WEED back within an old narrowing ascending channelWEED.TO finds itself back within an ascending channel, for the first time since losing it June 26th. Indicators on larger time frames are getting very extended as the price level tests the upper limit of the channel, and while the price is at all time highs and running on both hype and news, I do believe at least temporary consolidation is in the very near term future. That said, I expect this reentry to be rejected and for a new support level to be found.

Weedstocks

STF Cronos Group INC / CRON short. Time for a cool down.Cronos has performed great, especially today amid a minor weed stocks sell-off but the chart is showing signs of exhaustion and fundamentally it is over-priced for its sector, despite being one of the few making money.

FA

Horizons cannabis fund $HMMJ and $MJ will begin re-balancing around September. I predict some of CRON will be sold-off to maintain weighting.

Weed stocks are all "over-priced" and the recent cannabis supply agreement in Canada may mean further government supplied products hitting the market.

TA

RSI's both show over-bought.

Big gap up followed by lower volume.

APH bullish descending wedge patternAPH I'm also watching a descending wedge pattern, I prefer this to ACBs as there haven't been any violations of the trend lines so far

ACB Bullish Descending Wedge formationACB is forming a descending wedge on the daily & weekly. I prefer the second upper limit because it has more touches, and would consider the breakout a fakeout since the next day closed back within pattern. I'd also consider the lower trendline violation a fakeout as well for the same reason. This pattern should remain valid so long as 5.29 holds IMO

Previous support now resistancePrevious support trendline from low of the February dump on WEED that formed the base of the ascending wedge in March 2018 became a new resistance at last all time high in June 2018. That trendline is being approached again on this current blue-sky breakout, and will be one I'll be watching as the days go on. This trendline looks even better on the weekly chart

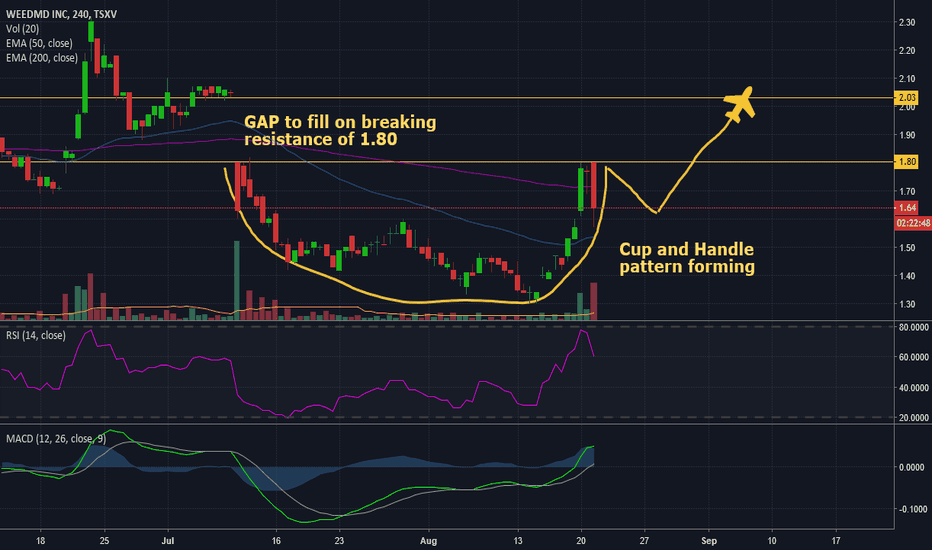

WeedMD [WMD.TO] CUP AND HANDLE PATTERN TO FILL GAPA very defined cup has been formed - awaiting handle

Watch for the handle to be formed over the next few days

A break thru 1.80 could signal strong bullish action

Resistance of 1.80 is bottom of gap from July

Potential to fill gap thru to 2.00-2.03 with resistance @ 1.90

Recent sector strength supports this action

CGC WEED stock breaking out to all time highs hereCGC another weed stock to keep on your radar. It is testing its highs here near 37. If this can break we are talking about an explosive MOVE. there is no level of supply overhead to hold it down.

Big Time Breakout in WEED STOCKSCRON has been basing since january in a tightening pattern with 4 tests of resistance. Today we have a confirmed breakout with VOLUME. Currently long this name near 7.00 with a 50 cent stop. Think we could see 9 or even 10 over the next month!

Watch this for pullbacks! it has a ton of momentum here and the sector is in fire!

Troubling signs for WEED continueFake out Breakout has reversed and rising wedge pattern has failed as well. This should negatively impact the whole space until investors get some fresh new reason to get excited. legalization in Canada and other countries has shown slowed progress and buyers don't really seem to excited to pile in a these elevated prices.

$ACB buyers are searching for a cheaper entry - dilution is goodWhile TSX:ACB is sitting at a new support of $7 - buyers are looking for a new avenue while production lags behind the Oct 11th date.

While FOMO locks into place we will see a new entry around $5.50 and maybe as low as $4 before the new year and before production starts.

LEAFers are still waiting for new shares.

Dilution is good.

Invest in pot while you canPot already had it's first huge takeoff, very similar to crypto. Unlike crypto though, we are seeing increased positivity and support for legalization nationwide year over year. I see a reverse head and shoulders here with volumes to verify the neckline. Waiting for it to correct a little to maybe 1.20 and then I'm in. Target is 1.92ish

Bullish Bounce Off SupportText book H&S formation followed by a Bear Flag

Bear Flag Bounced off BB

Acknowledging and understanding the bear flag, the indicator states that in one scenario we could see another leg down.

Givin the current support line holds, the bellow indicators show a possible area where shorts need to cover coming up to a short squeeze.

