts, this is where I'd look to employ leading indicators and look at their historical performance as a heads-up of the change in trend.

My honest hope? We go back to support and I'm able to load up at that level on the big weedstocks like CGC, assuming there's confluence on those individual charts.

CGC breaks trend on hourly/4hCGC broke trend today and will retrace to find a new base of support. After a near 50% increase in stock price this marked the temporary top

ACB on the weekly timeframeAs I trade (with the trend) on the lower timeframes, here's a chart to back up my analysis on the weekly chart.

FSD Pharma (HUGE) - accumulation before next move upFSD Pharma looks like it is in accumulation, before a move upwards that could reach as far as the local resistance 'first trouble area' before retracing back down - there would need to be significant upswing in buying volume to go further than that.

Indicators -

Bollinger Bands looks awfully similar to how they did in July 2018 shortly before accumulation and bull run.

RSI shows price currently sitting at support level.

10 Day MA is pretty neutral, no major bullish momentum but not falling under either.

This would be a good play if buying in the green box and selling somewhere in the region of the first trouble area.

Canopy Growth Corp idea - smoke one up at the trendlineCanopy looks overbought, if it cannot turn resistance to support on this second attempt, expect it to fall back to the diagonal trendline support. This would be a great point of entry for the next move upwards.

Indicators:

RSI shows overbought, a move down to the diagonal trendline would be in line with previous support zones on the RSI.

Support/Resistance: meeting the horizontal resistance now, may need to re-test it again before breaking through.

Green box indicates buy zone. This is invalidated if Canopy breaks through horizontal resistance and turns it to support.

NBEV about to break out?Been looking at this ascending triangle formation for a while. Not a pro at charting but looks about right?

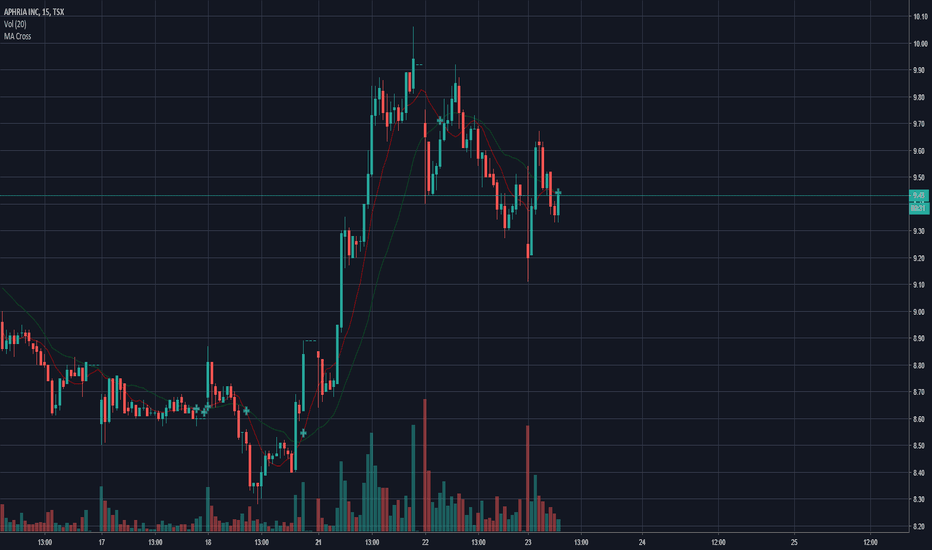

APH going to break out?Aphria holding 9.30 - 9.40 range well. If closes above 9.40 today I predict tomorrow to be an increase of 5%-12%. If tomorrow 10.30 resistance is broken I would expect a run until 10.60's and i will be putting a sell limit @ 10.55 to secure gains. Good luck everyone!

Mass Roots: MSRT operates a technology platform for cannabisMass Roots operates a technology platform for the medical cannabis community in the United States. Its platform enables users to share their cannabis content, follow their favorite dispensaries, and stay connected with the legalization movement. The company's MassRoots network is accessible as a free mobile application through the Apple App Store, the Amazon App Store, and the Google Play Marketplace. It also operates massroots.com a business and adverting portal that enable companies can edit their profiles, distribute information to users, and view analytics, such as impressions, views and clicks.

LIHT PULLBACK/CONSOLIDATIONCan't go up forever without some sort of consolidation around these price levels. Looking for a healthy correction to around the 0.618 fib and then hopefully more movement upward. The fundamentals look strong and the price/share will start to look more and more undervalued as the winter months drag on.