RSI is showing a over sold as well

Volume Has been decreasing, Looking for some action

ACB see's a dip to $7.92 after announcement about MedReleaf" ACB announces it has received shareholder approval at a special meeting, held today, for the issuance of shares in consideration for the planned acquisition of MedReleaf Corp. ("MedReleaf"), a well-known Canadian Licensed Producer based in Markham, Ontario that delivers premium medical cannabis products to domestic and global markets, and compelling brands to the adult-use recreational market."

Dillution, is a fact of company issuing shares for operating expenses, in this case it's a merger.

There won't be a dillution, more shares will be issued and capital value of company will increase. So, currently 4.2bln, and it will be 7.6 bln, about the same as Canopy. It's the reason why Canopy is declining, because Aurora is bigger now.

Leaders in the industry get higher p/e and share price as result... soon will be back at $9. There's some selling by Medreleaf are going on Aurora side, it's a reason, why we can't push back above 50 days.

More Information about the Announcement here:

Industry-leading scale: Funded capacity will increase to over 570,000 kg of high-quality cannabis per year, to be delivered through nine facilities in Canada and two in Europe

Low production costs and industry-leading yields: Aurora's automated 'Sky Class' greenhouses are expected to deliver industry-leading efficiencies and ultra-low production costs of well below $1 per gram, delivering sustainably robust margins. MedReleaf's high-yield cultivation techniques are expected to further enhance productivity and reduce costs across the combined entity's facilities.

International distribution: Aurora has established a strong and rapidly growing footprint in the international medical market. The combined entity is now well-positioned to rapidly gain market share in a number of significant markets. Most notable among these, is the European Union, which will have in excess of 400 million people following Brexit.

Expanding brand leadership: Aurora, CanniMed and MedReleaf represent three well-established medical cannabis brands, and a growing portfolio of premium consumer and wellness brands including San Rafael '71, Woodstock, and AltaVie that are backed by detailed consumer and marketplace insights and advanced analytical frameworks. This brand leadership positions the combined entity well to drive accelerated growth through its existing distribution channels for the domestic medical and consumer markets, as well as the international medical markets.

Scientific leadership: Each company is actively engaged in clinical trials and medical studies, which has resonated strongly with the international medical community, driving above-average prescription rates and referrals. Further, both companies have developed considerable expertise in cannabis plant genetics, enabling the development of new cultivars with specific traits for a variety of domestic and international markets, as well as strains optimized for automated cultivation.

R&D: The combined company will have an industry leading Science and Research & Development team that includes approximately 40 PhDs and MScs. Both companies have a proven track record in developing new products, adopting new technology throughout the value chain, and integrating innovations from third parties. Combining these capabilities will accelerate product development and technology adoption, creating strong, defensible competitive advantages, including, management believes higher-margin offerings to drive above average profitability.

WEED, Canopy Growth Corp, TSX. The Big 100 Idea!?Keeping it simple.

I personally am a bounce chaser, but occasionally like to post these long term goal charts.

I drew a long term 2 year wedge, that leads right into 2021. This is a long time to draw a wedge for waiting for it to play out, as there will be many factors contributing to the ups and downs of this one.

We have some sell signals on the weekly, which could destroy this wedge really fast, which may seem more practical.

The momentum is still bullish but starting to taper off into a possible couple month sell off to the bottom of the wedge.

This chart is for fun and perspective.

Happy trading, debating and speculating!

ACBFF takes a 20% hit down to $9.1After seeing $11 ACBFF takes a hit of 20% bringing it down to $9 showcasing a lot of support in this zone with its current volume. Keep an eye on the $8.5 levels as we are seeing a retrace after the recent pump

$CGC Canopy Growth Corp Oversold at Support$CGC Canopy Growth Corp Oversold at Support - RSI looking very oversold (15 on the hourly chart), expecting a bounce in the very near term.

Short term target: $27.00

Medium/Long term target: $36.00

Note: Observation/opinion, not investment advice.

ACBFF Aurora Cannabis INC. The bearish side of the story! :(Lets keep it simple?!

I have charted ACBFF already with great results with a more positive outlook. I've came across another possibility that is short term bearish, but still long term bullish.

I've explained most of the indicators in my previous chart, but here I just want to show levels, potential break outs and pull backs.

I have labeled a small bounce area already for tomorrow or the next day, but ultimately will get to the $6 area again.

This chart here shows what could happen if the wedge fails at that level, taking us to the 618 for what I believe could be the final bottom.

The end of this longer failed wedge rolls right into new years, which could be a perfect time for the 618 level wedge to break out.

Will update chart as time goes by, attempting to give clarity to the market. Corrections are healthy, health is never easy.

Happy Trading, debating and speculating! FOLLOW for updates!

TGODF Green Organic Dutchman Holdings LTD, Big Bull Flag?Lets keep it simple!

I've watched TGODF since release go from 2 to 6 in one month. 300% gains that soon may require a pull back.

There is not enough data to look at the longer time frames, as the shorter ones provide more current movements.

I've drawn a nice wedge pattern from the highs, and also found a larger BULL FLAG in the making. By the end of the month we should see where this is going.

Im going to wait until a safer entry zone appears, closer to the $4.30 area at the 618, and even the 786 area could be a second buy zone at the $3.7 area labeled in green.

The Ichimoku on smaller time frames is crossed bearish, and momentum continuing sells. but we can also see a decent amount of buy signals oversold, which I wont be counting on, considering the smaller time frame. There are no buy signals on the more important 4 hr to the WEEKLY.

A breakout of the wedge seems less likely, but still possible. Im a safe pull back level buyer, and will wait until they are reached, or move on to a different trade.

Happy Trading, Debating and Speculating! FOLLOW for more updates on all my charts!